Amundi: Third quarter and nine-month 2024 results

Amundi: Third quarter and nine-month 2024

results

Net

income1,2

up +16% Q3/Q3 and record assets under management at €2.2

trillion

|

Strong growth in earnings and

revenues |

|

Q3 - adjusted net

income1,2 at

€337m, fast-growing: +16.1% Q3/Q3

- Thanks to

revenue growth (+10.5%) and positive jaws

effect

- Q3/Q3

cost/income ratio improvement at

52.9%3

9 months - adjusted net

income1, 2 at

€1,005m, up +10.4% 9M/9M

Earnings per share2: €1.65 for Q3, €4.91 for 9M |

|

|

|

|

Record AuM

& dynamic MLT

inflows5 |

|

Record assets under

management3: €2,192bn at 30

September 2024, up +11% year-on-year

Q3 net inflows3 of +€2.9bn, or

+€14.5bn excluding the exit from a large,

low-income institutional mandate4

- +€9.1bn in MLT

assets4,5,6

- Solid commercial

momentum of Asian JVs: +€5.3bn

|

|

|

|

|

|

Continued strategic progress |

|

ETFs6: +€8bn in Q3 net

inflows, now more than €250bn in assets under management

Third-party distribution: +€7bn

Q3 net inflows, with contribution from all regions and asset

classes

Asia: +€7bn in Q3 net inflows, from JVs and direct

distribution in Japan, Singapore, Hong Kong, Taiwan and China

Technology: revenues +42% Q3/Q3

Victory Capital: approval7 of the

partnership with Amundi secured at EGM, transaction expected to

close in Q1 2025 |

Paris, 30 October 2024

Amundi's Board of Directors met on 29 October

2024 under the chairmanship of Philippe Brassac, and reviewed the

financial statements for the third quarter and the first 9 months

of 2024.

Valérie Baudson, Chief Executive

Officer, said:

« Amundi's results in the third quarter of 2024 demonstrate our

ongoing strategic progress and continued growth potential. Our Q3

net

profit1,2

of €337m, increased by +16% compared to the same period in 2023

and exceeded one billion euros over 9 months. Assets under

management reached a record level of €2.2 trillion.

We have been able to support our clients

whatever their profile and needs, which has resulted in a high

level of net inflows in our strategic development areas, namely

Asia, Third-Party Distributors, and ETFs.

By putting clients at the heart of our

strategy and by continuing to develop the areas of expertise that

primarily seek to meet their needs, we are ideally positioned to

seize growth opportunities in the savings industry. »

* * * * *

Further progress in achieving our 2025

Ambitions plan

Q3 2024 saw key areas of focus under the "2025

Strategic Ambitions" plan contribute to activity and earnings

growth.

-

ETFs exceeded €250bn in assets under management at

the end of September, up +31% year-on-year, thanks in particular to

very dynamic net inflows reaching +€17bn over 9 months, including

+€8bn in Q3. This places Amundi in second place in the European

market in terms of net inflows this quarter8. these

inflows are well diversified across equity and fixed income

products, with a high share of products classified as responsible

investment9 in net inflows (+€3bn, or 34% market share

in flows in this market segment). Amundi has had many commercial

successes this quarter: for example, the Amundi ETF Stoxx Europe

600 is the best-selling (+€0.85bn) European equity ETFs in Q3, the

Amundi ETF Euro Government Tilted Green Bond, launched last year,

saw its assets under management exceed €3bn after gathering +€1.1bn

since the beginning of the year, and the Amundi ETF Prime ACWI

exceeded €1bn in assets under management 8 months after its

launch.

- Third-Party

Distribution reached €377bn in assets under management at

the end of September, up +24% year-on-year, with net inflows +€19bn

for 9 months 2024, and +€7bn in Q3, thanks to contributions from

all regions and asset classes, from ETFs, treasury products and

active management;

-

Asia assets under management increased by +17%

year-on-year to €458bn; net inflows for 9 months 2024 stood at

+€30bn with a significant contribution from Amundi’s Indian JV SBI

MF, which now has €278bn in assets, up +19% year-on-year (+€18bn in

net inflows); €103bn of total Asian assets under management come

from direct distribution excluding JVs (+20% year-on-year), with

net inflows for 9 months 2024 standing at +€3bn in Japan, +€2.4bn

Singapore, +€1.4bn Hong Kong and also +€1.7bn in China outside the

two JVs, mainly with institutional clients;

- The

Technology & Services

offering is also experiencing strong growth, with

technology revenues of €54m over 9 months, up +28% compared to the

same period in 2023, and even +42% Q3/Q3; the Fund

Channel fund distribution platform exceeded €490bn in

assets at the end of September 2024; during the quarter it signed a

distribution agreement with ING Germany and integrated the fintech

AirFund into its ecosystem to digitise access to private markets;

Fund Channel was also ranked "Best Distribution Platform" for the

third consecutive year by the consulting and research firm

Platforum;

- In fixed

income expertise, Amundi now manages

€1,160bn in assets10 across a wide range of solutions,

from treasury products to target maturity funds, offering

attractive returns and capital protection; fixed income net inflows

stood at +€46bn10 over 9 months and +€14bn10

in Q3 thanks to sustained activity in active bond strategies

(+€11bn excluding JV) and ETFs (+€2.5bn);

- The partnership

project with Victory Capital reached an important

milestone with shareholder approval of resolutions7

necessary to finalise the transactions, expected in Q1 2025. As a

reminder, this partnership aims at creating a larger US investment

platform, via the contribution of Amundi US to Victory Capital in

return for Amundi taking a 26%-stake of the combined entity as well

as 15-year distribution agreements, to serve the clients of both

companies; Amundi would thus have a greater number of US and global

management expertise to offer its clients. The transaction, which

involves no disbursement of cash, is expected to bring a low

single-digit accretion for Amundi shareholders, with an increase in

the contribution of our US operations to the adjusted net income

and EPS.

Activity

Market environment

In the third quarter of 2024, equity

markets11 increased by +1.1%

in average compared to the previous quarter and by +15.6% compared

to Q3 2023. The European bond

markets12 also rose,

reflecting the shift in monetary policy and the ECB's decision to

cut rates. Year-on-year, our benchmark index12 increased

by +6.3% in Q3 2024 compared to Q3 2023 and by +2.1% compared to Q2

2024. The market effect is therefore positive on the evolution of

Amundi's revenues and net income.

When compared to the 2021 averages used as a

reference for the 2025 Ambitions plan, the market effect is only

slightly positive.

The European asset

management market continues its gradual

recovery. Open-ended fund volumes13, at +€213bn in

the third quarter, continued to be driven by treasury products

(+€93bn) and passive management (+€75bn). Nevertheless, the third

quarter recorded positive flows in medium- to long-term active

management for the second quarter in a row (+€45bn), driven by

fixed income strategies (+€69bn).

High level of activity over the quarter

in MLT assets5, assets

under management at a record level of €2.2tn

Activity this quarter continues to be marked,

like the rest of the European market, by risk aversion among retail

clients. However, Amundi performed well, driven in

particular by ETFs, bond solutions, third-party distributors and

Asia. Excluding the exceptional exit from a low-income insurance

mandate4, net inflows were

positive in all major medium- to long-term

areas of expertise (passive, active, structured products

and real assets), in all client segments (Retail,

Institutional and JV), and in all major markets

(France, Italy, Germany, Asia and the United States).

Amundi's assets under management at 30

September 2024 increased by +11.1%

year-on-year (compared to the end of September 2023) and by

+1.6% quarter-on-quarter (compared to the end of

June 2024), to €2,192bn, an all-time high.

In the third quarter of 2024, the market and

currency effect amounted to +€32.5bn (+€175.9bn over a year) and

Amundi generated positive net inflows of +€2.9bn.

As announced at the time of the second quarter results publication,

this amount includes the exit of a low-income multi-asset

mandate4 with a European insurer, of €11.6bn.

Adjusted for this exit4, net inflows

for the quarter were +€14.4bn of which

+€9.1bn in MLT

Assets5. It was positive in active management

(+€4.3bn) and ETFs (+€7.8bn), partially offset by outflows from

index strategies. Structured products and real and alternative

assets also recorded positive net inflows (+€0.8bn), while treasury

products were flat (+€0.1bn).

Finally, the

JVs14 continued their

solid commercial momentum, with net inflows of +€5.3bn,

reflecting a positive contribution from India (SBI MF, +€6.0bn) and

South Korea (NH-Amundi, +€0.4bn), partially offset this quarter by

slight net outflows in China (ABC-CA) despite continued open-ended

net inflows.

By Client Segment, Retail

recorded net inflows of +€6.3bn, of which

+€1.3bn in MLT

assets5, with contrasting

developments according to the sub-segments:

- Third-Party

Distributors had another very good quarter in terms of

total net inflows (+€6.8bn); all regions contributed to these

inflows, which were highly diversified across asset classes, with

positive contributions from ETFs, treasury products but also active

management (+€1.5bn);

- Risk aversion has a

larger impact on the activity of partner network clients in

France (+€1.1bn) and outside France excluding

Amundi BOC WM (-€0.9bn), despite the good performance of

structured and treasury products as well as bond strategies;

Sabadell's network in Spain continues its sales momentum

(+€0.4bn);

- In China,

Amundi BOC WM posted net outflows this quarter (-€0.7bn),

as the maturities of fixed-term funds were not offset by open-ended

fund subscriptions.

Excluding the loss of the low-income insurance

mandate already mentioned4, the Institutional

segment recorded very positive inflows in MLT

Assets5 (+€7.8bn), in all

sub-segments: Institutional & Sovereigns with

+€4.4bn, CA & SG insurance mandates with

+€2.4bn thanks to the continued recovery of the traditional life

insurance Euro contracts this quarter, Corporates and

Employee Savings (+€1.0bn) thanks to net inflows in

short-term bond products from corporates. Net outflows in

Treasury Products (-€4.9bn) are

to a large extent seasonal.

Results

Sustained growth in net income, +16%

Q3/Q3 to €337m, and more than €1bn in the 9 months of

2024

Adjusted

data2

In the third quarter of 2024, adjusted

net income2 reached €337m, up

+16.1% compared to the third quarter of 2023. Since the second

quarter, it includes Alpha Associates, whose acquisition was

finalised in early April.

The growth in net income was

mainly due to organic revenue growth, amplified by

operating efficiency, which led to a positive jaws

effect, and by the very strong momentum of Asian

JVs. These results were achieved against the backdrop of

continued client risk aversion, and inflation.

Adjusted net

revenues2 reached €862m, up

+10.5% compared to the third quarter of 2023.

- The sustained

growth in net management fees, up +9.2% compared

to the third quarter of 2023, to €805m, reflects the good level of

activity and the increase in average assets under management

excluding JVs (+8.6% over the same period);

- Performance

fees (€20m) doubled compared to the third quarter of 2023

(€10m), a low basis of comparison; however, they were down compared

to the second quarter of 2024 (€50m) due to the lower level of

crystallisation15 in the third quarter than in the

second and fourth quarters, as it does every year; however, the

performance of Amundi's management is at a good level, with more

than 71% of assets under management ranked in the first or second

quartiles according to Morningstar16 over 1, 3 or 5

years and 257 Amundi funds rated 4 or 5 stars by Morningstar as of

30 September;

- Amundi

Technology's revenues, at €20m, continued to grow steadily

(+41.8% compared to the third quarter of 2023; +13.0% compared to

the second quarter of 2024), confirming the development of this

business;

-

Finally, the Financial and other

income2 amounted to €17m, down slightly

compared to the third quarter of 2023 and previous quarters.

The increase in operating

expenses2, by +7.4% compared to the third

quarter of 2023, to €456m, remains lower than the increase in

revenues (+10.5%) over the same period, thus generating a

positive jaws effect which reflects the Group's

operational efficiency.

The increase is mainly due to:

- the first

consolidation of Alpha Associates;

- the provision for

individual variable remuneration in line with the increase in

results;

- and finally the

acceleration of investments in development initiatives according to

the axes of the 2025 Ambitions Plan, particularly in

technology.

The Cost income ratio improved

to 52.9% in adjusted data2 compared to

the same quarter last year, and remains in line with the

2025 target and at the best level in the industry.

The Adjusted gross operating

income2 (EBIT) amounted to

€406m, up +14.2% compared to the third

quarter of 2023, reflecting double-digit revenue growth amplified

by operational efficiency.

Income from equity-accounted

companies, which reflects Amundi's share of the net income

of minority JVs in India (SBI MF), China (ABC-CA), South Korea

(NH-Amundi) and Morocco (Wafa Gestion), was up

+36.5% compared to the third quarter of 2023, to

€33m, representing 10% of adjusted net income, reflecting

the good level of activity in India and Korea.

Adjusted earnings per

share2 in the third quarter of

2024 reached €1.65, up

+16.0%.

Accounting data in the third quarter

of 2024

Accounting Net income Group share amounted to

€320m and includes non-cash charges related to

acquisitions, in particular the amortisation of intangible assets

related to distribution and client contracts (-€24m before tax in

the quarter including the corresponding new charges related to

Alpha Associates, see details in p. 11), representing a total of

-€17m after tax.

Accounting earnings per share in the

third quarter of 2024 reached €1.56.

In the first 9 months of 2024,

adjusted net income2 amounted

to €1,005m, up +10.4%, reflecting the

same trends as in the third quarter:

- Adjusted

net revenues2 grew by +7.3% compared to the

first 9 months of 2023, to €2,573m, reflecting as in the quarter

the sustained growth in management fees (+6.6%) and the strong

increase in Amundi Technology's revenues (€54m, +28.2%) and

financial and other income2 (€67m, +38.2%); performance

fees, on the other hand, were down by -2.0% to €88m;

- Adjusted

operating expenses2 are well controlled with an

increase of +5.9% compared to the first 9 months of 2023, at

€1,356m, resulting in a positive jaws effect;

- Adjusted

cost income ratio2 stands at

52.7%.

Adjusted gross operating

income2 was €1,217m, up

+8,9% compared to the first 9 months of 2023,

showing a higher growth rate than revenue growth thanks to

operating efficiency.

Income from equity-accounted

companies increased by +28.6% compared to

the first 9 months of 2023, to €94m.

Adjusted earnings per

share2 for the first 9 months of

2024 reached €4.91, up +10.1% compared to

the first 9 months of 2023.

Accounting data for the first 9

months of 2024

Accounting Net income Group share amounted to

€956m and includes non-cash charges related to

acquisitions, in particular the amortisation of intangible assets

related to distribution and client contracts (-€68m before tax in

the 9 months including the corresponding new charges related to

Alpha Associates, see details on p. 11), representing a total of

-€49m after tax in the first 9 months of 2024.

Accounting earnings per share for the

first 9 months of 2024 reached €4.67.

To be noted for the fourth quarter and

full-year 2024

Success of the capital increase reserved

for employees - The capital increase reserved for

employees "We Share Amundi", announced on 23 September 2024, is

expected to be completed tomorrow, 31 October 2024. This operation

offered for the seventh consecutive year a subscription of shares

at a discount.

It was once again a great success this year:

more than 2,000 employees in 15 countries subscribed to this

capital increase, for a total amount of €36.3m. This represents

nearly two out of three employees in France and more than two out

of five

worldwide.

This transaction, which is in line with the existing legal

authorisations voted by the Shareholders' Meeting on 12 May 2023,

reflects Amundi's desire to involve its employees not only in the

development of the Company but also in the creation of economic

value.

The impact of this transaction on earnings per

share will be very limited: the number of shares to be created will

be 771,628 (i.e. ~0.4% of the share capital before the

transaction).

This issue will bring the number of shares making up Amundi's share

capital to 205,419,262 as of 31 October 2024, i.e. a share capital

increased to

€513,548,155.

Employees will now hold around 1.7% of Amundi's capital, compared

to 1.3% before the transaction. In the fourth quarter of 2024, the

Amundi Group will record in its consolidated financial statements a

charge relating to the subscription discount of €12.3m before

tax.

On the basis of the Finance Bill presented by

the French government, an exceptional tax contribution on

the profits of large companies would apply to Amundi,

whose turnover in France for tax purposes is more than €3bn.

* * * * *

APPENDICES

Adjusted income

statement2 of the

first 9 months of 2024 and 2023

|

(€m) |

|

9M 2024 |

9M 2023 |

% chg.

9M/9M |

| |

|

|

|

|

|

Net revenue - Adjusted |

|

2,573 |

2,397 |

+7.3% |

|

Management fees |

|

2,364 |

2,217 |

+6.6% |

|

Performance fees |

|

88 |

89 |

-2.0% |

|

Technology |

|

54 |

42 |

+28.2% |

|

Net financial & other net income |

|

67 |

49 |

+38.2% |

|

Operating expenses - Adjusted |

|

(1,356) |

(1,280) |

+5.9% |

|

Cost income ratio - Adjusted (%) |

|

52.7% |

53.4% |

-0.7pp |

|

Gross operating income - Adjusted |

|

1,217, |

1,117, |

+8.9% |

|

Cost of risk & other |

|

(7) |

(5) |

+24.5% |

|

Equity-accounted companies |

|

94 |

73 |

+28.6% |

|

Income before tax - Adjusted |

|

1,305 |

1,185 |

+10.1% |

|

Corporate tax |

|

(302) |

(277) |

+8.8% |

|

Non-controlling interests |

|

2 |

3 |

-25.2% |

|

Net income, Group share - Adjusted |

|

1,005 |

910 |

+10.4% |

|

Depreciation of intangible assets after tax |

|

(49) |

(44) |

+11.6% |

|

Integration costs net of tax |

|

0 |

0 |

NS |

|

Net income, Group share |

|

956 |

866 |

+10.3% |

|

Earnings per share (€) |

|

4.67 |

4.25 |

+10.0% |

|

Earnings per share - Adjusted (€) |

|

4.91 |

4.46 |

+10.1% |

Adjusted income

statement2 of the

third quarter of 2024

|

(€m) |

|

Q3 2024 |

Q3 2023 |

% chg.

Q3/Q3 |

|

Q2 2024 |

% chg.

Q3/Q2 |

| |

|

|

|

|

|

|

|

|

Net revenue - Adjusted |

|

862 |

780 |

+10.5% |

|

887 |

-2.9% |

|

Management fees |

|

805 |

737 |

+9.2% |

|

794 |

+1.3% |

|

Performance fees |

|

20 |

10 |

+97.3% |

|

50 |

-58.9% |

|

Technology |

|

20 |

14 |

+41.8% |

|

17 |

+13.0% |

|

Net financial & other net income |

|

17 |

19 |

-10.6% |

|

26 |

-34.0% |

|

Operating expenses - Adjusted |

|

(456) |

(424) |

+7.4% |

|

(461) |

-1.1% |

|

Cost income ratio - Adjusted (%) |

|

52.9% |

54.4% |

-1.5pp |

|

51.9% |

+1.0pp |

|

Gross operating income - Adjusted |

|

406 |

356 |

+14.2% |

|

426 |

-4.8% |

|

Cost of risk & other |

|

(2) |

(3) |

-36.0% |

|

(5) |

-63.4% |

|

Equity-accounted companies |

|

33 |

24 |

+36.5% |

|

33 |

-0.1% |

|

Income before tax - Adjusted |

|

437 |

377 |

+15.9% |

|

454 |

-3.9% |

|

Corporate tax |

|

(101) |

(88) |

+14.9% |

|

(105) |

-3.8% |

|

Non-controlling interests |

|

1 |

1 |

-23.5% |

|

0 |

NS |

|

Net income, Group share - Adjusted |

|

337 |

290 |

+16.1% |

|

350 |

-3.7% |

|

Depreciation of intangible assets after tax |

|

(17) |

(15) |

+17.9% |

|

(17) |

+1.2% |

|

Integration costs net of tax |

|

0 |

0 |

NS |

|

0 |

NS |

|

Net income, Group share |

|

320 |

276 |

+16.0% |

|

333 |

-4.0% |

|

Earnings per share (€) |

|

1.56 |

1.35 |

+15.9% |

|

1.63 |

-4.0% |

|

Earnings per share - Adjusted (€) |

|

1.65 |

1.42 |

+16.0% |

|

1.71 |

-3.7% |

Evolution of assets under management

from the end of 2020 to the end of September

202417

|

(€bn) |

Assets under management |

Net

inflows |

Market &

Forex Effect |

Scope effect |

|

Change in AuM

vs. previous quarter |

|

As of 31/12/2020 |

1,729 |

|

|

|

/ |

+4.0% |

|

Q1 2021 |

|

-12.7 |

+39.3 |

|

/ |

|

|

As of 31/03/2021 |

1,755 |

|

|

|

/ |

+1.5% |

|

Q2 2021 |

|

+7.2 |

+31.4 |

|

/ |

|

|

As of 30/06/2021 |

1,794 |

|

|

|

/ |

+2.2% |

|

Q3 2021 |

|

+0.2 |

+17.0 |

|

/ |

|

|

As of 30/09/2021 |

1,811 |

|

|

|

/ |

+1.0% |

|

Q4 2021 |

|

+65.6 |

+39.1 |

|

+14818 |

|

|

As of 31/12/2021 |

2,064 |

|

|

|

/ |

+14% |

|

Q1 2022 |

|

+3.2 |

-46.4 |

|

/ |

|

|

As of 31/03/2022 |

2,021 |

|

|

|

/ |

-2.1% |

|

Q2 2022 |

|

+1.8 |

-97.75 |

|

/ |

|

|

As of 30/06/2022 |

1,925 |

|

|

|

/ |

-4.8% |

|

Q3 2022 |

|

-12.9 |

-16.3 |

|

/ |

|

|

As of 30/09/2022 |

1,895 |

|

|

|

/ |

-1.6% |

|

Q4 2022 |

|

+15.0 |

-6.2 |

|

/ |

|

|

As of 31/12/2022 |

1,904 |

|

|

|

/ |

+0.5% |

|

Q1 2023 |

|

-11.1 |

+40.9 |

|

/ |

|

|

As of 31/03/2023 |

1,934 |

|

|

|

/ |

+1.6% |

|

Q2 2023 |

|

+3.7 |

+23.8 |

|

/ |

|

|

As of 31/06/2023 |

1,961 |

|

|

|

/ |

+1.4% |

|

Q3 2023 |

|

+13.7 |

-1.7 |

|

/ |

|

|

As of 30/09/2023 |

1,973 |

|

|

|

/ |

+0.6% |

|

Q4 2023 |

|

+19.5 |

+63.8 |

|

-20 |

|

|

As of 31/12/2023 |

2,037 |

|

|

|

/ |

+3.2% |

|

Q1 2024 |

|

+16.6 |

+63.0 |

|

/ |

|

|

As of 31/03/2024 |

2,116 |

|

|

|

/ |

+3.9% |

|

Q2 2024 |

|

+15.5 |

+16.6 |

|

+8 |

|

|

30/06/2024 |

2,156 |

|

|

|

|

+1.9% |

|

Q3 2024 |

|

+2.9 |

+32.5 |

|

/ |

|

|

30/09/2024 |

2,192 |

|

|

|

|

+1.6% |

Total over one year between September 30,

2023 and September 30, 2024: +11.1%

- Net inflows

+€54.5bn

- Market & exchange rate

effects +€175.9bn

- Scope

effects -€12.2bn

(disposal of Lyxor Inc. in Q4 2023, first consolidation of

Alpha Associates in Q2 2024)

Details of assets under management and

net inflows by client

segments19

|

(€bn) |

AuM

30.09.2024 |

AuM

30.09.2023 |

% change /30.09.2023 |

Net flows

Q3 2024 |

Net flows

Q3 2023 |

Net flows

9M 2024 |

Net flows

9M 2023 |

|

French networks |

138 |

126 |

+9.1% |

+1.1 |

+0.9 |

+0.3 |

+4.6 |

|

International networks |

167 |

156 |

+7.1% |

-1.6 |

-1.0 |

-4.4 |

-3.2 |

|

o/w Amundi BOC WM |

3 |

4 |

-26.9% |

-0.7 |

-0.5 |

-0.5 |

-3.3 |

|

Third-party distributors |

377 |

305 |

+23.5% |

+6.8 |

+2.1 |

+19.2 |

+4.1 |

|

Retail |

681 |

587 |

+16.1% |

+6.3 |

+2.0 |

+15.1 |

+5.6 |

|

Institutional & Sovereigns (*) |

518 |

489 |

+6.0% |

-9.3 |

+17.9 |

+1.4 |

+14.4 |

|

Corporates |

113 |

97 |

+16.0% |

+2.3 |

-3.8 |

-5.8 |

-7.4 |

|

Employee savings plans |

92 |

84 |

+9.8% |

-0.5 |

-0.9 |

+2.5 |

+2.6 |

|

CA & SG insurers |

428 |

406 |

+5.3% |

-1.2 |

-3.9 |

+0.5 |

-9.6 |

|

Institutional |

1,151 |

1,076 |

+6.9% |

-8.7 |

+9.3 |

-1.4 |

+0.0 |

|

JVs |

360 |

310 |

+16.0% |

+5.3 |

+2.4 |

+21.3 |

+0.7 |

|

Total |

2,192 |

1,973 |

+11.1% |

+2.9 |

+13.7 |

+35.0 |

+6.3 |

Details of assets under management and

net inflows by asset

classes19

|

(€bn) |

AuM

30.09.2024 |

AuM

30.09.2023 |

% change /30.09.2023 |

Net flows

Q3 2024 |

Net flows

Q3 2023 |

Net flows

9M 2024 |

Net flows

9M 2023 |

|

Equity |

527 |

443 |

+18.9% |

-0.7 |

+7.0 |

+0.0 |

+2.0 |

|

Multi-assets |

274 |

274 |

-0.0% |

-15.4 |

-5.9 |

-22.3 |

-17.0 |

|

Bonds |

732 |

624 |

+17.3% |

+12.8 |

+7.7 |

+36.8 |

+10.1 |

|

Real, alternative & structured assets |

114 |

124 |

-8.3% |

+0.8 |

-1.1 |

+1.5 |

+2.4 |

|

MLT ASSETS excl. JVs |

1,647 |

1,465 |

+12.4% |

-2.5 |

+7.8 |

+16.1 |

-2.4 |

|

Treasury products excl. JVs |

185 |

198 |

-6.5% |

+0.1 |

+3.5 |

-2.4 |

+8.0 |

|

Assets excl. JVs |

1,832 |

1,663 |

+10.1% |

-2.4 |

+11.3 |

+13.6 |

+5.6 |

|

JVs |

360 |

310 |

+16.0% |

+5.3 |

+2.4 |

+21.3 |

+0.7 |

|

TOTAL |

2,192 |

1,973 |

+11.1% |

+2.9 |

+13.7 |

+35.0 |

+6.3 |

|

o/w MLT assets |

1,973 |

1,745 |

+13.1% |

+3.4 |

+11.3 |

+34.9 |

-0.7 |

|

o/w Treasury products |

219 |

229 |

-4.2% |

-0.5 |

+2.5 |

+0.1 |

+7.1 |

Details of assets under management and

net inflows by management type and asset

classes19

|

(€bn) |

AuM

30.09.2024 |

AuM

30.09.2023 |

% change /30.09.2023 |

Net flows

Q3 2024 |

Net flows

Q3 2023 |

Net flows

9M 2024 |

Net flows

9M 2023 |

|

Active management |

1,136 |

1,022 |

+11.1% |

-7.1 |

-1.9 |

+2.2 |

-15.6 |

|

Equity |

208 |

187 |

+11.4% |

-2.3 |

-1.6 |

-5.4 |

-2.5 |

|

Multi-assets |

263 |

265 |

-0.9% |

-15.7 |

-6.3 |

-23.4 |

-18.2 |

|

Bonds |

665 |

570 |

+16.6% |

+10.8 |

+6.1 |

+31.0 |

+5.1 |

|

Structured products |

43 |

35 |

+22.3% |

+0.8 |

-0.2 |

+2.7 |

+2.9 |

|

Passive management |

397 |

319 |

+24.5% |

+3.8 |

+10.8 |

+12.4 |

+10.8 |

|

ETFs & ETC |

251 |

192 |

+31.1% |

+7.8 |

+3.6 |

+17.3 |

+8.0 |

|

Index & Smart Beta |

146 |

127 |

+14.5% |

-4.0 |

+7.2 |

-5.0 |

+2.8 |

|

Real & alternative assets |

71 |

89 |

-20.5% |

+0.0 |

-0.9 |

-1.2 |

-0.5 |

|

Real assets |

67 |

63 |

+4.8% |

+0.2 |

-0.3 |

-0.1 |

+0.2 |

|

Alternative assets |

4 |

25 |

-83.8% |

-0.2 |

-0.6 |

-1.1 |

-0.7 |

|

MLT ASSETS excl. JVs |

1,647 |

1,465 |

+12.4% |

-2.5 |

+7.8 |

+16.1 |

-2.4 |

|

Treasury products excl. JVs |

185 |

198 |

-6.5% |

+0.1 |

+3.5 |

-2.4 |

+8.0 |

|

TOTAL ASSETS excl. JVs |

1,832 |

1,663 |

+10.1% |

-2.4 |

+11.3 |

+13.6 |

+5.6 |

|

JVs |

360 |

310 |

+16.0% |

+5.3 |

+2.4 |

+21.3 |

+0.7 |

|

TOTAL |

2,192 |

1,973 |

+11.1% |

+2.9 |

+13.7 |

+35.0 |

+6.3 |

Details of assets under management and

net inflows by geographical

areas19

|

(€bn) |

AuM

30.09.2024 |

AuM

30.09.2023 |

% change /30.09.2023 |

Net flows

Q3 2024 |

Net flows

Q3 2023 |

Net flows

9M 2024 |

Net flows

9M 2023 |

|

France |

987 |

903 |

+9.3% |

+2.8 |

+4.1 |

+12.8 |

-1.2 |

|

Italy |

202 |

197 |

+2.7% |

-10.8 |

-1.5 |

-13.8 |

-2.2 |

|

Europe excl. France & Italy |

421 |

353 |

+19.2% |

+1.9 |

-0.8 |

+6.0 |

+6.0 |

|

Asia |

458 |

392 |

+17.0% |

+7.4 |

+3.4 |

+29.6 |

-0.3 |

|

Rest of the world |

124 |

129 |

-4.3% |

+1.7 |

+8.4 |

+0.4 |

+4.0 |

|

TOTAL |

2,192 |

1,973 |

+11.1% |

+2.9 |

+13.7 |

+35.0 |

+6.3 |

|

TOTAL outside France |

1,204 |

1,070 |

+12.5% |

+0.1 |

+9.6 |

+22.2 |

+7.5 |

Methodology Appendix

Accounting & adjusted

data

Accounting data - These include

the amortization of intangible assets, recorded as other income,

and since Q2 2024, other non-cash expenses spread according to the

schedule of payments of the earn-out until the end of 2029; these

expenses are recognized as deductions from net income, in finance

costs.

The aggregate amounts of these items are as

follows for the different periods under review:

- Q1

2023: -€20m before tax and -€15m after tax

- Q2

2023: -€20m before tax and -€15m after tax

- Q3

2023: -€20m before tax and -€15m after tax

- 9M

2023: -€61m before tax and -€44m after tax

-

2023: -€82m before tax and -€59m after tax

- Q1

2024: -€20m before tax and -€15m after tax

- Q2

2024: -€24m before tax and -€17m after tax

- Q3

2024: -€24m pre-tax and -€17m after tax

- 9M

2024: -€68m before tax and -€49m after tax

There were no significant integration costs

recorded in the third quarter as a result of the acquisition of

Alpha Associates

Adjusted data - in order to

present an income statement closer to economic reality, the

following adjustments are made: restatement of the amortization of

distribution contracts with Bawag, UniCredit and Banco Sabadell,

intangible assets representing the client contracts of Lyxor and,

since the second quarter of 2024, Alpha Associates, as well as

other non-cash charges related to the acquisition of Alpha

Associates; such depreciation and amortization and non-cash

expenses are recorded as a deduction from net revenues.

Acquisition of Alpha

Associates

In accordance with IFRS 3, recognition of

Amundi's balance sheet as at 01/04/2024:

- goodwill of

€290m;

- an intangible asset

of €50m representing client contracts, depreciable on a

straight-line basis until the end of 2030;

- a liability

representing the conditional earn-out not yet paid, for €160m,

including an actuarial discount of -€30m, which will be amortized

over 6 years.

In the Group's income statement, the following

is recorded:

- amortization of

intangible assets for a full-year expense of -€7.6m (-€6.1m after

tax)

- other non-cash

expenses spread according to the schedule of payments of the

earn-out until the end of 2029; These expenses are recorded as

deductions from net income, as finance costs.

In Q3 2024, the amortization of

intangible assets was -€1.9m before tax (-€1.5m after tax) and

non-cash expenses were -€1.4m before tax (i.e. -€1.1m after tax).

Over the first 9 months of 2024, these expenses

are respectively -€3.8m and -€2.9m (-€6.6m in total), since they

only started in Q2.

Alternative Performance

Measures20

In order to present an income statement that is

closer to economic reality, Amundi publishes adjusted data that

excludes the depreciation of intangible assets and, since the

second quarter of 2024, Alpha Associates, as well as other non-cash

charges related to the acquisition of Alpha Associates.

Adjusted, normalized data are reconciled with accounting data as

follows:

|

(m€) |

|

9M 2024 |

9M 2023 |

|

Q3 2024 |

Q3 2023 |

|

Q2 2024 |

| |

|

|

|

|

|

|

|

|

|

Net operating income |

|

2,452 |

2,307 |

|

825 |

747 |

|

844 |

|

Technology |

|

54 |

42 |

|

20 |

14 |

|

17 |

|

Net financial income and other income |

|

(1) |

(13) |

|

(6) |

(1) |

|

3 |

|

Adjusted net financial income and other income |

|

67 |

49 |

|

17 |

19 |

|

26 |

| |

|

|

|

|

|

|

|

|

|

Net revenues (a) |

|

2,505 |

2,336 |

|

838 |

760, |

|

864, |

|

- Depreciation of intangible assets before tax |

|

(65) |

(61) |

|

(22) |

(20) |

|

(22) |

|

- other non-cash charges relating to Alpha Associates |

|

(3) |

0 |

|

(1) |

0 |

|

(1) |

|

Net revenues - Adjusted (b) |

|

2,573 |

2,397 |

|

862, |

780, |

|

887 |

| |

|

|

|

|

|

|

|

|

|

Operating expenses (c) |

|

(1,356) |

(1,280) |

|

(456) |

(424) |

|

(461) |

|

- Integration costs before tax |

|

0 |

0 |

|

0 |

0 |

|

0 |

|

Operating expenses - Adjusted (d) |

|

(1,356) |

(1,280) |

|

(456) |

(424) |

|

(461) |

| |

|

|

|

|

|

|

|

|

|

Gross operating income (e) = (a) + (c) |

|

1,149 |

1,056 |

|

382 |

335 |

|

403 |

|

Gross operating income - Adjusted (f) = (b) +

(d) |

|

1,217 |

1,117 |

|

406 |

356 |

|

426 |

|

Cost-income ratio (%) -(c)/(a) |

|

54.1% |

54.8% |

|

54.4% |

55.9% |

|

53.4% |

|

Cost-income ratio - Adjusted (%) -(d)/(b) |

|

52.7% |

53.4% |

|

52.9% |

54.4% |

|

51.9% |

|

Cost of risk & other (g) |

|

(7) |

(5) |

|

(2) |

(3) |

|

(5) |

|

Equity-accounted companies (h) |

|

94 |

73 |

|

33 |

24 |

|

33 |

|

Income before tax (i) = (e) + (g) + (h) |

|

1,237 |

1,124 |

|

413 |

356 |

|

431 |

|

Income before tax - Adjusted (j) = (f) + (g) +

(h) |

|

1,305 |

1,185 |

|

437 |

377 |

|

454 |

|

Income tax (k) |

|

(283) |

(260) |

|

(94) |

(82) |

|

(98) |

|

Income tax - Adjusted (l) |

|

(302) |

(277) |

|

(101) |

(88) |

|

(105) |

|

Non-controlling interests (m) |

|

2 |

3 |

|

1 |

1 |

|

0 |

|

Net income, Group share (o) = (i)+(k)+(m) |

|

956 |

866 |

|

320 |

276 |

|

333 |

|

Net income, Group share - Adjusted (p) =

(j)+(l)+(m) |

|

1,005 |

910 |

|

337 |

290 |

|

350 |

| |

|

|

|

|

|

|

|

|

|

Earnings per share (€) |

|

4.67 |

4.25 |

|

1.56 |

1.35 |

|

1.63 |

|

Adjusted earnings per share (€) |

|

4.91 |

4.46 |

|

1.65 |

1.42 |

|

1.71 |

Shareholding

| |

|

30 September 2023 |

|

31 December 2023 |

|

30 September 2024 |

|

(units) |

|

Number

of shares |

% of share capital |

|

Number

of shares |

% of share capital |

|

Number

of shares |

% of share capital |

|

Crédit Agricole Group |

|

141,057,399 |

68.93% |

|

141,057,399 |

68.93% |

|

141,057,399 |

68.93% |

|

Employees |

|

3,042,292 |

1.49% |

|

2,918,391 |

1.43% |

|

2,751,891 |

1.34% |

|

Treasury shares |

|

1,297,231 |

0.63% |

|

1,247,998 |

0.61% |

|

958,031 |

0.47% |

|

Free float |

|

59,250,712 |

28.95% |

|

59,423,846 |

29.04% |

|

59,880,313 |

29.26% |

| |

|

|

|

|

|

|

|

|

|

|

Number of shares at end of period |

|

204,647,634 |

100.0% |

|

204,647,634 |

100.0% |

|

204,647,634 |

100.0% |

|

Average number of shares year-to-date |

|

204,050,516 |

- |

|

204,201,023 |

- |

|

204,647,634 |

- |

|

Average number of shares quarter-to-date |

|

204,425,079 |

- |

|

204,647,634 |

- |

|

204,647,634 |

- |

Average number of shares on a pro rata

basis.

- The average number

of shares is unchanged between Q2 and Q3 2024, it increased by

+0.1% between Q3 2023 and Q3 2024 and by +0.3% between the first 9

months of 2023 and the same period of 2024;

- A capital increase

reserved for employees will be carried out on October 31, 2024.

771,628 shares were created (approximately 0.4% of the share

capital before the transaction), bringing the share of employees to

about 1.7% of the capital, compared to 1.34% at September 30, 2024,

before the

transaction.

Financial communication

calendar

- Q4 and Full Year

2024 Results: February 4, 2025

- Q1 2025 earnings

release: April 29, 2025

- Annual General

Meeting: May 27, 2025

- Q2 and H1 2025

earnings release: July 29, 2025

- Q3 and 9-month 2025

results: October 28, 2025

About Amundi

Amundi, the leading European asset manager,

ranking among the top 10 global players21, offers its

100 million clients - retail, institutional and corporate - a

complete range of savings and investment solutions in active and

passive management, in traditional or real assets. This offering is

enhanced with IT tools and services to cover the entire savings

value chain. A subsidiary of the Crédit Agricole group and listed

on the stock exchange, Amundi currently manages close to €2.2

trillion of assets22.

With its six international investment

hubs23, financial and extra-financial research

capabilities and long-standing commitment to responsible

investment, Amundi is a key player in the asset management

landscape.

Amundi clients benefit from the expertise and

advice of 5,500 employees in 35 countries.

Amundi, a trusted partner, working

every day in the interest of its clients and

society.

www.amundi.com

Press contacts:

Natacha Andermahr

Tel. +33 1 76 37 86 05

natacha.andermahr@amundi.com

Corentin Henry

Tel. +33 1 76 36 26 96

corentin.henry@amundi.com

Investor contacts:

Cyril Meilland, CFA

Tel. +33 1 76 32 62 67

cyril.meilland@amundi.com

Thomas Lapeyre

Tel. +33 1 76 33 70 54

thomas.lapeyre@amundi.com

Annabelle Wiriath

Tel. + 33 1 76 32 43 92

annabelle.wiriath@amundi.com

WARNING

This document does not constitute an offer or

invitation to sell or purchase, or any solicitation of any offer to

purchase or subscribe for, any securities of Amundi in the United

States of America or in France. Securities may not be offered,

subscribed or sold in the United States of America absent

registration under the U.S. Securities Act of 1933, as amended (the

"U.S. Securities Act"), except pursuant to an exemption from, or in

a transaction not subject to, the registration requirements

thereof. The securities of Amundi have not been and will not be

registered under the U.S. Securities Act and Amundi does not intend

to make a public offer of its securities in the United States of

America or in France.

This document may contain forward looking

statements concerning Amundi's financial position and results. The

data provided do not constitute a profit “forecast” or “estimate”

as defined in Commission Delegated Regulation (EU)

2019/980.

These forward looking statements include

projections and financial estimates based on scenarios that employ

a number of economic assumptions in a given competitive and

regulatory context, assumptions regarding plans, objectives and

expectations in connection with future events, transactions,

products and services, and assumptions in terms of future

performance and synergies. By their very nature, they are therefore

subject to known and unknown risks and uncertainties, which could

lead to their non-fulfilment. Consequently, no assurance can be

given that these forward looking statement will come to fruition,

and Amundi’s actual financial position and results may differ

materially from those projected or implied in these forward looking

statements. [In particular, conditions to completion of the

announced transaction between Amundi and Victory Capital, may not

be satisfied and such transaction may not be completed on schedule,

or at all; risks relating to the expected benefits or impact of the

transaction on Victory Capital's and Amundi's respective businesses

are contained in their respective public filings.]

Amundi undertakes no obligation to publicly

revise or update any forward looking statements provided as at the

date of this document. Risks that may affect Amundi’s financial

position and results are further detailed in the “Risk Factors”

section of our Universal Registration Document filed with the

French Autorité des Marchés Financiers. The reader should take all

these uncertainties and risks into consideration before forming

their own opinion.

The figures presented were prepared in

accordance with applicable prudential regulations and IFRS

guidelines, as adopted by the European Union and applicable at that

date. The financial information set out herein do not constitute a

set of financial statements for an interim period as defined by IAS

34 “Interim Financial Reporting” and has not been audited.

Unless otherwise specified, sources for

rankings and market positions are internal. The information

contained in this document, to the extent that it relates to

parties other than Amundi or comes from external sources, has not

been verified by a supervisory authority or, more generally,

subject to independent verification, and no representation or

warranty has been expressed as to, nor should any reliance be

placed on, the fairness, accuracy, correctness or completeness of

the information or opinions contained herein. Neither Amundi nor

its representatives can be held liable for any decision made,

negligence or loss that may result from the use of this document or

its contents, or anything related to them, or any document or

information to which this document may refer.

The sum of values set out in the tables and

analyses may differ slightly from the total reported due to

rounding.

1

Net

income Group share

2

Adjusted

data: excluding amortisation of intangible assets

relating to distribution and client

contracts as well as other non-cash charges

relating to the acquisition of Alpha Associates

recorded in net financial income (see note p.

11)

3

Assets

under management and flows including assets under

advisory, marketed assets and funds of funds, and

taking into account 100% of Asian JV’s assets and

flows; for Wafa Gestion in Morocco, they

are reported in proportion to Amundi's

holding in the capital of the JV

4

As

announced at the time of the publication of the Q2 results, exit in

Q3 from a large low-income mandate (€11.6

billion) with a European insurer, in multi-asset; including this

exit, net inflows were positive by +€2.9bn in Q3 and +€35bn over 9

months

5

Medium-Long

Term Assets

6

Excluding

JVs

7

Extraordinary

General Meeting of Shareholders of Victory Capital, held on

11 October 2024

8

Source:

TrackInsight Q3 2024

9

Classified

as article 8 or 9 of the SFDR regulation of the European

Union

10

Including

JV: €234bn in assets, +€12bn net inflows

over 9 months and +€1bn in Q3

11 50%

MSCI World + 50% Eurostoxx 600 composite index for equity markets,

average values over each period considered

12

Bloomberg

Euro Aggregate for bond markets, average values over each reporting

period

13

Source:

Morningstar FundFile, ETFGI. European & cross-border open-ended

funds (excluding mandates and dedicated funds). Data as of the end

of June 2024.

14

Assets

under management and flows including assets under

advisory, marketed assets and funds of funds, and

taking into account 100% of Asian JV’s assets and

flows; for Wafa Gestion in Morocco, they

are reported in proportion to Amundi's

holding in the capital of the JV

15

Anniversary

dates of the funds triggering the recognition of these

fees

16

Source:

Morningstar Direct, Broadridge FundFile - Open-ended funds and

ETFs, global fund scope, September 2024; as a percentage of the

assets under management of the funds in question; the number of

Amundi open-ended funds rated by Morningstar was 1063 at the end of

September 2024. © 2024 Morningstar, all rights reserved

17

Assets

under management and flows including assets under

advisory, marketed assets and funds of funds, and

taking into account 100% of Asian JV’s assets and

flows; for Wafa Gestion in Morocco, they

are reported in proportion to Amundi's

holding in the capital of the JV

18

Lyxor,

integrated as of 31/12/2021

19

Assets

under management and flows including assets under

advisory, marketed assets and funds of funds, and

taking into account 100% of Asian JV’s assets and

flows; for Wafa Gestion in Morocco, they

are reported in proportion to Amundi's

holding in the capital of the JV; as of

01/01/2024, reclassification of short-term bond strategies (€30

billion in outstandings) as Bonds previously classified as Treasury

until that date; Outstanding amounts up to that date have not been

reclassified in these tables

20

See

also the section 4.3 of the 2023 Universal

Registration Document filed with the AMF on April 18, 2024

21 Source: IPE "Top 500 Asset Managers"

published in June 2024, based on assets under management as at

31/12/2023

22 Amundi data at 30/09/2024

23 Boston, Dublin, London, Milan, Paris and

Tokyo

- Amundi PR results Q3&9M 2024

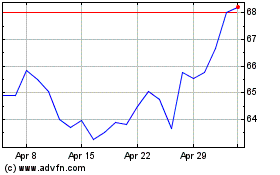

Amundi (EU:AMUN)

Historical Stock Chart

From Dec 2024 to Jan 2025

Amundi (EU:AMUN)

Historical Stock Chart

From Jan 2024 to Jan 2025