Cabka announces 30 May 2024 AGM Agenda

Amsterdam 18 April 2024.

Cabka N.V. (together with its subsidiaries “Cabka”, or the

“Company”), a company specialized in transforming hard to recycle

plastic waste into innovative Reusable Transport Packaging (RTP),

listed at Euronext Amsterdam, invites its shareholders to attend

the Company's annual general meeting (the “General Meeting”), to be

held on Thursday 30 May 2024 at 14.00 CEST.

The Company looks forward to welcoming

its shareholders in-person at Crown Plaza Amsterdam South, Room

“Times Square”, George Gershwinlaan 101, 1082 MT Amsterdam, the

Netherlands. Registration for admission to the General Meeting

starts at 13:00 CEST. The language of the General Meeting shall be

English.

AGENDA

1. Opening

2. Financial year 2023

(a) report of the management

board for the financial year 2023

(b)

remuneration report for the management board and supervisory

board for the financial year 2023 (advisory voting item)

(c) adoption of the company and

consolidated financial statements for the financial year 2023

including appropriation of the net result for the financial year

2023 (voting item)

(d) distribution in relation to

the financial year 2023 and related amendments of the articles of

association (voting item)

3. Discharge

(a) discharge of the managing

directors for the financial year 2023 (voting item)

(b) discharge of the supervisory

directors for the financial year 2023 (voting item)

4. Reappointment of the external auditor

for the financial year 2024 (voting item)

5. Amendment articles of association

(voting item)

6. Authorization of the management

board, subject to approval of the supervisory board, to repurchase

ordinary shares (voting item)

7. Designation of the management board,

subject to approval of the supervisory board, as the competent body

to (i) issue ordinary shares and (ii) restrict or exclude

pre-emptive rights upon issuance of ordinary shares (voting

item)

8. Business update

9. Any other business

10. Closing

EXPLANATORY NOTES TO THE AGENDA

Agenda item 2(a): Report of the

management board for the financial year 2023

Presentation by the management board on the

performance of the Company in 2023 and discussion of the annual

report of the management board drawn up in the English language,

which is included in the 2023 annual report (which can be found on

our website:

https://investors.cabka.com/reporting-and-investor-library/reports-and-presentation).

Agenda item 2(b): Remuneration report

for the management board and supervisory board for the financial

year 2023 (advisory voting item)

In accordance with section 2:135b paragraph 2

Dutch Civil Code annually the remuneration report will be tabled to

the General Meeting for an advisory vote. The remuneration report

reports on the implementation and execution of the remuneration

policies of the management board and supervisory board (the

remuneration policy (which remuneration policy contains both

policies) during the financial year 2023, can be found on our

website:

https://investors.cabka.com/corporate-governance/remuneration). The

remuneration report is included on pages 83 – 90 of the 2023 annual

report. Shareholders are requested to vote in favor of this

remuneration report.

Agenda item 2(c): Adoption of the

company and consolidated financial statements for the financial

year 2023 including appropriation of the net result for the

financial year 2023 (voting item)

It is proposed to adopt the company and

consolidated financial statements for the financial year 2023 as

prepared by the management board and included in the 2023 annual

report. The financial statements have been drawn up in the English

language and the audit has been performed by BDO Audit &

Assurance B.V.

The company financial statements for the

financial year 2023 present a net loss of EUR 1,375,000.00. By

adopting the company financial statements it is also resolved to

allocate the net loss for the financial year 2023 to the

accumulated deficits.

Agenda item 2(d): Distribution in

relation to the financial year 2023 and related amendments of the

articles of association (voting item)

As announced in the press release on 19 March

2024 and in accordance with the Company’s articles of association

it is proposed by the management board, with the approval of the

supervisory board, to distribute to the holders of ordinary shares

a total amount of EUR 0.15 per ordinary share in cash in the form

of a repayment of capital. This implies a resolution to formally

reduce the capital of the Company (kapitaalvermindering) to be

effectuated after the conclusion of a formal capital reduction

process including a two-month opposition period for creditors

(crediteurenverzet).

To be able to make a distribution in the form of

repaid capital, two subsequent changes to the current articles of

association of the Company have to be made, by first increasing the

nominal value of the shares with EUR 0.15, thus increasing the

issued share capital of the Company at the charge of the share

premium reserve recognized for Dutch tax purposes and secondly by

decreasing the nominal value of the shares back to the current

nominal value, thus decreasing the issued share capital of the

Company, which decrease of the nominal value of the ordinary shares

is paid to the shareholders for the repaid capital part of the

distribution and which decrease of the nominal value of the special

shares will be allocated to the general share premium reserve

(algemene agioreserve) of the Company. Reference is made to the

texts of the proposals to amend the articles of association in

English and Dutch, which can be found on the website.

Consequently, the proposal consists of three

parts:

- The proposal to

make a distribution as set out above;

- The proposal

to, with approval of the supervisory board, amend the articles of

association of the Company by an increase of the nominal value of

the shares from EUR 0.01 to EUR 0.16, thus increasing the issued

share capital of the Company at the charge of the share premium

reserve recognized for Dutch tax purposes; and

- The proposal

to, with approval of the supervisory board, amend the articles of

association of the Company by a decrease of the nominal value of

the shares from EUR 0.16 to the current nominal value of EUR 0.01,

thus decreasing the issued share capital of the Company, which

decrease of the nominal value of the ordinary shares is paid to the

shareholders for the repaid capital part of the distribution and

which decrease of the nominal value of the special shares will be

allocated to the general share premium reserve (algemene

agioreserve) of the Company.

The proposal to amend the articles of

association of the Company also includes authorizing any and all

managing directors of the Company, supervisory directors of the

Company and the company secretary as well as any and all lawyers

and paralegals practicing with Zuidbroek B.V., each individually,

to have the deeds of amendment to the articles of association

executed.

If the above distribution is resolved upon, the

ordinary shares will be traded ‘ex-dividend’ as of Thursday 8

August 2024. The ‘record date’ will be Friday 9 August 2024. The

distribution will be payable as of Friday 16 August 2024.

Planning distribution

|

8 August 2024 |

Ex-dividend before opening of business |

|

9 August 2024 |

Record date dividend at close of business |

|

16 August 2024 |

Payment date capital repayment |

Agenda item 3(a): Discharge of the

managing directors for the financial year 2023 (voting

item)

It is proposed to discharge all managing

directors in office in the financial year 2023 from all liability

in relation to the exercise of their duties in the financial year

2023, to the extent such performance is apparent from the financial

statements for the financial year 2023 or other public disclosures

prior to the adoption of these financial statements.

Agenda item 3(b): Discharge of the

supervisory directors for the financial year 2023 (voting

item)

It is proposed to discharge all supervisory

directors in office in the financial year 2023 from all liability

in relation to the exercise of their duties in the financial year

2023, to the extent such performance is apparent from the financial

statements for the financial year 2023 or other public disclosures

prior to the adoption of these financial statements.

Agenda item 4: Reappointment of the

external auditor for the financial year 2024 (voting

item)

The supervisory board, together with the audit

committee, has assessed the relationship with and performance of

the external auditor. Based on this assessment, it is proposed by

the supervisory board, upon recommendation of the audit committee,

to reappoint BDO Audit & Assurance B.V. as the external auditor

of the Company for the financial year 2024. The audit will be

carried out under the responsibility of Mr. Jeroen van Erve, audit

partner at BDO Audit & Assurance B.V.

Agenda item 5: Amendment articles of

association (voting item)

It is proposed to, with the approval of the

supervisory board, amend the articles of association to reflect

that if the management board consists of two or more members, any

managing director acting solely shall also be authorised to

represent the Company instead of any two managing directors acting

jointly.

The proposal to amend the articles of

association of the Company also includes authorizing any and all

managing directors of the Company, supervisory directors of the

Company and the company secretary as well as any and all lawyers

and paralegals practicing with Zuidbroek B.V., each individually,

to have the deed of amendment to the articles of association

executed.

Agenda item 6: Authorization of the

management board, subject to approval of the supervisory board, to

repurchase ordinary shares (voting item)

It is proposed to authorize the management

board, for a period of 18 months from the date of this General

Meeting (i.e., until and including 30 November 2025), to acquire

ordinary shares in the share capital of the Company with due

observance of the applicable statutory provisions, and subject to

the approval of the supervisory board.

This authorization concerns up to the statutory

maximum amount of 50% of the issued share capital as it reads now

or as it will read in the future. The purpose of this proposal is

to enable the management board to repurchase ordinary shares in the

Company’s share capital in order to cover obligations under

share-based compensation plans, or for other purposes.

Under the authorization, an ordinary share may

be repurchased at the stock exchange or otherwise, at a price

between the nominal value of the ordinary shares and 110% of the

average closing price of the ordinary shares on Euronext

Amsterdam’s stock exchange over a period of five (5) days preceding

the day of the acquisition of the ordinary shares.

If and when this authorization is approved, the

authorization granted by the general meeting on 8 June 2023 will no

longer be utilized.

Agenda item 7: Designation of the

management board, subject to approval of the supervisory board, as

the competent body to (i) issue ordinary shares and (ii) restrict

or exclude pre-emptive rights upon issuance of ordinary shares

(voting item)

It is proposed to designate the management

board, subject to the approval of the supervisory board, as the

competent body (i) to issue ordinary shares or grant rights to

acquire ordinary shares in the share capital of the Company, with

due observance of the applicable statutory provisions and (ii) to

restrict or exclude pre-emptive rights of existing shareholders

upon the issue of ordinary shares or the granting of rights to

subscribe for ordinary shares, such for a period of 18 months from

the date of this General Meeting (i.e, until and including 30

November 2025).

The number of ordinary shares to be issued is

limited to a maximum of 10% of the issued share capital of the

Company as per the date of this General Meeting.

The authority to issue ordinary shares or grant

rights to acquire ordinary shares is granted for general purposes,

including the issue of ordinary shares in respect of distributions

in kind, a share-based compensation plan for employees and managing

directors of the Company as well to react in a timely and flexible

manner in the context of mergers, acquisitions and/or (strategic)

alliances and to provide the possibility to react in a timely and

flexible manner in respect of the financing of the Company.

If and when this authorization is approved, the

current authorization granted by the general meeting on 8 June 2023

will no longer be utilized.

Agenda item 8: Business

update

Mr. Tim Litjens, CEO of the Company, will give

an update of the Company’s business during the financial year

2023.

Agenda item 9: Any other

business

Under this agenda item the General Meeting will

be invited to ask remaining questions.

AVAILABILITY OF MEETING DOCUMENTS

The agenda with explanatory notes, the 2023 annual report (which

contains the 2023 company and consolidated financial statements and

the information as meant in section 2:392 paragraph 1 Dutch Civil

Code) are made available on

https://investors.cabka.com/corporate-governance/shareholder-meetings.

These documents are also made available by ABN AMRO Bank N.V.

("ABN AMRO") and can be downloaded from

www.abnamro.com/evoting, and are available for review by

shareholders (by appointment through IR@cabka.com) at the office of

the Company.

RECORD DATE

The management board of the Company has determined that for this

meeting the persons who will be considered as entitled to attend

the meeting, are those holders of shares who on Thursday 2 May

2024, after close of trading on Euronext Amsterdam (the

"Record Date"), hold those rights and are

registered as such in one of the following (sub)registers:

- for holders of

deposit shares: the administrations of the banks and brokers which

are intermediaries according to the Dutch Securities Giro

Transactions Act (Wet giraal effectenverkeer);

- for holders of

non-deposit shares: the shareholders’ register of the Company.

REGISTRATION TO VOTE

Shareholders are entitled to vote up to the total number of

shares that they held at the close of trading at the Record Date,

provided they have registered their shares timely.

Upon registration via ABN AMRO (via www.abnamro.com/evoting)

shareholders will be requested to specify if they will attend the

meeting in-person. Alternatively, shareholders may also grant a

proxy to vote as referred to below.

A holder of deposit shares (electronic

securities) who wishes to attend the meeting in-person

must register with ABN AMRO (via www.abnamro.com/evoting) as of the

Record Date and no later than Thursday 23 May 2024, 17:00 CEST. A

confirmation by the intermediary in which administration the holder

is registered for the deposit shares (the

"Intermediary") must be submitted to ABN AMRO (via

www.abnamro.com/intermediary), stating that such shares were

registered in his/her name at the Record Date. This confirmation

should be provided by the Intermediary to ABN AMRO no later than

Friday 24 May 2024, 13:00 CEST. With this confirmation,

Intermediaries are furthermore requested to include the full

address details of the relevant holder in order to be able to

verify the shareholding on the Record Date in an efficient manner.

The receipt (of registration) to be supplied by ABN AMRO will serve

as admission ticket to the meeting for those attending the meeting

in-person.

A holder of non-deposit shares who wishes to

attend the meeting must register no later than Thursday 23 May

2024, 17:00 CEST, in the manner as set out in the letter of

notification.

VOTING BY PROXY

Without prejudice to the obligation to register for the meeting,

the right to attend and to vote at the meeting may be exercised by

a holder of a written proxy. A form of a written proxy is available

free of charge in the manner set out under "Availability of meeting

documents" above. The written proxy must be received by the Company

no later than on Thursday 23 May 2024, 17:00 CEST. A copy of the

proxy will need to be presented at the registration for admission

to the meeting.

The proxy to represent a shareholder that includes a voting

instruction may (but needs not) be granted electronically to B.J.

Kuck, civil-law notary in Amsterdam, or his deputy, via

www.abnamro.com/evoting no later than Thursday 23 May 2024, 17:00

CEST. The Intermediaries must submit to ABN AMRO a confirmation

including the number of shares notified for registration and held

by that shareholder at the Record Date. This confirmation should be

provided by the Intermediary to ABN AMRO no later than Friday 24

May 2024, 13:00 CEST.

If you intend to instruct your Intermediary for any of the

above, please be aware that their deadlines could be a number of

days before those mentioned above. Please check with the individual

Intermediaries as to their cut-off dates.

REGISTRATION AND IDENTIFICATION AT THE

MEETING

Registration for admission to the meeting will take place from

13:00 CEST until the commencement of the meeting at 14:00 CEST.

After this time registration is no longer possible. Persons

entitled to attend the meeting may be asked for identification

prior to being admitted by means of a valid identity document, such

as a passport or driver’s license.

ISSUED CAPITAL AND VOTING

RIGHTS

At the start of trading on Euronext Amsterdam on

the date of this notice, the Company's total issued share capital

amounted to 40,802,756 shares, which shares comprise a total number

of voting rights of 40,802,756. Of these shares an amount of

15,994,378 shares are held in treasury.

For further information, please see the

Company's website https://cabka.com/newsroom/ or contact us by

email at IR@cabka.com.

The supervisory board

The management board

Amsterdam, 18 April 2024

Financial Calendar 2024

|

|

Record Date for Annual General Meeting |

|

|

Annual General Meeting of Shareholders |

|

|

Ex-Dividend* Date |

|

|

Dividend* Record Date |

|

|

Half-Year Results and Half-Year Report 2024 |

|

|

Dividend* Payment Date |

|

|

Trading Update Q3 2024 |

* Reference to ‘dividend’ refers to proposed

distribution

For more information, please

contact:Nadia Lubbe, Investor & Press

contactIR@cabka.com, or n.lubbe@cabka.com;+49 152 243 254

79www.investors.cabka.comCommercial contact: info@cabka.com

www.cabka.com

About CabkaCabka is in the

business of recycling plastics from post-consumer and

post-industrial waste into innovative reusable transport packaging

(RTP), like pallets- and large container solutions enhancing

logistics chain sustainability. ECO product are mainly construction

and road safety products produced exclusively out of post-consumer

waste.

Cabka is leading the industry in its integrated

approach closing the loop from waste, to recycling, to

manufacturing. Backed by its own innovation center it has the rare

industry knowledge, capability, and capacity of making maximum use

bringing recycled plastics back in the production loop at

attractive returns. Cabka is fully equipped to exploit the full

value chain from waste to end-products.

Cabka is listed at Euronext Amsterdam as of 1

March 2022 under the CABKA ticker with international securities

identification number NL00150000S7.

DisclaimerThe content of this

press release may include statements that are, or may be deemed to

be, ‘’forward-looking statements’’. These forward-looking

statements may be identified by the use of forward-looking

terminology, including the terms ‘’believes’’, ‘’estimates’’,

‘’plans’’, ‘’projects’’, ‘’anticipates’’, ‘’expects’’, ‘’intends’’,

‘’may’’, ‘’will’’ or ‘’should’’ or, in each case, their negative or

other variations or comparable terminology, or by discussions of

strategy, plans, objectives, goals, future events or intentions.

Forward-looking statements may and often do differ materially from

actual results. Any forward-looking statements reflect the

Company’s current view with respect to future events and are

subject to risks relating to future events and other risks,

uncertainties and assumptions relating to the Company’s business,

results of operations, financial position, liquidity, prospects,

growth, or strategies.

Readers are cautioned that any forward-looking

statements are not guarantees of future performance. Given these

uncertainties, the reader is advised not to place any undue

reliance on such forward-looking statements. These forward-looking

statements speak only as of the date of publication of this press

release. The Company undertakes no obligation to publicly update or

revise the information in this press release, including any

forward-looking statements, except as may be required by law.

This document contains information that may

qualify as inside information within the meaning of Article 7(1) of

Regulation (EU) No 596/2014 on market abuse.

- 20240418_Cabka announces 30 May 2024 AGM agenda

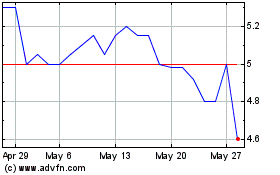

Cabka NV (EU:CABKA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Cabka NV (EU:CABKA)

Historical Stock Chart

From Nov 2023 to Nov 2024