Cabka 2024 Half Year: Major improvement in operating margins, but

sales behind last year

PRESS RELEASE

Online investor presentation and Q&A

at 10.30 CET on 13 August 2024 via:

https://channel.royalcast.com/landingpage/cabka/20240813_1/

Amsterdam, Netherlands - 13 August

2024 - Cabka N.V. (together with its

subsidiaries “Cabka”, or the “Company”), a company specialized in

transforming hard to recycle plastic waste into innovative Reusable

Transport Packaging (RTP), listed at Euronext Amsterdam, today

reports its non-audited 2024 Half Year results.

Highlights 2024 Half Year

- Sales of € 92.3 million 11% lower than prior

year (2023HY: €104.3 million), fully driven by softer demand and

lower prices in Q1, whilst Q2 sales remained stable versus last

year. In Europe, Portfolio sales grew at a record of 13%, whilst

Customised Solutions increased with 7% YoY. Continued soft market

demand in our Contract Manufacturing business, resulted in a

decline of €9.4 million (-53%) YoY.

In the US, our Portfolio business grew with 13.8% as a result of

our new sales strategy. However, our US Customised Solutions

business noted a significant decline of € 10.4 million, where key

customers deliberately restricted CAPEX spending.

- Gross profit from

operations at € 46.6 million (2023HY: € 48.51

million) representing a major improved margin of 4pp to 50.5% over

sales compared to last year (2023HY: 46.5%1).

- Net result

amounted to € -1.9 million, entirely driven by the lower sales

performance in Q1 (2023HY: € 0.8 million)

- Net Working

Capital in control at € 38.6 million or 20.0% of

sales.

- CAPEX of € 9.3

million (2023HY: €12.9 million), including maintenance &

replacement investments of € 4.6 million, 5% of sales.

- Raw material

intake amounted to 86%, which is substantially above the

average recycling rate for plastic packaging waste in the EU of

41%2, and above the overall plastic waste recycling rate

of only 14%3

- Alexander Masharov appointed CEO at

Extraordinary General Meeting of Shareholders on 1 August

2024.

Cabka CEO Alexander Masharov,

commented:

“Since my start at Cabka, I’ve seen a

company built on a strong foundation with a dedicated team of

people that has demonstrated resilience and innovation under

challenging market conditions. As 2024 commenced, we anticipated a

gradual start, with Q1 sales significantly impacted by the lower

demand in some of our end markets and intentional price reductions

we implemented in our customer pricing strategy.

Our Q2 sales is in line with our earlier

projections, with Quarter-on-Quarter sales showing a recovery of 9%

from the very slow first quarter. Despite our end markets being

impacted by persistent inflation and ongoing geopolitical issues,

we have seen our order intake progressively increase in most of our

strategic segments.

In Europe, our Portfolio business

demonstrated record growth of 12.8%, whilst our EU Customized

Solutions business remained resilient to market conditions,

resulting in 6.6% growth year-on-year. Weak market demand however

persisted in our Contract Manufacturing sales segment, with a €9.4

million decline compared to H1 2023.

In North America, our portfolio business

performed very well with a notable 13.8% increase as our concerted

efforts to win new customer deals started to bear fruits. However,

challenging market conditions continue to severely impact our

customized solutions segment with key customers not committing to

any further capex spend for the time being, resulting in a €10.4

million decline versus H1 2023.

Gross margin significantly improved compared

to prior year with 4pp, as we continue to focus on our internal

production capacities and strategic cost management across all our

segments. Our fixed cost base remained relatively stable, despite

inflationary pressure. The lower sales, however, led to a

deterioration of our operational EBITDA. Our focus within the

organisation will be on additional cost saving initiatives to

further enhance our operational efficiencies and boost our sales

organisation. Although the half year EBITDA margin of 11.3% is not

at our guidance level, we remain confident that our full year

margin will recover to the 13-15% range.

Looking ahead for the remainder of the year,

we expect customer demand in some of our end markets to remain

muted, whilst other segments will continue to grow. As we continue

to navigate these challenging market circumstances with agility and

resilience, we consider it prudent to adjust our outlook for the

year. Therefore, we lower our sales guidance to € 180-185 million,

reflecting the slow start of the year.

Together with the leadership team of Cabka,

I will revisit our business strategy. We will remain committed to

our mission of transforming hard to recycle plastic waste into

valuable and innovative RTP solutions. Sustainable growth and value

creation will form the foundation of our Strategy 2030, which we

intend to share in more detail during our planned Capital Markets

Day to be hosted on 25 November 2024 at our Cabka plant in Ieper,

Belgium.”

Condensed bridge from operational to

IFRS consolidated statement of profit and loss, 2024HY

unaudited 4

Condensed income statement bridge

operations to IFRS4 |

|

|

|

|

in € million

|

2024 HY

|

2023 HY

(restated)5

|

Change

|

|

|

|

|

Revenues |

92.3 |

104.3 |

-11% |

|

|

|

|

|

|

|

|

Other operating income items |

1.7 |

0.2 |

645% |

|

|

Total Operating Income |

94.0 |

104.5 |

-10% |

|

|

|

|

|

|

|

|

Expenses for materials, energy and purchased services |

(47.5) |

(56.0) |

-15% |

|

|

Gross Profit from operations |

46.6 |

48.5 |

-4% |

|

|

|

|

|

|

|

|

Operating expenses |

(36.2) |

(35.0) |

3% |

|

|

EBITDA from operations |

10.4 |

13.5 |

-23% |

|

|

|

|

|

|

|

|

Depreciation, amortization and impairment of intangible and

tangible fixed assets |

(9.7) |

(8.0) |

21% |

|

|

EBIT /Operating Income |

0.7 |

5.5 |

-87% |

|

|

|

|

|

|

|

|

Financial results |

(2.0) |

(1.5) |

40% |

|

|

Earnings before taxes |

(1.3) |

4.0 |

-133% |

|

|

|

|

|

|

|

|

Taxes |

(0.6) |

(1.0) |

-37% |

|

|

Net income from operations |

(1.9) |

3.0 |

-165% |

|

|

|

|

|

|

|

|

Non-operational and exceptional

items6 |

0.0 |

(2.2) |

|

|

|

|

|

|

|

|

|

Non-controlling interest |

- |

- |

|

|

|

|

|

|

|

|

|

Net result reported IFRS |

(1.9) |

0.8 |

n.m. |

|

Outlook

Based on the current challenging market conditions, we expect the

US customized solutions and contract manufacturing segments to

remain under pressure, whilst our other strategic segments continue

to perform well. In light of this, we expect sales to be in the

range of € 180-185 million, with a recovery in our EBITDA margin

towards 13-15%, reflecting an estimated EBITDA range of € 23-27

million.

Share price

On 30 June 2024 the Cabka shares closed at € 3.84.

Cabka share capital per

30 June 2024 |

30.06.2024 |

30.06.2023 |

ISIN |

|

Ordinary Shares issued |

24,710,600 |

24,380,213 |

CABKA /

NL00150000S7 |

| Ordinary

Shares in treasury |

15,994,378 |

15,989,978 |

DSC2S /

NL00150002R5 |

| |

|

|

|

| Total

Ordinary Shares |

40,704,978 |

40,370,191 |

|

| Special

Shares |

97,778 |

97,778 |

|

| |

|

|

|

|

Total shares |

40,802,756 |

40,467,969 |

|

Events after June 30, 2024

On 1 August 2024, an Extraordinary General Meeting of Shareholders

confirmed the appointment of Alexander Masharov as Chief Executive

Officer and a member of the Management Board, for a term ending

directly following the Annual General Meeting in 2028.

Proposed distribution

2023FY

The proposed distribution for Full Year 2023 of € 0.15 per share

will be paid on Friday 16 August 2024.

Financial Calendar 2024

|

|

Dividend* Payment Date |

|

|

Trading Update Q3 2024 |

|

|

Capital Markets Day |

|

|

Publication Preliminary Results 2024 |

* Reference to ‘dividend’ refers to proposed

distribution

For more information, please

contact:

Nadia Lubbe, Investor & Press contact

IR@cabka.com, or n.lubbe@cabka.com;

+49 152 243 254 79

www.investors.cabka.com

Commercial contact: info@cabka.com

www.cabka.com

About Cabka

Cabka is in the business of recycling plastics from post-consumer

and post-industrial waste into innovative reusable transport

packaging (RTP), like pallets- and large container solutions

enhancing logistics chain sustainability. ECO product are mainly

construction and road safety products produced exclusively out of

post-consumer waste.

Cabka is leading the industry in its integrated

approach closing the loop from waste, to recycling, to

manufacturing. Backed by its own innovation center it has the rare

industry knowledge, capability, and capacity of making maximum use

bringing recycled plastics back in the production loop at

attractive returns. Cabka is fully equipped to exploit the full

value chain from waste to end-products.

Cabka is listed at Euronext Amsterdam as of 1

March 2022 under the CABKA ticker with international securities

identification number NL00150000S7.

Disclaimer

All results in the press release are based on regular operations

excluding extraordinary items, unless mentioned otherwise. The

qualification extraordinary item is a management accounting term to

indicate this is not part of regular operations. The financial

statements in the appendix are based on IFRS and do not distinguish

between operational or extraordinary items. See appendix I. for

definitions of operational items by management.

The content of this press release may include

statements that are, or may be deemed to be, ‘’forward-looking

statements’’. These forward-looking statements may be identified by

the use of forward-looking terminology, including the terms

‘’believes’’, ‘’estimates’’, ‘’plans’’, ‘’projects’’,

‘’anticipates’’, ‘’expects’’, ‘’intends’’, ‘’may’’, ‘’will’’ or

‘’should’’ or, in each case, their negative or other variations or

comparable terminology, or by discussions of strategy, plans,

objectives, goals, future events or intentions. Forward-looking

statements may and often do differ materially from actual results.

Any forward-looking statements reflect the Company’s current view

with respect to future events and are subject to risks relating to

future events and other risks, uncertainties and assumptions

relating to the Company’s business, results of operations,

financial position, liquidity, prospects, growth, or

strategies.

Readers are cautioned that any forward-looking

statements are not guarantees of future performance. Given

these uncertainties, the reader is advised not to place any undue

reliance on such forward-looking statements. These forward-looking

statements speak only as of the date of publication of this press

release. The Company undertakes no obligation to publicly update or

revise the information in this press release, including any

forward-looking statements, except as may be required by law.

This document contains information that

qualifies as inside information within the meaning of Article 7(1)

of Regulation (EU) No 596/2014 on market abuse.

1 The presentation of the prior year income statement

of has been adjusted to reflect the new classification of

transportation cost and FX gains and losses. For further

information refer to our Half Year Report 2024.

2 Packaging waste by wate management company statisics

published by eurostat data covering up to 2021.

3 Systemiq April 2022 report Reshaping plastics. Pathway

to a circular climate neutral plastics system in Europe

4 The condensed income statement provides operational

and non-operational result items for insight on underlying

operational performance. The statements in the attached Half Year

Report 2024 provide integral IFRS statements without this

distinction.

5 The presentation of the prior year income statement of

has been adjusted to reflect the new classification of

transportation cost and FX gains and losses. For further

information refer to our Half Year Report 2024.

6 For more information on the non-operational and

exceptional items during the half year, please refer to our Half

Year Report 2024

- 20240813_Cabka 2024HY results PR v5

- 2024HY Report vdef

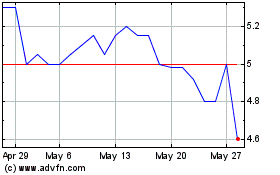

Cabka NV (EU:CABKA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Cabka NV (EU:CABKA)

Historical Stock Chart

From Nov 2023 to Nov 2024