Acquisition by Carmila of a shopping centre in Malaga

25 May 2022 - 1:45AM

Business Wire

Regulatory News:

Carmila (Paris:CARM) has agreed to acquire Rosaleda, a shopping

centre in Malaga, Southern Spain, for EUR 24.6 million including

transfer taxes.

The centre, which is made up of 73 stores attached to a

Carrefour hypermarket, has a Gross Leasable Area of 15 500 sq.m.

and includes two larger stores (Decathlon and Lefties, the fashion

retailer belonging to the Inditex Group). It benefits from a

leading position in its catchment area, a leisure complex with a

cinema and strong footfall, with 5.8 million visitors a year. The

agreed purchase price offers Carmila significant scope for value

creation.

This transaction is part of the asset rotation programme

announced at Carmila's Capital Markets Day in December 2021 and

follows the announcement of an agreement to sell a portfolio of six

assets in France. The acquisition is an opportunity for Carmila to

put to further use its expertise in renovation and improvement of

the merchandising mix in centres of this kind.

Carmila has a portfolio of 78 assets in Spain, valued at EUR

1.4bn, including two shopping centres close to Malaga, one of the

country’s most dynamic cities and a popular tourist

destination.

Marie Cheval, Chair and Chief Executive Officer of Carmila,

commented:

"Carmila has made another step in the roll out of the asset

rotation strategy announced in December 2021. After the agreement

to sell a portfolio of six mature assets in France, Carmila is

acquiring, on favourable terms, a high-potential shopping centre in

Malaga in Spain."

INVESTOR AGENDA

25 May 2022: Dividend payment date 27 July 2022 (after

trading): H1 2022 Results

ABOUT CARMILA

The third-largest listed owner of commercial property in

continental Europe, Carmila was founded by Carrefour and large

institutional investors in order to transform and enhance the value

of shopping centres adjoining Carrefour hypermarkets in France,

Spain and Italy. At 31 December 2021, its portfolio was valued at

€6.21 billion, comprising 214 shopping centres, all leaders in

their catchment areas.

Carmila is listed on Euronext-Paris Compartment A under the

symbol CARM. It benefits from the tax regime for French real estate

investment trusts (“SIIC”).

IMPORTANT NOTICE

Some of the statements contained in this document are not

historical facts but rather statements of future expectations,

estimates and other forward-looking statements based on

management's beliefs. These statements reflect such views and

assumptions prevailing as of the date of the statements and involve

known and unknown risks and uncertainties that could cause future

results, performance or events to differ materially from those

expressed or implied in such statements. Please refer to the most

recent Universal Registration Document filed in French by Carmila

with the Autorité des marchés financiers for additional information

in relation to such factors, risks and uncertainties. Carmila has

no intention and is under no obligation to update or review the

forward-looking statements referred to above. Consequently, Carmila

accepts no liability for any consequences arising from the use of

any of the above statements.

This press release is available in the

“Financial Press Releases” section of Carmila’s Finance webpage:

https://www.carmila.com/en/finance/financial-press-releases

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220524005883/en/

INVESTOR AND ANALYST CONTACT Jonathan Kirk – Head of

Investor Relations jonathan_kirk@carmila.com +33 6 31 71 83 98

PRESS CONTACT Kenza Kanache – Marie-Antoinette agency

kenza@marie-antoinette.fr +33 6 35 47 82 08

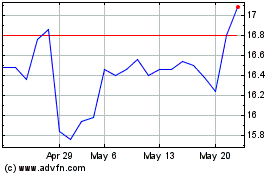

Carrefour Property Devel... (EU:CARM)

Historical Stock Chart

From Mar 2025 to Apr 2025

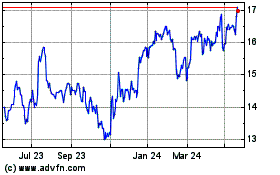

Carrefour Property Devel... (EU:CARM)

Historical Stock Chart

From Apr 2024 to Apr 2025