Coface SA : Coface records year-to-date net income of €207.7m, up

9.5%. Annualised ROATE at 14.8%

Coface records year-to-date net income of

€207.7m,

up 9.5%. Annualised ROATE at 14.8%

Paris, 5 November 2024 –

17.35

- Turnover: €1,376.6m, down

-2.1% at constant FX and perimeter

- Insurance revenue decreased by

-4.0% at constant FX with continued subdued client activity

contribution

- In Q3-24, total revenue stabilised

at -0.1% with other services up +6.0%

- Client retention is still high at

92.7% but down from 2023 records; pricing is down by -1.4%, in line

with historical trends

- Business Information once again

recorded double-digit growth (+17.2% at constant FX); factoring

down by -3.6% on the back of slow industrial activity in

Germany

- Net loss ratio at 35.5%,

improved by 4.8 ppts; net combined ratio at 64.4%, improved by

1.6 ppt

- Gross loss ratio at 32.9%, improved

by 5.9 ppts with high opening year reserving and high reserve

releases

- Net cost ratio increased by

3.2 ppts at 28.9%, reflecting lower revenues and continued

investments

- Net income (group share) at

€207.7m, of which €65.4m in Q3-24 and annualised

RoATE1 at

14.8%

Unless otherwise indicated, change comparisons

refer to the results as at 30 September 2023

Xavier Durand, Coface’s Chief Executive

Officer, commented:

“After several quarters of lower revenues due to lower

inflation and a slow economy, especially in Europe, the third

quarter turnover stabilized. Despite a moderate decline of -1.3%,

credit insurance recorded a positive net production.

Information services sales recorded another

quarter of double-digit growth and have increased +17.2%

year-to-date. Debt collection services rose +18.9% from a still low

base. These activities, which are structurally profitable, are

strategic for Coface and benefit from our continued

investments.

Our combined ratio remains excellent at

64.4% thanks to sound risk management, and despite a slow and

steady rise in the number of losses recorded by Coface in a context

of higher business failures. The period of high inflation has left

its mark on the weakest companies, and a number of cyclical sectors

– especially automotive – are continuing to suffer. This

deteriorated risk environment is expected to continue, despite the

recent rate cuts implemented by central banks.

Our financial income is improving and has

not been affected by negative mark to market movements.

Finally, our net income rose by 9% to €207.7m, which translates

into a return on average tangible equity of 14.8%, well above our

mid-cycle targets.”

Key figures at 30 September

2024

The Board of Directors

of COFACE SA examined the consolidated financial statements at 30

September 2024 at its meeting of 5 November 2024. The Audit

Committee at its meeting on 4 November 2024 also previously

reviewed them.

| Income

statement items in €m |

9M-23 |

9M-24 |

Variation |

% ex. FX* |

|

Insurance revenue |

1,187.8 |

1,130.2 |

(4.9)% |

(4.0)% |

| Other

revenues |

230.0 |

246.4 |

+7.1% |

+7.3% |

|

REVENUE |

1,417.8 |

1,376.6 |

(2.9)% |

(2.1)% |

|

UNDERWRITING INCOME/LOSS AFTER REINSURANCE |

290.0 |

283.8 |

(2.1)% |

(0.8)% |

| Investment

income, net of management expenses, excluding finance costs |

14.5 |

59.8 |

+313.3% |

+273.2% |

|

Insurance Finance Expenses |

(30.1) |

(25.4) |

(15.6)% |

(8.5)% |

|

CURRENT OPERATING INCOME |

274.4 |

318.2 |

+16.0% |

+14.5% |

| Other operating

income / expenses |

(0.9) |

(3.1) |

+227.0% |

+234.5% |

|

OPERATING INCOME |

273.4 |

315.1 |

+15.2% |

+13.7% |

|

NET INCOME (GROUP SHARE) |

189.7 |

207.7 |

+9.5% |

+6.7% |

| |

|

|

|

|

| Key

ratios |

9M-23 |

9M-24 |

Variation |

|

Loss ratio net of reinsurance |

40.2% |

35.5% |

(4.8) |

ppts |

|

Cost ratio net of reinsurance |

25.7% |

28.9% |

+3.2 |

ppt |

|

COMBINED RATIO NET OF REINSURANCE |

66.0% |

64.4% |

(1.6) |

ppts |

| |

|

|

|

|

| Balance

sheet items in €m |

FY-23 |

9M-24 |

Variation |

|

Total Equity (group share) |

2,050.8 |

2,106.0 |

+2.7% |

* Also excludes scope impact

1. Turnover

In the first nine months of the year, Coface

recorded a consolidated turnover of €1,376.6m, down -2.1% at

constant perimeter and FX compared to 9M-23. As reported (at

current FX and perimeter), turnover was

down -2.9%.

Revenues from insurance activities (including

bonding and Single Risk) were down by -4.0% at constant FX and

perimeter due to a decline in inflation and the absence of a

rebound in client activities, against a still fragile economic

backdrop. Client retention remains high at 92.7% (but down from the

record level of 9M-23), in a competitive market where Coface

implemented risk mitigation plans. Buoyed by an increase in demand

and the positive effects of investments for growth, new business

rose to €96m, up €7m compared to 9M-23.

Client activities have edged up 0.1%

year-to-date. The price effect remained negative at -1.4% in 9M-24,

in line with long-term trends.

Turnover from non-insurance activities was up

+7.3% compared to 9M-23. Factoring turnover fell -3.6% amid a weak

manufacturing sector, especially in Germany. Information services

turnover rose +17.2%. Fee and commission income (debt collection

commissions) increased by +18.9%, from a low base, due to the

increase in claims to be collected. Commissions were up +8.3%.

Total revenue - in €m

(by country of invoicing) |

9M-23 |

9M-24 |

Variation |

% ex. FX* |

|

Northern Europe |

291.3 |

271.8 |

(6.7)% |

(6.7)% |

|

Western Europe |

289.8 |

288.4 |

(0.5)% |

(3.1)% |

|

Central & Eastern Europe |

132.1 |

130.0 |

(1.6)% |

(3.5)% |

|

Mediterranean & Africa |

398.7 |

403.4 |

+1.2% |

+4.9% |

|

North America |

128.4 |

132.5 |

+3.2% |

(6.5)% |

|

Latin America |

76.5 |

58.1 |

(24.0)% |

+2.3% |

| Asia

Pacific |

101.0 |

92.3 |

(8.6)% |

(8.0)% |

|

Total Group |

1,417.8 |

1,376.6 |

(2.9)% |

(2.1)% |

In Northern Europe, turnover was down by -6.7%

at constant and current FX. The region was hit by a slowdown in

client activities and the selective non-renewal of some loss-making

policies. This decline was partially offset by the growth in

adjacent activities. Factoring turnover fell -3.6% amid a weak

manufacturing sector.

In Western Europe, turnover was down by -3.1% at

constant FX (-0.5% at current FX due to the integration of Maghreb,

West and Central Africa). The slowdown in client activities was

partially offset by the rise in information sales (services up

+24.8%).

In Central and Eastern Europe, turnover fell

-3.5% at constant FX (-1.6% at current FX) due to the decline in

client activities, which weighed on credit insurance. Factoring was

down -3.8% at constant exchange rates.

In the Mediterranean and Africa region, which is

driven by Italy and Spain, turnover rose +4.9% at constant FX and

+1.2% at current FX on the back of robust sales in credit insurance

and services as well as a stronger economic environment.

In North America, turnover was down -6.5% at

constant FX but increased by +3.2% at current FX due to the

integration of Mexico in this scope. The region saw a slowdown in

client activities despite higher retention.

In Latin America, turnover rose +2.3% at

constant FX but fell -24.0% at current FX. The region saw client

activity stabilise after several quarters of decline, mainly in

commodities and metals. However, the transfer of Mexico to the

North America region had a negative impact.

In Asia-Pacific, turnover decreased by -8.0% at

constant FX and -8.6% at current FX. This lower turnover was due to

a slowdown in client activities that robust sales were unable to

offset.

2. Result

The combined ratio net of reinsurance was 64.4%

in 9M-24, an improvement of 1.6 ppt year on year.

(i) Loss ratio

The gross loss ratio stood at 32.9%, a 5.9 ppts

improvement on the first half of the previous year. This

improvement reflects the gradual normalisation of the loss

experience, offset by high reserve releases. The number of

mid-sized claims increased.

The Group’s provisioning policy remained

unchanged. The amount of provisions related to the current

underwriting year, although discounted, remained in line with the

historical average. Strict management of past claims enabled the

Group to record 45.3 ppts of recoveries.

The net loss ratio improved by 4.8 ppts compared

to 9M-23, to 35.5%.

(ii) Cost ratio

Coface is pursuing a strict cost management

policy but is continuing to invest, in line with the Power the Core

strategic plan. Over the first nine months of 2024, costs rose by

+5.4% at constant FX and perimeter, and by +5.0% at current FX.

The cost ratio before reinsurance was 32.9%, up

2.4 ppts year on year. This rise was mainly due to the decline

in revenues (1.6 ppt), embedded cost inflation (2.2 ppts)

and ongoing investments (1.7 ppt). In contrast, the improved

product mix (information services, debt collection and fee and

commission income) had a positive effect. High reinsurance

commissions explain the remainder of the variation.

Net financial income was +€59.8m over the first

nine months of the year. This figure includes capital gains of

+€11.7m, which more than offset negative market value adjustments

on investments of -€3.4m. The FX effect remained negative at

-€10.0m and was primarily due to the euro’s rise against most of

the group’s other operating currencies.

The portfolio’s current yield (i.e. excluding

capital gains, depreciation and FX) was €70.9m. The accounting

yield2, excluding capital gains and fair value effect,

was 2.2% for 9M-24. The yield on new investments made year-to-date

was 4.3%.

Insurance Finance Expenses (IFE) stood at €25.4m

(€30.1m for 9M-23) due to lower discount rates and higher loss

reserves.

- Operating income

and net income

Operating income amounted to €315.1m in 9M-24,

up +15.2%.

The effective tax rate was 27% over the first

nine months of the year (vs. 24% for 9M-23). Coface does not

currently expect France’s draft budget to have a major impact.

In total, net income (group share) was €207.7m,

up +9.5% compared to 9M-23.

3. Shareholders’

equity

At 30 September 2024, Group shareholders’ equity

stood at €2,106.0m, up €52.2m or +2.7% (€2,050.8m at 31 December

2023).

These changes are mainly due to the positive net

income of €207.7m and the dividend payment of -€194.3m. Other items

such as changes in unrealised capital gains had only a minor

impact.

The annualised return on average tangible equity

(RoATE) was 14.8% at 30 September 2024, mainly due to the

improvement in financial income.

4. Outlook

The global economic recovery is a mixed picture.

Economic strength in the United States continues to surprise to the

upside and appears conducive to a soft landing. Meanwhile, Europe

is contending with much uncertainty, especially in the

manufacturing sector. Major investment efforts in the transition to

electric vehicles are coming up against modest demand and

competition from Chinese vehicles.

The Chinese authorities finally announced

stimulus measures, which efficiency remains to be proven. Other

emerging markets, led by the Gulf states and South America, are

expected to drive growth in 2025.

Central banks believe that inflation is now

under control and have started a cycle of rate cuts, albeit

somewhat belatedly for certain sectors that were hit hard by the

previous cycle of hikes. This more accommodative monetary policy

will run concurrently with fiscal policies that may have to be more

restrictive in certain cases.

Political risk remains higher than ever with

several armed conflicts that have potential to take a turn for the

worse. In France, the fragile balance of power and the need to

shore up public finances is creating an uncertain climate that is

hampering growth.

Finally, voting day in the US presidential

election (and the other ballots) is upon us.

Amid a tighter credit cycle, Coface remains

committed to its strategy of excellence in credit insurance,

drawing on its unique risk infrastructure, and growth in

information and debt collection. These services activities are

especially relevant for corporate clients amid such an unstable

economy. They are also structurally profitable (information gross

margin over 60%) and make up an increasing portion of Coface’s

portfolio of activities.

Conference call for financial

analysts

Coface’s results for the first nine months of

2024 will be discussed with financial analysts during the

conference call on Tuesday 5 November at 18.00 (Paris time). Dial

one of the following numbers:

- By webcast:

Coface 9M-2024 results - Webcast

- By telephone

(for sell-side analysts): Coface 9M-2024 - conference call

The presentation will be available (in English

only) at the following address:

http://www.coface.com/Investors/financial-results-and-reports

Appendices

Quarterly results

| Income

statement items in €m - Quarterly figures |

Q1-23 |

Q2-23 |

Q3-23 |

Q4-23 |

Q1-24 |

Q2-24 |

Q3-24 |

|

% |

% ex. FX* |

|

Insurance revenue |

395.3 |

407.8 |

384.7 |

371.3 |

378.6 |

375.6 |

375.9 |

|

(2.3)% |

(1.3)% |

|

Other revenue |

79.8 |

76.8 |

73.4 |

79.2 |

85.0 |

83.4 |

78.0 |

|

+6.2% |

+6.0% |

|

REVENUE |

475.1 |

484.5 |

458.1 |

450.4 |

463.7 |

459.1 |

453.8 |

|

(0.9)% |

(0.1)% |

|

UNDERWRITING INCOME (LOSS) AFTER REINSURANCE |

95.3 |

103.5 |

91.2 |

105.4 |

100.3 |

94.7 |

88.8 |

|

(2.6)% |

(1.5)% |

Investment income,

net of management expenses |

(2.6) |

4.0 |

13.0 |

(2.0) |

17.9 |

22.8 |

19.0 |

|

+45.7% |

+40.2% |

|

Insurance Finance Expenses |

(2.4) |

(12.3) |

(15.4) |

(9.9) |

(11.4) |

(6.7) |

(7.3) |

|

(52.2)% |

(48.2)% |

|

CURRENT OPERATING INCOME |

90.4 |

95.2 |

88.9 |

93.5 |

106.8 |

110.9 |

100.5 |

|

+13.0% |

+12.6% |

| Other

operating income / expenses |

(0.3) |

(0.4) |

(0.2) |

(4.0) |

(0.1) |

(0.5) |

(2.6) |

|

+1002.6% |

+1024.3% |

|

OPERATING INCOME |

90.0 |

94.8 |

88.6 |

89.5 |

106.8 |

110.4 |

97.9 |

|

+10.4% |

+10.0% |

|

NET INCOME (GROUP SHARE) |

61.2 |

67.7 |

60.9 |

50.8 |

68.4 |

73.8 |

65.4 |

|

+7.5% |

+5.2% |

| Income tax

rate |

25.5% |

21.9% |

24.2% |

36.0% |

27.2% |

26.8% |

25.5% |

|

+1,3 ppt |

|

Cumulated results*

| Income

statement items in €m - Cumulated figures |

Q1-23 |

H1-23 |

9M-23 |

FY-23 |

Q1-24 |

H1-24 |

9M-24 |

|

% |

% ex. FX* |

|

Insurance revenue |

395.3 |

803.1 |

1,187.8 |

1,559.1 |

378.6 |

754.3 |

1,130.2 |

|

(4.9)% |

(4.0)% |

|

Other revenue |

79.8 |

156.6 |

230.0 |

309.2 |

85.0 |

168.5 |

246.4 |

|

+7.1% |

+7.3% |

|

REVENUE |

475.1 |

959.7 |

1,417.8 |

1,868.2 |

463.7 |

922.7 |

1,376.6 |

|

(2.9)% |

(2.1)% |

|

UNDERWRITING INCOME (LOSS) AFTER REINSURANCE |

95.3 |

198.8 |

290.0 |

395.4 |

100.3 |

195.0 |

283.8 |

|

(2.1)% |

(0.8)% |

Investment income,

net of management expenses |

(2.6) |

1.4 |

14.5 |

12.4 |

17.9 |

40.8 |

59.8 |

|

+313.3% |

+273.2% |

|

Insurance Finance Expenses |

(2.4) |

(14.7) |

(30.1) |

(40.0) |

(11.4) |

(18.1) |

(25.4) |

|

(15.6)% |

(8.5)% |

|

CURRENT OPERATING INCOME |

90.4 |

185.5 |

274.4 |

367.9 |

106.8 |

217.7 |

318.2 |

|

+16.0% |

+14.5% |

| Other operating

income / expenses |

(0.3) |

(0.7) |

(0.9) |

(5.0) |

(0.1) |

(0.5) |

(3.1) |

|

+227.0% |

+234.5% |

|

OPERATING INCOME |

90.0 |

184.8 |

273.4 |

362.9 |

106.8 |

217.2 |

315.1 |

|

+15.2% |

+13.7% |

|

NET INCOME (GROUP SHARE) |

61.2 |

128.8 |

189.7 |

240.5 |

68.4 |

142.3 |

207.7 |

|

+9.5% |

+6.7% |

| Income tax

rate |

25.5% |

23.7% |

23.8% |

26.8% |

27.2% |

27.0% |

26.5% |

|

+ 2,7 ppts |

|

* Also excludes scope impact

CONTACTS

ANALYSTS / INVESTORS

Thomas JACQUET: +33 1 49 02 12 58 – thomas.jacquet@coface.com

Rina ANDRIAMIADANTSOA: +33 1 49 02 15 85 –

rina.andriamiadantsoa@coface.com

MEDIA RELATIONS

Saphia GAOUAOUI: +33 1 49 02 14 91 – saphia.gaouaoui@coface.com

Adrien BILLET: +33 1 49 02 23 63 – adrien.billet@coface.com

FINANCIAL CALENDAR 2025

(subject to change)

FY-2024 results: 20 February 2025 (after market

close)

Q1-2025 results: 5 May 2025 (after market close)

Annual General Shareholders’ Meeting: 14 May 2025

H1-2025 results: 31 July 2025 (after market close)

9M-2025 results: 3 November 2025 (after market close)

FINANCIAL INFORMATION

This press release, as well as COFACE SA’s integral regulatory

information, can be found on the Group’s website:

http://www.coface.com/Investors

For regulated information on Alternative

Performance Measures (APM), please refer to our Interim Financial

Report for H1-2024 and our 2023 Universal Registration Document

(see part 3.7 “Key financial performance indicators”).

|

|

Regulated

documents posted by COFACE SA have been secured and authenticated

with the blockchain technology by Wiztrust.

You can check the authenticity on the website

www.wiztrust.com. |

COFACE: FOR TRADE

With over 75 years of experience and the most extensive

international network, Coface is a leader in trade credit insurance

& risk management, and a recognised provider of Factoring, Debt

Collection, Single Risk insurance, Bonding, and Information

Services. Coface’s experts work to the beat of the global economy,

helping around 100,000 clients in 100 countries build successful,

growing, and dynamic businesses. With Coface’s insight and advice,

these companies can make informed decisions. The Group' solutions

strengthen their ability to sell by providing them with reliable

information on their commercial partners and protecting them

against non-payment risks, both domestically and for export. In

2023, Coface employed ~4,970 people and registered a turnover of

€1.87 billion.

www.coface.com

COFACE SA is listed in Compartment A of Euronext Paris

Code ISIN: FR0010667147 / Ticker: COFA

|

DISCLAIMER - Certain declarations featured

in this press release may contain forecasts that notably relate to

future events, trends, projects or targets. By nature, these

forecasts include identified or unidentified risks and

uncertainties, and may be affected by many factors likely to give

rise to a significant discrepancy between the real results and

those stated in these declarations. Please refer to chapter 5 “Main

risk factors and their management within the Group” of the Coface

Group's 2023 Universal Registration Document filed with AMF on 5

April 2024 under the number D.24-0242 in order to obtain a

description of certain major factors, risks and uncertainties

likely to influence the Coface Group's businesses. The Coface Group

disclaims any intention or obligation to publish an update of these

forecasts, or provide new information on future events or any other

circumstance.

1 Return on average tangible equity

2 Book yield calculated on the average of the investment

portfolio excluding non-consolidated subsidiaries.

- 2024 11 05 PR results 9M-2024 COFACE

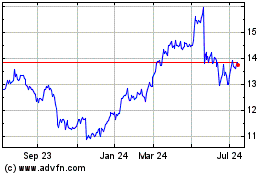

Coface (EU:COFA)

Historical Stock Chart

From Oct 2024 to Nov 2024

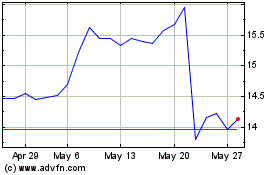

Coface (EU:COFA)

Historical Stock Chart

From Nov 2023 to Nov 2024