2024 revenue

Solid growth momentum for the second year

in a row

-

Full-year revenue: €841.1 million, with growth of 9.0% on a

like-for-like basis and at CER

- This

performance was achieved thanks to strong momentum in the Americas

(+20.5%) and Asia (+10.1%) and despite the contraction of activity

in France

Details on the 2024 financial

statements

- Expected

Restated EBITDA margin close to 14.9%

- Free

cash flow expected to be slightly negative

-

Significant improvement in financial leverage (net

debt/EBITDA)

Villepinte, February 6, 2025, 5:45

p.m.: Guerbet (FR0000032526 GBT), a

global specialist in contrast products and solutions for medical

imaging, is publishing its full-year revenue. At 31 December 2024,

the Group’s sales totalled €841.1 million, up 7.1% compared with

2023. This change includes an unfavourable currency effect of €12.3

million, mainly due to South American and Asian currencies. At

constant exchange rates (CER1), business grew by 8.6% in 2024. At

constant exchange rates and on a like-for-like basis, i.e.

excluding the urology and Accurate businesses which were sold in

July 2024 and January 2025 respectively, growth reached 9.0%. This

performance is very close to the annual guidance communicated

during the half-year results. It follows another year of remarkable

growth of 6.4% at CER in 2023.

Breakdown of consolidated Group revenue

(IFRS) by quarter

|

In € millions |

2023 |

2024 |

% change |

2024at CER1 |

% change at CER1 |

|

Q1 |

180.6 |

194.3 |

+7.6% |

196.5 |

+8.8% |

|

Q2 |

198.0 |

224.9 |

+13.6% |

226.8 |

+14.5% |

|

Q3 |

195.2 |

201.3 |

+3.1% |

205.8 |

+5.4% |

|

Q4 |

211.8 |

220.6 |

+4.1% |

224.3 |

+5.9% |

|

Total |

785.7 |

841.1 |

+7.1% |

853.4 |

+8.6% |

Constant exchange rates: the exchange rate

impact was eliminated by recalculating sales for the period on the

basis of the exchange rates used for the previous financial

year.

Geographical breakdown of consolidated

Group revenue (IFRS)

|

In millions of euros,at 31 December

2024 |

2023 |

2024 |

% change |

2024at CER1 |

% changeat CER |

|

Sales in EMEA |

347.7 |

352.4 |

+1.4% |

351.6 |

+1.1% |

|

Sales in the Americas |

217.6 |

255.5 |

+17.4% |

262.1 |

+20.5% |

|

Sales in Asia |

213.9 |

229.0 |

+7.0% |

235.4 |

+10.1% |

|

Total like-for-like |

779.2 |

836.9 |

+7.4% |

849.2 |

+9.0% |

|

Divested businesses (Accurate and urology) |

6.5 |

4.2 |

- |

4.2 |

- |

|

Total |

785.7 |

841.1 |

+7.1% |

853.4 |

+8.6% |

Constant exchange rates: the exchange rate

impact was eliminated by recalculating sales for the period on the

basis of the exchange rates used for the previous financial

year.

In EMEA, the Group made

full-year revenue of €352.4 million, up 1.1% at constant exchange

rates and on a like-for-like basis. 2024 saw a contraction in

activity in France (-11.8%) following the implementation on 1 March

2024 of a new supply management system between distributors and

practitioners. For the record, this contraction was nevertheless

accompanied by an improvement in the product mix, which limited the

impact on the Group’s profitability. Excluding France, growth in

the EMEA region was 8.8% at CER.

In the Americas, sales

increased by 20.5% at CER and on a like-for-like basis in 2024,

driven by higher prices and volumes as well as a remarkable

performance in Latin America thanks to significant market share

gains. In the Americas as a whole, after exceptional momentum

linked to the catch-up at the Raleigh site over three consecutive

quarters until mid-2024, Guerbet continued to post double-digit

growth (+11.8% in the fourth quarter alone).

In Asia, the Group saw another

very strong year, with annual growth of 10.1% at CER and on a

like-for-like basis, driven in particular by China (+10.4%). This

performance was achieved despite the decline in activity in South

Korea, in connection with a major strike by doctors. In the fourth

quarter of 2024, Guerbet generated growth in Asia of +9.3%.

Breakdown of consolidated Group revenue

(IFRS) by activity

|

In millions of euros,at 31 December

2024 |

2023 |

2024 |

% change |

2024at CER1 |

% changeat CER |

|

Diagnostic Imaging |

686.3 |

737.1 |

+7.4% |

748.1 |

+9.0% |

|

MRI |

256.9 |

262.6 |

+2.2% |

264.5 |

+3.0% |

|

X-ray |

429.4 |

474.5 |

+10.5% |

483.6 |

+12.6% |

|

Interventional Imaging |

92.9 |

99.9 |

+7.5% |

101.1 |

+8.8% |

|

Total like-for-like |

779.2 |

836.9 |

+7.4% |

849.2 |

+9.0% |

|

Divested businesses (Accurate and urology) |

6.5 |

4.2 |

- |

4.2 |

- |

|

Total |

785.7 |

841.1 |

+7.1% |

853.4 |

+8.6% |

Constant exchange rates: the exchange rate

impact was eliminated by recalculating sales for the period on the

basis of the exchange rates used for the previous financial

year.

By activity, sales at CER and on a like-for-like

basis in Diagnostic Imaging amounted to €748.1

million at 31 December 2024, up 9.0% (+7.5% in the fourth

quarter).

- In the

IRM division, revenue grew by 3.0% year-on-year at

CER and on a like-for-like basis. Growth in this division was

hampered by the situation in France, which penalised sales of

Dotarem® in particular. At the same time, there was a continued

ramp-up of EluciremTM sales despite the delay in some markets,

particularly in Switzerland where the commercial launch had to be

postponed due to a regulatory delay. Excluding the France effect,

growth in the IRM division was 9.4%.

- The

X-ray division posted full-year growth of 12.6% at

CER and on a like-for-like basis, driven by a sustained increase in

volumes and prices for both Xenetix® and Optiray®. Over the year,

Guerbet’s performance in this activity was driven by both gains in

market share and a favourable change in the product mix.

In Interventional Imaging, the

Group reached a new sales milestone of €100 million in 2024, with

revenue at CER and on a like-for-like basis of €101.1 million. This

represented growth of 8.8% over the year (+0.3% in the fourth

quarter alone) thanks to the increase in prices and volumes for

Lipiodol®, which saw particularly strong growth in vascular

embolization.

2024 financial statements: confirmation

of expected increase in profitability target

Slightly negative expected free cash

flow and significant improvement in financial leverage

The solid growth generated by Guerbet in 2024,

despite unprecedented disruptions in the French market, was

accompanied by an overall improvement in its product mix and good

cost control. The Group therefore is quietly confident it will

achieve its profitability target for the 2024 financial year and

has even raised this target: the restated EBITDA margin is expected

to be close to 14.9%.

At the same time, Guerbet now expects a slightly

negative free cash flow level in 2024, due to late payments in

France in connection with the new distribution channel. However, a

significant improvement in the net debt/EBITDA ratio is expected

for the 2024 financial year.

The Group will take the opportunity during the

publication of its full-year results, scheduled for 26 March, to

specify its financial objectives for the current financial

year.

Next event:

Publication of 2024 annual results26

March 2025 after market close

About GuerbetAt Guerbet, we

build lasting relationships so that we enable people to live

better. That is our purpose. We are a leader in medical imaging

worldwide, offering a comprehensive range of pharmaceutical

products, medical devices, and digital and AI solutions for

diagnostic and interventional imaging. A pioneer in contrast media

for 97 years, with more than 2,920 employees worldwide, we

continuously innovate and devote 10% of our sales to research and

development in four centres in France, the United States and

Israel. Guerbet (GBT) is listed on Euronext Paris (segment B – mid

caps) and generated €786 million in revenue in 2023.

Forward-looking

statementsCertain information contained in this press

release does not reflect historical data but constitutes

forward-looking statements. These forward-looking statements are

based on estimates, forecasts, and assumptions, including but not

limited to assumptions about the current and future strategy of the

Group and the economic environment in which the Group operates.

They involve known and unknown risks, uncertainties, and other

factors that may result in a significant difference between the

Group’s actual performance and results and those presented

explicitly or implicitly by these forward-looking statements.These

forward-looking statements are valid only as of the date of this

press release, and the Group expressly disclaims any obligation or

commitment to publish an update or revision of the forward-looking

statements contained in this press release to reflect changes in

their underlying assumptions, events, conditions, or circumstances.

The forward-looking statements contained in this press release are

for illustrative purposes only. Forward-looking statements and

information are not guarantees of future performance and are

subject to risks and uncertainties that are difficult to predict

and are generally beyond the Group’s control.

These risks and uncertainties include but are

not limited to the uncertainties inherent in research and

development, future clinical data and analyses (including after a

marketing authorization is granted), decisions by regulatory

authorities (such as the US Food and Drug Administration or the

European Medicines Agency) regarding whether and when to approve

any application for a drug, process, or biological product filed

for any such product candidates, and their decisions regarding

labeling and other factors that may affect the availability or

commercial potential of such product candidates. A detailed

description of the risks and uncertainties related to the Group’s

activities can be found in Chapter 4.9 “Risk factors” of the

Group’s Universal Registration Document filed with the AMF (French

financial markets authority) under number D.24-0224 on April

3, 2024, available on the Group’s website (www.guerbet.com).

Contacts:

Guerbet Jérôme Estampes, Chief Financial

Officer +33 1 45 91 50 00 / jerome.estampes@guerbet.comChristine

Allard, Head of Communications +33 6 30 11 57 82 /

christine.allard@guerbet.com

Seitosei Actifin

Marianne Py, Financial Communications +33 1 80 48 25 31 /

marianne.py@seitosei-actifin.com Jennifer Jullia, Press

+33.1.56.88.11.19 / jennifer.jullia@seitosei-actifin.com

- 25 0206 CP GBT CA annuel V Final En

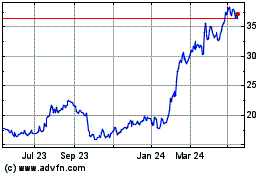

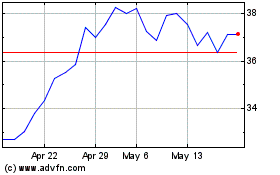

Guerbet (EU:GBT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Guerbet (EU:GBT)

Historical Stock Chart

From Feb 2024 to Feb 2025