Ipsen delivers solid results in 2024, driven by strong performance

across all therapeutic areas, and provides guidance for 2025

- FY 2024 total sales growth of 9.9%

at CER1, or 8.7% as reported, with growth driven by

strong performance across all therapeutic areas, including a 67.4%

increase in the Rare Diseases portfolio, 9.2% in Neuroscience, and

7.3% in Oncology; Somatuline® (lanreotide) sales grew by

5.6%, while all other products, excluding Somatuline, achieved

double-digit sales growth at 12.2%

- FY 2024 core operating income of

€1,109m, growing 10.8% as reported, with core operating margin of

32.6% of total sales

- Continued pipeline expansion in

2024, with significant regulatory approvals, addition of several

preclinical therapies with global rights and innovative modalities,

and a late-stage asset

- Four key regulatory and clinical

milestones expected in 2025, including the Proof-of-Concept data

readout for the Long-Acting Neurotoxin (LANT)

- Financial guidance2 for

2025 including total sales growth greater than 5.0%3 at

CER, and core operating margin greater than 30.0% of total sales,

based on accelerated sales growth of the ex-Somatuline portfolio

and assuming negative impact on Somatuline sales due to increased

generic competition in the U.S. and Europe

PARIS, FRANCE, 13 February 2025

- Ipsen (Euronext: IPN; ADR: IPSEY), a global

specialty-care biopharmaceutical company, today presents its

financial results for the full year 2024.

Extract of consolidated

results4 for FY 2024

and FY 2023:4

|

FY 2024 |

FY 2023 |

% change

|

|

€m |

€m |

Actual |

CER1 |

|

Total Sales |

3,400.6 |

3,127.5 |

8.7% |

9.9% |

|

Core Operating Income |

1,109.4 |

1,001.0 |

10.8% |

|

|

Core operating margin |

32.6% |

32.0% |

+0.6pts |

|

|

Core Consolidated Net Profit |

857.8 |

765.5 |

12.1% |

|

|

Core earnings per share (fully diluted) |

€10.27 |

€9.15 |

12.3% |

|

|

IFRS Operating Income |

496.75 |

816.0 |

-39.1% |

|

|

IFRS operating margin |

14.6% |

26.1% |

-11.5pts |

|

|

IFRS Consolidated Net Profit |

347.35 |

647.2 |

-46.3% |

|

|

IFRS earnings per share (fully diluted) |

€4.155 |

€7.73 |

-46.3% |

|

|

Dividend per

share6 |

€1.407 |

€1.20 |

16.7% |

|

|

Free Cash Flow |

774.4 |

710.9 |

8.9% |

|

|

Closing net cash |

160.3 |

65.1 |

n/a |

|

“Ipsen delivered solid results and advanced its

pipeline in 2024, laying a strong foundation for sustained growth,"

said David Loew, Chief Executive Officer, Ipsen. "With the

successful global rollout of Iqirvo and Bylvay, and the U.S. launch

of Onivyde, alongside multiple business development deals adding

several innovative assets, we are well positioned to execute our

strategic roadmap. This year, we look forward to achieving key

milestones, including the first data readout for the Long-Acting

Neurotoxin (LANT), and further expand and progress our pipeline

across all three therapeutic areas to bring promising new medicines

to patients.”

Pipeline Progress

Significant regulatory milestones were achieved

in 2024, including FDA approval of Onivyde® (irinotecan)

for first-line pancreatic ductal adenocarcinoma (PDAC), along with

accelerated U.S. approval and European approval for

Iqirvo® (elafibranor), respectively. Additionally,

Kayfanda® (odevixibat) was approved for Alagille

syndrome (ALGS) in the E.U.

The company also opted-in for the CABINET Phase

III study of Cabometyx® (cabozantinib) in patients with

advanced neuroendocrine tumors (NETs), with study results presented

at the 2024 European Society for Medical Oncology (ESMO) Congress

and published in the New England Journal of Medicine.

An IND application was filed for IPN01194, an

ERK inhibitor, advancing the potential medicine into clinical

development with a Phase I/IIa trial in advanced solid tumors.

Ipsen improved further the depth and breadth of

its pipeline by adding five preclinical innovative therapies with

global rights and new modalities, and an ex-U.S. licensing

agreement with DayOne Biopharmaceuticals for the late-stage

oncology asset tovorafenib, an oral RAF inhibitor for pediatric

low-grade glioma.

Two global licensing agreements for Antibody

Drug Conjugate (ADC) in oncology with Sutro Biopharma and Foreseen

Biotechnology were signed. An extension of the oncology partnership

with Marengo Therapeutics to include TriSTAR, a next-generation

precision T-cell engager was completed, as well as more recently,

in the fourth quarter, a global licensing agreement with Biomunex

for a preclinical novel T-cell engager (TCE). A collaboration with

Skyhawk Therapeutics to develop RNA-modulating small molecules for

rare neurological diseases was also signed during the year.

Ipsen executed several divestments in 2024,

including the sale of Increlex® (mecasermin injection) to Eton

Pharmaceuticals and the sale of its rare pediatric disease Priority

Review Voucher.

Environmental, Social and

Governance

Ipsen took important steps in 2024 in delivering

its ambitious sustainability strategy. The company continued to

integrate sustainability across its operations. From reducing its

environmental footprint to advancing patient access and fostering a

strong workplace culture, the company increased its commitment to

driving progress for patients, employees, communities, and the

planet.

Our sustainability efforts were recognized

across multiple environment initiatives. The company achieved a 45%

reduction in Scopes 1 & 2 greenhouse gas emissions and a 25%

reduction in Scope 3, fully in line with its 2030 targets (versus

2019 baseline). Significant efforts were made to engage suppliers

and third parties in Ipsen’s sustainability roadmap including the

first-ever “Ipsen Supplier Sustainability Day”. Following an

intensive transformation project, 99.8% of Ipsen’s global

electricity now comes from renewable sources. Through the Fleet for

Future project, the company continues to advance sustainable

transportation, with 43% of its total company’s fleet now electric

vehicles as of 2024.

We remain committed to gender balance in

leadership, with women now representing 55% of the Global

Leadership Team.

2025 Upcoming Milestones

Ipsen anticipates several key milestones across its portfolio in

2025, including:

- Cabometyx (CABINET trial) – Regulatory decision in Europe for

advanced neuroendocrine tumors (NETs), including pancreatic (pNETs)

and extra-pancreatic (epNETs) neuroendocrine tumors

- Tovorafenib (FIREFLY-1 trial) – Regulatory submission in Europe

for pediatric low-grade glioma

- Fidrisertib (FALKON trial) – Readout of the pivotal Phase IIb

trial in fibrodysplasia ossificans progressiva (FOP)

- LANT88(LANTIC trial) – Proof-of-concept

data readout, evaluating its potential in aesthetics

These milestones reinforce Ipsen’s commitment to advancing

innovative therapies and expanding treatment options for patients

worldwide.

2025 Financial Guidance

Ipsen has set for FY 2025 the following

financial guidance, which excludes any impact from potential

late-stage (Phase III clinical development or later) business

development transactions:

- Total sales growth greater than

5.0%, at constant currency. Based on the average level of exchange

rates in January 2025, a favorable effect on total sales of around

1% from currencies is expected.

- Core operating margin greater than

30.0% of total sales, which includes additional R&D expenses

from anticipated early and mid-stage external-innovation

opportunities.

Guidance on total sales and core operating

margin is based on accelerated sales growth of the ex-Somatuline

portfolio and assumes negative impact on Somatuline sales due to

increased generic competition in the U.S. and Europe.

Consolidated financial statements

The Board of Directors approved the consolidated

financial statements on 12 February 2025. The consolidated

financial statements have been audited and the Statutory Auditors’

report is in the process of being published. Ipsen’s comprehensive

audited financial statements will be available in due course on

ipsen.com (regulated-information section).

Conference call

A conference call and webcast for investors and

analysts will begin today at 1pm CET. Participants can access the

call and its details by registering here; webcast details can be

found here.

Calendar

Ipsen intends to publish its Q1 2025 sales on

April 16th, 2025.

Notes

All financial figures are in € millions (€m),

unless otherwise noted. The performance shown in this announcement

covers the twelve-month period to 31 December 2024 (FY 2024) and

the three-month period to 31 December 2024 (Q4 2024), compared to

the twelve-month period to 31 December 2023 (FY 2023) and the

three-month period to 31 December 2023 (Q4 2023), respectively,

unless stated otherwise. The commentary is based on the performance

in FY 2024, unless stated otherwise.

About Ipsen

We are a global biopharmaceutical company with a

focus on bringing transformative medicines to patients in three

therapeutic areas: Oncology, Rare Disease and Neuroscience.

Our pipeline is fueled by external innovation

and supported by nearly 100 years of development experience and

global hubs in the U.S., France and the U.K. Our teams in more than

40 countries and our partnerships around the world enable us to

bring medicines to patients in more than 100 countries.

Ipsen is listed in Paris (Euronext: IPN) and in

the U.S. through a Sponsored Level I American Depositary Receipt

program (ADR: IPSEY). For more information, visit ipsen.com.

Ipsen contacts

Investors

| Alina

Levchuk |

+41 79 572 8712 |

| Nicolas

Bogler |

+33 6 52 19 98

92 |

Media

| Sally

Bain |

+1 857 320 0517 |

| Anne

Liontas |

+33 7 67 34 72

96 |

1 At constant exchange rates (CER), which

exclude any foreign-exchange impact by recalculating the

performance for the relevant period by applying the exchange rates

used for the prior period.

2 Excluding any impact from potential late-stage (Phase III

clinical development or later) external-innovation

transactions.

3 Based on the average level of exchange rates in Jan 2024, a

favorable effect on total sales of about 1% from currencies is

expected.

4 Extract of consolidated results. The Company’s auditors performed

a limited review of the condensed consolidated financial

statements.

5 Including an impairment loss of €279m (or €2,33 /share) related

to Sohonos, reflecting lower revised sales following lower patient

uptake.

6 Dividend related to the current financial year to be paid the

following year.

7 Decided by the Ipsen S.A. Board of Directors and to be proposed

at the annual shareholders’ meeting on 21 May 2025.

8 Long-acting neurotoxin

- Ipsen PR_FY 2024 - Results announcement_13022025

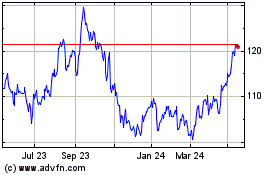

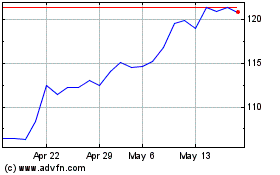

Ipsen (EU:IPN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Ipsen (EU:IPN)

Historical Stock Chart

From Feb 2024 to Feb 2025