McPhy Energy is making available information concerning a contemplated issue of bonds convertible into new ordinary shares and/or exchangeable for existing ordinary shares

18 May 2024 - 6:00AM

McPhy Energy is making available information concerning a

contemplated issue of bonds convertible into new ordinary shares

and/or exchangeable for existing ordinary shares

McPhy Energy is making available

information concerning a contemplated issue of bonds

convertible into new ordinary shares and/or exchangeable for

existing ordinary shares for the benefit of EDF Pulse Holding

and EPIC Bpifrance1 and, if applicable, other

investors

Grenoble, May 17, 2024 – 10:00 pm CEST – McPhy Energy, a

specialist in low-carbon hydrogen production and distribution

equipment (electrolyzers and refuelling stations) (the “Company”),

today announced the availability of additional information

regarding a contemplated issue of bonds convertible into new shares

and/or exchangeable for existing shares (OCEANEs), maturing 5 years

after their issue (the “Convertible Bonds”) to the benefit of EDF

Pulse Holding (“EDF Pulse”) and EPIC Bpifrance, acting on behalf of

the French State under the French Tech Souveraineté Agreement

(Convention French Tech Souveraineté) dated December 11, 2020

(“French Tech Souveraineté”), for a total nominal amount of €30

million (the “Issue”), which is the subject of resolutions

submitted to the approval of the Shareholders General Meeting to be

held on May 30, 2024. The Company will consider the possibility of

issuing an additional amount to other investors depending on market

conditions.

As previously disclosed2, the key financial

terms of the Convertible Bonds would be as follows:

- The Convertible Bonds would be issued and redeemed at par, bear

interest at 8% per annum, payable annually, and have a maturity of

5 years;

- The conversion price of the Convertible Bonds would represent a

premium of 20% over the reference price determined on the issue

date;

- Conversion (in whole or in part) may be requested by

bondholders at any time from the date of issue until maturity. In

the event of a conversion request, the issuer may deliver new

and/or existing shares and/or a cash amount (based on the share

price at the time of the conversion request).

The net proceeds of the Issue will enable the

Company to finance its working capital requirements and general

cash needs, in particular the development of its commercial

activity, industrial facilities and its research and development

activity.

Additional information relating to the Issue

concerns in particular the terms and conditions of the Convertible

Bonds, the legal framework of the Issue, the risk factors

associated with Issue and the Company, and the potential dilution

resulting from the Issue for shareholders.

This information is available on the Company's

website under the sections “General Meetings – CGM 30 May 2024”

(link:

https://mcphy-finance.com/index.php/en/general-meetings/cgm-30-may-2024)

and “Financial publications - Financial transactions” (link:

https://mcphy-finance.com/index.php/en/financial-publications/financial-operations/financial-transactions)3.

________________________________

Important information

This press release does not constitute an offer

to subscribe or a solicitation to buy, subscribe or sell any

securities to any person in the United States, Australia or Canada

or in any other jurisdiction in which such an issue would be

unlawful, and the Issue does not constitute an offer to the public

in any jurisdiction, including France, to persons other than

qualified investors.________________________________

ABOUT MCPHY

Specialized in hydrogen production and

distribution equipment, McPhy is contributing to the global

deployment of low carbon hydrogen as a solution for energy

transition. With its complete range of products dedicated to the

industrial, mobility and energy sectors, McPhy offers its customers

turnkey solutions adapted to their applications in industrial raw

material supply, recharging of fuel cell electric vehicles or

storage and recovery of electricity surplus based on renewable

sources. As designer, manufacturer and integrator of hydrogen

equipment since 2008, McPhy has three development, engineering and

production centers in Europe (France, Italy, Germany). Its

international subsidiaries provide broad commercial coverage for

its innovative hydrogen solutions. McPhy is listed on Euronext

Paris (compartment C, ISIN code: FR0011742329, MCPHY).

CONTACTS

|

NewCap |

|

|

Investor RelationsEmmanuel

HuynhT. +33 (0)1 44 71 94 99mcphy@newcap.eu |

Press RelationsNicolas

MerigeauT. +33 (0)1 44 71 94

98mcphy@newcap.eu |

Follow-us on @McPhyEnergy

1 EPIC Bpifrance acting on behalf of the French

State under the French Tech Souveraineté Agreement dated 11

December 2020.

2 Press release published by the Company on

March 7, 2024, available on the Company's website

(www.mcphy-finance.com) under section “Financial publications -

Press releases”.

3 In French version. English version will be

made available as well shortly.

- PR_McPhy OC_Mise à disposition_EN

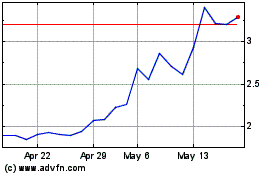

Mcphy Energy (EU:MCPHY)

Historical Stock Chart

From Nov 2024 to Dec 2024

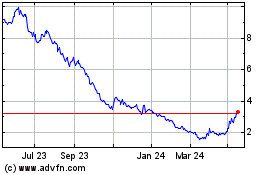

Mcphy Energy (EU:MCPHY)

Historical Stock Chart

From Dec 2023 to Dec 2024