Pernod Ricard Cuts Guidance, Blaming Coronavirus -- Update

13 February 2020 - 8:22PM

Dow Jones News

By Cristina Roca

--Pernod Ricard reported higher 1H net profit and sales but cut

its guidance due to the coronavirus outbreak

--The French spirits company sees its FY20 earnings growing

slower due to the virus

--Pernod based its new guidance on assumptions that most of

China will start recovering in March, with tourism rebounding in

April

Pernod Ricard SA on Thursday slashed its full-year guidance, and

said that it expects the coronavirus outbreak to have a severe

impact on its fiscal third-quarter, even as it reported higher net

profit and sales for the first half of its fiscal year.

The French spirits maker reported net profit of 1.03 billion

euros ($1.12 billion), up from EUR1.02 billion a year earlier.

Second-quarter sales were EUR2.99 billion, rising 4% on an organic

basis, which strips out currency fluctuations and acquisitions.

Despite the rise in sales and earnings, the maker of Absolut

vodka and Jameson whiskey said it now expects lower organic growth

in its underlying profit as it assumes the coronavirus to have a

"severe" impact on its China and travel-retail business, mainly

during the third quarter. Pernod cut its guidance for organic

growth in profit from recurring operations for fiscal 2020 to

2%-4%, from previous expectations of 5%-7%.

"For the first half of the year, profit from recurring

operations grew organically by 4.3%," Pernod said.

The company expects the coronavirus to hit its sales by 2% in

fiscal 2020, it said.

In China, Pernod expects the on-trade channel--sales of drinks

in hotels, restaurants, bars etc.--to start gradually recovering in

March and to return to normality by June, except in the Hubei

province, where recovery is expected to be slower. The Chinese

off-trade channel should recover in March, the company said.

Pernod assumes Chinese passenger numbers will drop by about 2/3

during the months of February and March, hitting its travel-retail

business in Asia. Pernod assumes Chinese tourist numbers will

gradually recover starting in April and be back to normal by June,

it said.

The "Asia-Rest of the World" region--excluding Europe and the

Americas--accounted for 44% of Pernod's first-half sales, making it

its biggest market.

According to Citi analysts, the big question is now whether

Pernod's assessment of the duration of disruption from the virus is

bearish enough.

"We will stay the strategic course and maintain priority

investments in order to continue maximising long-term value

creation," Chairman and Chief Executive Alexandre Ricard said.

Write to Cristina Roca at cristina.roca@dowjones.com;

@_cristinaroca

(END) Dow Jones Newswires

February 13, 2020 04:07 ET (09:07 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

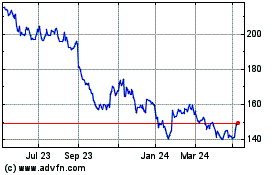

Pernod Ricard (EU:RI)

Historical Stock Chart

From Jun 2024 to Jul 2024

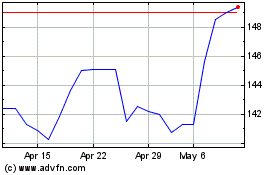

Pernod Ricard (EU:RI)

Historical Stock Chart

From Jul 2023 to Jul 2024