Solvay fourth quarter and full year 2024 results

| Press

release |

|

Regulated information |

Solid EBITDA and free cash flow supported by cost savings

acceleration

Brussels, March 6, 2025, 7.00am CET

Highlights

- “Essential for

Generations”: Solvay’s ambition is to be a leader in

Essential Chemistry. Despite challenging market conditions in 2024,

we proved the resilience of our business and our strong execution,

delivering solid results. This allows us to confirm our

2028 EBITDA mid-single digit annual growth

target.

- Launch of the “For

Generations” roadmap, defining the foundations of

Sustainability at Solvay.

- Underlying net

sales in Q4 2024 were slightly up (+0.5% organically)

compared to Q4 2023 despite lower pricing, with continued

year-on-year growth in volumes for certain businesses such as

Bicarbonate and Peroxides. Full year 2024 underlying net sales

amounted to €4,686 million, down -4.0% organically versus 2023,

with a positive impact from volumes for the fourth consecutive

quarter, while prices were down year on year.

- Underlying EBITDA

in Q4 2024 increased year-on-year to €256 million (+2.0%

organically), with 22.6% underlying EBITDA margin. Full year 2024

underlying EBITDA reached €1,052 million, down -8.2% organically,

as positive volume and cost savings partially offset lower Net

pricing. Underlying EBITDA margin was at 22.5% for the

year.

- Structural cost

savings initiatives delivered €110 million in 2024, well

above the target of €80 million thanks to the acceleration of

savings initiatives at manufacturing sites and in corporate

functions.

- Underlying net

profit from continuing operations was €445 million in 2024

vs. €588 million in 2023.

- Free Cash

Flow1 amounted to €361 million in 2024,

underpinned by the solid EBITDA performance and the working capital

discipline, while Capex accelerated in Q4 2024, as

planned, to reach €355 million for the full year.

- Underlying Net

Debt remained stable at €1.5 billion, implying a leverage

ratio of 1.5x.

- Total proposed gross

dividend of €2.43 per share, subject to shareholders’

approval during the next Ordinary General Meeting of May 13,

2025.

- 2025 Outlook:

Solvay expects the underlying EBITDA to be between €1.0 billion and

€1.1 billion, and the Free Cash Flow1 to be around €300

million.

|

Fourth quarter |

Full year |

Underlying

(in € million) |

2024 |

2023 |

% yoy |

% organic |

2024 |

2023 |

% yoy |

% organic |

|

Net sales |

1,134 |

1,131 |

+0.3% |

+0.5% |

4,686 |

4,880 |

-4.0% |

-4.0% |

|

EBITDA |

256 |

238 |

+7.4% |

+2.0% |

1,052 |

1,246 |

-15.6% |

-8.2% |

|

EBITDA margin |

22.6% |

21.1% |

+1.5pp |

- |

22.5% |

25.5% |

-3.1pp |

- |

|

FCF 1 |

41 |

8 |

n.m. |

- |

361 |

561 |

-35.7% |

- |

|

ROCE |

|

|

|

|

17.6% |

20.4% |

-2.8pp |

- |

Note: 2023 figures were restated to reflect the changes

mentioned in the introduction to Financial

performance.

1 Free Cash Flow (FCF) here is the free cash to

Solvay shareholders from continuing operations.

Philippe Kehren, Solvay CEO

“Since Solvay's separation in December 2023, our

teams have achieved a lot, and I extend my sincere thanks to every

Solvay employee for their contributions. Our new purpose-driven

culture is clearly driving our organization forward.

Despite a market environment that shows little

signs of recovery, our position as an essential chemical player

combined with our leadership positions in our core markets have

enabled us to deliver a solid financial performance in 2024, once

again demonstrating our resilience. This success is underpinned by

continued year-on-year growth in volumes for businesses such as

Bicarbonate and Peroxides, and significant cost savings achieved

through our ongoing transformation and digitalization efforts.

We have also made significant strides in

sustainability, by reaffirming our commitment to carbon neutrality,

launching our ambitious "For Generations" roadmap, and continuing

to advance new energy transition projects to reduce our

environmental footprint.

With our clear strategy in place, we are confident in our

ability to continue to meet our commitments, generate sustainable

cash flow to reward shareholders, and strategically position Solvay

for future growth."

2025 outlook

For 2025, current macroeconomic and geopolitical

contexts do not suggest any significant volume recovery in Solvay

main end markets. Solvay thus expects the trends of the latter part

of the previous year to continue for at least the first semester.

Net pricing is anticipated to be resilient compared to 2024,

including the impact of the soda ash annual contracts.

In light of these external dynamics, management

will continue to focus on the transformation of the company. Cost

savings are expected to reach €200 million by year end (from €110

million at the end of 2024), offsetting both inflation and the

temporary Corporate stranded costs expected in 2025 from the exit

of the Transition Service Agreement with Syensqo.

In that context, Solvay expects its full year

2025 underlying EBITDA to be between €1.0 billion and €1.1 billion

(representing an organic growth of -5 to +5% using EUR/USD rate of

1.05). Free cash flow to Solvay shareholders from continuing

operations is expected to be around €300 million. Capex are

expected to be between €300 million to €350 million, and provision

cash-out will increase by more than €50 million year-on-year,

mainly due to planned payments for the Dombasle energy transition

project, accrued for in prior years.

2028 financial targets

Solvay has a profile that allows the company to

deliver top quartile and resilient financial performance over the

years. Its focused strategy will enable Solvay to continue

generating sustainable cash flows and attractive returns, while

preparing the future growth of the company.

After a first successful year post spinoff,

Solvay confirms its 20282 underlying EBITDA growth,

underlying EBITDA margin and ROCE targets, increases its gross

savings annual run-rate target from €300 million to €350 million,

and replaces its free cash flow conversion ratio target by the

existing Capital Allocation policy, which confirms the company’s

commitment towards free cash flow generation:

- Investing in

essential capex, which will represent €250-300 million per year,

including €30-35 million capex in energy transition projects

- Rewarding

shareholders with stable to increasing dividends, with 2024

dividends at €260 million as a starting point

-

Preparing for the future with a priority given to growth capex

based on affordability and value creation, with an optionality for

additional shareholder return

2 Baseline is 2023 (restated underlying EBITDA of

€1.15 billion)

“For Generations” sustainability roadmap

launch

In 2024, Solvay defined its new For Generations

roadmap, which sets the Sustainability agenda of the company, while

aligning with the new Solvay profile and strategy. This roadmap is

structured around two pillars - Planet progress, focused on climate

and nature, and Better life, for people and communities.

At Solvay, we create a sustainable impact for

generations. Planet and Life are the past, present and future

foundations of Essential Chemistry. We act to build trust and value

for Solvay, its stakeholders and society.

For over 160 years, we have been mastering our

technologies. Combining our expertise with our values, we will turn

our sustainability ambition into reality. We will keep leading our

industry with responsibility.

Financial calendar

-

May 8, 2025: First quarter earnings

-

May 13, 2025: Ordinary General Shareholders’ Meeting

-

July 30, 2025: Second quarter and first half year 2025

earnings

-

November 6, 2025: Third quarter and first nine months 2025

earnings

-

Link to Solvay’s financial calendar

Details of analysts and investors

conference call

-

Time: March 6, 2025 - 2pm CET

-

Registration: register to the webcast here.

About Solvay

Solvay, a pioneering chemical company with a legacy rooted in

founder Ernest Solvay's pivotal innovations in the soda ash

process, is dedicated to delivering essential solutions globally

through its workforce of around 9,000 employees. Since 1863, Solvay

harnesses the power of chemistry to create innovative, sustainable

solutions that answer the world’s most essential needs such as

purifying the air we breathe and the water we drink, preserving our

food supplies, protecting our health and well-being, creating

eco-friendly clothing, making the tires of our cars more

sustainable and cleaning and protecting our homes. As a

world-leading company with €4.7 billion in net sales in 2024 and

listings on Euronext Brussels and Paris (SOLB), its unwavering

commitment drives the transition to a carbon-neutral future by

2050, underscoring its dedication to sustainability and a fair and

just transition. For more information about Solvay, please visit

solvay.com or follow Solvay on Linkedin.

Safe harbor

This press release may contain forward-looking

information. Forward-looking statements describe expectations,

plans, strategies, goals, future events or intentions. The

achievement of forward-looking statements contained in this press

release is subject to risks and uncertainties relating to a number

of factors, including general economic factors, interest rate and

foreign currency exchange rate fluctuations, changing market

conditions, product competition, the nature of product development,

impact of acquisitions and divestitures, restructurings, products

withdrawals, regulatory approval processes, all-in scenario of

R&I projects and other unusual items. Consequently, actual

results or future events may differ materially from those expressed

or implied by such forward-looking statements. Should known or

unknown risks or uncertainties materialize, or should our

assumptions prove inaccurate, actual results could vary materially

from those anticipated. The Company undertakes no obligation to

publicly update or revise any forward-looking statements.

Media relations

Peter Boelaert

+32 479 30 91 59

Laetitia Van Minnenbruggen

+32 484 65 30 47

Valérie Goutherot

+33 6 77 05 04 79

media.relations@solvay.com |

Investor relations

Boris Cambon-Lalanne

+32 471 55 37 49

Geoffroy d’Oultremont

+32 478 88 32 96

Vincent Toussaint

+33 6 74 87 85 65

investor.relations@solvay.com |

|

- Press release

- Financial report

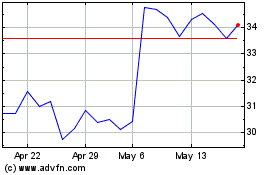

Solvay (EU:SOLB)

Historical Stock Chart

From Feb 2025 to Mar 2025

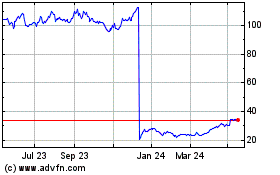

Solvay (EU:SOLB)

Historical Stock Chart

From Mar 2024 to Mar 2025