Trading update 30 September 2022

26 October 2022 - 3:00AM

Trading update 30 September 2022

STRONG OPERATIONAL RESULTS AND INCREASE OF THE

OUTLOOK

• Increase in net result from core activities of

10.3% to € 31.1M (30 September 2021: €

28.2M);• Slight increase in net

asset value per share to € 77.87 (31 December 2021: €

77.19);• Stable debt ratio of

28.5% (31 December 2021: 28.2%);•

Stable EPRA occupancy rate of the retail portfolio at 97.2% (30

June 2022: 97.0%);• Strong

increase in EPRA occupancy rate of the office portfolio to 82.4%

(30 June 2022: 77.2%);• Slight

increase in the fair value of the investment properties portfolio

at € 939.1M (31 December 2021: €

926M); and• Increase of the

outlook for the net result from core activities per share at the

high end of the range between €

4.80 and € 4.85.

- Trading update 30 September 2022

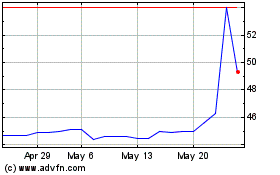

Wereldhave Belgium (EU:WEHB)

Historical Stock Chart

From Feb 2025 to Mar 2025

Wereldhave Belgium (EU:WEHB)

Historical Stock Chart

From Mar 2024 to Mar 2025