Wereldhave Belgium - Results 2024

11 February 2025 - 6:00PM

UK Regulatory

Wereldhave Belgium - Results 2024

STRONG RESULTS AND POSITIVE

OUTLOOK

- Increase in net rental income by 3.5% to € 64.8M (€

62.6M end 2023);

- Increase of the net result from core activities per

share to € 4.88 (€ 4.71 end 2023);

- Solid balance sheet with a debt ratio of 28.4% (29.6%

end 2023);

- Increase in net asset value per share to € 82.02 (+5.1%

vs. 2023: € 78.07);

- Increase in EPRA occupancy rate of 0.9% to 97.0% for

the entire portfolio (96.1% end 2023);

- Dividend proposal: € 4.30 gross - net € 3.01 per share,

an increase of 4.9% compare to 2023;

- Increase of the fair value of the investment property

portfolio (+4.5% compared to 31 December 2023);

- New financings amounting to € 80M (+ € 70M signed after

31 December 2024).

The net result from core activities increased by

3.8% to € 43.4M compared to 2023. This handsome increase is the

combined effect of an increase in rental income, a decrease in bad

debt provisions and a decrease of non-recoverable charges compared

to last year. As a result, the net result from core activities came

in at € 4.88 per share for 2024, at the upper end of the announced

earnings forecast.

The EPRA occupancy rate of the retail portfolio

was 99.0% at 31 December 2024 compared to 98.2% at 31 December

2023. In the office portfolio, the EPRA occupancy rate increased

from 84.7% as per 31 December 2023 to 85.4% by the end of 2024. For

the whole investment property portfolio, the EPRA occupancy rate

was 97.0% at 31 December 2024, compared with 96.1% a year

earlier.

The net asset value per share before dividend

distribution was € 82.02 as at 31 December 2024 (2023: €

78.07).

The debt ratio was 28.4% at 31 December 2024,

compared to 29.6% at 31 December 2023.

The Company has secured new financings amounting

to € 80M in 2024. More specifically, the Company has replaced its €

50M credit facility with ING with two new facilities of € 40M each.

In addition, the Company received a credit letter from Belfius for

the extension of two credit lines for a total amount of € 50M as

well as an additional extension of € 20M. This credit letter was

signed on behalf of the Company after 31 December 2024.

- Press release results 2024

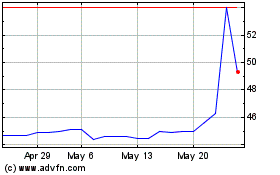

Wereldhave Belgium (EU:WEHB)

Historical Stock Chart

From Jan 2025 to Feb 2025

Wereldhave Belgium (EU:WEHB)

Historical Stock Chart

From Feb 2024 to Feb 2025