NZ Dollar Rises As Asian Stock Markets Traded Higher

06 December 2023 - 1:16PM

RTTF2

The New Zealand dollar strengthened against other major

currencies in the Asian session on Wednesday, as Asian stock

markets traded higher after the broad sell-off on Tuesday and

following the mixed cues from the global markets overnight. Traders

continued to cash in on recent strength in the markets amid

optimism about the outlook for interest rates that led to

overbought conditions.

While the U.S. Fed is widely expected to leave interest rates

unchanged in the coming months, traders are looking for more

evidence to solidify hopes of a rate cut in the near future.

In economic news, the Global Dairy Trade (GDT) price index rose

1.6 percent to 1,002 at its latest Global Dairy Trade auction held

overnight.

A total of 29,559 million tons was sold at the latest auction,

with an average selling price of $3,323 per metric ton.

Tuesday, the NZ dollar traded lower against its major

rivals.

In the Asian trading today, the NZ dollar rose to 2-day highs of

90.88 against the yen and 1.7498 against the euro, from yesterday's

closing quotes of 90.16 and 1.7604, respectively. If the kiwi

extends its uptrend, it is likely to find resistance around 92.00

against the yen and 1.73 against the euro.

Against the U.S. dollar, the kiwi edged up to 0.6171 from

yesterday's closing value of 0.6127. The kiwi may test resistance

near the 0.63 region.

Moving away from a recent low of 1.0696 against the Australian

dollar, the kiwi advanced to 1.0680. On the upside, 1.05 is seen as

the next resistance level for the kiwi.

In economic news, data from the Australian Bureau of Statistics

showed that Australia's gross domestic product expanded a

seasonally adjusted 0.2 percent on quarter in the third quarter of

2023. That was shy of expectations for an increase of 0.3 percent

and was down from 0.4 percent in the previous three months.

On an annualized basis, GDP climbed 2.1 percent, unchanged from

the second quarter and beating forecasts for a gain of 1.7

percent.

Looking ahead, U.K. construction PMI for November, Eurozone

retail sales data for October and U.K. financial stability report

are due to be released in the European session.

In the New York session, U.S. MBA mortgage approvals data, U.S.

ADP jobs data for November, U.S. EIA crude oil data and U.S. and

Canada trade data for October are set to be published.

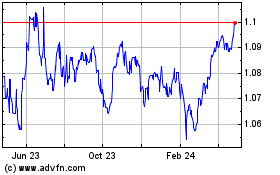

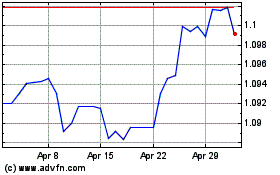

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Jun 2024 to Jul 2024

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Jul 2023 to Jul 2024