Australian Dollar Rises After RBA Rate-cut Decision

18 February 2025 - 1:56PM

RTTF2

The Australian dollar strengthened against other major

currencies in the Asian session on Tuesday, following the Reserve

Bank of Australia's (RBA) widely anticipated 25 basis point

interest rate drop.

The RBA lowered its benchmark rate by a quarter-point as upside

risks to inflation eased but policymakers remained cautious on

prospects for further policy easing.

The policy board of the RBA governed by Michele Bullock decided

to reduce the cash rate target by 25 basis points to 4.10 percent.

The decision came in line with expectations.

The interest rate paid on Exchange Settlement balances was cut

to 4 percent.

"In removing a little of the policy restrictiveness in its

decision today, the Board acknowledges that progress has been made

but is cautious about the outlook," RBA said.

The RBA's post-meeting press conference is currently the focus

of traders, as remarks made by Governor Michele Bullock could have

an impact on the AUD.

Asian stock markets reacted positively to easing geopolitical

tensions after U.S. President Donald Trump's decision to open talks

with Russia on ending the war with Ukraine without a European

presence. Concerns about the potential impact of higher tariffs by

the U.S. limited markets' upside.

Crude oil prices were also traded higher on the prospect of

peace in Eastern Europe, as talks to end the war between Russia and

Ukraine are expected to begin in Saudi Arabia later in the week.

West Texas Intermediate (WTI) Crude Oil Futures for April

settlement edged up 0.08 percent to close at $71.33 a barrel.

In the Asian trading today, the Australian dollar rose to 4-day

highs of 1.1142 against the NZ dollar and 96.79 against the yen,

from yesterday's closing quotes of 1.1090 and 96.25, respectively.

If the aussie extends its uptrend, it is likely to find resistance

around 1.12 against the kiwi and 99.00 against the yen.

The aussie advanced to a 6-day high of 1.6441 against the euro,

from a recent 4-day low of 1.6521. The aussie may test resistance

around the 1.62 region.

Against the U.S. dollar, the aussie edged up to 0.6368 from a

recent 4-day low of 0.6334. On the upside, 0.65 is seen as the next

resistance level for the aussie.

The aussie climbed to 0.9035 against the Canadian dollar, from

Monday's closing value of 0.9016. The next possible upside target

for the aussie is seen around the 0.914 area.

Looking ahead, Germany's ZEW economic confidence survey results

for February are due to be released at 5:00 am Et in the European

session. The economic sentiment index is expected to rise notably

to 19.9 in February from 10.3 in January.

In the New York session, Canada CPI data for January, U.S. NY

Empire State manufacturing index for February and U.S. NAHB housing

market index for February are slated for release.

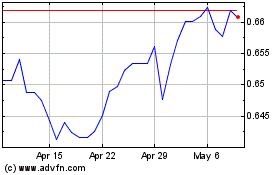

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Jan 2025 to Feb 2025

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Feb 2024 to Feb 2025