Euro Rises Amid German Debt Brake Reform

05 March 2025 - 4:32PM

RTTF2

The euro strengthened against other major currencies in the

European session on Wednesday, as traders reacted positively to

news about the German government's plans to increase defense and

infrastructure spending.

Germany's chancellor-in-waiting, Friedrich Merz, announced

yesterday that the nation's main centrist parties had agreed to

establish the infrastructure fund to invest in transportation,

energy grids, and housing. Merz also stated that Germany would

amend its constitution to exempt defense and security spending from

fiscal limits.

Investors were also reacting to comments from U.S. Commerce

Secretary Howard Lutnick that President Donald Trump will

"probably" announce a deal to reduce tariffs on Canada and

Mexico.

Investors are anticipating Thursday's announcement of the

European Central Bank's (ECB) monetary policy decision. For the

fifth consecutive time, the ECB is almost set to lower its Deposit

Facility Rate by 25 basis points (bps). As a result, following the

policy meeting, markets will closely monitor ECB President

Christine Lagarde's press conference.

In economic news, Eurozone private sector logged a marginal

growth in February. The HCOB composite output index remained

unchanged at 50.2 in February. The score matched the flash estimate

of 50.2. As the index stayed above the neutral 50.0 mark, the

figure signaled growth in the private sector.

At 50.6 in February, the service-sector measure was down from

51.3 in January to a three-month low, indicating a loss of growth

momentum.

The HCOB Germany Composite PMI was revised lower to 50.4 in

February 2025 from a preliminary of 51, compared to 50.5 in

January. Service sector business activity growth moderated to 51.1

from 52.5 a month earlier. Manufacturing activity score came in at

46.5, up from 45.0 a month earlier.

The euro held steady against its major rivals in the Asian

trading today.

In the European session today, the euro rose to nearly a 4-month

high of 1.0696 against the U.S. dollar and nearly a 3-week high of

0.8329 against the pound, from early lows of 1.0602 and 0.8299,

respectively. If the euro extends its uptrend, it is likely to find

resistance around 1.08 against the greenback and 0.84 against the

pound.

Against the yen and the Swiss franc, the euro advanced to near

3-week highs of 159.04 and 0.9496 from early lows of 158.74 and

0.9446, respectively. The euro may test resistance around 162.00

against the yen and 0.95 against the franc.

Against Australia, the New Zealand and the Canadian dollars, the

euro climbed to a 7-month high of 1.7039, a 5-year high of 1.8850

and more than a 4-year high of 1.5393 from early lows of 1.6941,

1.8750 and 1.5287, respectively. On the downside, 1.71 against the

aussie, 1.89 against the kiwi and 1.55 against the loonie are seen

as the next resistance levels for the euro.

Looking ahead, U.S. MBA mortgage approvals data, U.S. and Canada

PMI data for February, U.S. factory orders for January and U.S. EIA

crude oil data are slated for release in the New York session.

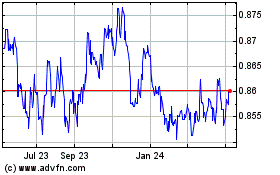

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Feb 2025 to Mar 2025

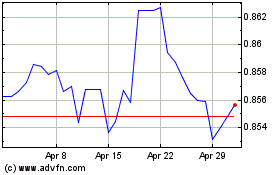

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Mar 2024 to Mar 2025