Pound Slides On Weak U.K. Retail Sales, Flash PMI Reports

22 November 2024 - 5:05PM

RTTF2

The British pound weakened against other major currencies in the

European session on Friday, as weak U.K. retail sales for October

and PMI data for November triggered expectations among traders for

interest-rate cuts by the Bank of England (BoE) in the December

meeting.

Data from S&P Global/CIPS showed that the Composite output

index fell to 49.9 from 51.8 in October. The reading was seen

unchanged at 51.8.

The Manufacturing PMI declined to 48.6 from 49.9.

The British sterling had fell earlier against its major rivals

after the U.K. retail sales declined more than expected in October,

as consumers reduced their spending on food and clothing.

Data from the Office for National Statistics showed that the

U.K. retail sales dropped 0.7 percent on a monthly basis in

October, in contrast to the revised 0.1 percent rise in September.

Sales were expected to fall 0.3 percent.

Year-on-year, retail sales growth eased to 2.4 percent in

October from 3.2 percent in September.

In other economic news, data from the market research group GfK

showed that consumer confidence ticked up in November ahead of the

shopping season. Moreover, concerns about the impact of the UK

budget and the US presidential election eased.

The consumer confidence index rose to -18 in November from -21

in October as all five sub-indices of the index were up from the

previous month.

Economic data updates from the region as well as the lingering

geopolitical concerns are however seen swaying market

sentiment.

In the European trading now, the pound fell to more than a

6-month low of 1.2493 against the U.S. dollar and more than a

3-week low of 1.1110 against the Swiss franc, from early highs of

1.2595 and 1.1164, respectively. If the pound extends its

downtrend, it is likely to find support around 1.23 against the

greenback and 1.09 against the franc.

Against the yen, the pound dropped to 1-1/2-month low of 192.96

from an early high of 194.81. The pound fell earlier to a 3-day low

of 193.79 against the yen. The pound may test support near the

190.00 region.

The pound fell slightly to 0.8329 against the euro, from an

early near 2-week low of 0.8268. The pound is likely to find

support around the 0.84 area.

In economic news, overall consumer prices in Japan were up 2.3

percent on year in October, the Ministry of Internal Affairs and

Communications said on Friday. That was in line with expectations

and down from 2.5 percent in September.

On a seasonally adjusted monthly basis, overall inflation was up

0.4 percent, exceeding forecasts for 0.2 percent following the 0.3

percent decline in the previous month. Core CPI, which excludes the

volatile prices of foods, rose 2.3 percent on year, above forecasts

for 2.2 percent but down from 2.3 percent a month earlier.

The latest survey from Jibun Bank revealed that the

manufacturing sector in Japan continued to contract in November,

and at a faster pace, with a manufacturing PMI score of 49.0.

That's down from 49.2 in October, although it moves further beneath

the boom-or-bust line of 50 that separates expansion from

contraction. The survey also showed that the services PMI improved

to 50.2 from 49.7 in the previous month. The composite PMI rose to

49.8 in November from 49.6 on October.

Looking ahead, Canada new housing price index for October,

retail sales for September, U.S. PMI data for November, U.S.

University of Michigan consumer sentiment for November and U.S.

Baker Hughes weekly oil rig count data are slated for release in

the New York session.

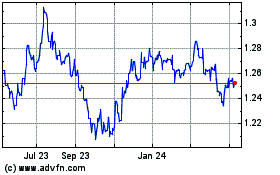

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Oct 2024 to Nov 2024

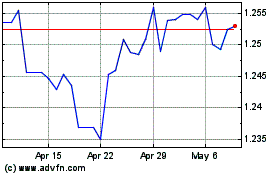

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Nov 2023 to Nov 2024