U.S. Dollar Climbs After PPI Data

11 October 2024 - 10:14PM

RTTF2

The U.S. dollar advanced against its most major counterparts in

the New York session on Friday, after producer prices came in

unchanged in September.

Data from the Labor Department showed that the producer price

index came in flat in September after rising by 0.2 percent in

August. Economists had expected producer prices to inch up by 0.1

percent.

The report also said the annual rate of growth by producer

prices slowed to 1.8 percent in September from an upwardly revised

1.9 percent in August.

Economists had expected the annual rate of producer price growth

to dip to 1.6 percent from the 1.7 percent originally reported for

the previous month.

The greenback rose to 1.0925 against the euro, 149.28 against

the yen and 0.8584 against the franc, off its early lows of 1.0953,

148.39 and 0.8559, respectively. The currency is seen finding

resistance around 1.08 against the euro, 150.00 against the yen and

0.89 against the franc.

In contrast, the greenback was down against the pound, at

1.3072. If the greenback falls further, it is likely to test

support around the 1.34 region.

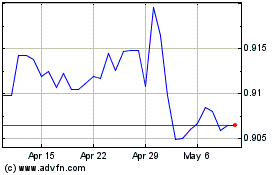

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Oct 2024 to Nov 2024

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Nov 2023 to Nov 2024