U.S. Dollar Weakens As Tariff Concerns Ease

07 March 2025 - 2:07AM

RTTF2

The U.S. dollar declined against its major counterparts in the

New York session on Thursday, as worries about tariffs eased

following the Trump administration's decision to delay car tariffs

for Canada and Mexico by a month.

Further, Commerce Secretary Howard Lutnick told CNBC that all

goods and services that are compliant with the United

States-Mexico-Canada trade agreement will likely be excluded from

Trump's tariffs for one month.

President Donald Trump announced on Truth Social that he will

delay tariffs on Mexico's USMCA-compliant goods until April 2.

In economic news, the Labor Department released a report showing

first-time claims for U.S. unemployment benefits fell by more than

expected in the week ended March 1st.

The report said initial jobless claims dipped to 221,000, a

decrease of 21,000 from the previous week's unrevised level of

242,000. Economists had expected jobless claims to edge down to

235,000.

On Friday, the Labor Department is scheduled to release its more

closely watched report on employment in the month of February.

The greenback fell to more than a 5-month low of 147.30 against

the yen and a 4-month low of 1.0853 against the euro. The greenback

is poised to challenge support around 141.00 against the yen and

1.10 against the euro.

The greenback touched 0.6363 against the aussie, 1.4239 against

the loonie and 0.5759 against the kiwi, setting 10-day lows. The

currency is likely to locate support around 0.65 against the

aussie, 1.38 against the loonie and 0.60 against the kiwi.

The greenback dropped to near a 3-month low of 0.8827 against

the franc, from an early 2-day high of 0.8925. If the currency

falls further, it is likely to test support around the 0.87

region.

In contrast, the greenback held steady against the pound after

falling to nearly a 4-month low of 1.2923 in the previous session.

The pair was worth 1.2893 at yesterday's close.

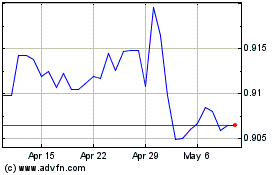

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Feb 2025 to Mar 2025

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Mar 2024 to Mar 2025