Current Report Filing (8-k)

12 July 2022 - 10:34PM

Edgar (US Regulatory)

0001844389

false

00-0000000

0001844389

2022-07-12

2022-07-12

0001844389

ACBA:UnitsEachConsistingOfOneOrdinaryShareParValue0.001PerShareAndOneRedeemableWarrantEntitlingHolderToReceiveOneOrdinaryShareMember

2022-07-12

2022-07-12

0001844389

ACBA:OrdinarySharesMember

2022-07-12

2022-07-12

0001844389

ACBA:WarrantsMember

2022-07-12

2022-07-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION

13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of

earliest event reported): July 12, 2022

ACE

GLOBAL BUSINESS ACQUISITION LIMITED

(Exact name of registrant

as specified in its charter)

| British Virgin Islands |

|

001-40309 |

|

N/A |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

6/F Unit B, Central

88, 88-89 Des Voeux Road Central,

Central, Hong Kong

(Address of principal

executive offices, including zip code)

Registrant’s telephone

number, including area code: (852) 9086 7042

Not Applicable

(Former name or former

address, if changed since last report)

Securities registered

pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| |

|

|

|

|

| Units, each consisting of one Ordinary Share, par value $0.001 per share, and one Redeemable Warrant entitling the holder to receive one Ordinary Share |

|

ACBAU |

|

NASDAQ Capital Market |

| |

|

|

|

|

| Ordinary Shares |

|

ACBA |

|

NASDAQ Capital Market |

| |

|

|

|

|

| Warrants |

|

ACBAW |

|

NASDAQ Capital Market |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.02. Mutual Termination of a Material Definitive Agreement.

As previously disclosed,

Ace Global Business Acquisition Limited, a British Virgin Islands company (“Ace”), entered into that certain Share Exchange

Agreement, dated as of August 23, 2021 (as amended, supplemented or otherwise modified from time to time, the “Share Exchange Agreement”)

with DDC Enterprise Limited (“DDC”) and Ka Yin Norma Chu, as representative of DDC’s shareholders (the “Shareholders’

Representative” and, collectively, the “Contracting Parties”) (the transaction being referred to herein as the “Business

Combination”).

On July 11, 2022, Ace

and DDC entered into that certain Mutual Termination of Share Exchange Agreement (the “Mutual Termination Agreement”) pursuant

to which Ace and DDC mutually agreed to terminate the Share Exchange Agreement pursuant to Section 12.3(a) thereof. Except as otherwise

set forth in the Share Exchange Agreement, none of the Contracting Parties shall have any further liability thereunder.

As a result of the mutual

termination of the Share Exchange Agreement, the Share Exchange Agreement is of no further force and effect, with the exception of Section 8.5

(Confidentiality), Article XI (Dispute Resolution), Section 12.4 (Effect of Termination) and Article XIII (Miscellaneous) of

the Share Exchange Agreement, each of which shall each survive the mutual termination of the Share Exchange Agreement and continue in

full force and effect in accordance with their respective terms. Neither party will be required to pay the other a termination fee as

a result of the mutual decision to enter into the Mutual Termination Agreement.

The mutual termination

of the Share Exchange Agreement also terminates and makes void, including but not limited to, the Shareholder Support Agreement entered

into between Ace and certain shareholders of DDC, which was executed concurrently with the Share Exchange Agreement.

Nonetheless, Ace shall

continue to pursue the consummation of a business combination with an appropriate target.

The foregoing descriptions

of the Share Exchange Agreement, the Mutual Termination Agreement and the Shareholder Support Agreement are not complete and are qualified

in their entirety by reference to and the terms and conditions of, respectively, (i) the Share Exchange Agreement, a copy of which

was previously filed as Exhibit 2.1 to Ace’s Current Report on Form 8-K on August 25, 2021, (ii) the Mutual Termination

Agreement, a copy of which is filed with this Current Report on Form 8-K as Exhibit 10.1, and the terms of which are incorporated

by reference herein, and (iii) the Shareholder Support Agreement, a copy of which was previously filed as Exhibit 10.1 to Ace’s

Current Report on Form 8-K on August 25, 2021.

Item 8.01. Other Events.

On July 12, 2022, Ace

and DDC issued a joint press release announcing the mutual termination of the Share Exchange Agreement. A copy of the press release is

attached as Exhibit 99.1 hereto and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

ACE GLOBAL BUSINESS ACQUISITION LIMITED |

| |

|

|

| |

By: |

/s/ Eugene Wong |

| |

|

Name: |

Eugene Wong |

| |

|

Title: |

Chief Executive Officer |

| |

|

|

| Dated: July 12, 2022 |

|

|

3

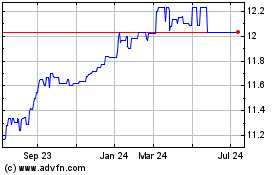

Ace Global Business Acqu... (NASDAQ:ACBA)

Historical Stock Chart

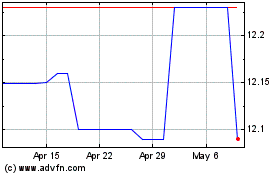

From Jan 2025 to Feb 2025

Ace Global Business Acqu... (NASDAQ:ACBA)

Historical Stock Chart

From Feb 2024 to Feb 2025