0001720580falseNONE00017205802025-03-062025-03-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): March 06, 2025 |

Adicet Bio, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-38359 |

81-3305277 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

131 Dartmouth Street, Floor 3 |

|

Boston, Massachusetts |

|

02116 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (650) 503-9095 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.0001 per share |

|

ACET |

|

The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On March 6, 2025, Adicet Bio, Inc. announced its financial results for the quarter and year ended December 31, 2024. A copy of the press release is being furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Current Report on Form 8-K and Exhibit 99.1 attached hereto is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

ADICET BIO, INC. |

|

|

|

|

Date: March 6, 2025 |

|

By: |

/s/ Nick Harvey |

|

|

Name: |

Nick Harvey |

|

|

Title: |

Chief Financial Officer |

Adicet Bio Reports Fourth Quarter and Full Year 2024 Financial Results and Highlights Recent Company Progress

Phase 1 clinical trial of ADI-001 in autoimmune diseases ongoing; on track to report preliminary clinical data from lupus nephritis (LN) patient cohort in 1H25

Additional LN clinical data and preliminary clinical data from other autoimmune patient cohorts anticipated in 2H25

Initiation of ADI-001 Phase 1 clinical trial patient enrollment in systemic lupus erythematosus (SLE), systemic sclerosis (SSc), idiopathic inflammatory myopathy (IIM) and stiff person syndrome (SPS) expected in 2Q25; anti-neutrophil cytoplasmic autoantibody (ANCA) associated vasculitis (AAV) patient enrollment expected to be initiated in 2H25

Advancing patient enrollment in ADI-270 Phase 1 clinical trial in patients with metastatic/advanced clear cell renal cell carcinoma (ccRCC); plan to report preliminary data in 1H25

$176.3 million in cash, cash equivalents and short-term investments as of December 31, 2024

REDWOOD CITY, Calif. & BOSTON – March 6, 2025 – Adicet Bio, Inc. (Nasdaq: ACET), a clinical stage biotechnology company discovering and developing allogeneic gamma delta T cell therapies for autoimmune diseases and cancer, today reported financial results and operational highlights for the fourth quarter and year ended December 31, 2024.

“In 2025 we plan to continue advancing our gamma delta 1 CAR T cell therapy programs, achieving key milestones and reporting preliminary data in autoimmune and oncology indications,” said Chen Schor, President and Chief Executive Officer of Adicet Bio. “The recent FDA Fast Track Designation for ADI-001 in refractory SLE with extrarenal involvement and in SSc highlights the significant unmet need for innovative, off-the-shelf therapies to treat autoimmune diseases. We are continuing to enroll LN patients in our ongoing Phase 1 trial in autoimmune diseases and look forward to sharing preliminary clinical data in the first half of 2025 and additional data in the second half of 2025. We expect to initiate enrollment for SLE, SSc, IIM and SPS patients in the second quarter and for AAV in the second half of the year, and to report clinical data from these additional cohorts in the second half as well.”

Mr. Schor continued: “In addition, we are continuing to enroll patients in our Phase 1 trial of ADI-270 in relapsed or refractory metastatic/advanced ccRCC patients and remain on track to announce preliminary clinical data in the first half of 2025. With a strong clinical foundation and growing momentum, Adicet is well-positioned to transform treatment paradigms for patients battling autoimmune diseases and solid tumors.”

Fourth Quarter 2024 and Recent Operational Highlights:

Autoimmune diseases

•Continuing to advance phase 1 trial of ADI-001 in autoimmune diseases. In November 2024, Adicet announced the dosing of the first patient in the Phase 1 trial evaluating ADI-001 in LN. Enrollment for SLE, SSc, IIM, and SPS patients is expected to commence in the second quarter of 2025, with the initiation of AAV patient enrollment anticipated in the second half of 2025. The Company remains on track to share preliminary clinical data from the trial’s LN cohort in the first half of 2025. Additional LN clinical data and preliminary clinical data from other autoimmune patient cohorts are anticipated in the second half of 2025, subject to study site initiation and patient enrollment.

•Fast Track Designation for ADI-001. In February 2025, Adicet received Fast Track Designation for ADI-001 for the treatment of refractory SLE with extrarenal involvement and SSc.

•ADI-001 clinical biomarker data presented at the American College of Rheumatology (ACR) Convergence 2024. In November 2024, Adicet showcased an oral abstract at the ACR Convergence 2024 detailing ADI-001 clinical biomarker data. The findings demonstrated significant chimeric antigen receptor (CAR) T cell activation, robust tissue trafficking and complete CD19+ B cell depletion in secondary lymphoid tissue, underscoring ADI-001's potential as a best-in-class off-the-shelf cell therapy for autoimmune diseases.

Solid tumor indications

·First patient dosed in phase 1 trial of ADI-270 in metastatic/advanced ccRCC. In December 2024, Adicet announced the dosing of the first patient in the Phase 1 clinical trial evaluating the safety and efficacy of ADI-270 in adults with relapsed or refractory metastatic/advanced ccRCC. Preliminary clinical data from the trial are anticipated in the first half of 2025.

·Presentation of ADI-270 data at the Society for Immunotherapy of Cancer (SITC) 2025 Spring Scientific Meeting. In March 2025, Adicet will present two posters highlighting ADI-270 preclinical data at the SITC 2025 Spring Scientific Meeting taking place March 12-14 in San Diego, CA.

Corporate updates

•Appointed Julie Maltzman, M.D., as Chief Medical Officer. In December 2024, Adicet appointed Julie Maltzman, M.D., as Chief Medical Officer, who brings over two decades of experience in clinical development and regulatory affairs to the Company's leadership team. Dr. Maltzman’s expertise spans across oncology and autoimmune diseases, encompassing all phases of drug development from early-stage research to global regulatory approvals and commercialization. Dr. Maltzman is leading Adicet’s clinical development functions to advance the company's pipeline of allogeneic gamma delta CAR T cell therapies.

Financial Results for Fourth Quarter and Full Year 2024:

Three months ended December 31, 2024

•Research and Development (R&D) Expenses: R&D expenses were $23.3 million for the three months ended December 31, 2024, compared to $24.8 million during the same period in 2023. The decrease in R&D expenses was primarily due to a $1.3 million decrease in expenses related to contract development and manufacturing organizations (CDMOs).

•General and Administrative (G&A) Expenses: G&A expenses were $7.5 million for the three months ended December 31, 2024, compared to $6.8 million during the same period in 2023. The increase in general and administrative expenses was primarily due to a $0.5 million increase in professional fees.

•Net Loss: Net loss for the three months ended December 31, 2024 was $28.7 million, or a net loss of $0.32 per basic and diluted share, including non-cash stock-based compensation expense of $3.8 million, as compared to a net loss of $29.5 million, or a net loss of $0.69 per basic and diluted share, including non-cash stock-based compensation expense of $4.9 million during the same period in 2023.

Twelve Months Ended December 31, 2024

•Research and Development (R&D) Expenses: R&D expenses were $99.3 million for the year ended December 31, 2024, compared to $106.0 million for the year ended December 31, 2023. The $6.7 million decrease was primarily driven by a $7.7 million decrease in expenses related to CDMOs. This decrease was partially offset by a $0.6 million increase in lab expenses as well as a $0.5 million increase in professional fees.

•General and Administrative (G&A) Expenses: G&A expenses were $28.3 million for the year ended December 31, 2024, compared to $26.5 million for the year ended December 31, 2023. The $1.8 million increase was primarily driven by a $0.9 million increase in professional fees for the period. There was also a net $0.4 million increase in payroll and personnel expenses and a $0.3 million increase in depreciation expense for the period.

•Net Loss: Net loss for the year ended December 31, 2024 was $117.1 million, or a net loss of $1.33 per basic and diluted share, including non-cash stock-based compensation expense of $22.2 million, as compared to a net loss of $142.7 million, or a net loss of $3.31 per basic and diluted share, including non-cash stock-based compensation expense of $20.3 million during the same period in 2023.

•Cash Position: Cash, cash equivalents and short-term investments were $176.3 million as of December 31, 2024, compared to $159.7 million as of December 31, 2023. The Company expects that current cash, cash equivalents and short-term investments as of December 31, 2024, will be sufficient to fund its operating expenses into the second half of 2026.

About Adicet Bio, Inc.

Adicet Bio, Inc. is a clinical stage biotechnology company discovering and developing allogeneic gamma delta T cell therapies for autoimmune diseases and cancer. Adicet is advancing a pipeline of “off-the-shelf” gamma delta T cells, engineered with chimeric antigen receptors (CARs), to facilitate durable activity in patients. For more information, please visit our website at https://www.adicetbio.com.

Forward-Looking Statements

This press release contains “forward-looking statements” of Adicet within the meaning of the Private Securities Litigation Reform Act of 1995 relating to the business and operations of Adicet. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements include, but are not limited to, express or implied statements regarding: clinical development of Adicet’s product candidates, including future plans or expectations for ADI-001 in autoimmune diseases and ADI-270 in ccRCC and the potential safety, tolerability and efficacy for the treatment of autoimmune diseases and cancer; ADI-001’s potential to be an off-the-shelf treatment option for autoimmune indications; ADI-270’s potential to be the first gamma delta CAR T cell therapy to address solid tumors; timing and success of the Phase 1 clinical trial of ADI-001 in LN, SLE, SSc, AAV, IIM and SPS, including timing and expectations for enrollment and future data releases; timing and success of the Phase 1 clinical trial of ADI-270 in ccRCC, including expectations for future data releases; and expectations regarding Adicet’s uses of capital, expenses and financial results, including the expected cash runway.

Any forward-looking statements in this press release are based on management’s current expectations and beliefs of future events, and are subject to a number of risks and uncertainties that could cause actual results to differ materially and adversely from those set forth in or implied by such forward-looking statements, including without limitation, the effect of global economic conditions and public health emergencies on Adicet’s business and financial results, including with respect to disruptions to our preclinical and clinical studies, business operations, employee hiring and retention, and ability to raise additional capital; Adicet’s ability to execute on its strategy including obtaining the requisite regulatory approvals on the expected timeline, if at all; that positive results, including interim results, from a preclinical or clinical study may not necessarily be predictive of the results of future or ongoing studies; clinical studies may fail to demonstrate adequate safety and efficacy of Adicet’s product candidates, which would prevent, delay, or limit the scope of regulatory approval and commercialization; and regulatory approval processes of the U.S. Food and Drug Administration and comparable foreign regulatory authorities are lengthy, time-consuming, and inherently unpredictable; and Adicet’s ability to meet production and product release expectations. For a discussion of these and other risks and uncertainties, and other important factors, any of which could cause Adicet’s actual results to differ from those contained in the forward-looking statements, see the section titled “Risk Factors” in Adicet’s most recent annual report on Form 10-K, as well as discussions of potential risks, uncertainties, and other important factors in Adicet’s other filings with the U.S. Securities and Exchange Commission, including its quarterly report on Form 10-Q. All information in this press release is as of the date of the release, and Adicet undertakes no duty to update this information unless required by law.

ADICET BIO, INC.

Consolidated Statements of Operations and Comprehensive Income

(in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

Years Ended December 31, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

$ 23,273 |

|

$ 24,759 |

|

$ 99,323 |

|

$ 106,043 |

General and administrative |

|

7,470 |

|

6,807 |

|

28,292 |

|

26,533 |

Goodwill impairment |

|

— |

|

— |

|

— |

|

19,462 |

Total operating expenses |

|

30,743 |

|

31,566 |

|

127,615 |

|

152,038 |

Loss from operations |

|

(30,743) |

|

(31,566) |

|

(127,615) |

|

(152,038) |

Interest income |

|

2,067 |

|

2,178 |

|

10,714 |

|

9,978 |

Interest expense |

|

(1) |

|

— |

|

(4) |

|

(25) |

Other expense, net |

|

(50) |

|

(101) |

|

(217) |

|

(573) |

Loss before income tax provision |

|

(28,727) |

|

(29,489) |

|

(117,122) |

|

(142,658) |

Income tax provision |

|

— |

|

— |

|

— |

|

— |

Net loss |

|

$ (28,727) |

|

$ (29,489) |

|

$ (117,122) |

|

$ (142,658) |

Net loss per share, basic and diluted |

|

$ (0.32) |

|

$ (0.69) |

|

$ (1.33) |

|

$ (3.31) |

Weighted-average common shares used in computing net loss per share, basic and diluted |

|

90,846,293 |

|

43,035,315 |

|

87,866,435 |

|

43,042,405 |

Other comprehensive income |

|

|

|

|

|

|

|

|

Unrealized (loss) gain on treasury securities, net of tax |

|

(105) |

|

— |

|

16 |

|

— |

Total other comprehensive income |

|

(105) |

|

— |

|

16 |

|

— |

Comprehensive loss |

|

$ (28,832) |

|

$ (29,489) |

|

$ (117,106) |

|

$ (142,658) |

ADICET BIO, INC.

Consolidated Balance Sheets Information

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

December 31, |

December 31, |

|

|

|

2024 |

|

|

2023 |

|

Cash, cash equivalents and short-term investments in treasury securities |

|

$ |

176,303 |

|

|

$ |

159,711 |

|

Working capital |

|

|

160,744 |

|

|

|

142,985 |

|

Total assets |

|

|

220,219 |

|

|

|

207,295 |

|

Accumulated deficit |

|

|

(497,894 |

) |

|

|

(380,772 |

) |

Total stockholders’ equity |

|

|

186,609 |

|

|

|

170,175 |

|

Adicet Bio, Inc.

Investor and Media Contacts

Investors:

Anne Bowdidge

abowdidge@adicetbio.com

Janhavi Mohite

Precision AQ

212-362-1200

janhavi.mohite@precisionaq.com

Media:

Kerry Beth Daly

kbdaly@adicetbio.com

v3.25.0.1

Document And Entity Information

|

Mar. 06, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 06, 2025

|

| Entity Registrant Name |

Adicet Bio, Inc.

|

| Entity Central Index Key |

0001720580

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-38359

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

81-3305277

|

| Entity Address, Address Line One |

131 Dartmouth Street, Floor 3

|

| Entity Address, City or Town |

Boston

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02116

|

| City Area Code |

(650)

|

| Local Phone Number |

503-9095

|

| Entity Information, Former Legal or Registered Name |

Not applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

ACET

|

| Security Exchange Name |

NONE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

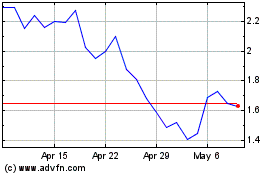

Adicet Bio (NASDAQ:ACET)

Historical Stock Chart

From Feb 2025 to Mar 2025

Adicet Bio (NASDAQ:ACET)

Historical Stock Chart

From Mar 2024 to Mar 2025