Acadia Healthcare Company, Inc. (NASDAQ: ACHC) today announced

financial results for the first quarter ended March 31, 2024.

First Quarter Highlights

- Revenue totaled $768.1 million, an increase of 9.1% over the

first quarter of 2023

- Same facility revenue increased 9.2% compared with the first

quarter of 2023, including an increase in revenue per patient day

of 6.9% and an increase in patient days of 2.2%

- Net income attributable to Acadia totaled $76.4 million, or

$0.83 per diluted share

- Adjusted income attributable to Acadia totaled $77.3 million,

or $0.84 per diluted share

- Adjusted EBITDA totaled $173.9 million, an increase of 14.9%

over the first quarter of 2023

- Adjusted EBITDA margin of 22.6%, an increase of 110 basis

points over the first quarter of 2023

- Continued progress on the execution of the Company’s growth

strategy, including the addition of 27 beds to the Company’s

existing facilities and through opening one new specialty de novo

facility and acquiring one specialty provider and three

comprehensive treatment centers (“CTCs”)

- Opened a 100-bed acute care hospital in Mesa, Arizona, in April

2024.

Adjusted income attributable to Acadia and Adjusted EBITDA are

non-GAAP financial measures. A reconciliation of all non-GAAP

financial measures in this press release begins on page 9.

First Quarter Results

Chris Hunter, Chief Executive Officer of Acadia Healthcare

Company, remarked, “We are pleased with our solid financial and

operating performance for the first quarter of 2024, with

year-over-year top line growth of 9.1%. Strong operating leverage,

including continued improvement in our labor trends, helped drive

year-over-year EBITDA growth of 14.9%. Overall, we continue to see

a robust need for our behavioral health services and remain

confident in our ability to meet our strategic growth objectives in

2024, including the addition of approximately 1,200 new beds this

year. With a proven operating model, a patient-centric approach

across the continuum of care, and a strong focus on clinical

quality, we are well positioned to meet expected demand and

continue to provide safe, quality patient care for those seeking

treatment for mental health and substance use issues.”

Strategic Investments for Long-Term Growth

During the first quarter of 2024, the Company continued to

advance its growth strategy with the following accomplishments

through its five distinct growth pathways.

- Facility Expansions – Added 27 beds to existing

facilities in the first quarter. The Company expects to add more

than 400 beds to existing facilities in 2024.

- De Novo Facilities – Opened a new 20-bed specialty

facility, Sabal Palms Recovery Center, located near Tampa, Florida,

that will provide residential addiction treatment services.

Following the end of the quarter, Acadia opened a new 100-bed acute

care hospital, Agave Ridge Behavioral Hospital, in Mesa,

Arizona.

- Joint Ventures – In January, Acadia announced a new

joint venture partnership with Ascension Seton, one of the nation’s

leading integrated healthcare systems, for a behavioral health

hospital in Austin, Texas. This hospital, expected to open later in

2024, marks the Company’s second joint venture partnership with

Ascension. During the quarter, the Company also commenced

construction on two new hospitals, holding ground-breaking

ceremonies in Apopka, Florida, in partnership with Orlando Health,

and in Malden, Massachusetts, in partnership with Tufts Medicine.

Acadia has 21 joint venture partnerships for 22 hospitals, with 11

hospitals already in operation and 11 additional hospitals expected

to open over the next few years.

- Acquisitions – In February, the Company closed the

previously announced acquisition of Turning Point Centers, a 76-bed

specialty provider of substance use disorder and primary mental

health treatment services that supports the Salt Lake City, Utah,

metropolitan market. In March, the Company completed the

acquisition of three CTCs in North Carolina, serving patients in

Raleigh, Greenville, Hillsborough, and their respective surrounding

communities. With these additions, Acadia now operates 10 CTC

locations in North Carolina and 160 locations in 32 states across

the country.

- Extend Continuum of Care – Expanded treatment options by

adding 15 outpatient programs during the first quarter. These

programs include Partial Hospitalization Programs (PHP), Intensive

Outpatient Programs (IOP) or virtual services.

Cash and Liquidity

Acadia has continued to maintain a strong financial position

with sufficient capital to make strategic investments in its

business. As of March 31, 2024, the Company had $77.3 million in

cash and cash equivalents and $371.5 million available under its

$600 million revolving credit facility with a net leverage ratio of

approximately 2.6x.

Net leverage ratio is a non-GAAP financial

measure. A reconciliation of all non-GAAP financial measures in

this press release begins on page 9.

Financial Guidance

Acadia today affirmed its previously announced financial

guidance for 2024, as follows:

2024

Guidance Range

Revenue (1)

$3.18 to $3.25 billion

Adjusted EBITDA (1)

$730 to $770 million

Adjusted earnings per diluted share

(1)

$3.40 to $3.70

Interest expense

$110 to $120 million

Tax rate

24.5% to 25.5%

Depreciation and amortization expense

$150 to $160 million

Stock compensation expense

$40 to $45 million

Operating cash flows

$525 to $575 million

Expansion capital expenditures

$425 to $475 million

Maintenance and IT capital

expenditures

$90 to $110 million

Total bed additions, excluding

acquisitions

Approx. 1,200 beds

(1)

Includes one-time payments from a state of approximately $10

million (or $0.09 per diluted share) for the year, of which

approximately $7 million (or $0.06 per diluted share) was received

in the first quarter of 2024.

The Company’s guidance does not include the impact of any future

acquisitions, divestitures, transaction, legal and other costs or

non-recurring legal settlements expense.

Conference Call

Acadia will hold a conference call to discuss its first quarter

financial results at 8:00 a.m. Central/9:00 a.m. Eastern Time on

Thursday, May 2, 2024. A live webcast of the conference call will

be available at www.acadiahealthcare.com in the “Investors” section

of the website. The webcast of the conference call will be

available for 30 days.

About Acadia

Acadia is a leading provider of behavioral healthcare services

across the United States. As of March 31, 2024, Acadia operated a

network of 258 behavioral healthcare facilities with approximately

11,300 beds in 38 states and Puerto Rico. With approximately 23,500

employees serving more than 75,000 patients daily, Acadia is the

largest stand-alone behavioral healthcare company in the U.S.

Acadia provides behavioral healthcare services to its patients in a

variety of settings, including inpatient psychiatric hospitals,

specialty treatment facilities, residential treatment centers and

outpatient clinics.

Forward-Looking Information

This press release contains forward-looking statements.

Generally, words such as “may,” “will,” “should,” “could,”

“anticipate,” “expect,” “intend,” “estimate,” “plan,” “continue,”

and “believe” or the negative of or other variation on these and

other similar expressions identify forward-looking statements.

These forward-looking statements are made only as of the date of

this press release. We do not undertake to update or revise the

forward-looking statements, whether as a result of new information,

future events or otherwise. Forward-looking statements are based on

current expectations and involve risks and uncertainties and our

future results could differ significantly from those expressed or

implied by our forward-looking statements. Factors that may cause

actual results to differ materially include, without limitation,

(i) potential difficulties in successfully integrating the

operations of acquired facilities or realizing the expected

benefits and synergies of our facility expansions, acquisitions,

joint ventures and de novo transactions; (ii) Acadia’s ability to

add beds, expand services, enhance marketing programs and improve

efficiencies at its facilities; (iii) potential reductions in

payments received by Acadia from government and commercial payors;

(iv) the occurrence of patient incidents, governmental

investigations, litigation and adverse regulatory actions, which

could adversely affect the price of our common stock and result in

substantial payments and incremental regulatory burdens; (v) the

risk that Acadia may not generate sufficient cash from operations

to service its debt and meet its working capital and capital

expenditure requirements; (vi) potential disruptions to our

information technology systems or a cybersecurity incident; and

(vii) potential operating difficulties, including, without

limitation, disruption to the U.S. economy and financial markets;

reduced admissions and patient volumes; increased costs relating to

labor, supply chain and other expenditures; changes in competition

and client preferences; and general economic or industry conditions

that may prevent Acadia from realizing the expected benefits of its

business strategies. These factors and others are more fully

described in Acadia’s periodic reports and other filings with the

SEC.

Acadia Healthcare Company, Inc. Condensed Consolidated

Statements of Operations (Unaudited) Three

Months Ended March 31,

2024

2023

(In thousands, except per share amounts) Revenue

$

768,051

$

704,267

Salaries, wages and benefits (including equity-based

compensationexpense of $8,678 and $7,629, respectively)

417,523

391,177

Professional fees

45,688

41,125

Supplies

26,652

26,021

Rents and leases

11,863

11,424

Other operating expenses

101,073

90,838

Depreciation and amortization

36,347

31,569

Interest expense, net

27,214

19,999

Transaction, legal and other costs

2,847

6,471

Total expenses

669,207

618,624

Income before income taxes

98,844

85,643

Provision for income taxes

20,074

19,085

Net income

78,770

66,558

Net income attributable to noncontrolling interests

(2,387

)

(543

)

Net income attributable to Acadia Healthcare Company, Inc.

$

76,383

$

66,015

Earnings per share attributable to Acadia Healthcare

Company, Inc.stockholders: Basic

$

0.84

$

0.73

Diluted

$

0.83

$

0.72

Weighted-average shares outstanding: Basic

91,363

90,101

Diluted

92,010

91,391

Acadia Healthcare Company, Inc. Condensed Consolidated

Balance Sheets (Unaudited) March 31,

December 31,

2024

2023

(In thousands) ASSETS Current assets: Cash and

cash equivalents

$

77,303

$

100,073

Accounts receivable, net

386,191

361,451

Other current assets

147,312

134,476

Total current assets

610,806

596,000

Property and equipment, net

2,376,059

2,266,610

Goodwill

2,261,026

2,225,962

Intangible assets, net

73,352

73,278

Deferred tax assets

2,777

6,658

Operating lease right-of-use assets

121,346

117,780

Other assets

71,881

72,553

Total assets

$

5,517,247

$

5,358,841

LIABILITIES AND EQUITY Current liabilities:

Current portion of long-term debt

$

61,452

$

29,219

Accounts payable

156,130

156,132

Accrued salaries and benefits

118,005

141,901

Current portion of operating lease liabilities

26,815

26,268

Other accrued liabilities

119,911

532,261

Total current liabilities

482,313

885,781

Long-term debt

1,794,296

1,342,548

Deferred tax liabilities

15,527

1,931

Operating lease liabilities

103,352

100,808

Other liabilities

146,404

140,113

Total liabilities

2,541,892

2,471,181

Redeemable noncontrolling interests

109,333

105,686

Equity: Common stock

916

913

Additional paid-in capital

2,657,002

2,649,340

Retained earnings

208,104

131,721

Total equity

2,866,022

2,781,974

Total liabilities and equity

$

5,517,247

$

5,358,841

Acadia Healthcare Company, Inc. Condensed Consolidated

Statements of Cash Flows (Unaudited) Three

Months Ended March 31,

2024

2023

(In thousands) Operating activities: Net income

$

78,770

$

66,558

Adjustments to reconcile net income to net cash (used in)

provided by operating activities: Depreciation and amortization

36,347

31,569

Amortization of debt issuance costs

1,016

824

Equity-based compensation expense

8,678

7,629

Deferred income taxes

17,476

212

Other

(4,094

)

1,089

Change in operating assets and liabilities, net of effect of

acquisitions: Accounts receivable, net

(22,930

)

(23,968

)

Other current assets

(15,629

)

(23,430

)

Other assets

696

(1,436

)

Accounts payable and other accrued liabilities

(403,340

)

13,633

Accrued salaries and benefits

(25,024

)

(30,386

)

Other liabilities

6,749

2,114

Net cash (used in) provided by operating activities

(321,285

)

44,408

Investing activities: Cash paid for acquisitions, net

of cash acquired

(50,353

)

—

Cash paid for capital expenditures

(142,410

)

(66,525

)

Proceeds from sale of property and equipment

9,056

409

Other

(907

)

(794

)

Net cash used in investing activities

(184,614

)

(66,910

)

Financing activities: Borrowings on long-term debt

350,000

—

Borrowings on revolving credit facility

160,000

40,000

Principal payments on revolving credit facility

(15,000

)

—

Principal payments on long-term debt

(10,242

)

(5,313

)

Payment of debt issuance costs

(1,518

)

—

Repurchase of shares for payroll tax withholding, net of proceeds

from stock option exercises

(1,013

)

(47,671

)

Contributions from noncontrolling partners in joint ventures

2,280

1,655

Distributions to noncontrolling partners in joint ventures

(1,020

)

—

Other

(358

)

11

Net cash provided by (used in) financing activities

483,129

(11,318

)

Net decrease in cash and cash equivalents

(22,770

)

(33,820

)

Cash and cash equivalents at beginning of the period

100,073

97,649

Cash and cash equivalents at end of the period

$

77,303

$

63,829

Effect of acquisitions: Assets acquired, excluding

cash

$

55,309

$

—

Liabilities assumed

(3,456

)

—

Contingent consideration issued in connection with an acquisition

(1,500

)

—

Cash paid for acquisitions, net of cash acquired

$

50,353

$

—

Acadia Healthcare Company, Inc. Operating Statistics

(Unaudited, Revenue in thousands) Three Months

Ended March 31,

2024

2023

% Change

Same Facility Results (1) Revenue

$

756,256

$

692,420

9.2

%

Patient Days

757,990

741,711

2.2

%

Admissions

48,158

49,006

-1.7

%

Average Length of Stay (2)

15.7

15.1

4.0

%

Revenue per Patient Day

$

998

$

934

6.9

%

Adjusted EBITDA margin

28.7

%

27.5

%

120 bps

Facility Results Revenue

$

768,051

$

704,267

9.1

%

Patient Days

768,678

754,858

1.8

%

Admissions

49,058

49,906

-1.7

%

Average Length of Stay (2)

15.7

15.1

3.6

%

Revenue per Patient Day

$

999

$

933

7.1

%

Adjusted EBITDA margin

27.5

%

26.5

%

100 bps

(1) Same facility results for the periods presented include

facilities we have operated for more than one year and exclude

certain closed services. (2) Average length of stay is defined as

patient days divided by admissions.

Acadia Healthcare Company,

Inc. Reconciliation of Net Income Attributable to Acadia

Healthcare Company, Inc. to Adjusted EBITDA (Unaudited)

Three Months Ended March 31,

2024

2023

(in thousands) Net income attributable to Acadia

Healthcare Company, Inc.

$

76,383

$

66,015

Net income attributable to noncontrolling interests

2,387

543

Provision for income taxes

20,074

19,085

Interest expense, net

27,214

19,999

Depreciation and amortization

36,347

31,569

EBITDA

162,405

137,211

Adjustments: Equity-based compensation expense (a)

8,678

7,629

Transaction, legal and other costs (b)

2,847

6,471

Adjusted EBITDA

$

173,930

$

151,311

Adjusted EBITDA margin

22.6

%

21.5

%

See footnotes on page 11.

Acadia Healthcare

Company, Inc. Reconciliation of Net Income Attributable to

Acadia Healthcare Company, Inc. to Adjusted Income

Attributable to Acadia Healthcare Company, Inc.

(Unaudited) Three Months Ended March 31,

2024

2023

(in thousands, except per share amounts) Net income

attributable to Acadia Healthcare Company, Inc.

$

76,383

$

66,015

Adjustments to income: Transaction, legal and other costs

(b)

2,847

6,471

Provision for income taxes

20,074

19,085

Adjusted income before income taxes attributable to Acadia

Healthcare Company, Inc.

99,304

91,571

Income tax effect of adjustments to income (c)

22,011

22,920

Adjusted income attributable to Acadia Healthcare Company, Inc.

$

77,293

$

68,651

Weighted-average shares outstanding - diluted

92,010

91,391

Adjusted income attributable to Acadia Healthcare Company,

Inc. per diluted share

$

0.84

$

0.75

See footnotes on page 11.

Acadia Healthcare

Company, Inc. Footnotes We have included certain

financial measures in this press release, including those listed

below, which are “non-GAAP financial measures” as defined under the

rules and regulations promulgated by the SEC. These non-GAAP

financial measures include, and are defined, as follows: •

EBITDA: net income attributable to

Acadia Healthcare Company, Inc. adjusted for net income

attributable to noncontrolling interests, provision for income

taxes, net interest expense and depreciation and amortization.

•

Adjusted EBITDA: EBITDA

adjusted for equity-based compensation expense and transaction,

legal and other costs. •

Adjusted

EBITDA margin: Adjusted EBITDA divided by revenue. •

Adjusted income before income taxes

attributable to Acadia Healthcare Company, Inc.: net income

attributable to Acadia Healthcare Company, Inc. adjusted for

transaction, legal and other costs and provision for income taxes.

•

Adjusted income attributable to

Acadia Healthcare Company, Inc.: Adjusted income before

income taxes attributable to Acadia Healthcare Company, Inc.

adjusted for the income tax effect of adjustments to income.

•

Net leverage ratio: Long-term debt

(excluding $11.2 million of unamortized debt issuance costs,

discount and premium) less cash and cash equivalents divided by

Adjusted EBITDA for the trailing twelve months. The non-GAAP

financial measures presented herein are supplemental measures of

our performance and are not required by, or presented in accordance

with, generally accepted accounting principles in the United States

(“GAAP”). The non-GAAP financial measures presented herein are not

measures of our financial performance under GAAP and should not be

considered as alternatives to net income or any other performance

measures derived in accordance with GAAP or as an alternative to

cash flow from operating activities as measures of our liquidity.

Our measurements of these non-GAAP financial measures may not be

comparable to similarly titled measures of other companies. We have

included information concerning the non-GAAP financial measures in

this press release because we believe that such information is used

by certain investors as measures of a company’s historical

performance. We believe these measures are frequently used by

securities analysts, investors and other interested parties in the

evaluation of issuers of equity securities, many of which present

similar non-GAAP financial measures when reporting their results.

Because the non-GAAP financial measures are not measurements

determined in accordance with GAAP and are thus susceptible to

varying calculations, the non-GAAP financial measures, as

presented, may not be comparable to other similarly titled measures

of other companies. Our presentation of these non-GAAP financial

measures should not be construed as an inference that our future

results will be unaffected by unusual or nonrecurring items.

The Company is not able to provide a reconciliation of projected

Adjusted EBITDA and adjusted earnings per diluted share, where

provided, to expected results due to the unknown effect, timing and

potential significance of transaction-related expenses and the tax

effect of such expenses. (a) Represents the equity-based

compensation expense of Acadia. (b) Represents transaction,

legal and other costs incurred by Acadia primarily related to

legal, management transition, termination, restructuring,

acquisition and other similar costs. (c) Represents the

income tax effect of adjustments to income based on tax rates of

22.2% and 25.0% for the three months ended March 31, 2024 and 2023,

respectively.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240501429601/en/

Investor Contact: Patrick Feeley Senior Vice President, Investor

Relations (615) 861-6000

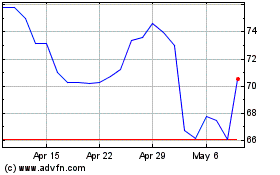

Acadia Healthcare (NASDAQ:ACHC)

Historical Stock Chart

From Apr 2024 to May 2024

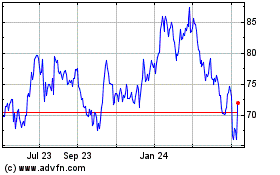

Acadia Healthcare (NASDAQ:ACHC)

Historical Stock Chart

From May 2023 to May 2024