false

0001113232

0001113232

2024-07-31

2024-07-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 31, 2024

Axcelis Technologies, Inc.

(Exact name of registrant as specified in

its charter)

| Delaware |

|

000-30941 |

|

34-1818596 |

| (State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

| of incorporation) |

|

File Number) |

|

Identification No.) |

| 108 Cherry Hill Drive, Beverly, Massachusetts |

|

01915 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (978) 787-4000

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common Stock, par value $0.001 per share |

ACLS |

NASDAQ Global Select Market |

Item 2.02 Results of Operations and Financial Condition

On July 31, 2024, Axcelis Technologies, Inc. (the “Company”)

issued a press release regarding its financial results for its quarter ended June 30, 2024. The Company’s press release is

attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: July 31, 2024 |

Axcelis Technologies, Inc. |

| |

|

| |

By: |

/s/ James Coogan |

| |

|

James Coogan |

| |

|

Executive Vice President |

| |

|

and Chief Financial Officer |

Exhibit 99.1

News

Release

Axcelis Announces

Financial Results for Second Quarter 2024

| · | Revenue

of $256.5 million |

| · | Operating

margin of 20.6% |

| · | Diluted

earnings per share of $1.55 |

BEVERLY,

Mass. — July 31, 2024—Axcelis Technologies, Inc. (Nasdaq: ACLS) today

announced financial results for the second quarter ended June 30, 2024. The Company reported second quarter revenue of $256.5 million,

compared to $252.4 million for the first quarter of 2024. Gross margin for the quarter was 43.8%, compared to 46.0% in the first quarter.

Operating profit for the quarter was $52.8 million, compared to $56.5 million for the first quarter. Net income for the quarter was $50.9

million, or $1.55 per diluted share, compared to $51.6 million, or $1.57 per diluted share in the first quarter.

President and CEO Russell Low

commented, “Axcelis delivered strong financial results in the second quarter, exceeding our expectations. This was driven by

better-than-expected conversion of evaluation units into revenue as well as continued robust demand in our Power segment -

particularly silicon carbide, which continues to be a key growth driver for Axcelis. We are well positioned to execute on our long

term strategy. As we look to the second half of the year, we expect revenue to be slightly better than the first half with momentum

expected to build into 2025.”

Executive Vice President and Chief Financial

Officer Jamie Coogan said, “We are very pleased with our second quarter results. Revenue, operating margin and earnings per share

exceeded our guidance for the period, and we delivered another quarter of healthy cash flow. Our product positioning and our disciplined

cost structure provide a solid foundation on which to grow revenue and profitability as our markets recover.”

Business

Outlook

For the third quarter ending September 30,

2024, Axcelis expects revenues of approximately $255 million, and earnings per diluted share of approximately $1.43.

Second Quarter 2024 Conference Call

The

Company will host a call to discuss the results for the second quarter 2024 on Thursday, August 1, 2024, at 8:30 a.m. ET. The

call will be available via webcast that can be accessed through the Investors page of Axcelis'

website at www.axcelis.com, or by registering as a Participant here: https://register.vevent.com/register/BIc2d772b56d7b46c0a39772ba7468e5a0

Webcast replays will be available for

30 days following the call.

News

Release

Safe

Harbor Statement

This press release and the conference

call contain forward-looking statements under the Private Securities Litigation Reform Act safe harbor provisions. These statements,

which include our expectations for spending in our industry and guidance for future financial performance, are based on management’s

current expectations and should be viewed with caution. They are subject to various risks and uncertainties that could cause actual results

to differ materially from those in the forward-looking statements, many of which are outside the control of the Company, including that

customer decisions to place orders or our product shipments may not occur when we expect, that orders may not be converted to revenue

in any particular quarter, or at all, whether demand will continue for the semiconductor equipment we produce or, if not, whether we

can successfully meet changing market requirements, and whether we will be able to maintain continuity of business relationships with

and purchases by major customers. Increased competitive pressure on sales and pricing, increases in material and other production costs

that cannot be recouped in product pricing and instability caused by changing global economic, political or financial conditions could

also cause actual results to differ materially from those in our forward-looking statements. These risks and other risk factors relating

to Axcelis are described more fully in the most recent Form 10-K filed by Axcelis and in other documents filed from time to time

with the Securities and Exchange Commission.

About Axcelis:

Axcelis

(Nasdaq: ACLS), headquartered in Beverly, Mass., has been providing innovative, high-productivity solutions for the semiconductor industry

for over 45 years. Axcelis is dedicated to developing enabling process applications through the design, manufacture and complete

life cycle support of ion implantation systems, one of the most critical and enabling steps in the IC manufacturing process. Learn more

about Axcelis at www.axcelis.com.

CONTACTS:

Investor Relations Contact:

David Ryzhik

Senior Vice President, Investor

Relations and Corporate Strategy

Telephone: (978) 787-2352

Email: David.Ryzhik@axcelis.com

Press/Media

Relations Contact:

Maureen Hart

Senior Director, Corporate &

Marketing Communications

Telephone: (978) 787-4266

Email: Maureen.Hart@axcelis.com

News

Release

Axcelis Technologies, Inc.

Consolidated

Statements of Operations

(In thousands,

except per share amounts)

(Unaudited)

| | |

Three months

ended | | |

Six months

ended | |

| | |

June 30, | | |

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Revenue: | |

| | | |

| | | |

| | | |

| | |

| Product | |

$ | 245,380 | | |

$ | 265,673 | | |

$ | 488,798 | | |

$ | 511,680 | |

| Services | |

| 11,132 | | |

| 8,297 | | |

| 20,085 | | |

| 16,310 | |

| Total

revenue | |

| 256,512 | | |

| 273,970 | | |

| 508,883 | | |

| 527,990 | |

| Cost of revenue: | |

| | | |

| | | |

| | | |

| | |

| Product | |

| 134,759 | | |

| 146,741 | | |

| 262,670 | | |

| 289,512 | |

| Services | |

| 9,344 | | |

| 7,526 | | |

| 17,753 | | |

| 14,756 | |

| Total

cost of revenue | |

| 144,103 | | |

| 154,267 | | |

| 280,423 | | |

| 304,268 | |

| Gross profit | |

| 112,409 | | |

| 119,703 | | |

| 228,460 | | |

| 223,722 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research

and development | |

| 25,786 | | |

| 24,130 | | |

| 51,448 | | |

| 47,903 | |

| Sales

and marketing | |

| 17,230 | | |

| 15,537 | | |

| 34,675 | | |

| 29,681 | |

| General

and administrative | |

| 16,583 | | |

| 16,328 | | |

| 32,988 | | |

| 31,073 | |

| Total

operating expenses | |

| 59,599 | | |

| 55,995 | | |

| 119,111 | | |

| 108,657 | |

| Income from operations | |

| 52,810 | | |

| 63,708 | | |

| 109,349 | | |

| 115,065 | |

| Other income (expense): | |

| | | |

| | | |

| | | |

| | |

| Interest

income | |

| 6,051 | | |

| 4,307 | | |

| 11,566 | | |

| 8,243 | |

| Interest

expense | |

| (1,339 | ) | |

| (1,349 | ) | |

| (2,684 | ) | |

| (2,702 | ) |

| Other,

net | |

| (257 | ) | |

| (2,050 | ) | |

| (1,968 | ) | |

| (3,088 | ) |

| Total

other income | |

| 4,455 | | |

| 908 | | |

| 6,914 | | |

| 2,453 | |

| Income before income taxes | |

| 57,265 | | |

| 64,616 | | |

| 116,263 | | |

| 117,518 | |

| Income

tax provision | |

| 6,399 | | |

| 3,037 | | |

| 13,803 | | |

| 8,242 | |

| Net income | |

$ | 50,866 | | |

$ | 61,579 | | |

$ | 102,460 | | |

$ | 109,276 | |

| Net income per share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 1.56 | | |

$ | 1.88 | | |

$ | 3.14 | | |

$ | 3.34 | |

| Diluted | |

$ | 1.55 | | |

$ | 1.86 | | |

$ | 3.12 | | |

$ | 3.29 | |

| Shares used in computing net

income per share: | |

| | | |

| | | |

| | | |

| | |

| Basic

weighted average shares of common stock | |

| 32,598 | | |

| 32,775 | | |

| 32,618 | | |

| 32,759 | |

| Diluted

weighted average shares of common stock | |

| 32,771 | | |

| 33,189 | | |

| 32,848 | | |

| 33,237 | |

News

Release

Axcelis Technologies, Inc.

Consolidated

Balance Sheets

(In thousands,

except per share amounts)

(Unaudited)

| | |

June 30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| ASSETS |

| Current assets: | |

| | | |

| | |

| Cash

and cash equivalents | |

$ | 145,166 | | |

$ | 167,297 | |

| Short-term

investments | |

| 403,143 | | |

| 338,851 | |

| Accounts

receivable, net | |

| 188,080 | | |

| 217,964 | |

| Inventories,

net | |

| 283,090 | | |

| 306,482 | |

| Prepaid

income taxes | |

| 4,107 | | |

| - | |

| Prepaid

expenses and other current assets | |

| 54,741 | | |

| 49,397 | |

| Total

current assets | |

| 1,078,327 | | |

| 1,079,991 | |

| Property, plant and equipment,

net | |

| 52,417 | | |

| 53,971 | |

| Operating lease assets | |

| 28,918 | | |

| 30,716 | |

| Finance lease assets, net | |

| 15,989 | | |

| 16,632 | |

| Long-term restricted cash | |

| 6,651 | | |

| 6,654 | |

| Deferred income taxes | |

| 55,441 | | |

| 53,428 | |

| Other assets | |

| 50,662 | | |

| 40,575 | |

| Total

assets | |

$ | 1,288,405 | | |

$ | 1,281,967 | |

| LIABILITIES

AND STOCKHOLDERS’ EQUITY |

| Current liabilities: | |

| | | |

| | |

| Accounts

payable | |

$ | 45,782 | | |

$ | 54,400 | |

| Accrued

compensation | |

| 16,069 | | |

| 31,445 | |

| Warranty | |

| 14,502 | | |

| 14,098 | |

| Income

taxes | |

| - | | |

| 6,164 | |

| Deferred

revenue | |

| 148,390 | | |

| 164,677 | |

| Current

portion of finance lease obligation | |

| 1,452 | | |

| 1,511 | |

| Other

current liabilities | |

| 17,984 | | |

| 12,834 | |

| Total

current liabilities | |

| 244,179 | | |

| 285,129 | |

| Long-term finance lease obligation | |

| 43,004 | | |

| 43,674 | |

| Long-term deferred revenue | |

| 25,621 | | |

| 46,208 | |

| Other long-term

liabilities | |

| 40,653 | | |

| 42,074 | |

| Total

liabilities | |

| 353,457 | | |

| 417,085 | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Common

stock, $0.001 par value, 75,000 shares authorized; 32,617 shares issued and outstanding at June 30, 2024; 32,685 shares issued

and outstanding at December 31, 2023 | |

| 33 | | |

| 33 | |

| Additional

paid-in capital | |

| 542,677 | | |

| 547,189 | |

| Retained

earnings | |

| 396,718 | | |

| 319,506 | |

| Accumulated

other comprehensive loss | |

| (4,480 | ) | |

| (1,846 | ) |

| Total

stockholders’ equity | |

| 934,948 | | |

| 864,882 | |

| Total

liabilities and stockholders’ equity | |

$ | 1,288,405 | | |

$ | 1,281,967 | |

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

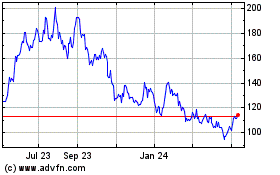

Axcelis Technologies (NASDAQ:ACLS)

Historical Stock Chart

From Jan 2025 to Feb 2025

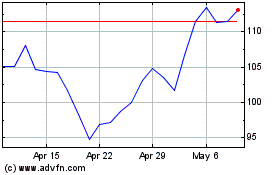

Axcelis Technologies (NASDAQ:ACLS)

Historical Stock Chart

From Feb 2024 to Feb 2025