- The 2024 holiday season was the most mobile of all time,

with smartphones driving 54.5% of online purchases—79.1% of ‘Buy

Now, Pay Later’ transactions were made through a

smartphone

- Consumers are embracing generative AI-powered chat bots as

shopping assistants to quickly find deals or locate products, with

a 1,300% increase in traffic to retail sites

- Competitive discounts this season drove consumers to ‘trade

up’ to higher ticket items, with share-of-units-sold for the most

expensive goods rising in electronics, appliances and sporting

goods

Today, Adobe (Nasdaq:ADBE) released online shopping data for the

2024 holiday season, covering the period from Nov. 1 through Dec.

31, 2024. Based on Adobe Analytics data, the analysis provides the

most comprehensive view into U.S. e-commerce by analyzing commerce

transactions online, covering over 1 trillion visits to U.S. retail

sites, 100 million SKUs and 18 product categories. Adobe Analytics

is part of Adobe Experience Cloud, relied upon by the majority of

the top 100 internet retailers in the U.S.* to deliver, measure and

personalize shopping experiences online.

Record holiday season online, propelled by mobile

shopping

Consumers spent $241.4 billion online from Nov. 1 to Dec.

31, up 8.7% year-over-year (YoY) and setting a new record

for e-commerce. 15 days saw consumers spend more than $4 billion in

a single day (up from 11 days in 2023). Mobile shopping hit a new

milestone, with the majority of online transactions (54.5%)

taking place through a smartphone this season (up from 51.1% in

2023); Mobile shopping was highest on Christmas Day (Dec. 25),

driving 65% of online sales (63% in 2023).

Of the $241.4 billion spent online this holiday season, over

half (54%) was driven by just three categories including

electronics ($55.3 billion, up 8.8% YoY), apparel ($45.6 billion,

up 9.9% YoY) and furniture/home goods ($29.2 billion, up 6.8% YoY).

The strongest growth was observed in the grocery ($21.5 billion, up

12.9% YoY) and cosmetics ($7.7 billion, up 12.2% YoY) categories,

as consumers become increasingly comfortable purchasing these goods

online. Other categories with notable growth this season included

sporting goods ($7.8 billion, up 7.4% YoY) and toys ($8.2 billion,

up 7.8% YoY).

Consumer demand driven by competitive prices

Strong discounts this season drew in consumers who have become

increasingly price sensitive. Shoppers found great deals in

electronics, where discounts peaked at 30.1% off listed price (vs

31% in 2023), as well as toys at 28% (vs 28%), apparel at 23.2%

(vs. 24%), computers at 22.8% (vs 24%) and furniture/home goods at

19% (vs 21%). Discounts also hit record highs for televisions at

24.2% (vs 23%), appliances at 19.2% (vs 18%) and sporting goods at

19.5% (vs 18%).

This season, Adobe’s data showed that for every 1% decrease in

price, demand increased by 1.029% compared to the 2023 season. This

drove an additional $2.25 billion in online spend—a figure

factored into the overall $241.4 billion spent online—and shows the

stronger response to discounts from price-sensitive shoppers.

Strong discounts this season also drove consumers to purchase

higher-ticket items in categories such as electronics, appliances

and sporting goods—propelling e-commerce growth as a result. This

season, the share-of-units-sold for the most expensive goods

increased by 21% overall. Within categories, this

figure was up 54% in sporting goods, up 48% in electronics, up 35%

in appliances, up 32% in personal care products and up 10% in

apparel.

Generative AI embraced as shopping assistant

This season, traffic to retail sites from generative AI-powered

chat bots (shoppers clicking on a link to a retail site) increased

by 1,300% compared to the year prior. Cyber Monday saw the

biggest growth in chat bot usage, up 1,950% YoY. While the

base of users remains modest, the uptick shows the value that chat

bots are playing as shopping assistants. In an Adobe survey of

5,000 U.S. consumers**, 7 in 10 respondents who have used

generative AI for shopping believe it enhances their experience.

Additionally, 20% of respondents turn to generative AI to find the

best deals, followed by quickly finding specific items online (19%)

and getting brand recommendations (15%).

“The 2024 holiday season showed that e-commerce is being

reshaped by a consumer who now prefers to transact on smaller

screens and lean on generative AI-powered services to shop more

efficiently,” said Vivek Pandya, lead analyst, Adobe Digital

Insights. “It presents opportunities for retailers to deliver new

services and experiences that capture the attention of consumers,

many of whom are now shopping online in different ways.”

‘Buy Now, Pay Later’ usage continues to rise

While consumers drove record spending online, many are giving

themselves greater flexibility with their budgets. This season,

‘Buy Now, Pay Later’ (BNPL) usage hit an all-time high,

contributing $18.2 billion in online spend, up 9.6%

YoY and representing $1.6 billion more than the last season.

Smartphones are the form factor of choice for consumers leveraging

this flexible payment method, driving the vast majority

(79.1%) of BNPL purchases this season. Additionally, Cyber

Monday was the biggest day on record for BNPL, driving $991.2

million (up 5.5% YoY). Per Adobe’s survey, consumers tend to

leverage BNPL for purchases in electronics (per 57% of

respondents), apparel (51%), video games (36%), groceries (33%),

toys (30%), health/beauty (28%) and home/garden (19%).

Additional Adobe Analytics insights

- Hot Sellers: Within the electronics category, top

sellers this season included TVs, Bluetooth headphones/speakers,

smart watches and fitness trackers. In apparel, puffer/fleece

jackets, boots, purses/crossbody bags and socks were top sellers.

In the furniture/home category, holiday decor, bedding/linen sets,

storage solutions, accent chairs and throw pillows/blankets were

popular. Top toys this season included LEGO sets, card/board games,

Tonie Audio Play figurines, X Shot Insanity, stuffed animals/dolls,

Cookeez Makery Oven playset and Harry Potter toys/figurines.

- Hot Sellers (cont.): In video games, Mario games (Super

Mario Odyssey/Mario Kart 8 Deluxe), Marvel's Spiderman 2, various

Zelda games, Animal Crossing New Horizons and Madden 25 were hot

sellers, and the Xbox Series X, Nintendo Switch OLED, PlayStation 5

and Meta Quest were top gaming consoles. Other hot sellers this

season included Dyson Airwrap, makeup/skincare sets, espresso

machines, gift cards, jewelry, electric scooters/bikes and

perfume/fragrances.

- Impact of influencers: Across major marketing channels,

paid search has remained the top driver of retail sales this

holiday season, with its share of revenue at 29.7% (up 1% YoY). In

affiliates and partners—which includes social media

influencers—share of revenue came in at 17.6% but has grown more

substantially (up 6% YoY). This channel also outpaced retailer

traffic from social media overall (around 5% of revenue share),

which grew 5.4% YoY. Influencers are also converting shoppers

(individuals making a purchase after seeing influencer content) 9

times more than social media overall. In Adobe’s survey, 37% of

GenZ respondents have purchased something based on an influencer’s

recommendation.

- Curbside pickup: The fulfillment method was used in

17.5% of online orders this holiday season, for retailers that

offer the service (down from 18.4% in 2023). While usage has come

down this season, a significant number of shoppers continue to find

value in the fulfillment service for speed and convenience. This

season, curbside pickup peaked on Dec. 23 (the day before Christmas

Eve), driving 37.8% of online orders as anxious shoppers used the

service to make sure they got gifts on time.

- Cyber Week recap: Record online spending this season was

bolstered by a strong Cyber Week (the five days from Thanksgiving

to Cyber Monday), which brought in $41.1 billion online overall, up

8.2% YoY. Cyber Monday remained the season’s and year’s biggest

online shopping day, driving $13.3 billion in spend, up 7.3% YoY.

However, growth was stronger on Thanksgiving ($6.1 billion, up 8.8%

YoY) and Black Friday ($10.8 billion, up 10.2% YoY), as consumers

embraced earlier deals.

Impact of inflation

Strong consumer spending online continues to be driven by

net-new demand and not higher prices. Adobe’s Digital Price Index

shows e-commerce prices have fallen consecutively for 27 months

(down 2.6% YoY in Nov. 2024). Adobe figures are not adjusted for

inflation, but if online deflation were factored in, growth in

consumer spend would be even stronger.

About Adobe

Adobe is changing the world through digital experiences. For

more information, visit www.adobe.com.

© 2025 Adobe. All rights reserved. Adobe and the Adobe logo are

either registered trademarks or trademarks of Adobe in the United

States and/or other countries. All other trademarks are the

property of their respective owners.

*Per the Digital Commerce 360 Top 500 report (2024) **Survey

fielded from Sept. 2 to 9, 2024

Disclaimer: The information and analysis in this release have

been prepared by Adobe Inc. for informational purposes only and may

contain statements about future events that could differ from

actual results. Adobe Inc. does not warrant that the material

contained herein is accurate or free of errors and has no

responsibility to update or revise information presented herein.

Adobe Inc. shall not be liable for any reliance upon the

information provided herein.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250107759280/en/

Public relations contacts

Kevin Fu Adobe kfu@adobe.com

Nisa Chavez Taylor Adobe nchaveztaylo@adobe.com

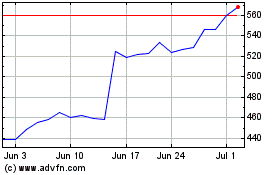

Adobe (NASDAQ:ADBE)

Historical Stock Chart

From Dec 2024 to Jan 2025

Adobe (NASDAQ:ADBE)

Historical Stock Chart

From Jan 2024 to Jan 2025