UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES

EXCHANGE ACT OF 1934

For

the month of September 2024

ANTELOPE

ENTERPRISE HOLDINGS LTD.

(Translation

of registrant’s name into English)

Room

1802, Block D, Zhonghai International Center,

Hi-

Tech Zone, Chengdu, Sichuan Province, PRC

(Address

of Principal Executive Office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form

20-F ☒ Form 40-F ☐

Entry

Into A Material Agreement

On

September 24, 2024, Antelope Enterprise Holdings Ltd. (the “Company” or the “Registrant”) closed a private placement

transaction pursuant to a securities purchase Agreement (the “Agreement”) with each of three investors whereby the investors

purchased an aggregate of 2,323,945 class A ordinary shares at 0.71 per share for an aggregate consideration of $1,650,000. Under the

Agreement, the Company does not have an obligation to register any of the securities issued in the placement. The Company intends to

use the proceeds from this financing for general working capital purposes. This private placement transaction was approved unanimously

by the board of directors and the audit committee of the board of directors of the Company.

The

form of the Agreement is attached hereto as an exhibits 99.1 and incorporated herein by reference.

Financial

Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| Date:

October 3, 2024 |

ANTELOPE

ENTERPRISE HOLDINGS LTD. |

| |

|

| |

By: |

/s/

Hen Man Edmund |

| |

|

Hen

Man Edmund |

| |

|

Chief

Financial Officer |

Exhibit

99.1

SECURITIES

PURCHASE AGREEMENT

证券购买协议

This

SECURITIES PURCHASE AGREEMENT (the “Agreement”) is dated as of September ______, 2024, by and among Antelope Enterprise

Holdings Ltd., a British Virgin Islands company, (the “Company”), and the purchaser identified on the signature pages

hereto (each, including its successors and assigns, the “Purchaser”).

本证券购买协议(“本协议”或“协议”)于2024年__月__日,由

Antelope Enterprise Holdings Ltd.,一家英属维京群岛豁免公司(“公司”),和在此合同签名页上签署的购买人(“购买人”)之间合意签订。

RECITALS

前言

WHEREAS,

the Company and the Purchaser are executing and delivering this Agreement in accordance with and in reliance upon the exemption from

securities registration afforded by Section 4(2) of the Securities Act of 1933 (the “Securities Act”) ;

鉴于,根据美国证监会在修订的1933年证券法条文4(2)下的豁免规定,公司和购买人在此签署和交换本协议;

WHEREAS,

the Company is offering certain Class A ordinary shares, no par value per share, (the “Ordinary Shares”) at price

of $0.71 per share to the Purchaser;

鉴于,公司在此要向购买人出售其公司A类普通股股票,无票面价值(“普通股”),每股购买价格0.71美元;

WHEREAS,

the Company is offering up to 1,350,000 Ordinary Shares to the Purchaser, who makes representations and warranties hereunder;

鉴于,公司向附录A下的购买人一共要约出售最高

1,350,000 股普通股,购买人作出合约下的各陈述和保证;

NOW,

THEREFORE, IN CONSIDERATION of the mutual covenants contained in this Agreement, and for other good and valuable consideration, the

receipt and adequacy of which are hereby acknowledged, the Company and the Purchaser hereby agree as follows:

鉴于此,公司和购买人认同双方经仔细考虑和双方合意,在此就以下内容表示同意:

ARTICLE

I

第一条

Purchase

and Sale of the Shares

普通股的购买和销售

Section

1.1 Purchase Price and Closing.

第1.1节

购买价格和交割。

(a)

Subject to the terms and conditions hereof, the Company agrees to issue and sell to the Purchaser and, in consideration of and in express

reliance upon the representations, warranties, covenants, terms and conditions of this Agreement, the Purchaser agrees to purchase for

$____ per Share, such number of Ordinary Shares (each a “Share” and collectively the “Shares”)

for an aggregate price of listed on the signature page hereto (the “Purchase Price”).

在以下条款和前提下,公司同意向购买人发行并出售;根据本协议的说明、保证、约定和条款规定,购买人同意以___美元每股的价格购买普通股(“股票”),购买股数及其总价列明在本协议附载的签字页中(“购买价格”)。

(b)

Subject to all conditions to closing being satisfied or waived, the closing of the purchase and sale of the Shares (the “Closing”)

shall take place remotely by electronic transfer of the closing deliverables or at such other location as the parties shall mutually

agree, on the date of the receipt by the Company of the Purchase Price (the “Closing Date”).

在交割的条件被满足或豁免的前提下,股票的买卖在公司收到购买价格时(“交割日”)通过电子途径交换交割文件或者双方同意的其他地点进行交割(“交割”)。

(c)

Subject to the terms and conditions of this Agreement, at the Closing the Company shall deliver or cause to be delivered to the Purchasers

(i) a certificate for such number of Shares, and (ii) any other documents required to be delivered pursuant to this Agreement. At the

time of the Closing, the Purchasers shall have delivered its Purchase Price by wire transfer pursuant to the wire information contained

in this Agreement or by check.

根据本协议的规定,在交割时公司应向购买人送达或使他人向购买人送达

(i) 写有购买人名字的普通股股权证书,

(ii) 其他任何根据本条款应送达的文件。在交割时,购买人应根据交本协议的汇款信息向公司汇入其购买资金,或以支票的方式支付。

ARTICLE

II

第二条

Representations

and Warranties

保证和承诺

Section

2.1 Representations and Warranties of the Company and its Subsidiaries. The Company hereby represents and warrants to the Purchaser

on behalf of itself, its Subsidiaries (as hereinafter defined), as of the date hereof (except as set forth on the Schedule of Exceptions

attached hereto with each numbered Schedule corresponding to the section number herein), as follows:

公司和其子公司的陈述和保证。公司在此代表其本身以及其子公司,就以下事项(但与本小段标号相对应的披露中的事项除外)作出陈述和保证:

(a)

Organization, Good Standing and Power. The Company is a corporation or other entity duly incorporated or otherwise organized,

validly existing and in good standing under the laws of its jurisdiction of incorporation or organization (as applicable) and respectively,

has the requisite corporate power to own, lease and operate its properties and assets and to conduct its business as it is now being

conducted. The Company and each of its Subsidiaries is duly qualified to do business and is in good standing in every jurisdiction in

which the nature of the business conducted or property owned by it makes such qualification necessary except for any jurisdiction(s)

(alone or in the aggregate) in which the failure to be so qualified will not have a Material Adverse Effect (as defined in Section 2.1(g)

hereof).

组织、合法持续性和权力。公司是在其管辖区内依法成立的,有效存续的经济实体,各自都有必需的公司权力来持有、出租和操作其财产和资产,并进行合法的商业运作。公司以及其每一个子公司在其每个有商业行为和资产的管辖区内有合法资格进行经营并有良好的经营持续性,除了一些管辖,如果公司不能在这些区域内有合法资格经营也不会对公司的产生重大不良影响。

(b)

Corporate Power; Authority and Enforcement. The Company has the requisite corporate power and authority to enter into and perform

its obligations under this Agreement, and to issue and sell the Shares in accordance with the terms hereof. The execution, delivery and

performance of this Agreement by the Company and the consummation by it of the transactions contemplated hereby and thereby have been

duly and validly authorized by all necessary corporate action, and no further consent or authorization of the Company or its Board of

Directors or shareholders is required. This Agreement constitutes, or shall constitute when executed and delivered, a valid and binding

obligation of the Company enforceable against the Company in accordance with its terms, except as such enforceability may be limited

by applicable bankruptcy, insolvency, reorganization, moratorium, liquidation, conservator ship, receiver ship or similar laws relating

to, or affecting generally the enforcement of, creditor’s rights and remedies or by other equitable principles of general application.

公司权力;授权和执行。公司有必须的公司权力和授权来签订和履行本协议下的义务。公司有必须的权力和授权按照本协议的规定来发行和出售股票。公司对交易文件的签署、送达和履行和完成在此由所有必要的公司行为合法有效授权,不需要再由公司或董事会或股东会进一步的同意或授权。每一个交易文件在签署和送达时包括且应包括对于公司有效和有约束力的执行义务,除非适用的破产、解散、重组、延期偿付、清算、委托管理或其他有关的法律或其他衡平法原则会限制债权人的权利和补救。

(c)

Capitalization. The authorized capital stock of the Company is 200,000,000 Ordinary Shares with no par value each. The number

of Ordinary Shares issued and outstanding as of March 11, 2024 was 4,942,097.

股本。公司授权可发行的股本是200,000,000

A类普通股,无票面价值。2024年3月11日时,公司已发行

4,942,097 A类普通股。

(i)

no Ordinary Shares are entitled to preemptive, conversion or other rights and there are no outstanding options, warrants, scrip, rights

to subscribe to, call or commitments of any character whatsoever relating to, or securities or rights convertible into, any shares of

capital stock of the Company;

不存在有优先配股权、转换权或其他权利的普通股;不存在流通的期权、认购权、承诺购买权、或转换成公司股本的任何股份的其他权利;

(ii)

there are no contracts, commitments, understandings, or arrangements by which the Company is or may become bound to issue additional

shares of capital stock of the Company or options, securities or rights convertible into shares of capital stock of the Company;

不存在公司为一方当事人或受其约束的合同、承诺、备忘录或安排,公司需要因此而发行额外股本股份或发行期权、证券或转换股而获得公司的股本股份;

(iii)

the Company is not a party to any agreement granting registration or anti-dilution rights to any person with respect to any of its equity

or debt securities;

公司没有在任何协议中同意对任何股权证券或债权证券给予登记注册权和反稀释权;

(iv)

the Company is not a party to, and it has no knowledge of, any agreement restricting the voting or transfer of any shares of the capital

stock of the Company.

公司没有在任何协议中同意或承诺对公司股本的任何股份的投票权和股份转让进行限制;

(v)

The offer and sale of all capital stock, convertible securities, rights, warrants, or options of the Company issued prior to the Closing

complied with all applicable Federal and state securities laws, except where non-compliance would not have a Material Adverse Effect.

The Company has furnished or made available to the Purchaser true and correct copies of the Company’s Memorandum and Articles of

Associations, as amended and in effect on the date hereof (the “M&A”). Except as restricted under applicable federal,

state, local or foreign laws and regulations, the Articles, this Agreement, no written or oral contract, instrument, agreement, commitment,

obligation, plan or arrangement of the Company shall limit the payment of dividends on the Company’s Preferred Shares, or its Ordinary

Shares.

公司在本次交易交割结算前发行的所有股本股票、可转证券、权益、期权的买卖都符合适用的联邦和州证券法的规定,除非这些违反不会对公司有重大不利影响。公司向购买人提供了真实的公司成立协议副本(“公司成立协议”)。除了适用的联邦、州、当地、国外法律和规则,公司成立协议,本交易文件,不存在任何书面或口头的合同、工具、协议、承诺、义务、计划或安排限制公司就其发行的普通股或优先股分配股息。

(d)

Issuance of Shares. The Shares to be issued at the Closing have been duly authorized by all necessary corporate action and the

Preferred Shares, when paid for or issued in accordance with the terms hereof, shall be validly issued and outstanding, fully paid and

non-assessable.

股份的发行。本交易结算时应发行的普通股已经必要的公司行为授权。普通股在支付和发行时应符合本交易文件的要求,经必要的公司行为授权,有效发行和流通。

(e)

Subsidiaries. All of the direct and indirect subsidiaries of the Company and their respective jurisdictions of incorporation are

set forth on Schedule 2.1(e). The Company owns, directly or indirectly, all of the capital stock or other equity interests of

each Subsidiary free and clear of any Liens, and all of the issued and outstanding shares of capital stock of each Subsidiary are validly

issued and are fully paid, non-assessable and free of preemptive and similar rights to subscribe for or purchase securities.

子公司。本公司的所有直接和间接子公司及其各自的注册成立司法管辖区均列在附表2.1(e)中。

本公司直接或间接拥有每个子公司的所有股本或其他权益,且无任何留置权,并且每个子公司的所有已发行和已发行股本均已有效发行且没有购买或购买证券的优先权和类似权利。

(f)

Commission Documents, Financial Statements. Except as set forth in Schedule 2.1 (f), the Company has filed all reports,

schedules, forms, statements and other documents required to be filed by it with the U.S. Securities and Exchange Commission (the “Commission”

or “SEC”) pursuant to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), including the Form 20-F and other material filed pursuant to Section 13(a) or 15(d) of the Exchange Act (all of the

foregoing including filings incorporated by reference therein being referred to herein as the “Commission Documents”).

The Company has not provided to the Purchaser any material non-public information or other information which, according to applicable

law, rule or regulation, was required to have been disclosed publicly by the Company but which has not been so disclosed, other than

(i) with respect to the transactions contemplated by this Agreement, or (ii) pursuant to a non-disclosure or confidentiality agreement

signed by the Purchaser. At the time of the respective filings, the Form 20-F’s complied in all material respects with the requirements

of the Exchange Act and the rules and regulations of the Commission promulgated thereunder and other federal, state and local laws, rules

and regulations applicable to such documents. As of their respective filing dates, none of the Form 20-F contained any untrue statement

of a material fact; and none omitted to state a material fact required to be stated therein or necessary in order to make the statements

therein, in light of the circumstances under which they were made, not misleading. The financial statements of the Company included in

the Commission Documents comply as to form in all material respects with applicable accounting requirements and the published rules and

regulations of the Commission or other applicable rules and regulations with respect thereto. Such financial statements have been prepared

in accordance with United States generally accepted accounting principles (“GAAP”) applied on a consistent basis during

the periods involved (except (i) as may be otherwise indicated in such financial statements or the notes thereto or (ii) in the case

of unaudited interim statements, to the extent they may not include footnotes or may be condensed or summary statements), and fairly

present in all material respects the consolidated financial position of the Company as of the dates thereof and the results of operations

and cash flows for the periods then ended (subject, in the case of unaudited statements, to normal year-end audit adjustments).

证监会文件、财务报表。根据修订后的1934年证券交易法(“交易法”)的要求,除了披露表2.1(f)中列明的项目,公司向证监会申报了所有的报告、批露表、表格、说明书和其他文件,包括根据交易法第13(a)

或15(d) 节申报的材料(所有上述申报材料在本协议中统称为“证监会文件”)。根据相关适用法的规定,公司没有向购买人批露任何应当首先向公众批露而未批露的内部信息,但不包括(i)

与本协议中的交易相关的信息,或(ii) 根据购买人签署的不公开或内部保密协议而批露的信息。在每一次申报时,表格20F都符合交易法的要求和证监会的规则以及其他联邦、州和当地的适用的法律、法规和规则。在每一次申报时,表格20F都没有对重大事实的不实陈述,也没有遗漏重大事实或必要的信息,进行误导。证监会文件中包含的公司财务报表都符合当关的会计规则要求,证监会的相关公告规则和其他适用的法规和规则。这些财务报表都符合美国一般会计准则的要求,并在一定时期内保持数据一致(除非(i)

财务报表或记录中作不同的说明, 或(ii)

在未经审计的内部财务报表的情况下,报表可能不包含脚注或进行简化或为概要性报表),并真实反映该季度内的公司合并财务情况,经营状况和该季度结束时的现金流(但在未审计的财务报表的情况下,应以正常年度结束时的调整数据为准)。

(g)

No Material Adverse Effect. As of December 31, 2022 till the date of this Agreement, the Company have not experienced or suffered

any Material Adverse Effect. For the purposes of this Agreement, “Material Adverse Effect” shall mean (i) any material adverse

effect upon the assets, properties, financial condition, business or prospects of the Company, and its Subsidiaries, when taken as a

consolidated whole, and/or (ii) any condition, circumstance, or situation that would prohibit or otherwise materially interfere with

the ability of the Company to perform any of its material covenants, agreements and obligations under this Agreement.

无重大负面影响。自从2022年12月31日至本协议签订之日截止,公司和子公司没有任何重大负面影响。出于本协议的目的,“重大负面影响”应指(i)任何公司以及在合并报表的情况下的子公司的经营、运作、财产或财务有任何重大负面影响的事件,和/或(ii)只要在任何条件、情况下会从任何重大方面阻止或重大干涉公司履行本协议下的任何重大承诺、协议和义务。

(h)

No Undisclosed Liabilities. Other than as disclosed in the Company’s Commission Documents to the knowledge of the Company,

neither the Company, nor the Subsidiaries has any liabilities, obligations, claims or losses (whether liquidated or unliquidated, secured

or unsecured, absolute, accrued, contingent or otherwise) other than those incurred in the ordinary course of the Company’s and

the Subsidiaries’ respective businesses and which, individually or in the aggregate, do not or would not have a Material Adverse

Effect.

无未披露的义务。除了公司的证监会文件所列的事项外,公司和其子公司没有任何未披露的义务、责任、诉讼或损失(不论是可清算的或不可清算的,有担保的或未担保的,全部的或计息的;附随的或其他),但公司和子公司在日常经营中产生的义务、责任、诉讼或损失,如果对于公司或子公司无重大负面影响,不应计入未披露的义务之内。

(i)

No Undisclosed Events or Circumstances. To the Company’s knowledge, no event or circumstance has occurred or exists with

respect to the Company, the Subsidiaries or their respective businesses, properties, operations or financial condition, which, under

applicable law, rule or regulation, requires public disclosure or announcement by the Company but which has not been so publicly announced

or disclosed.

无未披露事件或情况。在公司知道的范围内,不存在根据适用的法律、规则或法规,应进行公共披露或公告而未披露公告的关于公司、子公司、其经营、财产、运作或财务的事件和情况。

(j)

Title to Assets. Except where non-compliance would not have a Material Adverse Effect, each of the Company and the Subsidiaries

has good and marketable title to (i) all properties and assets purportedly owned or used by them as reflected in the Financial Statements,

(ii) all properties and assets necessary for the conduct of their business as currently conducted, and (iii) all of the real and personal

property reflected in the Financial Statements free and clear of any Lien. All leases are valid and subsisting and in full force and

effect.

资产所有权。除非不会对公司造成重大不利影响,公司和每个子公司对以下资产有合法有市场价值的所有权(i)所有计入财务报表的其所有和使用的资产和财产,(ii)

目前经营所必需的资产和财产,以及 (iii)

所有没有担保质权的计入财务报表的不动产和个人财产。

(k)

Actions Pending. There is no action, suit, claim, investigation, arbitration, alternate dispute resolution proceeding or any other

proceeding pending or, to the knowledge of the Company, threatened against or involving the Company which questions the validity of this

Agreement or the transactions contemplated hereby or thereby or any action taken or to be taken pursuant hereto or thereto. Except where

the same would not have a Material Adverse Effect, there is no action, suit, claim, investigation, arbitration, alternate dispute resolution

proceeding or any other proceeding pending or, to the knowledge of the Company, threatened against or involving the Company involving

any of their respective properties or assets. To the knowledge of the Company, there are no outstanding orders, judgments, injunctions,

awards or decrees of any court, arbitrator or governmental or regulatory body against the Company, the Subsidiaries or any of their respective

executive officers or directors in their capacities as such.

未决诉讼。在公司知道的范围内,不存在任何未决的和任何在其他程序中诉讼、索赔、调查、仲裁、争议,针对或涉及公司或任何中国经营实体,会质疑本协议或本交易或相关交易行为的有效性;除非不会对公司公司造成重大不利影响,也没有任何涉及公司、子公司、中国经营实体的各自的财产或资产的相关程序。在公司知道的范围内,不存在任何待执行的判决、判令、禁止令、法庭决定、仲裁决定或政府或监管主体对公司或其各自的行政管理人员或董事的行政令。

(l)

Compliance with Law. The Company and the Subsidiaries have all material franchises, permits, licenses, consents and other governmental

or regulatory authorizations and approvals necessary for the conduct of their respective business as now being conducted by it unless

the failure to possess such franchises, permits, licenses, consents and other governmental or regulatory authorizations and approvals,

individually or in the aggregate, could not reasonably be expected to have a Material Adverse Effect.

符合法律规定。公司和子公司拥有其进行各自经营所必须的连锁权、许可权、证书、同意或其他政府或监管机构授权和同意,除非公司和子公司不可能合理预期到没有该连锁权、许可权、证书、同意或其他政府或监管机构授权和同意会对公司经营造成重大负面影响。

(m)

No Violation. The business of the Company and the Subsidiaries is not being conducted in violation of any Federal, state, local

or foreign governmental laws, or rules, regulations and ordinances of any of any governmental entity, except for possible violations

which singularly or in the aggregate could not reasonably be expected to have a Material Adverse Effect. The Company is not required

under Federal, state, local or foreign law, rule or regulation to obtain any consent, authorization or order of, or make any filing or

registration with, any court or governmental agency in order for it to execute, deliver or perform any of its obligations under this

Agreement, or issue and sell the Shares in accordance with the terms hereof or thereof (other than (x) any consent, authorization or

order that has been obtained as of the date hereof, (y) any filing or registration that has been made as of the date hereof or (z) any

filings which may be required to be made by the Company with the Commission or state securities administrators subsequent to the Closing.)

无违法行为。公司和子公司的经营没有违反任何联邦、州、当地或外国政府的法律或规则、法律、政府实体的政令,除非公司或子公司不能合理预期到该违反会造成重大负面影响。根据联邦、州、当地或外国法、法规或规则的规定,公司不需获得任何同意、授权或命令,或向任何法庭或政府机构申报或注册来执行、送达或履行本交易文件下的义务,(不包括

(x) 已获得的任何同意、授权、或命令,(y)

已进行的申报或登记,或(z) 在交割结算后必须向证监会或州证券管理机构进行的任何申报。)

(n)

No Conflicts. The execution, delivery and performance of this Agreement by the Company and the consummation by the Company of

the transactions contemplated herein and therein do not and will not (i) violate any provision of the Company’s Certificate or

Bylaws, (ii) conflict with, or constitute a default (or an event which with notice or lapse of time or both would become a default) under,

or give to others any rights of termination, amendment, acceleration or cancellation of, any agreement, mortgage, deed of trust, indenture,

note, bond, license, lease agreement, instrument or obligation to which the Company is a party or by which it or its properties or assets

are bound, (iii) create or impose a lien, mortgage, security interest, pledge, charge or encumbrance (collectively, “Lien”)

of any nature on any property of the Company under any agreement or any commitment to which the Company is a party or by which the Company

is bound or by which any of its respective properties or assets are bound, or (iv) result in a violation of any federal, state, local

or foreign statute, rule, regulation, order, judgment or decree (including Federal and state securities laws and regulations) applicable

to the Company or any of its subsidiaries or by which any property or asset of the Company or any of its subsidiaries are bound or affected,

provided, however, that, excluded from the foregoing in all cases are such conflicts, defaults, terminations, amendments,

accelerations, cancellations and violations as would not, individually or in the aggregate, have a Material Adverse Effect.

无冲突。公司签署、送达和履行交易文件以及交易内容,没有也不会(i)违反公司的成立协议或章程的任何条款,(ii)

与公司为一方当事人或财产受约束的任何存在的和承诺的合同、保证、契约、债券、租赁合同、融资工具相冲突或会给予他人任何终止、修改、取消上述法律文件的权利,(iii)

在公司在一方当事人或财产受约束的任何协议或承诺中使公司本身或公司的任何财产上创造或附加留置权、抵押权

、保证金权益、质押权、其他费用或财产负担(统称“留置权”),或(iv)

违反任何公司或其任何子公司适用的或其任何资产、不动产受影响或约束的联邦、州、当地或外国法律、规则、法规、法令、判决或命令(包括联邦和州的证券法规);但如果上述的冲突、终止、修改、取消、违反不会对公司产生重大负面影响,则不应包括在内。

(o)

Certain Fees. No brokers fees, finders fees or financial advisory fees or commissions will be payable by the Company with respect

to the transactions contemplated by this Agreement.

特定费用。公司不需要根据本协议支付与本交易有关的中介费用、佣金费用或融资顾问费用或提成。

(p)

Disclosure. Except as set forth in Schedule 2.1(p), neither this Agreement nor the Schedules hereto nor any other documents,

certificates or instruments furnished to the Purchaser by or on behalf of the Company or the Subsidiaries in connection with the transactions

contemplated by this Agreement contain any untrue statement of a material fact or omit to state a material fact necessary in order to

make the statements made herein or therein, taken as a whole and in the light of the circumstances under which they were made herein

or therein, not false or misleading.

批露。除了批露表2.1(p)规定之外,公司或其子公司向购买人提供的与本交易有关的本协议、批露表、或其他文件、证明或工具证书没有关于重大事实的不实陈述或遗漏重大事实,没有错误或误导性陈述。

(q)

Intellectual Property. Each of the Company and the Subsidiaries owns or has the lawful right to use all patents, trademarks, domain

names (whether or not registered) and any patentable improvements or copyrightable derivative works thereof, websites and intellectual

property rights relating thereto, service marks, trade names, copyrights, licenses and authorizations, and all rights with respect to

the foregoing, which are necessary for the conduct of their respective business as now conducted without any conflict with the rights

of others, except where the failure to so own or possess would not have a Material Adverse Effect.

知识产权。公司和每个子公司对其各自进行经营所必需的全部专利、商标、知名品牌(不论是否注册)和任何其他可以申请专利的技术创新或衍生著作权、网站或其他知识产权、服务标识、商号、著作权、执照和授权拥有所有权或合法使用权,且不与他人的权利相冲突,但不包括那些即使不拥有也不会对公司产生重大不利影响的知识产权。

(r)

Books and Record Internal Accounting Controls. Except as may have otherwise been disclosed in the Forms 20-F, the books and records

of the Company and the Subsidiaries accurately reflect in all material respects the information relating to the business of the Company

and the Subsidiaries, the location and collection of their assets, and the nature of all transactions giving rise to the obligations

or accounts receivable of the Company, or the Subsidiaries. Except as disclosed in the Company’s Commission Documents or on Schedule

2.1(r), the Company and the Subsidiaries maintain a system of internal accounting controls sufficient, in the judgment of the Company,

to provide reasonable assurance that (i) transactions are executed in accordance with management’s general or specific authorizations,

(ii) transactions are recorded as necessary to permit preparation of financial statements in conformity with GAAP and to maintain asset

accountability, (iii) access to assets is permitted only in accordance with management’s general or specific authorization and

(iv) the recorded accountability for assets is compared with the existing assets at reasonable intervals and appropriate actions are

taken with respect to any differences.

会计账目内部控制。除了在表格20-F中作不同批露外,公司和子公司的会计账目准确体现了与公司和子公司经营有关的重大信息、资产的地点和保管、所有使公司和子公司承担义务或产生可记账收入的交易。除了在公司的证监会文件中或批露表2.1(r)中的披露外,公司和子公司有内部会计控制系统,根据公司的判断,该系统充分的提供以下合理保证:(i)

交易经公司管理层一般或特别授权,(ii)

交易的记账符合一般会计准则的要求,且维持了资产的可记录性,(iii)

资产的使用只有经管理层的一般或特别授权,(iv)

对现有资产和可入账资产按合理的差距进行了比较且针对该差别采取了合理的行动。

(s)

Material Agreements. Any and all written or oral contracts, instruments, agreements, commitments, obligations, plans or arrangements,

the Company and the Subsidiaries is a party to, that a copy of which would be required to be filed with the Commission as an exhibit

to the Company’s annual report on Form 20-F (collectively, the “Material Agreements”) if the Company were registering

securities under the Securities Act has previously been publicly filed with the Commission in the Commission Documents. Each of the Company

and the Subsidiaries has in all material respects performed all the obligations required to be performed by them to date under the foregoing

agreements, have received no notice of default and are not in default under any Material Agreement now in effect the result of which

would cause a Material Adverse Effect.

重大合同。如果公司或其任何子公司之前曾根据证券法向证交会申报登记证券,在20-F中附有或披露过公司作为一方当事人的书面或口头的合同、融资工具、协议、承诺、义务、计划或安排(统称“重大合同”),那么,公司或其子公司已经履行了生效合同下的义务,没有接到违约的通知,也没有会导致对公司经营有重大不利影响的重大违约行为。

(t)

Transactions with Affiliates. Except as set forth in the Financial Statements or in the Commission Documents, there are no loans,

leases, agreements, contracts, royalty agreements, management contracts or arrangements or other continuing transactions between (a)

the Company on the one hand, and (b) on the other hand, any officer, employee, consultant or director of the Company or any person owning

any capital stock of the Company or any member of the immediate family of such officer, employee, consultant, director or shareholder

or any corporation or other entity controlled by such officer, employee, consultant, director or shareholder, or a member of the immediate

family of such officer, employee, consultant, director or shareholder.

与关联人的交易。除了财务报表或证监会文件中说明的之外,没有存在于以下主体之间的贷款、租赁、协议、合同、使用协议、管理合同或安排或其他进行中的交易(a)一方主体为公司,且(b)对方主体为公司的管理人员、员工、顾问或董事,公司的持股人,或者为他们的直接亲属成员,或者任何受管理人员、员工,顾问、董事或他们的直接亲属成员控制的公司或实体。

Section

2.2 Representations and Warranties of the Purchaser. The Purchaser hereby makes the following representations and warranties to

the Company as of the date hereof:

第2.2节

购买人的陈述和保证。购买人于此就以下事项作出仅与购买人自身相关的陈述和保证:

(a)

No Conflicts. The execution, delivery and performance of this Agreement and the consummation by such Purchaser of the transactions

contemplated hereby and thereby or relating hereto do not and will not conflict with, or constitute a default (or an event which with

notice or lapse of time or both would become a default) under, or give to others any rights of termination, amendment, acceleration or

cancellation of any agreement, indenture or instrument or obligation to which such Purchaser is a party or by which its properties or

assets are bound, or result in a violation of any law, rule, or regulation, or any order, judgment or decree of any court or governmental

agency applicable to such Purchaser or its properties (except for such conflicts, defaults and violations as would not, individually

or in the aggregate, have a material adverse effect on such Purchaser). Such Purchaser is not required to obtain any consent, authorization

or order of, or make any filing or registration with, any court or governmental agency in order for it to execute, deliver or perform

any of its obligations under this Agreement, provided, that for purposes of the representation made in this sentence, such Purchaser

is assuming and relying upon the accuracy of the relevant representations and agreements of the Company herein.

无冲突。购买人签署、送达和履行交易文件以及交易内容,没有也不会在购买人在一方当事人或财产受约束的任何协议或承诺中使购买人本身或其任何财产上创造或附加留置权、抵押权

、保证金权益、质押权、其他费用或财产负担,或者使购买人违反任何适用购买人或其财产的任何法律、规则、规定、命令或判决或判令,但不会对购买人产生重大负面影响,则不应包括在内。购买人购买普通股,签署、送达和履行本协议和其他交易文件不需要额外授权,但是在本句陈述的范围内,购买人依赖于公司相关陈述的准确性作出以上陈述。

(b)

Business and Financial Experience. Each Investor, either alone or together with its representatives, has such knowledge, sophistication

and experience in business and financial matters so as to be capable of evaluating the merits and risks of the prospective investment

in the Shares, and has so evaluated the merits and risks of such investment.

商业和财务经验。

投资人单独或与其代表人一起,拥有足够的商业和金融知识、复杂度和经验以评估对此股票未来投资的实质和风险,并已按此做出评估。

(c)

Reliance on Exemptions. The Purchaser understands that the Shares are being offered and sold to it in reliance upon specific exemptions

from the registration requirements of United States federal and state securities laws and that the Company is relying upon the truth

and accuracy of, and the Purchaser’s compliance with, the representations, warranties, agreements, acknowledgments and understandings

of the Purchaser set forth herein in order to determine the availability of such exemptions and the eligibility of the Purchaser to acquire

the Shares.

依赖于豁免。购买人知道在此出售的证券是根据美国联邦和州证券法的登记注册要求的豁免出售的,公司依赖于购买人的声明、保证、同意、承认和认知的真实性和准确性,并对其的遵循,以决定这一豁免是否适用于购买人的购股行为。

(d)

Information. The Purchaser and its advisors, if any, have had the opportunity to ask questions of management of the Company and

its Subsidiaries and have been furnished with all information relating to the business, finances and operations of the Company and information

relating to the offer and sale of the Shares which have been requested by the Purchaser or its advisors. Neither such inquiries nor any

other due diligence investigation conducted by the Purchaser or any of its advisors or representatives shall modify, amend or affect

the Purchaser’s right to rely on the representations and warranties of the Company contained herein. The Purchaser understands

that its investment in the Shares involves a significant degree of risk. The Purchaser further represents to the Company that the Purchaser’s

decision to enter into this Agreement has been based solely on the independent evaluation of the Purchaser and its representatives.

信息。购买人以及其顾问有机会向公司和子公司的管理层就公司的经营、财务和运作以及与此融资有关的信息提问。购买人或其顾问所作的调查或尽职调查没有改变公司在此作出的陈述和保证。购买人明白他的投资有风险,并确认他的投资是在其对投资进行独自评估的基础上作出的。

(e)

Governmental Review. The Purchaser understands that no United States federal or state agency or any other government or governmental

agency has passed upon or made any recommendation or endorsement of the Shares.

政府审批。购买人明白美国联邦或州政府或其他行政机构没有审批或推荐出售该证券。

(f)

Restricted Shares.

限制性股票。

(1)

The Investor understands that the Shares have not been registered under the Securities Act, by reason of a specific exemption from the

registration provisions of the Securities Act which depends upon, among other things, the bona fide nature of the investment intent and

the accuracy of the Investor’s representations as expressed herein. The Investor understands that the Shares are “restricted

securities” under applicable U.S. federal and state securities laws and that, pursuant to these laws, the Investor must hold the

Shares indefinitely unless they are registered with the SEC and qualified by state authorities, or an exemption from such registration

and qualification requirements is available. The Investor acknowledges that the Company has no obligation to register or qualify the

Shares for resale. The Investor further acknowledges that if an exemption from registration or qualification is available, it may be

conditioned on various requirements including, but not limited to, the time and manner of sale, the holding period for the Shares, and

on requirements relating to the Company which are outside of the Investor’s control, and which the Company is under no obligation

and may not be able to satisfy. The Investor understands that this offering is not intended to be part of the public offering, and that

the Investor will not be able to rely on the protection of Section 11 of the Securities Act.

投资者理解,该股份尚未根据证券法进行注册,这是因为根据证券法注册要求下的特定豁免的规定,这取决于(除其他外)此处善意表达的投资意向和投资者陈述的准确性。投资者理解,根据适用的美国联邦和州证券法,股份是“限制性证券”,并且根据这些法律,除非股票已在美国证券交易委员会登记并获得州当局的资格,或可依赖于证券法注册的豁免条款,否则投资者必须无限期持有股份。投资者承认,公司没有义务登记或限定股份进行转售。投资者进一步承认,如果可以豁免注册或资格,该豁免可能要满足不在投资者的控制范围内的各种条件,包括但不限于出售的时间和方式、股份的持有期限以及与公司有关的要求,公司没有义务也可能无法满足。投资者明白,本次发行无意成为公开发行的一部分,投资者将无法依赖《证券法》第

11 条的保护。

(2)

Such Investor understands that the Shares must be held indefinitely unless such Shares are registered under the Securities Act or an

exemption from registration is available. Such Investor acknowledges that such Investor is familiar with Rule 144 and Rule 144A, of the

rules and regulations of the Commission, as amended, promulgated pursuant to the Securities Act (“Rule 144”),

and that such person has been advised that Rule 144 and Rule 144A, as applicable, permits resales only under certain circumstances. Such

Investor understands that to the extent that Rule 144 or Rule 144A is not available, such Investor will be unable to sell any Shares

without either registration under the Securities Act or the existence of another exemption from such registration requirement.

投资者理解,除非此类股份已根据证券法进行注册或可获得豁免注册,否则必须无限期持有这些股份。该投资者承认,该投资者熟悉根据证券法(“第

144 条”)颁布的经修订的委员会规则和条例的第

144 条和第 144A 条,并且该人已被告知第 144 条规则

144A(如适用)仅在特定情况下允许转售。此类投资者理解,在规则

144 或规则 144A 不可用的情况下,此类投资者将无法在未根据证券法进行注册或存在其他豁免注册要求的情况下出售任何股份。

(3)

The Investor understands that no United States federal or state agency or any other government or governmental agency has passed upon

or made any recommendation or endorsement of the Shares.

投资者了解,美国联邦或州机构或任何其他政府或政府机构均未对股份作出任何推荐或认可。

(4)

The Investor hereby acknowledges that upon the issuance thereof, and until such time as the same is no longer required under the applicable

securities laws and regulations, any certificates representing the Shares and the underlying securities may bear a restrictive legend

pursuant to applicable laws and may include language substantially similar to the below:

投资者特此承认,在股票发行后,直到适用的证券法律和法规不再要求之前,任何代表股份和相关证券的证书都可能根据适用法律带有限制性图例,并且可能包括与以下内容基本相似的语言:

“THE

SECURITIES REFERENCED HEREIN HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AND HAVE BEEN ACQUIRED FOR INVESTMENT AND NOT

WITH A VIEW TO, OR IN CONNECTION WITH, THE SALE OR DISTRIBUTION THEREOF. NO SUCH SALE OR DISTRIBUTION MAY BE EFFECTED WITHOUT AN EFFECTIVE

REGISTRATION STATEMENT RELATED THERETO OR AN OPINION OF COUNSEL IN A FORM SATISFACTORY TO THE COMPANY THAT SUCH REGISTRATION IS NOT REQUIRED

UNDER THE SECURITIES ACT OF 1933.”

“此处提及的证券尚未根据

1933 年《证券法》进行注册,并且已被收购用于投资,而不是为了出售或分配这些证券,或与之相关的目的。如果没有与之相关的有效注册声明或法律意见以公司满意的形式表示根据

1933 年证券法不需要进行此类注册,则不得进行此类销售或分发。”

(g)

No General Solicitation. The Purchaser acknowledges that the Shares were not offered to such Purchaser by means of any form of

general or public solicitation or general advertising, or publicly disseminated advertisements or sales literature, including (i) any

advertisement, article, notice or other communication published in any newspaper, magazine, or similar media, or broadcast over television

or radio, or (ii) any seminar or meeting to which such Purchaser was invited by any of the foregoing means of communications.

无一般招揽。购买人承认公司要约出售普通股没有采取一般或公众招揽或一般广告或公众广告或销售讲座的方式,包括(i)

任何广告、文章、通知或其他通过报纸、杂志或其他类似媒体登出的信息,或者电视或无线电广播,或(ii)任何通过上述沟通方式邀请购买人参与的讲座或会议。

(h)

Rule 144. Such Purchaser understands that the Shares must be held indefinitely unless such Shares are registered under the Securities

Act or an exemption from registration is available. Such Purchaser acknowledges that such Purchaser is familiar with Rule 144 and Rule

144A, and that such person has been advised that Rule 144 and Rule 144A, as applicable, permits resales only under certain circumstances.

Such Purchaser understands that to the extent that Rule 144 or Rule 144A is not available, such Purchaser will be unable to sell any

Shares without either registration under the Securities Act or the existence of another exemption from such registration requirement.

规则144。购买人明白股票的持有的时长是不确定的,除非股票经登记注册或登记注册被豁免。购买人承认其熟知规则144和规则144A,

并被告知根据规则144和规则144A,股票只有在特定的情况下才被允许出售;并且在不能适用规则144和规则144A时,如果股票没有登记注册或豁免,就不能出售。

(i)

Brokers. Purchaser does not have any knowledge of any brokerage or finder’s fees or commissions that are or will be payable

by the Company to any broker, financial advisor or consultant, finder, placement agent, investment banker, bank or other person or entity

with respect to the transactions contemplated by this Agreement.

融资代理。据投资人所知,公司不需要支付任何其他融资代理、金融顾问、发现者、券商、投资银行、银行或其他个人或主体任何与本交易有关的中介费、发理费或佣金。

(j)

Purchase for Own Account. Each Investor (a) is purchasing the Shares for its own account (not as a nominee or agent) for investment

purposes only and not with an intent or view to, or for, resale, distribution, or fractionalization thereof, in whole or in part, (b)

has no present arrangement or intention to sell or distribute the Shares, or to grant participation in the Shares, and (c) does not have

any contract, undertaking, agreement, or arrangement with any person to sell, transfer, or grant participation to such person, or to

any third person, with respect to any of the Shares.

自主购买。每个投资者a)均为自己购买该股票份额(而非代持或受托人)以换取投资回报,而非意向去转售,派发,分销部分或全部股票份额,b)

目前没有安排或意向去转售、派发,或授权参与认股该股票,并c)

没有与其他人进行合同,承诺,协议或安排来出售,转售,或授权参与认股该股票。

ARTICLE

III

第三条

Covenants

约定

The

Company covenants with the Purchaser as follows, which covenants are for the benefit of the Purchaser and its permitted assignees (as

defined herein).

出于购买人和他们的受让人的利益考虑,公司同意以下条款:

Section

3.1 Securities Compliance. The Company shall notify the Commission in accordance with its rules and regulations, of the transactions

contemplated by any of this Agreement, and shall take all other necessary action and proceedings as may be required and permitted by

applicable law, rule and regulation, for the legal and valid issuance of the Shares to the Purchaser or subsequent holders.

符合证券法的规定。公司应根据证券法的规定,向证监会通知申报交易文件,以及根据适用法律、法则和规则的要求,采取所有其他必需的行动和程序来有效合法的发行普通股。

Section

3.2 Confidential Information. The Purchaser agrees that such Purchaser and its employees, agents and representatives will keep

confidential and will not disclose, divulge or use (other than for purposes of monitoring its investment in the Company) any confidential

information which such Purchaser may obtain from the Company pursuant to financial statements, reports and other materials submitted

by the Company to such Purchaser pursuant to this Agreement, unless such information is known to the public through no fault of such

Purchaser or his or its employees or representatives; provided, however, that a Purchaser may disclose such information (i) to its attorneys,

accountants and other professionals in connection with their representation of such Purchaser in connection with such Purchaser’s

investment in the Company, (ii) to any prospective permitted transferee of the Shares, so long as the prospective transferee agrees to

be bound by the provisions of this Section 3.3, or (iii) to any general partner or affiliate of such Purchaser.

保密信息。购买人同意其对于公司根据本协议和其他交易文件提供给购买人、购买人员工、代理事代理的财务报表、报告或其他材料中的内部信息会保密、不披露、不泄露或使用,除非该内部信息非因购买人的过错而为公众所知悉,但是购买人可以披露以下(i)向购买人的律师、会计和其他专业人士披露其向公司的投资;(ii)

只要未来的股票受让人受本协议第3.3条约束,可以向未来受让人披露;或(iii)向购买人的一般合伙人或关联人披露。

Section

3.3 Compliance with Laws. The Company shall comply to comply in all material respects, with all applicable laws, rules, regulations

and orders, except where non-compliance could not reasonably be expected to have a Material Adverse Effect.

符合法律。公司应在重大方面,符合相关的法律、法规、规则和命令的规定,

除非不符合不会对公司造成重大不利影响。

Section

3.4 Keeping of Records and Books of Account. The Company shall keep adequate records and books of account, in which complete entries

will be made in accordance with GAAP consistently applied, reflecting all financial transactions of the Company, and in which, for each

fiscal year, all proper reserves for depreciation, depletion, obsolescence, amortization, taxes, bad debts and other purposes in connection

with its business shall be made.

记录和会计账册。公司应保存充分的记录和会计账册,与一般会计准则的记录规则相符,反映公司的所有金融交易。

Section

3.5 Disclosure of Material Information. The Company covenants and agrees that neither it nor any other person acting on its or

their behalf has provided or, from and after the filing of the Press Release, will provide any Purchaser or its agents or counsel with

any information that the Company believes constitutes material non-public information (other than with respect to the transactions contemplated

by this Agreement), unless prior thereto such Purchaser shall have executed a specific written agreement regarding the confidentiality

and use of such information. The Company understands and confirms that the Purchaser shall be relying on the foregoing covenants in effecting

transactions in securities of the Company. At the time of the filing of the Press Release, no Purchaser shall be in possession of any

material, nonpublic information received from the Company, any of its subsidiaries or any of its respective officers, directors, employees

or agents that is not disclosed in the Press Release. The Company shall not disclose the identity of any Purchaser in any filing with

the SEC except as required by the rules and regulations of the SEC thereunder. In the event of a breach of the foregoing covenant by

the Company, or any of its or their respective officers, directors, employees and agents, in addition to any other remedy provided herein,

a Purchaser may notify the Company, and the Company shall make public disclosure of such material nonpublic information within two (2)

trading days of such notification.

重大信息披露。公司承诺并同意,在公告之前或之后,除了与本交易有关的信息之外,公司或任何公司代表人没有向购买人或其代理或顾问披露任何重大内部信息,除非购买人在此之前签署了一份关于保密和使用该内部信息的特别书面协议。公司确认购买人会依赖上述承诺进行交易。在公告发表之明,购买人不应拥有任何从公司、管理人员、董事、员工、代理处获得的没有在公告中披露的重大内部信息。

Section

3.6 No Manipulation of Price. The Company will not take, directly or indirectly, any action designed to cause or result in, or

that has constituted or might reasonably be expected to constitute, the stabilization or manipulation of the price of any securities

of the Company.

无操纵价格。公司不会直接或间接采取任何行动,意图或导致,或构成或合理预期会构成对公司证券价格的稳定和操纵。

ARTICLE

IV

第四条

CONDITIONS

条件

Section

4.1 Conditions Precedent to the Obligation of the Company to Sell the Shares. The obligation hereunder of the Company to issue

and sell the Shares is subject to the satisfaction or waiver, at or before the Closing, of each of the conditions set forth below. These

conditions are for the Company’s sole benefit and may be waived by the Company at any time in its sole discretion.

公司出售股票的义务的前提条件。在此协议下,公司仅在以下各条件在交割时或交割之前被满足或被放弃时,才承担发行并向购买人出售股票的义务。此等条件是基于公司的利益,公司可随时依据自己的决定选择放弃此等条件。

(a)

Accuracy of the Purchaser’s Representations and Warranties. The representations and warranties of the Purchaser in this

Agreement shall be true and correct in all material respects as of the date when made and as of the Closing Date as though made at that

time, except for representations and warranties that are expressly made as of a particular date, which shall be true and correct in all

material respects as of such date.

购买人的陈述与保证的准确性。此协议中购买人的陈述与保证以在各个重大方面都应真实并且准确,此真实性和准确性是针对协议签署时和交割日来衡量,但是若陈述和保证中明示说明了产生日期,则按照此日期来衡量。

(b)

Performance by the Purchaser. The Purchaser shall have performed, satisfied and complied in all respects with all covenants, agreements

and conditions required by this Agreement to be performed, satisfied or complied with by such Purchaser at or prior to the Closing.

购买人的履行。在交割时或交割之前,购买人应在各方面履行,达到并符合购买人应履行,达到或符合此协议所必需的要求,合同和条件。

(c)

No Injunction. No statute, rule, regulation, executive order, decree, ruling or injunction shall have been enacted, entered, promulgated

or endorsed by any court or governmental authority of competent jurisdiction which prohibits the consummation of any of the transactions

contemplated by this Agreement.

无强制令。任何有管辖权的法院或政府机构不得制定,通过,颁布或支持任何禁止此协议中所述交易发生的法条,规则,规章,可执行命令,法令,判决或强制令。

(d)

Delivery of Purchase Price. The Purchase Price for the Shares shall have been delivered to the Company.

购买价格的支付。股票购买价格应已支付给公司。

(e)

Delivery of this Agreement. This Agreement shall have been duly executed and delivered by the Purchaser to the Company.

合同的签署。购买人应签署此合同并递交至公司。

Section

4.2 Conditions Precedent to the Obligation of the Purchaser to Purchase the Shares. The obligation hereunder of the Purchaser

to acquire and pay for the Shares offered in Offering is subject to the satisfaction or waiver, at or before the Closing, of each of

the conditions set forth below. These conditions are for the Purchaser’s sole benefit and may be waived by such Purchaser at any

time in its sole discretion.

购买人购买股票的义务的前提条件。在此协议下,购买人仅在以下各个条件在交割时或交割之前被满足或被放弃时,才承担购买股票并支付的义务。此等条件是基于购买人的利益,并且购买人可随时自行决定选择放弃此等条件。

(a)

Accuracy of the Company’s Representations and Warranties. Each of the representations and warranties of the Company in this

Agreement shall be true and correct in all respects as of the date when made and as of the Closing Date as though made at that time,

except for representations and warranties that are expressly made as of a particular date, which shall be true and correct in all respects

as of such date.

公司的陈述与保证的准确性。此协议中公司的陈述与保证在各个重大方面都应真实并且准确,此真实性和准确性是针对协议签署时和交割日来判定,但是若陈述和保证中明示说明了做出日期,则按照此日期来判定。

(b)

Performance by the Company. The Company shall have performed, satisfied and complied in all respects with all covenants, agreements

and conditions required by this Agreement to be performed, satisfied or complied with by the Company at or prior to the Closing.

公司的履行。在交割时或交割之前,公司应在各方面履行,满足并符合所有公司履行,满足或符合此协议所必需的合意,合同和条件。

(c)

No Injunction. No statute, rule, regulation, executive order, decree, ruling or injunction shall have been enacted, entered, promulgated

or endorsed by any court or governmental authority of competent jurisdiction which prohibits the consummation of any of the transactions

contemplated by this Agreement.

无强制令。任何有管辖权的法院或政府机构不得制定,通过,颁布或支持任何禁止此协议中所述交易发生的法条,规则,规章,可执行命令,法令,判决或强制令。

(d)

No Proceedings or Litigation. No action, suit or proceeding before any arbitrator or any governmental authority shall have been

commenced, and no investigation by any governmental authority shall have been threatened, against the Company, or any of the officers,

directors or affiliates of the Company seeking to restrain, prevent or change the transactions contemplated by this Agreement, or seeking

damages in connection with such transactions.

无诉讼程序或诉讼。不得在任何仲裁员或任何政府机构提起任何诉讼,案件或诉讼程序;任何政府机构不得针对公司,或公司的任何管理人员,董事会成员或附属机构发起调查,试图限制,禁止或改变此协议所述的交易或要去与此类交易有关的损害赔偿。

(e)

Certificates. The Company shall have executed and delivered to the Purchaser the certificates (in such denominations as such Purchaser

shall request) for the Shares being acquired by such Purchaser immediately after the Closing (in such denominations as such Purchaser

shall request) to such address set forth next to the Purchaser with respect to the Closing.

证书。公司应在交割后立即签署并向购买人送达由此购买人购买的股票证书,地址应为交割时购买人的地址。证书的种类/面值依购买人所要求。

(f)

Resolutions. The Board of Directors of the Company shall have adopted resolution consistent with Section 2.1(b) hereof in a form

reasonably acceptable to such Purchaser (the “Resolution”).

决议。公司董事会应采纳与此协议中第2.1节(b)相一致的,在形式上可被此购买人合理的接受的决议(

“决议”)。

(g)

Material Adverse Effect. No Material Adverse Effect shall have occurred at or before the Closing Date.

重大负面影响。在交割日或交割日之前不得产生重大负面影响。

ARTICLE

V

第五条

Stock

Certificate Legend

股权证书上的说明

Section

5.1 Legend. Each certificate representing the Shares shall be stamped or otherwise imprinted with a legend substantially in the

following form (in addition to any legend required by applicable state securities or “blue sky” laws):

限制交易说明。证券的股权证书都应盖印或刻印有与下段文字基本相同的限制交易说明(此受限说明是对任何相关的州证券法或“蓝天”法下的限制交易说明的补充):

“THE

SECURITIES REFERENCED HEREIN HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AND HAVE BEEN ACQUIRED FOR INVESTMENT AND NOT

WITH A VIEW TO, OR IN CONNECTION WITH, THE SALE OR DISTRIBUTION THEREOF. NO SUCH SALE OR DISTRIBUTION MAY BE EFFECTED WITHOUT AN EFFECTIVE

REGISTRATION STATEMENT RELATED THERETO OR AN OPINION OF COUNSEL IN A FORM SATISFACTORY TO THE COMPANY THAT SUCH REGISTRATION IS NOT REQUIRED

UNDER THE SECURITIES ACT OF 1933.”

“此处提及的证券尚未根据

1933 年《证券法》进行注册,并且已被收购用于投资,而不是为了出售或分配这些证券,或与之相关的目的。如果没有与之相关的有效注册声明或法律意见以公司满意的形式表示根据

1933 年证券法不需要进行此类注册,则不得进行此类销售或分发。”

ARTICLE

VI

第六条

Indemnification

补偿

Section

6.1 General Indemnity. The Company agrees to indemnify and hold harmless the Purchaser (and their respective directors, officers,

managers, partners, members, shareholders, affiliates, agents, successors and assigns) from and against any and all losses, liabilities,

deficiencies, costs, damages and expenses (including, without limitation, reasonable attorneys’ fees, charges and disbursements)

incurred by the Purchaser as a result of any inaccuracy in or breach of the representations, warranties or covenants made by the Company

herein. The Purchaser, severally but not jointly, agrees to indemnify and hold harmless the Company and its directors, officers, affiliates,

agents, successors and assigns from and against any and all losses, liabilities, deficiencies, costs, damages and expenses (including,

without limitation, reasonable attorneys’ fees, charges and disbursements) incurred by the Company as a result of any inaccuracy

in or breach of the representations, warranties or covenants made by such Purchaser herein. The maximum aggregate liability of the Purchaser

pursuant to its indemnification obligations under this Article VI shall not exceed the portion of the Purchase Price paid by the Purchaser

hereunder. In no event shall any “Indemnified Party” (as defined below) be entitled to recover consequential or punitive

damages resulting from a breach or violation of this Agreement.

常规补偿。公司同意补偿购买人(及其各自的董事会成员,高级职员,管理层人员,合伙人,成员,股东,附属机构,代理人,继承人和子实体)并保证其免受任何及所有的损失,责任,短缺,费用,损害赔偿和花销(包括但不限于,合理的律师费),以上所有损失都由购买人承担的,因公司做出的保证,陈述和协议中的不准确或违反了其中条款而产生。购买人同意分别但不连带的补偿公司及其董事会成员,附属机构,代理人,继承者和子实体,并使其免受任何及所有的损失,责任,短缺,费用,损害赔偿和花销(包括但不限于,合理的律师费),以上所有损失是由公司承担的,因购买人做出的保证,陈述和协议中的不准确或违反了其中条款而产生。购买人依此第6.1条中所述补偿而承担的最大的总责任不得超过此购买人所支付的购买价格。任何“受补偿方”

(定义见下)不得享有因违反此协议而引起的间接损害赔偿或惩罚性损害赔偿。

Section

6.2 Indemnification Procedure. Any party entitled to indemnification under this Article VI (an “Indemnified Party”)

will give written notice to the indemnifying party of any matters giving rise to a claim for indemnification; provided, that the

failure of any party entitled to indemnification hereunder to give notice as provided herein shall not relieve the indemnifying party

of its obligations under this Article VI except to the extent that the indemnifying party is actually prejudiced by such failure to give

notice. In case any action, proceeding or claim is brought against an Indemnified Party in respect of which indemnification is sought

hereunder, the indemnifying party shall be entitled to participate in and, unless in the reasonable judgment of the Indemnified Party

a conflict of interest between it and the indemnifying party may exist with respect of such action, proceeding or claim, to assume the

defense thereof with counsel reasonably satisfactory to the Indemnified Party. In the event that the indemnifying party advises an Indemnified

Party that it will contest such a claim for indemnification hereunder, or fails, within thirty (30) days of receipt of any indemnification

notice to notify, in writing, such person of its election to defend, settle or compromise, at its sole cost and expense, any action,

proceeding or claim (or discontinues its defense at any time after it commences such defense), then the Indemnified Party may, at its

option, defend, settle or otherwise compromise or pay such action or claim. In any event, unless and until the indemnifying party elects

in writing to assume and does so assume the defense of any such claim, proceeding or action, the Indemnified Party’s costs and

expenses arising out of the defense, settlement or compromise of any such action, claim or proceeding shall be losses subject to indemnification

hereunder. The Indemnified Party shall cooperate fully with the indemnifying party in connection with any negotiation or defense of any

such action or claim by the indemnifying party and shall furnish to the indemnifying party all information reasonably available to the

Indemnified Party which relates to such action or claim. The indemnifying party shall keep the Indemnified Party fully apprised at all

times as to the status of the defense or any settlement negotiations with respect thereto. If the indemnifying party elects to defend

any such action or claim, then the Indemnified Party shall be entitled to participate in such defense with counsel of its choice at its

sole cost and expense. The indemnifying party shall not be liable for any settlement of any action, claim or proceeding effected without

its prior written consent, provided, however, that the indemnifying party shall be liable for any settlement if the indemnifying

party is advised of the settlement but fails to respond to the settlement within thirty (30) days of receipt of such notification. Notwithstanding

anything in this Article VI to the contrary, the indemnifying party shall not, without the Indemnified Party’s prior written consent,

settle or compromise any claim or consent to entry of any judgment in respect thereof which imposes any future obligation on the Indemnified

Party or which does not include, as an unconditional term thereof, the giving by the claimant or the plaintiff to the Indemnified Party

of a release from all liability in respect of such claim. The indemnification required by this Article VI shall be made by periodic payments

of the amount thereof during the course of investigation or defense, as and when bills are received or expense, loss, damage or liability

is incurred, so long as the Indemnified Party irrevocably agrees to refund such moneys if it is ultimately determined by a court of competent

jurisdiction that such party was not entitled to indemnification. The indemnity agreements contained herein shall be in addition to (a)

any cause of action or similar rights of the Indemnified Party against the indemnifying party or others, and (b) any liabilities the

indemnifying party may be subject to pursuant to the law.

补偿程序。任何依据此第六条有权享有补偿的当事方(“受补偿方”)应就任何因此补偿而引出的诉讼请求向补偿方发出书面通知;前提是,若受补偿方未能发出此通知,补偿方仍需承担其在此第六条下的补偿责任,除非此不作为会对补偿方产生不公正结果。在就此补偿而向受补偿方提出的任何诉讼,诉讼程序或诉讼请求中,补偿方应有权参与其中并与法律顾问一起提出受补偿方合理的觉得满意的抗辩,除非依据受补偿方的合理的判断,存在利益冲突,并且补偿方很可能在此诉讼,诉讼程序或诉讼请求中胜出。若补偿方告知受补偿方其将应诉,或在收到任何关于补偿的通知后的三十(30)天内未能书面通知受补偿方其将选择自费应诉,调解或折中方式(或在应诉后的任何时候停止抗辩),则受补偿方可自由选择应诉,调解或其它折中方法,或支付此诉讼或诉讼请求的费用。在任何情况下,除非补偿方书面选择并确已开始抗辩,因此抗辩,调节或折中方式而产生的受补偿方的费用和花销应为可依此条款补偿的款项。受补偿方应就此诉讼或诉讼请求

的协商或抗辩与补偿方全力合作,并向补偿方提供受补偿方可合理获取的与此诉讼或诉讼请求相关的所有信息。补偿方应将抗辩或任何调解协商的进展情况及时通知受补偿方。若补偿方选择应诉此诉讼或诉讼请求,则受补偿方应有权自费与法律顾问参与到此抗辩中。补偿方不因任何未获其书面同意便生效的调解而承担责任,但是,若已将调解告知补偿方,但补偿方未能在收到此通知的三十(30)天内回应,则补偿方应对此调解承担责任。除非与此第六条规定相冲突,若未得到受补偿方的事先书面同意,补偿方不得同意调解或采用折中方式或同意任何要求受补偿方承担任何将来义务的判决或者不包含要求起诉方或原告免除所有受补偿方与此诉讼请求相关的所有责任这一无条件条款的判决。只要受补偿方同意(此同意为不可撤回)若适格法律管辖区的法院最终判定此当事方无权获得补偿,受补偿方将退还此所有补偿,则在调查或抗辩过程中收到的账单的款项,或在此期间产生的花销,损失,损害赔偿或责任的补偿应分期支付。此补偿协议是以下权利的补充(a)受补偿方针对补偿方所享有的任何诉因,及(b)任何补偿方可能依法承担的责任。

ARTICLE

VII

第七条

Miscellaneous

其他条款

Section

7.1 Fees and Expenses. Except as otherwise set forth in this Agreement, each party shall pay the fees and expenses of its advisors,

counsel, accountants and other experts, if any, and all other expenses, incurred by such party incident to the negotiation, preparation,

execution, delivery and performance of this Agreement.

费用和花销。除此协议所述,各当事方应自行支付其顾问,会计师和其他专家的费用和花销,以及所有其他与协商,准备,执行,送达和履行此协议有关的花销。

Section

7.2 Specific Enforcement, Consent to Jurisdiction.

特别履行,同意接受司法管辖。

(a)

The Company and the Purchaser acknowledge and agree that irreparable damage would occur in the event that any of the provisions of this

Agreement were not performed in accordance with their specific terms or were otherwise breached. It is accordingly agreed that the parties

shall be entitled to an injunction or injunctions to prevent or cure breaches of the provisions of this Agreement and to enforce specifically

the terms and provisions hereof or thereof, this being in addition to any other remedy to which any of them may be entitled by law or

equity.

公司和购买人承认并同意一旦发生无法补救的损失,不得要求此协议的特别履行。双方也就此同意各方都有权要求强制令以阻止或消除此协议的违约情况,并要求执行此协议中的具体条款,此救济是对任何依据法律或衡平法可适用的救济的补充。

(b)

Each of the Company and the Purchaser (i) hereby irrevocably submits to the jurisdiction of the United States District Court sitting

in the Southern District of New York and the courts of the State of New York located in New York county for the purposes of any suit,

action or proceeding arising out of or relating to this Agreement or the transactions contemplated hereby or thereby and (ii) hereby

waives, and agrees not to assert in any such suit, action or proceeding, any claim that it is not personally subject to the jurisdiction

of such court, that the suit, action or proceeding is brought in an inconvenient forum or that the venue of the suit, action or proceeding

is improper.

公司和购买人(i)就所有因此协议或其所述的交易而产生的诉讼或诉讼程序,接受位于纽约州南区的美国巡回法院以及位于纽约郡的纽约州法院的管辖,此接受不可撤回,并且(ii)放弃并同意不在任何诉讼或诉讼程序中提出任何关于不受此等法院属人管辖,或诉讼在不方便法院提起,或案件审判地不合适的诉讼请求。

Section

7.3 Entire Agreement; Amendment. This Agreement contains the entire understanding and agreement of the parties with respect to

the matters covered hereby and, except as specifically set forth herein, neither the Company nor any of the Purchaser makes any representations,

warranty, covenant or undertaking with respect to such matters and they supersede all prior understandings and agreements with respect

to said subject matter, all of which are merged herein. No provision of this Agreement may be waived or amended other than by a written

instrument signed by the Company and the Purchaser, and no provision hereof may be waived other than by a written instrument signed by

the party against whom enforcement of any such waiver is sought.

合同的完整性;修正。此协议中包含了合同各方对此协议的相关事项的完整理解和合意,除非此协议中明确指明,公司或购买人没有对此协议中所述事项做出其他任何陈述,保证,协议或承诺;针对所述事项的所有先前的理解和合意都合并到此协议中,并被此协议所取代。若无公司和购买人的书面同意,此协议的任何条款不得被取消或修改。

Section

7.4 Notices. All notices, demands, consents, requests, instructions and other communications to be given or delivered or permitted

under or by reason of the provisions of this Agreement or in connection with the transactions contemplated hereby shall be in writing

and shall be deemed to be delivered and received by the intended recipient as follows: (i) if personally delivered, on the business day

of such delivery (as evidenced by the receipt of the personal delivery service), (ii) if mailed certified or registered mail return receipt

requested, two (2) business days after being mailed, (iii) if delivered by overnight courier (with all charges having been prepaid),

on the business day of such delivery (as evidenced by the receipt of the overnight courier service of recognized standing), or (iv) if

delivered by facsimile transmission, on the business day of such delivery if sent by 6:00 p.m. in the time zone of the recipient, or

if sent after that time, on the next succeeding business day (as evidenced by the printed confirmation of delivery generated by the sending

party’s telecopier machine). If any notice, demand, consent, request, instruction or other communication cannot be delivered because

of a changed address of which no notice was given (in accordance with this Section 7.4), or the refusal to accept same, the notice, demand,

consent, request, instruction or other communication shall be deemed received on the second business day the notice is sent (as evidenced

by a sworn affidavit of the sender). All such notices, demands, consents, requests, instructions and other communications will be sent

to the following addresses or facsimile numbers as applicable:

通知。所有通知,要求,同意,请求,指示和其他因此协议需要或允许的交流或与此协议中的交易相关的交流应以书面形式出现,在以下情况中,应被视为已送达并由预期的接收者收取:(i)若人力递送,则是递送的工作日(以人力递送服务的收据为证),(ii)若由要求回执的挂号信邮寄,则为邮寄后的两(2)个工作日,(iii)若使用第二日送达的快递服务(预付所有费用),则为递送的工作日(以具有一定公信力的第二日送达服务的收据为证),或(iv)若通过传真,且在收信人当地时间下午六点前发出的,为传真当天,若在其他时间,则为下一个工作日(以发送方传真机器打印的确认发送的通知为证)。若任何通知,要求,同意,请求,指示和其他交流因地址改变且未事前通知(须符合第7.4节要求),或者拒绝接收,则此通知,要求,同意,请求,指示和其他交流应视为在通知发出的第二个工作受到(以发送方的宣誓书为证)。所有此类通知,要求,同意,请求,指示和其他交流应递送至以下地址或传真

号码:

If

to the Company:

若至公司:

Antelope

Enterprise Holdings Ltd.

Room

1802, Block D, Zhonghai International Center,

Hi-Tech

Zone, Chengdu, Sichuan Province, PRC

If

to Purchaser:

如至购买人:

The

address listed on each of Purchaser’s signature page

在附件A中列明的地址

Any

party hereto may from time to time change its address for notices by giving at least ten (10) days written notice of such changed address

to the other party hereto.

任何当事方可时常更改通知所用的地址,但需提前十(10)天以书面形式告知另一方。

Section

7.5 Waivers. No waiver by any party of any default with respect to any provision, condition or requirement of this Agreement shall

be deemed to be a continuing waiver in the future or a waiver of any other provisions, condition or requirement hereof, nor shall any

delay or omission of any party to exercise any right hereunder in any manner impair the exercise of any such right accruing to it thereafter.

豁免。任何一方关于对某一条款,条件或要求违约的豁免不能视为未来或对其他条款,条件或要求的豁免。

Section

7.6 Headings. The section headings contained in this Agreement (including, without limitation, section headings and headings in

the exhibits and schedules) are inserted for reference purposes only and shall not affect in any way the meaning, construction or interpretation

of this Agreement. Any reference to the masculine, feminine, or neuter gender shall be a reference to such other gender as is appropriate.

References to the singular shall include the plural and vice versa.

编号。此协议中的编号(包括但不限于各节编号以及附表和清单中的编号)仅是出于引用方便的考虑,不影响此协议的释义,解释或理解。任何分性别或不分性别的指代都应包括所有性别的指代。任何单数名词包应包括其相对应的复数名词,反之亦然。

Section

7.7 Successors and Assigns. This Agreement may not be assigned by a party hereto without the prior written consent of the Company

or the Purchaser, as applicable, provided, however, that, subject to federal and state securities laws, a Purchaser may

assign its rights and delegate its duties hereunder in whole or in part to an affiliate or to a third party acquiring all or substantially

all of its Shares in a private transaction without the prior written consent of the Company or the other Purchaser, after notice duly

given by such Purchaser to the Company provided, that no such assignment or obligation shall affect the obligations of such Purchaser

hereunder and that such assignee agrees in writing to be bound, with respect to the transferred securities, by the provisions hereof

that apply to the Purchaser. The provisions of this Agreement shall inure to the benefit of and be binding upon the respective permitted

successors and assigns of the parties. Nothing in this Agreement, express or implied, is intended to confer upon any party other than

the parties hereto or their respective successors and assigns any rights, remedies, obligations or liabilities under or by reason of

this Agreement, except as expressly provided in this Agreement.

继承者和子实体。若未获得公司和购买人的事前书面同意,各当事方公司不得转让本协议;但是,依据联邦和州的证券法或交易文件所述,在未获得公司或其他购买人的事前书面同意下,但此购买人告知公司之后,购买人可向附属机构或在非公开交易中收购了其全部或基本全部股份或期权的第三方转让其全部或部分权利及义务;但是,此权利或义务的转让会影响此购买人在协议下的义务,此受转让者书面同意就被转让的证券以及接受此协议中适用于此购买人的条款的约束力。此协议的条款对允许的各继承者和子实体具有约束力。除在此协议中明示之外,此协议的条款,明示或暗含的,都不赋予除协议中的当事方及其各自的继承者和子实体任何权利,救济,义务或责任。

Section

7.8 Governing Law. This Agreement shall be governed by and construed in accordance with the internal laws of the State of New

York, without giving effect to any of the conflicts of law principles which would result in the application of the substantive law of

another jurisdiction. This Agreement shall not be interpreted or construed with any presumption against the party causing this Agreement

to be drafted.

适用法律。此协议应根据纽约州的州内法执行和解释,但不包括任何可能导致适用非纽约州实体法的冲突法。此协议不适用“对起草人不利”的原则。

Section

7.9 Survival. The representations and warranties of the Company and the Purchaser shall survive the execution and delivery hereof

and the Closing hereunder for a period of three (3) years following the Closing Date.

存续。公司和购买人的保证与陈述在此协议签署和送达后继续有效,有效期为交割日之后的三年。

Section

7.10 Counterparts. This Agreement may be executed in any number of counterparts, each of which when so executed shall be deemed

to be an original and, all of which taken together shall constitute one and the same Agreement and shall become effective when counterparts

have been signed by each party and delivered to the other parties hereto, it being understood that all parties need not sign the same

counterpart. In the event that any signature is delivered by facsimile transmission, such signature shall create a valid binding obligation

of the party executing (or on whose behalf such signature is executed) the same with the same force and effect as if such facsimile signature

were the original thereof.

副本。此协议可在多个副本上签署,每一份副本都可视为原件,所有副本都可视为同一协议并且在各方签署并送达本协议另一方时生效,当事方无需签署每一份副本。若签名是通过传真发送,此传真签名对签署方的约束力与将此传真签名视为原件的约束力相同

Section

7.11 Severability. The provisions of this Agreement are severable and, in the event that any court of competent jurisdiction shall

determine that any one or more of the provisions or part of the provisions contained in this Agreement shall, for any reason, be held

to be invalid, illegal or unenforceable in any respect, such invalidity, illegality or unenforceability shall not affect any other provision

or part of a provision of this Agreement and such provision shall be reformed and construed as if such invalid or illegal or unenforceable

provision, or part of such provision, had never been contained herein, so that such provisions would be valid, legal and enforceable

to the maximum extent possible.

可分割性。此协议中的条款具有可分割性,若具有适格管辖权的法院判定此协议和交易文件中的任意条款无效,不合法或不可执行,其他条款的效力不受影响,并且在解释此有效条款时,应将无效的条款视为不存在,以便有效条款能在最大程度上被执行。

Section

7.12 Termination. This Agreement may be terminated prior to Closing by mutual written agreement of the Purchaser and the Company.

终止。此协议可在交割前由购买人和公司双方书面同意终止。

Section

7.13. Language. The Agreement is in both English and Chinese, with English version having binding effect.

语言。本协议含有英文和中文,英文版具有约束力。

[Remainder

of Page Intentionally Left Blank; Signature Pages Follow]

[余页故意留空;下页为签名页]

IN

WITNESS WHEREOF, the parties hereto have caused this Agreement to be duly executed by their respective authorized officer as of the date

first above written.

在此各方确认和签署。

|

| |

ANTELOPE

ENTERPRISE HOLDINGS LTD. |

| |

|

| |

By: |

|

| |

Name: |

Weilai

Zhang |

| |

Title: |

Chief

Executive Officer |

[Signature

Page of the Company]

[公司的签字页]

Signature

Page of the Purchaser

购买人签字页

IN

WITNESS WHEREOF, the Purchaser has caused this Agreement to be duly executed individually or by its authorized officer or member as of

the date first above written.

购买人在此确认和同意协议的条款,并有效签署该协议。

The

Purchaser:

Number

of Shares Purchased:

Total

Purchase Price:

| Address: |

|

| |

|

| Telephone

: |

|

| Fax

: |

|

| Email

: |

|

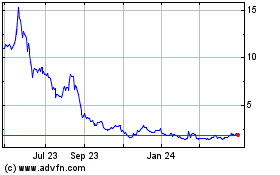

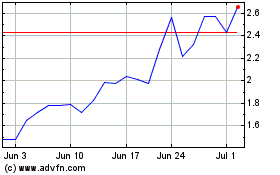

Antelope Enterprise (NASDAQ:AEHL)

Historical Stock Chart

From Oct 2024 to Nov 2024

Antelope Enterprise (NASDAQ:AEHL)

Historical Stock Chart

From Nov 2023 to Nov 2024