Form 8-K - Current report

06 March 2024 - 8:12AM

Edgar (US Regulatory)

0000353184false00003531842024-03-052024-03-050000353184us-gaap:CommonStockMember2024-03-052024-03-050000353184airt:CumulativeCapitalSecuritiesMember2024-03-052024-03-05

______________________________________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

______________________________________________________________________________

FORM 8-K

______________________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): March 05, 2024

______________________________________________________________________________

AIR T, INC.

(Exact Name of Registrant as Specified in Charter)

______________________________________________________________________________

| | | | | | | | | | | | | | |

| Delaware | | 001-35476 | | 52-1206400 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

11020 David Taylor Drive, Suite 350,

Charlotte, North Carolina 28262

(Address of Principal Executive Offices, and Zip Code)

________________(980) 595-2840__________________

Registrant’s Telephone Number, Including Area Code

Not applicable___

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | AIRT | NASDAQ Global Market |

| Alpha Income Preferred Securities (also referred to as 8% Cumulative Capital Securities) (“AIP”) | AIRTP | NASDAQ Global Market |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). |

| ☐ | Emerging growth company |

| ☐ | If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

Item 7.01 Regulation FD Disclosure

On March 5, 2024, Air T, Inc. issued a press release to provide additional information with respect to its recently completed $15,000,000 private notes transaction.

A copy of the press release is filed as Exhibit 99.1 to this report and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | |

| 99.1 | |

| 104 | Inline XBRL for the cover page of this Current Report on Form 8-K. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: March 5, 2024

AIR T, INC.

By: /s/ Brian Ochocki

Brian Ochocki, Chief Financial Officer

Air T, Inc. Secures $15.0 Million in Private and Non-Recourse Debt Transaction, Propelling Strategic Growth Initiatives Minneapolis, MN, March 5, 2024 – Air T, Inc. (the “Company”) recently announced the closing of a direct, structured $15,000,000 private note transaction with a major pension plan on February 22, 2024 (the “Transaction”). The Transaction involved 7-year notes bearing 8.5% interest per annum. The Company believes that the Transaction represents an important step forward as it allows the Company to securitize its ownership in more than fifteen aviation-related joint venture interests, currently managed by its subsidiaries, in order to raise non-recourse debt which the Company can use to pay down other debt, as well as make further aviation-related investments. As part of the Transaction, all of the cash flows from the securitized joint venture interests will be used to pay interest and principal, with the excess available to make additional aviation-related joint venture investments within the structure. The Transaction will also allow the Company to redeploy capital into other opportunities. Some of the proceeds from the Transaction were used to fully pay down the Company’s revolving debt facility with Minnesota Bank & Trust. “We believe this transaction represents a win-win result for all parties. We are pleased that we were able to close a transaction of this strategic importance with an experienced aviation investor. We are hopeful that this is the first of several transactions of this type” said Nick Swenson, CEO of the Company. For more information on this transaction, please see the Company’s 8-K filing dated February 26, 2024. NOTE REGARDING STOCKHOLDER QUESTIONS If you have questions related to this release or other Air T matters, please use our interactive Q&A capability, through Slido.com, accessible from our website, to submit your questions. We intend to keep that link open and available for shareholder questions. Questions submitted through Slido will be answered “live” and in writing at our Annual Meeting, and via a written response on a quarterly basis. Note that legal and pragmatic requirements restrict us from answering every question posted, yet we intend to address all reasonable and relevant questions with a written answer. ABOUT AIR T, INC. Established in 1980, Air T Inc. is a portfolio of powerful businesses and financial assets, each of which is independent yet interrelated. Its core segments are overnight air cargo, aviation ground support equipment manufacturing and sales, commercial jet engines and parts, and corporate and other. We seek to expand, strengthen and diversify Air T’s after-tax cash flow per share. Our goal is to build Air T’s core businesses, and when appropriate, to expand into adjacent and other industries. We seek to activate growth and overcome challenges while delivering meaningful value for all stakeholders. For more information, visit www.airt.net. FORWARD-LOOKING STATEMENTS Certain statements in this press release, including those contained in “Overview,” are “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the Company’s financial condition, results of operations, plans, objectives, future performance and business. Forward-looking statements include those preceded by, followed by or that include the words “believes”, “pending”, “future”, “expects,” “anticipates,” “estimates,” “depends” or similar expressions. These forward-looking statements involve risks and uncertainties. Actual results may differ materially from

those contemplated by such forward-looking statements, because of, among other things, potential risks and uncertainties, such as: • An inability to finance our operations through bank or other financing or through the sale of issuance of debt or equity securities; • Economic and industry conditions in the Company’s markets; • The risk that contracts with FedEx could be terminated or adversely modified; • The risk that the number of aircraft operated for FedEx will be reduced; • The risk that GGS customers will defer or reduce significant orders for deicing equipment; • The impact of any terrorist activities on United States soil or abroad; • The Company’s ability to manage its cost structure for operating expenses, or unanticipated capital requirements, and match them to shifting customer service requirements and production volume levels; • The Company's ability to meet debt service covenants and to refinance existing debt obligations; • The risk of injury or other damage arising from accidents involving the Company’s overnight air cargo operations, equipment or parts sold and/or services provided; • Market acceptance of the Company’s commercial and military equipment and services; • Competition from other providers of similar equipment and services; • Changes in government regulation and technology; • Changes in the value of marketable securities held as investments; • Mild winter weather conditions reducing the demand for deicing equipment; • Market acceptance and operational success of the Company’s relatively new aircraft asset management business and related aircraft capital joint venture; and • Despite our current indebtedness levels, we and our subsidiaries may still be able to incur substantially more debt, which could further exacerbate the risks associated with our substantial leverage. A forward-looking statement is neither a prediction nor a guarantee of future events or circumstances, and those future events or circumstances may not occur. We are under no obligation, and we expressly disclaim any obligation, to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise. For further inquiry: Jeff Golbus VP, Finance and Capital Markets jgolbus@airt.net 612-760-4707

v3.24.0.1

Cover

|

Mar. 05, 2024 |

| Entity Information |

|

| Document Type |

8-K

|

| Document Period End Date |

Mar. 05, 2024

|

| Entity Registrant Name |

AIR T, INC.

|

| Entity Incorporation, State |

DE

|

| Entity File Number |

001-35476

|

| Entity Tax Identification Number |

52-1206400

|

| Entity Address, Street |

11020 David Taylor Drive, Suite 350,

|

| Entity Address, City |

Charlotte

|

| Entity Address, State |

NC

|

| Entity Address, Postal Zip Code |

28262

|

| City Area Code |

980

|

| Local Phone Number |

595-2840

|

| Written Communications |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000353184

|

| Amendment Flag |

false

|

| Amendment Description |

|

| Document Effective Date |

Mar. 05, 2024

|

| Soliciting Material |

false

|

| Common Stock |

|

| Entity Information |

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

AIRT

|

| Security Exchange Name |

NASDAQ

|

| Cumulative Capital Securities |

|

| Entity Information |

|

| Title of 12(b) Security |

Alpha Income Preferred Securities (also referred to as 8% Cumulative Capital Securities) (“AIP”)

|

| Trading Symbol |

AIRTP

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe date when a document, upon receipt and acceptance, becomes officially effective, in YYYY-MM-DD format. Usually it is a system-assigned date time value, but it may be declared by the submitter in some cases.

| Name: |

dei_DocumentEffectiveDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=airt_CumulativeCapitalSecuritiesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

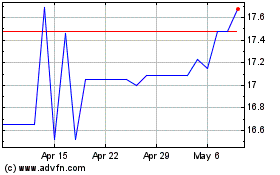

Air T (NASDAQ:AIRTP)

Historical Stock Chart

From Feb 2025 to Mar 2025

Air T (NASDAQ:AIRTP)

Historical Stock Chart

From Mar 2024 to Mar 2025