UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2024

Commission File Number: 001-41324

AKANDA CORP.

(Name of registrant)

1a, 1b Learoyd Road

New Romney TN28 8XU, United Kingdom

(Address of

principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

☒ Form 20-F

☐ Form 40-F

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

Attached hereto as Exhibit 99.1 and Exhibit 99.2 and incorporated

by reference herein are Akanda Corp.’s press release, dated November 12, 2024, and Akanda Corp.’s Articles of Amendment,

respectively.

The press release furnished in this report as Exhibit 99.1 shall not

be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the

liabilities of that section.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

AKANDA CORP. |

| |

(Registrant) |

| |

|

|

| Date: November 12, 2024 |

By: |

/s/ Katie Field |

| |

|

Name: |

Katie Field |

| |

|

Title: |

Interim Chief Executive Officer and Director |

2

Exhibit 99.1

Akanda Corp. Announces Reverse Stock Split

LONDON, UK November 12, 2024 — Akanda Corp.

(NASDAQ: AKAN) (the “Company” or “Akanda”), today announced that it expects to implement a 1-for-2 reverse stock

split of the Company’s common shares effective November 14, 2024. The reverse stock split was previously approved by the Company’s

shareholders on March 22, 2024 and Board of Directors on October 25, 2024 and will begin trading on an adjusted basis giving effect to

the reverse stock split at the opening of market on November 14, 2024 under the existing ticker symbol “AKAN”. The new CUSIP

number of the Company’s common shares will be 00971M403 and the new ISIN code will be CA00971M4039.

In accordance with the proposal approved by the

Company’s shareholders on March 22, 2024, the Company may effect one or more future consolidations of the Company’s issued

and outstanding common shares and on the basis of a consolidation ratio to be selected by the Board, in its sole discretion, within a

range between ten pre-consolidation common shares for one post-consolidation common share and 100 pre-consolidation common shares for

one post-consolidation common share, on such dates as the Board may determine. Since then, the Board approved a 1-for-40 reverse split

that was effective May 23, 2024 and has subsequently determined to approve a second reverse split within the 1-for-100 aggregate ratio

approved by shareholders, by fixing the split ratio at 2:1, so that every two common shares of the Company would be automatically combined

into one common share. This will reduce the number of outstanding common shares of the Company from approximately 4.1 million to approximately

2.0 million. The reverse stock split affects all shareholders uniformly and will not alter any shareholder’s percentage interest

in the Company’s outstanding common shares, except for adjustments that may result from the treatment of fractional shares.

Outstanding Company options, warrants and other

applicable convertible securities will be proportionately adjusted in accordance with their respective terms. No fractional shares will

be issued in connection with the reverse stock split. In the event that a shareholder would otherwise be entitled to receive a fractional

common share, such fraction will be rounded down to the nearest whole number. No cash will be paid in lieu of fractional post-reverse

split common shares.

Vstock Transfer is acting

as exchange agent for the reverse stock split and will send instructions to any shareholders of record who hold stock certificates regarding

the exchange of certificates. Shareholders with shares held in book-entry form or through a bank, broker, or other nominee are not required

to take any action and will see the impact of the reverse stock split reflected in their accounts on or after November 14, 2024. Such

beneficial holders may contact their bank, broker, or nominee for more information. Vstock Transfer may be reached for questions at (212)

828-8436.

Additional information concerning the reverse

stock split can be found in the Company’s Notice of Annual General and Special Meeting of Shareholders of Akanda Corp., which was

held on March 22, 2024, and accompanied Management Information Circular, each filed with the Securities and Exchange Commission on March

11, 2024 on a Report on Form 6-K. The Company will file Articles of Amendment with the Ontario Ministry of Public and Business Service

Delivery in advance of the market effective date of the reverse stock split on November 14, 2024.

—Ends—

For further information contact:

AKANDA CORP. GENERAL ENQUIRIES

E: ir@akandacorp.com

About Akanda Corp.

We are a cannabis cultivation, manufacturing and

distribution company whose mission is to provide premium quality medical cannabis products to patients worldwide. We are an early stage,

emerging growth company headquartered in London, the United Kingdom. We have a limited operating history and minimal revenues to date.

We expect to expand our subsidiaries’ local operations and develop sales channels of our medicinal-grade cannabis products and cannabis

based medical and wellness products in international markets and in particular, in the United Kingdom

Forward-Looking Statements

The information in this press release includes

“forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements

include, but are not limited to, statements regarding expectations, hopes, beliefs, intentions, or strategies regarding the future. In

addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including

any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “contemplate,”

“continue,” “could,” “estimate,” “expect,” “forecast,” “intends,”

“may,” “will,” “might,” “plan,” “possible,” “potential,” “predict,”

“project,” “should,” “would” and similar expressions may identify forward-looking statements, but

the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this press release may

include, for example, the Company’s ability to regain compliance with applicable Nasdaq standards or comply with the continued listing

standards of Nasdaq even if the Company regains compliance. These forward-looking statements are based on information available as of

the date of this press release, and current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties.

Accordingly, forward-looking statements should not be relied upon as representing views as of any subsequent date, and no obligation is

undertaken to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result

of new information, future events or otherwise, except as may be required under applicable securities laws. As a result of a number of

known and unknown risks and uncertainties, actual results or performance may be materially different from those expressed or implied by

these forward-looking statements. Some factors that could cause actual results to differ include: the ability to maintain the listing

of the Company’s shares on Nasdaq; changes in applicable laws or regulations; any lingering effects of the pandemics on Akanda’s

business; the ability to implement business plans, forecasts, and other expectations, and identify and realize additional opportunities;

the risk of downturns and the possibility of rapid change in the highly competitive industry in which Akanda operates; the risk that Akanda

and its current and future collaborators are unable to successfully develop and commercialize Akanda’s products or services, or

experience significant delays in doing so; the risk that the Company may never achieve or sustain profitability; the risk that the Company

will need to raise additional capital to execute its business plan, which may not be available on acceptable terms or at all; the risk

that the Company experiences difficulties in managing its growth and expanding operations; the risk that third-party suppliers and manufacturers

are not able to fully and timely meet their obligations; the risk that Akanda is unable to secure or protect its intellectual property;

the possibility that Akanda may be adversely affected by other economic, business, and/or competitive factors; and other risks and uncertainties

described in Akanda’s filings from time to time with the Securities and Exchange Commission.

Exhibit 99.2

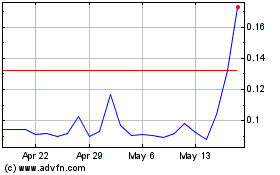

Akanda (NASDAQ:AKAN)

Historical Stock Chart

From Mar 2025 to Apr 2025

Akanda (NASDAQ:AKAN)

Historical Stock Chart

From Apr 2024 to Apr 2025