false

--12-31

0001860657

0001860657

2024-09-03

2024-09-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 3, 2024

ALLARITY THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-41160 |

|

87-2147982 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

24 School Street, 2nd Floor,

Boston, MA |

|

02108 |

| (Address of principal executive offices) |

|

(Zip Code) |

(401) 426-4664

(Registrant’s telephone number, including

area code)

Not applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

ALLR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 3.03 Material

Modifications to Rights of Security Holders.

The disclosure required by

this Item 3.03 is included in Item 5.03 of this Current Report on Form 8-K and is incorporated herein by reference.

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(e) At the 2024 Annual Meeting

of Stockholders of Allarity Therapeutics, Inc., a Delaware corporation (the “Company”) held on September 3, 2024 (the “Annual

Meeting”), the Company’s stockholders, upon the recommendation of the Company’s board of directors (the “Board”),

approved an amendment to the Allarity Therapeutics Inc. 2021 Equity Incentive Plan, as amended, (the “Plan”) to increase the

aggregate number of shares of our common stock, par value $0.0001 (the “Common Stock”) authorized for grant under the Plan

from 2,168,330 to 10,594,876.

A summary of the Plan was

included as part of Proposal 5 in the Company’s definitive proxy statement filed with the Securities and Exchange Commission (the

“SEC”) on August 20, 2024, and is incorporated herein by reference.

Item 5.03 Amendment to Articles of Incorporation

or Bylaws; Change in Fiscal Year.

At the Annual Meeting, the

Company’s stockholders approved two proposals to amend the Company’s Certificate of Incorporation, as amended to date (the

“Charter”). Subsequently, on September 9, 2024, the Company filed both a Sixth Certificate of Amendment to Certificate of

Incorporation (the “Sixth Certificate of Amendment”) and a Seventh Certificate of Amendment to Certificate of Incorporation

(the “Seventh Certificate of Amendment”) with the Secretary of State of the State of Delaware.

The Sixth Certificate of Amendment to Certificate

of Incorporation

On September 9, 2024, the

Company filed the Sixth Certificate of Amendment with the Secretary of State of the State of Delaware to decrease the number of authorized

shares from 750,500,000 to 250,500,000, and to decrease the number of our Common Stock from 750,000,000 to 250,000,000, effective as of

9:30 a.m. (Eastern Time) on September 9, 2024. This amendment was approved by the Company’s stockholders at the Annual Meeting,

as described below under Item 5.07.

The information set forth

herein is qualified in its entirety by reference to the complete text of the Sixth Certificate of Amendment, a copy of which is filed

as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated by reference herein.

The Seventh Certificate of Amendment to Certificate

of Incorporation

On September 9, 2024, the

Company filed the Seventh Certificate of Amendment with the Secretary of State of the State of Delaware to effect a 1-for-30 reverse stock

split of the shares of the Common Stock, effective as of 9:30 a.m. (Eastern Time) on September 11, 2024.

As described below under Item

5.07, at the Annual Meeting, the Company’s stockholders approved a proposal to amend the Charter, at the discretion of the Board

to effect a reverse stock split of the Company’s issued and outstanding Common Stock, at a ratio between 1-for-5 and 1-for-30 (the

“Range”), with the ratio within such Range to be determined at the discretion of the Board and included in a public announcement.

Upon receipt of the stockholder approval, the Board was granted the discretion to effect a reverse stock split of the Common Stock through

the filing of the Seventh Certificate of Amendment, at a ratio of not less than 1-for-5 and not more than 1-for-30, with such ratio to

be determined by the Board. Following such stockholder approval at the conclusion of the Annual Meeting, the Board determined a ratio

of 1-for-30 for the Reverse Stock Split.

As a result of the Reverse

Stock Split, every 30 shares of issued and outstanding Common Stock will be automatically combined into one issued and outstanding share

of Common Stock, without any change in the par value per share. No fractional shares will be issued as a result of the Reverse Stock Split.

Any fractional shares that would otherwise have resulted from the Reverse Stock Split will be rounded up to the next whole number.

Proportionate adjustments

will be made to the per share exercise price and the number of shares of Common Stock that may be purchased upon exercise of outstanding

stock options granted by the Company, and the number of shares of Common Stock reserved for future issuance under the Plan.

The Common Stock will begin

trading on a reverse stock split-adjusted basis on the Nasdaq Capital Market on September 11, 2024. The trading symbol for the Common

Stock will remain “ALLR.” The new CUSIP number for the Common Stock following the Reverse Stock Split is 016744500.

The information set forth

herein is qualified in its entirety by reference to the complete text of the Seventh Certificate of Amendment, a copy of which is filed

as Exhibit 3.2 to this Current Report on Form 8-K and is incorporated by reference herein.

Item 5.07 Submission of Matters to a Vote of

Security Holders.

At the Annual Meeting, seven

(7) proposals were submitted to the Company’s stockholders of record for a vote. The proposals are described in detail in the Definitive

Proxy Statement filed with the SEC on August 20, 2024 (the “Proxy Statement”). As of the close of business on August 20, 2024,

holders of the Company’s Common Stock and Series A Convertible Redeemable Preferred Stock were entitled to vote together as a single

class on the proposals described below.

The proposals were approved

by the requisite vote of the Company’s stockholders. Sufficient votes were received to approve the Adjournment Proposal (as defined

below), but such an adjournment was not necessary in light of the approval of the Director Proposal, the Independent Auditor Proposal,

the Share Decrease Proposal, the Reverse Stock Split Proposal, the 2021 Plan Amendment Proposal, and the Officer Exculpations Amendment

Proposal, (each as defined below).

The

final voting results for each proposal are described below. For more information on each of these proposals, please refer to the Proxy

Statement.

Proposal 1: To

elect two (2) Class II directors, Gerald W. McLaughlin and Laura E. Benjamin, to serve until the 2027 annual meeting

of stockholders or until their respective successors are duly elected and qualified (the “Director Proposal”).

| Name |

|

Votes For |

|

Votes Withheld |

|

Broker Non-Votes |

| Gerald W. McLaughlin |

|

28,435,573 |

|

3,189,245 |

|

5,601,367 |

| Laura E. Benjamin |

|

28,842,908 |

|

2,781,910 |

|

5,601,367 |

Proposal 2: To

ratify the appointment of Wolf & Company, P.C., as our independent registered public accounting firm for the fiscal year ending December

31, 2024 (the “Independent Auditor Proposal”).

| Votes For |

|

Votes Against |

|

Abstentions |

|

Broker Non-Votes |

| 35,573,867 |

|

1,230,893 |

|

421,425 |

|

N/A |

Proposal 3: To approve an amendment to

our Certificate of Incorporation, to decrease the number of authorized shares from 750,500,000 to 250,500,000, and to decrease the number

of our Common Stock from 750,000,000 to 250,000,000, in substantially the form attached to the Proxy Statement as Appendix A (the “Share

Decrease Proposal”).

| Votes For |

|

Votes Against |

|

Abstentions |

|

Broker Non-Votes |

| 33,489,052 |

|

3,601,552 |

|

135,581 |

|

N/A |

Proposal 4: To approve an amendment to

our Certificate of Incorporation, in substantially the form attached to the Proxy Statement as Appendix B, to, at the discretion of our

board of directors, effect a reverse stock split with respect to our issued and outstanding Common Stock, par value $0.0001 per share,

at a ratio between 1-for-5 and 1-for-30, with the board of directors having the discretion as to whether or not the reverse stock split

is to be effected, with the exact ratio of any reverse stock split (the “Split Ratio”) to be set within the above range as

determined by the board of directors in its discretion, and without a corresponding reduction in the total number of authorized shares

of Common Stock (the “Reverse Stock Split Proposal”).

| Votes For |

|

Votes Against |

|

Abstentions |

|

Broker Non-Votes |

| 24,181,251 |

|

13,030,619 |

|

14,315 |

|

N/A |

Proposal 5: To approve an amendment to

our Amended and Restated 2021 Equity Incentive Plan (the “2021 Plan”), in substantially the form attached to the Proxy Statement

as Appendix C, to increase the aggregate number of shares of Common Stock authorized for grant under the 2021 Plan from 2,168,330 to 10,594,876

(or the quotient obtained by dividing such number by the Split Ratio, if the Reverse Stock Split Proposal is approved and implemented)

(the “2021 Plan Amendment Proposal”).

| Votes For |

|

Votes Against |

|

Abstentions |

|

Broker Non-Votes |

| 25,677,975 |

|

5,876,819 |

|

70,024 |

|

5,601,367 |

Proposal 6: To approve an amendment to

our Certificate of Incorporation, in substantially the form attached to the Proxy Statement as Appendix D, to limit the liability of certain

officers as permitted by Delaware Law (the “Officer Exculpation Amendment Proposal”).

| Votes For |

|

Votes Against |

|

Abstentions |

|

Broker Non-Votes |

| 24,109,903 |

|

7,268,564 |

|

246,351 |

|

5,601,367 |

Proposal 7: To approve the adjournment

of the meeting, if necessary or advisable, to solicit additional proxies in favor of the Director Proposal, the Independent Auditor Proposal,

the Share Decrease Proposal, the Reverse Stock Split Proposal, the 2021 Plan Amendment Proposal or the Officer Exculpations Amendment

Proposal (the “Adjournment Proposal”).

| Votes For |

|

Votes Against |

|

Abstentions |

|

Broker Non-Votes |

| 25,519,301 |

|

11,497,129 |

|

209,755 |

|

N/A |

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Allarity Therapeutics, Inc. |

| |

|

| |

By: |

/s/ Thomas H. Jensen |

| |

|

Thomas H. Jensen |

| |

|

Chief Executive Officer |

| |

|

|

| Dated: September 9, 2024 |

|

|

4

Exhibit 3.1

SIXTH CERTIFICATE OF AMENDMENT

TO

CERTIFICATE OF INCORPORATION

OF

ALLARITY THERAPEUTICS, INC.

Allarity Therapeutics, Inc.,

a corporation organized and existing under the laws of the State of Delaware (hereinafter called the “Corporation”), does

hereby certify that:

1. This Sixth Certificate of

Amendment to Certificate of Incorporation (this “Sixth Amendment”) amends certain provisions of the Corporation’s original

Certificate of Incorporation filed with the Secretary of State of the State of Delaware on April 6, 2021, as amended by that

certain Certificate of Amendment filed on August 5, 2021, and as further amended by that certain Second Certificate of Amendment

filed on March 20, 2023, and as further amended by that certain Third Certificate of Amendment filed on March 23, 2023, and

as further amended by that certain Fourth Certificate of Amendment filed on June 28, 2023, and as further amended by that certain

Fifth Certificate of Amendment filed on April 4, 2024 (as amended, the “Certificate of Incorporation”).

2. The board of directors of

the Corporation, acting in accordance with the provisions of Sections 141(f) and 242 of the General Corporation Law of the State

of Delaware (the “DGCL”), has duly adopted resolutions approving the amendment set forth in this Sixth Amendment, declaring

said amendment to be advisable and in the best interests of the Corporation and its stockholders, and directing that such amendment be

considered for stockholder approval at the Annual Meeting of Stockholders held on September 3, 2024 (the “Annual Meeting”),

which meeting was noticed and has been held in accordance with Section 222 of the DGCL.

3. This Sixth Amendment was

duly adopted by the affirmative vote of the holders of the majority of the outstanding shares of the Corporation’s common stock

entitled to vote, together as a class, thereon at the Corporation’s Annual Meeting, in accordance with the provisions of Section 242

of the DGCL, and Articles FIFTH and TWELFTH of the Certificate of Incorporation.

4. Resolutions were duly

adopted by the board of directors of the Corporation, in accordance with the provisions of the Certificate of Incorporation set

forth below, providing that, effective as of 9:30 a.m., New York time, on September 9, 2024, or as soon as practicable

thereafter, the Corporation will decrease the number of authorized shares from, 750,500,000 to 250,500,000 and decrease the number

of common stock from 750,000,000 to 250,000,000 as constituted following such date.

5. The Certificate of Incorporation

is hereby amended by deleting the first paragraph of Article FIFTH thereof, and replacing in its entirety the following paragraph:

“FIFTH: The total number of

shares of all classes of capital stock that the Corporation is authorized to issue is 250,500,000 shares, consisting of (i) 250,000,000 shares

of common stock, $0.0001 par value per share (the “Common Stock”), and (ii) 500,000 shares of preferred stock, $0.0001

par value per share (the “Preferred Stock”). Subject to the rights of the holders of any series of Preferred Stock, the number

of authorized shares of any of the Common Stock or Preferred Stock may be increased or decreased (but not below the number of shares thereof

then outstanding) by the affirmative vote of the holders of a minority in voting power of the capital stock of the Corporation entitled

to vote thereon irrespective of the provisions of Section 242(b)(2) of the DGCL, and no vote of the holders of any of the Common

Stock or Preferred Stock voting separately as a class shall be required therefor.”

6. Except as set forth in this

Sixth Amendment, the Certificate of Incorporation remains in full force and effect.

[Remainder of page intentionally left blank,

signature page follows]

IN WITNESS WHEREOF, the Corporation has caused

this Sixth Amendment to be duly executed in its name and on its behalf by a duly authorized officer of the Corporation on this 9th

day of September 2024.

| |

By: |

/s/ Thomas H. Jensen |

| |

Name: |

Thomas H. Jensen |

| |

Title: |

Chief Executive Officer |

[SIGNATURE PAGE TO SIXTH CERTIFICATE OF AMENDMENT]

Exhibit 3.2

SEVENTH CERTIFICATE OF AMENDMENT

TO

CERTIFICATE OF INCORPORATION

OF

ALLARITY THERAPEUTICS, INC.

Allarity Therapeutics, Inc.,

a corporation organized and existing under the laws of the State of Delaware (hereinafter called the “Corporation”), does

hereby certify that:

1. This Seventh Certificate

of Amendment to Certificate of Incorporation (this “Seventh Amendment”) amends certain provisions of the Corporation’s

original Certificate of Incorporation filed with the Secretary of State of the State of Delaware on April 6, 2021, as amended by

that certain Certificate of Amendment filed on August 5, 2021, and as further amended by that certain Second Certificate of Amendment

filed on March 20, 2023, and as further amended by that certain Third Certificate of Amendment filed on March 23, 2023, and as further

amended by that certain Fourth Certificate of Amendment filed on June 28, 2023, and as further amended by that certain Fifth Certificate

of Amendment filed on April 4, 2024, and as further amended by that certain Sixth Certificate of Amendment filed on September 9, 2024

(as amended, the “Certificate of Incorporation”).

2. The board of directors of

the Corporation, acting in accordance with the provisions of Sections 141(f) and 242 of the General Corporation Law of the State of Delaware

(the “DGCL”), has duly adopted resolutions approving the amendment set forth in this Seventh Amendment, declaring said amendment

to be advisable and in the best interests of the Corporation and its stockholders, and directing that such amendment be considered for

stockholder approval at the Annual Meeting of Stockholders held on September 3, 2024 (the “Annual Meeting”), which meeting

was noticed and has been held in accordance with Section 222 of the DGCL.

3. This Seventh Amendment was

duly adopted by the affirmative vote of the holders of the majority of the outstanding shares of the Corporation’s common stock

entitled to vote, together as a class, thereon at the Corporation’s Annual Meeting, in accordance with the provisions of Section

242 of the DGCL, and Articles FIFTH and TWELFTH of the Certificate of Incorporation.

4. Resolutions were duly adopted

by the board of directors of the Corporation, in accordance with the provisions of the Certificate of Incorporation set forth below, providing

that, effective as of 9:30 a.m., New York time, on September 11, 2024, or as soon as practicable thereafter, every thirty (30) issued

and outstanding shares of the Corporation’s Common Stock, par value $0.0001 per share, shall be converted into one (1) share of

the Corporation’s Common Stock, par value $0.0001 per share, as constituted following such date.

5. The Certificate of Incorporation

is hereby amended by deleting the second and third paragraphs of Article FIFTH thereof, and replacing in their entirety the following

paragraphs:

“Effective as of 9:30

a.m. on September 11, 2024 (the “Effective Time”), every thirty (30) shares of the Corporation’s common stock, $0.0001

par value per share (the “Old Common Stock”), either issued or outstanding or held by the Corporation as treasury stock, immediately

prior to the Effective Time, will be automatically reclassified and combined (without any further act) into a smaller number of shares

such that each thirty (30) shares of Old Common Stock issued and outstanding or held by the Company as treasury stock immediately prior

to the Effective Time is reclassified into one (1) share of Common Stock, $0.0001 par value per share (the “New Common Stock”),

of the Corporation (the “Reverse Stock Split”). The board of directors shall make provision for the issuance of that number

of fractions of New Common Stock such that any fractional share of a holder otherwise resulting from the Reverse Stock Split shall be

rounded up to the next whole number of shares of New Common Stock. Stockholders who hold uncertificated shares of Old Common Stock electronically

in “book-entry” form will have their holdings electronically adjusted by the Transfer Agent (and, for beneficial owners, by

their brokers or banks that hold in “street name” for their benefit, as the case may be) to give effect to the Reverse Stock

Split and will automatically be adjusted to reflect the New Common Stock.

Any stock certificate that,

immediately prior to the Effective Time, represented shares of the Old Common Stock will, from and after the Effective Time, automatically

and without the necessity of presenting the same for exchange, be converted to Book Entries representing the number of shares of the New

Common Stock into which such shares of Old Common Stock shall have been reclassified of a share of New Common Stock, with any resulting

fractional shares rounded up to the nearest whole share.”

6. Except as set forth in this

Seventh Amendment, the Certificate of Incorporation remains in full force and effect.

[Remainder of page intentionally left blank,

signature page follows]

IN WITNESS WHEREOF, the Corporation has caused

this Seventh Amendment to be duly executed in its name and on its behalf by a duly authorized officer of the Corporation on this 9th

day of September, 2024.

| |

By: |

/s/ Thomas H. Jensen |

| |

Name: |

Thomas H. Jensen |

| |

Title: |

Chief Executive Officer |

[SIGNATURE PAGE TO SEVENTH CERTIFICATE OF AMENDMENT]

v3.24.2.u1

Cover

|

Sep. 03, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 03, 2024

|

| Current Fiscal Year End Date |

--12-31

|

| Entity File Number |

001-41160

|

| Entity Registrant Name |

ALLARITY THERAPEUTICS, INC.

|

| Entity Central Index Key |

0001860657

|

| Entity Tax Identification Number |

87-2147982

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

24 School Street

|

| Entity Address, Address Line Two |

2nd Floor

|

| Entity Address, City or Town |

Boston

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02108

|

| City Area Code |

401

|

| Local Phone Number |

426-4664

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

ALLR

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

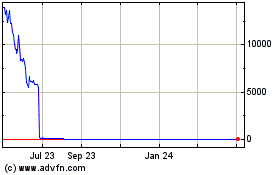

Allarity Therapeutics (NASDAQ:ALLR)

Historical Stock Chart

From Nov 2024 to Dec 2024

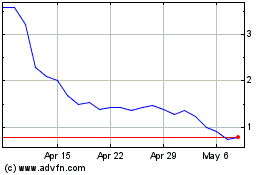

Allarity Therapeutics (NASDAQ:ALLR)

Historical Stock Chart

From Dec 2023 to Dec 2024