AMD (NASDAQ:AMD) today announced financial results for the fourth

quarter and full year of 2024. Fourth quarter revenue was a record

$7.7 billion, gross margin was 51%, operating income was $871

million, net income was $482 million and diluted earnings per share

was $0.29. On a non-GAAP(*) basis, gross margin was 54%, operating

income was a record $2.0 billion, net income was a record $1.8

billion and diluted earnings per share was $1.09.

For the full year 2024, AMD reported record revenue of $25.8

billion, gross margin of 49%, operating income of $1.9 billion, net

income of $1.6 billion, and diluted earnings per share of $1.00. On

a non-GAAP(*) basis, gross margin was a record 53%, operating

income was $6.1 billion, net income was $5.4 billion and diluted

earnings per share was $3.31.

“2024 was a transformative year for AMD as we delivered record

annual revenue and strong earnings growth,” said AMD Chair and CEO

Dr. Lisa Su. “Data Center segment annual revenue nearly doubled as

EPYC processor adoption accelerated and we delivered more than $5

billion of AMD Instinct accelerator revenue. Looking into 2025, we

see clear opportunities for continued growth based on the strength

of our product portfolio and growing demand for high-performance

and adaptive computing.”

“We closed 2024 with a strong fourth quarter, delivering record

revenue up 24% year-over-year, and accelerated earnings expansion

while investing aggressively in AI and innovation to position us

for long-term growth and value creation,” said AMD EVP, CFO and

Treasurer Jean Hu.

GAAP Quarterly Financial

Results

|

|

Q4 2024 |

Q4 2023 |

Y/Y |

Q3 2024 |

Q/Q |

|

Revenue ($M) |

$7,658 |

$6,168 |

Up 24% |

$6,819 |

Up 12% |

|

Gross profit ($M) |

$3,882 |

$2,911 |

Up 33% |

$3,419 |

Up 14% |

|

Gross margin |

51% |

47% |

Up 4 ppts |

50% |

Up 1% |

|

Operating expenses ($M) |

$3,022 |

$2,575 |

Up 17% |

$2,709 |

Up 12% |

|

Operating income ($M) |

$871 |

$342 |

Up 155% |

$724 |

Up 20% |

|

Operating margin |

11% |

6% |

Up 5 ppts |

11% |

Flat |

|

Net income ($M) |

$482 |

$667 |

Down 28% |

$771 |

Down 37% |

|

Diluted earnings per share |

$0.29 |

$0.41 |

Down 29% |

$0.47 |

Down 38% |

Non-GAAP(*) Quarterly Financial

Results

|

|

Q4 2024 |

Q4 2023 |

Y/Y |

Q3 2024 |

Q/Q |

|

Revenue ($M) |

$7,658 |

$6,168 |

Up 24% |

$6,819 |

Up 12% |

|

Gross profit ($M) |

$4,140 |

$3,133 |

Up 32% |

$3,657 |

Up 13% |

|

Gross margin |

54% |

51% |

Up 3 ppts |

54% |

Flat |

|

Operating expenses ($M) |

$2,125 |

$1,727 |

Up 23% |

$1,956 |

Up 9% |

|

Operating income ($M) |

$2,026 |

$1,412 |

Up 43% |

$1,715 |

Up 18% |

|

Operating margin |

26% |

23% |

Up 3 ppts |

25% |

Up 1 ppt |

|

Net income ($M) |

$1,777 |

$1,249 |

Up 42% |

$1,504 |

Up 18% |

|

Diluted earnings per share |

$1.09 |

$0.77 |

Up 42% |

$0.92 |

Up 18% |

Annual Financial Results

|

|

GAAP |

Non-GAAP(*) |

|

|

2024 |

2023 |

Y/Y |

2024 |

2023 |

Y/Y |

|

Revenue ($M) |

$25,785 |

$22,680 |

Up 14% |

$25,785 |

$22,680 |

Up 14% |

|

Gross profit ($M) |

$12,725 |

$10,460 |

Up 22% |

$13,759 |

$11,436 |

Up 20% |

|

Gross margin % |

49% |

46% |

Up 3 ppts |

53% |

50% |

Up 3 ppts |

|

Operating expenses ($M) |

$10,873 |

$10,093 |

Up 8% |

$7,669 |

$6,616 |

Up 16% |

|

Operating income ($M) |

$1,900 |

$401 |

Up 374% |

$6,138 |

$4,854 |

Up 26% |

|

Operating margin % |

7% |

2% |

Up 5 ppts |

24% |

21% |

Up 3 ppts |

|

Net income ($M) |

$1,641 |

$854 |

Up 92% |

$5,420 |

$4,302 |

Up 26% |

|

Diluted earnings per share |

$1.00 |

$0.53 |

Up 89% |

$3.31 |

$2.65 |

Up 25% |

Segment Summary

- Data Center segment revenue in the

quarter was a record $3.9 billion, up 69% year-over-year primarily

driven by the strong ramp of AMD Instinct™ GPU shipments and growth

in AMD EPYC™ CPU sales.

- For 2024, Data Center segment

revenue was a record $12.6 billion, an increase of 94% compared to

the prior year, driven by growth in both AMD Instinct and EPYC

processors.

- Client segment revenue in the

quarter was a record $2.3 billion, up 58% year-over-year primarily

driven by strong demand for AMD Ryzen™ processors.

- For 2024, Client segment revenue was

a record $7.1 billion, up 52% compared to the prior year, due to

strong demand for AMD Ryzen processors in desktop and mobile.

- Gaming segment revenue in the

quarter was $563 million, down 59% year-over-year, primarily due to

a decrease in semi-custom revenue.

- For 2024, Gaming segment revenue was

$2.6 billion, down 58% compared to the prior year, primarily due to

a decrease in semi-custom revenue.

- Embedded segment revenue in the

quarter was $923 million, down 13% year-over-year, as end market

demand continues to be mixed.

- For 2024, Embedded segment revenue

was $3.6 billion, down 33% from the prior year, primarily due to

customers normalizing their inventory levels.

Recent PR Highlights

- AMD continues expanding its

partnerships to deliver highly performant AI infrastructure at

scale:

- IBM announced plans to deploy AMD

Instinct MI300X accelerators to power generative AI and HPC

applications on IBM Cloud.

- Vultr and AMD announced a strategic

collaboration to leverage AMD Instinct MI300X accelerators and AMD

ROCm™ open software to power Vultr’s cloud infrastructure for

enterprise AI development and deployment.

- Aleph Alpha announced that it will

leverage AMD Instinct MI300 Series accelerators and ROCm software

to enable its tokenizer-free LLM architecture, a new approach to

generative AI that aims to simplify the development of sovereign AI

solutions for governments and enterprises.

- Fujitsu and AMD announced a

strategic partnership to develop more sustainable computing

infrastructure to accelerate open source AI.

- AMD expanded strategic investments

to advance the AI ecosystem and solutions, including investments in

LiquidAI, Vultr and Absci.

- AMD is accelerating its AI software

roadmap to deliver a robust open AI stack for the ecosystem:

- AMD released ROCm 6.3 with numerous

performance enhancements enabling faster inferencing on AMD

Instinct accelerators as well as additional compiler tools and

libraries.

- AMD shared an update on its 2025

plans for the ROCm software stack to enable easier adoption of and

improved out of box support for both inferencing and training

applications.

- Dell and AMD announced that AMD

Ryzen AI PRO processors will power new Dell Pro notebook and

desktop PCs, bringing exceptional battery life, on-device AI,

Copilot+ experiences and dependable productivity to enterprise

users. For the first time, Dell will offer a full portfolio of

commercial PCs based on Ryzen processors, marking a significant

milestone in the companies’ collaboration.

- AMD expanded its broad consumer and

commercial AI PC portfolio:

- New AMD Ryzen AI Max and Ryzen AI

Max PRO Series processors deliver workstation-level performance and

next-gen AI performance for gaming, content creation and complex

AI-accelerated workloads.

- Expanded Ryzen AI 300 and Ryzen AI

300 PRO Series processors bring premium AI capabilities to

mainstream and entry-level notebooks, as well as enhanced security,

manageability and support for Microsoft Copilot+ experiences

tailored for business users.

- Additional Ryzen 200 and Ryzen 200

PRO Series processors offer incredible AI experiences, performance

and battery life for everyday users and professionals.

- More than 150 Ryzen AI platforms are

expected to be available from leading OEMs this year.

- AMD extended its leadership in high

performance computing (HPC), enabling the most powerful and many of

the most energy efficient supercomputers in the world:

- The El Capitan supercomputer at

Lawrence Livermore National Laboratory became the second AMD

supercomputer to surpass the exascale barrier, placing #1 on the

latest Top500 list.

- The Hunter supercomputer at the

High-Performance Computing Center of the University of Stuttgart

(HLRS), powered by AMD Instinct MI300A APUs, began service,

delivering HPC and AI resources for scientists, researchers,

industry and the public sector.

- AMD EPYC processors and AMD Instinct

accelerators power many new supercomputing projects and AI

deployments, including the Eni HPC 6 system, the University of

Paderborn’s latest supercomputer and the Sigma2 AS system which is

slated to be the fastest system in Norway.

- AMD powers incredible experiences

for gamers across a broad range of devices:

- At CES 2025, AMD announced new AMD

Ryzen 9000X3D, Ryzen Z2 and Ryzen 9000HX processors, extending its

leadership in desktop, mobile and handheld gaming.

- AMD shared the latest version of AMD

Software: Adrenalin Edition™, 24.9.1, continuing to enhance gaming

experiences with AMD Fluid Motion Frames 2 and AMD HYPR-RX.

- AMD continues to deliver leadership

compute performance and capabilities at the edge with an expanded

portfolio of solutions:

- New AMD Versal™ Gen 2 portfolio with

next-generation interface and memory technologies for

data-intensive applications in the data center, communications,

test and measurement and aerospace and defense markets.

- AMD Versal RF Series adaptive SoCs,

combining high-resolution radio frequency data converters,

dedicated DSP hard IP, AI engines and programmable logic in a

single chip.

- Vodafone and AMD announced they are

collaborating on mobile base station silicon chip designs to enable

higher-capacity AI and digital services.

Current Outlook

AMD’s outlook statements are based on current expectations. The

following statements are forward-looking and actual results could

differ materially depending on market conditions and the factors

set forth under “Cautionary Statement” below.

For the first quarter of 2025, AMD expects revenue to be

approximately $7.1 billion, plus or minus $300 million. At the

mid-point of the revenue range, this represents year-over-year

growth of approximately 30% and a sequential decline of

approximately 7%. Non-GAAP gross margin is expected to be

approximately 54%.

AMD TeleconferenceAMD will hold a conference

call at 2:00 p.m. PT (5:00 p.m. ET) today to discuss its fourth

quarter and full year 2024 financial results. AMD will provide a

real-time audio broadcast of the teleconference on the Investor

Relations page of its website at www.amd.com.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

MEASURES

(in millions, except per share data)

(Unaudited)

| |

Three Months Ended |

|

Year Ended |

| |

December 28,2024 |

|

September 28,2024 |

|

December 30,2023 |

|

December 28,2024 |

|

December 30,2023 |

|

GAAP gross profit |

$ |

3,882 |

|

|

$ |

3,419 |

|

|

$ |

2,911 |

|

|

$ |

12,725 |

|

|

$ |

10,460 |

|

|

GAAP gross margin |

|

51 |

% |

|

|

50 |

% |

|

|

47 |

% |

|

|

49 |

% |

|

|

46 |

% |

|

Stock-based compensation |

|

6 |

|

|

|

5 |

|

|

|

6 |

|

|

|

22 |

|

|

|

30 |

|

|

Amortization of acquisition-related intangibles |

|

252 |

|

|

|

233 |

|

|

|

215 |

|

|

|

946 |

|

|

|

942 |

|

|

Acquisition-related and other costs (1) |

|

— |

|

|

|

— |

|

|

|

1 |

|

|

|

1 |

|

|

|

4 |

|

|

Inventory loss at contract manufacturer (2) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

65 |

|

|

|

— |

|

|

Non-GAAP gross profit |

$ |

4,140 |

|

|

$ |

3,657 |

|

|

$ |

3,133 |

|

|

$ |

13,759 |

|

|

$ |

11,436 |

|

|

Non-GAAP gross margin |

|

54 |

% |

|

|

54 |

% |

|

|

51 |

% |

|

|

53 |

% |

|

|

50 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

GAAP operating expenses |

$ |

3,022 |

|

|

$ |

2,709 |

|

|

$ |

2,575 |

|

|

$ |

10,873 |

|

|

$ |

10,093 |

|

|

GAAP operating expenses/revenue % |

|

39 |

% |

|

|

40 |

% |

|

|

42 |

% |

|

|

42 |

% |

|

|

45 |

% |

|

Stock-based compensation |

|

333 |

|

|

|

346 |

|

|

|

368 |

|

|

|

1,385 |

|

|

|

1,350 |

|

|

Amortization of acquisition-related intangibles |

|

332 |

|

|

|

352 |

|

|

|

420 |

|

|

|

1,448 |

|

|

|

1,869 |

|

|

Acquisition-related and other costs (1) |

|

46 |

|

|

|

55 |

|

|

|

60 |

|

|

|

185 |

|

|

|

258 |

|

|

Restructuring charges (3) |

|

186 |

|

|

|

— |

|

|

|

— |

|

|

|

186 |

|

|

|

— |

|

|

Non-GAAP operating expenses |

$ |

2,125 |

|

|

$ |

1,956 |

|

|

$ |

1,727 |

|

|

$ |

7,669 |

|

|

$ |

6,616 |

|

|

Non-GAAP operating expenses/revenue % |

|

28 |

% |

|

|

29 |

% |

|

|

28 |

% |

|

|

30 |

% |

|

|

29 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

GAAP operating income |

$ |

871 |

|

|

$ |

724 |

|

|

$ |

342 |

|

|

$ |

1,900 |

|

|

$ |

401 |

|

|

GAAP operating margin |

|

11 |

% |

|

|

11 |

% |

|

|

6 |

% |

|

|

7 |

% |

|

|

2 |

% |

|

Stock-based compensation |

|

339 |

|

|

|

351 |

|

|

|

374 |

|

|

|

1,407 |

|

|

|

1,380 |

|

|

Amortization of acquisition-related intangibles |

|

584 |

|

|

|

585 |

|

|

|

635 |

|

|

|

2,394 |

|

|

|

2,811 |

|

|

Acquisition-related and other costs (1) |

|

46 |

|

|

|

55 |

|

|

|

61 |

|

|

|

186 |

|

|

|

262 |

|

|

Inventory loss at contract manufacturer (2) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

65 |

|

|

|

— |

|

|

Restructuring charges (3) |

|

186 |

|

|

|

— |

|

|

|

— |

|

|

|

186 |

|

|

|

— |

|

|

Non-GAAP operating income |

$ |

2,026 |

|

|

$ |

1,715 |

|

|

$ |

1,412 |

|

|

$ |

6,138 |

|

|

$ |

4,854 |

|

|

Non-GAAP operating margin |

|

26 |

% |

|

|

25 |

% |

|

|

23 |

% |

|

|

24 |

% |

|

|

21 |

% |

| |

Three Months Ended |

|

Year Ended |

| |

December 28,2024 |

|

September 28,2024 |

|

December 30,2023 |

|

December 28,2024 |

|

December 30,2023 |

|

GAAP net income / earnings per share |

$ |

482 |

|

|

$ |

0.29 |

|

|

$ |

771 |

|

|

$ |

0.47 |

|

|

$ |

667 |

|

|

$ |

0.41 |

|

|

$ |

1,641 |

|

|

$ |

1.00 |

|

|

$ |

854 |

|

|

$ |

0.53 |

|

|

(Gains) losses on equity investments, net |

|

— |

|

|

|

— |

|

|

|

(1 |

) |

|

|

— |

|

|

|

1 |

|

|

|

— |

|

|

|

2 |

|

|

|

— |

|

|

|

(1 |

) |

|

|

— |

|

|

Stock-based compensation |

|

339 |

|

|

|

0.21 |

|

|

|

351 |

|

|

|

0.21 |

|

|

|

374 |

|

|

|

0.23 |

|

|

|

1,407 |

|

|

|

0.86 |

|

|

|

1,380 |

|

|

|

0.85 |

|

|

Equity income in investee |

|

(12 |

) |

|

|

(0.01 |

) |

|

|

(7 |

) |

|

|

— |

|

|

|

(6 |

) |

|

|

— |

|

|

|

(33 |

) |

|

|

(0.02 |

) |

|

|

(16 |

) |

|

|

(0.01 |

) |

|

Amortization of acquisition-related intangibles |

|

584 |

|

|

|

0.36 |

|

|

|

585 |

|

|

|

0.36 |

|

|

|

635 |

|

|

|

0.39 |

|

|

|

2,394 |

|

|

|

1.46 |

|

|

|

2,811 |

|

|

|

1.73 |

|

|

Acquisition-related and other costs (1) |

|

46 |

|

|

|

0.03 |

|

|

|

56 |

|

|

|

0.03 |

|

|

|

61 |

|

|

|

0.04 |

|

|

|

187 |

|

|

|

0.11 |

|

|

|

262 |

|

|

|

0.16 |

|

|

Inventory loss at contract manufacturer (2) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

65 |

|

|

|

0.04 |

|

|

|

— |

|

|

|

— |

|

|

Restructuring charges (3) |

|

186 |

|

|

|

0.11 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

186 |

|

|

|

0.11 |

|

|

|

— |

|

|

|

— |

|

|

Income tax provision |

|

152 |

|

|

|

0.10 |

|

|

|

(251 |

) |

|

|

(0.15 |

) |

|

|

(483 |

) |

|

|

(0.30 |

) |

|

|

(429 |

) |

|

|

(0.25 |

) |

|

|

(988 |

) |

|

|

(0.61 |

) |

|

Non-GAAP net income / earnings per share |

$ |

1,777 |

|

|

$ |

1.09 |

|

|

$ |

1,504 |

|

|

$ |

0.92 |

|

|

$ |

1,249 |

|

|

$ |

0.77 |

|

|

$ |

5,420 |

|

|

$ |

3.31 |

|

|

$ |

4,302 |

|

|

$ |

2.65 |

|

|

(1 |

) |

|

Acquisition-related and other

costs primarily include transaction costs, purchase price fair

value adjustments for inventory, certain compensation charges,

contract termination costs and workforce rebalancing charges. |

|

(2 |

) |

|

Inventory loss at contract

manufacturer is related to an incident at a third-party contract

manufacturing facility. |

|

(3 |

) |

|

Restructuring charges are related

to the 2024 Restructuring Plan which comprised of employee

severance charges and non-cash asset impairments. |

|

|

|

|

|

About AMDFor more than 50 years AMD has driven

innovation in high-performance computing, graphics and

visualization technologies. AMD employees are focused on building

leadership high-performance and adaptive products that push the

boundaries of what is possible. Billions of people, leading Fortune

500 businesses and cutting-edge scientific research institutions

around the world rely on AMD technology daily to improve how they

live, work and play. For more information about how AMD is enabling

today and inspiring tomorrow, visit the AMD (NASDAQ: AMD) website,

blog, LinkedIn and X pages.

Cautionary Statement

This press release contains forward-looking statements

concerning Advanced Micro Devices, Inc. (AMD) such as, the

opportunities for continued growth based on AMD’s product portfolio

and growing demand for high-performance and adaptive computing;

AMD’s ability to position itself for long-term growth and value

creation; the features, functionality, performance, availability,

timing and expected benefits of future AMD products; and AMD’s

expected first quarter 2025 financial outlook, including revenue

and non-GAAP gross margin, which are made pursuant to the Safe

Harbor provisions of the Private Securities Litigation Reform Act

of 1995. Forward-looking statements are commonly identified by

words such as "would," "may," "expects," "believes," "plans,"

"intends," "projects" and other terms with similar meaning.

Investors are cautioned that the forward-looking statements in this

press release are based on current beliefs, assumptions and

expectations, speak only as of the date of this press release and

involve risks and uncertainties that could cause actual results to

differ materially from current expectations. Such statements are

subject to certain known and unknown risks and uncertainties, many

of which are difficult to predict and generally beyond AMD's

control, that could cause actual results and other future events to

differ materially from those expressed in, or implied or projected

by, the forward-looking information and statements. Material

factors that could cause actual results to differ materially from

current expectations include, without limitation, the following:

Intel Corporation’s dominance of the microprocessor market and its

aggressive business practices; Nvidia’s dominance in the graphics

processing unit market and its aggressive business practices;

competitive markets in which AMD’s products are sold; the cyclical

nature of the semiconductor industry; market conditions of the

industries in which AMD products are sold; AMD's ability to

introduce products on a timely basis with expected features and

performance levels; loss of a significant customer; economic and

market uncertainty; quarterly and seasonal sales patterns; AMD's

ability to adequately protect its technology or other intellectual

property; unfavorable currency exchange rate fluctuations; ability

of third party manufacturers to manufacture AMD's products on a

timely basis in sufficient quantities and using competitive

technologies; availability of essential equipment, materials,

substrates or manufacturing processes; ability to achieve expected

manufacturing yields for AMD’s products; AMD's ability to generate

revenue from its semi-custom SoC products; potential security

vulnerabilities; potential security incidents including IT outages,

data loss, data breaches and cyberattacks; uncertainties involving

the ordering and shipment of AMD’s products; AMD’s reliance on

third-party intellectual property to design and introduce new

products; AMD's reliance on third-party companies for design,

manufacture and supply of motherboards, software, memory and other

computer platform components; AMD's reliance on Microsoft and other

software vendors' support to design and develop software to run on

AMD’s products; AMD’s reliance on third-party distributors and

add-in-board partners; impact of modification or interruption of

AMD’s internal business processes and information systems;

compatibility of AMD’s products with some or all industry-standard

software and hardware; costs related to defective products;

efficiency of AMD's supply chain; AMD's ability to rely on third

party supply-chain logistics functions; AMD’s ability to

effectively control sales of its products on the gray market;

long-term impact of climate change on AMD’s business; impact of

government actions and regulations such as export regulations,

tariffs and trade protection measures; AMD’s ability to realize its

deferred tax assets; potential tax liabilities; current and future

claims and litigation; impact of environmental laws, conflict

minerals related provisions and other laws or regulations; evolving

expectations from governments, investors, customers and other

stakeholders regarding corporate responsibility matters; issues

related to the responsible use of AI; restrictions imposed by

agreements governing AMD’s notes, the guarantees of Xilinx’s notes

and the revolving credit agreement; impact of acquisitions, joint

ventures and/or strategic investments on AMD’s business and AMD’s

ability to integrate acquired businesses; our ability to complete

the acquisition of ZT Systems; impact of any impairment of the

combined company’s assets; political, legal and economic risks and

natural disasters; future impairments of technology license

purchases; AMD’s ability to attract and retain qualified personnel;

and AMD’s stock price volatility. Investors are urged to review in

detail the risks and uncertainties in AMD’s Securities and Exchange

Commission filings, including but not limited to AMD’s most recent

reports on Forms 10-K and 10-Q.

|

(*) |

In

this earnings press release, in addition to GAAP financial results,

AMD has provided non-GAAP financial measures including non-GAAP

gross profit, non-GAAP gross margin, non-GAAP operating expenses,

non-GAAP operating expenses/revenue%, non-GAAP operating income,

non-GAAP operating margin, non-GAAP net income and non-GAAP diluted

earnings per share. AMD uses a normalized tax rate in its

computation of the non-GAAP income tax provision to provide better

consistency across the reporting periods. For fiscal 2024, AMD used

a non-GAAP tax rate of 13%, which excludes the tax impact of

pre-tax non-GAAP adjustments. AMD also provided adjusted EBITDA,

free cash flow and free cash flow margin as supplemental non-GAAP

measures of its performance. These items are defined in the

footnotes to the selected corporate data tables provided at the end

of this earnings press release. AMD is providing these financial

measures because it believes this non-GAAP presentation makes it

easier for investors to compare its operating results for current

and historical periods and also because AMD believes it assists

investors in comparing AMD’s performance across reporting periods

on a consistent basis by excluding items that it does not believe

are indicative of its core operating performance and for the other

reasons described in the footnotes to the selected data tables. The

non-GAAP financial measures disclosed in this earnings press

release should be viewed in addition to and not as a substitute for

or superior to AMD’s reported results prepared in accordance with

GAAP and should be read only in conjunction with AMD’s Consolidated

Financial Statements prepared in accordance with GAAP. These

non-GAAP financial measures referenced are reconciled to their most

directly comparable GAAP financial measures in the data tables in

this earnings press release. This earnings press release also

contains forward-looking non-GAAP gross margin concerning AMD’s

financial outlook, which is based on current expectations as of

February 4, 2025, and assumptions and beliefs that involve numerous

risks and uncertainties. Adjustments to arrive at the GAAP gross

margin outlook typically include stock-based compensation,

amortization of acquired intangible assets and acquisition-related

and other costs. The timing and impact of such adjustments are

dependent on future events that are typically uncertain or outside

of AMD's control, therefore, a reconciliation to equivalent GAAP

measures is not practicable at this time. AMD undertakes no intent

or obligation to publicly update or revise its outlook statements

as a result of new information, future events or otherwise, except

as may be required by law.© 2025 Advanced Micro Devices,

Inc. All rights reserved. AMD, the AMD Arrow logo, 3D V-Cache,

Alveo, AMD Instinct, EPYC, FidelityFX, Kria, Radeon, Ryzen,

Threadripper, Ultrascale+, Versal, Zynq, and combinations thereof,

are trademarks of Advanced Micro Devices, Inc. |

ADVANCED MICRO DEVICES, INC.CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS(Millions

except per share amounts and percentages) (Unaudited)

| |

Three Months Ended |

|

Year Ended |

|

|

December 28,2024 |

|

September 28,2024 |

|

December 30,2023 |

|

December 28,2024 |

|

December 30,2023 |

|

Net revenue |

$ |

7,658 |

|

|

$ |

6,819 |

|

|

$ |

6,168 |

|

|

$ |

25,785 |

|

|

$ |

22,680 |

|

| Cost

of sales |

|

3,524 |

|

|

|

3,167 |

|

|

|

3,042 |

|

|

|

12,114 |

|

|

|

11,278 |

|

|

Amortization of acquisition-related intangibles |

|

252 |

|

|

|

233 |

|

|

|

215 |

|

|

|

946 |

|

|

|

942 |

|

| Total

cost of sales |

|

3,776 |

|

|

|

3,400 |

|

|

|

3,257 |

|

|

|

13,060 |

|

|

|

12,220 |

|

|

Gross profit |

|

3,882 |

|

|

|

3,419 |

|

|

|

2,911 |

|

|

|

12,725 |

|

|

|

10,460 |

|

|

Gross margin |

|

51 |

% |

|

|

50 |

% |

|

|

47 |

% |

|

|

49 |

% |

|

|

46 |

% |

|

Research and development |

|

1,712 |

|

|

|

1,636 |

|

|

|

1,511 |

|

|

|

6,456 |

|

|

|

5,872 |

|

|

Marketing, general and administrative |

|

792 |

|

|

|

721 |

|

|

|

644 |

|

|

|

2,783 |

|

|

|

2,352 |

|

|

Amortization of acquisition-related intangibles |

|

332 |

|

|

|

352 |

|

|

|

420 |

|

|

|

1,448 |

|

|

|

1,869 |

|

|

Licensing gain |

|

(11 |

) |

|

|

(14 |

) |

|

|

(6 |

) |

|

|

(48 |

) |

|

|

(34 |

) |

|

Restructuring charges |

|

186 |

|

|

|

— |

|

|

|

— |

|

|

|

186 |

|

|

|

— |

|

|

Operating income |

|

871 |

|

|

|

724 |

|

|

|

342 |

|

|

|

1,900 |

|

|

|

401 |

|

|

Interest expense |

|

(19 |

) |

|

|

(23 |

) |

|

|

(27 |

) |

|

|

(92 |

) |

|

|

(106 |

) |

| Other

income (expense), net |

|

37 |

|

|

|

36 |

|

|

|

49 |

|

|

|

181 |

|

|

|

197 |

|

|

Income before income taxes and equity income |

|

889 |

|

|

|

737 |

|

|

|

364 |

|

|

|

1,989 |

|

|

|

492 |

|

|

Income tax provision (benefit) |

|

419 |

|

|

|

(27 |

) |

|

|

(297 |

) |

|

|

381 |

|

|

|

(346 |

) |

|

Equity income in investee |

|

12 |

|

|

|

7 |

|

|

|

6 |

|

|

|

33 |

|

|

|

16 |

|

|

Net income |

$ |

482 |

|

|

$ |

771 |

|

|

$ |

667 |

|

|

$ |

1,641 |

|

|

$ |

854 |

|

|

Earnings per share |

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.30 |

|

|

$ |

0.48 |

|

|

$ |

0.41 |

|

|

$ |

1.01 |

|

|

$ |

0.53 |

|

|

Diluted |

$ |

0.29 |

|

|

$ |

0.47 |

|

|

$ |

0.41 |

|

|

$ |

1.00 |

|

|

$ |

0.53 |

|

|

Shares used in per share calculation |

|

|

|

|

|

|

|

|

|

|

Basic |

|

1,623 |

|

|

|

1,620 |

|

|

|

1,616 |

|

|

|

1,620 |

|

|

|

1,614 |

|

|

Diluted |

|

1,634 |

|

|

|

1,636 |

|

|

|

1,628 |

|

|

|

1,637 |

|

|

|

1,625 |

|

ADVANCED MICRO DEVICES, INC.CONDENSED

CONSOLIDATED BALANCE SHEETS(Millions)

| |

December 28,2024 |

|

December 30,2023 |

| |

(Unaudited) |

|

|

|

ASSETS |

|

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

3,787 |

|

|

$ |

3,933 |

|

|

Short-term investments |

|

1,345 |

|

|

|

1,840 |

|

|

Accounts receivable, net |

|

6,192 |

|

|

|

4,323 |

|

|

Inventories |

|

5,734 |

|

|

|

4,351 |

|

|

Receivables from related parties |

|

113 |

|

|

|

9 |

|

|

Prepaid expenses and other current assets |

|

1,878 |

|

|

|

2,312 |

|

|

Total current assets |

|

19,049 |

|

|

|

16,768 |

|

|

Property and equipment, net |

|

1,802 |

|

|

|

1,589 |

|

|

Operating lease right-of-use assets |

|

623 |

|

|

|

633 |

|

|

Goodwill |

|

24,839 |

|

|

|

24,262 |

|

|

Acquisition-related intangibles, net |

|

18,930 |

|

|

|

21,363 |

|

|

Investment: equity method |

|

149 |

|

|

|

99 |

|

|

Deferred tax assets |

|

688 |

|

|

|

366 |

|

| Other

non-current assets |

|

3,146 |

|

|

|

2,805 |

|

|

Total Assets |

$ |

69,226 |

|

|

$ |

67,885 |

|

| |

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

Current liabilities: |

|

|

|

|

Accounts payable |

$ |

1,990 |

|

|

$ |

2,055 |

|

|

Payables to related parties |

|

476 |

|

|

|

363 |

|

|

Accrued liabilities |

|

4,260 |

|

|

|

3,082 |

|

|

Current portion of long-term debt, net |

|

— |

|

|

|

751 |

|

|

Other current liabilities |

|

555 |

|

|

|

438 |

|

|

Total current liabilities |

|

7,281 |

|

|

|

6,689 |

|

|

Long-term debt, net of current portion |

|

1,721 |

|

|

|

1,717 |

|

|

Long-term operating lease liabilities |

|

491 |

|

|

|

535 |

|

|

Deferred tax liabilities |

|

349 |

|

|

|

1,202 |

|

| Other

long-term liabilities |

|

1,816 |

|

|

|

1,850 |

|

| |

|

|

|

|

Stockholders' equity: |

|

|

|

|

Capital stock: |

|

|

|

|

Common stock, par value |

|

17 |

|

|

|

17 |

|

|

Additional paid-in capital |

|

61,362 |

|

|

|

59,676 |

|

|

Treasury stock, at cost |

|

(6,106 |

) |

|

|

(4,514 |

) |

|

Retained earnings |

|

2,364 |

|

|

|

723 |

|

|

Accumulated other comprehensive loss |

|

(69 |

) |

|

|

(10 |

) |

|

Total stockholders' equity |

|

57,568 |

|

|

|

55,892 |

|

|

Total Liabilities and Stockholders' Equity |

$ |

69,226 |

|

|

$ |

67,885 |

|

ADVANCED MICRO DEVICES, INC.CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS(Millions)

(Unaudited)

| |

Three Months Ended |

|

Year Ended |

| |

December 28,2024 |

|

December 30,2023 |

|

December 28,2024 |

|

December 30,2023 |

| Cash

flows from operating activities: |

|

|

|

|

|

|

|

|

Net income |

$ |

482 |

|

|

$ |

667 |

|

|

$ |

1,641 |

|

|

$ |

854 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

172 |

|

|

|

164 |

|

|

|

671 |

|

|

|

642 |

|

|

Amortization of acquisition-related intangibles |

|

583 |

|

|

|

635 |

|

|

|

2,393 |

|

|

|

2,811 |

|

|

Stock-based compensation |

|

339 |

|

|

|

374 |

|

|

|

1,407 |

|

|

|

1,384 |

|

|

Amortization of operating lease right-of-use assets |

|

31 |

|

|

|

25 |

|

|

|

113 |

|

|

|

98 |

|

|

Deferred income taxes |

|

(300 |

) |

|

|

(219 |

) |

|

|

(1,163 |

) |

|

|

(1,019 |

) |

|

Inventory loss at contract manufacturer |

|

— |

|

|

|

— |

|

|

|

65 |

|

|

|

— |

|

|

Other |

|

62 |

|

|

|

(23 |

) |

|

|

12 |

|

|

|

(54 |

) |

|

Changes in operating assets and liabilities |

|

|

|

|

|

|

|

|

Accounts receivable, net |

|

96 |

|

|

|

(379 |

) |

|

|

(1,865 |

) |

|

|

(1,339 |

) |

|

Inventories |

|

(362 |

) |

|

|

94 |

|

|

|

(1,458 |

) |

|

|

(580 |

) |

|

Prepaid expenses and other assets |

|

494 |

|

|

|

(34 |

) |

|

|

343 |

|

|

|

(383 |

) |

|

Receivables from and payables to related parties, net |

|

30 |

|

|

|

29 |

|

|

|

108 |

|

|

|

(107 |

) |

|

Accounts payable |

|

(585 |

) |

|

|

(181 |

) |

|

|

(109 |

) |

|

|

(419 |

) |

|

Accrued and other liabilities |

|

257 |

|

|

|

(771 |

) |

|

|

883 |

|

|

|

(221 |

) |

| Net cash provided by operating

activities |

|

1,299 |

|

|

|

381 |

|

|

|

3,041 |

|

|

|

1,667 |

|

| Cash flows from investing

activities: |

|

|

|

|

|

|

|

|

Purchases of property and equipment |

|

(208 |

) |

|

|

(139 |

) |

|

|

(636 |

) |

|

|

(546 |

) |

|

Purchases of short-term investments |

|

(786 |

) |

|

|

(410 |

) |

|

|

(1,493 |

) |

|

|

(3,722 |

) |

|

Proceeds from maturity of short-term investments |

|

65 |

|

|

|

770 |

|

|

|

1,416 |

|

|

|

2,687 |

|

|

Proceeds from sale of short-term investments |

|

25 |

|

|

|

52 |

|

|

|

616 |

|

|

|

300 |

|

|

Acquisitions, net of cash acquired |

|

— |

|

|

|

(117 |

) |

|

|

(548 |

) |

|

|

(131 |

) |

|

Related party equity method investment |

|

— |

|

|

|

— |

|

|

|

(17 |

) |

|

|

— |

|

|

Issuance of loan to related party |

|

(100 |

) |

|

|

— |

|

|

|

(100 |

) |

|

|

— |

|

|

Purchase of strategic investments |

|

(210 |

) |

|

|

(6 |

) |

|

|

(341 |

) |

|

|

(11 |

) |

|

Other |

|

— |

|

|

|

— |

|

|

|

2 |

|

|

|

— |

|

| Net cash provided by (used in)

investing activities |

|

(1,214 |

) |

|

|

150 |

|

|

|

(1,101 |

) |

|

|

(1,423 |

) |

| Cash flows from financing

activities: |

|

|

|

|

|

|

|

|

Repayment of debt |

|

— |

|

|

|

— |

|

|

|

(750 |

) |

|

|

— |

|

|

Proceeds from sales of common stock through employee equity

plans |

|

127 |

|

|

|

120 |

|

|

|

279 |

|

|

|

268 |

|

|

Repurchases of common stock |

|

(256 |

) |

|

|

(233 |

) |

|

|

(862 |

) |

|

|

(985 |

) |

|

Common stock repurchases for tax withholding on employee equity

plans |

|

(42 |

) |

|

|

(45 |

) |

|

|

(728 |

) |

|

|

(427 |

) |

|

Other |

|

— |

|

|

|

(1 |

) |

|

|

(1 |

) |

|

|

(2 |

) |

| Net cash used in financing

activities |

|

(171 |

) |

|

|

(159 |

) |

|

|

(2,062 |

) |

|

|

(1,146 |

) |

| Net increase (decrease) in

cash, cash equivalents and restricted cash |

|

(86 |

) |

|

|

372 |

|

|

|

(122 |

) |

|

|

(902 |

) |

| Cash, cash equivalents and

restricted cash at beginning of period |

|

3,897 |

|

|

|

3,561 |

|

|

|

3,933 |

|

|

|

4,835 |

|

| Cash, cash equivalents and

restricted cash at end of period |

$ |

3,811 |

|

|

$ |

3,933 |

|

|

$ |

3,811 |

|

|

$ |

3,933 |

|

ADVANCED MICRO DEVICES, INC.SELECTED

CORPORATE DATA(Millions) (Unaudited)

|

|

Three Months Ended |

|

Year Ended |

|

|

December 28,2024 |

|

September 28,2024 |

|

December 30,2023 |

|

December 28,2024 |

|

December 30,2023 |

|

Segment and Category

Information(1) |

|

|

|

|

|

|

|

|

|

|

Data Center |

|

|

|

|

|

|

|

|

|

|

Net revenue |

$ |

3,859 |

|

|

$ |

3,549 |

|

|

$ |

2,282 |

|

|

$ |

12,579 |

|

|

$ |

6,496 |

|

|

Operating income |

$ |

1,157 |

|

|

$ |

1,041 |

|

|

$ |

666 |

|

|

$ |

3,482 |

|

|

$ |

1,267 |

|

|

Client |

|

|

|

|

|

|

|

|

|

|

Net revenue |

$ |

2,313 |

|

|

$ |

1,881 |

|

|

$ |

1,461 |

|

|

$ |

7,054 |

|

|

$ |

4,651 |

|

|

Operating income (loss) |

$ |

446 |

|

|

$ |

276 |

|

|

$ |

55 |

|

|

$ |

897 |

|

|

$ |

(46 |

) |

|

Gaming |

|

|

|

|

|

|

|

|

|

|

Net revenue |

$ |

563 |

|

|

$ |

462 |

|

|

$ |

1,368 |

|

|

$ |

2,595 |

|

|

$ |

6,212 |

|

|

Operating income |

$ |

50 |

|

|

$ |

12 |

|

|

$ |

224 |

|

|

$ |

290 |

|

|

$ |

971 |

|

|

Embedded |

|

|

|

|

|

|

|

|

|

|

Net revenue |

$ |

923 |

|

|

$ |

927 |

|

|

$ |

1,057 |

|

|

$ |

3,557 |

|

|

$ |

5,321 |

|

|

Operating income |

$ |

362 |

|

|

$ |

372 |

|

|

$ |

461 |

|

|

$ |

1,421 |

|

|

$ |

2,628 |

|

|

All Other |

|

|

|

|

|

|

|

|

|

|

Net revenue |

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

Operating loss |

$ |

(1,144 |

) |

|

$ |

(977 |

) |

|

$ |

(1,064 |

) |

|

$ |

(4,190 |

) |

|

$ |

(4,419 |

) |

|

Total |

|

|

|

|

|

|

|

|

|

|

Net revenue |

$ |

7,658 |

|

|

$ |

6,819 |

|

|

$ |

6,168 |

|

|

$ |

25,785 |

|

|

$ |

22,680 |

|

|

Operating income |

$ |

871 |

|

|

$ |

724 |

|

|

$ |

342 |

|

|

$ |

1,900 |

|

|

$ |

401 |

|

| |

|

|

|

|

|

|

|

|

|

|

Other Data |

|

|

|

|

|

|

|

|

|

|

Capital expenditures |

$ |

208 |

|

|

$ |

132 |

|

|

$ |

139 |

|

|

$ |

636 |

|

|

$ |

546 |

|

|

Adjusted EBITDA (2) |

$ |

2,212 |

|

|

$ |

1,887 |

|

|

$ |

1,576 |

|

|

$ |

6,824 |

|

|

$ |

5,496 |

|

| Cash,

cash equivalents and short-term investments |

$ |

5,132 |

|

|

$ |

4,544 |

|

|

$ |

5,773 |

|

|

$ |

5,132 |

|

|

$ |

5,773 |

|

| Free

cash flow (3) |

$ |

1,091 |

|

|

$ |

496 |

|

|

$ |

242 |

|

|

$ |

2,405 |

|

|

$ |

1,121 |

|

| Total

assets |

$ |

69,226 |

|

|

$ |

69,636 |

|

|

$ |

67,885 |

|

|

$ |

69,226 |

|

|

$ |

67,885 |

|

| Total

debt |

$ |

1,721 |

|

|

$ |

1,720 |

|

|

$ |

2,468 |

|

|

$ |

1,721 |

|

|

$ |

2,468 |

|

|

(1 |

) |

|

The Data Center segment primarily includes Artificial Intelligence

(AI) accelerators, server microprocessors (CPUs), graphics

processing units (GPUs), accelerated processing units (APUs), data

processing units (DPUs), Field Programmable Gate Arrays (FPGAs),

Smart Network Interface Cards (SmartNICs) and Adaptive

System-on-Chip (SoC) products for data centers. |

| |

|

The Client segment primarily

includes CPUs, APUs, and chipsets for desktops and notebooks. |

| |

|

The Gaming segment primarily

includes discrete GPUs, and semi-custom SoC products and

development services. |

| |

|

The Embedded segment primarily

includes embedded CPUs, GPUs, APUs, FPGAs, System on Modules

(SOMs), and Adaptive SoC products. |

| |

|

From time to time, the Company

may also sell or license portions of its IP portfolio. |

| |

|

All Other category primarily

includes certain expenses and credits that are not allocated to any

of the operating segments, such as amortization of

acquisition-related intangible asset, employee stock-based

compensation expense, acquisition-related and other costs,

inventory loss at contract manufacturer, restructuring charges and

licensing gain. |

| |

|

|

|

(2 |

) |

|

Reconciliation of GAAP

Net Income to Adjusted EBITDA |

|

|

Three Months Ended |

|

Year Ended |

| (Millions) (Unaudited) |

December 28,2024 |

|

September 28,2024 |

|

December 30,2023 |

|

December 28,2024 |

|

December 30,2023 |

|

GAAP net income |

$ |

482 |

|

|

$ |

771 |

|

|

$ |

667 |

|

|

$ |

1,641 |

|

|

$ |

854 |

|

|

Interest expense |

|

19 |

|

|

|

23 |

|

|

|

27 |

|

|

|

92 |

|

|

|

106 |

|

|

Other (income) expense, net |

|

(37 |

) |

|

|

(36 |

) |

|

|

(49 |

) |

|

|

(181 |

) |

|

|

(197 |

) |

|

Income tax provision (benefit) |

|

419 |

|

|

|

(27 |

) |

|

|

(297 |

) |

|

|

381 |

|

|

|

(346 |

) |

|

Equity income in investee |

|

(12 |

) |

|

|

(7 |

) |

|

|

(6 |

) |

|

|

(33 |

) |

|

|

(16 |

) |

|

Stock-based compensation |

|

339 |

|

|

|

351 |

|

|

|

374 |

|

|

|

1,407 |

|

|

|

1,380 |

|

|

Depreciation and amortization |

|

186 |

|

|

|

171 |

|

|

|

164 |

|

|

|

685 |

|

|

|

642 |

|

|

Amortization of acquisition-related intangibles |

|

584 |

|

|

|

585 |

|

|

|

635 |

|

|

|

2,394 |

|

|

|

2,811 |

|

|

Inventory loss at contract manufacturer |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

65 |

|

|

|

— |

|

|

Acquisition-related and other costs |

|

46 |

|

|

|

56 |

|

|

|

61 |

|

|

|

187 |

|

|

|

262 |

|

|

Restructuring charges |

|

186 |

|

|

|

— |

|

|

|

— |

|

|

|

186 |

|

|

|

— |

|

|

Adjusted EBITDA |

$ |

2,212 |

|

|

$ |

1,887 |

|

|

$ |

1,576 |

|

|

$ |

6,824 |

|

|

$ |

5,496 |

|

| The Company presents “Adjusted

EBITDA” as a supplemental measure of its performance. Adjusted

EBITDA for the Company is determined by adjusting GAAP net income

for interest expense, other (income) expense, net, income tax

provision (benefit), equity income in investee, stock-based

compensation, depreciation and amortization expense, amortization

of acquisition-related intangibles, inventory loss at contract

manufacturer, acquisition-related and other costs, and

restructuring charges. The Company calculates and presents Adjusted

EBITDA because management believes it is of importance to investors

and lenders in relation to its overall capital structure and its

ability to borrow additional funds. In addition, the Company

presents Adjusted EBITDA because it believes this measure assists

investors in comparing its performance across reporting periods on

a consistent basis by excluding items that the Company does not

believe are indicative of its core operating performance. The

Company’s calculation of Adjusted EBITDA may or may not be

consistent with the calculation of this measure by other companies

in the same industry. Investors should not view Adjusted EBITDA as

an alternative to the GAAP operating measure of income or GAAP

liquidity measures of cash flows from operating, investing and

financing activities. In addition, Adjusted EBITDA does not take

into account changes in certain assets and liabilities that can

affect cash flows. |

|

(3 |

) |

|

Reconciliation of GAAP Net Cash Provided by Operating

Activities to Free Cash Flow |

|

|

Three Months Ended |

|

Year Ended |

|

(Millions except percentages) (Unaudited) |

December 28,2024 |

|

September 28,2024 |

|

December 30,2023 |

|

December 28,2024 |

|

December 30,2023 |

|

GAAP net cash provided by operating activities |

$ |

1,299 |

|

|

$ |

628 |

|

|

$ |

381 |

|

|

$ |

3,041 |

|

|

$ |

1,667 |

|

|

Operating cash flow margin % |

|

17 |

% |

|

|

9 |

% |

|

|

6 |

% |

|

|

12 |

% |

|

|

7 |

% |

|

Purchases of property and equipment |

|

(208 |

) |

|

|

(132 |

) |

|

|

(139 |

) |

|

|

(636 |

) |

|

|

(546 |

) |

| Free

cash flow |

$ |

1,091 |

|

|

$ |

496 |

|

|

$ |

242 |

|

|

$ |

2,405 |

|

|

$ |

1,121 |

|

|

Free cash flow margin % |

|

14 |

% |

|

|

7 |

% |

|

|

4 |

% |

|

|

9 |

% |

|

|

5 |

% |

| The Company also presents free

cash flow as a supplemental Non-GAAP measure of its performance.

Free cash flow is determined by adjusting GAAP net cash provided by

operating activities for capital expenditures, and free cash flow

margin % is free cash flow expressed as a percentage of the

Company's net revenue. The Company calculates and communicates free

cash flow in the financial earnings press release because

management believes it is of importance to investors to understand

the nature of these cash flows. The Company’s calculation of free

cash flow may or may not be consistent with the calculation of this

measure by other companies in the same industry. Investors should

not view free cash flow as an alternative to GAAP liquidity

measures of cash flows from operating activities. |

| |

Media Contact:Drew PrairieAMD

Communications512-602-4425drew.prairie@amd.com

Investor Contact:Matt

RamsayAMD Investor

Relations512-602-0113matthew.ramsay@amd.com

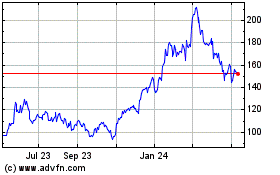

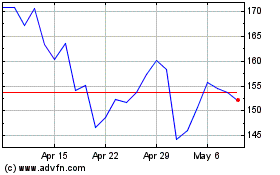

Advanced Micro Devices (NASDAQ:AMD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Advanced Micro Devices (NASDAQ:AMD)

Historical Stock Chart

From Feb 2024 to Feb 2025