0001083446

false

0001083446

2023-08-04

2023-08-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington,

DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

August 4, 2023

APOLLO MEDICAL HOLDINGS, INC.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

001-37392 |

95-4472349 |

| (State or Other Jurisdiction |

(Commission |

(I.R.S. Employer |

| of Incorporation) |

File Number) |

Identification No.) |

1668 S. Garfield Avenue, 2nd Floor, Alhambra, California 91801

(Address of Principal Executive Offices) (Zip Code)

(626) 282-0288

Registrant’s Telephone Number, Including

Area Code

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock |

AMEH |

Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 4.02 |

Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review. |

Restatement of Historical

Financial Results

On August 4, 2023, the Audit

Committee of the Board of Directors (the “Audit Committee”) of Apollo Medical Holdings, Inc. (the “Company”),

based on the recommendation of, and after consultation with, the Company’s management, concluded that the Company’s previously

issued audited consolidated financial statements as of December 31, 2022 and 2021 and for each of the years ended December 31, 2022, 2021

and 2020, included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 (the “2022 Annual Report”),

and the Company’s unaudited consolidated financial statements included in the Quarterly Reports on Form 10-Q for the quarterly 2022

fiscal year periods (the “Historical Quarterly Reports”), as well as the unaudited consolidated financial statements included

in the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2023 (the “Q1 Quarterly Report” and,

together with the 2022 Annual Report and the Historical Quarterly Reports, the “Reports” and all financial statements included

in the Reports, collectively, the “Affected Financials”), should no longer be relied upon due to material unintentional errors

related to the Company’s tax provision. Similarly, related earnings releases, press releases, shareholder communications, investor

presentations or other communications describing relevant portions of the Affected Financials should no longer be relied upon.

In the second quarter of 2023,

the Company began a review of its income tax filing structure, and related accounting matters, with the assistance of outside consultants.

In connection with such review, the Company identified unintentional errors in its accounting for the income tax effects of certain intercompany

dividends and certain net operating losses. Specifically, the Company failed to accrue for income tax expense on certain intercompany

dividends. Although the Company accrued taxes on the income generated by the subsidiary that made the intercompany dividend, the additional

taxes due by the subsidiary entitled to the dividend were not accrued. Also, based on a review of historical tax filings, the Company

concluded that its previous determination regarding the realizability of certain net operating losses was incorrect resulting in an overstatement

of the valuation allowance with respect to such net operating losses. The errors resulted in a net understatement of income tax expense

in prior periods and also had an impact on purchase accounting (goodwill) as a portion of the net operating losses affected by the errors

pertained to acquisitions in prior periods. The Company has determined that the adjustments as of December 31, 2022 and 2021 and for the

years ended December 31, 2022, 2021, and 2020, and the first quarter of 2023 were material and will require restatement.

The Company expects to record

decreases to previously reported net income of $0.2 million in 2020, $3.2 million in 2021, $4.8 million in 2022, and $1.8 million in the

first quarter of 2023. Certain GAAP and non-GAAP measures previously presented by the Company, including revenue, gross profit, pretax

income from continuing operations, EBITDA and Adjusted EBITDA, are not expected to be impacted by the restatement. The

Company is evaluating changes to its tax structure to reduce the current effective tax rate and amount of cash taxes.

Controls and Procedures

In connection with the restatement,

management has re-evaluated the effectiveness of the Company’s disclosure controls and procedures.

Management has concluded that the Company’s disclosure controls and procedures were not effective as of December 31, 2022, due to

a material weakness in its internal control over financial reporting related to the ineffective design of controls related to income taxes.

As a result of this newly identified material weakness, Management’s Annual Report on Internal Control Over Financial Reporting

and Ernst & Young LLP’s, the Company’s independent registered public accounting firm, opinion on the effectiveness of

the Company’s internal control over financial reporting as of December 31, 2022, included in the 2022 Annual Report, should no longer

be relied upon. The Company will provide further specifics on the material weakness in its internal control over financial reporting and

its disclosure controls and procedures, and its plan for remediation, in its amendment to the 2022 Annual Report.

The Company’s management

and Audit Committee discussed the matters disclosed in this Item 4.02 with Ernst & Young LLP.

Next Steps

As a result of the misstatements,

the Company plans to restate its consolidated financial statements as of December 31, 2022 and 2021 and for each of the years ended December

31, 2022, 2021 and 2020, as well as Management’s Annual Report on Internal Control Over Financial Reporting as of December 31, 2022,

and include them in an amendment to the 2022 Annual Report to be filed with the Securities and Exchange Commission as soon as practicable.

Additionally, the Company plans to restate its unaudited consolidated financial statements for the quarter ended March 31, 2023 and include

them in an amendment to the Q1 Quarterly Report to be filed with the Securities and Exchange Commission as soon as practicable. The Company

expects to timely file its Quarterly Report on Form 10-Q for the quarter ended June 30, 2023, which will include recast financial statements

for the second quarter of 2022, reflecting the restated financial information.

| Item 7.01 | Regulation FD Disclosure. |

The error and the accounting

treatment contemplated by the restatement described in Item 4.02 above have no impact on the Company’s previously communicated fiscal

2023 outlook.

The information contained

in Item 7.01 of this Current Report on Form 8-K is being furnished and shall not be deemed “filed” for purposes of Section

18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that

section. Such information shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the

Exchange Act, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Forward-Looking Statements

This Current Report on Form

8-K contains forward-looking statements within the meaning of the federal securities laws, including, without limitation, statements regarding

the Company’s expectations and preliminary estimates of the impact of the restatement on the Affected Financials; the scope of the

restatement and the controls and procedures deficiencies; the timing of the completion of the restatement and the filing of restated financial

statements; plans to remediate the deficiencies, including the material weakness, with respect to the Company’s internal control

over financial reporting and disclosure controls and procedures, including potential changes to its tax structure; the impact of these

matters on the Company’s performance and outlook; and any statements or assumptions underlying any of the foregoing. The estimates

included in this report are preliminary and are subject to change as the Company completes its financial close process. You can identify

forward looking statements by the fact that they do not relate strictly to historical or current facts. Forward-looking statements may

be identified by the use of forward-looking terms, such as “anticipate,” “could,” “can,” “may,”

“might,” “potential,” “predict,” “should,” “estimate,” “expect,”

“project,” “believe,” “think,” “plan,” “envision,” “intend,” “continue,”

“target,” “seek,” “contemplate,” “budgeted,” “will,” or “would,”

and the negative of such terms, other variations on such terms or other similar or comparable words, phrases, or terminology. The Company

cannot assure you that future developments affecting it will be those that it has anticipated. Important risks and uncertainties that

could cause actual results to differ materially from the Company’s expectations include, among others, risks related to the timely

and correct completion of the restatement and related filings; identification of errors in the Company’s financial reporting in

the future that require the Company to restate previously issued financial statements, which may subject the Company to unanticipated

costs or regulatory penalties and could cause investors to lose confidence in the accuracy and completeness of the Company’s financial

statements; the risk that additional information may become known prior to the expected filing with the Securities and Exchange Commission

of the periodic reports described herein or that other subsequent events may occur that would require the Company to make additional adjustments

to its financial statements or delay the filing of the corrected or future periodic reports with the Securities and Exchange Commission;

risks related to changes in the effects of the restatement on the Affected Financials or financial results; the risk that the Company

will be unable to obtain, if needed, any required waivers under its credit agreement; risks related to higher than expected charges after

completing the restatement process; risks related to delays in the filing of the restated financial statements; risks related to the Company’s

ability to implement and maintain effective internal control over financial reporting in the future, which may adversely affect the accuracy

and timeliness of the Company’s financial reporting; risks related to changes in accounting rules or regulations; risks related

to fluctuations in the Company’s tax obligations and effective tax rate and realization of the Company’s deferred tax assets,

including net operating loss carryforwards, which may result in volatility of the Company’s results of operations; risks relating

to the Company’s complex legal structure, which may cause tax authorities to question or disagree with the Company’s tax status,

potentially adversely impacting the Company; risks related to the Company’s plans to remediate any control and procedures deficiencies;

risks related to the timing and results of the Company’s review of the effectiveness of internal control over financial reporting

and related disclosure controls and procedures; risks related to whether a restatement of financial results will be required for other

accounting issues; risks related to the application of accounting or tax principles in an unanticipated manner; risks related to

the Company’s dependence on key personnel and any changes in the Company’s ability to retain key personnel; as well as those

risks and uncertainties discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, filed with the

Securities and Exchange Commission on March 1, 2023, including the risk factors discussed under the heading “Risk Factors”

in Part I, Item IA thereof, and similar disclosures in subsequent reports filed with the Securities and Exchange Commission. Any forward-looking

statement made by the Company in this report speaks only as of the date on which it is made. The Company undertakes no obligation to publicly

update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required

by any applicable securities laws.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

APOLLO MEDICAL HOLDINGS, INC. |

| |

|

|

| Date: August 7, 2023 |

By: |

/s/ Thomas S. Lam |

| |

Name: |

Thomas S. Lam, M.D., M.P.H. |

| |

Title: |

Co-Chief Executive Officer and President |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

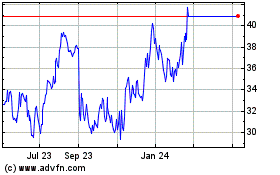

Apollo Medical (NASDAQ:AMEH)

Historical Stock Chart

From Feb 2025 to Mar 2025

Apollo Medical (NASDAQ:AMEH)

Historical Stock Chart

From Mar 2024 to Mar 2025