0001083446

false

0001083446

2023-08-07

2023-08-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington,

DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

August 7, 2023

APOLLO MEDICAL HOLDINGS, INC.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

001-37392 |

95-4472349 |

| (State or Other Jurisdiction |

(Commission |

(I.R.S. Employer |

| of Incorporation) |

File Number) |

Identification No.) |

1668 S. Garfield Avenue, 2nd Floor, Alhambra, California 91801

(Address of Principal Executive Offices) (Zip Code)

(626) 282-0288

Registrant’s Telephone Number, Including

Area Code

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock |

AMEH |

Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 | Results of Operations and Financial Condition. |

On August 7, 2023, Apollo

Medical Holdings, Inc. (the “Company”) issued a press release announcing its financial results for the three and six months

ended June 30, 2023. A copy of the press release and supplemental data is furnished with this Current Report on Form 8-K as Exhibit 99.1

and Exhibit 99.2, respectively, and incorporated herein by this reference.

In accordance with General

Instruction B.2 of Form 8-K, the information furnished pursuant to this Item 2.02, including Exhibit 99.1 and Exhibit 99.2 furnished herewith,

shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange

Act, except as shall be expressly set forth by specific reference in such filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

APOLLO MEDICAL HOLDINGS, INC. |

| |

|

| Date: August 7, 2023 |

By: |

/s/ Thomas S. Lam |

| |

Name: |

Thomas S. Lam, M.D., M.P.H. |

| |

Title: |

Co-Chief Executive Officer and President |

Exhibit 99.1

Apollo Medical Holdings, Inc. Reports Second

Quarter 2023 Results

Company to Host Conference Call on Monday, August

7, 2023, at 2:30 p.m. PT/5:30 p.m. ET

ALHAMBRA, Calif., August 7, 2023 /PRNewswire/

-- Apollo Medical Holdings, Inc. (“ApolloMed,” and together with its subsidiaries and affiliated entities, the “Company”)

(NASDAQ: AMEH), a leading physician-centric, technology-powered healthcare company focused on enabling providers in the successful delivery

of value-based care, today announced its consolidated financial results for the second quarter ended June 30, 2023.

Brandon Sim, Co-Chief Executive Officer of ApolloMed,

stated, “Our strong second quarter performance reflects the sustained momentum and scalability of the ApolloMed model, with revenue

up 29%, net income attributable to ApolloMed up 10%, and adjusted EBITDA up 44% compared to a year ago. We remain focused on our three

key operational goals of growing our membership, empowering our providers, and improving patient outcomes, and we continue to drive meaningful

progress in all three areas in California, Nevada, Texas, and beyond.”

“We want to thank our providers and teammates

for their hard work and dedication that resulted in our continued solid financial performance in the second quarter of 2023 and our confidence

in reiterating our previously provided guidance for full-year 2023.”

Financial Highlights for Second Quarter Ended

June 30, 2023:

All comparisons are to the quarter ended June

30, 2022 unless otherwise stated.

| • | Total revenue of $348.2 million, up 29% from $269.7 million |

| • | Care Partners revenue of $325.2 million, up 32% from $247.3 million |

| • | Net income attributable to ApolloMed of $13.2 million, up 10% from $12.0 million |

| • | Adjusted EBITDA of $35.8 million, up 44% from $24.9 million |

Financial Highlights for Six Months Ended

June 30, 2023:

All comparisons are to the six months ended June 30, 2022 unless

otherwise stated.

| • | Total revenue of $685.5 million, up 29% from $533.0 million |

| • | Care Partners revenue of $639.9 million, up 31% from $488.6 million |

| • | Net income attributable to ApolloMed of $26.3 million, up 2% from $25.7 million |

| • | Adjusted EBITDA of $65.6 million, up 11% from $59.3 million |

Recent Operating Highlights Subsequent to the

End of the Second Quarter:

| • | On July 12, 2023, the Company announced that it had entered into a definitive agreement to acquire assets

of Texas Independent Providers, LLC (“TIP”), a value-based provider network with over 120 primary care providers that is expected

to be an anchor for our high-quality Care Partners business in Houston. Through this transaction, ApolloMed intends to empower TIP’s

provider network to deliver best-in-class clinical outcomes and to improve the healthcare experience for patients. This transaction is

expected to close in the third quarter of 2023, and TIP’s providers are expected to be onboarded onto ApolloMed’s Care Enablement

platform by the end of 2023. |

| • | On July 27, 2023, the Company formed a long-term partnership with a primary care group operating in California with over 50 providers.

The group is expected to be onboarded onto ApolloMed’s Care Enablement platform by September 1, 2023. |

| • | On July 31, 2023, the Company announced a partnership with IntraCare,

an operator of a value-based primary care provider network with over 425 providers located in Dallas, Fort Worth, El Paso, Austin, and

Oklahoma City. Through this partnership, IntraCare’s providers are expected to join ApolloMed’s high-quality Care Partners

business in these regions and onboarded onto ApolloMed’s Care Enablement platform by the end of 2023. In addition, ApolloMed will

lend IntraCare a $25 million senior secured convertible promissory note maturing in 2028 to further IntraCare’s mission and growth. |

Segment Results for the Second Quarter Ended

June 30, 2023:

| | |

Three Months Ended June 30, 2023 | |

| | |

Care

Enablement | | |

Care

Partners | | |

Care

Delivery | | |

Other | | |

Intersegment

Elimination | | |

Corporate

Costs | | |

Consolidated

Total | |

| Total revenues | |

$ | 34,975 | | |

$ | 325,246 | | |

$ | 26,718 | | |

$ | 157 | | |

$ | (38,887 | ) | |

$ | — | | |

$ | 348,209 | |

| % change vs. prior year quarter | |

| 18 | % | |

| 32 | % | |

| 14 | % | |

| — | | |

| — | | |

| — | | |

| 29 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cost of services | |

| 15,162 | | |

| 292,119 | | |

| 22,523 | | |

| 70 | | |

| (36,998 | ) | |

| — | | |

| 292,876 | |

| General and administrative(1) | |

| 12,175 | | |

| 5,298 | | |

| 3,626 | | |

| 926 | | |

| (2,933 | ) | |

| 9,212 | | |

| 28,304 | |

| Total expenses | |

| 27,337 | | |

| 297,417 | | |

| 26,149 | | |

| 996 | | |

| (39,931 | ) | |

| 9,212 | | |

| 321,180 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Income (loss) from operations | |

$ | 7,638 | | |

$ | 27,829 | | |

$ | 569 | | |

$ | (839 | ) | |

$ | 1,044 | (2) | |

$ | (9,212 | ) | |

$ | 27,029 | |

| % change vs. prior year quarter | |

| 4 | % | |

| 250 | % | |

| (83 | )% | |

| — | | |

| — | | |

| — | | |

| 76 | % |

(1) Balance includes general and administrative

expenses and depreciation and amortization.

(2) Income from operations for the

intersegment elimination represents rental income from segments renting from other segments. Rental income is presented within other income

which is not presented in the table.

Guidance:

ApolloMed is reiterating the following guidance

for total revenue, net income, EBITDA, Adjusted EBITDA, and EPS - diluted, based on the Company’s existing business, current view

of existing market conditions and assumptions for the year ending December 31, 2023.

| ($ in millions) | |

2023 Guidance Range | |

| | |

Low | | |

High | |

| Total revenue | |

$ | 1,300.0 | | |

$ | 1,500.0 | |

| Net income | |

$ | 49.5 | | |

$ | 71.5 | |

| EBITDA | |

$ | 89.5 | | |

$ | 129.5 | |

| Adjusted EBITDA | |

$ | 120.0 | | |

$ | 160.0 | |

| EPS – diluted | |

$ | 0.95 | | |

$ | 1.20 | |

See “Guidance Reconciliation of Net Income

to EBITDA and Adjusted EBITDA” and “Use of Non-GAAP Financial Measures” below for additional information. There can

be no assurance that actual amounts will not be materially higher or lower than these expectations. See “Forward-Looking Statements”

below for additional information.

Conference Call and Webcast Information:

ApolloMed will host a conference call at 2:30

p.m. PT/5:30 p.m. ET today (Monday, August 7, 2023), during which management will discuss the results of the second quarter ended

June 30, 2023. To participate in the conference call, please use the following dial-in numbers about 5 minutes prior to the scheduled

conference call time:

| U.S. & Canada (Toll-Free): |

+1 (877) 858-9810 |

| International (Toll): |

+1 (201) 689-8517 |

The conference call can also be accessed via webcast at: https://event.choruscall.com/mediaframe/webcast.html?webcastid=SC6cioUx.

An accompanying slide presentation will be available

in PDF format on the “IR Calendar” page of the Company’s website (https://www.apollomed.net/investors/news-events/ir-calendar)

after issuance of the earnings release and will be furnished as an exhibit to ApolloMed’s current report on Form 8-K to be filed

with the SEC, accessible at www.sec.gov.

Those who are unable to attend the live conference

call may access the recording at the above webcast link, which will be made available shortly after the conclusion of the call.

Note About Consolidated Entities

The Company consolidates entities in which it

has a controlling financial interest. The Company consolidates subsidiaries in which it holds, directly or indirectly, more than 50% of

the voting rights, and VIEs in which the Company is the primary beneficiary. Noncontrolling interests represent third party equity ownership

interests in the Company’s consolidated entities (including certain VIEs). The amount of net income attributable to noncontrolling

interests is disclosed in the Company’s consolidated statements of income.

Note About Stockholders’ Equity,

Certain Treasury Stock and Earnings Per Share

As of the date of this press release, 140,954

holdback shares have not been issued to certain former shareholders of the Company’s subsidiary, Network Medical Management, Inc.

(“NMM”), who were NMM shareholders at the time of closing of the merger, as they have yet to submit properly completed letters

of transmittal to ApolloMed in order to receive their pro rata portion of ApolloMed’s common stock and warrants as contemplated

under that certain Agreement and Plan of Merger, dated December 21, 2016, among ApolloMed, NMM, Apollo Acquisition Corp. (“Merger

Subsidiary”) and Kenneth Sim, M.D., as amended, pursuant to which Merger Subsidiary merged with and into NMM, with NMM as the surviving

corporation. Pending such receipt, such former NMM shareholders have the right to receive, without interest, their pro rata share of dividends

or distributions with a record date after the effectiveness of the merger. The Company’s consolidated financial statements have

treated such shares of common stock as outstanding, given the receipt of the letter of transmittal is considered perfunctory and ApolloMed

is legally obligated to issue these shares in connection with the merger.

Shares of ApolloMed’s common stock owned

by Allied Physicians of California, a Professional Medical Corporation d.b.a. Allied Pacific of California (“APC”), a VIE

of the Company, are legally issued and outstanding but excluded from shares of common stock outstanding in the Company’s consolidated

financial statements, as such shares are treated as treasury shares for accounting purposes. Such shares, therefore, are not included

in the number of shares of common stock outstanding used to calculate the Company’s earnings per share.

About Apollo Medical Holdings, Inc.

ApolloMed is a leading physician-centric, technology-powered,

risk-bearing healthcare company. Leveraging its proprietary end-to-end technology solutions, ApolloMed operates an integrated healthcare

delivery platform that enables providers to successfully participate in value-based care arrangements, thus empowering them to deliver

outcomes-based medical care to patients in a cost-effective manner.

Headquartered in Alhambra, California, ApolloMed’s

subsidiaries and affiliates include management services organizations (MSOs), affiliated independent practice associations (IPAs), and

entities participating in the Centers for Medicare & Medicaid Services Innovation Center (CMMI) innovation models. For more information,

please visit www.apollomed.net.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995, such as statements about the Company’s

guidance for the year ending December 31, 2023, ability to meet operational goals, ability to meet expectations in deployment of

care coordination and management capabilities, ability to decrease cost of care while improving quality and outcomes, ability to deliver

sustainable revenue and EBITDA growth as well as long-term value, ability to respond to the changing environment, and successful implementation

of strategic growth plans, acquisition strategy, and merger integration efforts. Forward-looking statements reflect current views

with respect to future events and financial performance and therefore cannot be guaranteed. Such statements are based on the

current expectations and certain assumptions of the Company’s management, and some or all of such expectations and assumptions may

not materialize or may vary significantly from actual results. Actual results may also vary materially from forward-looking statements

due to risks, uncertainties and other factors, known and unknown, including the risk factors described from time to time in the Company’s

reports to the SEC, including, without limitation the risk factors discussed in the Company’s Annual Report on

Form 10-K/A for the year ended December 31, 2022, and any subsequent quarterly reports on Form 10-Q. Any forward-looking statement

made by the Company in this release speaks only as of the date on which it is made. The Company undertakes no obligation to publicly update

any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by

any applicable securities laws.

Restatement

In connection with a review of the Company’s

income tax filing structure, the Company identified unintentional errors in its accounting for the income tax effects of certain intercompany

dividends and certain net operating losses, which resulted in an understatement of income tax expense in prior periods and also had an

impact on purchase accounting (goodwill) as a portion of the net operating losses affected by the errors pertained to acquisitions in

prior periods. As a result of the errors, the Company has restated the December 31, 2022 consolidated balance sheet and the consolidated

statement of operations for each of the three and six months ended June 30, 2022.

FOR MORE INFORMATION, PLEASE CONTACT:

Investor Relations

(626) 943-6491

investors@apollomed.net

Carolyne Sohn, The Equity Group

(408) 538-4577

csohn@equityny.com

APOLLO MEDICAL HOLDINGS, INC.

CONSOLIDATED BALANCE SHEETS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

(UNAUDITED)

| | |

June 30,

2023 | | |

December 31,

2022 | |

| | |

| | |

(Restated) | |

| Assets | |

| | | |

| | |

| | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 293,921 | | |

$ | 288,027 | |

| Restricted cash | |

| 345 | | |

| — | |

| Investments in marketable securities | |

| 3,789 | | |

| 5,567 | |

| Receivables, net | |

| 66,927 | | |

| 49,631 | |

| Receivables, net – related parties | |

| 82,820 | | |

| 65,147 | |

| Other receivables | |

| 1,201 | | |

| 1,834 | |

| Prepaid expenses and other current assets | |

| 15,088 | | |

| 14,798 | |

| Loans receivable | |

| 973 | | |

| 996 | |

| Loan receivable – related party | |

| — | | |

| 2,125 | |

| | |

| | | |

| | |

| Total current assets | |

| 465,064 | | |

| 428,125 | |

| | |

| | | |

| | |

| Non-current assets | |

| | | |

| | |

| Land, property, and equipment, net | |

| 123,859 | | |

| 108,536 | |

| Intangible assets, net | |

| 74,421 | | |

| 76,861 | |

| Goodwill | |

| 274,029 | | |

| 269,053 | |

| Income taxes receivable, non-current | |

| 15,943 | | |

| 15,943 | |

| Investments in other entities – equity method | |

| 45,831 | | |

| 40,299 | |

| Investments in privately held entities | |

| 2,896 | | |

| 896 | |

| Operating lease right-of-use assets | |

| 17,905 | | |

| 20,444 | |

| Other assets | |

| 7,229 | | |

| 6,056 | |

| | |

| | | |

| | |

| Total non-current assets | |

| 562,113 | | |

| 538,088 | |

| | |

| | | |

| | |

| Total assets(1) | |

$ | 1,027,177 | | |

$ | 966,213 | |

| | |

| | | |

| | |

| Liabilities, mezzanine equity and equity | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 49,904 | | |

$ | 49,562 | |

| Fiduciary accounts payable | |

| 8,603 | | |

| 8,065 | |

| Medical liabilities | |

| 100,047 | | |

| 81,255 | |

| Income taxes payable | |

| 19,628 | | |

| 4,279 | |

| Dividend payable | |

| 638 | | |

| 664 | |

| Finance lease liabilities | |

| 591 | | |

| 594 | |

| Operating lease liabilities | |

| 3,027 | | |

| 3,572 | |

| | |

June 30,

2023 | | |

December 31,

2022 | |

| | |

| | |

(Restated) | |

| Current portion of long-term debt | |

| 2,630 | | |

| 619 | |

| Total current liabilities | |

| 185,068 | | |

| 148,610 | |

| | |

| | | |

| | |

| Non-current liabilities | |

| | | |

| | |

| Deferred tax liability | |

| 12,383 | | |

| 14,217 | |

| Finance lease liabilities, net of current portion | |

| 1,078 | | |

| 1,275 | |

| Operating lease liabilities, net of current portion | |

| 17,852 | | |

| 19,915 | |

| Long-term debt, net of current portion and deferred financing costs | |

| 205,136 | | |

| 203,389 | |

| Other long-term liabilities | |

| 21,383 | | |

| 20,260 | |

| | |

| | | |

| | |

| Total non-current liabilities | |

| 257,832 | | |

| 259,056 | |

| | |

| | | |

| | |

| Total liabilities(1) | |

| 442,900 | | |

| 407,666 | |

| | |

| | | |

| | |

| Mezzanine equity | |

| | | |

| | |

| Non-controlling interest in Allied Physicians of California, a Professional Medical Corporation | |

| 14,523 | | |

| 14,237 | |

| | |

| | | |

| | |

| Stockholders’ equity | |

| | | |

| | |

| Series A Preferred stock, par value $0.001; 5,000,000 shares authorized (inclusive of Series B Preferred stock); 1,111,111 issued and zero outstanding | |

| — | | |

| — | |

| Series B Preferred stock, par value $0.001; 5,000,000 shares authorized (inclusive of Series A Preferred stock); 555,555 issued and zero outstanding | |

| — | | |

| — | |

| Common stock, $0.001 par value per share; 100,000,000 shares authorized, 46,553,517 and 46,575,699 shares issued and outstanding, excluding 10,569,340 and 10,299,259 treasury shares, at June 30, 2023, and December 31, 2022, respectively | |

| 47 | | |

| 47 | |

| Additional paid-in capital | |

| 357,246 | | |

| 360,097 | |

| Retained earnings | |

| 208,720 | | |

| 182,417 | |

| Total stockholders’ equity | |

| 566,013 | | |

| 542,561 | |

| | |

| | | |

| | |

| Non-controlling interest | |

| 3,741 | | |

| 1,749 | |

| | |

| | | |

| | |

| Total equity | |

| 569,754 | | |

| 544,310 | |

| | |

| | | |

| | |

| Total liabilities, mezzanine equity and equity | |

$ | 1,027,177 | | |

$ | 966,213 | |

(1) The Company’s consolidated balance sheets include the assets

and liabilities of its consolidated variable interest entities (“VIEs”). The consolidated balance sheets include total assets

that can be used only to settle obligations of the Company’s consolidated VIEs totaling $520.8 million and $515.1 million

as of June 30, 2023 and December 31, 2022, respectively, and total liabilities of the Company’s consolidated VIEs for

which creditors do not have recourse to the general credit of the primary beneficiary of $145.8 million and $133.5 million as

of June 30, 2023 and December 31, 2022, respectively. The VIE balances do not include $325.5 million of investment in affiliates

and $5.4 million of amounts due to affiliates as of June 30, 2023 and $304.8 million of investment in affiliates and $30.3 million

of amounts due from affiliates as of December 31, 2022 as these are eliminated upon consolidation and not presented within the consolidated

balance sheets.

APOLLO MEDICAL HOLDINGS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

(UNAUDITED)

| | |

Three Months Ended

June 30, | | |

Six Months Ended

June 30, | |

| | |

2023 | | |

2022

(restated) | | |

2023 | | |

2022

(restated) | |

| Revenue | |

| | | |

| | | |

| | | |

| | |

| Capitation, net | |

$ | 300,549 | | |

$ | 227,623 | | |

$ | 600,753 | | |

$ | 449,682 | |

| Risk pool settlements and incentives | |

| 20,121 | | |

| 18,793 | | |

| 33,583 | | |

| 36,868 | |

| Management fee income | |

| 12,493 | | |

| 9,984 | | |

| 22,389 | | |

| 20,457 | |

| Fee-for-service, net | |

| 13,262 | | |

| 11,740 | | |

| 25,324 | | |

| 22,835 | |

| Other revenue | |

| 1,784 | | |

| 1,557 | | |

| 3,404 | | |

| 3,112 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total revenue | |

| 348,209 | | |

| 269,697 | | |

| 685,453 | | |

| 532,954 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Cost of services, excluding depreciation and amortization | |

| 292,876 | | |

| 230,070 | | |

| 582,273 | | |

| 450,798 | |

| General and administrative expenses | |

| 24,056 | | |

| 19,894 | | |

| 45,236 | | |

| 31,837 | |

| Depreciation and amortization | |

| 4,248 | | |

| 4,351 | | |

| 8,541 | | |

| 8,725 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total expenses | |

| 321,180 | | |

| 254,315 | | |

| 636,050 | | |

| 491,360 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income from operations | |

| 27,029 | | |

| 15,382 | | |

| 49,403 | | |

| 41,594 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense) | |

| | | |

| | | |

| | | |

| | |

| Income from equity method investments | |

| 2,723 | | |

| 1,512 | | |

| 5,207 | | |

| 2,945 | |

| Interest expense | |

| (3,632 | ) | |

| (1,854 | ) | |

| (6,901 | ) | |

| (2,927 | ) |

| Interest income | |

| 3,327 | | |

| 421 | | |

| 6,335 | | |

| 467 | |

| Unrealized gain (loss) on investments | |

| 859 | | |

| (1,866 | ) | |

| (5,533 | ) | |

| (10,829 | ) |

| Other income | |

| 1,185 | | |

| 3,034 | | |

| 2,389 | | |

| 3,647 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total other income (expense), net | |

| 4,462 | | |

| 1,247 | | |

| 1,497 | | |

| (6,697 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income before provision for income taxes | |

| 31,491 | | |

| 16,629 | | |

| 50,900 | | |

| 34,897 | |

| | |

| | | |

| | | |

| | | |

| | |

| Provision for income taxes | |

| 14,009 | | |

| 5,352 | | |

| 20,930 | | |

| 12,170 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income | |

| 17,482 | | |

| 11,277 | | |

| 29,970 | | |

| 22,727 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) attributable to non-controlling interest | |

| 4,312 | | |

| (673 | ) | |

| 3,668 | | |

| (2,987 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net income attributable to Apollo Medical Holdings, Inc. | |

$ | 13,170 | | |

$ | 11,950 | | |

$ | 26,302 | | |

$ | 25,714 | |

| | |

| | | |

| | | |

| | | |

| | |

| Earnings per share – basic | |

$ | 0.28 | | |

$ | 0.27 | | |

$ | 0.57 | | |

$ | 0.57 | |

| | |

| | | |

| | | |

| | | |

| | |

| Earnings per share – diluted | |

$ | 0.28 | | |

$ | 0.26 | | |

$ | 0.56 | | |

$ | 0.56 | |

Reconciliation of Net Income to EBITDA and Adjusted EBITDA

| | |

Three Months Ended

June 30, | | |

Six Months Ended

June 30, | |

| (in thousands) | |

2023 | | |

2022 (restated) | | |

2023 (restated) | | |

2022 (restated) | |

| Net income | |

$ | 17,482 | | |

$ | 11,277 | | |

$ | 29,970 | | |

$ | 22,727 | |

| Interest expense | |

| 3,632 | | |

| 1,854 | | |

| 6,901 | | |

| 2,927 | |

| Interest income | |

| (3,327 | ) | |

| (421 | ) | |

| (6,335 | ) | |

| (467 | ) |

| Provision for income taxes | |

| 14,009 | | |

| 5,352 | | |

| 20,930 | | |

| 12,170 | |

| Depreciation and amortization | |

| 4,248 | | |

| 4,351 | | |

| 8,541 | | |

| 8,725 | |

| EBITDA | |

| 36,044 | | |

| 22,413 | | |

| 60,007 | | |

| 46,082 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income from equity method investments | |

| (297 | ) | |

| (180 | ) | |

| (546 | ) | |

| (328 | ) |

| Other, net | |

| (1,618 | ) (1) | |

| — | | |

| (216 | )(1) | |

| — | |

| Stock-based compensation | |

| 4,213 | | |

| 3,920 | | |

| 7,658 | | |

| 6,975 | |

| APC excluded assets costs | |

| (2,570 | ) | |

| (1,247 | ) | |

| (1,304 | ) | |

| 6,537 | |

| Adjusted EBITDA | |

$ | 35,772 | | |

$ | 24,906 | (2) | |

$ | 65,599 | | |

$ | 59,266 | (2) |

(1) Other, net for the three and six

months ended June 30, 2023 relates to non-cash changes in the fair value of our financing obligation to purchase the remaining equity

interests, changes in the fair value of our contingent liabilities, and changes in the fair value of the Company's Collar Agreement.

(2) Adjusted EBITDA under the historical

method for the three and six months ended June 30, 2022 was $36.9 million and $75.1 million, respectively. See “Use

of Non-GAAP Financial Measures” below for additional information on change of methodology.

Guidance Reconciliation of Net Income to EBITDA and Adjusted EBITDA

| | |

2023 Guidance Range | |

| (in thousands) | |

Low | | |

High | |

| Net income | |

$ | 49,500 | | |

$ | 71,500 | |

| Interest expense | |

| 1,000 | | |

| 1,000 | |

| Provision for income taxes | |

| 23,000 | | |

| 38,000 | |

| Depreciation and amortization | |

| 16,000 | | |

| 19,000 | |

| EBITDA | |

| 89,500 | | |

| 129,500 | |

| | |

| | | |

| | |

| Loss (income) from equity method investments | |

| (750 | ) | |

| (750 | ) |

| Other, net | |

| 3,250 | | |

| 3,250 | |

| Stock-based compensation | |

| 16,000 | | |

| 16,000 | |

| APC excluded assets costs | |

| 12,000 | | |

| 12,000 | |

| Adjusted EBITDA | |

$ | 120,000 | | |

$ | 160,000 | |

Use of Non-GAAP Financial Measures

This earnings release contains the non-GAAP financial

measures EBITDA and Adjusted EBITDA, of which the most directly comparable financial measure presented in accordance with U.S. generally

accepted accounting principles (“GAAP”) is net income. These measures are not in accordance with, or alternatives to GAAP,

and may be calculated differently from similar non-GAAP financial measures used by other companies. The Company uses Adjusted EBITDA as

a supplemental performance measure of our operations, for financial and operational decision-making, and as a supplemental means of evaluating

period-to-period comparisons on a consistent basis. Adjusted EBITDA is calculated as earnings before interest, taxes, depreciation, and

amortization, excluding income or loss from equity method investments, non-recurring and non-cash transactions, stock-based compensation,

and APC excluded assets costs. Beginning in the third quarter ended September 30, 2022, the Company has revised the calculation for Adjusted

EBITDA to exclude provider bonus payments and losses from recently acquired IPAs, which it believes to be more reflective of its business.

The Company believes the presentation of these

non-GAAP financial measures provides investors with relevant and useful information, as it allows investors to evaluate the operating

performance of the business activities without having to account for differences recognized because of non-core or non-recurring financial

information. When GAAP financial measures are viewed in conjunction with non-GAAP financial measures, investors are provided with a more

meaningful understanding of the Company’s ongoing operating performance. In addition, these non-GAAP financial measures are among

those indicators the Company uses as a basis for evaluating operational performance, allocating resources, and planning and forecasting

future periods. Non-GAAP financial measures are not intended to be considered in isolation, or as a substitute for, GAAP financial measures.

To the extent this release contains historical or future non-GAAP financial measures, the Company has provided corresponding GAAP financial

measures for comparative purposes. The reconciliation between certain GAAP and non-GAAP measures is provided above.

Exhibit 99.2

1 Powered by Technology. Built by Doctors. For Patients. Apollo Medical Holdings (NASDAQ: AMEH) Second Quarter 2023 Earnings Call Supplement August 7, 2023

Forward - Looking Statements This presentation contains forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 , Section 27A of the Securities Act and Section 21E of the Exchange Act. Forward - looking statements include any statements about t he Company's business, financial condition, operating results, plans, objectives, expectations and intentions, expansion plans, int egration of acquired companies and any projections of earnings, revenue, EBITDA, Adjusted EBITDA or other financial items, such as the Company's projected capitation and future liquidity, and may be identified by the use of forward - looking terms such as “anticipa te,” “could,” “can,” “may,” “might,” “potential,” “predict,” “should,” “estimate,” “expect,” “project,” “believe,” “plan,” “envisi on, ” “intend,” “continue,” “target,” “seek,” “will,” “would,” and the negative of such terms, other variations on such terms or other simila r o r comparable words, phrases or terminology. Forward - looking statements reflect current views with respect to future events and financial performance and therefore cannot be guaranteed. Such statements are based on the current expectations and certain assumptions of the Company’s management, and some or all of such expectations and assumptions may not materialize or may vary significantly from actual results. Actual results may also vary materially from forward - looking statements due to risks, uncerta inties and other factors, known and unknown, including the risk factors described from time to time in the Company’s reports to the U.S. Securities and Exchange Commission (the “SEC”), including without limitation the risk factors discussed in the Company's Annu al Report on Form 10 - K for the year ended December 31, 2022, and subsequent Quarterly Reports on Form 10 - Q. Because the factors referred to above could cause actual results or outcomes to differ materially from those expressed or imp lie d in any forward - looking statements, you should not place undue reliance on any such forward - looking statements. Any forward - looking statements speak only as of the date of this presentation and, unless legally required, the Company does not undertake any ob lig ation to update any forward - looking statement, as a result of new information, future events or otherwise. 2

15 * ma naged IPAs and groups 1.3M managed lives Company Overview 3 12,000+ contracted physicians 25+ years in operation ApolloMed is a technology - powered, value - based healthcare platform that enables the delivery of high - quality, coordinated, efficient, and accessible care for all through the following business segments: Care Enablement delivers an integrated clinical and administrative platform to enable payers and providers in the delivery of high - quality, value - based care. Care Partners enables aligned providers to participate in high - performing, risk - bearing organizations. Care Delivery provides patient - centric clinical operations, including primary care, multi - specialty, and ancillary services. ApolloMed At - A - Glance Ticker NASDAQ: AMEH Headquarters Alhambra, California Recent Stock Price (as of 8/4/2023) $37.67 Market Cap (as of 8/4/2023) $2.2 billion Common Shares Outstanding* (as of 8/1/2023) 57.6 million Book Value Per Common Share $9.94 TTM Revenues $1.30 billion IPA: independent physician association *As of 6/30/2023 *Includes 10.6 million in treasury shares Information as of 6/30/2023 unless otherwise noted

Highlights 4 Operational updates Revenue $348.2M 29% Net income attr. to AMEH $13.2M 10% EPS – diluted $0.28 8% Adj. EBITDA* $35.8M 44% *See “Reconciliation of Net Income to EBITDA and Adjusted EBITDA” and “Use of Non - GAAP Financial Measures” slides for more infor mation. Please note that beginning the third quarter ended September 30, 2022, the Company has revised the calculation for Adjusted EBITDA to exclude addbacks relat ed to provider bonus payments and losses from recently acquired IPAs, which it believes to be more reflective of its business. • Formed a long - term partnership with a primary care group in California with over 50 providers • Expected to be onboarded onto Care Enablement (CE) platform by September 1, 2023 • Entered definitive agreement to acquire assets relating to Texas Independent Providers, a primary care service provider serving patients in Houston metro with a network of over 120 providers • Transaction expected to close in Q3 2023 and providers onboarded onto CE platform by end of 2023 • Formed partnership with IntraCare , an operator of a value - based primary care network with over 425 providers in Texas & Oklahoma • Expected to be onboarded onto CE platform by end of 2023 Q2 2023 financial results % vs. prior - year period

Historical Financial Profile 5 2021 Adjusted EBITDA benefitted from tailwinds of lower utilization during the COVID - 19 pandemic; Return to pre - pandemic utilization in 2022 and 2023 $561 $687 $774 $1,144 $1,300 - $1,500 Historical Revenue Growth ($ in millions) 2019 2020 2021 2022 2023 26% CAGR from 2019 - 2023E $54.2 $102.8 $133.5 $140.0 ($ in millions) Historical Adjusted EBITDA (1) 27% CAGR from 2019 - 2023E 2019 2020 2021 2022 2023 $120.0 - $160.0 (1) See “Use of Non - GAAP Financial Measures” slide for more information

Tax Restatement 6 Note: 2019 was immaterial and therefore no restatement As Restated As Original $ Change $ in 000s except per share data 2022 2021 2020 2022 2021 2020 2022 2021 2020 Income before provision for income tax $ 86,616 77,748 178,427 $ 86,616 77,748 178,427 $ - - - Provision for income tax 40,875 31,693 56,344 36,085 28,454 56,107 4,790 3,239 237 Net income 45,741 46,055 122,083 50,531 49,294 122,320 (4,790) (3,239) (237) Net income (loss) attributable to non - controlling interest 570 (22,868) 84,395 1,482 (24,564) 84,454 (912) 1,696 (59) Net income attributable to Apollo Medical Holdings 45,171 68,923 37,688 49,049 73,858 37,866 (3,878) (4,935) (178) Earnings per share – basic $ 1.00 1.57 1.03 $ 1.09 1.69 1.04 $ (0.09) (0.12) (0.01) Earnings per share – diluted $ 0.99 1.52 1.01 $ 1.08 1.63 1.01 $ (0.09) (0.11) - Please see Form 8 - K filed on August 7, 2023, for more details. In summary: • The Company did not appropriately account for the income tax impact associated with certain intercompany dividends and also neglected to include certain loss generating entities in certain consolidated tax filing groups. • Going forward, we are evaluating changes to our tax structure to reduce the current effective tax rate and amount of cash tax es. • We expect to have this put in place by the fourth quarter of 2023, which we believe will result in a normalized tax rate movi ng forward. • There was no impact on GAAP and non - GAAP measures the Company reports, including revenue, gross profit, pretax income from continuing operations, EBITDA, or Adjusted EBITDA, in past and go - forward periods as a result of this tax - related restateme nt.

Summary of Selected Financial Results 7 Three Months Ended June 30, Six Months Ended June 30, $ in 000s except per share data 2023 2022 (restated) 2023 (restated) 2022 (restated) Revenue Capitation, net $ 300,549 $ 227,623 $ 600,753 $ 449,682 Risk pool settlements and incentives 21,121 18,793 33,583 36,868 Management fee income 12,493 9,984 22,389 20,457 Fee - for - service, net 13,262 11,740 25,324 22,835 Other income 1,784 1,557 3,404 3,112 Total revenue 348,209 269,697 685,453 532,954 Total expenses 321,180 254,315 636,050 491,360 Income from operations 27,029 15,382 49,403 41,594 Net income 17,482 11,277 29,970 22,727 Net income (loss) attributable to noncontrolling interests 4,312 (673) 3,668 (2,987) Net income attributable to ApolloMed $ 13,170 $ 11,950 $ 26,302 $ 25,714 Earnings per share – diluted $ 0.28 $ 0.26 $ 0.56 $ 0.56 EBITDA $ 36,044 $ 22,413 $ 60,007 $ 46,082 Adjusted EBITDA $ 35,772 $ 24,906 $ 65,599 $ 59,266

Segment Results 8 $ in 000s Care Enablement Care Partners Care Delivery Other Intersegment Elimination Corporate Costs Consolidated Total Total revenues $ 34,975 325,246 26,718 157 (38,887) - 348,209 % change vs prior year quarter 18% 31% 14% 29% Cost of services 15,162 292,119 22,523 70 (36,988) - 292,876 General and administrative expenses (1) 12,175 5,298 3,626 926 (2,933 ) 9,212 28,304 Total expenses 27,337 297,417 26,149 996 (39,931) 9,212 321,180 Income (loss) from operations $ 7,638 27,829 569 (839) 1044 (2) (9,212) 27,029 % change vs prior year quarter 4% 250% (82%) 76% For the three months ended June 30, 2023 (1) Balance includes general and administrative expenses and depreciation and amortization . (2) Income from operations for the intersegment elimination represents rental income from segments renting from other segments. R ent al income is presented within other income, which is not presented in the table.

Revenue Breakdown 9 For the six months ended June 30, 2023 Revenue by Line of Business Business Mix By Payer Type 87.6% 4.9% 3.3% 3.7% 0.5% Capitation, net Risk Pool Settlements & Incentives Management Fee Income Fee-for-service, net Other Income 64% 20% 12% 4% Medicare Medicaid Commerical Other Third Parties

Balance Sheet Highlights 10 $ in millions 6/30/2023 12/31/2022 $ Change % Change Cash and cash equivalents and investments in marketable securities* $297.7 $293.6 $4.1 1.0% Working capital $280.0 $279.5 $0.5 0.2% Total stockholders’ equity $566.0 $542.6 $23.4 4.3% *Excluding restricted cash

2023 Guidance 11 $ in millions, except for per share information Actual YE 2022 Results 2023 Guidance Range Total Revenue $1,144.2 $1,300.0 - $1,500.0 Net Income (1) $50.5 $49.5 - $71.5 EBITDA (1,2) $110.1 $89.5 - $129.5 Adjusted EBITDA (2) $140.0 $120.0 - $160.0 EPS – Diluted $1.08 $0.95 - $1.20 (1) Net income and EBITDA forecast includes the impact of APC excluded assets, which assume no change in value. (2) See “Reconciliation of Net Income to EBITDA and Adjusted EBITDA,” “Guidance Reconciliation of Net Income to EBITDA and Adjust ed EBITDA” and “Use of Non - GAAP Financial Measures” slides for more information. There can be no assurance that actual amounts will not be materially higher or lower than these expectations. See “Forward - Looking Statements” on slide 2.

Reconciliation of Net Income to EBITDA and Adjusted EBITDA 12 (1) See “Use of Non - GAAP Financial Measures” slide for more information. (2) Other, net for the three and six months ended June 30, 2023, relates to non - cash changes in the fair value of the Company’s fina ncing obligations to purchase the remaining equity interest, changes in the fair value of its contingent liabilities, and changes in the fair value of the Comp any ’s Collar Agreement. (3) Adjusted EBITDA under the historical method for the three and six months ended June 30, 2023, was $36.9 million and $75.1 mil lio n, respectively. See “Use of Non - GAAP Financial Measures” slide for additional information on change of methodology. ($ in millions) 2023 2022 2023 2022 Net income $ 17.5 $ 11.3 $ 30.0 $ 22.7 Interest expense 3.6 1.9 6.9 2.9 Interest income (3.3) (0.4) (6.3) (0.5) Provision for income taxes 14.0 5.4 20.9 12.2 Depreciation and amortization 4.2 4.4 8.5 8.7 EBITDA (1) $ 36.0 $ 22.4 $ 60.0 $ 46.1 Income from equity method investments $ (0.3) $ (0.2) $ (0.5) $ (0.3) Other, net (2) (1.6) - (0.2) - Stock-based compensation 4.2 3.9 7.7 7.0 APC excluded assets costs (2.6) (1.2) (1.3) 6.5 Adjusted EBITDA (1,3) $ 35.8 $ 24.9 $ 65.6 $ 59.3 Three Months Ended June 30, Six Months Ended June 30,

Guidance Reconciliation of Net Income to EBITDA and Adjusted EBITDA 13 (1) See “Use of Non - GAAP Financial Measures” slide for more information. ($ in millions) Low High Net income $ 49.5 $ 71.5 Interest expense 1.0 1.0 Provision for income taxes 23.0 38.0 Depreciation and amortization 16.0 19.0 EBITDA (1) $ 89.5 $ 129.5 Income from equity method investments $ (0.8) $ (0.8) Other, net 3.3 3.3 Stock-based compensation 16.0 16.0 APC excluded assets costs 12.0 12.0 Adjusted EBITDA (1) $ 120.0 $ 160.0 Year Ending December 31, 2023

14 Six Months Ended June 30, 2023 Six Months Ended June 30, 2022 $ in millions ApolloMed Consolidated Excluded Assets (1) ApolloMed Assets ApolloMed Consolidated Excluded Assets (1) ApolloMed Assets Revenue Capitation, net $ 600.8 - 600.8 $ 449.7 - 449.7 Risk pool settlements and incentives 33.6 - 33.6 36.9 - 36.9 Management fee income 22.4 - 22.4 20.5 - 20.5 Fee - for - service, net 25.3 - 25.3 22.8 - 22.8 Other income 3.4 - 3.4 3.1 - 3.1 Total revenue 685.5 - 685.5 533.0 - 533.0 Total operating expenses 636.0 1.3 634.8 491.3 1.6 489.7 Income (loss) from operations 49.4 (1.3) 50.7 41.7 (1.6) 43.3 Total other income (expense), net 1.5 2.1 (0.6) (6.7) (8.5) 1.8 Net income (loss) $ 30.0 0.9 29.1 $ 22.8 (10.1) 32.9 Summary of Selected Financial Results – Breaking Out Excluded Assets (1) Includes AP Excluded Assets and certain other assets such as APC's minority interests in LMA and PMIOC where APC owns the as set but not the right to the dividends associated with those assets. (1)

15 Summary Balance Sheet – Breaking Out Excluded Assets $ in millions ApolloMed Consolidated Excluded Assets ApolloMed Assets ApolloMed Consolidated Excluded Assets ApolloMed Assets Current assets Cash and cash equivalents $ 294.2 13.1 281.1 $ 288.0 30.2 257.8 Investments in marketable securities 3.8 1.1 2.7 5.6 4.5 1.1 Receivables, net 66.9 - 66.9 49.6 - 49.6 Receivables - related parties and loan receivable - related party 82.8 - 82.8 67.2 - 67.2 Other receivables, prepaid expenses and other current assets 17.3 1.2 16.1 17.6 0.8 16.8 Income taxes receivable - - - - (1.1) 1.1 Total current assets 465.0 15.4 449.6 428.0 34.4 393.6 Non-current assets Land, property, and equipment, net 123.9 116.9 7.0 108.5 101.3 7.2 Goodwill and intangibles 348.4 - 348.4 346.0 - 346.0 Loan receivable and loan receivable - related parties, net of current portion - - - - - - Income taxes receivable, non-current 15.9 - 15.9 15.9 - 15.9 Investments in other entities and privately held entities 48.7 32.2 16.5 41.2 27.6 13.6 Other assets and right-of-use assets 25.1 4.2 20.9 26.5 3.2 23.3 Total non-current assets 562.0 153.3 408.7 538.1 132.1 406.0 Total assets $ 1,027.0 168.7 858.3 $ 966.1 166.5 799.6 June 30, 2023 December 31, 2022 (1) Includes AP Excluded Assets and certain other assets such as APC's minority interests in LMA and PMIOC where APC owns the as set but not the right to the dividends associated with those assets. (1) (1)

16 Summary Balance Sheet – Breaking Out Excluded Assets (continued) $ in millions ApolloMed Consolidated Excluded Assets ApolloMed Assets ApolloMed Consolidated Excluded Assets ApolloMed Assets Current liabilities Fiduciary payable, accounts payable and accrued liabilities $ 58.5 0.7 57.8 $ 57.7 2.8 54.9 Medical liabilities 100.0 - 100.0 81.3 - 81.3 Income taxes payable 19.6 1.1 18.5 4.3 - 4.3 Dividend payable 0.6 - 0.6 0.7 - 0.7 Finance and operating lease liabilities 3.6 0.1 3.5 4.2 - 4.2 Current portion of long-term debt 2.6 0.6 2.0 0.6 0.6 - Total current liabilities 184.9 2.5 182.4 148.8 3.4 145.4 Non-current liabilities Deferred tax liability 12.4 0.9 11.5 14.2 0.9 13.3 Finance and operating lease liabilities, net of current portion 19.0 0.90 18.1 21.2 - 21.2 Other long-term liabilities 21.4 - 21.4 20.3 - 20.3 Long-term debt, net of current portion and deferred financing costs 205.1 27.9 177.2 203.4 26.6 176.8 Total non-current liabilities 257.9 29.7 228.2 259.1 27.5 231.6 Total liabilities 442.8 32.2 410.6 407.9 30.9 377.0 Total mezzanine equity and stockholder's equity $ 584.2 136.5 447.1 $ 558.2 135.6 422.6 June 30, 2023 December 31, 2022 (1) Includes AP Excluded Assets and certain other assets such as APC's minority interests in LMA and PMIOC where APC owns the as set but not the right to the dividends associated with those assets. (1) (1)

Summary Cash Flow Statement – Breaking Out Excluded Assets 17 $ in millions ApolloMed Consolidated Excluded Assets ApolloMed Assets ApolloMed Consolidated Excluded Assets ApolloMed Assets Cash flows from operating activities Net income $ 30.0 0.9 29.1 $ 22.7 (10.1) 32.8 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization $ 8.5 0.8 7.7 $ 8.7 0.5 8.2 Amortization of debt issuance cost 0.5 - 0.5 0.5 - 0.5 Share-based compensation 7.7 - 7.7 7.0 - 7.0 Unrealized loss on investments 5.5 3.5 2.0 13.7 11.3 2.4 Gain on sales of investment - - - (2.3) - (2.3) Loss (income) from equity method investments, net (5.2) (4.7) (0.5) (2.9) (0.1) (2.8) Unrealized gain on interest rate swaps - - - (2.8) (2.8) - Deferred tax (3.7) - (3.7) 3.4 - 3.4 Changes in operating assets and liabilities, net of acquisition amounts: Receivables, net, receivable, net - related parties, other receivable, prepaid expenses and other current assets, right of use assets, other assets, fiduciary accounts payable, medical liabilities, and operating lease liabilities (22.4) (0.5) (21.9) (15.1) 0.7 (15.8) Accounts payable and accrued liabilities (2.9) (2.1) (0.8) 14.2 (0.1) 14.3 Income taxes payable 15.3 - 15.3 (14.0) - (14.0) Net cash provided by (used in) operating activities $ 33.3 (2.1) 35.4 $ 33.1 (0.6) 33.7 June 30, 2022June 30, 2023 (1) Includes AP Excluded Assets and certain other assets such as APC's minority interests in LMA and PMIOC where APC owns the as set but not the right to the dividends associated with those assets. (1) (1)

Summary Cash Flow Statement – Breaking Out Excluded Assets (continued) 18 $ in millions ApolloMed Consolidated Excluded Assets ApolloMed Assets ApolloMed Consolidated Excluded Assets ApolloMed Assets Cash flows from investing activities Payments for business and asset acquisition, net of cash acquired $ 0.4 - 0.4 $ (0.9) - (0.9) Proceeds from repayment of loans receivable - related parties 2.1 - 2.1 4.0 4.0 - Purchase of marketable securities (2.0) - (2.0) $ (1.8) - (1.8) Purchase of investments - privately held (2.0) - (2.0) - - - Purchase of investments - equity method (0.3) - (0.3) - - - Proceeds from sale of marketable securities - - - 6.5 (0.1) 6.6 Distribution from investments - equity method - - - 0.4 0.4 - Contribution to investment - equity method - - - (1.7) (1.7) - Purchases of property and equipment -17.4 -16.4 -1.0 -18.8 -17.8 -1.0 Net cash (used in) provided by investing activities (19.2) (16.4) (2.8) (12.3) (15.2) 2.9 Cash flows from financing activities Dividends paid $ (0.8) - (0.8) $ (12.6) (10.0) (2.6) Repayments on long-term debt (0.3) (0.3) - (0.2) (0.2) - Payment of finance lease obligations (0.3) - (0.3) (0.3) - (0.3) Proceeds from exercise of stock options and warrants 1.3 - 1.3 1.7 - 1.7 Repurchase of common stock - - (9.5) - (9.5) Repurchase of treasury shares (9.5) - (9.5) - - - Purchase of non-controlling interest (0.1) - (0.1) (0.2) - (0.2) Proceeds from sale of non-controlling interest - - - - - - Borrowings on loans 1.7 1.6 0.1 1.2 0.6 0.6 Amounts due from affiliates - - - - (16.6) 16.6 Net cash (used in) provided by financing activities $ (8.0) 1.3 (9.3) $ (19.9) (26.2) 6.3 Net change in cash and cash equivalents 6.1 (17.2) 23.3 1.1 (41.9) 43.0 Cash and cash equivalents at beginning of year $ 288.0 30.2 257.8 $ 233.1 62.5 170.6 Cash and cash equivalents at end of year $ 294.1 13.0 281.1 $ 234.2 20.6 213.6 June 30, 2022June 30, 2023(1) Includes AP Excluded Assets and certain other assets such as APC's minority interests in LMA and PMIOC where APC owns the as set but not the right to the dividends associated with those assets. (1) (1)

Use of Non - GAAP Financial Measures This presentation contains the non - GAAP financial measures EBITDA and Adjusted EBITDA, of which the most directly comparable fin ancial measure presented in accordance with U.S. generally accepted accounting principles (“GAAP”) is net income. These measures are not in acc ordance with, or alternatives to GAAP, and may be different from other non - GAAP financial measures used by other companies. The Company uses Adju sted EBITDA as a supplemental performance measure of our operations, for financial and operational decision - making, and as a supplemental means o f evaluating period - to - period comparisons on a consistent basis. Adjusted EBITDA is calculated as earnings before interest, taxes, depreciation, and am ortization, excluding income or loss from equity method investments, non - recurring transactions, stock - based compensation, and APC excluded assets costs. Beg inning in the third quarter ended September 30, 2022, the Company has revised the calculation for Adjusted EBITDA to exclude provider bonus payme nts and losses from recently acquired IPAs, which it believes to be more reflective of its business. The Company believes the presentation of these non - GAAP financial measures provides investors with relevant and useful informati on, as it allows investors to evaluate the operating performance of the business activities without having to account for differences recogniz ed because of non - core or non - recurring financial information. When GAAP financial measures are viewed in conjunction with non - GAAP financial measures, in vestors are provided with a more meaningful understanding of the Company’s ongoing operating performance. In addition, these non - GAAP financial measu res are among those indicators the Company uses as a basis for evaluating operational performance, allocating resources, and planning and forecas tin g future periods. Non - GAAP financial measures are not intended to be considered in isolation, or as a substitute for, GAAP financial measures. To t he extent this release contains historical or future non - GAAP financial measures, the Company has provided corresponding GAAP financial measures for comparative purposes. The reconciliation between certain GAAP and non - GAAP measures is provided above. 19

20 For inquiries, please contact: ApolloMed Investor Relations (626) 943 - 6491 investors@apollomed.net Carolyne Sohn, The Equity Group (408) 538 - 4577 csohn@equityny.com

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

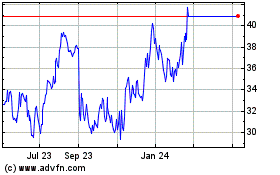

Apollo Medical (NASDAQ:AMEH)

Historical Stock Chart

From Feb 2025 to Mar 2025

Apollo Medical (NASDAQ:AMEH)

Historical Stock Chart

From Mar 2024 to Mar 2025