0001083446

false

0001083446

2023-09-08

2023-09-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington,

DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

September 8, 2023

APOLLO MEDICAL HOLDINGS, INC.

(Exact Name of Registrant as Specified in its Charter)

| Delaware |

001-37392 |

95-4472349 |

| (State or Other Jurisdiction |

(Commission |

(I.R.S. Employer |

| of Incorporation) |

File Number) |

Identification No.) |

1668 S. Garfield Avenue, 2nd Floor, Alhambra, California 91801

(Address of Principal Executive Offices) (Zip Code)

(626) 282-0288

Registrant’s Telephone Number, Including

Area Code

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock |

AMEH |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry into a Material Definitive Agreement. |

On September 8, 2023, Apollo Medical Holdings, Inc. (the “Company”)

entered into the Second Amendment to Amended and Restated Credit Agreement and Waiver (the “Amendment”) to the Amended and

Restated Credit Agreement, dated as of June 16, 2021, by and among the Company, as borrower, the lenders party thereto, and Truist Bank,

as administrative agent (as amended, the “Credit Agreement”). Among other things, the Amendment (i) increased the letter

of credit sub-facility from $25.0 million to $50.0 million; (ii) revised the form of compliance certificate required to be submitted by

the Company to the lenders on a quarterly basis; and (iii) waived the Specified Events of Default (as defined in the Amendment) that occurred

under the Credit Agreement, relating to the Company’s calculation of Consolidated Total Net Leverage Ratio (as defined in the Credit

Agreement) and payment of certain interest and letter of credit fees, in each case, for the periods from the quarter ended September 30,

2021 through the quarter ended March 31, 2023 (the “Prior Periods”). The Company also provided the lenders with updated calculations

of Consolidated Total Net Leverage Ratio and Consolidated Interest Coverage Ratio (each as defined in the Credit Agreement) for the Prior

Periods and paid an aggregate fee of $200,000 to the lenders, as payment in full of the interest and letter of credit fees due for the

Prior Periods as a result of the Specified Events of Default.

The above description of the Amendment does not purport to be complete

and is subject to, and qualified in its entirety by, the full text of the Amendment, a copy of which is filed as Exhibit 10.1 to this

Current Report on Form 8-K and is incorporated herein by reference.

| Item 2.03 | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The information set forth in Item 1.01 of this Current Report on Form

8-K is incorporated by reference into this item.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

Exhibit

No. |

|

Description |

| 10.1 |

|

Second Amendment to Amended and Restated Credit Agreement and Waiver, dated as of September 8, 2023, by and among Apollo Medical Holdings, Inc., as borrower, Network Medical Management, Inc., as guarantor, the lenders party thereto, and Truist Bank, as administrative agent, issuing bank and the swingline lender. |

| 104 |

|

Cover Page Interactive Data File (the cover page XBRL tags are embedded within the inline XBRL document) |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

APOLLO MEDICAL HOLDINGS, INC. |

| |

|

| Date: September 8, 2023 |

By: |

/s/ Thomas S. Lam |

| |

Name: |

Thomas S. Lam, M.D., M.P.H. |

| |

Title: |

Co-Chief Executive Officer and President |

Exhibit 10.1

SECOND AMENDMENT TO AMENDED AND RESTATED CREDIT

AGREEMENT AND WAIVER

THIS SECOND AMENDMENT TO

AMENDED AND RESTATED CREDIT AGREEMENT AND WAIVER, dated as of September 8, 2023 (this “Amendment”), is made

by and among APOLLO MEDICAL HOLDINGS, INC., a Delaware corporation (the “Borrower”), NETWORK MEDICAL

MANAGEMENT, INC., a California corporation (the “Guarantor”), each of the banks and other financial institutions

signatory hereto as “Lenders” and TRUIST BANK, in its capacity as Administrative Agent (in such capacity, the “Administrative

Agent”) for the Lenders, as Issuing Bank and as the Swingline Lender.

W I T N E S S E T H:

WHEREAS, the Borrower, the

Lenders and the Administrative Agent are parties to that certain Amended and Restated Credit Agreement dated as of June 16, 2021

(as amended by that certain First Amendment to Amended and Restated Credit Agreement dated as of December 20, 2022, and as otherwise

amended, restated, supplemented or modified from time to time prior to the date hereof, the “Existing Credit Agreement”);

WHEREAS, the Administrative

Agent and the Lenders have been made aware that certain Events of Default have occurred and are continuing under (a) Sections

8.1(c) and 8.1(d) of the Credit Agreement (collectively, the “Specified Reporting Events of Default”)

as a result of the Borrower’s failure to accurately calculate and report the Consolidated Total Net Leverage Ratio in the Compliance

Certificates delivered for the reporting periods commencing with the Fiscal Quarter ended September 30, 2021 through the Fiscal Quarter

ended March 31, 2023 (the “Subject Periods”) due to the failure to (i) calculate “Consolidated Total

Net Debt” as required by the definition thereof by (A) incorrectly deducting debt issuance costs from the total principal amount

of Indebtedness (which is permitted to be deducted under GAAP, but is not permitted to be deducted for purposes of determining “Consolidated

Total Net Debt” under the Existing Credit Agreement), (B) not including the face amount of issued and outstanding Letters of

Credit as “Consolidated Total Net Debt”, (C) not including Capital Lease Obligations as “Consolidated Total Net

Debt” and (D) not including the deferred acquisition consideration (including the requirement to purchase the remaining equity

of a target) as “Consolidated Total Net Debt” resulting from the acquisitions of David C.P. Chen M.D., Inc., DBA Diagnostic

Medical Group and Sun Clinical Laboratories, and (ii) reduce Consolidated EBITDA by an amount equal to the net income attributable

to the Capital Stock of David C.P. Chen M.D., Inc., DBA Diagnostic Medical Group and Sun Clinical Laboratories that is owned by unaffiliated

third parties (as required by clause (iii)(c) of the definition of “Consolidated EBITDA”); and (b) Section 8.1(b) of

the Credit Agreement (the “Specified Payment Events of Default”; and together with the Specified Reporting Events of

Default, collectively, the “Specified Events of Default”) as a result of the Borrower’s failure to pay the appropriate

amount of interest and letter of credit fees for certain prior periods due to the application of an incorrect Applicable Margin resulting

from the Specified Reporting Events of Default;

WHEREAS, the Borrower has

requested that the Administrative Agent and the Required Lenders (1) waive the Specified Events of Default and (2) amend certain

provisions of the Existing Credit Agreement, all as more particularly set forth below; and

WHEREAS, subject to the terms

and conditions set forth herein, the Administrative Agent and the Required Lenders are willing to waive the Specified Events of Default

and amend the Existing Credit Agreement.

NOW, THEREFORE, for and in

consideration of the above premises and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged

by the parties hereto, the parties hereto hereby agree as follows:

Section 1.

Defined Terms. Except as otherwise defined herein, capitalized terms used but not defined herein shall have the respective meanings

ascribed to such terms in the Existing Credit Agreement, as amended by this Amendment (the “Amended Credit Agreement”).

Section 2. Amendments

to Existing Credit Agreement and Loan Documents. The Loan Parties, the Administrative Agent and the Lenders signatory hereto (which,

for the avoidance of doubt, constitute “Required Lenders”) hereby agree to the following amendments:

(a) Section 1.1

of the Existing Credit Agreement is hereby amended by deleting the reference to “$25,000,000” in the definition of “LC

Commitment” and substituting reference to “$50,000,000” in lieu thereof.

(b) Section 10.1(a)(i) of

the Existing Credit Agreement is hereby amended by deleting the “To the Borrower:” address and contact information and substituting

the following new address and contact information for the Borrower in lieu thereof:

| |

“To the Borrower: |

Apollo Medical Holdings, Inc.

1668 S. Garfield Avenue, 2nd Floor

Alhambra, CA 91801

Attention: Chan Basho, CFO

Email:

CBasho@networkmedicalmanagement.com

Telephone Number: 626-943-6008” |

(c) The

Exhibits to the Existing Credit Agreement are hereby amended to replace Exhibit 5.1(c) (Form of Compliance Certificate)

in its entirety with the corresponding new Exhibit 5.1(c) set forth in Annex B attached hereto.

Section 3. Conditions

Precedent to Effectiveness. This Amendment shall become effective as of the date on which each of the following conditions precedent

are satisfied (such date, the “Second Amendment Effective Date”):

(a) the

Administrative Agent (or its counsel) shall have received a counterpart of this Amendment duly executed by each of the Borrower, the Guarantor,

the Administrative Agent, and the Required Lenders;

(b) the

Administrative Agent shall have received $200,000 for the benefit of each Lender in accordance with its Pro Rata Share of the Commitments

(notwithstanding whether or not such Lender shall have signed this Amendment), which represents payment in full to the Lenders for the

Specified Payment Events of Default;

(c) substantially

concurrent with the effectiveness of this Amendment, the Administrative Agent shall have received evidence of payment by the Borrower

of all reasonable, out-of-pocket fees, charges and disbursements of Alston & Bird LLP, counsel to the Administrative Agent, and

any other fees payable pursuant to the Loan Documents; and

(d) the

representations and warranties in Sections 4 and 5 hereof (including as relates to Annex A attached hereto) shall

be true and correct in all material respects on and as of the date hereof (other than those representations and warranties that are expressly

qualified by a Material Adverse Effect or other materiality, in which case such representations and warranties shall be true and correct

in all respects).

The Loan Parties, the Lenders

and the Administrative Agent hereby acknowledge and agree that as of the date hereof, the conditions precedent to effectiveness as set

forth in this Section 3 have been satisfied and this Amendment is effective as of the date hereof.

Section 4. Representations.

The Loan Parties represent and warrant to the Administrative Agent and the Lenders that:

(a) Power

and Authority. Each of the Loan Parties has the power and authority to execute, deliver and perform the terms and provisions of this

Amendment and the Amended Credit Agreement, and have taken all necessary corporate or equivalent action to duly authorize the execution,

delivery and performance of this Amendment. This Amendment has been duly executed and delivered by each Loan Party. Each of this Amendment

and the Amended Credit Agreement constitutes the legal, valid and binding obligation of the Borrower or the Guarantor (as the case may

be) enforceable in accordance with its terms, except to the extent that the enforceability thereof may be limited by applicable bankruptcy,

insolvency, reorganization, moratorium or other similar laws generally affecting creditors’ rights and by equitable principles.

(b) No

Violation. The execution, delivery and performance by the other Loan Parties of this Amendment, and compliance by them with the terms

and provisions of the Amended Credit Agreement: (i) will not violate any Requirement of Law or any judgment, order or ruling of any

Governmental Authority, (ii) will not violate or result in a default under any Contractual Obligation of the Borrower or any of its

Subsidiaries or any of its assets or give rise to a right thereunder to require any payment to be made by the Borrower or any of its Subsidiaries,

or (iii) will not result in the creation or imposition of any Lien on any asset of any Loan Party except Liens created under the

Loan Documents.

(c) Governmental

Approvals. No order, consent, approval, license, authorization or validation of, or filing, recording or registration with (except

for those that (x) have otherwise been obtained or made on or prior to the date of the effectiveness of this Amendment and which

remain in full force and effect on such date and (y) the failure of which to obtain or make could not, individually or in the aggregate,

reasonably be expected to have a Material Adverse Effect), or exemption by, any Governmental Authority, is required to authorize, or is

required in connection with, (i) the execution, delivery and performance of this Amendment by the Loan Parties or (ii) the legality,

validity, binding effect or enforceability of the Amended Credit Agreement.

(d) No

Default. No Default or Event of Default has occurred and is continuing as of the date hereof (other than the Specified Events of Default

before giving effect to the waiver set forth herein) and no Default or Event of Default will exist immediately after giving effect to

this Amendment.

(e) Annex

A; Revised Applicable Margin. The true, correct and complete calculations of the “Consolidated Total Net Leverage Ratio”

and “Consolidated interest Coverage Ratio” for each of the Subject Periods are attached hereto as Annex A (the “Revised

Calculations”), and the disclosures, representations and warranties relating thereto as set forth in Annex A are accurate

in all material respects. As a result of the revised Consolidated Total Net Leverage Ratio Calculations set forth in Annex A, the

Borrower acknowledges and agrees that the Applicable Margin reflected by “Pricing Level III” on Schedule I to the Existing

Credit Agreement should have applied as a result of the Compliance Certificate delivered for the Fiscal Quarter ended March 31, 2023

(in lieu of “Pricing Level II”, which was applied for each such period) and, as a result, additional interest and letter of

credit fees should have been paid to the Lenders in accordance with their Pro Rata Share of the Commitments during such periods. It is

understood and agreed that all of such interest and letter of credit fees are being paid to the Administrative Agent for the benefit of

the Lenders as a condition to this Amendment pursuant to Section 3(b) hereof.

Section 5. Reaffirmation

of Representations. The Borrower and the other Loan Parties hereby repeat and reaffirm in all material respects all

representations and warranties made to the Administrative Agent and the Lenders in the Existing Credit Agreement and the other Loan

Documents on and as of the date hereof (and after giving effect to this Amendment) with the same force and effect as if such

representations and warranties were set forth in this Amendment in full (except to the extent that such representations and

warranties relate expressly to an earlier date, in which case such representations and warranties were true and correct in all

material respects as of such earlier date).

Section 6. Limited

Waiver. The Administrative Agent and the Required Lenders hereby waive the Specified Events of Default. The waiver contained in

this Section 6 shall not amend any covenant, term or provision in the Credit Agreement or hinder, restrict or otherwise modify

the rights and remedies of the Lenders and the Administrative Agent following the occurrence of any other present or future Default

or Event of Default under the Credit Agreement or any other Loan Document. For the avoidance of doubt, if it is later determined by

the Loan Parties or the Lenders that the Revised Calculations are incorrect in any material respect as set forth in Annex A,

there shall be (and have been) an Event of Default outstanding as of the date that such inaccuracy was first required to be reported

under the Existing Credit Agreement.

Section 7. No

Further Amendments; Ratification of Liability. Except as expressly amended hereby, the Existing Credit Agreement and each of the other

Loan Documents, as amended hereby, shall remain in full force and effect in accordance with their respective terms, and the Lenders and

the Administrative Agent hereby require strict compliance with the terms and conditions of the Amended Credit Agreement and the other

Loan Documents, as amended hereby, in the future. No Loan Party has any knowledge of any challenge to the Administrative Agent’s

or any Lender’s claims arising under the Loan Documents. Each of the Borrower and the other Loan Parties hereby (i) ratifies,

confirms and reaffirms its respective liabilities, payment and performance obligations (contingent or otherwise) and each and every term,

covenant and condition set forth in the Amended Credit Agreement and the other Loan Documents to which it is a party, all as amended by

this Amendment and (ii) acknowledges and agrees that this Amendment shall not in any way affect the validity and enforceability of

any Loan Document, as amended hereby, to which it is a party, or reduce, impair or discharge the obligations of the Borrower or any other

Loan Party. The Guarantor hereby acknowledges its receipt of a copy of this Amendment and its review of the terms and conditions hereof

and consents to the terms and conditions of this Amendment and the transactions contemplated hereby. The Guarantor hereby (a) affirms

and confirms its guarantees under the Guaranty and Security Agreement, and (b) agrees that (i) Guaranty and Security Agreement

shall continue to be in full force and effect and (ii) all guarantees under the Guaranty and Security Agreement shall continue to

be in full force and effect and shall accrue to the benefit of the Lenders. The Lenders’ agreement to the terms of this Amendment

or any other amendment of the Existing Credit Agreement or any other Loan Document shall not be deemed to establish or create a custom

or course of dealing between the Borrower or any other Loan Party or the Lenders, or any of them. This Amendment shall be deemed to be

a “Loan Document” for all purposes under the Amended Credit Agreement. After the effectiveness of this Amendment, each reference

to the Existing Credit Agreement in any of the Loan Documents shall be deemed to be a reference to the Amended Credit Agreement.

Section 8. Miscellaneous.

Sections 10.5 (Governing Law; Jurisdiction; Consent to Service of Process), 10.6 (Waiver of Jury Trial), 10.8

(Counterparts; Integration), 10.10 (Severability) and 10.21 (Electronic Signatures), of the Amended Credit

Agreement are hereby incorporated by reference into this Amendment and shall apply hereto mutatis

mutandis.

[Signature Pages Follow]

IN WITNESS WHEREOF, the Borrower,

the Guarantor, the Lenders and the Administrative Agent have caused this Second Amendment to Amended and Restated Credit Agreement and

Waiver to be duly executed by their respective duly authorized officers and representatives as of the day and year first above written.

| |

bORROWER: |

| |

|

| |

APOLLO MEDICAL HOLDINGS, INC. |

| |

|

| |

|

| |

By: |

/s/ Brandon Sim |

| |

Name: Brandon Sim |

| |

Title: Co-Chief Executive Officer |

| |

|

| |

By: /s/ Chandan Basho |

| |

Name: Chandan Basho |

| |

Title: Chief Strategy Officer and Chief Financial Officer |

| |

|

| |

|

| |

GUARANTOR: |

| |

|

| |

network medical management, inc. |

| |

|

| |

|

| |

By: |

/s/ Thomas S. Lam |

| |

Name: Thomas S. Lam, M.D., M.P.H |

| |

Title: Chief Executive Officer |

APOLLO MEDICAL HOLDINGS, INC.

SECOND AMENDMENT TO A&R CREDIT AGREEMENT AND

WAIVER

SIGNATURE

PAGE

| |

TRUIST BANK, as Administrative Agent, as an Issuing Bank,

as the Swingline Lender and as a Lender |

| |

|

| |

|

| |

By: |

/s/ Anton Brykalin |

| |

Name: Anton Brykalin |

| |

Title: Director |

APOLLO MEDICAL HOLDINGS, INC.

SECOND AMENDMENT TO A&R CREDIT AGREEMENT AND

WAIVER

SIGNATURE

PAGE

| |

JPMORGAN

CHASE BANK, N.A., as a Lender |

| |

|

| |

By: |

/s/ Ling Li |

| |

|

Name: Ling Li |

| |

|

Title: Executive Director |

APOLLO MEDICAL HOLDINGS, INC.

SECOND AMENDMENT TO A&R CREDIT AGREEMENT AND

WAIVER

SIGNATURE

PAGE

| |

MUFG

UNION BANK, N.A., as a Lender |

| |

|

| |

|

| |

By: |

/s/ Erik Siegfried |

| |

|

Name: Erik Siegfried |

| |

|

Title: Vice President |

APOLLO MEDICAL HOLDINGS, INC.

SECOND AMENDMENT TO A&R CREDIT AGREEMENT AND

WAIVER

SIGNATURE

PAGE

| |

PREFERRED

BANK, as a Lender |

| |

|

| |

By: |

/s/ Samuel Leung |

| |

|

Name: Samuel Leung |

| |

|

Title: Senior Vice President |

APOLLO MEDICAL HOLDINGS, INC.

SECOND AMENDMENT TO A&R CREDIT AGREEMENT AND

WAIVER

SIGNATURE

PAGE

| |

FIFTH

THIRD BANK, NATIONAL ASSOCIATION, as a Lender |

| |

|

| |

By: |

/s/ Thomas Avery |

| |

|

Name: Thomas Avery |

| |

|

Title: Managing Director |

APOLLO MEDICAL HOLDINGS, INC.

SECOND AMENDMENT TO A&R CREDIT AGREEMENT AND

WAIVER

SIGNATURE

PAGE

| |

BMO BANK N.A., successor in interest to |

| |

BANK

OF THE WEST, as a Lender |

| |

|

| |

By: |

/s/ Shikha Rehman |

| |

|

Name: Shikha Rehman |

| |

|

Title: Director |

APOLLO MEDICAL HOLDINGS, INC.

SECOND AMENDMENT TO A&R CREDIT AGREEMENT AND

WAIVER

SIGNATURE

PAGE

| |

ROYAL

BANK OF CANADA, as a Lender |

| |

|

| |

By: |

/s/ Emily Grams |

| |

|

Name: Emily Grams |

| |

|

Title: Authorized Signatory |

APOLLO MEDICAL HOLDINGS, INC.

SECOND AMENDMENT TO A&R CREDIT AGREEMENT AND

WAIVER

SIGNATURE

PAGE

| |

THE

TORONTO DOMINION BANK, NEW YORK BRANCH, as a Lender |

| |

|

| |

By: |

/s/ Victoria Roberts |

| |

|

Name: Victoria Roberts |

| |

|

Title: Authorized Signatory |

APOLLO MEDICAL HOLDINGS, INC.

SECOND AMENDMENT TO A&R CREDIT AGREEMENT AND

WAIVER

SIGNATURE

PAGE

| |

WELLS

FARGO BANK, NATIONAL ASSOCIATION, as a Lender |

| |

|

| |

By: |

/s/ Ashley Griffith |

| |

|

Name: Ashley Griffith |

| |

|

Title: Assistant Vice President |

APOLLO MEDICAL HOLDINGS, INC.

SECOND AMENDMENT TO A&R CREDIT AGREEMENT AND

WAIVER

SIGNATURE

PAGE

| |

CITY

NATIONAL BANK, as a Lender |

| |

|

| |

By: |

/s/ Eric Rezai |

| |

|

Name: Eric Rezai |

| |

|

Title: Vice President |

APOLLO MEDICAL HOLDINGS, INC.

SECOND AMENDMENT TO A&R CREDIT AGREEMENT AND

WAIVER

SIGNATURE

PAGE

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

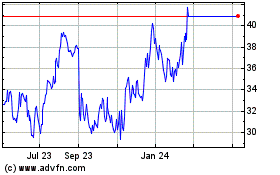

Apollo Medical (NASDAQ:AMEH)

Historical Stock Chart

From Feb 2025 to Mar 2025

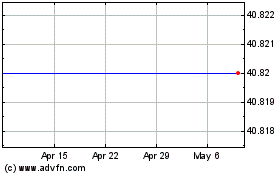

Apollo Medical (NASDAQ:AMEH)

Historical Stock Chart

From Mar 2024 to Mar 2025