ARKO Corp. Negotiates Enhanced Value for Stockholders in Final Payment for TEG Acquisition

28 March 2024 - 10:00PM

ARKO Corp. (Nasdaq: ARKO) (“ARKO” or the “Company”), a Fortune 500

company and one of the largest convenience store operators in the

United States, announced today that it has negotiated improved

deferred payment terms and value related to the Company’s

previously reported acquisition of the assets of Transit Energy

Group and its affiliates (“TEG”).

As previously disclosed, on March 1, 2023, the

Company closed on the acquisition from TEG of 135 convenience

stores and gas stations, contracts to supply fuel to 181 dealer

locations, and certain other assets. The purchase agreement

originally provided for a total purchase price of approximately

$370 million plus the value of inventory, of which $50 million was

deferred and payable in two annual payments of $25 million on the

first and second anniversaries of the closing, which ARKO could

elect to pay in either cash or, subject to certain conditions,

shares of ARKO’s common stock.

Pursuant to the original asset purchase agreement,

on March 1, 2024, ARKO issued 3,417,915 shares of ARKO common stock

to TEG (the “First Installment Shares”) at a price per share of

$7.31 which was based on a 10-day volume weighted average price

calculation outlined in the purchase agreement. The closing price

of ARKO’s common stock on the date ARKO notified TEG of its

election to pay the first $25.0 million installment in shares was

$8.36 per share, and the closing price on the date prior to the

date of issuance was $6.53 per share.

Subsequently, on March 26, 2024, ARKO entered into

an amendment to the original purchase agreement with TEG, providing

for ARKO’s repurchase of the First Installment Shares at $5.66 per

share, a 22.6% discount to the price at which the shares were

issued, for a payment of approximately $19.3 million. ARKO and TEG

also agreed to settle the second $25 million installment payment

(which would have been due on March 1, 2025) for approximately

$17.2 million in cash. In aggregate, ARKO satisfied the $50 million

deferred purchase price for the TEG transaction for $36.5 million

and the release of certain obligations and liabilities, which was

fully funded by ARKO’s existing liquidity through its Capital One

Line of Credit. ARKO repurchased the First Installment Shares as

part of its previously announced $100 million share repurchase

program.

“Prior to the March 1, 2024 deferred purchase price

payment being due, we chose to satisfy the $25 million liability

through issuing shares to create additional liquidity in the stock

and to deploy cash against strategic investments,” said Arie

Kotler, Chairman, President, and Chief Executive Officer of ARKO.

“However, we believe that the post-issuance decline in the price of

ARKO’s common stock created a unique opportunity for us to buy back

these recently issued shares at a value well below what we believe

is ARKO’s intrinsic value. At the same time, we were able to also

satisfy a future $25 million deferred payment for a reduced price

of $17.2 million. We believe that our ability to be agile capital

allocators and take advantage of changing market conditions and

business opportunities continues to be one of our key strengths,”

Kotler continued.

About ARKO Corp.

ARKO Corp. (Nasdaq: ARKO) is a Fortune 500 company

that owns 100% of GPM Investments, LLC and is one of the largest

operators of convenience stores and wholesalers of fuel in the

United States. Based in Richmond, VA, our highly recognizable

family of community brands offers delicious, prepared foods, beer,

snacks, candy, hot and cold beverages, and multiple popular quick

serve restaurant brands. Our high value fas REWARDS® loyalty

program offers exclusive savings on merchandise and gas. We operate

in four reportable segments: retail, which includes convenience

stores selling merchandise and fuel products to retail customers;

wholesale, which supplies fuel to independent dealers and

consignment agents; GPM Petroleum, which sells and supplies fuel to

our retail and wholesale sites and charges a fixed fee, primarily

to our fleet fueling sites; and fleet fueling, which includes the

operation of proprietary and third-party cardlock locations, and

issuance of proprietary fuel cards that provide customers access to

a nationwide network of fueling sites. To learn more about GPM

stores, visit: www.gpminvestments.com. To learn more about ARKO,

visit: www.arkocorp.com.

Forward-Looking Statements

This document includes certain “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements may address,

among other things, the Company’s expected financial and

operational results and the related assumptions underlying its

expected results. These forward-looking statements are

distinguished by use of words such as “anticipate,” “aim,”

“believe,” “continue,” “could,” “estimate,” “expect,” “guidance,”

“intends,” “may,” “might,” “plan,” “possible,” “potential,”

“predict,” “project,” “should,” “will,” “would” and the negative of

these terms, and similar references to future periods. These

statements are based on management’s current expectations and are

subject to uncertainty and changes in circumstances. Actual results

may differ materially from these expectations due to, among other

things, changes in economic, business and market conditions; the

Company’s ability to maintain the listing of its common stock and

warrants on the Nasdaq Stock Market; changes in its strategy,

future operations, financial position, estimated revenues and

losses, projected costs, prospects and plans; expansion plans and

opportunities; changes in the markets in which it competes; changes

in applicable laws or regulations, including those relating to

environmental matters; market conditions and global and economic

factors beyond its control; and the outcome of any known or unknown

litigation and regulatory proceedings. Detailed information about

these factors and additional important factors can be found in the

documents that the Company files with the Securities and Exchange

Commission, such as Form 10-K, Form 10-Q and Form 8-K.

Forward-looking statements speak only as of the date the statements

were made. The Company does not undertake an obligation to update

forward-looking information, except to the extent required by

applicable law.

Media Contact & Investor Contact

Jordan Mann, Senior Vice President of Corporate Strategy, Capital Markets and Investor Relations

ARKO Corp.

investors@gpminvestments.com

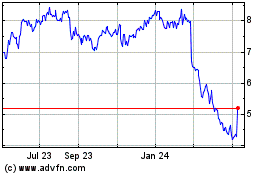

ARKO (NASDAQ:ARKO)

Historical Stock Chart

From Dec 2024 to Jan 2025

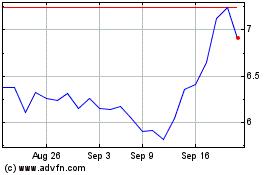

ARKO (NASDAQ:ARKO)

Historical Stock Chart

From Jan 2024 to Jan 2025