ARKO Corp. (Nasdaq: ARKO) (“ARKO” or the “Company”), a Fortune 500

company and one of the largest convenience store operators in the

United States, today announced financial results for the third

quarter ended September 30, 2024.

Third Quarter 2024 Key Highlights (vs.

Year-Ago Quarter)1,2

- Net income for the quarter was $9.7 million compared to $21.5

million.

- Adjusted EBITDA for the quarter was $78.8 million, as compared

to $87.3 million for the prior year period; performance for the

quarter was at the midpoint of the Company’s previously issued

guidance of $70 million to $86 million.

- Retail fuel margin for the quarter was 41.3 cents per gallon,

as compared to 40.3 cents for the prior year period.

- Merchandise margin rate for the quarter was 32.8%, as compared

to 31.7% for the prior year period.

- Merchandise contribution for the quarter was $154.0 million, as

compared to $160.7 million for the prior year period.

- Retail fuel contribution for the quarter was $117.1 million, as

compared to $121.3 million for the prior year period.

___________________1 See Use of Non-GAAP Measures below.2 All

figures for fuel contribution and fuel margin per gallon exclude

the estimated fixed margin or fixed fee paid to the Company’s

wholesale fuel distribution subsidiary, GPM Petroleum LP (“GPMP”)

for the cost of fuel (intercompany charges by GPMP).

Other Key Highlights

- As part of the Company’s developing transformation plan, the

Company converted 51 retail stores to dealer sites in the nine

months ended on September 30, 2024. The Company expects to convert

another approximately 100 retail stores by the end of the fourth

quarter of 2024, which together with the initial 51 stores is

expected to represent a cumulative annualized benefit to combined

wholesale segment and retail segment Operating Income of

approximately $8.5 million. Such conversions are part of our

channel optimization strategy, which is expected to yield a

cumulative annualized benefit to combined wholesale segment and

retail segment Operating Income of approximately $15 million to $20

million.

- The Company has expanded its pipeline to eight NTI (new to

industry) stores, including two Dunkin’ locations. During the

quarter, the Company opened a NTI Handy Mart store in Newport,

North Carolina. The Company expects to open three more NTI stores

later this year, with the balance over the course of 2025.

- The Board declared a quarterly dividend of $0.03 per share of

common stock to be paid on December 3, 2024 to stockholders of

record as of November 19, 2024.

“As our customers continue to face macroeconomic

pressure related to inflation and elevated prices for everyday

goods, we continue to focus on delivering essential value to our

customers,” said Arie Kotler, Chairman, President, and CEO of

ARKO.

Mr. Kotler continued: “Our focus on operational

excellence, improving customer offerings, and strengthening

store-level performance remains a top priority. We believe that we

are well-positioned to manage near-term macroeconomic challenges,

and we remain confident in ARKO’s long-term potential for sustained

growth. We believe the improvements in our operations and

investments in our stores will guide us through the current

environment and build the foundation for our multi-year

transformation.” Third Quarter 2024 Segment

Highlights

Retail

|

|

For the Three Months Ended

September 30, |

|

|

For the Nine Months Ended

September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

(in thousands) |

|

|

Fuel gallons sold |

|

283,189 |

|

|

|

300,796 |

|

|

|

822,134 |

|

|

|

843,286 |

|

|

Same store fuel gallons sold decrease (%) 1 |

|

(6.6 |

%) |

|

|

(5.3 |

%) |

|

|

(6.6 |

%) |

|

|

(4.5 |

%) |

|

Fuel contribution 2 |

$ |

117,090 |

|

|

$ |

121,266 |

|

|

$ |

328,004 |

|

|

$ |

325,986 |

|

|

Fuel margin, cents per gallon 3 |

|

41.3 |

|

|

|

40.3 |

|

|

|

39.9 |

|

|

|

38.7 |

|

|

Same store fuel contribution 1,2 |

$ |

113,192 |

|

|

$ |

118,250 |

|

|

$ |

306,673 |

|

|

$ |

317,828 |

|

|

Same store merchandise sales (decrease) increase (%) 1 |

|

(7.7 |

%) |

|

|

0.1 |

% |

|

|

(5.7 |

%) |

|

|

1.4 |

% |

|

Same store merchandise sales excluding cigarettes (decrease)

increase (%) 1 |

|

(5.7 |

%) |

|

|

1.0 |

% |

|

|

(4.3 |

%) |

|

|

3.9 |

% |

|

Merchandise revenue |

$ |

469,616 |

|

|

$ |

506,425 |

|

|

$ |

1,358,519 |

|

|

$ |

1,391,274 |

|

|

Merchandise contribution 4 |

$ |

154,019 |

|

|

$ |

160,726 |

|

|

$ |

444,696 |

|

|

$ |

438,349 |

|

|

Merchandise margin 5 |

|

32.8 |

% |

|

|

31.7 |

% |

|

|

32.7 |

% |

|

|

31.5 |

% |

|

Same store merchandise contribution 1,4 |

$ |

147,223 |

|

|

$ |

154,719 |

|

|

$ |

413,992 |

|

|

$ |

424,789 |

|

|

Same store site operating expenses 1 |

$ |

192,548 |

|

|

$ |

195,334 |

|

|

$ |

557,425 |

|

|

$ |

555,631 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Same store is a common metric used in the convenience store

industry. We consider a store a same store beginning in the first

quarter in which the store had a full quarter of activity in the

prior year. Refer to Use of Non-GAAP Measures below for discussion

of this measure. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 Calculated as fuel revenue less fuel costs; excludes the

estimated fixed margin or fixed fee paid to GPMP for the cost of

fuel. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 Calculated as fuel contribution divided by fuel gallons

sold. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 Calculated as merchandise revenue less merchandise costs. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 Calculated as merchandise contribution divided by merchandise

revenue. |

|

Total merchandise contribution for the third

quarter of 2024 decreased $6.7 million, or 4.2%, compared to the

third quarter of 2023, primarily due to a decrease in same store

merchandise contribution of approximately $7.5 million and a

decrease from underperforming retail stores that were closed or

converted to dealers, which was partially offset by approximately

$2.7 million in incremental merchandise contribution from recent

acquisitions. Same store merchandise contribution decreased

primarily due to lower same store sales caused by a decline in

customer transactions reflecting the challenging macro-economic

environment. The impact of the same store sales decline was

partially offset by an increase in same store merchandise margin

rate, which increased 100 basis points as compared to the year-ago

period.

For the third quarter of 2024, retail fuel

contribution decreased $4.2 million to $117.1 million compared to

the prior year period, with gallon demand declines reflecting the

challenging macro-economic environment. The impact of the gallon

demand decline was partially offset by resilient fuel margin

capture of 41.3 cents per gallon, which was up 1.0 cent per gallon

compared to the third quarter of 2023. The decline in retail fuel

contribution was caused by a reduction in same store fuel

contribution of $5.1 million and a decrease from underperforming

retail stores that were closed or converted to dealers, which was

partially offset by incremental fuel contribution from recent

acquisitions of approximately $2.2 million.

Wholesale

|

|

For the Three Months Ended

September 30, |

|

|

For the Nine Months Ended

September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

(in thousands) |

|

|

Fuel gallons sold – fuel supply locations |

|

203,187 |

|

|

|

205,836 |

|

|

|

593,479 |

|

|

|

601,399 |

|

|

Fuel gallons sold – consignment agent locations |

|

39,155 |

|

|

|

45,365 |

|

|

|

115,997 |

|

|

|

127,861 |

|

|

Fuel contribution 1 – fuel supply locations |

$ |

12,077 |

|

|

$ |

13,222 |

|

|

$ |

35,926 |

|

|

$ |

36,896 |

|

|

Fuel contribution 1 – consignment locations |

$ |

11,283 |

|

|

$ |

13,107 |

|

|

$ |

32,150 |

|

|

$ |

34,412 |

|

|

Fuel margin, cents per gallon 2 – fuel supply locations |

|

5.9 |

|

|

|

6.4 |

|

|

|

6.1 |

|

|

|

6.1 |

|

|

Fuel margin, cents per gallon 2 – consignment agent locations |

|

28.8 |

|

|

|

28.9 |

|

|

|

27.7 |

|

|

|

26.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Calculated as fuel revenue less fuel costs; excludes the

estimated fixed margin or fixed fee paid to GPMP for the cost of

fuel. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 Calculated as fuel contribution divided by fuel gallons

sold. |

|

In wholesale, total fuel contribution was

approximately $23.4 million for the third quarter of 2024 compared

to $26.3 million for the third quarter of 2023. Fuel contribution

for the third quarter of 2024 at fuel supply locations decreased by

$1.2 million, and fuel contribution at consignment agent locations

decreased by $1.8 million, compared to the prior year period, with

corresponding decreases in fuel margin per gallon, primarily due to

decreased prompt pay discounts related to lower fuel costs and

lower volumes. For the third quarter of 2024, site operating

expenses decreased by $0.2 million compared to the prior year

period.

Fleet Fueling

|

|

For the Three Months Ended

September 30, |

|

|

For the Nine Months Ended

September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

(in thousands) |

|

|

Fuel gallons sold – proprietary cardlock locations |

|

34,089 |

|

|

|

34,277 |

|

|

|

103,216 |

|

|

|

97,710 |

|

|

Fuel gallons sold – third-party cardlock locations |

|

3,105 |

|

|

|

2,985 |

|

|

|

9,575 |

|

|

|

6,631 |

|

|

Fuel contribution 1 – proprietary cardlock locations |

$ |

15,699 |

|

|

$ |

13,497 |

|

|

$ |

46,789 |

|

|

$ |

41,539 |

|

|

Fuel contribution 1 – third-party cardlock locations |

$ |

482 |

|

|

$ |

794 |

|

|

$ |

1,168 |

|

|

$ |

971 |

|

|

Fuel margin, cents per gallon 2 – proprietary

cardlock locations |

|

46.1 |

|

|

|

39.4 |

|

|

|

45.3 |

|

|

|

42.5 |

|

|

Fuel margin, cents per gallon 2 – third-party

cardlock locations |

|

15.5 |

|

|

|

26.6 |

|

|

|

12.2 |

|

|

|

14.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Calculated as fuel revenue less fuel costs; excludes the

estimated fixed fee paid to GPMP for the cost of fuel. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 Calculated as fuel contribution divided by fuel gallons

sold. |

|

In fleet fueling, fuel contribution increased by

$1.9 million compared to the third quarter of 2023. At proprietary

cardlocks, fuel contribution increased by $2.2 million, and fuel

margin per gallon also increased for the third quarter of 2024

compared to the third quarter of 2023. At third-party cardlock

locations, fuel contribution decreased by $0.3 million, and fuel

margin per gallon also decreased for the third quarter of 2024

compared to the third quarter of 2023. These changes were primarily

due to differing market conditions impacting the third quarters of

2024 and 2023.

Site Operating Expenses

For the quarter ended September 30, 2024,

convenience store operating expenses decreased $3.1 million, or

1.5%, as compared to the prior year period, primarily due to a

decrease in same store expenses of $2.8 million, or 1.4%, and a

decrease from underperforming retail stores that were closed or

converted to dealers. This decline in same store expenses was

primarily related to lower personnel costs and lower credit card

fees. These decreases were partially offset by $3.8 million of

incremental expenses related to recent acquisitions.

Liquidity and Capital

Expenditures

As of September 30, 2024, the Company’s total

liquidity was approximately $869 million, consisting of

approximately $292 million of cash and cash equivalents and

approximately $577 million of availability under lines of credit.

Outstanding debt was $885 million, resulting in net debt, excluding

lease related financing liabilities, of approximately $593 million.

Capital expenditures were approximately $29.3 million for the

quarter ended September 30, 2024.

Quarterly Dividend and Share Repurchase

Program

The Company’s ability to return cash to its

stockholders through its cash dividend program and share repurchase

program is consistent with its capital allocation framework and

reflects the Company’s confidence in the strength of its cash

generation ability and strong financial position.

The Board declared a quarterly dividend of $0.03

per share of common stock to be paid on December 3, 2024 to

stockholders of record as of November 19, 2024.

There was approximately $25.7 million remaining

under the share repurchase program as of September 30,

2024.

Company-Operated Retail Store Count and

Segment Update

The following tables present certain information

regarding changes in the retail, wholesale and fleet fueling

segments for the periods presented:

|

|

For the Three Months Ended

September 30, |

|

|

For the Nine Months Ended

September 30, |

|

|

Retail Segment |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Number of sites at beginning of period |

|

1,548 |

|

|

|

1,547 |

|

|

|

1,543 |

|

|

|

1,404 |

|

|

Acquired sites |

|

— |

|

|

|

7 |

|

|

|

21 |

|

|

|

166 |

|

|

Newly opened or reopened sites |

|

1 |

|

|

|

1 |

|

|

|

2 |

|

|

|

4 |

|

|

Company-controlled sites converted to consignment or fuel supply

locations, net |

|

(49 |

) |

|

|

(2 |

) |

|

|

(51 |

) |

|

|

(13 |

) |

|

Closed or divested sites |

|

(9 |

) |

|

|

(1 |

) |

|

|

(24 |

) |

|

|

(9 |

) |

|

Number of sites at end of period |

|

1,491 |

|

|

|

1,552 |

|

|

|

1,491 |

|

|

|

1,552 |

|

|

|

For the Three Months Ended

September 30, |

|

|

For the Nine Months Ended

September 30, |

|

|

Wholesale Segment 1 |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Number of sites at beginning of period |

|

1,794 |

|

|

|

1,824 |

|

|

|

1,825 |

|

|

|

1,674 |

|

|

Acquired sites |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

190 |

|

|

Newly opened or reopened sites 2 |

|

10 |

|

|

|

34 |

|

|

|

30 |

|

|

|

58 |

|

|

Consignment or fuel supply locations converted from

Company-controlled or fleet fueling sites, net |

|

49 |

|

|

|

2 |

|

|

|

51 |

|

|

|

13 |

|

|

Closed or divested sites |

|

(21 |

) |

|

|

(35 |

) |

|

|

(74 |

) |

|

|

(110 |

) |

|

Number of sites at end of period |

|

1,832 |

|

|

|

1,825 |

|

|

|

1,832 |

|

|

|

1,825 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Excludes bulk and spot purchasers. |

|

|

2 Includes all signed fuel supply agreements irrespective of fuel

distribution commencement date. |

|

|

|

For the Three Months Ended

September 30, |

|

|

For the Nine Months Ended

September 30, |

|

|

Fleet Fueling Segment |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Number of sites at beginning of period |

|

294 |

|

|

|

293 |

|

|

|

298 |

|

|

|

183 |

|

|

Acquired sites |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

111 |

|

|

Closed or divested sites |

|

(14 |

) |

|

|

(2 |

) |

|

|

(18 |

) |

|

|

(3 |

) |

|

Number of sites at end of period |

|

281 |

|

|

|

295 |

|

|

|

281 |

|

|

|

295 |

|

Fourth Quarter and Full Year 2024

Guidance

The Company currently expects fourth quarter 2024

Adjusted EBITDA to range between $53 million and $63 million, with

an assumed range of average retail fuel margin from 38 to 42 cents

per gallon. This outlook translates to a full year 2024 Adjusted

EBITDA range of $245 million to $255 million.

The Company is not providing guidance on net

income at this time due to the volatility of certain required

inputs that are not available without unreasonable efforts,

including future fair value adjustments associated with its stock

price, as well as depreciation and amortization related to its

capital allocation as part of its focus on accelerating organic

growth.

Conference Call and Webcast

Details

The Company will host a conference call today to

discuss these results at 5:00 p.m. Eastern Time. Investors and

analysts interested in participating in the live call can dial

800-343-4136 or 203-518-9848.

A simultaneous, live webcast will also be

available on the Investor Relations section of the Company’s

website at https://www.arkocorp.com/news-events/ir-calendar. The

webcast will be archived for 30 days.

About ARKO Corp.

ARKO Corp. (Nasdaq: ARKO) is a Fortune 500 company

that owns 100% of GPM Investments, LLC and is one of the largest

operators of convenience stores and wholesalers of fuel in the

United States. Based in Richmond, VA, we operate A Family of

Community Brands that offer delicious, prepared foods, beer,

snacks, candy, hot and cold beverages, and multiple popular quick

serve restaurant brands. Our high value fas REWARDS® loyalty

program offers exclusive savings on merchandise and gas. We operate

in four reportable segments: retail, which includes convenience

stores selling merchandise and fuel products to retail customers;

wholesale, which supplies fuel to independent dealers and

consignment agents; GPM Petroleum, which sells and supplies fuel to

our retail and wholesale sites and charges a fixed fee, primarily

to our fleet fueling sites; and fleet fueling, which includes the

operation of proprietary and third-party cardlock locations, and

issuance of proprietary fuel cards that provide customers access to

a nationwide network of fueling sites. To learn more about GPM

stores, visit: www.gpminvestments.com. To learn more about ARKO,

visit: www.arkocorp.com.

Forward-Looking Statements

This document includes certain “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements may address,

among other things, the Company’s expected financial and

operational results and the related assumptions underlying its

expected results. These forward-looking statements are

distinguished by use of words such as “anticipate,” “aim,”

“believe,” “continue,” “could,” “estimate,” “expect,” “guidance,”

“intends,” “may,” “might,” “plan,” “possible,” “potential,”

“predict,” “project,” “should,” “will,” “would” and the negative of

these terms, and similar references to future periods. These

statements are based on management’s current expectations and are

subject to uncertainty and changes in circumstances. Actual results

may differ materially from these expectations due to, among other

things, changes in economic, business and market conditions; the

Company’s ability to maintain the listing of its common stock and

warrants on the Nasdaq Stock Market; changes in its strategy,

future operations, financial position, estimated revenues and

losses, projected costs, prospects and plans; expansion plans and

opportunities; changes in the markets in which it competes; changes

in applicable laws or regulations, including those relating to

environmental matters; market conditions and global and economic

factors beyond its control; and the outcome of any known or unknown

litigation and regulatory proceedings. Detailed information about

these factors and additional important factors can be found in the

documents that the Company files with the Securities and Exchange

Commission, such as Form 10-K, Form 10-Q and Form 8-K.

Forward-looking statements speak only as of the date the statements

were made. The Company does not undertake an obligation to update

forward-looking information, except to the extent required by

applicable law.

Use of Non-GAAP Measures

The Company discloses certain measures on a “same

store basis,” which is a non-GAAP measure. Information disclosed on

a “same store basis” excludes the results of any store that is not

a “same store” for the applicable period. A store is considered a

same store beginning in the first quarter in which the store had a

full quarter of activity in the prior year. The Company believes

that this information provides greater comparability regarding its

ongoing operating performance. Neither this measure nor those

described below should be considered an alternative to measurements

presented in accordance with generally accepted accounting

principles in the United States (“GAAP”).

The Company defines EBITDA as net income before

net interest expense, income taxes, depreciation and amortization.

Adjusted EBITDA further adjusts EBITDA by excluding the gain or

loss on disposal of assets, impairment charges, acquisition and

divestiture costs, share-based compensation expense, other non-cash

items, and other unusual or non-recurring charges.

At the segment level, the Company defines

Operating Income, as adjusted, as operating income excluding the

estimated fixed margin or fixed fee paid to GPMP for the cost of

fuel. Each of Operating Income, as adjusted, EBITDA and Adjusted

EBITDA is a non-GAAP financial measure.

The Company uses EBITDA and Adjusted EBITDA for

operational and financial decision-making and believe these

measures are useful in evaluating its performance because they

eliminate certain items that it does not consider indicators of its

operating performance. Additionally, the Company believes Operating

Income, as adjusted provides greater comparability regarding its

ongoing segment operating performance by eliminating intercompany

charges at the segment level. EBITDA and Adjusted EBITDA are also

used by many of its investors, securities analysts, and other

interested parties in evaluating its operational and financial

performance across reporting periods. The Company believes that the

presentation of EBITDA and Adjusted EBITDA provides useful

information to investors by allowing an understanding of key

measures that it uses internally for operational decision-making,

budgeting, evaluating acquisition targets, and assessing its

operating performance.

Operating Income, as adjusted, EBITDA and Adjusted

EBITDA are not recognized terms under GAAP and should not be

considered as a substitute for net income or any other financial

measure presented in accordance with GAAP. These measures have

limitations as analytical tools and should not be considered in

isolation or as substitutes for analysis of its results as reported

under GAAP. The Company strongly encourages investors to review its

financial statements and publicly filed reports in their entirety

and not to rely on any single financial measure.

Because non-GAAP financial measures are not

standardized, same store measures, Operating Income, as adjusted,

EBITDA and Adjusted EBITDA, as defined by the Company, may not be

comparable to similarly titled measures reported by other

companies. It therefore may not be possible to compare the

Company’s use of these non-GAAP financial measures with those used

by other companies.

Company Contact Jordan Mann ARKO

Corp. investors@gpminvestments.com

Investor Contact Sean Mansouri,

CFA Elevate IR (720) 330-2829 ARKO@elevate-ir.com

|

|

|

|

|

|

Condensed Consolidated Statements of

Operations |

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended

September 30, |

|

|

For the Nine Months Ended

September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

(in thousands) |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

Fuel revenue |

$ |

1,783,871 |

|

|

$ |

2,086,392 |

|

|

$ |

5,302,734 |

|

|

$ |

5,705,156 |

|

|

Merchandise revenue |

|

469,616 |

|

|

|

506,425 |

|

|

|

1,358,519 |

|

|

|

1,391,274 |

|

|

Other revenues, net |

|

25,749 |

|

|

|

29,237 |

|

|

|

78,600 |

|

|

|

83,141 |

|

|

Total revenues |

|

2,279,236 |

|

|

|

2,622,054 |

|

|

|

6,739,853 |

|

|

|

7,179,571 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Fuel costs |

|

1,626,399 |

|

|

|

1,923,869 |

|

|

|

4,855,462 |

|

|

|

5,262,854 |

|

|

Merchandise costs |

|

315,597 |

|

|

|

345,699 |

|

|

|

913,823 |

|

|

|

952,925 |

|

|

Site operating expenses |

|

222,744 |

|

|

|

226,698 |

|

|

|

665,366 |

|

|

|

637,383 |

|

|

General and administrative expenses |

|

38,636 |

|

|

|

44,116 |

|

|

|

123,230 |

|

|

|

127,192 |

|

|

Depreciation and amortization |

|

33,132 |

|

|

|

33,713 |

|

|

|

98,425 |

|

|

|

94,949 |

|

|

Total operating expenses |

|

2,236,508 |

|

|

|

2,574,095 |

|

|

|

6,656,306 |

|

|

|

7,075,303 |

|

|

Other expenses, net |

|

1,159 |

|

|

|

3,885 |

|

|

|

3,896 |

|

|

|

11,561 |

|

|

Operating income |

|

41,569 |

|

|

|

44,074 |

|

|

|

79,651 |

|

|

|

92,707 |

|

|

Interest and other financial income |

|

3,135 |

|

|

|

9,371 |

|

|

|

26,462 |

|

|

|

18,897 |

|

|

Interest and other financial expenses |

|

(26,759 |

) |

|

|

(23,950 |

) |

|

|

(73,910 |

) |

|

|

(67,238 |

) |

|

Income before income taxes |

|

17,945 |

|

|

|

29,495 |

|

|

|

32,203 |

|

|

|

44,366 |

|

|

Income tax expense |

|

(8,300 |

) |

|

|

(7,993 |

) |

|

|

(9,139 |

) |

|

|

(10,849 |

) |

|

Income (loss) from equity investment |

|

29 |

|

|

|

(14 |

) |

|

|

79 |

|

|

|

(77 |

) |

|

Net income |

$ |

9,674 |

|

|

$ |

21,488 |

|

|

$ |

23,143 |

|

|

$ |

33,440 |

|

|

Less: Net income attributable to non-controlling

interests |

|

— |

|

|

|

48 |

|

|

|

— |

|

|

|

149 |

|

|

Net income attributable to ARKO Corp. |

$ |

9,674 |

|

|

$ |

21,440 |

|

|

$ |

23,143 |

|

|

$ |

33,291 |

|

|

Series A redeemable preferred stock dividends |

|

(1,446 |

) |

|

|

(1,449 |

) |

|

|

(4,305 |

) |

|

|

(4,301 |

) |

|

Net income attributable to

common shareholders |

$ |

8,228 |

|

|

$ |

19,991 |

|

|

$ |

18,838 |

|

|

$ |

28,990 |

|

|

Net income per share attributable to common shareholders –

basic |

$ |

0.07 |

|

|

$ |

0.17 |

|

|

$ |

0.16 |

|

|

$ |

0.24 |

|

|

Net income per share attributable to common shareholders –

diluted |

$ |

0.07 |

|

|

$ |

0.17 |

|

|

$ |

0.16 |

|

|

$ |

0.24 |

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

115,771 |

|

|

|

118,389 |

|

|

|

116,262 |

|

|

|

119,505 |

|

|

Diluted |

|

117,888 |

|

|

|

120,292 |

|

|

|

117,342 |

|

|

|

120,602 |

|

|

|

|

|

|

|

Condensed Consolidated Balance Sheets |

|

|

|

|

|

|

|

|

|

|

September 30, 2024 |

|

|

December 31, 2023 |

|

|

|

(in thousands) |

|

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

291,697 |

|

|

$ |

218,120 |

|

|

Restricted cash |

|

27,314 |

|

|

|

23,301 |

|

|

Short-term investments |

|

5,132 |

|

|

|

3,892 |

|

|

Trade receivables, net |

|

117,890 |

|

|

|

134,735 |

|

|

Inventory |

|

236,487 |

|

|

|

250,593 |

|

|

Other current assets |

|

101,428 |

|

|

|

118,472 |

|

|

Total current assets |

|

779,948 |

|

|

|

749,113 |

|

|

Non-current assets: |

|

|

|

|

|

|

Property and equipment, net |

|

740,761 |

|

|

|

742,610 |

|

|

Right-of-use assets under operating leases |

|

1,406,429 |

|

|

|

1,384,693 |

|

|

Right-of-use assets under financing leases, net |

|

159,110 |

|

|

|

162,668 |

|

|

Goodwill |

|

300,032 |

|

|

|

292,173 |

|

|

Intangible assets, net |

|

187,999 |

|

|

|

214,552 |

|

|

Equity investment |

|

2,964 |

|

|

|

2,885 |

|

|

Deferred tax asset |

|

58,573 |

|

|

|

52,293 |

|

|

Other non-current assets |

|

52,485 |

|

|

|

49,377 |

|

|

Total assets |

$ |

3,688,301 |

|

|

$ |

3,650,364 |

|

|

Liabilities |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Long-term debt, current portion |

$ |

15,372 |

|

|

$ |

16,792 |

|

|

Accounts payable |

|

209,102 |

|

|

|

213,657 |

|

|

Other current liabilities |

|

173,578 |

|

|

|

179,536 |

|

|

Operating leases, current portion |

|

70,120 |

|

|

|

67,053 |

|

|

Financing leases, current portion |

|

11,175 |

|

|

|

9,186 |

|

|

Total current liabilities |

|

479,347 |

|

|

|

486,224 |

|

|

Non-current liabilities: |

|

|

|

|

|

|

Long-term debt, net |

|

869,323 |

|

|

|

828,647 |

|

|

Asset retirement obligation |

|

87,331 |

|

|

|

84,710 |

|

|

Operating leases |

|

1,424,834 |

|

|

|

1,395,032 |

|

|

Financing leases |

|

211,380 |

|

|

|

213,032 |

|

|

Other non-current liabilities |

|

236,081 |

|

|

|

266,602 |

|

|

Total liabilities |

|

3,308,296 |

|

|

|

3,274,247 |

|

|

|

|

|

|

|

|

|

Series A redeemable preferred stock |

|

100,000 |

|

|

|

100,000 |

|

|

|

|

|

|

|

|

|

Shareholders' equity: |

|

|

|

|

|

|

Common stock |

|

12 |

|

|

|

12 |

|

|

Treasury stock |

|

(106,123 |

) |

|

|

(74,134 |

) |

|

Additional paid-in capital |

|

272,604 |

|

|

|

245,007 |

|

|

Accumulated other comprehensive income |

|

9,119 |

|

|

|

9,119 |

|

|

Retained earnings |

|

104,393 |

|

|

|

96,097 |

|

|

Total shareholders' equity |

|

280,005 |

|

|

|

276,101 |

|

|

Non-controlling interest |

|

— |

|

|

|

16 |

|

|

Total equity |

|

280,005 |

|

|

|

276,117 |

|

|

Total liabilities, redeemable preferred stock and

equity |

$ |

3,688,301 |

|

|

$ |

3,650,364 |

|

|

|

|

|

|

|

Condensed Consolidated Statements of Cash

Flows |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended

September 30, |

|

|

For the Nine Months Ended

September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

(in thousands) |

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

$ |

9,674 |

|

|

$ |

21,488 |

|

|

$ |

23,143 |

|

|

$ |

33,440 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

33,132 |

|

|

|

33,713 |

|

|

|

98,425 |

|

|

|

94,949 |

|

|

Deferred income taxes |

|

2,269 |

|

|

|

10,087 |

|

|

|

(3,660 |

) |

|

|

(4,028 |

) |

|

Loss on disposal of assets and impairment charges |

|

1,752 |

|

|

|

2,265 |

|

|

|

5,137 |

|

|

|

5,543 |

|

|

Foreign currency (gain) loss |

|

(16 |

) |

|

|

72 |

|

|

|

41 |

|

|

|

130 |

|

|

Gain from issuance of shares as payment of deferred

consideration related to business acquisition |

|

— |

|

|

|

— |

|

|

|

(2,681 |

) |

|

|

— |

|

|

Gain from settlement related to business acquisition |

|

— |

|

|

|

— |

|

|

|

(6,356 |

) |

|

|

— |

|

|

Amortization of deferred financing costs and debt

discount |

|

668 |

|

|

|

644 |

|

|

|

2,000 |

|

|

|

1,857 |

|

|

Amortization of deferred income |

|

(3,757 |

) |

|

|

(2,373 |

) |

|

|

(10,126 |

) |

|

|

(6,302 |

) |

|

Accretion of asset retirement obligation |

|

628 |

|

|

|

572 |

|

|

|

1,871 |

|

|

|

1,690 |

|

|

Non-cash rent |

|

3,634 |

|

|

|

3,860 |

|

|

|

10,805 |

|

|

|

10,418 |

|

|

Charges to allowance for credit losses |

|

92 |

|

|

|

448 |

|

|

|

733 |

|

|

|

1,021 |

|

|

(Income) loss from equity investment |

|

(29 |

) |

|

|

14 |

|

|

|

(79 |

) |

|

|

77 |

|

|

Share-based compensation |

|

2,149 |

|

|

|

4,614 |

|

|

|

8,262 |

|

|

|

13,238 |

|

|

Fair value adjustment of financial assets and liabilities |

|

1,443 |

|

|

|

(6,379 |

) |

|

|

(10,763 |

) |

|

|

(11,627 |

) |

|

Other operating activities, net |

|

66 |

|

|

|

1,303 |

|

|

|

752 |

|

|

|

2,279 |

|

|

Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

Decrease (increase) in trade receivables |

|

37,596 |

|

|

|

(44,314 |

) |

|

|

16,112 |

|

|

|

(62,487 |

) |

|

Decrease (increase) in inventory |

|

14,655 |

|

|

|

(9,178 |

) |

|

|

17,427 |

|

|

|

(17,386 |

) |

|

Decrease (increase) in other assets |

|

8,066 |

|

|

|

(17,464 |

) |

|

|

13,909 |

|

|

|

(28,429 |

) |

|

(Decrease) increase in accounts payable |

|

(32,614 |

) |

|

|

15,087 |

|

|

|

(6,137 |

) |

|

|

29,667 |

|

|

Increase in other current liabilities |

|

23,768 |

|

|

|

16,643 |

|

|

|

17,844 |

|

|

|

8,992 |

|

|

(Decrease) increase in asset retirement obligation |

|

(163 |

) |

|

|

— |

|

|

|

(283 |

) |

|

|

46 |

|

|

Increase in non-current liabilities |

|

6,143 |

|

|

|

1,719 |

|

|

|

22,754 |

|

|

|

5,719 |

|

|

Net cash provided by operating activities |

|

109,156 |

|

|

|

32,821 |

|

|

|

199,130 |

|

|

|

78,807 |

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Purchase of property and equipment |

|

(29,269 |

) |

|

|

(25,565 |

) |

|

|

(77,781 |

) |

|

|

(75,603 |

) |

|

Purchase of intangible assets |

|

— |

|

|

|

(10 |

) |

|

|

— |

|

|

|

(45 |

) |

|

Proceeds from sale of property and equipment |

|

1,058 |

|

|

|

10,621 |

|

|

|

51,353 |

|

|

|

307,106 |

|

|

Business acquisitions, net of cash |

|

(91 |

) |

|

|

(13,268 |

) |

|

|

(54,549 |

) |

|

|

(494,904 |

) |

|

Loans to equity investment, net |

|

14 |

|

|

|

— |

|

|

|

42 |

|

|

|

— |

|

|

Net cash used in investing activities |

|

(28,288 |

) |

|

|

(28,222 |

) |

|

|

(80,935 |

) |

|

|

(263,446 |

) |

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Receipt of long-term debt, net |

|

— |

|

|

|

4,600 |

|

|

|

47,556 |

|

|

|

78,833 |

|

|

Repayment of debt |

|

(6,714 |

) |

|

|

(6,006 |

) |

|

|

(20,563 |

) |

|

|

(16,517 |

) |

|

Principal payments on financing leases |

|

(1,274 |

) |

|

|

(1,325 |

) |

|

|

(3,580 |

) |

|

|

(4,237 |

) |

|

Early settlement of deferred consideration related to business

acquisition |

|

— |

|

|

|

— |

|

|

|

(17,155 |

) |

|

|

— |

|

|

Proceeds from sale-leaseback |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

80,397 |

|

|

Payment of Ares Put Option |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(9,808 |

) |

|

Common stock repurchased |

|

— |

|

|

|

(11,636 |

) |

|

|

(31,989 |

) |

|

|

(25,199 |

) |

|

Dividends paid on common stock |

|

(3,473 |

) |

|

|

(3,559 |

) |

|

|

(10,542 |

) |

|

|

(10,775 |

) |

|

Dividends paid on redeemable preferred stock |

|

(1,446 |

) |

|

|

(1,449 |

) |

|

|

(4,305 |

) |

|

|

(4,301 |

) |

|

Net cash (used in) provided by financing activities |

|

(12,907 |

) |

|

|

(19,375 |

) |

|

|

(40,578 |

) |

|

|

88,393 |

|

|

Net increase (decrease) in cash and

cash equivalents and restricted

cash |

|

67,961 |

|

|

|

(14,776 |

) |

|

|

77,617 |

|

|

|

(96,246 |

) |

|

Effect of exchange rate on cash and cash equivalents and

restricted cash |

|

11 |

|

|

|

(62 |

) |

|

|

(27 |

) |

|

|

(83 |

) |

|

Cash and cash equivalents and restricted cash, beginning of

period |

|

251,039 |

|

|

|

235,278 |

|

|

|

241,421 |

|

|

|

316,769 |

|

|

Cash and cash equivalents and restricted

cash, end of period |

$ |

319,011 |

|

|

$ |

220,440 |

|

|

$ |

319,011 |

|

|

$ |

220,440 |

|

Supplemental Disclosure of Non-GAAP

Financial Information

|

|

|

Reconciliation of EBITDA and Adjusted EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended

September 30, |

|

|

For the Nine Months Ended

September 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

(in thousands) |

|

|

Net income |

|

$ |

9,674 |

|

|

$ |

21,488 |

|

|

$ |

23,143 |

|

|

$ |

33,440 |

|

|

Interest and other financing expenses, net |

|

|

23,624 |

|

|

|

14,579 |

|

|

|

47,448 |

|

|

|

48,341 |

|

|

Income tax expense |

|

|

8,300 |

|

|

|

7,993 |

|

|

|

9,139 |

|

|

|

10,849 |

|

|

Depreciation and amortization |

|

|

33,132 |

|

|

|

33,713 |

|

|

|

98,425 |

|

|

|

94,949 |

|

|

EBITDA |

|

|

74,730 |

|

|

|

77,773 |

|

|

|

178,155 |

|

|

|

187,579 |

|

|

Acquisition and divestiture costs (a) |

|

|

1,729 |

|

|

|

1,127 |

|

|

|

3,919 |

|

|

|

7,980 |

|

|

Loss on disposal of assets and impairment charges (b) |

|

|

1,752 |

|

|

|

2,265 |

|

|

|

5,137 |

|

|

|

5,543 |

|

|

Share-based compensation expense (c) |

|

|

2,149 |

|

|

|

4,614 |

|

|

|

8,262 |

|

|

|

13,238 |

|

|

(Income) loss from equity investment (d) |

|

|

(29 |

) |

|

|

14 |

|

|

|

(79 |

) |

|

|

77 |

|

|

Fuel and franchise taxes received in arrears (e) |

|

|

(862 |

) |

|

|

— |

|

|

|

(1,427 |

) |

|

|

— |

|

|

Adjustment to contingent consideration (f) |

|

|

(706 |

) |

|

|

952 |

|

|

|

(998 |

) |

|

|

(672 |

) |

|

Other (g) |

|

|

14 |

|

|

|

558 |

|

|

|

(957 |

) |

|

|

726 |

|

|

Adjusted EBITDA |

|

$ |

78,777 |

|

|

$ |

87,303 |

|

|

$ |

192,012 |

|

|

$ |

214,471 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional information |

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-cash rent expense (h) |

|

$ |

3,634 |

|

|

$ |

3,860 |

|

|

$ |

10,805 |

|

|

$ |

10,418 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) Eliminates costs incurred that are directly attributable

to business acquisitions and divestitures (including conversion of

retail stores to dealer sites) and salaries of employees whose

primary job function is to execute the Company's acquisition and

divestiture strategy and facilitate integration of acquired

operations. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(b) Eliminates the non-cash loss from the sale of property and

equipment, the loss recognized upon the sale of related leased

assets, and impairment charges on property and equipment and

right-of-use assets related to closed and non-performing

sites. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(c) Eliminates non-cash share-based compensation expense

related to the equity incentive program in place to incentivize,

retain, and motivate employees, certain non-employees and members

of the Board. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(d) Eliminates the Company's share of (income) loss

attributable to its unconsolidated equity investment. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(e) Eliminates the receipt of historical fuel and franchise

tax amounts for multiple prior periods. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(f) Eliminates fair value adjustments to the contingent

consideration owed to the seller for the 2020 Empire

acquisition. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(g) Eliminates other unusual or non-recurring items that the

Company does not consider to be meaningful in assessing operating

performance. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(h) Non-cash rent expense reflects the extent to which GAAP

rent expense recognized exceeded (or was less than) cash rent

payments. GAAP rent expense varies depending on the terms of the

Company's lease portfolio. For newer leases, rent expense

recognized typically exceeds cash rent payments, whereas, for more

mature leases, rent expense recognized is typically less than cash

rent payments. |

|

Supplemental Disclosures of Segment

Information

Retail Segment

|

|

For the Three Months Ended

September 30, |

|

|

For the Nine Months Ended

September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

(in thousands) |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

Fuel revenue |

$ |

929,783 |

|

|

$ |

1,086,405 |

|

|

$ |

2,730,583 |

|

|

$ |

2,945,243 |

|

|

Merchandise revenue |

|

469,616 |

|

|

|

506,425 |

|

|

|

1,358,519 |

|

|

|

1,391,274 |

|

|

Other revenues, net |

|

16,082 |

|

|

|

19,750 |

|

|

|

49,496 |

|

|

|

57,302 |

|

|

Total revenues |

|

1,415,481 |

|

|

|

1,612,580 |

|

|

|

4,138,598 |

|

|

|

4,393,819 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Fuel costs |

|

826,765 |

|

|

|

980,161 |

|

|

|

2,443,499 |

|

|

|

2,661,406 |

|

|

Merchandise costs |

|

315,597 |

|

|

|

345,699 |

|

|

|

913,823 |

|

|

|

952,925 |

|

|

Site operating expenses |

|

202,097 |

|

|

|

205,216 |

|

|

|

602,664 |

|

|

|

578,496 |

|

|

Total operating expenses |

|

1,344,459 |

|

|

|

1,531,076 |

|

|

|

3,959,986 |

|

|

|

4,192,827 |

|

|

Operating income |

|

71,022 |

|

|

|

81,504 |

|

|

|

178,612 |

|

|

|

200,992 |

|

|

Intercompany charges by GPMP 1 |

|

14,072 |

|

|

|

15,022 |

|

|

|

40,920 |

|

|

|

42,149 |

|

|

Operating income, as adjusted |

$ |

85,094 |

|

|

$ |

96,526 |

|

|

$ |

219,532 |

|

|

$ |

243,141 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Represents the estimated fixed margin or fixed fee paid to GPMP

for the cost of fuel. |

|

The table below shows financial information and

certain key metrics of recent acquisitions in the Retail Segment

that do not have (or have only partial) comparable information for

any of the prior periods.

|

|

For the Three Months EndedSeptember 30,

2024 |

|

|

For the Nine Months

EndedSeptember 30, 2024 |

|

|

|

Speedy's 1 |

|

|

SpeedyQ 2 |

|

|

Total |

|

|

Speedy's 1 |

|

|

SpeedyQ 2 |

|

|

Total |

|

|

|

(in thousands) |

|

|

Date of Acquisition: |

Aug 15, 2023 |

|

|

Apr 9, 2024 |

|

|

|

|

|

Aug 15, 2023 |

|

|

Apr 9, 2024 |

|

|

|

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fuel revenue |

$ |

4,894 |

|

|

$ |

14,222 |

|

|

$ |

19,116 |

|

|

$ |

14,248 |

|

|

$ |

27,578 |

|

|

$ |

41,826 |

|

|

Merchandise revenue |

|

2,668 |

|

|

|

7,512 |

|

|

|

10,180 |

|

|

|

7,577 |

|

|

|

14,250 |

|

|

|

21,827 |

|

|

Other revenues, net |

|

50 |

|

|

|

271 |

|

|

|

321 |

|

|

|

156 |

|

|

|

498 |

|

|

|

654 |

|

|

Total revenues |

|

7,612 |

|

|

|

22,005 |

|

|

|

29,617 |

|

|

|

21,981 |

|

|

|

42,326 |

|

|

|

64,307 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fuel costs |

|

4,400 |

|

|

|

12,466 |

|

|

|

16,866 |

|

|

|

12,873 |

|

|

|

24,280 |

|

|

|

37,153 |

|

|

Merchandise costs |

|

1,713 |

|

|

|

5,363 |

|

|

|

7,076 |

|

|

|

4,806 |

|

|

|

10,236 |

|

|

|

15,042 |

|

|

Site operating expenses |

|

1,195 |

|

|

|

3,329 |

|

|

|

4,524 |

|

|

|

3,307 |

|

|

|

6,387 |

|

|

|

9,694 |

|

|

Total

operating expenses |

|

7,308 |

|

|

|

21,158 |

|

|

|

28,466 |

|

|

|

20,986 |

|

|

|

40,903 |

|

|

|

61,889 |

|

|

Operating income |

|

304 |

|

|

|

847 |

|

|

|

1,151 |

|

|

$ |

995 |

|

|

$ |

1,423 |

|

|

$ |

2,418 |

|

|

Intercompany charges by GPMP 3 |

|

79 |

|

|

|

212 |

|

|

|

291 |

|

|

|

229 |

|

|

|

405 |

|

|

|

634 |

|

|

Operating income,

as adjusted |

$ |

383 |

|

|

$ |

1,059 |

|

|

$ |

1,442 |

|

|

$ |

1,224 |

|

|

$ |

1,828 |

|

|

$ |

3,052 |

|

|

Fuel gallons sold |

|

1,590 |

|

|

|

4,240 |

|

|

|

5,830 |

|

|

|

4,593 |

|

|

|

8,097 |

|

|

|

12,690 |

|

|

Fuel contribution 4 |

$ |

573 |

|

|

$ |

1,968 |

|

|

$ |

2,541 |

|

|

$ |

1,604 |

|

|

$ |

3,703 |

|

|

$ |

5,307 |

|

|

Merchandise contribution 5 |

$ |

955 |

|

|

$ |

2,149 |

|

|

$ |

3,104 |

|

|

$ |

2,771 |

|

|

$ |

4,014 |

|

|

$ |

6,785 |

|

|

Merchandise margin 6 |

|

35.8 |

% |

|

|

28.6 |

% |

|

|

|

|

|

36.6 |

% |

|

|

28.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Acquisition of seven Speedy's retail stores. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 Acquisition of 21 SpeedyQ retail stores. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 Represents the estimated fixed margin paid to GPMP for the cost

of fuel. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 Calculated as fuel revenue less fuel costs; excludes the

estimated fixed margin paid to GPMP for the cost of fuel. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 Calculated as merchandise revenue less merchandise costs. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 Calculated as merchandise contribution divided by merchandise

revenue. |

|

Wholesale Segment

|

|

For the Three Months Ended

September 30, |

|

|

For the Nine Months Ended

September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

(in thousands) |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

Fuel revenue |

$ |

720,646 |

|

|

$ |

843,891 |

|

|

$ |

2,147,853 |

|

|

$ |

2,339,878 |

|

|

Other revenues, net |

|

6,751 |

|

|

|

6,265 |

|

|

|

20,459 |

|

|

|

18,866 |

|

|

Total revenues |

|

727,397 |

|

|

|

850,156 |

|

|

|

2,168,312 |

|

|

|

2,358,744 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Fuel costs |

|

709,408 |

|

|

|

830,121 |

|

|

|

2,115,367 |

|

|

|

2,305,098 |

|

|

Site operating expenses |

|

9,817 |

|

|

|

10,009 |

|

|

|

28,682 |

|

|

|

29,303 |

|

|

Total operating expenses |

|

719,225 |

|

|

|

840,130 |

|

|

|

2,144,049 |

|

|

|

2,334,401 |

|

|

Operating income |

|

8,172 |

|

|

$ |

10,026 |

|

|

$ |

24,263 |

|

|

$ |

24,343 |

|

|

Intercompany charges by GPMP 1 |

|

12,122 |

|

|

|

12,559 |

|

|

|

35,590 |

|

|

|

36,528 |

|

|

Operating income, as adjusted |

$ |

20,294 |

|

|

$ |

22,585 |

|

|

$ |

59,853 |

|

|

$ |

60,871 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Represents the estimated fixed margin or fixed fee paid to GPMP

for the cost of fuel. |

|

Fleet Fueling Segment

|

|

For the Three Months Ended

September 30, |

|

|

For the Nine Months Ended

September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

(in thousands) |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

Fuel revenue |

$ |

125,933 |

|

|

$ |

145,496 |

|

|

$ |

398,266 |

|

|

$ |

394,136 |

|

|

Other revenues, net |

|

2,335 |

|

|

|

2,575 |

|

|

|

7,004 |

|

|

|

5,202 |

|

|

Total revenues |

|

128,268 |

|

|

|

148,071 |

|

|

|

405,270 |

|

|

|

399,338 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Fuel costs |

|

111,554 |

|

|

|

133,037 |

|

|

|

355,761 |

|

|

|

356,703 |

|

|

Site operating expenses |

|

5,876 |

|

|

|

6,206 |

|

|

|

18,861 |

|

|

|

16,039 |

|

|

Total operating expenses |

|

117,430 |

|

|

|

139,243 |

|

|

|

374,622 |

|

|

|

372,742 |

|

|

Operating income |

|

10,838 |

|

|

|

8,828 |

|

|

|

30,648 |

|

|

|

26,596 |

|

|

Intercompany charges by GPMP 1 |

|

1,802 |

|

|

|

1,832 |

|

|

|

5,452 |

|

|

|

5,077 |

|

|

Operating income, as adjusted |

$ |

12,640 |

|

|

$ |

10,660 |

|

|

$ |

36,100 |

|

|

$ |

31,673 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Represents the estimated fixed fee paid to GPMP for the cost of

fuel. |

|

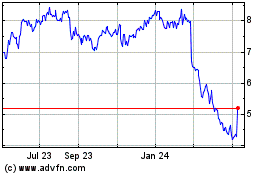

ARKO (NASDAQ:ARKO)

Historical Stock Chart

From Dec 2024 to Jan 2025

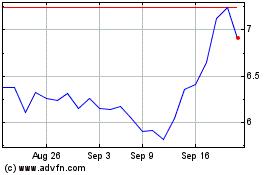

ARKO (NASDAQ:ARKO)

Historical Stock Chart

From Jan 2024 to Jan 2025