false

0001462418

0001462418

2025-01-24

2025-01-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 24, 2025

ALTISOURCE PORTFOLIO SOLUTIONS S.A.

(Exact name of Registrant as specified in its Charter)

| |

Luxembourg |

|

001-34354 |

|

98-0554932 |

|

| |

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification

No.) |

|

33, Boulevard Prince Henri

L-1724 Luxembourg

Grand Duchy of Luxembourg

(Address of principal executive offices including

zip code)

+352 2060 2055

(Registrant’s telephone number, including

area code)

NOT APPLICABLE

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common Stock, $1.00 par value |

|

ASPS |

|

NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02 – Departure of Directors or

Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

Rescission of Temporary Compensation Modification

As disclosed in the Form 8-K filed by Altisource

Portfolio Solutions S.A. (the “Company”) on November 3, 2023, William B. Shepro, Chairman and Chief Executive Officer,

and Michelle D. Esterman, Chief Financial Officer, of the Company, each voluntarily agreed to allow up to 30% of their base compensation

to be paid in unrestricted Company common stock (“common stock”) instead of cash. This change was implemented as part of the

Company’s cost reduction plan that began in July 2023.

On January 24, 2025, Mr. Shepro and

Ms. Esterman notified the Company’s board of directors (the “Board”) of their decisions to rescind the previously

disclosed voluntary modification to their compensation structures, effective February 1, 2025.

Pursuant to their written notifications to the

Board, both executives have elected to revert to receiving their full base compensation in cash. This change will be effective February 1,

2025.

Partial Termination of Certain Management Restricted

Stock Unit Awards

On January 28, 2025, certain executives,

including each of the Named Executive Officers ("NEOs"), voluntarily agreed to terminate 112,000 market-based restricted stock

units granted under Restricted Stock Unit Award Agreements dated October 1, 2020 (“RSU Agreements”), pursuant to the

Company's 2009 Equity Incentive Plan, as amended and restated ("Market-Based RSUs"). To effectuate this termination, the Company

entered into Consent to Partial Termination of Restricted Stock Unit Award Agreements (the "Consents") with the NEOs and certain

other executives. Under the terms of the Consents, effective January 29, 2025, the Market-Based RSUs are terminated and canceled

in their entirety. In particular, Mr. Shepro, Ms. Esterman and Mr. Ritts voluntarily agreed to terminate 40,000, 19,000

and 19,000 Market-Based RSUs, respectively.

All other provisions of the applicable RSU Agreements

remain in full force and effect, and the Consents do not impact any other compensation arrangements, including employment agreements,

confidentiality agreements, or other equity awards of the NEOs.

Approval of Management Restricted Stock Units

As previously disclosed, on December 16,

2024, the Company and its wholly owned subsidiary, Altisource S.à r.l., entered a Transaction Support Agreement (the “TSA”)

with the holders of approximately 99% of the total outstanding principal amount of term loans outstanding (the “Consenting Lenders”).

Pursuant to the TSA and, subject to the conditions contained in the definitive documents to be entered into pursuant to the TSA (the “Definitive

Documents”), the Company expects to engage in certain transactions (the “Transactions”) to, among other things, amend

the terms of, reduce the principal amount owed under and extend the maturity of the Company’s existing term loans. In addition,

pursuant to the terms of the TSA and subject to the terms of the Definitive Documents, as part of the Transactions, the Company expects

to issue to its lenders shares of common stock representing up to 63.5% of the Company’s outstanding shares immediately following

the effective date of the Transactions (the “Debt Exchange Shares”).The Transactions are more fully described in the Company’s

definitive proxy statement on Schedule 14A filed with the Securities and Exchange Commission on January 3, 2024 (the “Proxy

Statement”).

Under the terms of the TSA, members of the Company’s

management, including its NEOs, are to receive restricted share units (“RSUs”) which, if vested pursuant to their terms, would,

in the aggregate, equal up to 5% of the Company’s common stock outstanding immediately following the effective date of the Transactions

(the “Management RSUs”). The provision of the Management RSUs to members of the Company’s management was important to

the Consenting Term Lenders to ensure that management is sufficiently incentivized to grow the Company’s business and to reenforce

the alignment between management and shareholders by tying executive compensation to the Company’s long-term performance and value

creation.

On January 29, 2025, the Compensation Committee

of the Board (the “Compensation Committee”) approved the grant of Management RSUs to certain members of management, including

the NEOs, effective on February 13, 2025. The vesting of the Management RSUs will be subject to, among other things, the closing

of the Transactions, which, in turn is subject to shareholder approval of certain proposals to facilitate the Transactions described in

the Proxy Statement. The RSUs that are to be granted to the NEOs represent up to 4.5109% of the Company’s common stock outstanding

immediately following the effective date of the Transactions, pro forma for the issuance of the Debt Exchange Shares.

The allocation of Management RSUs to the NEOs

is as follows:

| NEO | |

Title | |

RSU Allocation (% of post-Transactions common stock

outstanding) |

| William B. Shepro | |

Chairman & Chief Executive Officer | |

2.7174% |

| Michelle D. Esterman | |

Chief Financial Officer | |

0.9783% |

| Gregory J. Ritts | |

Chief Legal & Compliance Officer | |

0.8152% |

| Total | |

| |

4.5109% |

The Management RSUs will vest in three equal installments, with one-third vesting on each of the first three anniversaries of the effective

date of the Transactions.

As described in the Proxy Statement, the Management

RSUs will be eligible to receive warrants that will be issued to holders of common stock, restricted share units and penny warrants as

of the record date for the issuance of such warrants, which is expected to be February 14, 2025.

The Compensation Committee has determined that

the NEOs will not participate in the Company’s Long-Term Incentive Plans commencing in the years 2025–2027 due to the issuance

of the Management RSUs.

Forward-Looking Statements

This Form 8-K contains forward-looking statements

that involve a number of risks and uncertainties. These forward-looking statements include all statements that are not historical fact,

including statements that relate to, among other things, the issuance and allocation of the Management RSU, the expected record date for

the distribution of warrants, the closing of the Transactions. These statements may be identified by words such as “anticipate,”

“intend,” “expect,” “may,” “could,” “should,” “would,” “plan,”

“estimate,” “seek,” “believe,” “potential” or “continue” or the negative of

these terms and comparable terminology. Such statements are based on expectations as to the future and are not statements of historical

fact. Furthermore, forward-looking statements are not guarantees of future performance and involve a number of assumptions, risks and

uncertainties that could cause actual results to differ materially. Important factors that could cause actual results to differ materially

from those suggested by the forward-looking statements include, but are not limited to, the risks discussed in Item 1A of Part I

“Risk Factors” of our Form 10-K for the year ended December 31, 2023 filed with the Securities and Exchange Commission

on March 7, 2024, as the same may be updated from time to time in our subsequent Form 10-Q filings. We caution you not to place

undue reliance on these forward-looking statements which reflect our view only as of the date of this Form 8-K. We are under no obligation

(and expressly disclaim any obligation) to update or alter any forward-looking statements contained herein to reflect any change in our

expectations with regard thereto or change in events, conditions or circumstances on which any such statement is based. The risks and

uncertainties to which forward-looking statements are subject include, but are not limited to, risks related to customer concentration,

the timing of the expiration of certain governmental and servicer foreclosure and eviction moratoriums and forbearance programs and the

anticipated increase in default related referrals (if any) following the same, and any other delays occasioned by government, investor

or servicer actions, the use and success of our products and services, our ability to retain existing customers and attract new customers

and the potential for expansion or changes in our customer relationships, technology disruptions, our compliance with applicable data

requirements, our use of third party vendors and contractors, our ability to effectively manage potential conflicts of interest, macro-economic

and industry specific conditions, our ability to effectively manage our regulatory and contractual obligations, the adequacy of our financial

resources, including our sources of liquidity and ability to repay borrowings and comply with our debt agreements, including the financial

and other covenants contained therein, as well as Altisource’s ability to retain key executives or employees, behavior of customers,

suppliers and/or competitors, technological developments, governmental regulations, taxes and policies, and the risks and uncertainties

related to completion of the Transactions on the anticipated terms or at all, including the negotiation of and entry into the definitive

agreements and the satisfaction of the closing conditions of such definitive agreements, including the obtaining of the required shareholder

approval of the Proposals. We undertake no obligation to update these statements, scenarios and projections as a result of a change in

circumstances, new information or future events, except as required by law.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

Date: January 30, 2025

| |

Altisource Portfolio Solutions S.A. |

|

| |

|

|

| |

By: |

/s/ Michelle D. Esterman |

|

| |

Name: |

Michelle D. Esterman |

|

| |

Title: |

Chief Financial Officer |

|

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

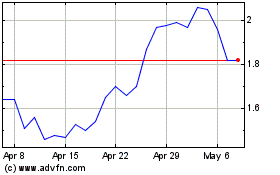

Altisource Portfolio Sol... (NASDAQ:ASPS)

Historical Stock Chart

From Jan 2025 to Feb 2025

Altisource Portfolio Sol... (NASDAQ:ASPS)

Historical Stock Chart

From Feb 2024 to Feb 2025