Assertio Holdings, Inc. (“Assertio” or the “Company”) (Nasdaq:

ASRT), a specialty pharmaceutical company offering differentiated

products to patients, today announced preliminary, unaudited

financial results for its fourth quarter and full year 2022, ended

December 31, 2022, including its highest quarter of net product

sales in the past five years.

Preliminary unaudited fourth quarter and full year 2022

financial results are approximately as follows:

(All amounts in $ millions other than per share amounts)

|

|

Fourth Quarter 2022 |

|

Full Year 2022 |

|

Net Product Sales |

$49.0 |

to |

$50.0 |

|

$154.0 |

to |

$155.0 |

|

Total Operating Costs and Expenses |

$39.5 |

to |

$40.5 |

|

$116.5 |

to |

$117.5 |

|

Income Tax Benefit1 |

$78.0 |

to |

$80.0 |

|

$78.0 |

to |

$80.0 |

|

Net Income |

$88.0 |

to |

$89.0 |

|

$109.0 |

to |

$110.0 |

|

Diluted Earnings Per Share |

$1.32 |

to |

$1.33 |

|

$2.02 |

to |

$2.03 |

|

Adjusted EBITDA (Non-GAAP) |

$32.5 |

to |

$33.5 |

|

$101.0 |

to |

$102.0 |

|

Adjusted Earnings Per Share (Non-GAAP) |

$0.31 |

to |

$0.32 |

|

$1.18 |

to |

$1.19 |

|

Cash Flows from Operations |

$26.0 |

to |

$27.0 |

|

$78.0 |

to |

$79.0 |

The preliminary results demonstrate the upside across the

product portfolio from commercial execution, particularly with

Indocin, and the addition of Sympazan. In addition, our GAAP Net

Income was positively affected by a tax benefit from the reversal

of a valuation allowance against our deferred tax assets. This

adjustment reflects the positive change in the Company’s financial

performance which has now been consistently generating positive Net

Income and Operating Cash Flows.

“Assertio’s preliminary 2022 results demonstrated our ability to

scale net product sales and generate substantial cash flow to fund

our growth objectives, both organic and strategic,” said Dan

Peisert, Chief Executive Officer. “We ended 2022 with cash and cash

equivalents of $64.9 million, which was greater than our September

cash balance even after funding $25 million of asset purchase

payments for Otrexup and Sympazan in the fourth quarter.”

The Company expects to provide its initial 2023 outlook on the

March full year 2022 financial results call.

Fourth Quarter and Full Year 2022 Results

The Company will release fourth quarter and full year 2022

audited financial results on Wednesday, March 8, 2023, after the

market close. Following the release of its financial results,

Assertio’s management will host a live webcast of the earnings

conference call at 4:30 p.m. Eastern Time.

To access the live webcast, conference call information, and

other materials, please visit Assertio’s investor relations website

at http://investor.assertiotx.com/overview/default.aspx. Please

connect at least 10 minutes prior to the live webcast to ensure

adequate time for any software download that may be needed to

access the webcast. For those wishing to join by telephone only,

please dial +1-404-975-4839 and reference access code 800382.

A webcast replay of the call will be available approximately two

hours after the call on Assertio’s investor website.

About AssertioAssertio is a specialty

pharmaceutical company offering differentiated products to patients

utilizing a non-personal promotional model. We have built and

continue to build our commercial portfolio by identifying new

opportunities within our existing products as well as acquisitions

or licensing of additional approved products. To learn more about

Assertio, visit www.assertiotx.com.

Preliminary 2022 Financial Results

The preliminary, unaudited financial results included in this

press release are based on information available as of February 21,

2023 and management's initial review of operations for the fourth

quarter and year ended December 31, 2022. They remain subject to

change based on management’s ongoing review of the fourth quarter

and full year results and are forward-looking statements. We assume

no obligation to update these statements. The actual results remain

subject to the completion of management’s and our audit committee’s

reviews and our other financial closing procedures, as well as the

completion of the preparation of our audited consolidated financial

results for the year ended December 31, 2022 and related

independent audit. During that process, we may identify items that

would require us to make adjustments, which may be material, to the

information presented in this press release. While we do not expect

that our actual results for the year ended December 31, 2022 will

vary materially from the preliminary, unaudited financial results

presented in this press release, there can be no assurance that

these estimates will be realized. Actual results may be materially

different and are affected by the risk factors and uncertainties

identified in this press release and in our annual and quarterly

filings with the Securities and Exchange Commission (“SEC”).

Non-GAAP Financial Measures

To supplement our preliminary unaudited financial results

presented on a U.S. generally accepted accounting principles

(“GAAP”) basis, we have included information about non-GAAP

measures of adjusted EBITDA and adjusted earnings per share as

useful financial metrics that enhance investors’ understanding of

our business. We believe that the presentation of these non-GAAP

financial measures, when viewed with results under GAAP provides

supplementary information to analysts, investors, lenders, and our

management in assessing our performance and results from period to

period. We use these non-GAAP measures internally to understand,

manage and evaluate our performance. These non-GAAP financial

measures should be considered in addition to, and not a substitute

for, or superior to, net income or other financial measures

calculated in accordance with GAAP. Non-GAAP financial measures

used by us may be calculated differently from, and therefore may

not be comparable to, non-GAAP measures used by other companies. We

plan to provide further commentary on the fourth quarter and full

year 2022 and our outlook for 2023 in March as part of our full

year 2022 earnings release and conference call.

Forward Looking Statements

Statements in this communication that are not historical facts

are forward-looking statements that reflect Assertio's current

expectations, assumptions and estimates of future performance and

economic conditions. These forward-looking statements are made in

reliance on the safe harbor provisions of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. These forward-looking

statements relate to, among other things, the preliminary,

unaudited financial results included in this press release, future

events or the future performance or operations of Assertio,

including our ability to realize the benefits from our operating

model, successfully acquire and integrate new assets and explore

new business development initiatives. All statements other than

historical facts may be forward-looking statements and can be

identified by words such as "anticipate," "believe," "could,"

"design," "estimate," "expect," "forecast," "goal," "guidance,"

"imply," "intend," "may", "objective," "opportunity," "outlook,"

"plan," "position," "potential," "predict," "project,"

"prospective," "pursue," "seek," "should," "strategy," "target,"

"would," "will," "aim" or other similar expressions that convey the

uncertainty of future events or outcomes and are used to identify

forward-looking statements. Such forward-looking statements are not

guarantees of future performance and are subject to risks,

uncertainties and other factors, some of which are beyond the

control of Assertio, including the risks described in Assertio's

Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed

with the U.S. Securities and Exchange Commission ("SEC") and in

other filings Assertio makes with the SEC from time to time.

Investors and potential investors are urged not to place undue

reliance on forward-looking statements in this communication, which

speak only as of this date. While Assertio may elect to update

these forward-looking statements at some point in the future, it

specifically disclaims any obligation to update or revise any

forward-looking-statements contained in this press release whether

as a result of new information or future events, except as may be

required by applicable law.

Investor Contact Matt KrepsDarrow Associates

Investor Relations+1-214-597-8200mkreps@darrowir.com

1 In the fourth quarter, approximately $80 million of previously

recognized valuation allowance against net deferred tax assets was

released, resulting in tax benefit impact.

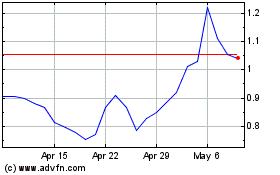

Assertio (NASDAQ:ASRT)

Historical Stock Chart

From Nov 2024 to Dec 2024

Assertio (NASDAQ:ASRT)

Historical Stock Chart

From Dec 2023 to Dec 2024