Assertio Holdings, Inc. (“Assertio” or the “Company”) (Nasdaq:

ASRT), a pharmaceutical company with comprehensive commercial

capabilities offering differentiated products to patients, today

reported financial results for the third quarter ended

September 30, 2024.

“Third quarter results reflected solid performance as we

continue to establish Rolvedon as our lead asset and drive economic

returns from our commercial portfolio,” said Brendan O’Grady, Chief

Executive Officer. “Rolvedon has been well received by physicians,

posting another quarter of stable performance and the continued

expansion of our customer base. The Rolvedon same day dosing trial

has concluded and the results have been accepted for presentation

at the San Antonio Breast Cancer Symposium in December 2024.”

“Additionally, we have implemented new sales and marketing

tactics for Sympazan, which are designed to drive prescriber

awareness and prescription growth in key markets. We are

maintaining our share of Indocin and working to maximize the value

of this product and our other commercial assets moving forward. We

are also evaluating new approaches to grow existing assets as well

as the acquisition of additional assets to fuel further

growth.”

Financial Highlights (unaudited):

| |

Three Months Ended |

|

Nine Months Ended |

| (in millions, except per share

amounts) |

September 30, 2024 |

|

June 30, 2024 |

|

September 30, 2023 |

|

September 30, 2024 |

|

September 30, 2023 |

|

Net Product Sales (GAAP) |

$ |

28.7 |

|

|

$ |

30.7 |

|

|

$ |

35.1 |

|

|

$ |

91.3 |

|

|

$ |

117.0 |

|

| Net Loss

(GAAP) |

$ |

(2.9 |

) |

|

$ |

(3.7 |

) |

|

$ |

(279.5 |

) |

|

$ |

(11.1 |

) |

|

$ |

(274.6 |

) |

| Loss Per Share

(GAAP) |

$ |

(0.03 |

) |

|

$ |

(0.04 |

) |

|

$ |

(3.42 |

) |

|

$ |

(0.12 |

) |

|

$ |

(4.35 |

) |

| Adjusted EBITDA

(Non-GAAP)1 |

$ |

5.3 |

|

|

$ |

5.0 |

|

|

$ |

12.9 |

|

|

$ |

17.7 |

|

|

$ |

63.3 |

|

| Adjusted Earnings Per

Share (Non-GAAP)1 |

$ |

0.03 |

|

|

$ |

0.02 |

|

|

$ |

0.01 |

|

|

$ |

0.09 |

|

|

$ |

0.46 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Third quarter results included the following highlights (our

discussion below focuses on a comparison of third quarter 2024 to

second quarter 2024 given the acquisition of Spectrum and the

generic competition of Indocin introduced in the third quarter

2023):

- Rolvedon net product sales were stable at $15.0 million in the

third quarter, from $15.1 million in the second quarter, driven by

continued volume growth offset by lower net pricing.

- Indocin net product sales in the third quarter were $5.7

million, decreased from $6.9 million in the second quarter, due to

the previously announced generic competition affecting

pricing.

- Gross margin2 in the third quarter increased to 74%, from 71%

in the second quarter, primarily due a decrease in the level of

inventory write downs in late life-cycle stage products and the

completion of Rolvedon inventory step-up amortization.

- SG&A expense in the third quarter was $16.7 million,

decreased from $18.4 million in the second quarter. The decrease

was primarily due to lower sales and marketing and other general

and administrative costs, partially offset by net higher legal

related charges.

- Adjusted EBITDA3 was $5.3 million in the third quarter,

increased from $5.0 million in the second quarter, primarily due to

lower SG&A expense, partially offset by lower net product

sales.

Balance Sheet and Cash Flow

- For the quarter ended September 30, 2024, cash, cash

equivalents and short-term investments were $88.6 million,

compared with $88.4 million at June 30, 2024. Cash flow generation

during the quarter was impacted by the timing of working capital as

well as lower net product sales.

- Debt at September 30, 2024 was $40.0 million, comprised of

the Company’s 6.5% convertible notes, with no maturities until

September 2027.

Board Updates

Peter Staple retired from the board after more than 20 years as

an independent director. Also, Dr. Jeffrey Vacirca has elected to

depart from the board to focus on his other business interests.

Both departures were effective November 7, 2024.

Assertio announced the appointment of Heather Mason as Board

Chair. Mason has served as an independent director since 2019 and

as interim CEO of Assertio from January to May of 2024. Further,

David Stark was appointed to the board as an independent director

and member of the Nominating and Corporate Governance Committee.

Stark was previously Executive Vice President and Chief Legal

Officer at Teva Pharmaceutical Industries Limited.

“I want thank Jeff and Peter for their service to Assertio and

its shareholders,” said Mason. “Jeff’s insight into the oncology

market since joining the board as part of the Spectrum transaction

has been invaluable. Peter has served for more than 20 years on the

Assertio board, offering calm leadership and wise counsel through

transitions and challenges faced by the organization during his

tenure. I also appreciate Peter extending his board service during

the time of transition to Brendan O’Grady as the new CEO. I want to

welcome David to the board and look forward to his partnership.

David brings extensive litigation, compliance and acquisition

experience from his time at Teva and earlier in private law firm

practice.”

Conference Call and Investor Presentation

Information

Assertio’s management will host a conference call to discuss its

third quarter 2024 financial results today:

|

Date: |

Monday, November 11, 2024 |

|

Time: |

4:30 p.m. Eastern Time |

|

Webcast (live and archive): |

http://investor.assertiotx.com/overview/default.aspx(Events &

Webcasts, Investor Page) |

|

Dial-in numbers: |

1-646-307-1963, Conference ID 3278948 |

|

|

|

To access the live webcast, the recorded conference call replay,

and other materials, please visit Assertio’s investor relations

website at http://investor.assertiotx.com/overview/default.aspx.

Please connect at least 15 minutes prior to the live webcast to

ensure adequate time for any software download that may be needed

to access the webcast. The replay will be available approximately

two hours after the call on Assertio’s investor website.

1 Non-GAAP measures are reconciled to the corresponding GAAP

measures in the schedules attached.2 Gross margin represents the

ratio of net product sales less cost of sales to net product

sales.3 See “Non-GAAP Financial Measures” below for information

about reconciling our Adjusted EBITDA guidance to Net Loss.

About Assertio

Assertio is a commercial pharmaceutical company with

comprehensive commercial capabilities offering differentiated

products to patients. We have built our commercial portfolio

through acquisition or licensing of approved products. Our

commercial capabilities include marketing through both a sales

force and a non-personal promotion model, market access through

payor contracting, and trade and distribution. To learn more about

Assertio, visit www.assertiotx.com.

Investor Contact

Matt Kreps, Managing DirectorDarrow AssociatesM:

214-597-8200mkreps@darrowir.com

Forward Looking Statements

The statements in this communication include forward-looking

statements. Forward-looking statements may discuss goals,

intentions and expectations as to future plans, trends, events,

results of operations or financial condition, or otherwise, based

on current beliefs. Forward-looking statements speak only as of the

date they are made or as of the dates indicated in the statements

and should not be relied upon as predictions of future events, as

there can be no assurance that the events or circumstances

reflected in these statements will be achieved or will occur.

Forward-looking statements can often, but not always, be identified

by the use of forward-looking terminology such as “anticipate,”

“approximate”, “believe,” “could,” “estimate,” “expect,” “goal,”

“intend,” “may,” “might,” “opportunity,” “plan,” “potential,”

“project,” “prospective,” “pursue,” “seek,” “should,” “strategy,”

“target,” “will,” or the negative of these words and phrases, other

variations of these words and phrases or comparable terminology.

These forward-looking statements involve risks and uncertainties

that could cause actual results to differ materially from those

contemplated by the statements, including: Assertio’s ability to

grow sales of, and the commercial success and market acceptance of,

Rolvedon and Assertio’s other products; Assertio’s ability to

successfully develop and execute its sales, marketing and promotion

strategies using its sales force and non-personal promotion model

capabilities; the impact on sales and profits from the entry and

sales of generics of Assertio’s products and/or other products

competitive with any of Assertio’s products (including indomethacin

suppositories compounded by hospitals and other institutions

including a 503B compounder which we believe to be violation of

certain provisions of the Food, Drug and Cosmetic Act); the timing

and impact of additional generic approvals and uncertainty around

the recent approvals and launches of generic Indocin products

(which are not patent protected and now face generic competition as

a result of the August 2023 approval and launch of generic

indomethacin suppositories and January 2024 approval and subsequent

launch of a generic indomethacin oral suspension product); risks

that any new businesses will not be integrated successfully or that

the combined company will not realize estimated cost savings, value

of certain tax assets, synergies and growth, or that such benefits

may take longer and/or cost more to realize than expected; expected

industry trends, including pricing pressures and managed healthcare

practices; Assertio’s ability to attract and retain executive

leadership and key employees; the ability of Assertio’s third-party

manufacturers to manufacture adequate quantities of commercially

salable inventory and active pharmaceutical ingredients for each of

Assertio’s products on commercially reasonable terms and in

compliance with their contractual obligations to Assertio, and

Assertio’s ability to maintain its supply chain which relies on

single-source suppliers; the outcome of, and Assertio’s intentions

with respect to, any litigation or government investigations,

including pending and potential future shareholder litigation

relating to the Spectrum Merger and/or the recent approval and

launch of generic indomethacin suppositories, opioid-related

government investigations and opioid-related litigation, the

recently unsealed qui tam litigation, as well as Spectrum’s legacy

shareholder and other litigation and, and other disputes and

litigation, and the costs and expenses associated therewith;

Assertio’s financial cost and outcomes of clinical trials,

including the extent to which data from the Rolvedon same-day

dosing trial may support ongoing commercialization efforts;

Assertio’s compliance with legal and regulatory requirements

related to the development or promotion of its products; variations

in revenues obtained from commercialization agreements and the

accounting treatment with respect thereto; Assertio’s common stock

maintaining compliance with The Nasdaq Capital Market’s minimum

closing bid requirement of at least $1.00 per share, particularly

in light of Assertio’s stock trading below or only slightly above

$1.00 per share recently as well as recent market activity by a

short seller; and Assertio’s ability to obtain and maintain

intellectual property protection for its products and operate its

business without infringing the intellectual property rights of

others. For a discussion of additional factors that could cause

actual results to differ materially from those contemplated by

forward-looking statements, see the risks described in Assertio’s

Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and

other filings with the Securities and Exchange Commission. Many of

these risks and uncertainties may be exacerbated by public health

emergencies and general macroeconomic conditions. Assertio does not

assume, and hereby disclaims, any obligation to update

forward-looking statements, except as may be required by law.

Non-GAAP Financial Measures

To supplement the Company’s financial results presented on a

U.S. generally accepted accounting principles (“GAAP”) basis, the

Company has included information about non-GAAP measures of EBITDA,

adjusted EBITDA, adjusted earnings, and adjusted earnings per share

as useful operating metrics. The Company believes that the

presentation of these non-GAAP financial measures, when viewed with

results under GAAP and the accompanying reconciliation, provides

supplementary information to analysts, investors, lenders, and the

Company’s management in assessing the Company’s performance and

results from period to period. The Company uses these non-GAAP

measures internally to understand, manage and evaluate the

Company’s performance, and in part, in the determination of bonuses

for executive officers and employees. These non-GAAP financial

measures should be considered in addition to, and not a substitute

for, or superior to, net income or other financial measures

calculated in accordance with GAAP. Non-GAAP financial measures

used by us may be calculated differently from, and therefore may

not be comparable to, non-GAAP measures used by other

companies.

Specified Items

Non-GAAP measures presented within this release exclude

specified items. The Company considers specified items to be

significant income/expense items not indicative of current

operations. Specified items may include adjustments to interest

expense and interest income, income tax expense (benefit),

depreciation expense, amortization expense, sales reserves

adjustments for products the Company is no longer selling,

stock-based compensation expense, fair value adjustments to

contingent consideration or derivative liability, restructuring

charges, amortization of fair value inventory step-up as a result

of purchase accounting, transaction-related costs, gains, losses or

impairments from adjustments to long-lived assets and assets not

part of current operations, changes in valuation allowances on

deferred tax assets, and gains or losses resulting from debt

refinancing or extinguishment.

| |

| CONDENSED

CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS(in

thousands, except per share

amounts)(unaudited) |

| |

|

|

|

| |

Three Months Ended |

|

Nine Months Ended |

| |

September 30,2024 |

|

June 30,2024 |

|

September 30,2023 |

|

September 30,2024 |

|

September 30,2023 |

| Revenues: |

|

|

|

|

|

|

|

|

|

|

Product sales, net |

$ |

28,705 |

|

|

$ |

30,695 |

|

|

$ |

35,137 |

|

|

$ |

91,262 |

|

|

$ |

116,989 |

|

|

Royalties and milestones |

|

499 |

|

|

|

431 |

|

|

|

490 |

|

|

|

1,516 |

|

|

|

1,910 |

|

|

Other revenue |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

185 |

|

| Total revenues |

|

29,204 |

|

|

|

31,126 |

|

|

|

35,627 |

|

|

|

92,778 |

|

|

|

119,084 |

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

Cost of sales |

|

7,550 |

|

|

|

8,889 |

|

|

|

7,060 |

|

|

|

27,616 |

|

|

|

17,299 |

|

|

Research and development expenses |

|

1,005 |

|

|

|

798 |

|

|

|

1,316 |

|

|

|

2,536 |

|

|

|

1,819 |

|

|

Selling, general and administrative expenses |

|

16,726 |

|

|

|

18,385 |

|

|

|

21,005 |

|

|

|

53,635 |

|

|

|

54,680 |

|

|

Change in fair value of contingent consideration |

|

300 |

|

|

|

— |

|

|

|

(17,532 |

) |

|

|

300 |

|

|

|

(8,124 |

) |

|

Amortization of intangible assets |

|

6,671 |

|

|

|

6,671 |

|

|

|

10,184 |

|

|

|

18,973 |

|

|

|

22,752 |

|

|

Loss on impairment of intangible assets |

|

— |

|

|

|

— |

|

|

|

238,831 |

|

|

|

— |

|

|

|

238,831 |

|

|

Restructuring charges |

|

— |

|

|

|

— |

|

|

|

3,034 |

|

|

|

720 |

|

|

|

3,034 |

|

| Total costs and expenses |

|

32,252 |

|

|

|

34,743 |

|

|

|

263,898 |

|

|

|

103,780 |

|

|

|

330,291 |

|

| Loss from operations |

|

(3,048 |

) |

|

|

(3,617 |

) |

|

|

(228,271 |

) |

|

|

(11,002 |

) |

|

|

(211,207 |

) |

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

Debt-related expenses |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(9,918 |

) |

|

Interest expense |

|

(761 |

) |

|

|

(758 |

) |

|

|

(752 |

) |

|

|

(2,276 |

) |

|

|

(2,625 |

) |

|

Interest income |

|

887 |

|

|

|

842 |

|

|

|

605 |

|

|

|

2,441 |

|

|

|

1,713 |

|

|

Other gain (loss) |

|

45 |

|

|

|

8 |

|

|

|

(467 |

) |

|

|

57 |

|

|

|

(112 |

) |

| Total other income

(expense) |

|

171 |

|

|

|

92 |

|

|

|

(614 |

) |

|

|

222 |

|

|

|

(10,942 |

) |

| Net loss before income

taxes |

|

(2,877 |

) |

|

|

(3,525 |

) |

|

|

(228,885 |

) |

|

|

(10,780 |

) |

|

|

(222,149 |

) |

| Income tax expense |

|

(44 |

) |

|

|

(149 |

) |

|

|

(50,659 |

) |

|

|

(325 |

) |

|

|

(52,409 |

) |

| Net loss and comprehensive

loss |

$ |

(2,921 |

) |

|

$ |

(3,674 |

) |

|

$ |

(279,544 |

) |

|

$ |

(11,105 |

) |

|

$ |

(274,558 |

) |

| |

|

|

|

|

|

|

|

|

|

| Basic net loss per share |

$ |

(0.03 |

) |

|

$ |

(0.04 |

) |

|

$ |

(3.42 |

) |

|

$ |

(0.12 |

) |

|

$ |

(4.35 |

) |

| Diluted net loss per

share |

$ |

(0.03 |

) |

|

$ |

(0.04 |

) |

|

$ |

(3.42 |

) |

|

$ |

(0.12 |

) |

|

$ |

(4.35 |

) |

| Shares used in computing basic

net loss per share |

|

95,352 |

|

|

|

95,240 |

|

|

|

81,713 |

|

|

|

95,191 |

|

|

|

63,066 |

|

| Shares used in computing

diluted net loss per share |

|

95,352 |

|

|

|

95,240 |

|

|

|

81,713 |

|

|

|

95,191 |

|

|

|

63,066 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

CONDENSED CONSOLIDATED BALANCE SHEETS(in

thousands, except share and per share data) |

| |

|

|

|

| |

(Unaudited) |

|

|

| |

September 30, 2024 |

|

December 31, 2023 |

| ASSETS |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

37,981 |

|

|

$ |

73,441 |

|

|

Short-term investments |

|

50,598 |

|

|

|

— |

|

|

Accounts receivable, net |

|

44,944 |

|

|

|

47,663 |

|

|

Inventories, net |

|

39,788 |

|

|

|

37,686 |

|

|

Prepaid and other current assets |

|

7,845 |

|

|

|

12,272 |

|

|

Total current assets |

|

181,156 |

|

|

|

171,062 |

|

| Property and equipment,

net |

|

624 |

|

|

|

770 |

|

| Intangible assets, net |

|

92,359 |

|

|

|

111,332 |

|

| Other long-term assets |

|

1,860 |

|

|

|

3,255 |

|

| Total assets |

$ |

275,999 |

|

|

$ |

286,419 |

|

| LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

13,153 |

|

|

$ |

13,439 |

|

|

Accrued rebates, returns and discounts |

|

60,482 |

|

|

|

58,137 |

|

|

Accrued liabilities |

|

12,964 |

|

|

|

18,213 |

|

|

Contingent consideration, current portion |

|

3,000 |

|

|

|

2,700 |

|

|

Other current liabilities |

|

505 |

|

|

|

954 |

|

|

Total current liabilities |

|

90,104 |

|

|

|

93,443 |

|

| Long-term debt |

|

38,840 |

|

|

|

38,514 |

|

| Other long-term

liabilities |

|

16,537 |

|

|

|

16,459 |

|

| Total liabilities |

|

145,481 |

|

|

|

148,416 |

|

| Commitments and

contingencies |

|

|

|

| Shareholders’ equity: |

|

|

|

|

Common stock, $0.0001 par value, 200,000,000 shares authorized;

95,360,756 and 94,668,523 shares issued and outstanding as of

September 30, 2024 and December 31, 2023, respectively. |

|

9 |

|

|

|

9 |

|

|

Additional paid-in capital |

|

793,157 |

|

|

|

789,537 |

|

|

Accumulated deficit |

|

(662,648 |

) |

|

|

(651,543 |

) |

|

Total shareholders’ equity |

|

130,518 |

|

|

|

138,003 |

|

| Total liabilities and

shareholders' equity |

$ |

275,999 |

|

|

$ |

286,419 |

|

| |

|

|

|

|

|

|

|

| |

| CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS(in

thousands)(unaudited) |

| |

|

| |

Nine Months Ended September 30, |

| |

2024 |

|

2023 |

| Operating

Activities |

|

|

|

|

Net loss |

$ |

(11,105 |

) |

|

$ |

(274,558 |

) |

| Adjustments to reconcile net loss to net cash from operating

activities: |

|

|

|

|

Depreciation and amortization |

|

19,118 |

|

|

|

23,321 |

|

|

Amortization of debt issuance costs and Royalty Rights |

|

326 |

|

|

|

350 |

|

|

Accretion of interest income from short-term investments |

|

(538 |

) |

|

|

— |

|

|

Loss on impairment of intangible assets |

|

— |

|

|

|

238,831 |

|

|

Recurring fair value measurements of assets and liabilities |

|

269 |

|

|

|

(7,612 |

) |

|

Debt-related expenses |

|

— |

|

|

|

9,918 |

|

|

Provisions for inventory and other assets |

|

4,982 |

|

|

|

2,129 |

|

|

Stock-based compensation |

|

3,911 |

|

|

|

6,516 |

|

|

Deferred income taxes |

|

— |

|

|

|

47,192 |

|

| Changes in assets and

liabilities, net of acquisition: |

|

|

|

|

Accounts receivable |

|

2,719 |

|

|

|

33,865 |

|

|

Inventories |

|

(7,084 |

) |

|

|

(8,898 |

) |

|

Prepaid and other assets |

|

5,822 |

|

|

|

6,769 |

|

|

Accounts payable and other accrued liabilities |

|

(5,255 |

) |

|

|

(21,523 |

) |

|

Accrued rebates, returns and discounts |

|

2,345 |

|

|

|

(11,027 |

) |

|

Interest payable |

|

(650 |

) |

|

|

(1,376 |

) |

|

Net cash provided by operating activities |

|

14,860 |

|

|

|

43,897 |

|

| Investing

Activities |

|

|

|

| Purchases of property and

equipment |

|

— |

|

|

|

(528 |

) |

| Purchase of Sympazan |

|

— |

|

|

|

(280 |

) |

| Net cash acquired in Spectrum

Merger |

|

— |

|

|

|

1,950 |

|

| Proceeds from sale of

short-term investments |

|

— |

|

|

|

2,194 |

|

| Proceeds from maturities of

short-term investments |

|

23,534 |

|

|

|

— |

|

| Purchases of short-term

investments |

|

(73,563 |

) |

|

|

— |

|

|

Net cash (used in) provided by investing activities |

|

(50,029 |

) |

|

|

3,336 |

|

| Financing

Activities |

|

|

|

| Payments in connection with

2027 Convertible Notes |

|

— |

|

|

|

(10,500 |

) |

| Payment of direct transaction

costs related to convertible debt inducement |

|

— |

|

|

|

(1,119 |

) |

| Payment of contingent

consideration |

|

— |

|

|

|

(15,408 |

) |

| Payments related to the

vesting and settlement of equity awards, net |

|

(291 |

) |

|

|

(7,770 |

) |

| Other financing

activities |

|

— |

|

|

|

(489 |

) |

|

Net cash used in financing activities |

|

(291 |

) |

|

|

(35,286 |

) |

| Net (decrease) increase in

cash and cash equivalents |

|

(35,460 |

) |

|

|

11,947 |

|

| Cash and cash equivalents at

beginning of year |

|

73,441 |

|

|

|

64,941 |

|

| Cash and cash equivalents at

end of period |

$ |

37,981 |

|

|

$ |

76,888 |

|

| Supplemental

Disclosure of Cash Flow Information |

|

|

|

|

Net cash paid for income taxes |

$ |

1,388 |

|

|

$ |

3,424 |

|

|

Cash paid for interest |

$ |

2,600 |

|

|

$ |

3,651 |

|

|

|

|

|

|

|

|

|

|

| |

|

RECONCILIATION OF GAAP NET LOSS TO NON-GAAP EBITDA and

ADJUSTED EBITDA(in

thousands)(unaudited) |

| |

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Nine Months Ended |

|

|

| |

|

September 30, 2024 |

|

June 30, 2024 |

|

September 30, 2023 |

|

September 30, 2024 |

|

September 30, 2023 |

|

Financial

Statement Classification |

|

GAAP Net Loss |

|

$ |

(2,921 |

) |

|

$ |

(3,674 |

) |

|

$ |

(279,544 |

) |

|

$ |

(11,105 |

) |

|

$ |

(274,558 |

) |

|

|

|

Interest expense |

|

|

761 |

|

|

|

758 |

|

|

|

752 |

|

|

|

2,276 |

|

|

|

2,625 |

|

|

Interest expense |

|

Income tax expense |

|

|

44 |

|

|

|

149 |

|

|

|

50,659 |

|

|

|

325 |

|

|

|

52,409 |

|

|

Income tax expense |

|

Depreciation expense |

|

|

40 |

|

|

|

40 |

|

|

|

172 |

|

|

|

145 |

|

|

|

569 |

|

|

Selling, general and

administrative expenses |

|

Amortization of intangible assets |

|

|

6,671 |

|

|

|

6,671 |

|

|

|

10,184 |

|

|

|

18,973 |

|

|

|

22,752 |

|

|

Amortization of intangible

assets |

| EBITDA

(Non-GAAP) |

|

$ |

4,595 |

|

|

$ |

3,944 |

|

|

$ |

(217,777 |

) |

|

$ |

10,614 |

|

|

$ |

(196,203 |

) |

|

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Legacy product reserves |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(185 |

) |

|

Other revenue |

|

Stock-based compensation |

|

|

1,296 |

|

|

|

1,408 |

|

|

|

1,864 |

|

|

|

3,911 |

|

|

|

6,516 |

|

|

Selling, general and

administrative expenses |

|

Change in fair value of contingent consideration(1) |

|

|

300 |

|

|

|

— |

|

|

|

(17,532 |

) |

|

|

300 |

|

|

|

(8,124 |

) |

|

Change in fair value of

contingent consideration |

|

Debt-related expenses(2) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

9,918 |

|

|

Debt-related expenses |

|

Transaction-related expenses(3) |

|

|

— |

|

|

|

— |

|

|

|

2,736 |

|

|

|

— |

|

|

|

8,539 |

|

|

Selling, general and

administrative expenses |

|

Loss on impairment of intangible assets(4) |

|

|

— |

|

|

|

— |

|

|

|

238,831 |

|

|

|

— |

|

|

|

238,831 |

|

|

Loss on impairment of

intangible assets |

|

Restructuring costs(5) |

|

|

— |

|

|

|

— |

|

|

|

3,034 |

|

|

|

720 |

|

|

|

3,034 |

|

|

Restructuring charges |

|

Other(6) |

|

|

(887 |

) |

|

|

(366 |

) |

|

|

1,755 |

|

|

|

2,123 |

|

|

|

967 |

|

|

Multiple |

| Adjusted EBITDA

(Non-GAAP) |

|

$ |

5,304 |

|

|

$ |

4,986 |

|

|

$ |

12,911 |

|

|

$ |

17,668 |

|

|

$ |

63,293 |

|

|

|

|

(1) |

|

The fair value of the contingent consideration is remeasured each

reporting period, with changes in the fair value resulting from

changes in the underlying inputs being recognized as a benefit or

expense in operating expenses until the contingent consideration

arrangement is settled. |

|

(2) |

|

Debt-related expenses consist of an induced conversion expense of

approximately $8.8 million and direct transaction costs of

approximately $1.1 million incurred as a result of the

privately negotiated exchange of $30.0 million principal amount of

the Company’s 6.5% Convertible Senior Notes due 2027 in the first

quarter of 2023. |

|

(3) |

|

Represents transaction-related expenses associated with the

acquisition of Spectrum, which closed effective July 31, 2023. |

|

(4) |

|

Represents the charge in the period for the impairment of

intangible assets resulting from the revaluation of the Company’s

long-lived assets. |

|

(5) |

|

Restructuring costs represent non-recurring costs associated with

the Company’s announced restructuring plans. |

|

(6) |

|

Other for the three and nine months ended September 30, 2024

and 2023, and the three months ended June 30, 2024, represents

the following adjustments (in thousands): |

| |

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

|

September 30, 2024 |

|

June 30, 2024 |

|

September 30, 2023 |

|

September 30, 2024 |

|

September 30, 2023 |

|

Financial

Statement Classification |

| Amortization

of inventory step-up |

|

$ |

— |

|

|

$ |

476 |

|

|

$ |

1,848 |

|

|

$ |

4,564 |

|

|

$ |

2,168 |

|

|

Cost of

sales |

| Interest income |

|

|

(887 |

) |

|

|

(842 |

) |

|

|

(605 |

) |

|

|

(2,441 |

) |

|

|

(1,713 |

) |

|

Interest income |

| Derivative fair value

adjustment |

|

|

— |

|

|

|

— |

|

|

|

512 |

|

|

|

— |

|

|

|

512 |

|

|

Other gain (loss) |

|

Total Other |

|

$ |

(887 |

) |

|

$ |

(366 |

) |

|

$ |

1,755 |

|

|

$ |

2,123 |

|

|

$ |

967 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

RECONCILIATION OF GAAP NET LOSS and NET LOSS PER SHARE

TONON-GAAP ADJUSTED EARNINGS and ADJUSTED EARNINGS

PER SHARE(1)(in thousands, except per share

amounts)(unaudited) |

| |

|

| |

Three Months Ended |

| |

September 30, 2024 |

|

June 30, 2024 |

|

September 30, 2023 |

|

|

Amount |

|

Diluted EPS(2) |

|

Amount |

|

Diluted EPS(2) |

|

Amount |

|

Diluted EPS(2) |

|

Net loss (GAAP)(2) |

$ |

(2,921 |

) |

|

$ |

(0.03 |

) |

|

$ |

(3,674 |

) |

|

$ |

(0.04 |

) |

|

$ |

(279,544 |

) |

|

$ |

(3.42 |

) |

| Add: Convertible debt interest

expense and other income statement impacts, net of tax(2) |

|

— |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of intangible assets |

|

6,671 |

|

|

|

|

|

6,671 |

|

|

|

|

|

10,184 |

|

|

|

|

Stock-based compensation |

|

1,296 |

|

|

|

|

|

1,408 |

|

|

|

|

|

1,864 |

|

|

|

|

Change in fair value of contingent consideration |

|

300 |

|

|

|

|

|

— |

|

|

|

|

|

(17,532 |

) |

|

|

|

Contingent consideration cash payable(3) |

|

(253 |

) |

|

|

|

|

— |

|

|

|

|

|

(3,590 |

) |

|

|

|

Transaction-related expenses |

|

— |

|

|

|

|

|

— |

|

|

|

|

|

2,736 |

|

|

|

|

Loss on impairment of intangible assets(4) |

|

— |

|

|

|

|

|

— |

|

|

|

|

|

238,831 |

|

|

|

|

Restructuring costs |

|

— |

|

|

|

|

|

— |

|

|

|

|

|

3,034 |

|

|

|

|

Other |

|

(887 |

) |

|

|

|

|

(366 |

) |

|

|

|

|

1,755 |

|

|

|

|

Increase in deferred tax asset valuation allowance(5) |

|

— |

|

|

|

|

|

— |

|

|

|

|

|

43,035 |

|

|

|

|

Income tax benefit expense, as adjusted(6) |

|

(1,782 |

) |

|

|

|

|

(1,928 |

) |

|

|

|

|

387 |

|

|

|

| Adjusted earnings

(Non-GAAP) |

$ |

2,424 |

|

|

$ |

0.03 |

|

|

$ |

2,111 |

|

|

$ |

0.02 |

|

|

$ |

1,160 |

|

|

$ |

0.01 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Diluted shares used in

calculation (GAAP)(2) |

|

95,352 |

|

|

|

|

|

95,240 |

|

|

|

|

|

81,713 |

|

|

|

| Add: Dilutive effect of

stock-based awards and equivalents(2) |

|

933 |

|

|

|

|

|

394 |

|

|

|

|

|

2,191 |

|

|

|

| Add: Dilutive effect of 2027

Convertible Notes(2) |

|

— |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

| Diluted shares used in

calculation (Non-GAAP)(2) |

|

96,285 |

|

|

|

|

|

95,634 |

|

|

|

|

|

83,904 |

|

|

|

|

(1) |

|

Certain adjustments included here are the same as those reflected

in the Company’s reconciliation of GAAP net loss to non-GAAP

adjusted EBITDA and therefore should be read in conjunction with

that reconciliation and respective footnotes. |

|

(2) |

|

The Company uses the if-converted method with respect to its

convertible debt to compute GAAP and Non-GAAP diluted earnings per

share when the effect is dilutive. Under the if-converted method,

the Company assumes the 2027 Convertible Notes were converted at

the beginning of each period presented and outstanding. As a

result, interest expense, net of tax, and any other income

statement impact associated with the 2027 Convertible Notes, net of

tax, is added back to net income used in the diluted earnings per

share calculation. |

|

|

|

For the three months ended September 30, 2024, June 30, 2024, and

September 30, 2023, the Company’s potentially dilutive convertible

debt under the if-converted method and stock-based awards under the

treasury-stock method were not included in the computation of GAAP

net loss and diluted net loss per share, and the potentially

dilutive convertible debt under the if-converted method were not

included in non-GAAP adjusted earnings and adjusted earnings per

share, because to do so would be anti-dilutive. |

|

|

|

For the three months ended September 30, 2023, the Company’s

potentially dilutive convertible debt under the if-converted method

was not included in the computation of both non-GAAP adjusted

earnings per share and GAAP diluted net loss per share, because to

do so would be anti-dilutive. However, the potentially dilutive

stock-based awards under the treasury-stock method were included in

the computation of non-GAAP adjusted earnings and adjusted earnings

per share because the effect was dilutive. |

|

(3) |

|

Represents the accrued cash payable, if any, of the INDOCIN

contingent consideration for the respective period based on 20%

royalty for annual INDOCIN net sales over $20.0 million. |

|

(4) |

|

Represents the charge in the period for the impairment of

intangible assets resulting from the revaluation of the Company’s

long-lived assets. |

|

(5) |

|

Represents the amount of income tax expense related to the

recognition of a full valuation allowance against deferred tax

assets in the period. |

|

(6) |

|

Represents the Company’s income tax expense adjustment from the tax

effect of pre-tax adjustments excluded from adjusted earnings. The

tax effect of pre-tax adjustments excluded from adjusted earnings

is computed at the blended federal and state statutory rate of

25%. |

|

|

|

|

| |

|

RECONCILIATION OF GAAP NET LOSS and NET LOSS PER SHARE

TONON-GAAP ADJUSTED EARNINGS and ADJUSTED EARNINGS

PER SHARE(1)(in thousands, except per share

amounts)(unaudited) |

| |

|

| |

Nine Months Ended |

| |

September 30, 2024 |

|

September 30, 2023 |

|

|

Amount |

|

Diluted EPS(2) |

|

Amount |

|

Diluted EPS(2) |

|

Net loss (GAAP)(2) |

$ |

(11,105 |

) |

|

$ |

(0.12 |

) |

|

$ |

(274,558 |

) |

|

$ |

(4.35 |

) |

| Add: Convertible debt interest

expense and other income statement impacts, net of tax(2) |

|

— |

|

|

|

|

|

1,969 |

|

|

|

| Adjustments: |

|

|

|

|

|

|

|

|

Amortization of intangible assets |

|

18,973 |

|

|

|

|

|

22,752 |

|

|

|

|

Legacy products revenue reserves |

|

— |

|

|

|

|

|

(185 |

) |

|

|

|

Stock-based compensation |

|

3,911 |

|

|

|

|

|

6,516 |

|

|

|

|

Debt-related expenses, net |

|

— |

|

|

|

|

|

9,639 |

|

|

|

|

Change in fair value of contingent consideration |

|

300 |

|

|

|

|

|

(8,124 |

) |

|

|

|

Contingent consideration cash payable(3) |

|

(253 |

) |

|

|

|

|

(11,274 |

) |

|

|

|

Transaction-related expenses |

|

— |

|

|

|

|

|

8,539 |

|

|

|

|

Loss on impairment of intangible assets(4) |

|

— |

|

|

|

|

|

238,831 |

|

|

|

|

Restructuring costs |

|

720 |

|

|

|

|

|

3,034 |

|

|

|

|

Other |

|

2,123 |

|

|

|

|

|

967 |

|

|

|

|

Increase in deferred tax asset valuation allowance(5) |

|

— |

|

|

|

|

|

43,035 |

|

|

|

|

Income tax benefit expense, as adjusted(6) |

|

(6,444 |

) |

|

|

|

|

(5,556 |

) |

|

|

| Adjusted earnings

(Non-GAAP) |

$ |

8,225 |

|

|

$ |

0.09 |

|

|

$ |

35,585 |

|

|

$ |

0.46 |

|

| |

|

|

|

|

|

|

|

| Diluted shares used in

calculation (GAAP)(2) |

|

95,191 |

|

|

|

|

|

63,066 |

|

|

|

| Add: Dilutive effect of

stock-based awards and equivalents(2) |

|

503 |

|

|

|

|

|

3,770 |

|

|

|

| Add: Dilutive effect of 2027

Convertible Notes(2) |

|

— |

|

|

|

|

|

11,324 |

|

|

|

| Diluted shares used in

calculation (Non-GAAP)(2) |

|

95,694 |

|

|

|

|

|

78,160 |

|

|

|

|

(1) |

|

Certain adjustments included here are the same as those reflected

in the Company’s reconciliation of GAAP net loss to non-GAAP

adjusted EBITDA and therefore should be read in conjunction with

that reconciliation and respective footnotes. |

|

(2) |

|

The Company uses the if-converted method with respect to its

convertible debt to compute GAAP and Non-GAAP diluted earnings per

share when the effect is dilutive. Under the if-converted method,

the Company assumes the 2027 Convertible Notes were converted at

the beginning of each period presented and outstanding. As a

result, interest expense, net of tax, and any other income

statement impact associated with the 2027 Convertible Notes, net of

tax, is added back to net income used in the diluted earnings per

share calculation. |

|

|

|

For the nine months ended September 30, 2024, the Company’s

potentially dilutive convertible debt under the if-converted method

and stock-based awards under the treasury-stock method were not

included in the computation of GAAP net loss and diluted net loss

per share, and the potentially dilutive convertible debt under the

if-converted method were not included in non-GAAP adjusted earnings

and adjusted earnings per share, because to do so would be

anti-dilutive. However, the potentially dilutive stock-based awards

under the treasury-stock method were included in the computation of

non-GAAP adjusted earnings and adjusted earnings per share because

the effect was dilutive. |

|

|

|

For the nine months ended September 30, 2023, the Company’s

potentially dilutive convertible debt under the if-converted method

and stock-based awards under the treasury-stock method were not

included in the computation of GAAP diluted net income per share,

because to do so would be anti-dilutive. However, the potentially

dilutive convertible debt under the if-converted method and

stock-based awards under the treasury-stock method were included in

the computation of non-GAAP adjusted earnings and adjusted earnings

per share because the effect was dilutive. |

|

(3) |

|

Represents the accrued cash payable, if any, of the INDOCIN

contingent consideration for the respective period based on 20%

royalty for annual INDOCIN net sales over $20.0 million. |

|

(4) |

|

Represents the charge in the period for the impairment of

intangible assets resulting from the revaluation of the Company’s

long-lived assets. |

|

(5) |

|

Represents the amount of income tax expense related to the

recognition of a full valuation allowance against deferred tax

assets in the period. |

|

(6) |

|

Represents the Company’s income tax expense adjustment from the tax

effect of pre-tax adjustments excluded from adjusted earnings. The

tax effect of pre-tax adjustments excluded from adjusted earnings

is computed at the blended federal and state statutory rate of

25%. |

|

|

|

|

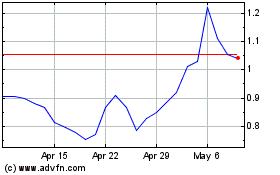

Assertio (NASDAQ:ASRT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Assertio (NASDAQ:ASRT)

Historical Stock Chart

From Feb 2024 to Feb 2025