Atossa Therapeutics, Inc. (Nasdaq: ATOS) (“Atossa” or the

“Company”) a clinical-stage biopharmaceutical company developing

innovative medicines for breast cancer, today announced financial

results for the fiscal quarter ended September 30, 2024, and

provided an update on recent company developments.

Key developments from Q3 2024 include:

- Positive

Topline Data from KARISMA-Endoxifen Phase 2 Study: Atossa

reported topline results from its KARISMA-Endoxifen Phase 2 study

conducted at the Karolinska Institute in Sweden, evaluating

(Z)-endoxifen in premenopausal women with mammographic breast

density (MBD). The study demonstrated significant MBD reductions of

19.3 percent and 26.5 percent in the 1 mg and 2 mg treatment arms,

respectively, compared to placebo, over a six-month period. The

treatment was well tolerated, with minimal side effects and no

significant safety concerns. Although vasomotor symptoms slightly

increased in active treatment groups, they were not a major reason

for discontinuation. The Company believes that these findings

support the potential of (Z)-endoxifen as a preventative therapy

for women with dense breast tissue, an independent risk factor for

breast cancer.

- Promising

Preliminary Analysis from Phase 2 I-SPY 2 EOP Trial:

Atossa released a preliminary analysis from its Phase 2 trial of

(Z)-endoxifen in ER+/HER2- breast cancer, showing that

(Z)-endoxifen met the primary endpoint with 95 percent (19/20) of

patients completing >75 percent of planned treatment. The data

showed a rapid reduction in key breast cancer biomarkers, including

a 69 percent reduction in Ki-67 and a 30.4 percent reduction in

functional tumor volume after three weeks. The treatment was well

tolerated, with mild side effects and no dose reductions or

treatment discontinuations.

- Initiation

of Combination Trial with Quantum Leap Healthcare

Collaborative™: Atossa, in collaboration with Quantum Leap

Healthcare Collaborative™, announced that the first patient was

dosed in their clinical trial evaluating (Z)-endoxifen in

combination with abemaciclib (VERZENIO®) as a neoadjuvant treatment

for high-risk women with newly diagnosed ER+/HER2- breast cancer.

Part of the ongoing I-SPY 2 Endocrine Optimization Pilot Protocol

(EOP), the trial targets patients whose tumors are predicted to be

sensitive to endocrine therapy but unlikely to benefit from

chemotherapy. The study is expected enroll approximately 80

participants, with pre- and postmenopausal women receiving daily

(Z)-endoxifen and abemaciclib for 24 weeks prior to surgery. The

trial aims to assess the efficacy and safety of this combination,

with results anticipated in 2026.

- New U.S.

Patent Granted for (Z)-Endoxifen Compositions: The United

States Patent and Trademark Office (USPTO) granted Atossa a new

patent covering certain compositions of (Z)-endoxifen in free base

or salt forms with enteric material, as well as methods of

administering these compositions. This fourth issued patent for

(Z)-endoxifen broadens Atossa’s protection and validates its

intellectual property strategy.

- Appointment

of New Vice President of Investor and Public Relations:

Atossa appointed Michael Parks as Vice President of Investor and

Public Relations. With nearly 30 years of experience in investor

relations and corporate communications, Mr. Parks leads Atossa's

corporate, executive, and digital communications, investor

relations, and branding.

- Appointment

of Claudia Lopez, DVM, MSc, as Vice President, Clinical Product

Development: Dr. Lopez brings over 20 years of clinical

development experience, including leadership roles at Landos

Biopharma, Arena Pharmaceuticals, and Takeda Pharmaceuticals. Her

expertise in global clinical programs and regulatory strategy will

support Atossa’s efforts to advance its clinical pipeline and

develop next-generation cancer treatments.

“We are energized by the substantial progress

Atossa has made this quarter, particularly the positive results

from our KARISMA-Endoxifen Phase 2 study, which demonstrated that

low doses of (Z)-endoxifen elicited significant reductions in

mammographic breast density—an important risk factor for breast

cancer,” said Steven Quay, M.D., Ph.D., Atossa’s President and

Chief Executive Officer. “Combined with the promising preliminary

data from the I-SPY 2 EOP trial of (Z)-endoxifen showing rapid

reductions in Ki-67 and tumor volume, we believe these results

further validate the substantial potential of our programs and

demonstrate our commitment to developing innovative therapies that

can meaningfully impact breast cancer treatment and

prevention.”

Comparison of Three and Nine Months

Ended September 30, 2024 and 2023

Operating Expenses. Total

operating expenses were $6.4 million and $20.5 million for the

three and nine months ended September 30, 2024 which was a decrease

of $1.1 million and $1.9 million, from total operating expenses for

the three and nine months ended September 30, 2023 of $7.5 million

and $22.4 million, respectively. Factors contributing to the

decrease in operating expenses in the three and nine months ended

September 30, 2024 are explained below.

Research & Development (R&D)

Expenses. The following table provides a breakdown of

major categories within R&D expenses for the three and nine

months ended September 30, 2024 and 2023, together with the dollar

change in those categories (dollars in thousands):

| |

For the Three Months Ended September 30, |

|

For the Nine Months Ended September 30, |

| |

2024 |

|

2023 |

|

Increase (Decrease) |

|

% Increase (Decrease) |

|

2024 |

|

2023 |

|

Increase (Decrease) |

|

% Increase (Decrease) |

| Research and

Development Expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Clinical and non-clinical trials |

$ |

2,490 |

|

$ |

3,365 |

|

$ |

(875 |

) |

(26)% |

|

$ |

7,875 |

|

$ |

8,239 |

|

$ |

(364 |

) |

(4)% |

|

Compensation |

|

701 |

|

|

763 |

|

|

(62 |

) |

(8)% |

|

|

2,006 |

|

|

2,696 |

|

|

(690 |

) |

(26)% |

|

Professional fees and other |

|

221 |

|

|

339 |

|

|

(118 |

) |

(35)% |

|

|

833 |

|

|

745 |

|

|

88 |

|

12% |

|

Research and Development Expense Total |

$ |

3,412 |

|

$ |

4,467 |

|

$ |

(1,055 |

) |

(24)% |

|

$ |

10,714 |

|

$ |

11,680 |

|

$ |

(966 |

) |

(8%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Clinical and non-clinical trial

expense decreased $0.9 million and $0.4 million for the three and

nine months ended September 30, 2024, respectively, compared to the

prior year periods due to a decrease in spending for the

(Z)-endoxifen trials, including a decrease in drug development

costs.

- The decrease in R&D

compensation expense of $0.1 million and $0.7 million for the three

and nine months ended September 30, 2024, respectively, compared to

the prior year periods was primarily due to a decrease in non-cash

stock-based compensation expense of $0.1 million and $0.8 million

for the three and nine months ended September 30, 2024,

respectively. Non-cash stock-based compensation expense

decreased compared to the prior year periods due to the weighted

average fair value of stock options amortizing in the 2024 periods

being lower.

- The decrease in R&D

professional fees and other expense of $0.1 million for the three

months ended September 30, 2024 compared to the prior year period

was primarily due to the timing of the study cohorts in clinical

and non-clinical trials. The increase in R&D professional fees

and other expense of $0.1 million for the nine months ended

September 30, 2024 compared to the prior year period was primarily

due to higher consulting fees in 2024 related to our (Z)-endoxifen

program.

General and Administrative (G&A)

Expenses. The following table provides a breakdown of

major categories within G&A expenses for the three and nine

months ended September 30, 2024 and 2023, together with the dollar

change in those categories (dollars in thousands):

| |

For the Three Months Ended September 30, |

|

For the Nine Months Ended September 30, |

| |

2024 |

|

2023 |

|

Increase (Decrease) |

|

% Increase (Decrease) |

|

2024 |

|

2023 |

|

Increase (Decrease) |

|

% Increase (Decrease) |

| General and

Administrative Expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation |

$ |

1,342 |

|

$ |

1,534 |

|

$ |

(192 |

) |

(13)% |

|

$ |

3,698 |

|

$ |

6,153 |

|

$ |

(2,455 |

) |

(40)% |

|

Professional fees and other |

|

1,425 |

|

|

1,127 |

|

|

298 |

|

26% |

|

|

5,374 |

|

|

3,502 |

|

|

1,872 |

|

53% |

|

Insurance |

|

206 |

|

|

340 |

|

|

(134 |

) |

(39)% |

|

|

684 |

|

|

1,023 |

|

|

(339 |

) |

(33)% |

|

General and Administrative Expense Total |

$ |

2,973 |

|

$ |

3,001 |

|

$ |

(28 |

) |

(1)% |

|

$ |

9,756 |

|

$ |

10,678 |

|

$ |

(922 |

) |

(9)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- The decrease in G&A

compensation expense of $0.2 million and $2.5 million for the three

and nine months ended September 30, 2024, respectively, compared to

the prior year periods was due to a decrease in both cash

compensation and non-cash stock-based compensation expense.

Non-cash stock-based compensation expense decreased by $0.1 million

and $1.7 million for the three and nine months ended September 30,

2024, respectively, compared to the prior year periods due to the

weighted average fair value of stock options amortizing in 2024

being lower. Cash compensation decreased by $0.1 million for the

three months ended September 30, 2024 compared to the prior year

period due to a different mix of employees. Cash compensation

decreased by $0.7 million for the nine months ended September 30,

2024 compared to the prior year period primarily due to salary and

bonus severance expense of $0.6 million for the nine months ended

September 30, 2023 related to the departure of our former Chief

Financial Officer.

- G&A professional fees and other

expense increased by $0.3 million and $1.9 million for the three

and nine months ended September 30, 2024, respectively, compared to

the prior year periods primarily due to the increase in legal fees

of $0.2 million and $1.0 million for the three and nine months

ended September 30, 2024, respectively, due to higher

patent-related activity as well as other legal matters. Investor

relations expenses increased by $0.5 million for the nine months

ended September 30, 2024 compared to the prior year period due to

an increase in investor outreach costs. Accounting fees increased

by $0.2 million for the nine months ended September 30, 2024

compared to the prior year period due to a change in our accounting

firm as well as the increased complexity of the business.

- The decrease in G&A insurance

expense of $0.1 million and $0.3 million for the three and nine

months ended September 30, 2024, respectively, compared to the

prior year periods was due to lower negotiated insurance premiums

for the same or better coverage in 2024.

Interest Income. Interest

income of $1.0 million for the three months ended September 30,

2024 represented a decrease of $0.3 million compared to the prior

year period, and was primarily due to a decrease in funds invested

in the money market account. Interest income of $3.2 million for

the nine months ended September 30, 2024 represented an increase of

$0.1 million compared to the prior year period, and was primarily

due to a change in the mix of our money market accounts which

yielded a higher rate of return in 2024.

Impairment Charge on Investment in

Equity Securities. For the nine months ended September 30,

2024, we wrote down our Investment in equity securities by $1.7

million and for the nine months ended September 30, 2023, we wrote

down our Investment in equity securities by $3.0 million due to

impairment of our investment.

About

(Z)-Endoxifen(Z)-endoxifen is one of the most potent

Selective Estrogen Receptor Modulator (SERM) for estrogen receptor

inhibition and may cause estrogen receptor degradation. It has also

been shown to have efficacy in the setting of patients with tumor

resistance to other hormonal treatments. In addition to its potent

anti-estrogen effects, (Z)-endoxifen has been shown to target

PKCβ1, a known oncogenic protein, at clinically attainable blood

concentrations. Finally, (Z)-endoxifen appears to deliver similar

or even greater bone agonistic effects while resulting in little or

no endometrial proliferative effects compared with standard

treatments, like tamoxifen.

Atossa is developing a proprietary oral

formulation of (Z)-endoxifen that is encapsulated to bypass the

stomach, as acidic conditions in the stomach convert a significant

proportion of (Z)-endoxifen to the inactive (E)-endoxifen. Atossa’s

(Z)-endoxifen has been shown to be well tolerated in Phase 1

studies and in a small Phase 2 study of women with breast cancer.

(Z)-endoxifen is currently being studied in five Phase 2 trials:

one in healthy women with measurable breast density, one in women

diagnosed with ductal carcinoma in situ, and three other studies

including the EVANGELINE study and two I-SPY studies in women with

ER+/HER2- breast cancer. Atossa’s (Z)-endoxifen is protected by

four issued U.S. patents and numerous pending patent

applications.

About Atossa TherapeuticsAtossa

Therapeutics, Inc. is a clinical-stage biopharmaceutical company

developing innovative medicines in areas of significant unmet

medical need in oncology with a focus on using (Z)-endoxifen to

prevent and treat breast cancer. For more information, please visit

www.atossatherapeutics.com.

ContactMichael Parks, VP Investor and Public

Relations 484-356-7105michael.parks@atossainc.com

FORWARD LOOKING STATEMENTSThis

press release contains certain information that may constitute

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. We may identify these

forward-looking statements by the use of words such as “expect,”

“potential,” “continue,” “may,” “will,” “should,” “could,” “would,”

“seek,” “intend,” “plan,” “estimate,” “anticipate,” “believe,”

“design,” “predict,” “future,” or other comparable words. All

statements made in this press release that are not statements of

historical fact, including statements regarding data related to the

(Z)-endoxifen program, the potential of (Z)-endoxifen as a breast

cancer prevention and treatment agent, the expected timing of data

and related publications, and the potential milestones and growth

opportunities for the Company, are forward-looking statements.

Forward-looking statements in this press release are subject to

risks and uncertainties that may cause actual results, outcomes, or

the timing of actual results or outcomes, to differ materially from

those projected or anticipated, including risks and uncertainties

associated with: macroeconomic conditions and increasing

geopolitical instability; the expected timing of releasing data;

any variation between interim or preliminary and final clinical

results or analysis; actions and inactions by the FDA and foreign

regulatory bodies; the outcome or timing of regulatory approvals

needed by Atossa, including those needed to continue our planned

(Z)-endoxifen trials; our ability to satisfy regulatory

requirements; our ability to remain compliant with the continued

listing requirements of the Nasdaq Stock Market; our ability to

successfully develop and commercialize new therapeutics; the

success, costs and timing of our development activities, including

our ability to successfully initiate or complete our clinical

trials, including our (Z)-endoxifen trials; our anticipated rate of

patient enrollment; our ability to contract with third-parties and

their ability to perform adequately; our estimates on the size and

characteristics of our potential markets; our ability to

successfully defend litigation and other similar complaints and to

establish and maintain intellectual property rights covering our

products; whether we can successfully complete our clinical trial

of oral (Z)-endoxifen in women with mammographic breast density and

our trials of (Z)-endoxifen in women with breast cancer, and

whether the studies will meet their objectives; our expectations as

to future financial performance, expense levels and capital

sources, including our ability to raise capital; our ability to

attract and retain key personnel; our anticipated working capital

needs and expectations around the sufficiency of our cash reserves;

and other risks and uncertainties detailed from time to time in

Atossa’s filings with the Securities and Exchange Commission,

including without limitation its Annual Reports on Form 10-K and

Quarterly Reports on 10-Q. Forward-looking statements are presented

as of the date of this press release. Except as required by law, we

do not intend to update any forward-looking statements, whether as

a result of new information, future events or circumstances or

otherwise.

|

ATOSSA THERAPEUTICS, INC. |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(amounts in thousands, except share and per share

data) |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

September 30, 2024 |

|

|

December 31, 2023 |

|

| Assets |

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

74,766 |

|

|

$ |

88,460 |

|

|

Restricted cash |

|

110 |

|

|

|

110 |

|

|

Prepaid materials |

|

1,285 |

|

|

|

1,487 |

|

|

Prepaid expenses and other current assets |

|

950 |

|

|

|

2,162 |

|

|

Total current assets |

|

77,111 |

|

|

|

92,219 |

|

|

Investment in equity securities |

|

— |

|

|

|

1,710 |

|

|

Other assets |

|

2,366 |

|

|

|

2,323 |

|

|

Total assets |

$ |

79,477 |

|

|

$ |

96,252 |

|

| Liabilities and

stockholders' equity |

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

Accounts payable |

$ |

1,561 |

|

|

$ |

806 |

|

|

Accrued expenses |

|

1,694 |

|

|

|

973 |

|

|

Payroll liabilities |

|

1,061 |

|

|

|

1,654 |

|

|

Other current liabilities |

|

1,480 |

|

|

|

1,803 |

|

|

Total current liabilities |

|

5,796 |

|

|

|

5,236 |

|

|

Total liabilities |

|

5,796 |

|

|

|

5,236 |

|

| Commitments and

contingencies |

|

|

|

|

|

| Stockholders' equity |

|

|

|

|

|

|

Convertible preferred stock - $0.001 par value; 10,000,000 shares

authorized; 582 shares issued and outstanding as of September 30,

2024 and December 31, 2023 |

|

— |

|

|

|

— |

|

|

Common stock - $0.18 par value; 350,000,000 and 175,000,000 shares

authorized as of September 30, 2024 and December 31, 2023,

respectively; 125,801,254 and 125,304,064 shares issued and

outstanding as of September 30, 2024 and December 31, 2023,

respectively |

|

22,882 |

|

|

|

22,792 |

|

|

Additional paid-in capital |

|

257,719 |

|

|

|

255,987 |

|

|

Treasury stock, at cost; 1,320,046 shares of common stock

at September 30, 2024 and December 31, 2023 |

|

(1,475 |

) |

|

|

(1,475 |

) |

|

Accumulated deficit |

|

(205,445 |

) |

|

|

(186,288 |

) |

|

Total stockholders' equity |

|

73,681 |

|

|

|

91,016 |

|

|

Total liabilities and stockholders' equity |

$ |

79,477 |

|

|

$ |

96,252 |

|

|

ATOSSA THERAPEUTICS, INC. |

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

(amounts in thousands, except share and per share

data) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

|

For the Three Months EndedSeptember 30, |

|

|

|

For the Nine Months EndedSeptember 30, |

|

|

|

2024 |

|

|

2023 |

|

|

|

2024 |

|

|

2023 |

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

$ |

3,412 |

|

|

$ |

4,467 |

|

|

|

$ |

10,714 |

|

|

$ |

11,680 |

|

| General and

administrative |

|

2,973 |

|

|

|

3,001 |

|

|

|

|

9,756 |

|

|

|

10,678 |

|

|

Total operating expenses |

|

6,385 |

|

|

|

7,468 |

|

|

|

|

20,470 |

|

|

|

22,358 |

|

| Operating loss |

|

(6,385 |

) |

|

|

(7,468 |

) |

|

|

|

(20,470 |

) |

|

|

(22,358 |

) |

| Impairment charge on

investment in equity securities |

|

(1,710 |

) |

|

|

— |

|

|

|

|

(1,710 |

) |

|

|

(2,990 |

) |

| Interest income |

|

1,001 |

|

|

|

1,274 |

|

|

|

|

3,213 |

|

|

|

3,107 |

|

| Other expense, net |

|

(136 |

) |

|

|

(35 |

) |

|

|

|

(190 |

) |

|

|

(99 |

) |

| Loss before income taxes |

|

(7,230 |

) |

|

|

(6,229 |

) |

|

|

|

(19,157 |

) |

|

|

(22,340 |

) |

| Income tax benefit |

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

— |

|

| Net loss |

|

(7,230 |

) |

|

|

(6,229 |

) |

|

|

|

(19,157 |

) |

|

|

(22,340 |

) |

| Net loss per share of common

stock - basic and diluted |

$ |

(0.06 |

) |

|

$ |

(0.05 |

) |

|

|

$ |

(0.15 |

) |

|

$ |

(0.18 |

) |

| Weighted average shares

outstanding used to compute net loss per share - basic and

diluted |

|

125,772,664 |

|

|

|

125,793,112 |

|

|

|

|

125,608,794 |

|

|

|

126,343,629 |

|

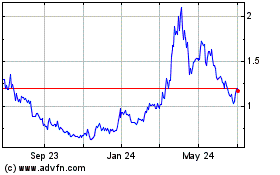

Atossa Therapeutics (NASDAQ:ATOS)

Historical Stock Chart

From Dec 2024 to Jan 2025

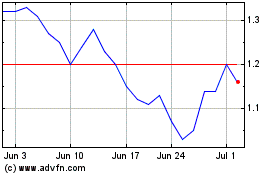

Atossa Therapeutics (NASDAQ:ATOS)

Historical Stock Chart

From Jan 2024 to Jan 2025