Augmedix (Nasdaq: AUGX), a leader in ambient AI medical

documentation and data solutions, today reported financial results

for the three months ended June 30, 2024.

“We believe we are approaching the proposed

combination with Commure, Inc. from a position of strength, with

consistent double-digit revenue growth and improving gross

margins,” commented Manny Krakaris, Augmedix CEO. “Together, we

believe we will be well-positioned to continue to streamline the

medical documentation ecosystem with a growing base of health

system customers, solid partners, and proven solutions. As part of

Commure, we expect to scale our ambient documentation solutions,

leveraging valuable integrations and AI capabilities. The ultimate

goal is to create the health AI operating system of the future, a

single, powerful, integrated platform that drives unprecedented

efficiency.”

The closing of the transaction with Commure is

expected in late Q3 or early Q4, subject to approval by Augmedix

stockholders and the satisfaction of other customary closing

conditions.

| |

|

Three Months Ended June 30, |

|

|

|

Financial Highlights: |

|

|

2024 |

|

|

|

2023 |

|

|

Change |

|

Revenues |

|

$13,664 |

|

|

$10,780 |

|

|

27% |

|

| Gross profit |

|

$6,455 |

|

|

$5,065 |

|

|

27% |

|

|

Gross margin |

|

|

47.2% |

|

|

|

47.0% |

|

|

20 bps |

|

| Net loss |

|

$(8,450) |

|

|

$(5,033) |

|

|

(68)% |

|

| Loss per share |

|

$(0.16) |

|

|

$(0.12) |

|

|

(33)% |

|

| Adjusted EBITDA

(non-GAAP) |

|

$(5,960) |

|

|

$(4,107) |

|

|

(45)% |

|

| |

|

|

|

|

|

|

|

|

|

Second Quarter 2024 Financial

Highlights

All comparisons, unless otherwise noted, are to

the three months ended June 30, 2023.

- Total revenue was $13.7 million, an

increase of 27% compared to $10.8 million.

- Dollar-based Net Revenue Retention

was 129% for our Health Enterprise customers compared to 148%.

- Gross Profit increased 27% to $6.5

million from $5.1 million.

- Gross Margin increased 20 basis

points to 47.2% compared to 47.0%.

- Operating Expenses were $15.2

million compared to $10.0 million. Adjusted operating expenses, a

Non-GAAP metric, increased 32% to $12.9 million compared to $9.5

million.

- Net loss was $8.5 million compared

to $5.0 million.

- Adjusted EBITDA loss, a Non-GAAP

metric, was $6.0 million compared to $4.1 million.

- Operating cash burn was $3.8

million compared to $6.0 million.

- Cash, cash equivalents, and

restricted cash as of June 30, 2024, was $33.4 million

compared to $46.3 million as of December 31, 2023.

- Common shares and pre-funded

warrants outstanding as of June 30, 2024 were 53,455,759. The

pre-funded warrants are included in the weighted average shares

outstanding for the EPS calculation.

Adjusted operating expenses and Adjusted EBITDA

are Non-GAAP financial measures. See “Non-GAAP Financial Measures.”

Please see “Non-GAAP Financial Measures” below and the

Reconciliation of GAAP to Non-GAAP Metrics table below.

Definition of Key Metrics

Average Clinicians in Service:

We define a clinician in service as an individual doctor, nurse

practitioner or other healthcare professional using our products.

We average the month-end number of clinicians in service for all

months in the measurement period and the number of clinicians in

service at the end of the month immediately preceding the

measurement period. We believe growth in the average number of

clinicians in service is a key indicator of the performance of our

business as it demonstrates our ability to penetrate the market and

grow our business. At this time clinicians in service does not

include clinicians using Augmedix Go.

Average Annual Revenue Per

Clinician: Average revenue per clinician is determined as

total revenue, excluding Data Services revenue, recognized during

the period presented divided by the average number of clinicians in

service during that same period. Using the number of clinicians in

service at the end of each month, we derive an average number of

clinicians in service for the periods presented. The average annual

revenue per clinician will vary based upon minimum hours of service

requested by clinicians, pricing, and our product mix.

Dollar-Based Net Revenue

Retention: Dollar-based net revenue retention is

determined as the revenue from Health Enterprises as of twelve

months prior to such period end as compared to revenue from these

same Health Enterprises as of the current period end, or current

period revenue. We define a "Health Enterprise" as a company or

network of doctors that has at least 50 clinicians currently

employed or affiliated that could utilize our services. Current

period revenue includes any expansion or new products and is net of

contraction or churn over the trailing twelve months but excludes

revenue from new Health Enterprises in the current period. We

believe growth in dollar-based net revenue retention is a key

indicator of the performance of our business as it demonstrates our

ability to increase revenue across our existing customer base

through expansion of users and products, as well as our ability to

retain existing customers.

About Augmedix

Augmedix (Nasdaq: AUGX) empowers clinicians to

connect with patients by liberating them from administrative burden

through the power of ambient AI, data, and trust. The platform

transforms natural conversations into organized medical notes,

structured data, and point-of-care notifications that enhance

efficiency and clinical decision support. Incorporating data from

millions of interactions across all care settings, Augmedix

collaborates with hospitals and health systems to improve clinical,

operational, and financial outcomes. Augmedix is headquartered in

San Francisco, CA, with offices around the world. To learn more,

visit www.augmedix.com.

Non-GAAP Financial Measures

To supplement our consolidated financial

statements, which are prepared and presented in accordance with

GAAP, we use the following non-GAAP financial measures: Adjusted

Operating Expenses, and Adjusted EBITDA. The presentation of this

financial information is not intended to be considered in isolation

or as a substitute for, or superior to, the financial information

prepared and presented in accordance with GAAP.

We define Adjusted Operating Expense as total

operating expenses less share-based compensation expense and

acquisition related expenses.

In the fourth quarter of 2023, Augmedix changed

its computation of Adjusted EBITDA to better reflect the

performance of the Company’s business predominantly due to the

equity financing that occurred in November of 2023, which

significantly increased the Company’s cash balance. We now define

Adjusted EBITDA as net income (loss) adjusted to exclude

depreciation and amortization; share-based compensation expense;

income tax expense (benefit); acquisition related expenses; and

other income (expense) net, which consists of interest expense on

our debt facility, interest income from our cash and cash

equivalents, realized foreign currency gains and losses, loss on

extinguishment of debt, change in fair value of a warrant

liability, and grant income from the Bangladesh government related

to our Bangladesh subsidiary. Prior to the fourth quarter of 2023,

the Company did not exclude interest income earned on cash

balances, realized foreign currency transaction gains or losses or

grant income received from the Bangladesh government from the

computation of Adjusted EBITDA. Adjusted EBITDA has been recast in

prior periods to reflect this change for consistency in

presentation.

We use these non-GAAP financial measures for

financial and operational decision-making and as a means to

evaluate period-to-period comparisons. We believe that these

non-GAAP financial measures provide meaningful supplemental

information regarding our performance by excluding certain items

that may not be indicative of our recurring core business operating

results. We believe that both management and investors benefit from

reviewing these non-GAAP financial measures in assessing our

performance and when planning, forecasting, and analyzing future

periods. These non-GAAP financial measures also facilitate

management's internal comparisons to our historical performance and

liquidity as well as comparisons to our competitors' operating

results. We believe these non-GAAP financial measures are useful to

investors both because (1) they allow for greater transparency with

respect to key metrics used by management in its financial and

operational decision-making and (2) they are used by our

institutional investors and the analyst community to help them

analyze the health of our business.

There are a number of limitations related to the

use of non-GAAP financial measures. We compensate for these

limitations by providing specific information regarding the GAAP

amounts excluded from these non-GAAP financial measures and

evaluating these non-GAAP financial measures together with their

relevant financial measures in accordance with GAAP.

For more information on the non-GAAP financial

measures, please see the Reconciliation of GAAP to non-GAAP Metrics

table in this press release. This accompanying table includes

details on the GAAP financial measures that are most directly

comparable to Non-GAAP financial measures and the related

reconciliations between these financial measures.

Cautionary Statement Regarding

Forward-Looking Statements

This communication may contain forward-looking

statements, which include all statements that do not relate solely

to historical or current facts, such as statements regarding the

pending acquisition (the “Merger”) of the Company by Commure, Inc.

(“Parent”), statements regarding approaching the proposed

combination with Parent from a position of strength; statements

regarding the combined company being well-positioned to continue to

modernize the medical documentation ecosystem with a growing base

of health system customers, solid partners, and proven solutions;

statements regarding the combined company scaling ambient

documentation solutions, leveraging valuable integrations and AI

capabilities; statements regarding the ultimate goal being to

create the health AI operating system of the future, a single,

powerful, integrated platform that drives unprecedented efficiency;

and other statements that concern the Company’s expectations,

intentions or strategies regarding the future. In some cases, you

can identify forward-looking statements by the following words:

“may,” “will,” “could,” “would,” “should,” “expect,” “intend,”

“plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,”

“aim,” “potential,” “continue,” “ongoing,” “goal,” “can,” “seek,”

“target” or the negative of these terms or other similar

expressions, although not all forward-looking statements contain

these words. These forward-looking statements are based on the

Company’s beliefs, as well as assumptions made by, and information

currently available to, the Company. Because such statements are

based on expectations as to future financial and operating results

and are not statements of fact, actual results may differ

materially from those projected and are subject to a number of

known and unknown risks and uncertainties, including, but not

limited to: (i) the risk that the Merger may not be completed on

the anticipated timeline or at all; (ii) the failure to satisfy any

of the conditions to the consummation of the Merger, including the

receipt of required approval from the Company’s stockholders; (iii)

the occurrence of any event, change or other circumstance or

condition that could give rise to the termination of the merger

agreement with respect to the contemplated Merger, including in

circumstances requiring the Company to pay a termination fee; (iv)

the effect of the announcement or pendency of the Merger on the

Company’s business relationships, operating results and business

generally; (v) risks that the Merger disrupts the Company’s current

plans and operations; (vi) the Company’s ability to retain and hire

key personnel and maintain relationships with key business partners

and customers, and others with whom it does business; (vii) risks

related to diverting management’s or employees’ attention during

the pendency of the Merger from the Company’s ongoing business

operations; (viii) the amount of costs, fees, charges or expenses

resulting from the Merger; (ix) potential litigation relating to

the Merger; (x) uncertainty as to timing of completion of the

Merger and the ability of each party to consummate the Merger; (xi)

risks that the benefits of the Merger are not realized when or as

expected; (xii) the risk that the price of the Company’s common

stock may fluctuate during the pendency of the Merger and may

decline significantly if the Merger is not completed; and (xiii)

other risks described in the Company’s filings with the U.S.

Securities and Exchange Commission (the “SEC”), such as the risks

and uncertainties described under the headings “Cautionary Note

Regarding Forward-Looking Statements,” “Risk Factors,”

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” and other sections of the Company’s Annual

Report on Form 10-K, the Company’s Quarterly Reports on Form 10-Q,

and in the Company’s other filings with the SEC. While the list of

risks and uncertainties presented here is, and the discussion of

risks and uncertainties to be presented in the proxy statement on

Schedule 14A that the Company will file with the SEC relating to

its special meeting of stockholders will be, considered

representative, no such list or discussion should be considered a

complete statement of all potential risks and uncertainties.

Unlisted factors may present significant additional obstacles to

the realization of forward-looking statements. Consequences of

material differences in results as compared with those anticipated

in the forward-looking statements could include, among other

things, business disruption, operational problems, financial loss,

legal liability to third parties and/or similar risks, any of which

could have a material adverse effect on the completion of the

Merger and/or the Company’s consolidated financial condition. The

forward-looking statements speak only as of the date they are made.

Except as required by applicable law or regulation, the Company

undertakes no obligation to update any forward-looking statements,

whether as a result of new information, future events or

otherwise.

The information that can be accessed through

hyperlinks or website addresses included in this communication is

deemed not to be incorporated in or part of this communication.

Additional Information and Where to Find

It

This communication is being made in respect of

the Merger. In connection with the proposed Merger, the Company

will file with the SEC a proxy statement on Schedule 14A relating

to its special meeting of stockholders and may file or furnish

other documents with the SEC regarding the Merger. When completed,

a definitive proxy statement will be mailed to the Company’s

stockholders. STOCKHOLDERS ARE URGED TO CAREFULLY READ THE PROXY

STATEMENT REGARDING THE MERGER (INCLUDING ANY AMENDMENTS OR

SUPPLEMENTS THERETO AND ANY DOCUMENTS INCORPORATED BY REFERENCE

THEREIN) AND ANY OTHER RELEVANT DOCUMENTS FILED OR FURNISHED WITH

THE SEC IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY

WILL CONTAIN IMPORTANT INFORMATION ABOUT THE MERGER. The Company’s

stockholders may obtain free copies of the documents the Company

files with the SEC from the SEC’s website at www.sec.gov or through

the Company’s website at ir.augmedix.com under the link “SEC

Filings” or by contacting the Company’s Investor Relations

department via e-mail at investors@augmedix.com.

Participants in the

Solicitation

The Company and its directors and executive

officers may be deemed to be participants in the solicitation of

proxies from the Company’s stockholders with respect to the Merger.

Information about the Company’s directors and executive officers

and their ownership of the Company’s common stock is set forth in

the Company’s Amended Annual Report on Form 10-K/A for the fiscal

year ended December 31, 2023 filed with the SEC on April 29, 2024.

To the extent that such individual’s holdings of the Company’s

common stock have changed since the amounts printed in the

Company’s Amended Annual Report on Form 10-K/A for the fiscal year

ended December 31, 2023 filed with the SEC on April 29, 2024, such

changes have been or will be reflected on Statements of Change in

Ownership on Form 4 filed with the SEC. Additional information

regarding the identity of such participants, and their direct or

indirect interests in the Merger, by security holdings or

otherwise, will be set forth in the proxy statement and other

materials to be filed with SEC in connection with the Merger.

Investors:Matt Chesler, CFAFNK

IRinvestors@augmedix.com

Media:Kaila GrafemanAugmedixpr@augmedix.com

|

AUGMEDIX, INC.Condensed Consolidated

Statements of Operations(Unaudited, in thousands,

except shares and key metrics) |

| |

| |

|

Three Months Ended June 30, |

| |

|

|

2024 |

|

|

|

2023 |

|

| Revenues |

|

$13,664 |

|

|

$10,780 |

|

|

Cost of revenues |

|

|

7,209 |

|

|

|

5,715 |

|

|

Gross profit |

|

|

6,455 |

|

|

|

5,065 |

|

|

Operating expenses: |

|

|

|

|

|

General and administrative |

|

|

7,013 |

|

|

|

4,760 |

|

|

Sales and marketing |

|

|

3,749 |

|

|

|

2,649 |

|

|

Research and development |

|

|

4,418 |

|

|

|

2,590 |

|

|

Total operating expenses |

|

|

15,180 |

|

|

|

9,999 |

|

|

Loss from operations |

|

|

(8,725) |

|

|

|

(4,934) |

|

|

Other income (expense): |

|

|

|

|

|

Interest expense |

|

|

(639) |

|

|

|

(558) |

|

|

Interest income |

|

|

410 |

|

|

|

276 |

|

|

Other |

|

|

590 |

|

|

|

303 |

|

|

Total other income (expense), net |

|

|

361 |

|

|

|

(48) |

|

|

Net loss before income taxes |

|

|

(8,364) |

|

|

|

(4,982) |

|

|

Income tax expense |

|

|

86 |

|

|

|

51 |

|

|

Net loss |

|

$(8,450) |

|

|

$(5,033) |

|

| |

|

|

|

|

|

Weighted average shares of common stock outstanding, basic and

diluted |

|

|

53,387,349 |

|

|

|

43,607,984 |

|

| |

|

|

|

|

| Key

Metrics: |

|

|

|

|

|

Average clinicians in service |

|

|

1,887 |

|

|

|

1,534 |

|

|

Average annual revenue per clinician |

|

$28,700 |

|

|

$27,900 |

|

|

Dollar-based net revenue retention rate |

|

|

129% |

|

|

|

148% |

|

|

|

|

|

|

|

|

|

|

|

|

AUGMEDIX, INC.Condensed Consolidated

Balance Sheet(Unaudited, in

thousands) |

| |

| |

|

June 30,2024 |

|

December 31,2023 |

| Assets |

|

|

|

|

| Current

assets: |

|

|

|

|

| Cash and cash equivalents |

|

$28,220 |

|

$46,217 |

|

Restricted cash |

|

|

— |

|

|

125 |

|

Accounts receivable, net of allowance for credit losses of $204 and

$110 at June 30, 2024 and December 31, 2023,

respectively |

|

|

9,252 |

|

|

8,572 |

|

Prepaid expenses and other current assets |

|

|

2,453 |

|

|

1,909 |

|

Total current assets |

|

|

39,925 |

|

|

56,823 |

|

Property and equipment, net |

|

|

3,333 |

|

|

3,739 |

|

Operating lease right of use asset |

|

|

4,431 |

|

|

5,220 |

|

Restricted cash, non-current |

|

|

5,207 |

|

|

— |

|

Deposits and other assets |

|

|

776 |

|

|

930 |

|

Total assets |

|

$53,672 |

|

$66,712 |

| |

|

|

|

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

Accounts payable |

|

$881 |

|

$721 |

|

Accrued expenses and other current liabilities |

|

|

6,929 |

|

|

6,589 |

|

Deferred revenue |

|

|

8,902 |

|

|

8,963 |

|

Customer deposits |

|

|

851 |

|

|

851 |

|

Operating lease liability, current portion |

|

|

1,432 |

|

|

1,494 |

|

Loan payable, current portion |

|

|

5,000 |

|

|

5,000 |

|

Total current liabilities |

|

|

23,995 |

|

|

23,618 |

|

Operating lease liability, net of current portion |

|

|

3,303 |

|

|

4,049 |

|

Loan payable, net of current portion |

|

|

15,540 |

|

|

15,303 |

|

Other liabilities |

|

|

360 |

|

|

421 |

|

Total liabilities |

|

|

43,198 |

|

|

43,391 |

| Total stockholders'

equity |

|

|

10,474 |

|

|

23,321 |

| Total liabilities and

stockholders' equity |

|

$53,672 |

|

$66,712 |

| |

|

|

|

|

|

AUGMEDIX, INC.Condensed Consolidated

Statement of Cash Flows(Unaudited, in

thousands) |

| |

|

|

|

|

| |

|

Six Months Ended June 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

| Net cash used in operating

activities |

|

$ |

(12,045) |

|

|

$ |

(12,175) |

|

| Net cash used in investing

activities |

|

|

(903) |

|

|

|

(1,475) |

|

| Net cash provided by financing

activities |

|

|

133 |

|

|

|

16,969 |

|

| Effect of exchange rate

changes on cash and restricted cash |

|

|

(100) |

|

|

|

(47) |

|

| Net decrease in cash and

restricted cash |

|

|

(12,915) |

|

|

|

3,272 |

|

| Cash and restricted cash at

beginning of year |

|

|

46,342 |

|

|

|

21,988 |

|

| Cash and restricted cash at

end of year |

|

$ |

33,427 |

|

|

$ |

25,260 |

|

| |

|

|

|

|

|

|

|

|

|

AUGMEDIX, INC.Reconciliation of GAAP to

Non-GAAP Metrics(Unaudited, in

thousands) |

| |

| |

|

Three Months Ended June 30, |

|

Adjusted EBITDA: |

|

|

2024 |

|

|

|

2023 |

|

| Net loss |

|

$ |

(8,450) |

|

|

$ |

(5,033) |

|

| |

|

|

|

|

| Other (income) expense ,

net |

|

|

(361) |

|

|

|

48 |

|

| Depreciation |

|

|

416 |

|

|

|

262 |

|

| Share-based compensation |

|

|

1,152 |

|

|

|

565 |

|

| Income tax expense

(benefit) |

|

|

86 |

|

|

|

51 |

|

| Acquisition related

expenses |

|

|

1,197 |

|

|

|

— |

|

| Total adjustments |

|

|

2,490 |

|

|

|

926 |

|

| Adjusted EBITDA |

|

$ |

(5,960) |

|

|

$ |

(4,107) |

|

| |

|

|

|

|

| Adjusted Operating

Expenses: |

|

|

|

|

| Total operating expenses |

|

$ |

15,180 |

|

|

$ |

9,999 |

|

| Less: Share-based

compensation |

|

|

1,106 |

|

|

|

538 |

|

| Less: Acquisition related

expense |

|

$ |

1,197 |

|

|

$ |

— |

|

| Adjusted operating

expenses |

|

$ |

12,877 |

|

|

$ |

9,461 |

|

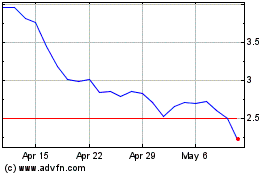

Augmedix (NASDAQ:AUGX)

Historical Stock Chart

From Jan 2025 to Feb 2025

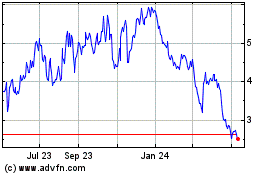

Augmedix (NASDAQ:AUGX)

Historical Stock Chart

From Feb 2024 to Feb 2025