Table of Contents

PRELIMINARY OFFERING CIRCULAR DATED

AUGUST 23, 2024

An

offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information

contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers

to buy be accepted before the offering statement filed with the Commission is qualified. This Preliminary Offering Circular shall not

constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which

such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect

to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of

our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular

was filed may be obtained.

OFFERING CIRCULAR

Auddia Inc.

28,301,886 Shares of Common Stock

By this offering circular (the “Offering

Circular”), Auddia Inc., a Delaware corporation, is offering on a “best-efforts” basis a maximum of 28,301,886

shares of its common stock, par value $0.001 per share (the “Offered Shares”), at a fixed price of $1.40 to $2.65

per share (to be fixed by post-qualification supplement), pursuant to Tier 2 of Regulation A of the United States Securities and

Exchange Commission (the “SEC”). There is no minimum purchase requirement for investors in this offering.

This offering is being conducted on a “best-efforts”

basis, which means that there is no minimum number of Offered Shares that must be sold by us for this offering to close; thus, we may

receive no or minimal proceeds from this offering. None of the proceeds received will be placed in an escrow or trust account. All proceeds

from this offering will become immediately available to us and may be used as they are accepted. Purchasers of the Offered Shares will

not be entitled to a refund and could lose their entire investments. Please see the “Risk Factors” section, beginning on page

8, for a discussion of the risks associated with a purchase of the Offered Shares.

We estimate that this offering will commence

within two days of SEC qualification; this offering will terminate at the earliest of (a) the date on which the maximum offering has

been sold, (b) one year from the date of SEC qualification, or (c) the date on which this offering is earlier terminated by us, in our

sole discretion. (See “Plan of Distribution”).

| | |

Number of

Shares | | |

Price

to Public(1) | | |

Commissions(2) | | |

Proceeds

to Company(3) | |

| Per Share: | |

| – | | |

$ | 2.65 | | |

$ | 0 | | |

$ | 1.57 | |

| Total Minimum: | |

| 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | |

| Total Maximum: | |

| 28,301,886 | | |

$ | 74,999,997.90 | | |

$ | 0 | | |

$ | 74,999,997.90 | |

| (1) |

Assumes a public offering price of $2.65, which represents the high end of the

offering price range of $1.40 to $2.65 per share |

| |

|

| (2) |

We may also offer the Offer Shares through registered broker-dealers and we may pay finders. However, information as to any such broker-dealer or finder shall be disclosed in an amendment to this Offering Circular. |

| |

|

| (3) |

Does not account for the payment of expenses of this offering estimated at $525,000. See “Plan of Distribution.” |

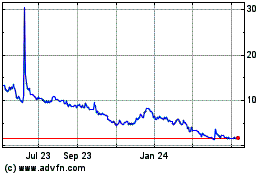

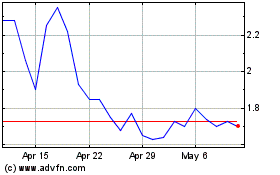

Our common stock is listed on The Nasdaq Capital

Market (“Nasdaq”), under the symbol “AUUD.” On August 22, 2024, the last reported sale price of our common

stock was $1.10 per share.

Investing in the Offered Shares is speculative

and involves substantial risks. You should purchase Offered Shares only if you can afford a complete loss of your investment. See “Risk Factors”, beginning on page 8, for a discussion of certain risks that you should consider before purchasing any of the Offered

Shares.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION

DOES NOT PASS UPON THE MERITS OF, OR GIVE ITS APPROVAL TO, ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON

THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION

FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE

EXEMPT FROM REGISTRATION.

The use of projections or forecasts in this

offering is prohibited. No person is permitted to make any oral or written predictions about the benefits you will receive from an investment

in Offered Shares.

No sale may be made to you in this offering,

if you do not satisfy the investor suitability standards described in this Offering Circular under “Plan of Distribution—State Law Exemption and Offerings to “Qualified Purchasers” on page 18. Before making any representation that you satisfy the

established investor suitability standards, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on

investing, we encourage you to refer to www.investor.gov.

This Offering Circular follows the disclosure

format of Form S-1, pursuant to the General Instructions of Part II(a)(1)(ii) of Form 1-A.

The date of this Offering Circular is _______________,

2024.

TABLE OF CONTENTS

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

The information contained

in this Offering Circular includes forward-looking statements, which involve risks and uncertainties. These forward-looking statements

can be identified by the use of forward-looking terminology, including the terms “believe,” “estimate,” “project,”

“anticipate,” “expect,” “seek,” “predict,” “continue,” “possible,”

“intend,” “may,” “might,” “will,” “could,” would” or “should”

or, in each case, their negative, or other variations or comparable terminology. These forward-looking statements include all matters

that are not historical facts. They appear in a number of places throughout this Offering Circular and the documents incorporated by reference

in this Offering Circular, and include statements regarding our intentions, beliefs or current expectations concerning, among other things,

our product candidates, research and development, commercialization objectives, prospects, strategies, the industry in which we operate

and potential collaborations. We derive many of our forward-looking statements from our operating budgets and forecasts, which are based

upon many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict

the impact of known factors, and, of course, it is impossible for us to anticipate all factors that could affect our actual results. Forward-looking

statements should not be read as a guarantee of future performance or results and may not be accurate indications of when such performance

or results will be achieved. In light of these risks and uncertainties, the forward-looking events and circumstances discussed in this

Offering Circular may not occur and actual results could differ materially from those anticipated or implied in the forward-looking statements.

Forward-looking statements

speak only as of the date of this Offering Circular. You should not put undue reliance on any forward-looking statements. We assume no

obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting

forward-looking information, except to the extent required by applicable laws. If we update one or more forward-looking statements, no

inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

You should read this Offering

Circular, the documents incorporated by reference in this Offering Circular, and the documents that we reference in this Offering Circular

and have filed with the SEC as exhibits to this Offering Circular with the understanding that our actual future results, levels of activity,

performance and events and circumstances may be materially different from what we expect. All forward-looking statements are based upon

information available to us on the date of this Offering Circular.

By their nature, forward-looking

statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the

future. We caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations,

financial condition, business and prospects may differ materially from those made in or suggested by the forward-looking statements contained

in this Offering Circular. In addition, even if our results of operations, financial condition, business and prospects are consistent

with the forward-looking statements contained (or incorporated by reference) in this Offering Circular, those results may not be indicative

of results in subsequent periods.

Forward-looking statements

necessarily involve risks and uncertainties, and our actual results could differ materially from those anticipated in the forward-looking

statements due to a number of factors, including those set forth below under “Risk Factors” and elsewhere in this Offering

Circular. The factors set forth below under “Risk Factors” and other cautionary statements made in this Offering Circular

should be read and understood as being applicable to all related forward-looking statements wherever they appear in this Offering Circular.

The forward-looking statements contained in this Offering Circular represent our judgment as of the date of this Offering Circular. We

caution readers not to place undue reliance on such statements. Except as required by law, we undertake no obligation to update publicly

any forward-looking statements for any reason, even if new information becomes available or other events occur in the future. All subsequent

written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety

by the cautionary statements contained above and throughout this Offering Circular.

You should read this Offering

Circular, the documents incorporated by reference in this Offering Circular, and the documents that we reference in this Offering Circular

and have filed as exhibits to this Offering Circular completely and with the understanding that our actual future results may be materially

different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

OFFERING CIRCULAR SUMMARY

The following summary highlights

material information contained in this Offering Circular. This summary does not contain all of the information you should consider before

purchasing our common stock. Before making an investment decision, you should read this Offering Circular carefully, including the section

entitled “Risk Factors,” included elsewhere in this Offering Circular and the documents incorporated by reference as listed

in the “Incorporation of Certain Information by Reference” section of this Offering Circular. Except as otherwise indicated

herein or as the context otherwise requires, references in this Offering Circular and the documents incorporated by reference in this

Offering Circular to “Auddia,” “the Company,” “we,” “us” and “our” refer to

Auddia Inc.

Overview

Auddia is a technology company

headquartered in Boulder, CO that is reinventing how consumers engage with audio through the development of a proprietary AI platform

for audio and innovative technologies for podcasts. Auddia is leveraging these technologies within its industry-first audio Superapp,

faidr (previously known as the Auddia App).

faidr gives consumers the

opportunity to listen to any AM/FM radio station with commercial breaks replaced with personalized audio content, including popular and

new music, news, and weather. The faidr app represents the first-time consumers can combine the local content uniquely provided by AM/FM

radio with commercial-free and personalized listening many consumers demand from digital-media consumption. In addition to commercial-free

AM/FM, faidr includes podcasts – also with ads removed or easily skipped by listeners – as well as exclusive content, branded

faidrRadio, which includes new artist discovery, curated music stations, and Music Casts. Music Casts are unique to faidr. Hosts and DJs

can combine on-demand talk segments with dynamic music streaming, which allows users to hear podcasts with full music track plays embedded

in the episodes.

Auddia has also developed

a differentiated podcasting capability with ad-reduction features and also provides a unique suite of tools that helps podcasters create

additional digital content for their podcast episodes as well as plan their episodes, build their brand, and monetize their content with

new content distribution channels. This podcasting feature also gives users the ability to go deeper into the stories through supplemental,

digital content, and eventually comment and contribute their own content to episode feeds.

The combination of AM/FM streaming

and podcasting, with Auddia’s unique, technology-driven differentiators, addresses large and rapidly growing audiences.

The Company has developed

its AI platform on top of Google’s TensorFlow open-source library that is being “taught” to know the difference between

all types of audio content on the radio. For instance, the platform recognizes the difference between a commercial and a song and is learning

the differences between all other content to include weather reports, traffic, news, sports, DJ conversation, etc. Not only does the technology

learn the differences between the various types of audio segments, but it also identifies the beginning and end of each piece of content.

The Company is leveraging

this technology platform within its premium AM/FM radio listening experience through the faidr App. The faidr App is intended to be downloaded

by consumers who will pay a subscription fee in order to listen to any streaming AM/FM radio station and podcasts, all with commercial

interruptions removed from the listening experience, in addition to the faidrRadio exclusive content offerings. Advanced features will

allow consumers to skip any content heard on the station and request audio content on-demand. We believe the faidr App represents a significant

differentiated audio streaming product, or Superapp, that will be the first to come to market since the emergence of popular streaming

music apps such as Pandora, Spotify, Apple Music, Amazon Music, etc. We believe that the most significant point of differentiation

is that in addition to ad-free AM/FM streaming and ad-reduced podcasts, the faidr App is intended to deliver non-music content that includes

local sports, news, weather, traffic and the discovery of new music alongside exclusive programming. No other audio streaming app available

today, including category leaders like TuneIn, iHeart, and Audacy, can compete with faidr’s full product offerings.

The Company launched an MVP

version of faidr through several consumer trials in 2021 to measure consumer interest and engagement with the App. The full app launched

on February 15, 2022, and included all major U.S. radio stations in the US. In February 2023, the Company added faidrRadio, Auddia’s

exclusive content offerings, to the app. Podcasts (standard) were added to the app for the iOS version before the end of Q1 2023 as planned

and added to the Android app in May of 2023. Podcast functionality will continue to be enhanced through 2024, including the deployment

of the Company’s ad-reduction technology.

The Company also developed

a testbed differentiated podcasting capability called Vodacast, which leveraged technologies and proven product concepts to differentiate

its podcasts offering from other competitors in the radio-streaming product category.

With podcasting growing and

predicted to grow at a rapid rate, the Vodacast podcast platform was conceptualized to fill a void in the emerging audio media space.

The platform was built to become the preferred podcasting solution for podcasters by enabling them to deliver digital content feeds that

match the audio of their podcast episodes, and by enabling podcasters to make additional revenue from new digital advertising channels,

subscription channels, on-demand fees for exclusive content, and through direct donations from their listeners. Throughout 2023, Auddia

has been migrating their podcasting capabilities into the flagship faidr app with the intention to sunset the Vodacast platform and instead

bring the advanced podcasting functionality that was found on Vodacast into faidr as part of the overall strategy to build a single audio

Superapp. This includes Auddia’s new podcast ad-reduction technology.

Today, podcasters do not have

a preference as to where their listeners access their episodes, as virtually all listening options (mobile apps and web players) deliver

only their podcast audio. By creating significant differentiation on which they can make net new and higher margin revenue, we believe

that podcasters will promote faidr to their listeners, thus creating a powerful, organic marketing dynamic.

One innovative and proprietary

part of Auddia’s podcast capabilities, originally presented on their Vodacast differentiated podcasting capability, is the availability

of tools to create and distribute an interactive digital feed, which supplements podcast episode audio with additional digital. These

content feeds allow podcasters to tell deeper stories to their listeners while giving podcasters access to digital revenue for the first

time. Podcasters will be able to build these interactive feeds using The Podcast Hub, a content management system that was originally

developed and trialed as part of Auddia’s Vodacast platform, which also serves as a tool to plan and manage podcast episodes. The

digital feed activates a new digital ad channel that turns every audio ad into a direct-response, relevant-to-the-story, digital ad, increasing

the effectiveness and value of their established audio ad model. The feed also presents a richer listening experience, as any element

of a podcast episode can be supplemented with images, videos, text and web links. This feed will appear fully synchronized in the faidr

mobile App, and it also can be hosted and accessed independently (e.g., through any browser), making the content feed universally distributable.

Over time, users will be able

to comment, and podcasters will be able to grant some users publishing rights to add content directly into the feed on their behalf. This

will create another first for podcasting, a dialog between creator and fan, synchronized to the episode content. The interactive feed

for podcasts has been developed and tested on Vodacast and is expected to be another differentiator added into faidr for podcast listeners

later in 2024.

The podcast capabilities within

faidr will also introduce a unique and industry first multi-channel, highly flexible set of revenue channels that podcasters can activate

in combination to allow listeners to choose how they want to consume and pay for content. “Flex Revenue” allows podcasters

to continue to run their standard audio ad model and complement those ads with direct response enabled digital ads in each episode content

feed, increasing the value of advertising on any podcast. “Flex Revenue” will also activate subscriptions, on-demand fees

for content (e.g., listen without audio ads for a micro payment fee) and direct donations from listeners. Using these channels in combination,

podcasters can maximize revenue generation and exercise higher margin monetization models, beyond basic audio advertising. “Flex

Revenue” and the initial inclusion of the new revenue channels that come with it will be added to podcasting in the faidr app, and

the first elements of this new monetization capability is expected to be commercially available in 2024, beginning with subscription

plans to access ad-reduction in podcasts.

The faidr mobile App is available

today through the iOS and Android App stores.

Recent Developments

Replacement

Equity Line with White Lion

On August 20, 2024, we

closed on a sale of Common Stock under the White Lion Purchase Agreement. We issued an aggregate of 1,650,000 common shares and received

aggregate proceeds of approximately $2.0 million.

Private Placement of Preferred Stock and

Common Warrants

On April 23, 2024, we entered

into the 2024 SPA with the Selling Stockholders for a convertible preferred stock and warrants financing. At the closing, we issued 2,314

shares of Series B Convertible Preferred Stock at a purchase price of $1,000 per share of Series B Convertible Preferred Stock. The Series

B Convertible Preferred Stock is convertible into common stock at an initial conversion price of $1.851 per share of common stock. The

Company also issued the Common Warrants exercisable for 1,250,137 shares of common stock with a five-year term.

The Common Warrants are immediately

exercisable for $1.851 per share of common stock, subject to certain adjustments, including with respect to stock dividends, splits, subsequent

rights offerings, pro rata distributions and a Fundamental Transaction (as defined in the Common Warrant) and until the fifth anniversary

of the original issuance date (the “Expiration Date”). The exercise of the Warrants are subject to beneficial ownership limitations.

In connection with the PIPE

Offering, we entered into a Registration Rights Agreement with the Purchasers, dated April 23, 2024 (the “Registration Rights Agreement”).

The Registration Rights Agreement provides that we shall file a registration statement covering the resale of all of the Registrable Securities

(as defined in the Registration Rights Agreement) with the SEC no later than the 30th calendar day following the date of the Registration

Rights Agreement, and have the registration statement declared effective by the SEC as promptly as possible after the filing thereof,

but in any event no later than the 60th calendar day following the date of the Registration Rights Agreement.

On May 23, 2024, the Company

filed a registration statement with the SEC registering up to 5,905,898 shares of common stock in connection with the PIPE Offering.

Mergers and Acquisitions Strategy

We are exploring various merger

and acquisition options as part of a broader strategy which aims to scale the business more rapidly; accelerate user adoption and subscriber

growth; enter new markets (international); and open new pathways toward raising capital. The overall strategy focuses on three areas:

(1) acquiring users of a radio-streaming app, (2) bringing our proprietary ad-free products to that the acquired userbase to generate

significant subscription revenue, and (3) bringing together other differentiated features into the larger audio Superapp platform.

RFM Acquisition

On January 26, 2024, we entered

into a Purchase Agreement (the “RFM Purchase Agreement”), pursuant to which we agreed to acquire RadioFM (the “RFM Acquisition”),

which is currently a component of both AppSmartz and RadioFM (partnerships under common control). The aggregate consideration for the

RFM Acquisition is $13,000,000 (plus $2,000,000 in contingent consideration if certain post-close milestones are reached), in addition

to the assumption of certain liabilities, as may be adjusted pursuant to the terms of the RFM Purchase Agreement.

In March 2024, the parties

mutually agreed to terminate the RFM Purchase Agreement.

Reverse

Share Split

We filed an amendment to our

Certificate of Incorporation with the Secretary of State in Delaware which became effective as of 5:00 P.M. Eastern Time on February 26,

2024. As a result, every twenty-five (25) issued shares of common stock were automatically combined into one share of common stock.

Shares of our common stock

were assigned a new CUSIP number (05072K 206) and began trading on a split-adjusted basis on February 27, 2024.

The reverse stock split did

not change the authorized number of shares of our common stock. No fractional shares were issued and any fractional shares resulting from

the reverse stock split were rounded up to the nearest whole share. Therefore, stockholders with less than 25 shares received one share

of stock.

The reverse stock split applied

to our outstanding warrants, stock options and restricted stock units. The number of shares of common stock into which these outstanding

securities are convertible or exercisable were adjusted proportionately as a result of the reverse stock split. The exercise prices of

any outstanding warrants or stock options were also proportionately adjusted in accordance with the terms of those securities and our

equity incentive plans.

Going Concern Opinion

Our working capital deficiency,

stockholders’ deficit, and recurring losses from operations raise substantial doubt about our ability to continue as a going concern.

As a result, our independent registered public accounting firm included an explanatory paragraph in its report on our financial statements

for the year ended December 31, 2023 with respect to this uncertainty. Our ability to continue as a going concern will require us to obtain

additional funding.

The Company secured approximately

$9.2 million in additional financing year-to-date through August 20, 2024, which enabled us to pay down $2.75 million in connection with

the Secured Bridge Notes and will only be sufficient to fund our current operating plans into the first quarter of 2025. The Company

has based these estimates, however, on assumptions that may prove to be wrong. We will need additional funding to complete the development

of our full product line and scale products with a demonstrated market fit. Management has plans to secure such additional funding. If

we are unable to raise capital when needed or on acceptable terms, we would be forced to delay, reduce, or eliminate our technology development

and commercialization efforts.

As a result of the Company’s

recurring losses from operations, and the need for additional financing to fund its operating and capital requirements, there is uncertainty

regarding the Company’s ability to maintain liquidity sufficient to operate its business effectively, which raises substantial doubt

as to the Company’s ability to continue as a going concern.

Our Corporate Information

We

were originally formed as Clip Interactive, LLC in January 2012, as a limited liability company under the laws of the State of Colorado.

Immediately prior to our initial public offering in February 2021, we converted into a Delaware corporation pursuant to a statutory conversion

and were renamed Auddia Inc.

Our principal executive offices

are located at 1680 38th Street, Suite 130, Boulder, CO 80301. Our main telephone number is (303) 219-9771. Our internet website

is www.auddia.com. The information contained in, or that can be accessed through, our website is not incorporated by reference and is

not a part of this Offering Circular.

Offering Summary

| Securities Offered |

|

The Offered Shares, 28,301,886 shares of common stock, are

being offered by the Company in a “best-efforts” offering. |

| |

|

|

| Offering Price Per Share |

|

$1.40 to $2.65 per Offered Share (to be fixed by post-qualification

supplement). |

| |

|

|

| Shares Outstanding Before This Offering |

|

4,444,196 shares of common stock issued and outstanding as of August 22,

2024. |

| |

|

|

| Shares Outstanding After This Offering |

|

32,746,082 shares of common stock issued and outstanding, assuming all

of the Offered Shares are sold hereunder. |

| |

|

|

| Minimum Number of Shares to Be Sold in This Offering |

|

None |

| |

|

|

| Investor Suitability Standards |

|

The Offered Shares are being offered and sold to “qualified purchasers” (as defined in Regulation A under the Securities Act of 1933, as amended (the “Securities Act”). “Qualified purchasers” include any person to whom securities are offered or sold in a Tier 2 offering pursuant to Regulation A under the Securities Act. |

| |

|

|

| Market for our Common Stock |

|

Our common stock is listed on Nasdaq under the symbol “AUUD.” |

| |

|

|

| Termination of this Offering |

|

This offering will terminate at the earliest of (a) the date on which all of the Offered Shares have been sold, (b) the date which is one year from this offering being qualified by the SEC and (c) the date on which this offering is earlier terminated by us, in our sole discretion. (See “Plan of Distribution”). |

| |

|

|

| Use of Proceeds |

|

We intend to use the net proceeds from this offering to build out and complete our product offerings, expand our sales and marketing efforts, fund acquisitions and other working capital and general corporate purposes. See “Use of Proceeds”. |

| |

|

|

| Risk Factors |

|

An investment in the Offered Shares involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investments. You should carefully consider the information included in the Risk Factors section of this Offering Circular, as well as the other information contained in this Offering Circular, prior to making an investment decision regarding the Offered Shares. |

| |

|

|

| Closing |

|

We

may undertake one or more closings on a rolling basis. You may not subscribe to this offering

prior to the date offering statement of which this offering circular forms a part is qualified

by the SEC. Before such date, you may only make non-binding indications of your interest

to purchase securities in the offering. For any subscription agreements received after such

date, we have the right to review and accept or reject the subscription in whole or in part,

for any reason or for no reason. We intend to conduct the initial closing on a date based

on the number of investors with funds in escrow that have cleared the requisite background

checks and the total amount of funds confirmed pending an initial closing (although no minimum

amount of funds is required to conduct an initial closing).

|

| |

|

|

| |

|

Following the initial closing of this offering, we expect to have several

subsequent closings of this offering until the maximum offering amount is raised or the offering is terminated. An investor’s

subscription is binding and irrevocable and investors will not have the right to withdraw their subscription or receive a return

of funds prior to the next closing unless we reject the investor’s subscription. You will receive a confirmation of your purchase

promptly following the closing in which you participate. |

The number

of shares outstanding after this offering is based on 4,444,196 shares of our common stock outstanding as of August 22, 2024, and

excludes:

| |

· |

8,929 shares of our common stock reserved for issuance under outstanding stock options granted under our 2013 Equity Incentive Plan, |

| |

· |

10,990 shares of our common stock reserved for issuance under outstanding restricted stock units granted under our 2020 Equity Incentive Plan, |

| |

· |

39,632 shares of our common stock reserved for issuance under outstanding stock options granted under our 2020 Equity Incentive Plan, |

| |

· |

103,308 shares of our common stock reserved for future grant under our 2020 Equity Incentive Plan, |

| |

· |

32,150 shares of our common stock reserved for issuance under outstanding stock options and outstanding RSUs granted as employment inducement awards to four of our former and current executives outside of our 2013 and 2020 Equity Incentive Plans, |

| |

· |

1,026,674 shares of common stock reserved for issuance upon the exercise of outstanding common stock warrants, |

| |

· |

139,956 shares of common stock reserved for issuance upon the exercise of our publicly traded outstanding Series A Warrants, |

| |

· |

1,250,137 shares of common stock reserved for issuance upon the exercise of warrants sold in a private placement, |

| |

· |

12,774 shares of common stock reserved for issuance upon the exercise of an outstanding IPO underwriter representative common stock warrant, and |

| |

· |

Up to 3,515,263 shares or $3,141,917

of common stock that may be sold in the future by the Company to While Lion pursuant to the Equity Line Purchase Agreement. |

Continuing Reporting Requirements Under Regulation

A

We are required to file

periodic and other reports with the SEC, pursuant to the requirements of Section 13(a) of the Exchange Act. Our continuing reporting obligations

under Regulation A are deemed to be satisfied as long as we comply with our Section 13(a) reporting requirements.

RISK FACTORS

An investment in the

Offered Shares involves substantial risks. You should carefully consider the following risk factors, in addition to the other information

contained in this Offering Circular, before purchasing any of the Offered Shares. The occurrence of any of the following risks might cause

you to lose a significant part of your investment. The risks and uncertainties discussed below are not the only ones we face, but do represent

those risks and uncertainties that we believe are most significant to our business, operating results, prospects and financial condition.

Some statements in this Offering Circular, including statements in the following risk factors, constitute forward-looking statements.

See “Cautionary Statement Regarding Forward-Looking Statements”.

Summary of Risk Factors

The following is a short description

of the risks and uncertainties you should carefully consider in evaluating our business and us which are more fully described under the

heading “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the “2023

Form 10-K”), which report is incorporated by reference in this offering circular. The factors listed below and in the annual

report and quarterly reports, represent certain important factors that we believe could cause our business results to differ. These factors

are not intended to represent a complete list of the general or specific risks that may affect us. It should be recognized that other

risks may be significant, presently or in the future, and the risks set forth below may affect us to a greater extent than indicated.

If any of the following risks occur, our business, financial condition or results of operations could be materially and adversely affected.

Risks related to our financial position and

need for additional capital

| · | Our auditors have expressed substantial doubt about our ability to continue as a going concern, which

may hinder our ability to obtain further financing. |

| · | We have incurred significant net losses since inception and anticipate that we will continue to incur

net losses for the foreseeable future and may never achieve or maintain profitability. |

| · | We will need additional funding, which may not be available on acceptable terms, or at all. Failure to

obtain this capital when needed may force us to delay, limit or terminate our product development efforts or other operations. |

| · | Raising additional capital may cause dilution to our existing stockholders, restrict our operations or

require us to relinquish rights to our technologies and product candidates. |

| · | We have generated historical revenue from our mobile app platform for radio stations, but future revenue

growth is dependent on new software services. |

| · | Our limited operating history of our current business plan may make

it difficult for investors to evaluate the success of our business to date and to assess our future viability. |

| · | We have identified material weaknesses in our internal control over financial reporting. Failure to achieve

and maintain effective internal control over financial reporting could result in our failure to accurately or timely report our financial

condition or results of operations, which could have a material adverse effect on our business and securities prices. |

| · | If we fail to maintain proper and effective internal controls, our ability to produce accurate financial

statements on a timely basis could be impaired, which would adversely affect our business. |

Risks related to the development of our products

| · | Our subscription revenue margins and our freedom to operate our faidr radio platform rely on continuity

of the established music licensing framework. |

| · | Our faidr platform will rely on the established “personal use exemption” which allows individuals

to record content for time-shifting purposes. |

| · | If we are unable to obtain and maintain patent protection for our products and product candidates, or

if the scope of the patent protection obtained is not sufficiently broad, our competitors could develop and commercialize products and

product candidates similar or identical to ours, and our ability to successfully commercialize our products and product candidates may

be adversely affected. |

| · | Real or perceived errors, failures or bugs in our platform or products could materially and adversely

affect our operating results and growth prospects. |

Risks related to our business operations

| · | Our recently announced growth strategy includes seeking acquisitions

of other companies or assets in our industry sector. We may not be successful in identifying, making and integrating business or asset

acquisitions, if any, in the future. |

| · | Our future success depends on our ability to retain key employees, consultants and advisors and to attract,

retain and motivate qualified personnel. |

| · | If we are unable to manage expected growth in the scale and complexity of our operations, our performance

may suffer. |

| · | Any cybersecurity-related attack, significant data breach or disruption

of the information technology systems or networks on which we rely could negatively affect our business. |

| · | Changing regulations and increased awareness relating to privacy, information security and data protection

could increase our costs, affect or limit how we collect and use personal information and harm our brand. |

| · | Our business depends on a strong brand, and if we are not able to develop, maintain and enhance our brand,

our business and operating results may be harmed. Moreover, our brand and reputation could be harmed if we were to experience significant

negative publicity. |

| · | Enacted and future legislation may increase the difficulty and cost for us to commercialize our product

candidates and may affect the prices we may set. |

| · | We may be subject to litigation, disputes or regulatory inquiries for a variety of claims, which could

adversely affect our results of operations, harm our reputation or otherwise negatively affect our business. |

Risks related to our

intellectual property

| · | Our business is subject to the risks of earthquakes, fire, floods and other natural catastrophic events,

and to interruption by man-made problems such as power disruptions, computer viruses, cyberattack, data security breaches or terrorism. |

| · | Any failure to protect our intellectual property rights could impair our business. |

| · | If third parties claim that we infringe upon or otherwise violate their intellectual property rights,

our business could be adversely affected. |

| · | Indemnity provisions in various agreements potentially expose us to substantial liability for intellectual

property infringement and other losses. |

Risks related to ownership of common stock

| · | A significant portion of our total outstanding shares are eligible for sale into the public market. Substantial

sales of our shares into the public market could cause the market price of our common stock to drop significantly, even if our business

is performing well. |

| · | The issuance of common stock pursuant to our equity line facility may cause substantial dilution to our

existing shareholders, and the sale of such shares acquired by our equity line provider could cause the price of our common stock to decline. |

| · | The price of our common stock may be volatile and fluctuate substantially, which could result in substantial

losses for investors in our securities. |

| · | If securities analysts do not publish research or reports about our business or if they publish negative

evaluations of our stock, the price of our stock could decline. |

| · | We may not be able to continue our current listing of our common stock on the Nasdaq Capital Market. A

delisting of our common stock from Nasdaq could limit the liquidity of our stock, increase its volatility and hinder our ability to raise

capital. |

| · | We are an “emerging growth company,” and the reduced disclosure requirements applicable to

emerging growth companies may make our common stock less attractive to investors. |

| · | We continue to incur increased costs as a result of operating as a public company, and our management

will be required to devote substantial time to new compliance initiatives. |

| · | Failure to establish and maintain effective internal controls in accordance with Section 404 of the Sarbanes-Oxley

Act could have a material adverse effect on our business and stock price. |

| · | Provisions in our corporate charter and our bylaws and under Delaware law could make an acquisition of

us, which may be beneficial to our stockholders, more difficult and may prevent attempts by our stockholders to replace or remove our

current management. |

| · | Because we do not anticipate paying any cash dividends on our capital stock in the foreseeable future,

capital appreciation, if any, will be your sole source of gain. |

| · | Our charter provides that the Court of Chancery of the State of Delaware is the exclusive forum for certain

litigation that may be initiated by our stockholders, which could limit our stockholders’ ability to obtain a favorable judicial

forum for such disputes with us or our directors, officers or employees. |

Risks Relating to

this Offering and Ownership of Our Securities

Purchasers in the

offering will suffer immediate dilution.

If

you purchase Offered Shares in this offering, the value of your shares based on our pro forma

net tangible book value will immediately be less than the offering price you paid. This reduction

in the value of your equity is known as dilution. At an assumed public offering price of

$2.65 per share, which represents the high end of the offering price range herein, purchasers

of common stock in this offering will experience immediate dilution of approximately $0.26

per share, representing the difference between the assumed public offering price per share

in this offering and our pro forma as adjusted net tangible book value per share as of June

30, 2024, after giving effect to the Pro Forma Adjustments (as defined herein), this offering,

and after deducting estimated offering expenses payable by us. See “Dilution.”

You may experience

future dilution as a result of future equity offerings or acquisitions.

In

order to raise additional capital, we may in the future offer additional shares of our common stock or other securities convertible into

or exchangeable for our common stock at prices that may not be the same as the price per share in this offering. We may sell shares or

other securities in any future offering at a price per share that is less than the price per share paid by investors in this offering,

and investors purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per share

at which we sell additional shares of our common stock, or securities convertible or exchangeable into our common stock, in future transactions

or acquisitions may be higher or lower than the price per share paid by investors in this offering.

In

addition, we may engage in one or more potential acquisitions in the future, which could involve issuing our common stock as some or all

of the consideration payable by us to complete such acquisitions. If we issue common stock or securities linked to our common stock, the

newly issued securities may have a dilutive effect on the interests of the holders of our common stock. Additionally, future sales of

newly issued shares used to effect an acquisition could depress the market price of our common stock.

This is a “best

efforts” offering; no minimum amount of Offered Shares is required to be sold, and we may not raise the amount of capital we believe

is required for our business.

There

is no required minimum number of Offered Shares that must be sold as a condition to completion of this offering. Because there is no minimum

offering amount required as a condition to the closing of this offering, the actual offering amount, and proceeds to us are not presently

determinable and may be substantially less than the maximum amounts set forth in this Offering Circular. We may sell fewer than all of

the Offered Shares offered hereby, which may significantly reduce the amount of proceeds received by us, and investors in this offering

will not receive a refund in the event that we do not sell an amount of Offered Shares sufficient to pursue the business goals outlined

in this Offering Circular. Thus, we may not raise the amount of capital we believe is required for our business and may need to raise

additional funds, which may not be available or available on terms acceptable to us. Despite this, any proceeds from the sale of the Offered

Shares offered by us will be available for our immediate use, and because there is no escrow account and no minimum offering amount in

this offering, investors could be in a position where they have invested in us, but we are unable to fulfill our objectives due to a lack

of interest in this offering.

Our management

will have broad discretion over the use of the net proceeds from this offering.

We

currently intend to use the net proceeds from the sale of Offered Shares under this offering, together with our existing cash, to build

out the product platforms, expand our sales and marketing efforts, and for general and administration expenses and other general corporate

purposes. We have not reserved or allocated specific amounts for any of these purposes and we cannot specify with certainty how we will

use the net proceeds. See “Use of Proceeds”. Accordingly, our management will have considerable discretion in the application

of the net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being

used appropriately. We may use the net proceeds for corporate purposes that do not increase our operating results or market value.

Risks related to Financial,

Operational, Commercial and Manufacturing matters

Our auditors have

expressed substantial doubt about our ability to continue as a going concern, which may hinder our ability to obtain further financing.

Our past working capital

deficiency, stockholders’ deficit and recurring losses from operations raised substantial doubt about our ability to continue as

a going concern. As a result, our independent registered public accounting firm has included an explanatory paragraph in its report on

our financial statements for the year ended December 31, 2023 with respect to this uncertainty. Our existing cash of $804,556 at December

31, 2023. The Company secured approximately $9.2 million in additional financing year-to-date through August 20, 2024, which enabled us

to pay down $2.75 million in connection with the Secured Bridge Notes and will only be sufficient to fund our current operating plans

into the first quarter of 2025. The Company has based these estimates, however, on assumptions that may prove to be wrong. We will need

additional funding to complete the development of our full product line and scale products with a demonstrated market fit. Management

has plans to secure such additional funding. If we are unable to raise capital when needed or on acceptable terms, we would be forced

to delay, reduce, or eliminate our technology development and commercialization efforts.

We may not be able

to continue our current listing of our common stock on the Nasdaq Capital Market. A delisting of our common stock from Nasdaq could limit

the liquidity of our stock, increase its volatility and hinder our ability to raise capital.

We

may not be able to satisfy the requirements for the continued listing of our common stock on Nasdaq.

In particular, the Nasdaq

listing rules require listed securities to maintain a minimum bid price of $1.00 per share. As previously reported in our Current Report

on Form 8-K filed on November 28, 2023, we received a written notice from Nasdaq indicating that we were was not in compliance with the

$1.00 minimum bid price requirement set forth in Nasdaq Listing Rule 5550(a)(2) for continued listing. As a result, the Nasdaq staff determined

to delist our Common Stock from Nasdaq, unless we timely requests an appeal of the Staff’s determination to a Hearings Panel (the

“Panel”), pursuant to the procedures set forth in the Nasdaq Listing Rule 5800 Series. Our hearing with the Panel occurred

on January 18, 2024.

On

November 21, 2023, we received a written notice from Nasdaq indicating that we are not in compliance with Nasdaq Listing Rule 5550(b)(1),

which requires companies listed on The Nasdaq Capital Market to maintain a minimum of $2,500,000 in stockholders’ equity for continued

listing (the “Stockholders’ Equity Requirement”). In its quarterly report on Form 10-Q for the period ended September

30, 2023, we reported stockholders’ equity of $2,415,012, and, as a result, do not currently satisfy Listing Rule 5550(b)(1). Nasdaq’s

November written notice has no immediate impact on the listing of our common stock. Our hearing with the Panel occurred on January 18,

2024. The hearing addressed all outstanding listing compliance matters, including compliance with the Stockholders’ Equity Notice

as well as compliance with the Bid Price Requirement.

On January 30, 2024, the Panel

granted our request for an exception to the Exchange’s listing rules until April 22, 2024, to demonstrate with all applicable continued

listing requirements for the Nasdaq Capital Market.

On

March 20, 2024, we received a letter from Nasdaq stating we had regained compliance with the minimum bid requirement. The Panel reminded

us that although we regained compliance with the minimum bid requirement, we are also required to regain compliance with the equity requirement.

Therefore, this matter will remain open until we demonstrate compliance with all requirements.

On April 16, 2024, the Company

received a letter from Nasdaq granting an exception to the Exchange’s listing rules until May 20, 2024, to demonstrate compliance

with Listing Rule 5550(b)(1) (the “Equity Rule”.)

On May 24, 2024, the Company

received a letter from Nasdaq indicating that the Company has regained compliance with the equity requirement in Listing rule 5550(b)

(1) (the Equity Rule”.) The Company will be subject to a Mandatory Panel Monitor for a period of one year from the date of the letter

in accordance with application of Listing Rule 5815(d)(4)(B).

If our common stock is delisted

by Nasdaq, our common stock may be eligible for quotation on an over-the-counter quotation system or on the pink sheets. Upon any such

delisting, our common stock would become subject to the regulations of the SEC relating to the market for penny stocks. A penny stock

is any equity security not traded on a national securities exchange that has a market price of less than $5.00 per share. The regulations

applicable to penny stocks may severely affect the market liquidity for our common stock and could limit the ability of shareholders to

sell securities in the secondary market. In such a case, an investor may find it more difficult to dispose of or obtain accurate quotations

as to the market value of our common stock, and there can be no assurance that our common stock will be eligible for trading or quotation

on any alternative exchanges or markets.

Delisting from Nasdaq could

adversely affect our ability to raise additional financing through public or private sales of equity securities, would significantly affect

the ability of investors to trade our securities and would negatively affect the value and liquidity of our common stock. Delisting could

also have other negative results, including the potential loss of confidence by employees, the loss of institutional investor interest

and fewer business development opportunities.

If

our common stock is delisted by Nasdaq, our common stock may be eligible for quotation on an over-the-counter quotation system or on the

pink sheets. Upon any such delisting, our common stock would become subject to the regulations of the SEC relating to the market for penny

stocks. A penny stock is any equity security not traded on a national securities exchange that has a market price of less than $5.00 per

share. The regulations applicable to penny stocks may severely affect the market liquidity for our common stock and could limit the ability

of shareholders to sell securities in the secondary market. In such a case, an investor may find it more difficult to dispose of or obtain

accurate quotations as to the market value of our common stock, and there can be no assurance that our common stock will be eligible for

trading or quotation on any alternative exchanges or markets.

Delisting

from Nasdaq could adversely affect our ability to raise additional financing through public or private sales of equity securities, would

significantly affect the ability of investors to trade our securities and would negatively affect the value and liquidity of our common

stock. Delisting could also have other negative results, including the potential loss of confidence by employees, the loss of institutional

investor interest and fewer business development opportunities.

DILUTION

If you invest in our common

stock in this offering, your ownership interest will be diluted immediately to the extent of the difference between the public offering

price per share of our common stock and the pro forma as adjusted net tangible book value per share of our common stock after this offering.

Our historical net tangible

book value as of June 30, 2024, was $1,691,100, or $0.61 per share of common stock based on 2,794,196 shares of common stock outstanding

as of June 30, 2024. Historical net tangible book value per share is calculated by subtracting our total liabilities from our total tangible

assets, which is total assets less intangible assets and Deferred Offering costs, and dividing this amount by the number of shares of

common stock outstanding as of such date.

After giving effect

to (i) the issuance of 1,650,000 shares of our common stock for $2,005,575 subsequent to June 30, 2024 (the “Pro Forma Adjustments”),

our pro forma net tangible book value would have been approximately $3,696,675, or $0.83 per share.

After giving further

effect to the assumed sale by us of the Offered Shares at an assumed public offering price of $2.65 per share (which represents the high

end of the offering price range herein), and after deducting estimated offering expenses, our pro forma as adjusted net tangible book

value as of June 30, 2024 would have been approximately $78,171,673 or $2.39 per share of common stock. This represents an immediate

increase in the net tangible book value of $1.56 per share to our existing stockholders and an immediate and substantial dilution in

net tangible book value of $0.26 per share to new investors. The following table illustrates this hypothetical per share dilution:

| Assumed public offering price per share |

|

$ |

2.65 |

|

| Historical net tangible book value per share as of June 30, 2024 |

|

$ |

0.61 |

|

| Increase in net tangible book value per share attributable to the Pro Forma Adjustments |

|

$ |

0.23 |

|

| Pro forma net tangible book value per share as of June 30, 2024 |

|

$ |

0.83 |

|

| Increase in pro forma net tangible book value per share attributable to this offering |

|

$ |

1.56 |

|

| Pro forma as adjusted net tangible book value per share as of June 30, 2024 after giving effect

to this offering |

|

$ |

2.39 |

|

| Dilution per share to purchasers of Offered Shares in this offering |

|

$ |

0.26 |

|

A

$1.00 increase in the assumed public offering price of $2.65 per Offered Share, would increase the pro forma as adjusted net tangible

book value per share by $2.30, and increase dilution to new investors by $0.52 per share, in each case assuming that the number of Offered

Shares offered by us, as set forth on the cover page of this Offering Circular, remains the same and after deducting estimated offering

expenses payable by us.

The pro forma as adjusted

information discussed above is illustrative only. Our net tangible book value following the completion of this offering is subject to

adjustment based on the actual public offering price of our Offered Shares and other terms of this offering determined at pricing.

The

number of shares outstanding after this offering is based on 2,794,196 shares of our common stock outstanding as of June 30, 2024, and

excludes:

| |

· |

9,476 shares of our common stock reserved for issuance under outstanding stock options granted under our 2013 Equity Incentive Plan, |

| |

· |

10,990 shares of our common stock reserved for issuance under outstanding restricted stock units granted under our 2020 Equity Incentive Plan, |

| |

· |

39,632 shares of our common stock reserved for issuance under outstanding stock options granted under our 2020 Equity Incentive Plan, |

| |

· |

103,308 shares of our common stock reserved for future grant under our 2020 Equity Incentive Plan, |

| |

· |

32,150 shares of our common stock reserved for issuance under outstanding stock options and outstanding RSUs granted as employment inducement awards to four of our former and current executives outside of our 2013 and 2020 Equity Incentive Plans, |

| |

· |

64,154 shares of common stock reserved for issuance upon the exercise of outstanding common stock warrants, |

| |

· |

139,956 shares of common stock reserved for issuance upon the exercise of our publicly traded outstanding Series A Warrants, |

| |

· |

1,250,137 shares of common stock reserved for issuance upon the exercise of warrants sold in a private placement, |

| |

· |

12,774 shares of common stock reserved for issuance upon the exercise of an outstanding IPO underwriter representative common stock warrant, and |

| |

· |

Up to 5,165,263 shares or $5,147,492 of common stock that may be

sold in the future by the Company to While Lion pursuant to the Equity Line Purchase Agreement. |

USE OF PROCEEDS

The table below sets forth

the estimated proceeds we would derive from this offering, assuming the sale of 25%, 50%, 75% and 100% of the Offered Shares at an assumed

per share price of $2.65, which represents the high end of the offering price range herein. There is, of course, no guaranty that

we will be successful in selling any of the Offered Shares in this offering.

| | |

Assumed Percentage of Offered Shares

Sold in This Offering | |

| | |

25% | | |

50% | | |

75% | | |

100% | |

| Offered Shares sold | |

| 7,075,472 | | |

| 14,150,943 | | |

| 21,226,415 | | |

| 28,301,886 | |

| Gross proceeds | |

$ | 18,750,000.80 | | |

$ | 37,499,998.95 | | |

$ | 56,249,999.75 | | |

$ | 74,999,997.90 | |

| Offering expenses (1) | |

| (187,500 | ) | |

| (337,500 | ) | |

| (450,000 | ) | |

| (525,000 | ) |

| Net proceeds | |

$ | 18,562,500.80 | | |

$ | 37,162,498.95 | | |

$ | 55,799,999.75 | | |

$ | 74,474,997.90 | |

| (1) |

Represents placement agent fees, legal and accounting fees and expenses and out-of-pocket costs of escrow and clearing agent (See “Plan of Distribution”). |

We

intend to use the net proceeds from this offering for working capital and other general corporate purposes.

We reserve the right to change

the foregoing use of proceeds, should our management believe it to be in the best interest of our company. The allocations of the proceeds

of this offering presented above constitute the current estimates of our management and are based on our current plans, assumptions made

with respect to the industry in which we currently or, in the future, expect to operate, general economic conditions and our future revenue

and expenditure estimates.

Investors are cautioned that

expenditures may vary substantially from the estimates presented above. Investors must rely on the judgment of our management, who will

have broad discretion regarding the application of the proceeds of this offering. The amounts and timing of our actual expenditures will

depend upon numerous factors, including market conditions, cash generated by our operations (if any), business developments and the rate

of our growth. We may find it necessary or advisable to use portions of the proceeds of this offering for other purposes.

In the event we do not obtain

the entire offering amount hereunder, we may attempt to obtain additional funds through private offerings of our securities or by borrowing

funds. Currently, we do not have any committed sources of financing.

PLAN OF DISTRIBUTION

In General

Our company is offering

a maximum of 28,301,886 Offered Shares on a “best-efforts” basis, at a fixed price of $2.65, which represents the high end

of the offering price range of $1.40 to $2.65 per share (to be fixed by post-qualification supplement). There is no minimum purchase

requirement for investors in this offering. This offering will terminate at the earliest of (a) the date on which the maximum offering

has been sold, (b) the date which is one year from this offering being qualified by the SEC or (c) the date on which this offering is

earlier terminated by us, in our sole discretion.

There is no minimum number

of Offered Shares that we are required to sell in this offering. All funds derived by us from this offering will be immediately available

for use by us, in accordance with the uses set forth in the section entitled “Use of Proceeds” of this Offering Circular.

No funds will be placed in an escrow account during the offering period and no funds will be returned once an investor’s subscription

agreement has been accepted by us.

We intend to sell the Offered

Shares in this offering through the efforts of our Executive Chairman, Jeffery Thramann. Mr. Thramann will not receive any compensation

for offering or selling the Offered Shares. We believe that Mr. Thramann is exempt from registration as a broker-dealer under the provisions

of Rule 3a4-1 promulgated under the Exchange Act. In particular, Mr. Thramann:

| · | is not subject to a statutory disqualification, as that term is defined in Section 3(a)(39) of the Securities

Act; and |

| · | is not to be compensated in connection with his participation by the payment of commissions or other remuneration

based either directly or indirectly on transactions in securities; and |

| · | is not an associated person of a broker or dealer; and |

| · | meets the conditions of the following: |

| · | primarily performs, and will perform at the end of this offering, substantial duties for us or on our

behalf otherwise than in connection with transactions in securities; and |

| · | was not a broker or dealer, or an associated person of a broker or dealer, within the preceding 12 months;

and |

| · | did not participate in selling an offering of securities for any issuer more than once every 12 months

other than in reliance on paragraphs (a)(4)(i) or (iii) of Rule 3a4-1 under the Exchange Act. |

As of the date of this Offering

Circular, we have not entered into any agreements with selling agents for the sale of the Offered Shares. However, we reserve the right

to engage FINRA-member broker-dealers. In the event we engage FINRA-member broker-dealers, we expect to pay sales commissions of up to

3.0% of the gross offering proceeds from their sales of the Offered Shares. In connection with our appointment of a selling broker-dealer,

we intend to enter into a standard selling agent agreement with the broker-dealer pursuant to which the broker-dealer would act as our

non-exclusive sales agent in consideration of our payment of commissions of up to 3.0% on the sale of Offered Shares effected by the broker-dealer.

Procedures for Subscribing

If you are interested in subscribing

for Offered Shares in this offering, please submit a request for information by e-mail to Mr. Thramann at jeff@thramann.com; all relevant

information will be delivered to you by return e-mail. Thereafter, should you decide to subscribe for Offered Shares, you are required

to follow the procedures described in the subscription agreement included in the delivered information, which are:

| · | Electronically execute and deliver to us a subscription agreement; and |

| · | Deliver funds directly by check or by wire or electronic funds transfer via ACH to our specified bank

account. |

Right to Reject Subscriptions

After we receive your complete,

executed subscription agreement and the funds required under the subscription agreement have been transferred to us, we have the right

to review and accept or reject your subscription in whole or in part, for any reason or for no reason. We will return all monies from

rejected subscriptions immediately to you, without interest or deduction.

Acceptance of Subscriptions

Conditioned upon our acceptance

of a subscription agreement, we will countersign the subscription agreement and issue the Offered Shares subscribed. Once you submit the

subscription agreement and it is accepted, you may not revoke or change your subscription or request your subscription funds. All accepted

subscription agreements are irrevocable.

This Offering Circular will

be furnished to prospective investors upon their request via electronic PDF format and will be available for viewing and download 24 hours

per day, 7 days per week on our company’s page on the SEC’s website: www.sec.gov.

An investor will become a

shareholder of the Company and the Offered Shares will be issued, as of the date of settlement. Settlement will not occur until an investor’s

funds have cleared and we accept the investor as a shareholder.

By executing the subscription

agreement and paying the total purchase price for the Offered Shares subscribed, each investor agrees to accept the terms of the subscription

agreement and attests that the investor meets certain minimum financial standards.

An approved trustee must process

and forward to us subscriptions made through IRAs, Keogh plans and 401(k) plans. In the case of investments through IRAs, Keogh plans

and 401(k) plans, we will send the confirmation and notice of our acceptance to the trustee.

State Law Exemption and Offerings to “Qualified

Purchasers”

The Offered Shares are being

offered and sold to “qualified purchasers” (as defined in Regulation A under the Securities Act). As a Tier 2 offering pursuant

to Regulation A under the Securities Act, this offering will be exempt from state “Blue Sky” law review, subject to certain

state filing requirements and anti-fraud provisions, to the extent that the Offered Shares offered hereby are offered and sold only to

“qualified purchasers”.

“Qualified purchasers”

include any person to whom securities are offered or sold in a Tier 2 offering pursuant to Regulation A under the Securities Act. We reserve

the right to reject any investor’s subscription in whole or in part for any reason, including if we determine, in our sole and absolute

discretion, that such investor is not a “qualified purchaser” for purposes of Regulation A. We intend to offer and sell the

Offered Shares to qualified purchasers in every state of the United States.

Issuance of Offered Shares

Upon settlement, that is,

at such time as an investor’s funds have cleared and we have accepted an investor’s subscription agreement, we will either

issue such investor’s purchased Offered Shares in book-entry form or issue a certificate or certificates representing such investor’s

purchased Offered Shares.

Transferability of the Offered Shares

The Offered Shares will be

generally freely transferable, subject to any restrictions imposed by applicable securities laws or regulations.

Listing of Offered Shares

The Offered Shares will be

listed on The Nasdaq Capital Market under the symbol “AUUD.”

DESCRIPTION OF SECURITIES

The following description

is intended as a summary of our certificate of incorporation (which we refer to as our “charter”) and our bylaws, each of

which is filed as an exhibit to the Offering Circular, and to the applicable provisions of the Delaware General Corporation Law. Because

the following is only a summary, it does not contain all of the information that may be important to you. For a complete description,

you should refer to our charter and bylaws.

We

have two classes of securities registered under Section 12 of the Exchange Act. Our shares of common stock are listed on The Nasdaq Stock

Market under the trading symbol “AUUD.” Our Series A Warrants are listed on the Nasdaq Stock Market under the trading symbol

“AUUDW.”

Authorized Capital

Stock

Our

authorized capital stock consists of 100,000,000 shares of common stock, par value $0.001 per share, and 10,000,000 shares of preferred

stock, par value $0.001 per share.

Common Stock

The

holders of our common stock are entitled to one vote for each share held on all matters submitted to a vote of the stockholders. The holders

of our common stock do not have any cumulative voting rights. Holders of our common stock are entitled to receive ratably any dividends

declared by our board of directors out of funds legally available for that purpose, subject to any preferential dividend rights of any

outstanding preferred stock. Our common stock has no preemptive rights, conversion rights or other subscription rights or redemption or

sinking fund provisions.

In

the event of our liquidation, dissolution or winding up, holders of our common stock will be entitled to share ratably in all assets remaining

after payment of all debts and other liabilities and any liquidation preference of any outstanding preferred stock. Each outstanding share

of common stock is duly and validly issued, fully paid and non-assessable.

Preferred stock

Our

board will have the authority, without further action by our stockholders, to issue up to 10,000,000 shares of preferred stock in one

or more series and to fix the rights, preferences, privileges and restrictions thereof. These rights, preferences and privileges could

include dividend rights, conversion rights, voting rights, terms of redemption, liquidation preferences, sinking fund terms and the number

of shares constituting, or the designation of, such series, any or all of which may be greater than the rights of common stock. The issuance

of our preferred stock could adversely affect the voting power of holders of common stock and the likelihood that such holders will receive

dividend payments and payments upon our liquidation. In addition, the issuance of preferred stock could have the effect of delaying, deferring

or preventing a change in control of our company or other corporate action.

Series A Preferred

Stock

On

November 10, 2023, we entered into a securities purchase agreement with Jeffrey Thramann, our Executive Chairman, pursuant to which we

issued and sold one (1) share of our newly designated Series A Preferred Stock for an aggregate purchase price of $1,000.

The

share of Series A Preferred Stock will have 30,000,000 votes and will vote together with the outstanding shares of our common stock as

a single class exclusively with respect to any proposal to amend our Certificate of Incorporation to effect a reverse stock split of our

common stock. The share of Series A Preferred Stock will be voted, without action by the holder, on any such reverse stock split proposal

in the same proportion as shares of common stock are voted on such proposal (excluding any shares of common stock that are not voted).

On

December 29, 2023, we redeemed the one outstanding share of Series A Preferred Stock in accordance with its terms. The redemption price

was $1,000. No Series A Preferred Stock remains outstanding.

The

Series A Preferred Stock otherwise has no voting rights, except as may otherwise be required by the General Corporation Law of the State

of Delaware. The share of Series A Preferred Stock is not convertible into, or exchangeable for, shares of any other class or series of

our stock or other securities. The share of Series A Preferred Stock has no rights with respect to any distribution of our assets, including

upon a liquidation, bankruptcy, reorganization, merger, acquisition, sale, dissolution or winding up, whether voluntarily or involuntarily.

The holder of the Share of Series A Preferred Stock will not be entitled to receive dividends of any kind. The share of Series A Preferred

Stock shall be redeemed in whole, but not in part, at any time (i) if such redemption is ordered by our board in its sole discretion or

(ii) automatically upon the effectiveness of the amendment to the Certificate of Incorporation implementing a reverse stock split. Upon

such redemption, the holder of the Series A Preferred Stock will receive consideration of $1,000.00 in cash.

Series B Convertible

Preferred Stock

On

April 23, 2024, we entered into a securities purchase agreement with accredited investors, pursuant to which we issued and sold 2,314

shares of our newly designated Series B Convertible Preferred Stock for an aggregate purchase price of $2,314,000.

Holders of the Series

B Convertible Preferred Stock will be entitled to dividends in the amount of 10% per annum, payable quarterly. We have the option to pay

dividends on the Series B Convertible Preferred Stock in additional shares of common stock. If we elect to pay in the form of common stock,

the number of dividend shares to be issued shall be calculated by using a “Dividend Conversion Price” equal to the lower of

(i) the then applicable Conversion Price (as defined in the Certificate of Designations) as in effect on the applicable dividend date,