Filed by AeroVironment, Inc.

Pursuant to Rule 425 under the Securities

Act of 1933,

as amended, and deemed filed pursuant to 14a-12

under the Securities Exchange Act of 1934, as amended

Subject Company: AeroVironment, Inc.

Commission File No.: 001-33261

The following is a transcript of an earnings conference call hosted

by AeroVironment, Inc. on March 4, 2025.

Operator

Good day, and thank you for standing by. Welcome to the AeroVironment

fiscal 2025 third-quarter conference call. (Operator Instructions) Please be advised that today's conference is being recorded.

I would now like to hand the conference over to your speaker, Jonah

Teeter-Balin. Please go ahead.

Jonah

Teeter-Balin - AeroVironment Inc - Investor Relations

Thanks, and good afternoon, ladies and gentlemen.

Welcome to AeroVironment's fiscal year 2025 third-quarter earnings call. This is Jonah Teeter-Balin, Vice President of Corporate Development

and Investor Relations.

Before we begin, please note that certain information

presented on this call contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995.

These statements involve many risks and uncertainties that could cause actual results to differ materially from our expectations.

Further

information on these risks and uncertainties is contained in the company's 10-K and other filings with the SEC, in particular, in the

risk factors and forward-looking statement portions of such filings. Copies are available from the SEC on the AeroVironment website at

www.avinc.com, or from our Investor Relations team.

This afternoon, we also filed a slide presentation

with our earnings release and posted the presentation to the Investors section of our website under Events and Presentations. The content

of this conference call contains time-sensitive information that is accurate only as of today, March 4, 2025. The company undertakes

no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Joining me today from AeroVironment are Chairman,

President and Chief Executive Officer, Mr. Wahid Nawabi; and Senior Vice President and Chief Financial Officer, Mr. Kevin McDonnell.

We will now begin with remarks from Wahid Nawabi.

Wahid?

Wahid

Nawabi - AeroVironment Inc - Chairman of the Board, President, Chief Executive Officer

Thank you, Jonah. Welcome, everyone, to our third

quarter fiscal year 2025 earnings conference call. I'll start by summarizing our quarterly performance and provide an update on the BlueHalo

transaction, followed by Kevin, who will review our financial results in greater detail. Next, I will provide an update on our expectations

for the rest of fiscal year 2025 before Kevin, Jonah, and I take your questions.

I'm pleased to report that we made significant

progress on our long-term growth strategy this quarter despite several short-term challenges. We continue to see strong demand for our

solutions while expanding capabilities and capacity as the global leader in defense technology.

Our key messages, which are included on slide

number 3 (sic - "slide number 4") of our earnings presentation are as follows. First, we won large contract awards tied to key

long-term strategic programs, including the US Army's LASSO, US DoD's Replicator and the Danish Ministry of Defense, while growing our

backlog to a record $764 million. Second, we continue to make disciplined investments, expanding production capacity, launching innovative

products and new capabilities and leveraging our acquisitions to strengthen our market leadership position.

Third, despite our solid progress, third quarter

financial performance came in slightly below our expectations, primarily due to the unprecedented LA windstorms. And fourth, given recent

challenges, we are lowering our guidance but remain on track for record fourth quarter revenue and accelerating growth in fiscal year

2026.

While we encountered challenges in executing our

plans this quarter, we remain firmly on track with our long-term growth strategy. The defense technology sector is experiencing a generational

shift driven by distributed autonomous AI-enabled solutions. We continue to believe we are uniquely positioned to meet our customers'

evolving needs by leveraging our core strengths, cutting-edge technology, unmatched production capacity, and decades of battlefield experience.

We are further strengthening these advantages

through strategic organic and inorganic investments by developing new innovative products, expanding into adjacent markets, and increasing

our production capacity. Given our progress and favorable market dynamics, we are confident that AV is well positioned to deliver sustained

growth while creating value for our stakeholders for years to come.

The evolving global security landscape continues

to highlight the critical needs for cost-effective AI-driven autonomous defense solutions. In response, the US Department of Defense and

allied nations are prioritizing the rapid deployment of Uncrewed Systems and Loitering Munitions technologies we pioneered.

Recently, Secretary of Defense, Pete Hegseth,

reaffirmed the administration's focus on AI, drones, counter drones, and autonomous warfare capabilities. These priorities directly align

with AV's core product offerings and long-term growth strategy.

We have been proactively preparing for a shift

in demand related to Ukraine this fiscal year. While AV shipments to Ukraine continue to decline as expected, the conflict has underscored

the battlefield effectiveness of our solutions, driving unprecedented high demand from the US DoD, NATO, and the Pacific and other allied

partners. This shift aligns with evolving US defense policy and procurement priorities, further strengthening and validating our global

expansion strategy.

To illustrate this point, let me share the following

facts. With approximately $40 million worth of Switchblade 600 deployments, Ukraine has destroyed nearly $3 billion worth of enemy military

assets. In other words, for every Switchblade 600 launched, $13 million worth of enemy military assets have been destroyed.

We are now nearing the end of this transition

from Ukraine to larger and more enduring growth opportunities. For the full fiscal year, we expect all AV shipments to Ukraine to represent

only 17% of revenues compared to 38% of revenues last fiscal year. Further, in total, Ukraine will represent only about 6% of Q4 revenues

and is not material to our future growth plans.

Despite this significant shift, we remain on track

to achieve more than 10% revenue growth and $1 billion in orders in fiscal year 2025.

Beyond our organic successes, this quarter, we

made significant progress towards closing the BlueHalo transaction and preparing for integration. The BlueHalo transaction will further

increase our total market opportunity and growth potential by adding space technologies, counter-UAS, directed energy, electronic warfare

and cyber solutions to our portfolio. Through this combination, we will enhance our technology and capabilities, increase our facility

footprint, and deliver a more comprehensive set of solutions across the air, land, sea, space and cyber domains.

Since announcing the transaction, we have engaged

extensively with our customers and received overwhelming positive feedback. Customers recognize that AV brings a unique combination of

innovation and product leadership and are excited that the future company will have the experience and resources to successfully deliver

on major defense initiatives at scale.

In terms of next steps, we have successfully secured

key regulatory approvals, clearing HSR antitrust and SEC S-4 reviews earlier this year. Our next major milestone is a shareholder vote

to approve the transaction, which is scheduled for April 1. While a few outstanding international regulatory reviews are still in

progress, we remain on track to close the transaction in the second quarter of calendar year 2025. In parallel, our team has been actively

preparing for integration, and we look forward to sharing additional details in the coming months.

As I mentioned earlier, we faced short-term challenges,

including the unprecedented high winds and fires in Los Angeles, which tragically claimed lives, homes and businesses in our community.

Our hearts go out to those impacted, including many AV employees. While AV's facilities were not directly damaged, we experienced extended

periods of forced shutdowns and power outages, which disrupted both our manufacturing and supply chain logistics.

Given the timing at the end of our fiscal year,

these events partially constrained our ability to achieve our full operational goals, impacting our quarterly results and full year expectations.

We are working hard to recover lost time while also executing our distributed manufacturing strategy to build resiliency for the future.

Just this week, we also received stop-work orders

tied to four foreign military sales contracts, representing about $13 million in orders, majority of which we expected to ship in Q4.

Further, the US government recently paused military aid to Ukraine and implemented new tariffs. The stop-work orders will directly impact

our Q4 deliveries, while the effect of the other evolving situations is less clear. We have incorporated the estimated impact of these

events into our new revised guidance and we'll provide further updates when appropriate.

With that, I would like to now provide updates

on each of our three business segments, starting with Loitering Munitions Systems, or LMS. The LMS team delivered record revenue this

quarter, achieving several key strategic milestones. Starting with orders, the LMS team secured more than $350 million in Switchblade

contracts, including a single $288 million award under our $990 million IDIQ contract. This order is the single largest award in AV's

50-year history.

Global adoption is also increasing for both Switchblade

300 and 600 with 10 countries having placed firm orders and more than 20 more in active engagements. To meet this growing demand, we have

aggressively expanded manufacturing capacity already.

Additionally, our newly announced Switchblade

production facility in Utah will be more than 5 times larger than our current plant and is set to double production throughput again,

positioning us to support over $1 billion in annual LMS revenue by the end of fiscal year 2027. We expect the facility to come online

towards the end of this calendar year.

Despite the extreme challenges posed by the high

winds and LA fires, Switchblade production remains on track to exit this Q4 at about a $500 million annualized run rate. We believe that

our investments in Utah and other facilities nationwide, including those to be gained through our combination with BlueHalo, will enhance

our operational resilience and mitigate future disruptions.

In summary, the LMS segment continues to support

our growth strategy through key awards and expanded production capacity.

Now, on to our Uncrewed Systems segment or UxS.

The UxS segment continued to transition away from Ukraine related revenue shifting to other long-term growth opportunities as demonstrated

by several key strategic wins in the quarter. We recently secured a sole-source contract with a $181 million ceiling to support -- to

supply the Danish military with JUMP 20 UAS over the next 10 years. This was a highly competitive bid process, which reinforces our confidence

that JUMP 20 is the best Group 2 UAS available today in the market.

Additionally, we were awarded a major contract

with the German Federal Armed Forces to supply more than 40 uncrewed ground vehicles. This was also one of the largest UGV awards in our

company history.

Our international pipeline continues to grow,

and we expect to announce another major international JUMP 20 award in the coming months. To support increasing demand, the team established

the new P550 production line, positioning for future demand. We believe P550 will continue to lead the entire small UAS industry in terms

of innovation and global adoption in future years, similar to Raven and Puma.

As you may be aware, Raven and Puma UAVs have

been multibillion-dollar product franchises for AV already. We expect the same from P550.

We also expanded our European presence by opening

a new office in the United Kingdom, strengthening our engagement with key European defense customers and enhancing our ability to support

regional programs. At the same time, the team continued to drive innovation, bringing new capabilities to market.

For example, we recently launched the new JUMP

20-X platform, an enhanced maritime variant of our JUMP 20 UAS optimized for shipboard operations. We also introduced new software capabilities

for our Puma AE and LE UAS that provide enhanced autonomy, flexibility, and performance in contested environments. While the UxS segment

is in a transition year, we remain confident in its long-term growth trajectory driven by a growing market, key contract wins, new product

introductions, new US DoD programs of record, and an expanding global footprint.

Moving now to our MacCready Works segment. MacCready

Works continues to progress the development of next-generation technologies that drive the evolution of AI-enabled autonomous warfare

systems. This quarter, the team made significant progress in our new software-defined autonomous one-way attack drones. This whole new

family of systems is designed, leveraging key battlefield insights and can be affordably mass produced in very high volumes.

We are seeing a lot of interest from our customers

with units already delivered to early adopters. We believe this solution set will provide a crucial advantage for customers operating

in high-threat contested environments, and we look forward to sharing more details in the coming months.

We continue to expand AVACORE autonomy capabilities

across AV's entire portfolio, enhancing adaptive mission execution and real-time decision-making. Additionally, our SPOTR-Edge computer

vision software is also now being integrated into multiple other uncrewed systems, delivering advanced AI-driven threat detection, tracking

and situational awareness. These technologies further strengthen our competitive differentiation, making AV solutions smarter, faster

and more effective in contested environments.

MacCready Works continues to push the boundaries

of what is possible in autonomous warfare, reinforcing AV's position as the leading innovator in uncrewed systems and loitering munitions.

In summary, the company achieved major milestones

in the quarter that give us confidence in our future. However, the high winds and unprecedented fires in LA area impacted our operations,

limiting our ability to meet our quarterly goals.

Further, the recent soft work orders from the

US DoD are impacting our ability to achieve fourth quarter goals. As a result, we're lowering our fiscal year 2025 revenue, adjusted EBITDA,

and non-GAAP EPS guidance ranges. However, we have record backlog and a strong pipeline and remain confident in our long-term growth trajectory.

With that, I would like to now turn the call

over to Kevin McDonnell for a review of our third quarter financials. Kevin?

Kevin

McDonnell - AeroVironment Inc - Chief Financial Officer, Senior Vice President

Thank you, Wahid. Today, I will be reviewing

the highlights of our third quarter performance, during which I will occasionally refer to both our press release and earnings presentation

available on our website. Overall, we had a mixed financial quarter with record orders and backlog, but with revenue and profitability

below expectations.

Our revenues were impacted by production issues

related to shutdowns as a result of the high winds in the Simi Valley area, and to a lesser extent, some sporadic supplier challenges

as we continue to ramp up LMS production. Given the pending BlueHalo acquisition, any references to future performance exclude the impact

of BlueHalo, which is expected to close in Q2 of calendar 2025.

As Wahid mentioned in his remarks, revenue for

the third quarter of fiscal 2025 was $167.6 million, a decrease of 10% as compared to the $186.6 million for the third quarter of fiscal

2024. As Wahid explained in his remarks, Ukraine revenues accounted for approximately 5% of revenues in Q3.

Slide 6 of the earnings presentation provides

a breakdown of revenue by segment for the quarter. The biggest revenue story during the quarter was our continued growth of our Loitering

Munitions business despite some challenges mentioned earlier. The LMS segment recorded revenue of $83.9 million, a 46% increase as compared

to the $57.7 million during last year's third quarter.

Switchblade 600 represented over 70% of the LMS

revenue for the quarter. Our Uncrewed Systems segment, UxS, which is a combination of our small UAS, medium UAS and UGV businesses generated

$63.8 million of revenue in the quarter, which is down 44% from last year's total of $113.3 million, primarily driven by a decrease in

Ukraine revenue of $47 million. However, we expect strong growth in the UxS segment in the fourth quarter, driven by recent awards for

the JUMP 20 and other products even with the impact of the stop work orders.

Revenue from our MacCready Works segment came

in at $20 million, an increase of 28% as compared to the $15.6 million from the third quarter of fiscal last fiscal year, primarily driven

by HAPS, SoftBank program and the SOAR Autonomous resupply drone program.

Slide 7 of the earnings presentation shows the

trend of adjusted product and service revenues, while slide 12 reconciles the GAAP gross margins to adjusted gross margins, which excludes

intangible amortization expense and other noncash purchase accounting items. In the third quarter, consolidated GAAP gross margins finished

at 38%, which is higher than the third quarter of last year due to LMS margin increases, partially offset by lower surface margins.

Now turning to adjusted gross margins. Third quarter

adjusted gross margins were 40%, an increase from the 38% for the same period last year due to the change in sales mix described previously.

Adjusted product gross margins for the quarter were 44% versus 38% in the third quarter of last fiscal year. The stronger year-over-year

margin was driven by improving margins at the LMS segment due to obtaining favorable commercial pricing on certain internally developed

components, contract pricing favorability, and gains in productivity.

In terms of adjusted service gross margins, the

third quarter was at 20% versus 40% during the same quarter last year. The lower level of service margins was primarily a result of lower

LMS and UxS margins due to higher field service costs. We continue to expect overall adjusted gross margins of the AV legacy business

to be approximately 40% to 41% for the full year.

In terms of adjusted EBITDA, slide 13 of our earnings

presentation shows the reconciliation of GAAP net income to adjusted EBITDA. Adjusted EBITDA for Q3 was $21.8 million, down from last

year's Q3 of $28.8 million as a lower revenue and higher SG&A expense was offset by lower investments in R&D and higher gross

margin.

However, these higher SG&A expenses are in

line with guidance for the year, and I'll go more in detail that shortly. We still expect adjusted EBITDA for Q4 to be significantly higher

than any of the first 3 quarters. Also note that we incurred approximately $10 million of acquisition-related expenses in Q3.

We will continue to incur these expenses related

to the BlueHalo transaction in Q4 and likely into next fiscal year. Because of the difficulty in predicting the timing and amount of the

transaction expenses, which impact GAAP net income, we're only providing revenue, non-GAAP EPS and adjusted EBITDA guidance. SG&A

expense, excluding intangible amortization and acquisition-related expense for the third quarter was $33 million or 20% of revenue compared

to $26 million or 14% of revenue in the prior year.

The increase in adjusted SG&A expense is partially

a result of an increase in sales and marketing expense, primarily driven by an increase in bid and proposal activity, along with employee-related

costs due to an increase in average headcount to help support the growth and expansion of our operations.

R&D expense for the third quarter was $22

million or 13% of revenue compared to $25 million or 13% of revenue in the prior year.

This also represented about a $6 million decline

from the prior quarter as we scaled down the development activity on the recently introduced JUMP 20-X all-domain system and the P550

Group 2 system. LMS continues to make investments across the Switchblade product line, including new variants. We still expect R&D

to be in the range of 12% to 13% of revenue for fiscal 2025 as a result of continued investment in our long-term initiatives.

Now turning to GAAP earnings. In the third quarter,

company generated a net loss of $1.8 million versus net income of $13.9 million recorded in the same period last year. The decrease in

net income of $15.6 million can be attributed to several factors, namely a $10 million increase in deal and integration costs associated

with the pending BlueHalo acquisition, an increase of $5.9 million in SG&A expenses, including intangible amortization and a $4 million

decrease in gross margin. These were partially offset by a [$2.6 million] (corrected by company after the call) decrease in investments

in R&D and a $1.9 million decrease in tax expense.

Slide 11 shows a reconciliation of GAAP and adjusted

or non-GAAP diluted EPS. The company posted adjusted earnings per share of $0.30 for the third quarter of fiscal 2025 versus $0.63 per

diluted share for the third quarter of fiscal 2024. Turning to our balance sheet.

At the close of the third quarter, our total cash

and investments amounted to $72.5 million compared to $91.9 million at the end of the second quarter of fiscal 2025. Unbilled receivables

increased $25 million during the third quarter. The elevated amount of unbilled receivables is largely attributable to the transition

of the LMS progress billings, which has taken longer than expected, but is moving forward, so we expect a significant reduction in unbilled

in Q4.

In fact, we started receiving the LMS progress

billing payments this quarter. We have access to a $200 million revolving credit facility which we drew $25 million on the revolver at

the end of Q3.

I'd like to conclude with some highlights of our

backlog metrics. Our funded backlog at the end of the third quarter of fiscal 2025 finished at a record $763.5 million. Approximately

$13 million of the backlog relates to contracts we recently received a stop work order on. However, we now have 100% visibility to the

midpoint of our revised lower guidance range for fiscal 2025.

We expect bookings for the year to exceed $1 billion

and position us for strong organic revenue growth in FY26. Now I'd like to turn things back to Wahid.

Wahid

Nawabi - AeroVironment Inc - Chairman of the Board, President, Chief Executive Officer

Thanks, Kevin. Given our third quarter performance

and recent developments, we have lowered and narrowed our full fiscal year guidance. For fiscal year 2025, we now expect revenues of $780

million to $795 million, adjusted EBITDA of $135 million to $142 million. And non-GAAP earnings of $2.92 to $3.13 per share. We also expect

R&D expenses of 12% to 13% of revenues and adjusted gross margins of 40% to 41% for the full fiscal year.

Before turning the call over for questions, let

me summarize the key takeaways from today's call. First, we won large awards tied to key long-term strategic programs, growing our backlog

to a record $764 million. Second, we continue to make disciplined investments to reinforce our market leadership, expanding our capabilities

and support our growth.

Third, high winds and fires in Los Angeles area

impacted our third quarter financial performance, creating short-term operational challenges. And fourth, we have lowered our fiscal year

2025 guidance, but remain on track for another record fourth quarter revenue with accelerating growth in fiscal year 2026.

At the start of this call, I highlighted

the significant progress we made this quarter. AV is not just responding to the evolution of modern warfare. We are driving this transformation

in our industry. The world is now recognizing what we have long believed that autonomous AI-enabled drones and loitering munitions will

be much more widely adopted as they transform defense strategy.

These are categories we pioneered and that we

continue to lead on a global scale. We're also encouraged by the momentum within the new administration, which has prioritized the rapid

fielding of AI-driven autonomous systems, a vision that aligns seamlessly with AV's capabilities, expertise, and industry leadership.

With battle-proven technology, the largest global

installed base, and unmatched production capacity, AV is not just prepared to meet this demand. We are defining the future of modern warfare.

This is our mission. This is why we exist. Our employees come to work every day, driven by the belief that what we do truly matters.

I want to personally thank our employees, shareholders,

and customers for their commitment to delivering cutting-edge solutions that protect our nation and its allies. We are honored to support

the most critical defense missions at this pivotal moment.

And with that, Kevin, Jonah, and I will now take

your questions.

QUESTIONS AND ANSWERS

Operator

(Operator Instructions) Greg Konrad, Jefferies.

Greg

Konrad - Jefferies Group LLC - Analyst

Good evening. Can you just -- you teased fiscal year '26 a bit in the

script. I mean if we look at guidance, it implies an exit run rate of sales of like $240 million in Q4. How are you thinking about the

bridge to fiscal year '26 given the backlog and some of your commentary around Ukraine?

Wahid

Nawabi - AeroVironment Inc - Chairman of the Board, President, Chief Executive Officer

Thanks, Greg. Sure. So, we are very, very well

poised for a strong accelerating growth and profitable growth year for fiscal ‘26. As you mentioned, our backlog is at unprecedented

levels – record levels, close to $750 million, number one. Number two, we’re going to exit Q4 roughly at about $240 million

to $250 million in revenue, which is again going to be a significant quarter for us, a very large quarter. That positions us to nearly

$1 billion year next year.

While there’s still some uncertainties related

to the current administration’s decisions, and – but we feel very confident that the demand for our systems across the world

is growing, we have an incredibly strong backlog. We have a growing pipeline of opportunities. The administration is incredibly positive

towards the categories that we play and we lead the market globally. And the world is still a very sort of unsafe place.

There are lots of conflicts around the globe.

And our solutions have performed and delivered exceptionally well during the conflicts of Ukraine. And so, I really believe that

next year is going to be another record year for us with accelerating growth, and our pipeline supports nearly $1 billion business for

us next year organically alone. And of course, when you couple that with BlueHalo acquisition, which brings significant new capabilities

to our portfolio, as long as that goes through, which we expect it to happen sometimes in the next quarter, then we’re going to

be very much in great position globally.

Greg

Konrad – Jefferies Group LLC – Analyst

And then maybe just as a follow-up to stick with

BlueHalo, pretty impressive forecast in the S-4. It seems like there’s some acceleration for that business next year. Without maybe

getting into specifics, just thinking about the deal closing in Q2, what are some of the areas that you’re most excited for in terms

of BlueHalo growth into next year after the deal closes?

Wahid

Nawabi – AeroVironment Inc – Chairman of the Board, President, Chief Executive Officer

Well, Greg, clearly, the Blue Halo acquisition

is going to transform AV in the industry that we’re leading already. It is unprecedented in our industry for two companies and two

businesses to come together that has nearly no overlap and is incredibly complementary in order to achieve what we refer to our future

state to be able to deliver to our customers an integrated portfolio of robotic systems that are connected with each other, integrated,

interoperable, and enabled with AI, autonomy and computer vision.

The areas that we’re very, very excited

about, number one, is their counter-UAS business. They are the leading player in that market, including capabilities and lasers in directed

energy for counter-UAS and a layered approach to that. So that’s one area.

Another area of focus and excitement also is their

space communication. They have won a $1 billion-plus program with the US Department of Defense, Air Force, and Space Force to overhaul

and upgrade the US satellite to military satellite communications. So those two by itself – but also in the cyber and intelligence

community, they are a leading player with most advanced capabilities in that area.

And so, there's lots of different areas, but those

three areas really stand out as incredibly complementary to what we do and potential high growth for the combined entity.

Let's not also forget that the combined entity

will be incredibly well positioned with market-leading growth, revenue, and profitability that's sustainable and has the track record

to continue to deliver to the market. So, we're very excited about that beyond our own organic growth opportunities.

Operator

Peter Arment, Baird.

Peter

Arment - Baird - Analyst

Wahid, could you give us a little more color on the work stoppage?

You mentioned it's four FMS contracts. What were the reasons for that? And is this something that is going to linger into Q4 or beyond?

Wahid

Nawabi - AeroVironment Inc - Chairman of the Board, President, Chief Executive Officer

Yes, Peter. So great question. As I mentioned

in my remarks, just this week, yesterday, I believe, we received an information from the US Department of Defense that specific contracts

that is roughly about $13 million in value. These are foreign military sales contracts that we have already secured, and we were in the

process of actually delivering those in the fourth quarter. Majority of that has been -- we've been asked to stop work on those particular

contracts.

It is not clear whether this is a temporary sort

of suspension or is it a permanent. My guess would be -- and my personal view would be that I do not believe that these countries are

going to stay without these capabilities. There is a serious real need for our capabilities for these customers, international allies.

And US is obviously using this to reassess its priorities and reassess things.

So, we have removed that from our outlook for

fourth quarter, and that obviously affects our fourth quarter results, which we have lowered our guidance accordingly.

Regardless of that, our ability to grow next year

despite this particular event and despite the tariffs is very, very good. We believe that next year is going to be a very strong growth

year. We have never been in such a great position, in my view, as a company to have the backlog that we have, the demand drivers that

are out there and the focus of the US DoD in terms of the autonomous drones and Loitering Munitions that we are the leader in the world.

So that's the extent of it. As the situation evolves, which is very fluid today, we'll keep you updated.

Peter

Arment - Baird - Analyst

Okay. And then just as a follow-up, you mentioned

the $500 million-plus kind of revenue kind of run rate opportunity in LMS. But you talked about '26 being basically on a run rate path

to get close to $1 billion, which implies that the UnCrewed segment would be kind of seeing a significant step-up in volume.

I mean, I know this is the trough this quarter

at $64 million. You're expecting the JUMP 20 volumes to pick up in the fourth quarter. But it implies basically that there's going to

be a pretty healthy step-up in uncrewed. Could you maybe talk about the demand environment that gives us more confidence around the uncrewed

backdrop?

Wahid

Nawabi - AeroVironment Inc - Chairman of the Board, President, Chief Executive Officer

Absolutely. Peter, so overall, we feel very confident

about our UnCrewed Systems business in general. There are several strong drivers for demand for that business to grow over the next several

years. Specifically, we're introducing new capabilities. We're investing in new generation of solutions, including the P550, which the

US DoD has already announced at least one or two programs each worth $1 billion-plus in value.

One of those, for example, is the long-range reconnaissance

program. So, over the next three to five years, we expect our UxS business to continue to grow in terms of adoption, as well as top line

revenue, and we expect it to be a significant driver of profitability and revenue for the company.

Regardless of that, fiscal year '25 has been really

a transition year for us. We proactively transitioned ourselves and pivoted away from the fiscal '25 spike that we received in demand

from Ukraine, primarily for Puma and Switchblade systems. As I said on the remarks, that represented 38% of our revenue, Ukraine did last

fiscal year. This year, it's going to be around 17%. And in the fourth quarter, it will be about 6% of our total revenue expected from

Ukraine.

So essentially, we have completely pivoted away

from the Ukraine demand. And despite all that, we have an unprecedented historic backlog that allows us to grow next year. So, we expect

Loitering Munitions to lead that growth, but UxS also will grow and so would our MacCready segment.

Operator

Louie DiPalma, William Blair.

Louie

Dipalma - William Blair - Analyst

Wahid and Kevin, you indicated that you are confident

in AV stand-alone generating close to $1 billion in revenue for fiscal 2026. I was wondering, are you also confident in BlueHalo generating

close to $1 billion for fiscal 2026? I think there was that projection in the S-4 filing that just came out. But I was wondering just

how current are the projections from that S-4.

Wahid

Nawabi - AeroVironment Inc - Chairman of the Board, President, Chief Executive Officer

Sure. So, Louie, obviously, we feel very compelled

for AV organically. I truly believe that we've never been in such a strong position even compared to last fiscal year. Our backlog as

a percentage of revenue and also our backlog as a total amount is unprecedented. It sets us up for a very strong fiscal '26 sort of performance

and the demand for our systems continue to increase. And I believe that the new administration's focus on the priorities that they have

publicly stated is going to support our growth even more.

In terms of BlueHalo, we have already published

specific forecast that has been developed internally by BlueHalo and has been vetted and also verified by third-party experts, including

ourselves. That's part of the S-4. I encourage you to refer to those and look at those. They are absolutely a growing business, very complementary

to AV, and we expect that to continue going beyond this fiscal year.

And so, while the closing is not guaranteed yet

and it's not done yet, we feel strongly that the two -- the combination of the two businesses is going to be fantastic for the market.

We're going to be unparalleled in terms of our offering in the market and incredibly well positioned to benefit from the priorities of

the current administration and the conflicts and the threats that are around the globe worldwide. So, I feel very bullish about that,

and I think it's going to be very, very positive long term for AeroVironment.

Kevin

McDonnell - AeroVironment Inc - Chief Financial Officer, Senior Vice President

And we'll do the combined guidance when we do year-end results.

Wahid

Nawabi - AeroVironment Inc - Chairman of the Board, President, Chief Executive Officer

That's right.

Louie

Dipalma - William Blair - Analyst

Great. And on the last quarter earnings call, you mentioned that you

were close to closing two different JUMP 20 orders, and you formally announced one of the orders. Did you close the second order? Or is

that still pending?

Wahid

Nawabi - AeroVironment Inc - Chairman of the Board, President, Chief Executive Officer

It's a great question. You're absolutely correct that we said two last

quarter. and we're pleased to report this quarter that we have announced one of them, which was the $181 million contract value sole source

IDIQ for the next 10 years with the Danish military. The second one --

Kevin

McDonnell - AeroVironment Inc - Chief Financial Officer, Senior Vice President

Competitive bid.

Wahid

Nawabi - AeroVironment Inc - Chairman of the Board, President, Chief Executive Officer

It was a very competitive bid. As Kevin mentioned,

that was an incredibly competitive bid. It basically highlights that JUMP 20 is the leading solution in the market, best-in-class solution

in the market. And that competition actually was protested and protested again and we eventually prevail.

Regardless, we are actively working the second

one. We expect that announcement to come in sometimes in the fourth quarter. Obviously, the timing of those are in the hands of our customer,

but we believe that we're positioned very well. It is also a large program that we're going to be unseating another competitor, hopefully,

and we'll keep you updated. And we feel very strong and very positive about our position on that. And we expect that to be decided and

announced sometimes either Q4 or beginning of first quarter of fiscal '26.

Louie

Dipalma - William Blair - Analyst

Great. And one final one. Regarding the Army stop

work order, you indicated that it was for foreign military sales. And I believe that it's for multiple countries. But does this relate

to multiple countries using their own funds to buy either the Switchblade or the Puma or one of your other systems, and the US Army is

blocking countries or allies from using their own funds to buy AeroVironment systems?

Wahid

Nawabi - AeroVironment Inc - Chairman of the Board, President, Chief Executive Officer

Louie, great question. So, the stop work that

we received just yesterday is specific to particular contracts that is under the FMS, foreign military sales contracts with US Army and

AeroVironment for specific countries around the world. I'm not in a position to be able to disclose the specific countries. However, the

total of it roughly adds up to about $13 million in bookings that we have in our backlog, majority of which we were expecting to ship

in Q4.

The future of that is undetermined. We don't exactly

know whether this is a temporary hold. We do know that the US DoD as well as the current administration is using all of these tools at

its position to negotiate terms and negotiate various positions with these countries. Most of these deals are also foreign military funded,

which means that the orders -- the funding for these contracts actually are provided by the US government through an FMS process.

And therefore, US DoD is reevaluating whether

they should proceed or not in each case. It is undetermined at this point as to what the outcome would be and how long would that last.

All sorts of possibilities are probable in my view, and we don't know. What I do know that these countries desperately need these capabilities,

number one. Number two, our solutions are quite affordable -- and so there is also a possibility that if these countries do not get US

funding for these acquisitions that they may come up with their own funding, which many countries do already anyways.

And so, we felt compelled enough to share that,

we feel very strong about our backlog, and we believe that we're going to have another growth year. We're going to be able to execute

our Q4. The administration's position is really, really changing and evolving and fluid, and we'll keep you updated as we go forward.

Operator

Andre Madrid, BTIG.

Andre

Madrid - BTIG LLC - Analyst

On the topic of international sales, you mentioned last quarter, there

were an incremental six nations that were in different phases of the acquisition process. Can you maybe give an update on those and how

negotiations are trending?

Wahid

Nawabi - AeroVironment Inc - Chairman of the Board, President, Chief Executive Officer

Sure. So, Andre, as I mentioned in my remarks,

we have now received firm orders for approximately six of those countries in our backlog, and we expect to ship those sometime throughout

the next few months and next year. And then in addition to that, there is an additional 20 countries that we're actively engaged with.

All of these countries are interested in Switchblade 300 and 600 flavors or variants. And the list of these countries continue to grow.

And let's not forget that almost every one of

these countries, these are their first-time buys, which means that as they buy these systems, they will use some of them to train their

forces and also inform their usage and their force structure deployment, which eventually will lead to more adoption.

So, I truly believe that our Loitering Munitions

business is looking at a very large long-term growth and adoption opportunity here with our allies for Switchblade. Switchblade's performance

and the conflict in Ukraine has absolutely validated this capability. We are leading the industry. We have a significant advantage in

terms of our ability to deliver in volume and produce these in volume.

And that's why we continue to expand capacity.

We've already increase capacity significantly. But with the new facility, we're going to increase our footprint by 5x again. And that

facility is going to come online sometime this calendar year, towards the end of this calendar year, which, again, it's all indicators

that we strongly believe in the growth of this business, not only now or next year, but beyond next year. And so, we truly believe that

this is a $1 billion franchise that we're growing very aggressively over the next several years.

And again, all of our businesses are growing and

will grow next year, but LMS is obviously leading the pack, and it's growing in size considerably.

Andre

Madrid - BTIG LLC - Analyst

Got it. And then I guess maybe if I pivot away from that, I mean,

kind of revisiting the wildfires, could you maybe quantify exactly how much of the negative impact in 3Q was attributable to the South

California fires?

Wahid

Nawabi - AeroVironment Inc - Chairman of the Board, President, Chief Executive Officer

Sure. So, Andre, I won't be able to get into

the specifics because there's lots of different details and complexities to it. But remember, these were unprecedented levels of fires

as well as wins. So, what happened as a result of these extremely high wins, the utility, the local utilities essentially forced shutdowns

for long and extended periods of time. Many weeks, we were losing power day-in and day-out on multiple of our sites, in some cases, almost

all of our sites here in Southern California.

Not only our sites were affected in terms of power

outages, so were our employee base and our supplier base, too, that are local.

So, all of that happened in a time period, which

was towards middle to end of our third quarter, which does not give us enough time to recover all the plans that we had. So, we've made

these adjustments. We're very pleased with our results still. We continue to grow as a company. It's going to be another record fourth

quarter revenues and profitability for the year for us.

And we're going to exit the year with a strong,

strong performance setting us up for next year. And I think that our company has not been in such a great position compared to even last

year this time, looking beyond fiscal '25 into '26. So, we're excited about the future, and we look forward to that.

Operator

I'm showing no further questions in the queue at this time. I would

now like to turn the call back over to Jonah for any closing remarks.

Jonah

Teeter-Balin - AeroVironment Inc - Investor Relations

Great. Thank you once again for joining today's

conference call and for your interest in AeroVironment. As a reminder, an archived version of this call, SEC filings and relevant news

can be found under the Investors section of our website. We hope you have a good evening and look forward to speaking with you again following

next quarter's results. Good evening.

Operator

This concludes today's program. Thank you all for participating. You

may now disconnect.

Statement Regarding Forward-Looking Information

This communication contains statements regarding AeroVironment, Inc.

(the “Company”), BlueHalo, the proposed transactions and other matters that are forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”). In some cases, forward-looking statements can be identified by words

such as “anticipate,” “approximate,” “believe,” “plan,” “estimate,” “expect,”

“project,” “could,” “should,” “strategy,” “will,” “intend,” “may”

and other similar expressions or the negative of such words or expressions. Statements in this communication concerning (i) the Company’s

or BlueHalo’s expected future financial position, business strategy, production capacity, competitive positions, growth opportunities,

plans and objectives of management and (ii) the Company’s proposed acquisition of BlueHalo, the expected benefits of the acquisition,

including with respect to the business outlook or future economic performance, and product or services line growth, the structure of the

proposed acquisition, the closing date of the proposed acquisition, and plans following the closing of the proposed acquisition, together

with other statements that are not historical facts, are forward-looking statements that are estimates reflecting management’s best

judgment based upon currently available information. Such forward-looking statements are inherently uncertain, and stockholders and other

potential investors must recognize that actual results may differ materially from expectations as a result of a variety of factors, including,

without limitation, those discussed below. Such forward-looking statements are based upon management’s current expectations and

include known and unknown risks, uncertainties and other factors, many of which the Company and BlueHalo are unable to predict or control,

that may cause actual results, performance or plans to differ materially from any future results, performance or plans expressed or implied

by such forward-looking statements. These statements involve risks and uncertainties that could cause actual results to differ materially

from those anticipated in these statements as a result of a number of factors, including, but not limited to:

| · | the risk that the transaction described herein will not be completed or will not provide the expected benefits, or that we will not

be able to achieve the cost or revenue synergies anticipated; |

| · | the failure to timely or at all obtain Company stockholder approval for the acquisition; |

| · | the inability to obtain required regulatory approvals for the acquisition; |

| · | the timing of obtaining such approvals and the risk that such approvals may result in the imposition of conditions that could adversely

affect the combined company or the expected benefits of the acquisition; |

| · | the risk that a condition to closing of the acquisition may not be satisfied on a timely basis or at all; |

| · | the possible occurrence of an event, change or other circumstance that would give rise to the termination of the transaction agreement; |

| · | the risk of shareholder litigation in connection with the proposed transaction, including resulting expense or delay in delay in closing

of the transaction; |

| · | the failure of the proposed transaction to close for any other reason; |

| · | the diversion of the attention of the Company and BlueHalo management from ongoing business operations; |

| · | unexpected costs, liabilities, charges or expenses resulting from the acquisition; |

| · | the risk that the integration of the Company and BlueHalo will be more difficult, time-consuming or expensive than anticipated; |

| · | the risk of customer loss or other business disruption in connection with the transaction, or of the loss of key employees; |

| · | the fact that unforeseen liabilities of the Company or BlueHalo may exist; |

| · | the risk of doing business internationally; |

| · | the challenging macroeconomic environment, including disruptions in the defense industry; |

| · | risks that the Company may not be able to manage strains associated with its growth; |

| · | dependence on key personnel; |

| · | the effect of legislative initiatives or proposals, statutory changes, governmental or other applicable regulations and/or changes

in industry requirements; |

| · | the Company’s and BlueHalo’s ability to protect their intellectual property and litigation risks; and |

| · | other risks and uncertainties identified in the “Risk Factors,” “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” and “Business” sections of the Company’s most recent Annual Report on Form 10-K

and its subsequent Quarterly Reports on Form 10-Q, and other risks as identified from time to time in its Securities and Exchange

Commission (“SEC”) reports. |

Other unknown or unpredictable factors also could have a material adverse

effect on the Company’s business, financial condition, results of operations and prospects. Accordingly, readers should not place

undue reliance on these forward-looking statements. These forward-looking statements are inherently subject to uncertainties, risks and

changes in circumstances that are difficult to predict. Except as required by applicable law or regulation, neither the Company nor BlueHalo

undertakes (and each of the Company and BlueHalo expressly disclaim) any obligation and do not intend to publicly update or review any

of these forward-looking statements, whether as a result of new information, future events or otherwise.

No Offer or Solicitation

This communication is not intended to and does not constitute an offer

to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation

of any vote in any jurisdiction pursuant to the proposed transactions or otherwise, nor shall there be any sale, issuance or transfer

of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus

meeting the requirements of Section 10 of the Securities Act. Subject to certain exceptions to be approved by the relevant regulators

or certain facts to be ascertained, the public offer will not be made directly or indirectly, in or into any jurisdiction where to do

so would constitute a violation of the laws of such jurisdiction, or by use of the mails or by any means or instrumentality (including

without limitation, facsimile transmission, telephone and the internet) of interstate or foreign commerce, or any facility of a national

securities exchange, of any such jurisdiction.

Additional Information and Where to Find It

This communication is being made in respect of the proposed transaction

between the Company and BlueHalo. In connection with the proposed transaction, the Company filed with the SEC a registration statement

on Form S-4, that includes a proxy statement and a prospectus, to register the shares of the Company stock that will be issued to

BlueHalo’s shareholders (the “Proxy and Registration Statement”), as well as other relevant documents regarding the

proposed transaction. INVESTORS ARE URGED TO READ IN THEIR ENTIRETY THE PROXY AND REGISTRATION STATEMENT REGARDING THE TRANSACTION THAT

HAVE BEEN FILED AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE

THEY CONTAIN IMPORTANT INFORMATION.

A

free copy of the Proxy and Registration Statement, as well as other filings containing information about the Company, may be obtained

at the SEC’s website (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from the Company at

https://investor.avinc.com/ or by emailing ir@avinc.com.

Participants in the Solicitation

The Company and its respective directors and executive officers may

be deemed to be participants in the solicitation of proxies from its respective stockholders in respect of the proposed transactions contemplated

by the Proxy and Registration Statement. Information regarding the persons who are, under the rules of the SEC, participants in the

solicitation of the stockholders of the Company in connection with the proposed transactions, including a description of their direct

or indirect interests, by security holdings or otherwise, are set forth in the Proxy and Registration Statement filed with the SEC. Information

regarding the Company’s directors and executive officers is contained in its Annual Report on Form 10-K for the year ended

April 30, 2024 and its Proxy Statement on Schedule 14A, dated August 12, 2024, which are filed with the SEC.

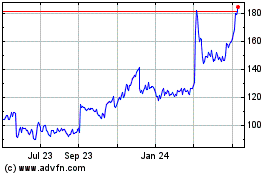

AeroVironment (NASDAQ:AVAV)

Historical Stock Chart

From Feb 2025 to Mar 2025

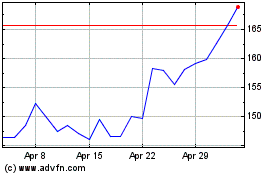

AeroVironment (NASDAQ:AVAV)

Historical Stock Chart

From Mar 2024 to Mar 2025