false

0000727207

0000727207

2025-01-10

2025-01-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934

| Date of Report (Date of earliest event reported) |

January 10, 2025 |

Accelerate

Diagnostics, Inc.

(Exact name of registrant

as specified in its charter)

Delaware

(State

or other jurisdiction of incorporation)

| 001-31822 |

|

84-1072256 |

| (Commission File Number) |

|

(IRS Employer Identification No.) |

| 3950

South Country Club Road, Suite

470, Tucson,

Arizona |

|

85714 |

| (Address of principal executive offices) |

|

(Zip Code) |

(520)

365-3100

(Registrant’s

telephone number, including area code)

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title

of each class |

Trading

Symbol |

Name

of each exchange on which

registered |

| Common

Stock, $0.001 par value per share |

AXDX |

The

Nasdaq Stock Market LLC

(The Nasdaq Capital Market) |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item

2.02. Results of Operations and Financial Condition.

On January 10, 2025, Accelerate

Diagnostics, Inc. (the “Company”) issued a press release announcing certain preliminary results for the quarter and year ending

December 31, 2024. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference in its entirety.

In accordance with General

Instruction B.2 for Form 8-K, the information in this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities

of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange

Act, except as expressly set forth by specific reference in such filing.

Item

9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ACCELERATE DIAGNOSTICS, INC. |

| |

(Registrant) |

| Date: January 10, 2025 |

|

| |

/s/ David Patience |

| |

David Patience |

| |

Chief Financial Officer |

Exhibit 99.1

Accelerate Diagnostics Announces Certain Preliminary

Fourth Quarter and Full-Year 2024 Results

TUCSON, Ariz., January 10, 2025 -- Accelerate Diagnostics, Inc. (Nasdaq:

AXDX) (Accelerate), an in vitro diagnostics company dedicated to providing services that improve patient outcomes and lower healthcare

costs through the rapid diagnosis of serious infections, today announced certain preliminary, unaudited results for the quarter and year

ended December 31, 2024.

“During the fourth quarter, we continued our momentum across

our innovation pipeline with significant progress of the clinical trial for our Accelerate WAVETM system and the Gram-Negative

assay while also further driving progress in our commercial strategy and making additional meaningful reductions in our cash burn,”

commented Jack Phillips, President and CEO of Accelerate Diagnostics, Inc. “Specifically relating to our ongoing clinical

trial, we believe we are close to finalizing enrollment, with very encouraging results to-date, and anticipate FDA submission shortly

after enrollment is complete. Throughout the clinical trial, we have been able to demonstrate the distinct features and benefits of the

WAVE system compared to emerging rapid antimicrobial susceptibility systems without any loss of performance or features,” Mr. Phillips

continued.

2024 Fourth Quarter and Full-Year Operational Results

| § | Notable highlights of our ongoing WAVE System and Gram-Negative (GN) Positive

Blood Culture (PBC) Assay Clinical Trial: |

| ▬ | Clinical trial performance consistent with previously released pre-clinical data |

| ▬ | Anticipate largest Gram-Negative bug-drug combination offering for rapid PBC AST |

| ▬ | Time-to-result remains approximately 4.5 hours, on average |

| ▬ | Strong instrument, consumable and software reliability across clinical trial sites |

| ▬ | Continued positive feedback from laboratory technicians on simple pre-analytical workflow and seamless system ease of use |

| ▬ | Anticipate remaining on-track for FDA submission during the first quarter of 2025 with anticipated commercial launch in late 2025 |

| § | Contracted a large U.S. reference lab for the Accelerate ArcTM system,

underscoring the utility of cost-effective, rapid, and automated microbial identification on MALDI directly from positive blood culture

samples. |

| § | In the U.S., we maintained approximately 350 of our existing clinically live

Pheno® revenue-generating instruments, consistent with our commercial strategy.

|

| § | Continued to execute contract extensions with strategic customers with greater

than 75% of U.S. Pheno customers secured through the anticipated WAVE commercial launch, subject to regulatory approvals. |

| § | Received 510(k) clearance of the Accelerate Arc system and BC kit, an innovative,

automated positive blood culture sample preparation platform. |

2024 Fourth Quarter and Full-Year Financial Results

| § | Preliminary revenue was approximately $11.7 million for the year, compared

to $12.1 million in the prior year. While year-over-year revenues for consumable products increased by approximately 3%, overall revenue

was down year-over-year due to lower revenues from capital sales of Pheno instruments compared

to the prior year. |

| § | Ended the year with approximately $16.3 million in cash and cash equivalents,

compared to $20.9 million at the start of the fourth quarter, a reduction in cash and cash equivalents for the fourth quarter of

2024 of $4.5 million. This reflects our continued reduction in operating cash use over the prior quarters of 2024. |

The preliminary financial results set forth above are unaudited, are

based on management’s initial review of Accelerate’s results as of and for the year ended December 31, 2024, and are subject

to revisions based upon Accelerate’s year-end closing procedures and the completion of the external audit of Accelerate’s

year-end financial statements. Actual results may differ materially from these preliminary unaudited results as a result of the completion

of year-end closing procedures, final adjustments and other developments arising between now and the time that Accelerate’s financial

results are finalized. In addition, these preliminary unaudited results are not a comprehensive statement of Accelerate’s financial

results for the year ended December 31, 2024, should not be viewed as a substitute for full, audited financial statements, prepared in

accordance with generally accepted accounting principles, and are not necessarily indicative of the Company’s results for any future

period. Accordingly, investors are cautioned not to place undue reliance on these preliminary unaudited results.

Accelerate expects to announce full-year 2024 financial results in

advance of its earnings conference call in March 2025.

About Accelerate Diagnostics, Inc.

Accelerate Diagnostics, Inc. is an in vitro diagnostics company dedicated

to providing solutions for the global challenges of antibiotic resistance and sepsis. In addition to the Accelerate Arc system, the Accelerate

Pheno system and Accelerate PhenoTest® BC kit combine several technologies aimed at reducing the time clinicians must wait to determine

the most optimal antibiotic therapy for deadly infections. The FDA-cleared Accelerate Pheno system and Accelerate PhenoTest BC kit fully

automate sample preparation, identification and phenotypic antibiotic susceptibility testing in approximately seven hours directly from

positive blood cultures. Recent external studies indicate the solution offers results 1–2 days faster than existing methods, enabling

clinicians to optimize antibiotic selection and dosage specific to the individual patient days earlier.

© Copyright 2024 Accelerate Diagnostics, Inc. All Rights Reserved.

The "ACCELERATE DIAGNOSTICS," "ACCELERATE PHENO," "ACCELERATE PHENOTEST," "ACCELERATE ARC" and

"ACCELERATE WAVE" diamond shaped logos and marks are trademarks or registered trademarks of Accelerate Diagnostics, Inc. All

other trademarks are the property of their respective owners.

For more information about the company, its products and technology,

or recent publications, visit axdx.com.

Forward-Looking Statements

Certain statements made in this press release and the related conference

call are forward-looking or may have forward-looking implications within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and the company intends that such forward-looking statements

be subject to the safe harbors created thereby. These forward-looking statements, which can be identified by the use of words such as

“may,” “will,” “expect,” “believe,” “anticipate,” “estimate,”

or “continue,” or variations thereon or comparable terminology, include but are not limited to, statements about: the company’s

preliminary expected results for the quarter and year ended December 31, 2024; the company’s product innovation progress and plans;

the potential or benefits of the company’s existing and future products and technologies, including the WAVE system, such as the

expectation of the performance of the WAVE system based on pre-clinical trials; WAVE system clinical trial results and timing; FDA submission

and approval for the WAVE system, as well as commercialization launch timelines and results; and the company’s cash burn. Actual

results or developments may differ materially from those projected or implied in these forward-looking statements due to significant risks

and uncertainties, including, but not limited to: volatility throughout the global economy and the related impacts to the businesses of

the company’s suppliers and customers, whether due to customer demand fluctuations, supply chain constraints and inflationary pressures

or otherwise; difficulties in resolving the company’s continuing financial condition and ability to obtain additional capital to

meet its financial obligations; the company’s ability to obtain any regulatory approvals; and less than expected operating and financial

benefits resulting from cost cutting measures. Other important factors that could cause the company’s actual results to differ materially

from those in its forward-looking statements include those discussed in the company’s filings with the Securities and Exchange Commission

(the “SEC”), including in the “Risk Factors” sections of the company’s most recently filed periodic reports

on Form 10-K and Form 10-Q and subsequent filings with the SEC. These forward-looking statements are also based on certain additional

assumptions, including, but not limited to, that the company will retain key management personnel; the company will be successful in the

commercialization of its products; the company will obtain sufficient capital to commercialize its products and continue development of

complementary products; the company will be successful in obtaining marketing authorization for its products from the FDA and other regulatory

agencies and governing bodies; the company will be able to protect its intellectual property; the company’s ability to respond effectively

to technological change; the company’s ability to accurately anticipate market demand for its products; and that there will be no

material adverse change in the company’s operations or business and general market and industry conditions. Except as required by

federal securities laws, the company undertakes no obligation to update or revise these forward-looking statements to reflect new events,

uncertainties or other contingencies. Forward-looking statements speak only as of the date they are made and should not be relied upon

as representing the company’s plans and expectations as of any subsequent date.

###

For further information: Investor Inquiries & Media Contact: Laura

Pierson, Accelerate Diagnostics, +1 520 365-3100, investors@axdx.com

Source: Accelerate Diagnostics Inc.

v3.24.4

Cover

|

Jan. 10, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 10, 2025

|

| Entity File Number |

001-31822

|

| Entity Registrant Name |

Accelerate

Diagnostics, Inc.

|

| Entity Central Index Key |

0000727207

|

| Entity Tax Identification Number |

84-1072256

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

3950

South Country Club Road

|

| Entity Address, Address Line Two |

Suite

470

|

| Entity Address, City or Town |

Tucson

|

| Entity Address, State or Province |

AZ

|

| Entity Address, Postal Zip Code |

85714

|

| City Area Code |

520

|

| Local Phone Number |

365-3100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.001 par value per share

|

| Trading Symbol |

AXDX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

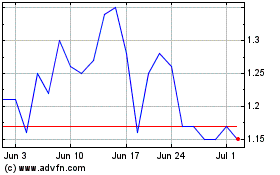

Accelerate Diagnostics (NASDAQ:AXDX)

Historical Stock Chart

From Dec 2024 to Jan 2025

Accelerate Diagnostics (NASDAQ:AXDX)

Historical Stock Chart

From Jan 2024 to Jan 2025