false

--12-31

0001086745

0001086745

2024-12-02

2024-12-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

Current

Report

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 2, 2024

AYRO,

Inc.

(Exact

name of Registrant as specified in its charter)

| Delaware |

|

001-34643 |

|

98-0204758 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

No.) |

|

(IRS

Employer

Identification

No.) |

AYRO,

Inc.

900

E. Old Settlers Boulevard, Suite 100

Round

Rock, Texas 78664

(Address

of principal executive offices and zip code)

Registrant’s

telephone number, including area code: 512-994-4917

N/A

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock, par value $0.0001 per share |

|

AYRO |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

As

previously disclosed, on August 7, 2023, AYRO, Inc. (the “Company”) entered into a Securities Purchase Agreement (the “Purchase

Agreement”) with certain accredited investors (the “Investors”), pursuant to which it agreed to sell to the Investors

(i) an aggregate of 22,000 shares of the Company’s Series H-7 Convertible Preferred Stock, with a stated value of $1,000 per share

(the “Preferred Stock”), and (ii) warrants to purchase shares of the Company’s common stock (“Common Stock”),

par value $0.0001 per share (the “Warrants”). The terms of the Preferred Stock are as set forth in the Certificate of Designations

filed with the Secretary of State for the State of Delaware on August 9, 2023 (as amended, the “Certificate of Designations”).

On

December 2, 2024, the Company entered into a Wavier and Amendment Agreement (the “Amendment”) with the Required Holders (as

defined in the Certificate of Designations). Pursuant to the Amendment, the Company and the Required Holders agreed (i) to amend (a)

the Certificate of Designations, by filing a Certificate of Amendment to the Certificate of Designations (the “Certificate of Amendment”),

and (b) the Purchase Agreement, such that, in each case, the Director Equity Grants (as defined below) are deemed to constitute “Excluded

Securities” under the Transaction Documents (as such term is defined in the Purchase Agreement), and (ii) that the Required Holders

waive the applicability of certain other provisions of the Transaction Documents with respect to such Director Equity Grants.

The

Certificate of Amendment was filed with the Secretary of State of the State of Delaware, effective as of December 2, 2024.

The

foregoing descriptions of the Amendment and the Certificate of Amendment are qualified in their entirety by reference to the full text

of such documents, forms of which are filed as Exhibit 3.1 and Exhibit 10.1 to this Current Report on Form 8-K, respectively, and are

incorporated by reference herein.

Item

3.03 Material Modification to Rights of Security Holders.

The

matters described in Item 1.01 of this Current Report on Form 8-K related to the Preferred Stock and the filing of the Certificate of

Amendment are incorporated herein by reference.

Item

5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

On

December 2, 2024 (the “Grant Date”), the board of directors of the Company (the “Board”), based on the recommendation

of the Compensation and Human Resources Committee of the Board, approved equity awards to the directors of the Company in lieu of any

other awards previously approved by the Board, but never issued by the Company, since the beginning of the fourth quarter of the Company’s

2023 fiscal year, as an annual award grant to each director for 2024 and a partial annual award grant for the last quarter of 2023 of:

(i) an aggregate of 562,992 fully vested restricted shares (the “Stock Awards”) of the Company’s Common Stock

under the AYRO, Inc. Long-Term Incentive Plan (as amended, the “Plan”) at a price per share equal to $0.76, which

was the closing price of the Company’s Common Stock on the Grant Date, and (ii) an aggregate of 375,328 fully vested cash-settled

restricted stock units (the “Cash-Settled RSU Awards” and together with the Stock Awards, the “Director Equity Awards”)

at a price per unit equal to $0.76, which was the closing price of the Company’s Common Stock on the Grant Date, which shall

be immediately converted into a cash payment on the Grant Date for the purpose of satisfying each director’s applicable tax obligation

with respect to the applicable Director Equity Awards equal to 40% of the Fair Market Value (as defined in

the Plan) of the applicable Director Equity Awards as of the Grant Date, in each case, pursuant to Restricted Stock and Cash-Settled

Restricted Stock Unit Award Agreements entered into on December 2, 2024 with each director (collectively, the “Director Award Agreements”).

The Director Equity Awards are subject to the terms of the Plan and each Director Award Agreement, as applicable.

The

foregoing description of the Director Award Agreements is qualified in its entirety by reference to the full text of such documents,

a form of which is filed as Exhibit 10.2 to this Current Report on Form 8-K and is incorporated by reference herein.

Item

5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year

The

matters described in Item 1.01 of this Current Report on Form 8-K related to the Preferred Stock and the filing of the Certificate of

Amendment are incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

AYRO,

INC. |

| |

|

|

| Date:

December 2, 2024 |

By:

|

/s/

Joshua Silverman |

| |

|

Joshua

Silverman |

| |

|

Executive

Chairman |

Exhibit

3.1

CERTIFICATE

OF AMENDMENT OF

CERTIFICATE

OF DESIGNATIONS OF

SERIES

H-7 CONVERTIBLE PREFERRED STOCK OF

AYRO,

INC.

PURSUANT

TO SECTION 242 OF THE

DELAWARE

GENERAL CORPORATION LAW

This

Certificate of Amendment to the Certificate of Designations of Series H-7 Convertible Preferred Stock (the “Amendment”)

is dated as of December 2, 2024.

WHEREAS,

the board of directors (the “Board”) of AYRO, Inc., a Delaware corporation (the “Company”), pursuant

to the authority granted to it by the Company’s Amended and Restated Certificate of Incorporation (as amended, the “Certificate

of Incorporation”) and Section 151(g) of the Delaware General Corporation Law (the “DGCL”), has previously

fixed the rights, preferences, restrictions and other matters relating to a series of the Company’s preferred stock, consisting

of 22,000 authorized shares of preferred stock, classified as Series H-7 Convertible Preferred Stock (the “Preferred Stock”)

and the Certificate of Designations of the Preferred Stock (as amended, the “Certificate of Designations”) was initially

filed with the Secretary of State of the State of Delaware on August 9, 2023 evidencing such terms;

WHEREAS,

pursuant to Section 32(b) of the Certificate of Designations, the Certificate of Designations or any provision thereof may be amended

by obtaining the affirmative vote at a meeting duly called for such purpose, or written consent without a meeting in accordance with

the DGCL, of at least a majority of the outstanding shares of Preferred Stock (the “Required Holders”), voting separately

as a single class, and with such stockholder approval, if any, as may then be required pursuant to the DGCL and the Certificate of Incorporation;

WHEREAS,

the Required Holders pursuant to the Certificate of Designations have consented, in accordance with the DGCL, on December 2, 2024, to

this Amendment on the terms set forth herein; and

WHEREAS,

the Board has duly adopted resolutions proposing to adopt this Amendment and declaring this Amendment to be advisable and in the best

interest of the Company and its stockholders.

NOW,

THEREFORE, this Amendment has been duly adopted in accordance with Section 242 of the DGCL and has been executed by a duly authorized

officer of the Company as of the date first set forth above to amend the terms of the Certificate of Designations as follows:

1.

Section 33(cc) of the Certificate of Designations is hereby amended and restated to read as follows (emphasis added):

(cc)

“Excluded Securities” means (i) shares of Common Stock or standard options to purchase Common Stock issued or issuable

to directors, officers, employees or other service providers of the Company for services rendered to the Company in their capacity as

such pursuant to an Approved Stock Plan (as defined above), provided that (A) all such issuances (taking into account the shares of Common

Stock issuable upon exercise of such options) after the Subscription Date pursuant to this clause (i) do not, in the aggregate, exceed

more than 10% of the Common Stock issued and outstanding immediately prior to the Subscription Date and (B) the exercise price of any

such options is not lowered, none of such options are amended to increase the number of shares issuable thereunder and none of the terms

or conditions of any such options are otherwise materially changed in any manner that adversely affects any of the Buyers (as defined

in the Securities Purchase Agreement; (ii) shares of Common Stock issued or issuable upon the conversion or exercise of Convertible Securities

(other than standard options to purchase Common Stock issued or issuable pursuant to an Approved Stock Plan that are covered by clause

(i) above) issued prior to the Subscription Date, provided that the conversion price of any such Convertible Securities (other than standard

options to purchase shares of Common Stock issued pursuant to an Approved Stock Plan that are covered by clause (i) above) is not lowered

(other than in accordance with the terms thereof in effect as of the Subscription Date) from the conversion price in effect as of the

Subscription Date (whether pursuant to the terms of such Convertible Securities or otherwise), none of such Convertible Securities (other

than standard options to purchase Common Stock issued pursuant to an Approved Stock Plan that are covered by clause (i) above) are amended

to increase the number of shares issuable thereunder and none of the terms or conditions of any such Convertible Securities (other than

standard options to purchase Common Stock issued pursuant to an Approved Stock Plan that are covered by clause (i) above) are otherwise

materially changed in any manner that adversely affects any of the Buyers; (iii) the Conversion Shares issuable upon conversion of the

Preferred Shares or otherwise pursuant to the terms of this Certificate of Designations; provided, that the terms of this Certificate

of Designations are not amended, modified or changed on or after the Subscription Date (other than in accordance with the terms thereof,

including antidilution adjustments pursuant to the terms thereof in effect as of the Subscription Date), (iv) the Warrant Shares; provided,

that the terms of the Warrants are not amended, modified or changed on or after the Subscription Date (other than antidilution adjustments

pursuant to the terms thereof in effect as of the Subscription Date), (v) securities issued as consideration for the acquisition of another

entity by the Company by merger, purchase of substantially all of the assets or other reorganization or bona fide joint venture agreement,

provided that such issuance is approved by the majority of the disinterested directors of the Company and provided that such securities

are issued as “restricted securities” (as defined in Rule 144) and carry no registration rights that require or permit

the filing of any registration statement in connection therewith during the Restricted Period and such issuance does not, in the aggregate,

exceed more than 5% of the shares of Common Stock issued and outstanding immediately prior to the date hereof and (vi) securities

issued pursuant to those certain Restricted Stock and Cash-Settled Restricted Stock Unit Award Agreements, dated as of December 2, 2024,

by and between the Company and each director of the Company, which includes the issuance of (i) fully vested restricted shares of the

Company’s Common Stock issued under the AYRO, Inc. Long-Term Incentive Plan, as amended and (ii) fully vested cash-settled

restricted stock units of the Company (the “RSUs”), representing shares of Common Stock and shares of Common Stock underlying

the RSUs in an aggregate amount equal to the quotient of (i) $713,125 divided by (ii) the Closing Sale Price of the Company’s Common

Stock on December 2, 2024.

[Signature

Page Follows]

IN

WITNESS WHEREOF, the Company has caused this Amendment to be signed by its duly authorized officer this 2nd day of December, 2024.

| AYRO,

INC. |

|

| |

|

|

| By: |

/s/

Joshua Silverman |

|

| Name: |

Joshua Silverman |

|

| Title: |

Executive Chairman |

|

Exhibit 10.1

FORM

OF Waiver and AMENDMENT AGREEMENT

This Waiver and Amendment Agreement

(this “Agreement”), dated as of December 2, 2024, is by and among AYRO, Inc., a Delaware corporation (the “Company”),

and each investor listed on the signature page attached hereto (collectively, the “Investors”).

WITNESSETH

Whereas,

the Company and the Investors are party to that certain Securities Purchase Agreement, dated as of August 7, 2023 (the “Purchase

Agreement”), pursuant to which the Company issued to the Investors shares of the Company’s H-7 Convertible Preferred Stock,

par value $0.0001 per share (the “Preferred Stock”), the terms of which are set forth in the Certificate of Designations

for the Series H-7 Convertible Preferred Stock (as amended, the “Certificate of Designations”), and warrants (the “Warrants,”

and, together with the Purchase Agreement and the Certificate of Designations, the “Transaction Documents”) to purchase

shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock”);

WHEREAS, the Company desires to

issue as equity awards to the directors of the Company (i) fully vested restricted shares of Common Stock and (ii) fully vested cash-settled

restricted stock units (“RSUs”) of the Company, representing shares of Common Stock and shares of Common Stock underlying

the RSUs in an aggregate amount equal to the quotient of (i) $713,125 divided by (ii) the closing sale price of the Company’s Common

Stock on December 2, 2024 (such shares and RSUs, the “Director Awards”);

WHEREAS, the aggregate number

of shares of Common Stock issuable pursuant to Director Awards (including those underlying RSUs), is in excess of 10% of the shares of

Common Stock issued and outstanding immediately prior to the date of the Purchase Agreement;

WHEREAS, the undersigned constitute

the Required Holders pursuant to each of the Transaction Documents; and

WHEREAS, the Company and the Investors

desire to amend certain provisions of the Certificate of Designations and the Purchase Agreement to exclude the Director Awards from all

covenants and provisions in the Transaction Documents that may be applicable to such issuances.

Now,

therefore, in consideration of the premises and mutual covenants and obligations hereinafter set forth, the parties hereto, intending

legally to be bound, hereby agree as follows:

| |

1. |

Definitions. Capitalized terms used herein but not otherwise defined herein shall have the respective meanings given such terms in the Purchase Agreement. |

| |

|

|

| |

2. |

Waiver and Amendment to the Certificate of Designations. The parties hereto hereby agree to amend the rights of the Preferred Stock as set forth in the Amendment to the Certificate of Designations attached as Exhibit A hereto (the “Amendment”). Upon the effectiveness of this Agreement, the Company shall promptly file the Amendment and provide a copy thereof to each Investor promptly after such filing. In addition, the Investors hereby waive any breach or violation of Certificate of Designations resulting from the issuance of the Director Awards and further agree that the issuance of the Director Awards shall not result in any adjustment to the Preferred Stock or otherwise trigger any right or remedy of the Investors. |

| |

3. |

Waiver and Amendment to the Purchase Agreement. The parties hereto hereby agree that Section 4(k) of the Purchase Agreement is hereby amended such that the issuance of the Director Awards shall be deemed to constitute “Excluded Securities” under the Purchase Agreement. In addition, the Investors hereby waive any breach or violation of the Purchase Agreement and the Warrants resulting from the issuance of the Director Awards and further agree that the issuance of the Director Awards shall not result in any adjustment to the Warrants or otherwise trigger any right or remedy of the Investors. |

| |

|

|

| |

4. |

Counterparts; Facsimile Execution. This Agreement may be executed in one or more counterparts (including by electronic mail, in PDF or by DocuSign or similar electronic signature), all of which shall be considered one and the same agreement and shall become effective when one or more counterparts have been signed by each of the parties and delivered to the other parties. Counterparts may be delivered via facsimile, electronic mail (including any electronic signature covered by the U.S. federal ESIGN Act of 2000, Uniform Electronic Transactions Act, the Electronic Signatures and Records Act or other applicable law, e.g., www.docusign.com) or other transmission method and any counterpart so delivered shall be deemed to have been duly and validly delivered and be valid and effective for all purposes. |

| |

|

|

| |

5. |

Governing Law. THIS AGREEMENT SHALL BE SUBJECT TO THE PROVISIONS REGARDING GOVERNING LAW SET FORTH IN SECTION 9(a) OF THE Purchase AGREEMENT, AND SUCH PROVISIONS ARE INCORPORATED HEREIN BY THIS REFERENCE, MUTATIS MUTANDIS. |

| |

|

|

| |

6. |

Terms and Conditions of the Transaction Documents. Except as modified and amended herein, all of the terms and conditions of the Transaction Documents shall remain in full force and effect. |

[Signature pages follow immediately.]

IN WITNESS WHEREOF, the undersigned

has executed and delivered this Agreement as of the date first above written.

| |

Company: |

| |

|

|

| |

AYRO, Inc. |

| |

|

|

| |

By: |

|

| |

Name:

|

Joshua Silverman |

| |

Title: |

Executive Chairman |

In

witness whereof, the undersigned has executed and delivered this Agreement as of the date first above written.

| |

Name of Investor: |

| |

|

|

| |

By: |

|

| |

Name of signatory: |

| |

Title: |

|

[Investor Signature Page to Waiver

and Amendment Agreement]

EXHIBT A

Form Amendment to the

Certificate of Designations of Series H-7 Convertible Preferred Stock

Exhibit

10.2

RESTRICTED

STOCK AND CASH-SETTLED RESTRICTED STOCK UNIT AWARD AGREEMENT

AYRO,

INC.

LONG-TERM

INCENTIVE PLAN

1.

Grant of Awards. Pursuant to the AYRO, Inc. Long-Term Incentive Plan (the “Plan”) for Employees, Contractors,

and Outside Directors of AYRO, Inc., a Delaware corporation (the “Company”), the Company grants to ______________

(the “Participant”) on __________, 2024 (the “Date of Grant”) the following Awards

under this Restricted Stock and Cash-Settled Restricted Stock Unit Award Agreement (the “Agreement”):

a)

Restricted Stock in accordance with Section 6.4 of the Plan. An Award of _______________ shares of Common Stock (the “Awarded

Shares”).

b)

Restricted Stock Units in accordance with Section 6.6 of the Plan (Cash-Settled). An Award of _______________ Restricted Stock

Units (the “Awarded Units”) which shall be converted into a cash payment in an amount equal to the aggregate

Fair Market Value of the number of shares of Common Stock of the Company equal to the number of Restricted Stock Units, subject to the

terms and conditions of the Plan and this Agreement. Each Awarded Unit shall be a notional share of Common Stock, with the cash-equivalent

value of each Awarded Unit being equal to the Fair Market Value of a share of Common Stock at any time. Awarded Units which have become

vested pursuant to the terms of Section 3 below are collectively referred to herein as “Vested RSUs”.

2.

Subject to Plan. This Agreement is subject to the terms and conditions of the Plan, and the terms of the Plan shall control to

the extent not otherwise inconsistent with the provisions of this Agreement. The capitalized terms used herein that are defined in the

Plan shall have the same meanings assigned to them in the Plan. This Agreement is subject to any rules promulgated pursuant to the Plan

by the Board or the Committee and communicated to the Participant in writing.

3.

Vesting. Subject to certain restrictions and conditions set forth in the Plan, the Awarded Shares and Awarded Units shall be 100%

vested on the Date of Grant.

4.

Payments with Respect to Vested RSUs and Tax Obligation Amounts. Subject to the terms hereof and in connection with payments related

to the Vested RSUs and the payment of the Tax Obligation Amount (as defined below), the Company shall convert all of the Participant’s

Vested RSUs, into a cash payment in an aggregate amount equal to the Vested RSUs multiplied by the Fair Market Value of a share of Common

Stock as of the Date of Grant to cover the tax obligation required for purposes of the Participant’s applicable income tax rate

then in effect plus any required social security taxes (the “Tax Obligation Amount”) and remit such Tax Obligation

Amount to the Internal Revenue Service or any other applicable taxing authority on behalf of the Participant.

5.

Delivery of Certificates; Registration of the Awarded Shares. The Company shall deliver certificates for the Awarded Shares

to the Participant or shall electronically register the Awarded Shares in the Participant’s name, free of restriction under this

Agreement promptly after the Date of Grant.

6.

Rights of a Stockholder for the Awarded Shares. The Participant shall have, with respect to the Awarded Shares, all of the rights

of a stockholder of the Company, including the right to vote the shares and the right to receive any dividends thereon.

7.

Voting for the Awarded Shares. The Participant, as record holder of the Awarded Shares, has the exclusive right to vote, or consent

with respect to, such Awarded Shares.

8.

Adjustment to Number of the Awarded Shares. The number of Awarded Shares shall be subject to adjustment in accordance with Articles

11-13 of the Plan.

9.

Specific Performance. The parties acknowledge that remedies at law will be inadequate remedies for a breach of this Agreement

and consequently agree that this Agreement shall be enforceable by specific performance. The remedy of specific performance shall be

cumulative of all of the rights and remedies at law or in equity of the parties under this Agreement.

10.

Participant’s Representations. Notwithstanding any of the provisions hereof, the Participant hereby agrees that the Participant

will not acquire any Awarded Shares, and that the Company will not be obligated to issue any Awarded Shares to the Participant hereunder,

if the issuance of such shares shall constitute a violation by the Participant or the Company of any provision of any law or regulation

of any governmental authority. Any determination in this connection by the Company shall be final, binding, and conclusive. The rights

and obligations of the Company and the rights and obligations of the Participant are subject to all Applicable Laws, rules, and regulations.

11.

Investment Representation. Unless the Awarded Shares are issued in a transaction registered under applicable federal and state

securities laws, by his execution hereof, the Participant represents and warrants to the Company that all Common Stock which may be purchased

and/or received hereunder will be acquired by the Participant for investment purposes for his own account and not with any intent for

resale or distribution in violation of federal or state securities laws. Unless the Common Stock is issued to him in a transaction registered

under the applicable federal and state securities laws, all certificates issued with respect to the Common Stock shall bear an appropriate

restrictive investment legend and shall be held indefinitely, unless they are subsequently registered under the applicable federal and

state securities laws or the Participant obtains an opinion of counsel, in form and substance satisfactory to the Company and its counsel,

that such registration is not required.

12.

Participant’s Acknowledgments. The Participant acknowledges that a copy of the Plan has been made available for his review

by the Company and represents that the Participant is familiar with the terms and provisions thereof, and hereby accepts this Award subject

to all the terms and provisions thereof. The Participant hereby agrees to accept as binding, conclusive, and final all decisions or interpretations

of the Committee or the Board, as appropriate, upon any questions arising under the Plan or this Agreement.

13.

Law Governing. This Agreement shall be governed by, construed, and enforced in accordance with the laws of the State of Delaware

(excluding any conflict of laws rule or principle of Delaware law that might refer the governance, construction, or interpretation of

this Agreement to the laws of another state).

14.

No Right to Continue Service or Employment. Nothing herein shall be construed to confer upon the Participant the right to continue

in the employ or to provide services to the Company or any Subsidiary, whether as an Employee, Contractor, or Outside Director, or to

interfere with or restrict in any way the right of the Company or any Subsidiary to discharge the Participant as an Employee, Contractor,

or Outside Director at any time.

15.

Legal Construction. In the event that any one or more of the terms, provisions, or agreements that are contained in this Agreement

shall be held by a court of competent jurisdiction to be invalid, illegal, or unenforceable in any respect for any reason, the invalid,

illegal, or unenforceable term, provision, or agreement shall not affect any other term, provision, or agreement that is contained in

this Agreement, and this Agreement shall be construed in all respects as if the invalid, illegal, or unenforceable term, provision, or

agreement had never been contained herein.

16.

Covenants and Agreements as Independent Agreements. Each of the covenants and agreements that are set forth in this Agreement

shall be construed as a covenant and agreement independent of any other provision of this Agreement. The existence of any claim or cause

of action of the Participant against the Company, whether predicated on this Agreement or otherwise, shall not constitute a defense to

the enforcement by the Company of the covenants and agreements that are set forth in this Agreement.

17.

Entire Agreement. This Agreement together with the Plan supersede any and all other prior understandings and agreements, either

oral or in writing, between the parties with respect to the subject matter hereof and constitute the sole and only agreements between

the parties with respect to the said subject matter. All prior negotiations and agreements between the parties with respect to the subject

matter hereof are merged into this Agreement. Each party to this Agreement acknowledges that no representations, inducements, promises,

or agreements, orally or otherwise, have been made by any party or by anyone acting on behalf of any party, which are not embodied in

this Agreement or the Plan and that any agreement, statement, or promise that is not contained in this Agreement or the Plan shall not

be valid or binding or of any force or effect.

18.

Parties Bound. The terms, provisions, and agreements that are contained in this Agreement shall apply to, be binding upon, and

inure to the benefit of the parties and their respective heirs, executors, administrators, legal representatives, and permitted successors

and assigns, subject to the limitation on assignment expressly set forth herein. No person shall be permitted to acquire any Awarded

Shares without first executing and delivering an agreement in the form satisfactory to the Company making such person or entity subject

to the restrictions on transfer contained herein.

19.

Modification. No change or modification of this Agreement shall be valid or binding upon the parties unless the change or modification

is in writing and signed by the parties; provided, however, that the Company may change or modify this Agreement without the Participant’s

consent or signature if the Company determines, in its sole discretion, that such change or modification is necessary for purposes of

compliance with or exemption from the requirements of Section 409A of the Code or any regulations or other guidance issued thereunder.

Notwithstanding the preceding sentence, the Company may amend the Plan to the extent permitted by the Plan.

20.

Headings. The headings that are used in this Agreement are used for reference and convenience purposes only and do not constitute

substantive matters to be considered in construing the terms and provisions of this Agreement.

21.

Gender and Number. Words of any gender used in this Agreement shall be held and construed to include any other gender, and words

in the singular number shall be held to include the plural, and vice versa, unless the context requires otherwise.

22.

Notice. Any notice required or permitted to be delivered hereunder shall be deemed to be delivered only when actually received

by the Company or by the Participant, as the case may be, at the addresses set forth below, or at such other addresses as they have theretofore

specified by written notice delivered in accordance herewith:

a.

Notice to the Company shall be addressed and delivered as follows:

AYRO,

Inc.

900

E. Old Settlers Boulevard, Suite 100

Round

Rock, TX 78664

Attn:

Executive Chairman and Principal Executive Officer

b.

Notice to the Participant shall be addressed and delivered to the most recent address in the Company’s records.

23.

Section 409A. The Company intends that the Awarded Units be structured to satisfy an exemption from Section 409A, such that the

Awarded Units would not be subject to Section 409A.

24.

Tax Requirements. The Participant is hereby advised to consult immediately with the Participant’s own tax advisor regarding

the tax consequences of this Agreement. The Participant acknowledges and agrees that the Participant is responsible for any and all federal,

state, local, or other tax liabilities and obligations arising in connection with this Agreement.

[Remainder

of Page Intentionally Left Blank;

Signature

Page Follows.]

IN

WITNESS WHEREOF, the Company has caused this Agreement to be executed by its duly authorized officer, and the Participant, to evidence

his consent and approval of all the terms hereof, has duly executed this Agreement, as of the date specified in Section 1 hereof.

| |

COMPANY: |

| |

|

| |

AYRO,

Inc. |

| |

By: |

|

| |

Name: |

Joshua

Silverman |

| |

Title: |

Executive

Chairman and Principal Executive Officer |

v3.24.3

Cover

|

Dec. 02, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 02, 2024

|

| Current Fiscal Year End Date |

--12-31

|

| Entity File Number |

001-34643

|

| Entity Registrant Name |

AYRO,

Inc.

|

| Entity Central Index Key |

0001086745

|

| Entity Tax Identification Number |

98-0204758

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

AYRO,

Inc.

|

| Entity Address, Address Line Two |

900

E. Old Settlers Boulevard

|

| Entity Address, Address Line Three |

Suite 100

|

| Entity Address, City or Town |

Round

Rock

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78664

|

| City Area Code |

512

|

| Local Phone Number |

994-4917

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

stock, par value $0.0001 per share

|

| Trading Symbol |

AYRO

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

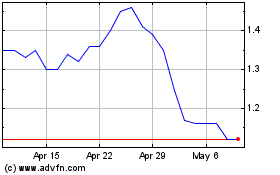

AYRO (NASDAQ:AYRO)

Historical Stock Chart

From Mar 2025 to Apr 2025

AYRO (NASDAQ:AYRO)

Historical Stock Chart

From Apr 2024 to Apr 2025