0001723580FALSE200 West Cypress Creek Rd., Suite 220Fort LauderdaleFL00017235802024-01-082024-01-080001723580bfi:CommonStockParValue00001PerShareMember2024-01-082024-01-080001723580bfi:RedeemableWarrantsEachExercisableForOneShareOfCommonStockAtAnExercisePriceOf1150PerShareMember2024-01-082024-01-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________________________________

FORM 8-K

_______________________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 8, 2024

_______________________________________

BurgerFi International, Inc.

(Exact name of registrant as specified in its charter)

_______________________________________

| | | | | | | | |

| 001-38417 | Delaware | 82-2418815 |

(Commission File Number) | (State or Other Jurisdiction of Incorporation) | (I.R.S. Employer Identification No.) |

| | | | | |

200 West Cypress Creek Rd., Suite 220 Fort Lauderdale, FL | 33309 |

| (Address of Principal Executive Offices) | (Zip Code) |

(954) 618-2000

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, If Changed Since Last Report)

_______________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2 (b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4 (c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.0001 per share | | BFI | | The Nasdaq Stock Market LLC |

| Redeemable warrants, each exercisable for one share of common stock at an exercise price of $11.50 per share | | BFIIW | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

The information contained in Item 7.01 of this Current Report on Form 8-K is incorporated by reference in this Item 2.02.

Item 7.01. Regulation FD Disclosure.

On January 8, 2024, BurgerFi International, Inc. (the “Company”) issued a press release (the “Press Release”) providing the Company’s preliminary fiscal year 2023 revenue, adjusted EBITDA, same-store sales, store openings and cap ex spending. The Company also provided expectations for fiscal year 2024 revenue, cost of goods sold and store openings. As previously announced, the Company indicated that Carl Bachmann, Chief Executive Officer, and Christopher Jones, Chief Financial Officer, will participate in a fireside chat at the 26th Annual ICR Conference on Tuesday, January 9, 2024, at 10:30 am ET. Attached hereto as Exhibit 99.1 and incorporated into this Item 7.01 by reference is the Press Release.

The information in this Item 7.01 (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities under that section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

Exhibit

No. | Description |

| |

| 99.1 | |

| |

| 99.2 | |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

* Furnished but not filed.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: January 8, 2024

| | | | | | | | |

| BURGERFI INTERNATIONAL, INC. | |

| | |

| By: | /s/ Christopher Jones | |

| Christopher Jones, Chief Financial Officer | |

BurgerFi Provides Fiscal Year 2023 Business Update

Sets Initial Business Outlook for Fiscal Year 2024

Focused on Five Key Strategic Initiatives

FORT LAUDERDALE, FL – January 8, 2024 (GLOBE NEWSWIRE) – BurgerFi International, Inc. (NASDAQ: BFI, BFIIW) (“BurgerFi” or the “Company”), owner of the high-quality, casual dining pizza brand under the name Anthony’s Coal Fired Pizza & Wings (“Anthony’s”) and one of the nation’s leading fast-casual “better burger” dining concepts through the BurgerFi brand, today reported preliminary results for the fiscal year 2023 which ended on January 1, 2024. The Company also set its initial business outlook for fiscal year 2024 as it focuses on five key strategic initiatives.

Management Commentary

Carl Bachmann, Chief Executive Officer of BurgerFi stated, “Since joining the Company in July, I have been working diligently to fix the foundations of both brands, to ensure the next best turnaround story in the restaurant space, is a success. Both these founder brands (Anthony’s and BurgerFi) are what attracted me to this opportunity and despite some near-term challenges, my view of the brands and the opportunity hasn’t changed. Leveraging my prior experience in turnaround situations at burger and pizza concepts, we have implemented five key strategic priorities that should drive long-term, profitable growth. Notably, we have begun to see early leading indicators that these efforts are already taking hold. Across both brands, we continue to see a decrease in hourly and management turnover, coupled with an increase in consumer satisfaction scores and faster ticket times. We also introduced new menu items at BurgerFi and Anthony’s and the feedback has been resounding.”

Bachmann continued, “In December, we celebrated the grand opening of our first-ever co-branded BurgerFi and Anthony’s restaurant in Kissimmee, Florida. This location, which includes the inaugural Anthony’s franchise agreement, is part of a three-unit deal with a new franchisee, NDM Hospitality. We also expanded our footprint through a nontraditional venue with the opening of a BurgerFi within Apple Cinemas in Rochester, New York. This new growth channel helps increase our visibility and brand awareness, and we will look to open additional nontraditional locations in the future. Finally, later this month, BurgerFi will return to New York City with the grand reopening of our flagship, company-owned, BurgerFi restaurant and Better Burger Lab.”

Christopher Jones, Chief Financial Officer of BurgerFi, noted, “We have started to see early signs of improvement across the business. During the fourth quarter we saw encouraging trends, despite the larger headwinds that the industry has experienced in Southern Florida, with strong performance from the Anthony’s brand during the holidays, including a positive sequential improvement in sales and traffic in 4Q23 vs 3Q23. Performance continues to be volatile at BurgerFi, though followed a similar positive trend with sequential improvement in traffic and comp store sales at both company and franchise locations.”

“Looking forward, we expect the BurgerFi concept to generate positive same store sales and EBITDA in the second half of 2024 and for Anthony’s to deliver positive same-store sales and EBITDA throughout 2024. We are also in discussions with several interested parties for a multi-unit Anthony’s franchise deal.”

Preliminary Outcomes for the Fourth Quarter 2023 are as Follows*:

•Total revenue of approximately $42 million;

•Consolidated systemwide restaurant sales of approximately $65 million;

•Corporate-owned same-store sales decreased 3% at Anthony’s;

•Systemwide same-store sales decreased 9% at BurgerFi.

Preliminary Outcomes for the Fiscal Year 2023 are as Follows*:

•Total store revenue of approximately $170 million;

•Systemwide restaurant sales of approximately $275 million;

•Corporate-owned same-store sales decreased 1% at Anthony’s;

•Systemwide same-store sales decreased 7% at BurgerFi.

•No update to our previously communicated Adjusted EBITDA1 guidance of $6-8 million or capital expenditures of approximately $2 million.

*The fourth quarter and fiscal year 2023 reporting periods for BurgerFi changed to a quarter 4-4-5 calendar with a 52-53 week fiscal year ending on the Monday nearest December 31 of each year to improve the alignment of financial and business processes following the acquisition of Anthony’s. We have adjusted for differences arising from the different fiscal-period ends for the quarter and fiscal year 2023 when comparing to 2022.

Restaurant Development

As of January 2, 2024, the Company operated and franchised 168 total restaurants of which 108 were BurgerFi (28 corporate-owned and 80 franchised) and 60 were Anthony’s (59 corporate-owned and 1 franchised). During the fourth quarter 2023, the Company acquired two locations from franchisees and opened an additional 3 BurgerFi locations, including a BurgerFi inside Apple Cinemas in Rochester and the first dual-brand franchise location. In January 2024, the Company will reopen a flagship, company-owned, BurgerFi in New York City with the unveiling of its Better Burger Lab experience.

Key Strategic Initiatives

During fiscal year 2024, the Company will continue executing its five key strategic initiatives, which are positioning BurgerFi for sustained long-term, profitable growth.

1.Infrastructure

•Decrease turnover at both brands and significantly reduce the training labor needed at the restaurant level;

•Achieve higher consumer satisfaction scores as well as faster throughput and ticket times; and

•Upgrade the POS system across both brands so they are on one system to allow for better inventory control.

2.Taste and Quality

•Added new menu items at both brands; and

•Rightsized the menu at BurgerFi, removing less popular and process intense items.

3.Gold Standards

•Pride in product, process and facility and creates Brand Promises;

•Listening to employee and guest feedback; and

•Removed the AI-phone answering bot at Anthony’s.

4.Telling the World About Our Brands

•Being intentional with marketing efforts; and

•Focusing on driving digital engagement and the rewards programs.

5.Defining the Portfolio

•Closely reviewing existing portfolio and pipeline;

•Closing underperforming units; and

•Focusing growth on infilling the eastern seaboard within existing markets, where there is already strong brand awareness.

Preliminary Fiscal Year 2024 Outlook

•Total revenue of approximately $170-$180 million;

•Reopened flagship, company-owned, BurgerFi in New York City;

•10-15 new franchised restaurant openings including 1 new Anthony’s;

•Continued improvement in COG’s driven by increased adoption of inventory management at both brands

ICR Conference Fireside Chat Discussion

As previously communicated, Carl Bachmann, Chief Executive Officer, and Christopher Jones, Chief Financial Officer, will be hosting a fireside chat on Tuesday, January 9, 2024, at 10:30 am ET at the 26th Annual ICR Conference. The fireside chat will be webcast live and available for replay on the Company’s Investor Relations website at ir.burgerfi.com under ‘News & Events.’

Key Metrics Definitions

The following definitions apply to the terms listed below:

“Systemwide Restaurant Sales” is presented as informational data in order to understand the aggregation of Franchise Restaurant Sales and Corporate-Owned Restaurant Sales performance. Systemwide Restaurant Sales growth refers to the percentage change in sales at all franchised restaurants and corporate-owned restaurants in one period from the same period in the prior year. Systemwide Restaurant Same-Store Sales growth refers to the percentage change in sales at all franchised restaurants and corporate-owned restaurants after 14 months of operations. See definition below for “Same-Store Sales”.

“Corporate-Owned Restaurant Sales” represent the sales generated only by corporate-owned restaurants. Corporate-Owned Restaurant Sales growth refers to the percentage change in sales at all corporate-owned restaurants in one period from the same period in the prior year. Corporate-Owned Restaurant Same-Store Sales growth refers to the percentage change in sales at all corporate-owned restaurants after 14 months of operations. These measures highlight the performance of existing corporate-owned restaurants.

“Franchise Restaurant Sales” represent the sales generated only by franchisee-owned restaurants and are not recorded as revenue, however, the royalties based on a percentage of these franchise restaurant sales are recorded as revenue. Franchise Restaurant Sales growth refers to the percentage change in sales at all franchised restaurants in one period from the same period in the prior year. Franchise Restaurant Same-Store Sales growth refers to the percentage change in sales at all franchised restaurants after 14 months of operations. These measures highlight the performance of existing franchised restaurants.

“Same-Store Sales” is used to evaluate the performance of our store base, which excludes the impact of new stores and closed stores, in both periods under comparison. We include a restaurant in the calculation of Same-Store Sales after 14 months of operations. A restaurant which is temporarily closed, is included in the Same-Store Sales computation. A restaurant which is closed permanently, such as upon termination of the lease, or other permanent closure, is immediately removed from the Same-Store Sales computation. Our calculation of Same-Store Sales may not be comparable to others in the industry.

“Adjusted EBITDA,” a non-GAAP measure, is defined as net loss before goodwill impairment, lease termination recovery, employee retention credits, share-based compensation expense, depreciation and amortization expense, interest expense (which includes accretion on the value of preferred stock and interest accretion on the related party note), restructuring costs, merger, acquisition and integration costs, legal settlements, net of gains, store closure costs, loss (gain) on change in value of warrant liability, pre-opening costs, (gain) loss on sale of assets and income tax expense (benefit).

Unless otherwise stated, Systemwide Restaurant Sales, Systemwide Sales growth, and Same-Store Sales are presented on a systemwide basis, which means they include franchise restaurants and company-owned restaurants. Franchise restaurant sales represent sales at all franchise restaurants and are revenues to our franchisees. We do not record franchise sales as revenues; however, our royalty revenues and brand royalty revenues are calculated based on a percentage of franchise sales.

About BurgerFi International (Nasdaq: BFI, BFIIW)

BurgerFi International, Inc. is a leading multi-brand restaurant company that develops, markets, and acquires fast-casual and premium-casual dining restaurant concepts around the world, including corporate-owned stores and franchises. BurgerFi International is the owner and franchisor of the two following brands with a combined 168 locations.

Anthony’s. Anthony’s is a premium pizza and wing brand with 60 restaurants (59 corporate-owned casual restaurant locations and 1 dual brand franchise location), as of January 1, 2024. Known for serving fresh, never frozen and quality ingredients, Anthony’s is centered around a 900-degree coal-fired oven with menu offerings including “well-done” pizza, coal-fired chicken wings, homemade meatballs, and a variety of handcrafted sandwiches and salads. Anthony’s was named “The Best Pizza Chain in America” by USA Today's Great American Bites and “Top 3 Best Major Pizza Chain” by Mashed in 2021. To learn more about Anthony’s, please visit www.acfp.com.

BurgerFi. BurgerFi is among the nation’s fast-casual better burger concepts with 108 BurgerFi restaurants (80 franchised and 28 corporate-owned) as of January 1, 2024. BurgerFi is chef-founded and committed to serving fresh, all-natural and quality food at all locations, online and via first-party and third-party deliveries. BurgerFi uses 100% American Angus Beef with no steroids, antibiotics, growth hormones, chemicals or additives. BurgerFi's menu also includes high-quality Wagyu Beef Blend Burgers, Antibiotic and Cage-Free Chicken offerings, Hand-Cut Sides, and Frozen Custard Shakes. BurgerFi was named "The Very Best Burger" at the 2023 edition of the nationally acclaimed SOBE Wine and Food Festival and “Best Fast Food Burger” in USA Today’s 10Best 2023 Readers’ Choice Awards for its BBQ Rodeo Burger, "Best Fast Casual Restaurant" in USA Today's 10Best 2023 Readers' Choice Awards for the third consecutive year, QSR Magazine's Breakout Brand of 2020 and Fast Casual's 2021 #1 Brand of the Year. In 2021, Consumer Reports awarded BurgerFi an “A Grade Angus Beef” rating for the third consecutive year. To learn more about BurgerFi or to find a full list of locations, please visit www.burgerfi.com. BurgerFi® is a Registered Trademark of BurgerFi IP, LLC, a wholly-owned subsidiary of BurgerFi.

About Non-GAAP Projected Financial Measures

To supplement our consolidated financial statements, which are prepared and presented in accordance with GAAP, we use the measure Adjusted EBITDA. The presentation of this financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

We use this non-GAAP financial measure for financial and operational decision-making and as a means to evaluate period-to-period comparisons. We believe that this non-GAAP financial measure provides meaningful supplemental information regarding our performance and liquidity by excluding certain items that may not be indicative of our recurring core business operating results. We believe that both management and investors benefit from referring to this non-GAAP financial measure in assessing our performance and when planning, forecasting, and analyzing future periods. This non-GAAP

financial measure also facilitates management’s internal comparisons to our historical performance and liquidity as well as comparisons to our competitors’ operating results. We believe this non-GAAP financial measure is useful to investors both because (1) it allows for greater transparency with respect to key metrics used by management in its financial and operational decision-making and (2) it is used by our institutional investors and the analyst community to help them analyze the health of our business.

There are a number of limitations related to the use of this non-GAAP financial measure. We compensate for these limitations by providing specific information regarding the GAAP amounts excluded from this non-GAAP financial measure and evaluating this non-GAAP financial measure together with its relevant financial measures in accordance with GAAP.

A reconciliation of Adjusted EBITDA guidance is not being provided due to the nature of this forward-looking non-GAAP measure containing certain elements that are impractical to predict given their market-based nature, such as share-based compensation expense and gain and losses on change in value of warrant liabilities, without unreasonable efforts. For the same reasons, we are unable to address the probable significance of the unavailable information, nor can we accurately predict all of the components of the applicable non-GAAP financial measure and reconciling adjustments thereto; accordingly, guidance for the corresponding GAAP measure may be materially different than guidance for the non-GAAP measure. Such forward looking information is also subject to uncertainty and various risks, and there can be no assurance that any forecasted results or conditions will actually be achieved.

Forward-Looking Statements

This press release may contain “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995, including statements relating to BurgerFi's estimates of its future business outlook, liquidity, prospects or financial results, long-term opportunities, executing on growth and improvement strategies, new franchise opportunities, increased revenue, liquidity, improved operating margins in both brands, improved labor trends, seasonality trends, product improvements, including new products and services, expected customer acceptance, improved operating efficiencies, store opening plans, and expectations regarding adjusted EBITDA in 2023 and EBITDA in 2024, as well as statements set forth under the section titled “Preliminary Fiscal Year 2024 Outlook” above. Forward-looking statements generally can be identified by words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “projects,” “will be,” “will continue,” “will likely result,” and similar expressions. These forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results to differ materially from those reflected in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in our Annual Report on Form 10-K for the year ended January 2, 2023, and those discussed in other documents we file with the Securities and Exchange Commission, including our ability to continue to access liquidity from our credit agreement and remain compliant with financial covenants therein, as well as to successfully realize the expected benefits of the acquisition of Anthony’s or any other factors. All subsequent written and oral forward-looking statements attributable to BurgerFi or persons acting on BurgerFi’s behalf are expressly qualified in their entirety by the cautionary statements included in this press release. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

Investor Relations:

ICR

Michelle Michalski

IR-BFI@icrinc.com

646-277-1224

Company Contact:

BurgerFi International Inc.

IR@burgerfi.com

Media Relations Contact:

Ink Link Marketing

Kim Miller

Kmiller@inklinkmarketing.com

BFI Investor Presentation ICR Conference Jan 8-10th, 2024

This presentation contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 and Private Securities. Litigation Reform Act, as amended, including statements relating to BurgerFi's estimates of its future business outlook, liquidity, prospects or financial results, long-term opportunities, executing on growth and improvement strategies, new franchise opportunities, increased revenue, liquidity, improved operating margins in both brands, improved labor trends, seasonality trends, product improvements, including new products and services, expected customer acceptance, improved operating efficiencies, store opening plans, and expectations regarding adjusted EBITDA in 2023 and EBITDA in 2024, as well as statements set forth under the section titled “Preliminary Fiscal Year 2024 Outlook”. Forward-looking statements generally can be identified by words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “projects,” “will be,” “will continue,” “will likely result,” and similar expressions. These forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results to differ materially from those reflected in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in our Annual Report on Form 10-K for the year ended January 2, 2023, and those discussed in other documents we file with the Securities and Exchange Commission, including our ability to continue to access liquidity from our credit agreement and remain compliant with financial covenants therein, as well as to successfully realize the expected benefits of the acquisition of Anthony’s or any other factors. All subsequent written and oral forward-looking statements attributable to BurgerFi or persons acting on BurgerFi’s behalf are expressly qualified in their entirety by the cautionary statements included in this press release. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. Forward Looking Statements

Fiscal Year 2023 Update and Preliminary 2024 Sales Outlook • Total revenues of approximately $170 million • Opened 8 new BurgerFi and 1 Anthony’s restaurants • No update to our previously communicated Adjusted EBITDA1 guidance of $6-8 million or capital expenditures of approximately $2 million. For the Fiscal Year ended January 1, 2024 Restricted – Do not distribute 3 1) See slide 21 for definition of key metrics and non-U.S. GAAP financial measures Management’s initial outlook for the fiscal year 2024 • Total revenue of approximately $170-$180 million • Reopened flagship, company-owned, BurgerFi in New York City; • 10-15 new franchised restaurant openings including 1 new Anthony’s; • Continued improvement in COG’s driven by increased adoption of inventory management at both brands.

Restricted – Do not distribute VALUE CREATION INITIATIVES STRATEGIC PRIORITIES ACTIONS & INITIATIVES PRELIMINARY RESULTS Improving Labor Productivity & Food Cost Infrastructure • Instability of leadership has stabilized store and regional management • Investment into technology, to manage COG’s • Implementation of CrunchTime • Improving Regional and GM retention • CrunchTime to be 100% implemented at both brands by January 2024. Including, Coke, wine/beer and produce Taste Superiority – Menu Enhancements • Fixing the fries • Custard • Beverages • Taste of the Burger • Entering Chicken Wars • Vast reduction in negative reviews. No longer the most reviewed item • Improving non-carbonated beverage in partnership with Coke • Chicken Wings already launched, with grilled chicken, late 1Q24. Defining the Portfolio: Real Estate • BFI – Franchise focus, with eye on contiguous market growth • ACFP – Finalize franchise business and explore strategic sale of select stores to experienced franchised operators with committed development agreements • Prioritization of four wall experience across both brands - (new POS at ACFP, new menus, etc) • Actively terminating unproductive franchise and company owned BFI locations where viable. Purchased two locations in Miami, at minimal costs and opening in NYC in January 2024 • Opened first ACFP franchise in Florida • New POS, expected to be in place in all 59 company- owned restaurants by 2Q24 Gold Standards: Food Innovation • Entering Chicken Wars • New Processes & Systems • Stage Gate • Focused on moving from 6% of revs to 12%-15% in Chicken. Already up 2% with wings and 1.3% for Burger Bowls World Class Marketing: Fixing Brand Reputation • Social Media • Brand Reputation/Reviews • Marketing Strategy • +4% increase in BFI NPS since August • 4.4 average 5-star online rating improvement, up from 4.15 in July 2023

Improving Labor Productivity & Food Cost Infrastructure Restricted – Do not distribute 5 Moving both brands onto Inventory Management o By January 2024, both brands had fully implemented comprehensive inventory management systems, representing a first for both. o Believe there is an opportunity to improve COG’s by several hundred bps, based on prior experience and limited existing COG’s controls. New POS in ACFP, a Path to Refranchising: o Paper tickets, no KDS and no analytics on Speed of service, limited ACFP to drive efficiency in the dining room or in the kitchen. The restaurant staff and management is very excited by the new POS, expected to be in place in all 59 company-owned restaurants by 2Q24. Representing the final step before a more comprehensive refranchising effort. o Although, the improvement in customer service from the KDS is worth it alone, we believe that once fully ramped the system should yield at least a 2%-3% in topline, driven by better attachment and faster turnaround on the restaurant floor.

Menu Enhancement Restricted – Do not distribute • New jumbo chicken wings • Burger Bowls – launch grilled chicken & new fried chicken bowls • Grilled Chicken – Sous Vide breast going in test improves quality, reduces cook time, increases menu flexibility and reduces cost. • Improved Fried Chicken Sandwich – hand breading sous vide product creates best in class fried chicken sandwich entering the Chicken Wars • Vegan Fi Sauce BurgerFi Anthony’s • New food innovation going into test: Shrimp, Steak (Italian Beef), Calzones, Stromboli, Pinwheels • New Happy Hour (Meatball Martini Night) Improve customer satisfaction through product innovation Product Innovations 6

Restaurant Footprint Optimization Master franchise in international markets – Saudi Arabia, South Korea, Japan, etc. Enter non-traditional markets – Apple Cinemas, Airports, Casinos, etc. Reopen key strategic markets – NYC & refocus unit growth of contiguous market development Launch ACFP franchise program Eliminate underperforming stores and poorly executed leases/locations Define our four-wall experience Initiatives Recent Updates Our first-ever co-branded BurgerFi and Anthony’s in Kissimmee near Orlando opened this December – America’s top tourist destination. It eliminates a veto vote with larger parties because there is something for everyone in your group. The location has the First Dual-Brand menu Boards and sit-down service providing the guest with what they want. Guests are looking for better experiences which means we need to go where the guest is in life. We have started a partnership with Apple Cinemas and opening our first in-line BurgerFi in a premier movie theater. We will provide in-theater services and full-service capabilities outside the theater environment through popular delivery platforms such as Uber Eats, DoorDash, and GrubHub, ensuring accessibility and convenience. Once again establishing we are going where the guest is going in their everyday life. BurgerFi NYC Better Burger Lab Grand reopening of our flagship including new Better Burger Lab which is an exciting innovation and will offer an exclusive line up of limited-edition offers not available at our other locations. 2 Restricted – Do not distribute 7

Restaurant Footprint Optimization Define our four-wall experience 2 Orlando Dual Brand Apple Cinema NYC 8

Restaurant Footprint Optimization (Cont’d) Improve overall portfolio quality by prioritizing highest impact locations • To identify the locations with the greatest opportunity for improvement, we conducted a strategic assessment of BurgerFi’s portfolio and segmented each restaurant location into four performance buckets based on the correlation between online ratings and comp sales growth • Our assessment validated the high correlation between guest ratings and financial performance, with locations above a 4- star rating generating +13.6% average comp sales growth versus -9.5% comp sales for those below Restricted – Do not distribute 9 Top Performing (23) (High Star Ratings & Comp Sales) Bottom Performing (25) (Lowest Star Ratings & Comp Sales) Underperforming (9) (Average Star Ratings & Lower Comp Sales) Growth at Risk (7) (Lower Average Star Ratings & High Comp Sales)

On-The-Go InnovationLabs New Flavors New Experiences - Co-Branded openings Technology Menu Variety Restricted – Do not distribute 12Gold Standard - New Innovative Developments 10

Strategic Social Media Presence Enhanced Marketing Campaigns Improved Brand Marketing Strategy Drive Brand Awareness and Loyalty Restricted – Do not distribute *End of Q3 Improving Guest Review Scores Grow Loyalty & Mobile App Base Increasing Q4 Gift Card Sales Social media engagement rate continues to improve, with 60% net positive sentiment at BFI and 56% at ACFP* New media agency with 2024 media planning Q3 Total: 3,563,001,503 PR Impressions and $82,386,055 in Publicity Value for both ACFP & BFI brands +4% increase in our BFI NPS (net promoter score) since August 2023 driven by enhanced marketing strategy. These early indicators are signs that the marketing strategy is working and cultural events along with improved creative and improved social content is working "punching above our weight“ 5-star online reviews have increased from 4.2 to 4.4 since July 2023 2023 YTD loyalty registrations have improved by 10% for ACFP and BFI app downloads by 15%: − ACFP 19.7k (since July launch) – we have seen 90% growth since month of launch − BFI 127.6k (previous 12m) – 5% increase in 3Q23 v. 2Q23 Anthony's record gift card sales for the month of November surpassed total 2022 holiday gift card sales( $1.15MM) Enhanced marketing strategy has been resonating with our customers Initiatives Recent Updates 11

Why BFI ? – A Compelling Turnaround Opportunity 12 Improved Topline and comp store sales, driven by: o New unit franchise growth at both BurgerFi and Anthony’s o Enhanced product offering at both brands, to expand customer awareness and frequency o Better pricing matrix at both concepts Refranchising of Anthony’s & BurgerFi locations to improve liquidity and accelerate unit growth: o FDD already complete for ACFP, with new POS at ACFP and improved industry multiples the only thing holding us back. First franchise location opened in Orlando, in late 2023 o Focus BF refranchise on established and experienced operators and primary MSA markets (NYC, Miami, Orlando..) Improved Cost of Goods performance to drive margins: o Both brands have fully implemented inventory management systems. Believe there is an opportunity to improve COG’s by several hundred bps. See this yielding continued improvement for several years, with significant operating leverage opportunity once we return to positive same store sales, as early as 2024. New POS in ACFP to drive topline and productivity: o Although the improvement in customer service from the KDS is worth it alone, we believe that once fully ramped the system should yield a minimum 2%-3% in topline, driven by better attachment and faster turnaround on the restaurant floor. Continued focus on aggressively managing Corp G&A dollars and restaurant labor margin % o Believe BFI is poised for a considerable improvement in overall profitability as the company starts to return to positive topline line trends Restricted – Do not distribute

OUR MANAGEMENT TEAM 13 John Iannucci Chief Operating Officer Debbie Allison SVP Supply Chain Michelle Zavolta Chief People Officer Karl Goodhew Chief Technology Officer Cindy Syracuse Chief Marketing Officer Chris Jones Chief Financial Officer Carl Bachmann Chief Executive Officer Richard Cohn Interim GC

14 Corporate Overview Anthony‘s Coal Fired Pizza & Wings The 900 Degree Difference o Streamlined menu offering signature “well-done” pizza that can’t be replicated, plus coal fired chicken wings, homemade meatballs and handcrafted sandwiches & salads o No freezers, fryers or microwaves – coal fired ovens in every restaurant give the food its signature flavor o Proprietary recipes are fresh & made-to-order using high-quality, purposefully- sourced ingredients: Imported tomatoes and olive oil from Italy Winona mozzarella Homemade pizza dough Fresh, never frozen jumbo chicken wings BurgerFi Location Anthony’s Location BurgerFi & Anthony’s Location (1) As of 1/1/2024 Anthony‘s Locations 108 BurgerFi Locations 60 Total168 Locations(1) BurgerFi Award-Winning, Fast Casual “Better Burger” Concept o Chef-founded and committed to serving fresh, all-natural and quality food o 100% American Angus Beef with no steroids, antibiotics, growth hormones, chemicals or additives o High-quality wagyu beef, antibiotic and cage-free chicken offerings, hand-cut sides, custard shakes, draft beer and more o Modern, eco-friendly restaurants served by passionate team members o Concentrated along Eastern Seaboard

More than 20 years after our first restaurant opened, we’re still a favorite with guests. Here are just a few of our recent accolades and awards: W E L L - D O N E & W E L L - L O V E D . - 2022 The Absolute Best Wings in the U.S. (Mashed) - America's Favorite Restaurant Chains of 2022 (Newsweek) - 2021 Readers' Choice for both Best Chicken Wings Spot and Best Pizza Spot (Boca Observer) - #3 Best Major Pizza Chain of 2021 (Mashed) - 2021 Readers’ Pick for Best New Restaurant (Bethesda Magazine) - The Best Pizza Chain in America (USA Today's Great American Bites ) - Best Pizza (Miami Herald, Miami.com, Palm Beach Post & WFLA's iHeart Tampa Bay) Restricted – Do not distribute

Restricted – Do not distribute Start Spreading the News

OUR BOARD OF DIRECTORS Vivian Lopez-Blanco Andrew C. Taub Allison GreenfieldOphir Sternberg Executive Chairman Gregory Mann David Heidecorn Founder & CEO Lionheart Capital , Co-owner Cigarette Racing Team, Executive Chairman BurgerFi Nasdaq: BFI, Chairman Security Matters Nasdaq ,SMX Board of Directors LifeWallet Nasdaq: LIFW Entrepreneurial Executive | Board of Directors Board And Management Advisory Services Managing Partner at LCatterton Partner and Chief Risk Officer at L Catterton Chief Development Officer at Lionheart Capital

Appendix

Classified - Confidential

21 Adjusted EBITDA Reconciliation & Key Metrics Definitions About Non-GAAP Projected Financial Measures To supplement our consolidated financial statements, which are prepared and presented in accordance with GAAP, we use the measure Adjusted EBITDA. The presentation of this financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. We use this non-GAAP financial measure for financial and operational decision-making and as a means to evaluate period-to-period comparisons. We believe that this non-GAAP financial measure provides meaningful supplemental information regarding our performance and liquidity by excluding certain items that may not be indicative of our recurring core business operating results. We believe that both management and investors benefit from referring to this non-GAAP financial measure in assessing our performance and when planning, forecasting, and analyzing future periods. This non-GAAP financial measure also facilitates management’s internal comparisons to our historical performance and liquidity as well as comparisons to our competitors’ operating results. We believe this non- GAAP financial measure is useful to investors both because (1) it allows for greater transparency with respect to key metrics used by management in its financial and operational decision-making and (2) it is used by our institutional investors and the analyst community to help them analyze the health of our business. There are a number of limitations related to the use of this non-GAAP financial measure. We compensate for these limitations by providing specific information regarding the GAAP amounts excluded from this non-GAAP financial measure and evaluating this non- GAAP financial measure together with its relevant financial measures in accordance with GAAP.A reconciliation of Adjusted EBITDA guidance is not being provided due to the nature of this forward-looking non-GAAP measure containing certain elements that are impractical to predict given their market-based nature, such as share-based compensation expense and gain and losses on change in value of warrant liabilities, without unreasonable efforts. For the same reasons, we are unable to address the probable significance of the unavailable information, nor can we accurately predict all of the components of the applicable non-GAAP financial measure and reconciling adjustments thereto; accordingly, guidance for the corresponding GAAP measure may be materially different than guidance for the non-GAAP measure. Such forward looking information is also subject to uncertainty and various risks, and there can be no assurance that any forecasted results or conditions will actually be achieved. Key Metrics Definitions • “Systemwide Restaurant Sales” is presented as informational data in order to understand the aggregation of Franchise Restaurant Sales and Corporate-Owned Restaurant Sales performance. Systemwide Restaurant Sales growth refers to the percentage change in sales at all franchised restaurants and corporate-owned restaurants in one period from the same period in the prior year. Systemwide Restaurant Same-Store Sales growth refers to the percentage change in sales at all franchised restaurants and corporate-owned restaurants after 14 months of operations. See definition below for “Same-Store Sales”. • “Corporate-Owned Restaurant Sales” represent the sales generated only by corporate-owned restaurants. Corporate-Owned Restaurant Sales growth refers to the percentage change in sales at all corporate-owned restaurants in one period from the same period in the prior year. Corporate-Owned Restaurant Same-Store Sales growth refers to the percentage change in sales at all corporate-owned restaurants after 14 months of operations. These measures highlight the performance of existing corporate-owned restaurants. • “Franchise Restaurant Sales” represent the sales generated only by franchisee-owned restaurants and are not recorded as revenue, however, the royalties based on a percentage of these franchise restaurant sales are recorded as revenue. Franchise Restaurant Sales growth refers to the percentage change in sales at all franchised restaurants in one period from the same period in the prior year. Franchise Restaurant Same-Store Sales growth refers to the percentage change in sales at all franchised restaurants after 14 months of operations. These measures highlight the performance of existing franchised restaurants. • “Same-Store Sales” is used to evaluate the performance of our store base, which excludes the impact of new stores and closed stores, in both periods under comparison. We include a restaurant in the calculation of Same-Store Sales after 14 months of operations. A restaurant which is temporarily closed, is included in the Same-Store Sales computation. A restaurant which is closed permanently, such as upon termination of the lease, or other permanent closure, is immediately removed from the Same-Store Sales computation. Our calculation of Same-Store Sales may not be comparable to others in the industry. • “Adjusted EBITDA,” a non-GAAP measure, is defined as net loss before goodwill impairment, lease termination recovery, employee retention credits, share-based compensation expense, depreciation and amortization expense, interest expense (which includes accretion on the value of preferred stock and interest accretion on the related party note), restructuring costs, merger, acquisition and integration costs, legal settlements, net of gains, store closure costs, loss (gain) on change in value of warrant liability, pre-opening costs, (gain) loss on sale of assets and income tax expense (benefit). • Unless otherwise stated, Systemwide Restaurant Sales, Systemwide Sales growth, and Same-Store Sales are presented on a systemwide basis, which means they include franchise restaurants and company-owned restaurants. Franchise restaurant sales represent sales at all franchise restaurants and are revenues to our franchisees. We do not record franchise sales as revenues; however, our royalty revenues and brand royalty revenues are calculated based on a percentage of franchise sales. • The fourth quarter and fiscal year 2023 reporting periods for BurgerFi changed to a quarter 4-4-5 calendar with a 52-53 week fiscal year ending on the Monday nearest December 31 of each year to improve the alignment of financial and business processes following the acquisition of Anthony’s. We have adjusted for differences arising from the different fiscal-period ends for the quarter and fiscal year 2023 when comparing to 2022. Restricted – Do not distribute

v3.23.4

Cover

|

Jan. 08, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 08, 2024

|

| Entity Registrant Name |

BurgerFi International, Inc.

|

| Entity File Number |

001-38417

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

82-2418815

|

| Entity Address, Address Line One |

200 West Cypress Creek Rd., Suite 220

|

| Entity Address, City or Town |

Fort Lauderdale

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33309

|

| City Area Code |

954

|

| Local Phone Number |

618-2000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001723580

|

| Common stock, par value $0.0001 per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

BFI

|

| Security Exchange Name |

NASDAQ

|

| Redeemable warrants, each exercisable for one share of common stock at an exercise price of $11.50 per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Redeemable warrants, each exercisable for one share of common stock at an exercise price of $11.50 per share

|

| Trading Symbol |

BFIIW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bfi_CommonStockParValue00001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bfi_RedeemableWarrantsEachExercisableForOneShareOfCommonStockAtAnExercisePriceOf1150PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

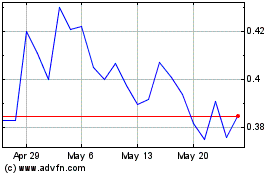

BurgerFi (NASDAQ:BFI)

Historical Stock Chart

From Apr 2024 to May 2024

BurgerFi (NASDAQ:BFI)

Historical Stock Chart

From May 2023 to May 2024