Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

01 February 2025 - 12:30AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE

13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2025

Commission File Number 001-39001

Blue

Hat Interactive Entertainment Technology

(Translation of registrant’s name into

English)

7th Floor, Building C, No. 1010 Anling Road

Huli District, Xiamen, China 361009

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F ☒

Form 40-F ☐

Blue Hat interactive Entertainment Technology, a Cayman

Islands exempted company, (the “Company”) furnishes under the cover of Form 6-K the following:

Entry into a Material Agreement

On January 27, 2025, Golden Alpha Strategy Limited

(the “Buyer”), a wholly owned subsidiary of the Company, entered into a certain tail fee payment agreement (the “Agreement”)

with Rongxin Precious Metal Technology Co., Ltd. (the “Seller”, collectively with the Buyer, the “Parties”). Pursuant

to the Agreement, the Buyer shall pay off the remaining balance of $33,876,967 in connection with that certain sales agreement dated August

28, 2024, by and between the Parties, in the form of ordinary shares of the Company, par value $0.01 per share (the “Ordinary Shares”).

In addition, the Parties mutually agreed that the

Company shall issue a total of 248,182,908 Ordinary Shares (the “Securities”) at 30% premium of the average closing price

of the Ordinary Shares in the past 30 days, which is $0.1365 per share, to the designees of the Seller (each, a “Designee”,

collectively, the “Designees”).

The foregoing description of the Agreement is not

complete and is qualified in its entirety by reference to the full text of the Agreement, a copy of which is filed herewith as Exhibit

10.1 to this Foreign Report on Form 6-K and is incorporated herein by reference.

The

Company’s Securities mentioned above, if and when issued, will not be registered under the Securities Act of 1933, as amended

(the “Securities Act”), or the securities laws of any state, and are being offered and issued in reliance on the exemption

from registration under the Securities Act afforded by Regulation S promulgated thereunder for the issuance of the shares to the person

who is a non-U.S. person as the securities are being issued to the person through an offshore transaction which was negotiated and consummated

outside the United States.

On

January 30, 2025, each of the Designees entered into a power of attorney (the “POA”) with Xiaodong Chen (“Mr. Chen”),

the chief executive officer of the Company. Pursuant to the POA, each of the Designees irrevocably authorized Mr. Chen to act as sole

and exclusive proxy to (i) attend the shareholders’ meeting of the Company; and (ii) exercise the voting rights and all the other

rights in accordance with the laws of Cayman Islands and Amended and Restated Memorandum and Articles of Association of the Company then

in effect during the term when the Designee holds the Securities.

Corporate Governance

The

Company’s corporate governance practices do not differ from those followed by domestic companies listed on the NASDAQ Capital Market

other than disclosed below, in addition to those disclosed on the annual report on Form 20-F/A filed with the Securities and Exchange

Commission on August 8, 2024.

NASDAQ

Listing Rule 5635 generally provides that shareholder approval is required of U.S. domestic companies listed on the NASDAQ Capital Market

prior to issuance (or potential issuance) of securities in connection with the acquisition of the stock or assets of another company if

the issuance (i) of the common stock has or will have upon issuance voting power equal to or in excess of 20% of the voting power outstanding

before the issuance of stock or securities convertible into or exercisable for common stock, (ii) constitutes more than 20% of the then

outstanding shares of the Company. Notwithstanding this general requirement, NASDAQ Listing Rule 5615(a)(3)(A) permits foreign private

issuers to follow their home country practice rather than these shareholder approval requirements. The Cayman Islands do not require shareholder

approval prior to any of the foregoing types of issuances. The Company, therefore, is not required to obtain such shareholder approval

prior to entering into a transaction with the potential to issue securities as described above. The Board of Directors of the Company

has elected to follow the Company’s home country rules as to such issuances and will not be required to seek shareholder approval

prior to entering into such a transaction.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: January 31, 2025

| BLUE HAT INTERACTIVE ENTERTAINMENT TECHNOLOGY |

|

| |

|

| By: |

/s/

Xiaodong Chen |

|

| |

Name: Xiaodong Chen |

|

| |

Title: Chief Executive

Officer |

|

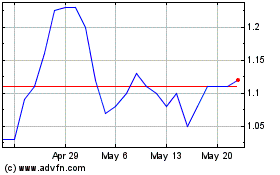

Blue Hat Interactive Ent... (NASDAQ:BHAT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Blue Hat Interactive Ent... (NASDAQ:BHAT)

Historical Stock Chart

From Feb 2024 to Feb 2025