UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. __)

__________________________________

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☒ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to § 240.14a-12

___________________________________

Allbirds, Inc.

(Exact name of registrant as specified in its charter)

___________________________________

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required.

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

Allbirds, Inc.

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD VIRTUALLY ON AUGUST 13, 2024

Dear Stockholder:

We cordially invite you to virtually attend the Special Meeting of Stockholders of Allbirds, Inc., a Delaware public benefit corporation (the “Company”). The meeting will be held on Tuesday, August 13, 2024 at 12:00 p.m. Pacific Time through a live audio-only webcast at www.virtualshareholdermeeting.com/BIRD2024SM.

We are holding the Special Meeting for the following purposes, which are more fully described in the accompanying materials:

1.To approve an amendment to our Ninth Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”) to effect a Reverse Stock Split of our outstanding shares of Class A Common Stock, par value $0.0001 per share (the “Class A Common Stock”) and Class B Common Stock, par value $0.0001 per share (the “Class B Common Stock” and together with the Class A Common Stock, the “Common Stock”), at a ratio, ranging from one-for-ten (1:10) to one-for-fifty (1:50), with the exact ratio to be set within that range at the discretion of our Board of Directors without further approval or authorization of our stockholders (the “Reverse Stock Split Proposal”); and

2.To conduct any other business properly brought before the meeting or any adjournments, continuations, or postponements thereof.

We have elected to provide Internet access to our proxy materials, which includes the proxy statement for our Special Meeting (the “Proxy Statement”) accompanying this notice, in lieu of mailing printed copies. Providing our proxy materials for the Special Meeting via the Internet reduces the costs associated with our Special Meeting and lowers our environmental impact, all without negatively affecting our stockholders’ ability to timely access our proxy materials for the Special Meeting.

On or about June 28, 2024, we expect to mail to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access the Proxy Statement. The Notice provides instructions on how to vote online and includes instructions on how to receive a paper copy of proxy materials by mail. The Proxy Statement can be accessed directly at www.proxyvote.com using the control number located on the Notice, on your proxy card, or in the instructions that accompanied your proxy materials.

Our Board of Directors has fixed June 20, 2024 as the record date for the Special Meeting and any adjournment thereof. Only stockholders of record at the close of business on June 20, 2024 are entitled to notice of and to vote during the Special Meeting or any adjournment thereof.

Your vote is important. Whether or not you plan to virtually attend the Special Meeting, please ensure that your shares are voted during the Special Meeting by promptly signing and returning a proxy card if you requested a printed set of proxy materials or by using our Internet or telephonic voting system. Even if you have voted by proxy, you may still vote online if you attend the Special Meeting. Please note, however, that if your shares are held on your behalf by a brokerage firm, bank, or other agent and you wish to vote at the Special Meeting, you may need to obtain a proxy issued in your name from that record holder. Please contact

your broker, bank, or other agent for information about specific requirements if you would like to vote your shares at the meeting.

On behalf of the Board of Directors of Allbirds, we thank you for your continued support and look forward to seeing you at the Special Meeting.

Sincerely,

| | | | | |

| |

/s/ Joe Vernachio | |

| Joe Vernachio | |

| President and Chief Executive Officer | |

| |

San Francisco, California

June 28, 2024

| | |

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting to Be Held on Tuesday, August 13, 2024 at 12:00 p.m. Pacific Time. The Proxy Statement is available at www.proxyvote.com. |

PROXY STATEMENT

SPECIAL MEETING OF STOCKHOLDERS

To Be Held On August 13, 2024

MEETING AGENDA

| | | | | | | | | | | |

| Proposals | Page | Board Recommendation |

Proposal 1 | Approval of an amendment to our Certificate of Incorporation to effect a reverse stock split | | For |

Proposal 2 | Approval of the adjournment of the special meeting, if necessary, to solicit additional proxies if there are insufficient votes at the time of the special meeting to approve the reverse stock split proposal | | For |

TABLE OF CONTENTS

| | | | | |

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS, OUR SPECIAL MEETING AND VOTING | |

PROPOSAL 1: APPROVAL OF AN AMENDMENT TO OUR CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT | |

PROPOSAL 2: APPROVAL OF THE ADJOURNMENT OF THE SPECIAL MEETING, IF NECESSARY, TO SOLICIT ADDITIONAL PROXIES IF THERE ARE INSUFFICIENT VOTES AT THE TIME OF THE SPECIAL MEETING TO APPROVE THE REVERSE STOCK SPLIT PROPOSAL | |

OTHER MATTERS | |

HOUSEHOLDING | |

STOCKHOLDER PROPOSALS | |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | |

WHERE YOU CAN FIND MORE INFORMATION | |

ANNEX A: FORM OF REVERSE STOCK SPLIT AMENDMENT | |

Allbirds, Inc.

PROXY STATEMENT FOR THE SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD VIRTUALLY ON AUGUST 13, 2024

We are providing you with these proxy materials because the Board of Directors of Allbirds, Inc. (the “Board” or the “Board of Directors”) is soliciting your proxy to vote at the special meeting of stockholders of Allbirds, Inc., a Delaware public benefit corporation (the “Company”), and any postponements, adjournments or continuations thereof (the “Special Meeting”). The Special Meeting will be held on Tuesday, August 13, 2024 at 12:00 p.m. Pacific Time through a live audio-only webcast at www.virtualshareholdermeeting.com/BIRD2024SM.

This proxy statement contains important information for you to consider when deciding how to vote on the matters for which we are soliciting proxies. Please read it carefully.

You are invited to attend the Special Meeting to vote on the proposals described in this Proxy Statement. However, you do not need to attend the Special Meeting to vote your shares. Instead you may simply follow the instructions below to submit your proxy. The proxy materials, including this Proxy Statement, are being distributed and made available on or about June 28, 2024. As used in this Proxy Statement, references to “we,” “us,” “our,” “Allbirds,” and the “Company” refer to Allbirds, Inc. and its subsidiaries.

Our Board of Directors has fixed June 20, 2024 as the record date for the Special Meeting and any adjournment thereof. Only stockholders of record at the close of business on June 20, 2024 are entitled to notice of and to vote during the Special Meeting or any adjournment thereof.

QUESTIONS AND ANSWERS

ABOUT THE PROXY MATERIALS, OUR SPECIAL MEETING AND VOTING

The information provided in the “question and answer” format below is for your convenience only and is merely a summary of the information contained in this proxy statement. You should read this entire proxy statement carefully. Information contained on, or that can be accessed through, our website is not incorporated by reference into this proxy statement and references to our website address in this proxy statement are inactive textual references only.

Why are you holding a virtual Special Meeting?

Our Special Meeting will be held solely in a virtual format, which will be conducted via a live audio-only webcast and online stockholder tools. We have created and implemented the virtual format in order to facilitate stockholder attendance and participation by enabling stockholders to participate fully and equally from any location around the world, at no cost. However, you will bear any costs associated with your internet access, such as usage charges from internet access providers and telephone companies. A virtual Special Meeting makes it possible for more stockholders (regardless of size, resources, or physical location) to have direct access to information more quickly, while saving the Company and our stockholders time and money. We also believe that the online tools we have selected will increase stockholder communication. For example, the virtual format allows stockholders to communicate with us in advance of, and during, the Special Meeting so they can ask questions of our Board of Directors or management. During the live Q&A session of the Special Meeting, we may answer questions as they come in and address those asked in advance, to the extent relevant to the business of the Special Meeting and as time permits.

Why did I receive a notice regarding the availability of proxy materials on the internet?

Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the internet. Accordingly, we have sent you a Notice of Internet Availability of Proxy Materials (the “Notice”) because our Board is soliciting your proxy to vote at the Special Meeting, including at any adjournments, continuations, or postponements of the meeting. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the internet or to request a printed copy may be found in the Notice.

We intend to mail the Notice on or about June 28, 2024 to all stockholders of record entitled to vote at the Special Meeting.

How do I attend the Special Meeting?

We will be hosting the Special Meeting only through a live audio-only webcast. You can attend the Special Meeting live online at www.virtualshareholdermeeting.com/BIRD2024SM by logging on with your control number. The Special Meeting will start at 12:00 p.m. Pacific Time, on Tuesday, August 13, 2024. Online check-in will start approximately 15 minutes before the meeting. We recommend that you log in a few minutes before the Special Meeting to ensure you are logged in when the Special Meeting begins. To access the meeting, follow the instructions you will receive in subsequent emails you receive after registration. Information on how to vote online during the Special Meeting is discussed below. You will not be able to attend the Special Meeting physically in person.

You are entitled to attend the Special Meeting if you were a stockholder as of the close of business on June 20, 2024, the record date, or hold a valid proxy for the meeting. To be admitted to the Special Meeting, you will need to visit www.virtualshareholdermeeting.com/BIRD2024SM and enter the 16-digit control number found next to the label “Control Number” on your Notice or proxy card if you requested a printed set of proxy materials. If you are a

beneficial stockholder, you should contact the bank, broker, or other institution where you hold your account well in advance of the meeting if you have questions about obtaining your control number or proxy to vote.

Whether or not you participate in the Special Meeting, it is important that you vote your shares.

What if I cannot find my control number?

Please note that if you do not have your control number and you are a registered stockholder, you will be able to login as a guest. To view the meeting webcast visit www.virtualshareholdermeeting.com/BIRD2024SM and register as a guest. If you login as a guest, you will not be able to vote your shares or ask questions during the meeting.

If you are a beneficial owner (that is, you hold your shares in an account at a bank, broker, or other holder of record), you will need to contact that bank, broker, or other holder of record to obtain your control number prior to the Special Meeting.

Where can we get technical assistance?

If you encounter any difficulties while accessing the virtual meeting during the check-in or meeting time, a technical assistance phone number will be made available on the virtual meeting registration page 15 minutes prior to the start time of the meeting.

For the Special Meeting, how do we ask questions of management and the board?

If you are a stockholder, you may submit a question in advance of the meeting at www.proxyvote.com after logging in with your control number. Questions may be submitted during the Special Meeting through www.virtualshareholdermeeting.com/BIRD2024SM. We do not intend to post questions received during the Special Meeting on our website.

To help ensure that we have a productive and efficient meeting, and in fairness to all stockholders in attendance, you will also find posted our rules of conduct for the Special Meeting when you log in prior to its start. In accordance with the rules of conduct, we ask that you limit your remarks to one brief question or comment that is relevant to the Special Meeting and that remarks are respectful of your fellow stockholders and meeting participants. Questions may be grouped by topic by management with a representative question read aloud and answered. In addition, questions may be deemed to be out of order if they are, among other things, irrelevant to the matters presented at the meeting, repetitious of statements already made, or in furtherance of the speaker’s own personal, political, or business interests. Questions will only be addressed in the Q&A portion of the Special Meeting.

Will a list of registered stockholders as of the record date be available?

For the ten days ending the day prior to the Special Meeting, a list of our registered stockholders as of close of business on the record date will be available for examination by any stockholder of record for a legally valid purpose related to the Special Meeting at our corporate headquarters during regular business hours.

When is the record date for, and who can vote at, the Special Meeting?

The record date for the Special Meeting is June 20, 2024. Only stockholders of record at the close of business on June 20, 2024 will be entitled to vote at the Special Meeting. On the record date, there were [·] shares of Class A Common Stock outstanding and [·] shares of our Class B Common Stock outstanding. Each share of Class A Common Stock is entitled to one vote on each proposal and each share of Class B Common Stock is entitled to ten votes on each proposal. Our Class A Common Stock and Class B Common Stock are collectively referred to in this proxy statement as our Common Stock.

What am I voting on?

There are two matters scheduled for a vote at the Special Meeting:

•To approve an amendment to our Certificate of Incorporation (the “Certificate of Incorporation”) to effect a Reverse Stock Split of our outstanding shares of Class A Common Stock, par value $0.0001 per share (the “Class A Common Stock”) and Class B Common Stock, par value $0.0001 per share (the “Class B Common Stock” and together with the Class A Common Stock, the “Common Stock”), at a ratio, ranging from one-for-ten (1:10) to one-for-fifty (1:50), with the exact ratio to be set within that range at the discretion of our Board of Directors without further approval or authorization of our stockholders (the “Reverse Stock Split Proposal” or “Proposal 1”); and

•To approve a proposal to adjourn the Special Meeting to a later date or dates, if necessary or appropriate, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of the Reverse Stock Split Proposal (the “Adjournment Proposal” or “Proposal 2”).

Other than these proposals, there are no other proposals that will be presented for a vote at the Special Meeting.

Why is the Company electing to effect a Reverse Stock Split?

Our Board has adopted a resolution declaring advisable, and recommending to our stockholders for their approval, an amendment to our Certificate of Incorporation authorizing a Reverse Stock Split of the outstanding shares of our Common Stock at a ratio in the range of one-for-ten (1:10) to one-for-fifty (1:50), with the exact ratio to be set within that range at the discretion of the Board (the “Reverse Stock Split”), and granting the Board the discretion to file a Certificate of Amendment (the “Certificate of Amendment”) to our Certificate of Incorporation with the Secretary of State of the State of Delaware effecting the Reverse Stock Split. The primary goal of the Reverse Stock Split is to increase the per share market price of our Class A Common Stock to meet the minimum closing bid price criteria for continued listing on the Nasdaq Global Select Market (“Nasdaq”).

The form of the proposed Certificate of Amendment is attached to this proxy statement as Annex A. The Reverse Stock Split will be effected by reducing the number of outstanding shares of Common Stock as compared to the number of outstanding shares immediately prior to the effectiveness of the Reverse Stock Split, but will not change the par value of Common Stock, and will not change the number of authorized shares of our capital stock. Stockholders are urged to carefully read Annex A. If implemented, the number of shares of our Common Stock owned by each of our stockholders will be reduced by the same proportion as the reduction in the total number of shares of our Common Stock outstanding, so that the percentage of our outstanding Common Stock owned by each of our stockholders will remain approximately the same, except to the extent that the Reverse Stock Split could result in some or all of our stockholders receiving one share of Common Stock in lieu of a fractional share.

How does the Board of Directors recommend that I vote on these proposals?

The Board recommends a vote:

•“FOR” the approval of an amendment to our Charter to effect a Reverse Stock Split of our outstanding shares of Class A Common Stock and Class B Common Stock, at a ratio, ranging from one-for-ten (1:10) to one-for-fifty (1:50), with the exact ratio to be set within that range at the discretion of our Board of Directors without further approval or authorization of our stockholders; and

•“FOR” the approval of a proposal to adjourn the Special Meeting to a later date or dates, if necessary or appropriate, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of the Reverse Stock Split Proposal.

What if another matter is properly brought before the meeting?

The Board knows of no other matters that will be presented for consideration at the Special Meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

How do I vote?

For each of the Reverse Stock Split Proposal and Adjournment Proposal, you may vote “For” or “Against” or abstain from voting.

The procedures for voting depend on whether your shares are registered in your name or are held by a bank, broker, or nominee:

Stockholder of Record: Shares Registered in Your Name

If on June 20, 2024, your shares were registered directly in your name with Allbirds’ transfer agent, Computershare, then you are a stockholder of record. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote at the meeting even if you have already voted by proxy. If you are a stockholder of record, you may vote by following the procedures below:

•To vote during the Special Meeting, if you are a stockholder of record as of the record date, follow the instructions at www.virtualshareholdermeeting.com/BIRD2024SM. You will need to enter the 16-digit control number found on your Notice, or proxy card if you requested a printed set of proxy materials.

•To vote prior to the Special Meeting (until 11:59 p.m. Eastern Time on August 12, 2024), you may vote via the Internet at www.proxyvote.com; by telephone; or by completing and returning the proxy card if you requested a printed set of proxy materials, as described below.

•To vote using the proxy card, simply complete, sign, and date the proxy card that may be delivered and return it promptly in the envelope provided. If you return your signed proxy card to us before the Special Meeting, we will vote your shares as you direct.

•To vote over the telephone, dial toll-free 1-800-690-6903 using a touch-tone phone and follow the recorded instructions. You will be asked to provide your control number from the Notice. Your telephone vote must be received by 11:59 p.m. Eastern Time on August 12, 2024 to be counted.

•To vote through the internet prior to the meeting, go to www.proxyvote.com and follow the instructions to submit your vote on an electronic proxy card. You will be asked to provide your control number from the Notice. Your internet vote must be received by 11:59 p.m. Eastern Time on August 12, 2024 to be counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If on June 20, 2024, your shares were held not in your name but rather in an account at a brokerage firm, bank, or other similar organization, then you are the beneficial owner of shares held in “street name” and you should have received a Notice containing voting instructions from that organization rather than from Allbirds. Follow the instructions from your broker, bank, or other agent included with the Notice or contact your broker, bank, or other agent regarding how to vote the shares in your account.

Internet proxy voting will be provided to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your internet access, such as usage charges from internet access providers and telephone companies.

How many votes do I have?

Each holder of shares of our Class A Common Stock will have one vote per share of Class A Common Stock held as of June 20, 2024, and each holder of shares of our Class B Common Stock will have ten votes per share of Class B Common Stock held as of June 20, 2024. The holders of the shares of our Class A Common Stock and Class B Common Stock will vote on all matters described in this proxy statement for which your vote is being solicited.

If I am a stockholder of record and I do not vote, or if I return a proxy card or otherwise vote without giving specific voting instructions, what happens?

If you are a stockholder of record and do not vote via the internet at www.proxyvote.com, by telephone, by completing your proxy card if you requested a printed set of materials, or virtually during the Special Meeting, your shares will not be voted.

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted “For” the Reverse Stock Split Proposal and “For” the Adjournment Proposal. If any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

If I am a beneficial owner of shares held in street name and I do not provide my broker, bank, or other agent with voting instructions, what happens?

If you are a beneficial owner of shares held in street name and you do not instruct your broker, bank, or other agent how to vote your shares, your broker, bank, or other agent may still be able to vote your shares in its discretion. In this regard, under stock exchange rules, brokers, banks, and other securities intermediaries may use their discretion to vote your “uninstructed” shares with respect to matters considered to be “routine” under such rules, but not with respect to “non-routine” matters.

Each of the Reverse Stock Split Proposal and Adjournment Proposal is considered to be “routine” under stock exchange rules, and we therefore do not expect broker non-votes on either of these proposals.

If you are a beneficial owner of shares held in street name and you do not plan to attend the meeting, in order to ensure your shares are voted in the way you would prefer, you must provide voting instructions to your broker, bank, or other agent by the deadline provided in the materials you receive from your broker, bank, or other agent.

What are abstentions?

Under Delaware law, an “abstain” vote is counted as present for the purposes of determining whether a quorum exists but is not considered a vote cast either for or against a proposal.

Abstentions will have the same effect as votes against the Reverse Stock Split Proposal and will not have any effect on the Adjournment Proposal.

What are “broker non-votes”?

A “broker non-vote” occurs when your broker submits a proxy for the meeting with respect to “routine” matters but does not vote on “non-routine” matters because you did not provide voting instructions on these matters. These un-voted shares with respect to the “non-routine” matters are counted as “broker non-votes.”

Each of the Reverse Stock Split Proposal and Adjournment Proposal is considered to be “routine” under stock exchange rules, and we therefore do not expect broker non-votes on either of these proposals.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will count, with respect to each of the Reverse Stock Proposal and Adjournment Proposal, votes “For” and “Against” and abstentions. Abstentions will have the same effect as votes against the Reverse Stock Split Proposal and will not have any effect on the Adjournment Proposal.

How many votes are needed to approve the proposals?

•Reverse Stock Split Proposal: The approval of the Reverse Stock Split Proposal requires the affirmative vote of the holders of a majority of the voting power of all outstanding Common Stock entitled to vote on the proposal. Abstentions will have the same effect as votes against the Reverse Stock Split Proposal. Brokerage firms have authority to vote shares held in street name on the Reverse Stock Split Proposal, without instructions from beneficial owners, and as a result, we do not expect there will be any broker non-votes on this matter.

•Adjournment Proposal: The approval of the Adjournment Proposal requires the affirmative vote of the holders of a majority of the voting power of the shares of Common Stock present virtually or represented by proxy and voting affirmatively or negatively (excluding abstentions and broker non-votes) on the matter. Abstentions will have no effect on the Adjournment Proposal. Brokerage firms have authority to vote shares held in street name on the Adjournment Proposal, without instructions from beneficial owners, and as a result, we do not expect there will be any broker non-votes on this matter.

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the final vote at the meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

•You may submit another properly completed proxy card with a later date.

•You may grant a subsequent proxy by telephone or through the internet.

•You may send a timely written notice that you are revoking your proxy to Allbirds’ Secretary at 30 Hotaling Place, San Francisco, CA 94111.

•You may attend the Special Meeting and vote online. Simply attending the meeting will not, by itself, revoke your proxy.

Your most current proxy card or telephone or internet proxy is the one that is counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held by your broker, bank, or other agent, you should follow the instructions provided by your broker, bank, or other agent.

What does it mean if I receive more than one Notice?

If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on the Notices to ensure that all of your shares are voted.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the voting power of all issued and outstanding shares entitled to vote at the meeting are present at the meeting or represented by proxy.

Abstentions, withhold votes, and broker non-votes, if any, will be counted for purposes of determining whether a quorum is present for the transaction of business at the Special Meeting. If there is no quorum, the holders of a majority of shares present at the meeting or represented by proxy may adjourn the meeting to another date.

How can I find out the results of the voting at the Special Meeting?

Preliminary voting results will be announced at the Special Meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the Special Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We will also reimburse brokerage firms, banks, and other agents for the cost of forwarding proxy materials to beneficial owners.

PROPOSAL NO. 1

APPROVAL OF AN AMENDMENT TO OUR CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT

At the Special Meeting, stockholders are being asked to approve an amendment to our Certificate of Incorporation to effect a Reverse Stock Split of our outstanding shares of Class A Common Stock and Class B Common Stock at a ratio ranging from one-for-ten (1:10) to one-for-fifty (1:50), with the exact ratio to be set within that range at the discretion of our Board of Directors without further approval or authorization of our stockholders, which we refer to as the Reverse Stock Split.

Pursuant to the Delaware law, our Board of Directors must adopt any amendment to our Certificate of Incorporation and submit the amendment to stockholders for their approval. The form of the proposed Certificate of Amendment, which would be filed with the Secretary of State of the State of Delaware, is attached to this Proxy Statement as Annex A.

By approving this proposal, stockholders will approve alternative amendments to our Certificate of Incorporation pursuant to which a whole number of outstanding shares of each of Class A Common Stock and Class B Common Stock, between 10 and 50, would be combined into one share of Class A Common Stock and Class B Common Stock, as applicable. Upon receiving stockholder approval, our Board of Directors will have the authority, but not the obligation, in its sole discretion, to elect, without further action on the part of our stockholders, whether to effect the Reverse Stock Split and, if so, to determine the ratio for the Reverse Stock Split from among the approved range described above and to effect the Reverse Stock Split by filing the Certificate of Amendment with the Secretary of State of the State of Delaware. We believe that enabling our Board of Directors to fix the specific ratio of the Reverse Stock Split within the stated range will provide us with the flexibility to implement the Reverse Stock Split in a manner designed to maximize the anticipated benefits for the Company and our stockholders. Even if our stockholders approve this proposal, our Board of Directors may also elect not to effect any Reverse Stock Split. See “Board Discretion to Implement the Reverse Stock Split.”

Our Board of Directors has unanimously approved and declared advisable the proposed amendment to our Certificate of Incorporation to effect the Reverse Stock Split, and recommends that our stockholders adopt and approve the Certificate of Amendment. However, our Board of Directors’ decision as to whether and when to effect the Reverse Stock Split will be based on a number of factors, including our ability to maintain compliance with the minimum price criteria of Nasdaq; the historical trading price and trading volume of our Class A Common Stock; the number of shares of Class A Common Stock outstanding immediately before and after the Reverse Stock Split; the then-prevailing trading price and trading volume of our Class A Common Stock and the anticipated impact of the Reverse Stock Split on the trading price and trading volume of our Class A Common Stock; the anticipated impact of a particular ratio on the number of holders of our Class A Common Stock; business developments affecting us; and prevailing general market conditions. Although our stockholders may approve this proposal, we will not effect the Reverse Stock Split if our Board of Directors does not deem it to be in the Company and our stockholders’ best interests. See “Board Discretion to Implement the Reverse Stock Split.”

The Reverse Stock Split will not change the number of authorized shares of Class A Common Stock or Class B Common Stock or the relative voting power of holders of our Class A Common Stock or Class B Common Stock. Therefore, the Reverse Stock Split would result in a relative increase in the number of authorized but unissued shares of Common Stock. See “Principal Effects of the Reverse Stock Split-Relative Increase in the Number of Authorized Shares of Common Stock for Issuance.”

The Reverse Stock Split will also not change the par value of shares of Class A Common Stock or Class B Common Stock.

Reasons for the Reverse Stock Split

On June 13, 2024, our Board of Directors approved the proposed amendment to our Certificate of Incorporation to effect the Reverse Stock Split. Our Board of Directors believes that effecting the Reverse Stock Split could be an effective means of regaining compliance with the minimum price criteria for continued listing of our Class A Common Stock on Nasdaq and of achieving a higher stock price.

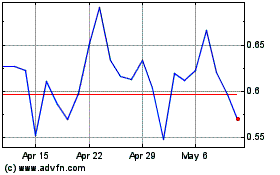

Nasdaq’s continued listing minimum closing bid price criteria (“minimum price criteria”) requires listed companies to maintain an average closing share price of at least $1.00 over a consecutive 30-trading-day period. On April 2, 2024, we received a notice from Nasdaq that we were not in compliance with the minimum price criteria. We have a period of 180 calendar days from receipt of the notice to regain compliance with the minimum price criteria. To regain compliance, the closing bid price of the Company's Class A Common Stock must meet or exceed $1.00 per share for a minimum of 10 consecutive business days during this 180-calendar day compliance period.

The notice had no immediate impact on the listing of our Class A Common Stock, which will remain listed and traded on Nasdaq during the cure period, subject to our compliance with other continued listing requirements. Given the inherent uncertainty of general economic, market and industry conditions, our Board of Directors believes that the Reverse Stock Split is an effective method for us to regain compliance with the minimum price criteria.

Continued listing on Nasdaq has the potential to maintain overall credibility to an investment in our stock, given Nasdaq’s stringent listing and disclosure requirements. Notably, some trading firms discourage investors from investing in lower-priced stocks that are traded in the over-the-counter market because they are not held to the same stringent standards as stocks listed on a national securities exchange, such as Nasdaq. In addition, continued listing on Nasdaq could maintain visibility of our stock among a larger pool of potential investors and could result in higher trading volumes, which could also help facilitate potential financings and business development opportunities.

A higher stock price, which may be achieved through a Reverse Stock Split, could encourage investor interest and improve the marketability of our Class A Common Stock to a broader range of investors and thus enhance liquidity of our Class A Common Stock. Because of the trading volatility often associated with low-priced stocks, many brokerage firms and institutional investors have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. Additionally, investors may be dissuaded from purchasing low-priced stocks because the brokerage commissions, as a percentage of the total transaction, tend to be higher for such stocks. A higher stock price could allow a broader range of institutions to invest in our Class A Common Stock and could help attract, retain and motivate employees, as such employees receive part of their compensation as stock-based compensation.

In light of the above reasons, our Board of Directors approved the proposed amendment to our Certificate of Incorporation to effect the Reverse Stock Split and determined that such Certificate of Amendment is in our and our stockholders’ best interests.

Board Discretion to Implement the Reverse Stock Split

Our Board of Directors believes that stockholder approval of a range of ratios, as opposed to a single Reverse Stock Split ratio, is in our and our stockholders’ best interests because it is not possible to predict market conditions at the time that the Reverse Stock Split would be effected. We believe that a range of Reverse Stock Split ratios provides us with the most flexibility to achieve the desired results of the Reverse Stock Split. The Reverse Stock Split ratio to be selected by our Board of Directors will be a whole number in a range of one-for-ten (1:10) to one-for-fifty (1:50). The Board of Directors also has the authority to abandon the Reverse Stock Split entirely.

In determining the Reverse Stock Split ratio and whether and when to effect the Reverse Stock Split following the receipt of stockholder approval, our Board of Directors may consider a number of factors, including, without limitation:

•our ability to maintain compliance with the minimum price criteria of Nasdaq;

•the historical trading price and trading volume of our Class A Common Stock;

•the number of shares of Class A Common Stock outstanding immediately before and after the Reverse Stock Split;

•the then-prevailing trading price and trading volume of our Class A Common Stock and the anticipated impact of the Reverse Stock Split on the trading price and trading volume of our Class A Common Stock;

•the anticipated impact of a particular ratio on the number of holders of our Class A Common Stock;

•business developments affecting us; and

•prevailing general market conditions.

Risks Associated with the Reverse Stock Split

The Reverse Stock Split may not increase our stock price.

The effect of the Reverse Stock Split, if any, upon the market price of our Class A Common Stock cannot be accurately predicted. In particular, there can be no assurance that the price for a share of Class A Common Stock after the Reverse Stock Split will increase in proportion to the reduction in the number of shares of Class A Common Stock outstanding immediately prior to the Reverse Stock Split. Furthermore, even if the market price of our Class A Common Stock does rise following the Reverse Stock Split, there can be no assurance that the market price of our Class A Common Stock immediately after the Reverse Stock Split will be maintained for any period of time. Even if an increased per-share price can be maintained, the Reverse Stock Split may not achieve the desired results that have been outlined above. Moreover, because some investors may view the Reverse Stock Split negatively, the Reverse Stock Split may adversely impact the market price of our Class A Common Stock.

Further, as noted above, the principal purpose of the Reverse Stock Split is to increase the trading price of our Class A Common Stock to meet the minimum stock price standards of Nasdaq. However, the effect of the Reverse Stock Split on the market price of our Class A Common Stock cannot be predicted with any certainty, and we cannot assure you that the Reverse Stock Split will accomplish this objective for any meaningful period of time, or at all.

The market price of our Class A Common Stock will also be based on our performance and other factors, some of which are unrelated to the Reverse Stock Split or the number of shares outstanding. If the Reverse Stock Split is effected and the market price of our Class A Common Stock declines, the percentage decline as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the absence of a Reverse Stock Split. The total market capitalization of our Class A Common Stock after implementation of the Reverse Stock Split, when and if implemented, may also be lower than the total market capitalization before the Reverse Stock Split.

The Reverse Stock Split may lead to a decrease in our overall market capitalization.

The Reverse Stock Split may be viewed negatively by the market and, consequently, could lead to a decrease in our overall market capitalization. If the per share market price of our Class A Common Stock does not increase in proportion to the Reverse Stock Split ratio, or following such increase does not maintain or exceed such price, then the value of our Company, as measured by our market capitalization, will be reduced. Additionally, any reduction in our market capitalization may be magnified as a result of the smaller number of total shares of Common Stock outstanding following the Reverse Stock Split.

The Reverse Stock Split may decrease the liquidity of our Class A Common Stock.

The Board believes that the Reverse Stock Split may result in an increase in the market price of our Class A Common Stock, which could lead to increased interest in our Class A Common Stock and possibly promote greater liquidity for our stockholders. However, the Reverse Stock Split will also reduce the total number of outstanding shares of Common Stock, which may lead to reduced trading and a smaller number of market makers for our

Class A Common Stock, particularly if the price per share of our Class A Common Stock does not increase as a result of the Reverse Stock Split.

The Reverse Stock Split may result in higher transaction costs for transactions in our Class A Common Stock.

If the Reverse Stock Split is implemented, it will increase the number of stockholders who own “odd lots” of fewer than 100 shares of Class A Common Stock. Brokerage commissions and other costs of transactions in odd lots are generally higher than the costs of transactions of more than 100 shares. Therefore, stockholders who own fewer than 100 shares following the Reverse Stock Split may be required to pay higher transaction costs should they then determine to sell their shares.

Principal Effects of the Reverse Stock Split

General

If the Reverse Stock Split is approved by our stockholders and implemented by our Board of Directors, each holder of our Class A Common Stock and Class B Common Stock outstanding immediately prior to the Effective Time (as defined below) will own a reduced number of shares of Class A Common Stock or Class B Common Stock, as applicable, upon the Effective Time. The Reverse Stock Split will be effected simultaneously for all issued and outstanding shares of Class A Common Stock and Class B Common Stock, and the Reverse Stock Split ratio will be the same for all issued and outstanding shares of Class A Common Stock and Class B Common Stock. The Reverse Stock Split will affect all of our stockholders uniformly and will not affect any stockholder’s percentage ownership interests in the Company, except to the extent that the Reverse Stock Split results in any of our stockholders owning a fractional share that is paid out in cash. See “Fractional Shares.” The Reverse Stock Split will not affect the voting or other rights of our Class A Common Stock or Class B Common Stock. Common Stock issued pursuant to the Reverse Stock Split will remain fully paid and non-assessable.

Effects on Shares of Common Stock

The following table contains information as of June 20, 2024, relating to our Common Stock based on the proposed Reverse Stock Split ratios assuming that the proposal is approved and the Reverse Stock Split is implemented. The following table does not give effect to the treatment of fractional shares following the Reverse Stock Split and does not give effect to any other changes, including any issuance of securities, after June 20, 2024.

| | | | | | | | | | | | | | | | | | | | | | | |

| Class A Common Stock |

| | Number of shares before the Reverse Stock Split | | 1-for-10 | | 1-for-30 | | 1-for-50 |

| Authorized | [·] | | [·] | | [·] | | [·] |

| Issued and Outstanding | [·] | | [·] | | [·] | | [·] |

| Issuable under Outstanding Stock Options | [·] | | [·] | | [·] | | [·] |

| Issuable under Outstanding RSUs and PSUs | [·] | | [·] | | [·] | | [·] |

Reserved for Issuance (1) | [·] | | [·] | | [·] | | [·] |

Authorized but Unissued (2) | [·] | | [·] | | [·] | | [·] |

| Class B Common Stock |

| | Number of shares before the Reverse Stock Split | | 1-for-10 | | 1-for-30 | | 1-for-50 |

| Authorized | [·] | | [·] | | [·] | | [·] |

| Issued and Outstanding | [·] | | [·] | | [·] | | [·] |

| Issuable under Outstanding Stock Options | [·] | | [·] | | [·] | | [·] |

| Issuable under Outstanding RSUs and PSUs | [·] | | [·] | | [·] | | [·] |

Reserved for Issuance (1) | [·] | | [·] | | [·] | | [·] |

Authorized but Unissued (2) | [·] | | [·] | | [·] | | [·] |

(1) Shares reserved for future issuance under the Company’s existing equity incentive plans, excluding shares issuable under outstanding stock options, outstanding restricted stock units and outstanding performance stock units.

(2) Shares authorized but unissued represent Class A Common Stock or Class B Common Stock, as applicable, available for future issuance beyond shares outstanding as of June 20, 2024 and shares issuable under outstanding stock options, outstanding restricted stock units and outstanding performance stock units.

Effects on Outstanding Equity Awards and Equity Plans

The Company maintains the 2021 Equity Incentive Plan (the “2021 Plan”) and the 2021 Employee Stock Purchase Plan (the “2021 ESPP” and together with the 2021 Plan, the “Equity Plans”).

In the event of a Reverse Stock Split, the Compensation Committee of our Board of Directors, in order to prevent diminution or enlargement of the benefits or potential benefits intended to be made available under each of the Equity Plans, will make equitable adjustments, as applicable, and in each case in accordance with Sections 409A, 423 and 424 of the Code, as applicable, to (i) the aggregate number of shares of Common Stock that may be delivered under each Equity Plan, (ii) the number, class and exercise or purchase price of shares of Common Stock covered by each outstanding award or purchase right under each Equity Plan and (iii) the terms and conditions of any outstanding awards or purchase rights under each Equity Plan. Accordingly, if the Reverse Stock Split is effected, the number of shares available for future issuance under each of the Equity Plans, as well as the number of shares subject to any outstanding award or purchase right under each of the Equity Plans, and the exercise or purchase price and other terms relating to any such award or purchase right outstanding under each of the Equity Plans, are expected to be proportionately adjusted by the Compensation Committee to reflect the Reverse Stock Split.

In addition, pursuant to its administrative authority under the Equity Plans, the Compensation Committee will effect any other changes necessary, desirable or appropriate to give effect to the Reverse Stock Split.

Relative Increase in Number of Authorized Shares of Stock

The Reverse Stock Split will not affect the number of authorized shares or the par value of our capital stock, which will remain at 2,000,000,000 shares of Class A Common Stock, 200,000,000 shares of Class B Common Stock, and 20,000,000 shares of preferred stock (collectively, “capital stock”). Although the number of authorized shares of capital stock will not change as a result of the Reverse Stock Split, the number of shares of Class A Common Stock and Class B Common Stock issued and outstanding will be reduced in proportion to the ratio selected by our Board of Directors. Thus, the Reverse Stock Split will effectively increase the number of authorized and unissued shares of Class A Common Stock and Class B Common Stock available for future issuance by the amount of the reduction effected by the Reverse Stock Split. The purpose of the relative increase in the amount of authorized and unissued shares of Class A Common Stock and Class B Common Stock is to allow for the ability to issue additional shares in connection with future financings, employee and director benefit programs and other desirable corporate activities without requiring our stockholders to approve an increase in the authorized number of shares of Common Stock each time any such an action is contemplated. If a Reverse Stock Split is implemented, all or any of the authorized and unissued shares of Class A Common Stock and Class B Common Stock may be issued in the future for such corporate purposes and such consideration as our Board of Directors deems advisable from time to time, subject to any limitations in our Certificate of Incorporation, without further action by our stockholders and without first offering such shares to our stockholders. Except pursuant to the Equity Plans, we presently have no plan, commitment, arrangement, understanding or agreement regarding the issuance of capital stock. However, we regularly consider our capital requirements and business development opportunities and may conduct equity offerings and pursue strategic opportunities in the future.

Because our stockholders have no preemptive rights to purchase or subscribe for any of our unissued Common Stock, the future issuance of additional shares of Common Stock will reduce our current stockholders’ percentage ownership interest in the total outstanding shares of Common Stock. In the absence of a proportionate increase in our future earnings and book value, an increase in the number of outstanding shares of Common Stock would dilute our projected future earnings per share, if any, and book value per share of all our outstanding shares of Common Stock. If these factors were reflected in the market price of our Class A Common Stock, the potential realizable value of a stockholder’s investment could be adversely affected. An issuance of additional shares could therefore have an adverse effect on the potential realizable value of a stockholder’s investment.

Effects on Exchange Act Obligations

The Reverse Stock Split will not affect the Company continuing to be subject to the periodic reporting requirements of the Exchange Act.

Effects on Par Value

The Reverse Stock Split will not affect the par value of our Common Stock, which will remain at $0.0001 per share.

Effects on CUSIP

After the Effective Time, our Class A Common Stock would have a new CUSIP number.

Procedure for Effecting the Reverse Stock Split

Effective Time

If the Reverse Stock Split proposal is approved by our stockholders and our Board of Directors determines to effect the Reverse Stock Split, the Reverse Stock Split will become effective at 5:00 p.m. Eastern time, on the date of effectiveness stated in the Certificate of Amendment filed with the Secretary of State of the State of Delaware (the “Effective Time”). At the Effective Time, shares of Common Stock issued and outstanding immediately prior thereto will be combined, automatically and without any action on the part of our stockholders, into new shares of Common Stock in accordance with the Reverse Stock Split ratio contained in the Certificate of Amendment.

Stockholders of Record

As soon as practicable after the Effective Time, stockholders of record will be notified by our transfer agent that the Reverse Stock Split has been effected. If you hold shares of Common Stock in book-entry form, you will not need to take any action to receive post-Reverse Stock Split shares of our Common Stock. As soon as practicable after the Effective Time, the Company’s transfer agent will send to your registered address a transmittal letter along with a statement of ownership indicating the number of post-Reverse Stock Split shares of Common Stock you hold. In addition, if you are entitled to a payment of cash in lieu of fractional shares, a check will be mailed to you at your registered address as soon as practicable after the Effective Time. As of the date of this Proxy Statement, none of our shares of Common Stock were held in certificated form. In the event any stockholders of record at the Effective Time hold shares of Common Stock in certificated form, they will be sent a transmittal letter by the Company’s transfer agent after the Effective Time that will contain the necessary materials and instructions on how a stockholder should surrender his, her or its certificates representing shares of Common Stock to the Company’s transfer agent.

Beneficial Owners

At the Effective Time, we intend to treat stockholders holding shares of Common Stock in “street name” (that is, through a broker, bank or other holder of record) in the same manner as registered stockholders whose shares of Common Stock are registered in their names. Brokers, banks or other holders of record will be instructed to effect the Reverse Stock Split for their beneficial holders holding shares of Common Stock in “street name”; however, these brokers, banks or other holders of record may apply their own specific procedures for processing the Reverse Stock Split. If you hold your shares of Common Stock with a broker, bank or other holder of record, and you have any questions in this regard, we encourage you to contact your holder of record.

Fractional Shares

No scrip or warrants or fractional shares would be issued if, as a result of the Reverse Stock Split, a stockholder would otherwise become entitled to a fractional share. Instead, each stockholder will be entitled to receive a cash

payment equal to the fraction of which such stockholder would otherwise be entitled multiplied by the closing price per share of Class A Common Stock on the date of the Effective Time as reported by Nasdaq (as adjusted to give effect to the Reverse Stock Split). No transaction costs would be assessed to stockholders for the cash payment. Stockholders would not be entitled to receive interest for their fractional shares for the period of time between the Effective Time and the date payment is received.

After the Effective Time, then-current stockholders would have no further interest in our Company with respect to their fractional shares. A person entitled to a fractional share would not have any voting, dividend or other rights in respect of their fractional share except to receive the cash payment as described above. Such cash payments would reduce the number of post-Reverse Stock Split stockholders to the extent that there are stockholders holding fewer than that number of pre-Reverse Stock Split shares within the Reverse Stock Split ratio that is determined by us as described above. Reducing the number of post-Reverse Stock Split stockholders, however, is not the purpose of this proposal.

Stockholders should be aware that, under the escheat laws of the various jurisdictions where stockholders reside, where we are domiciled and where the funds for fractional shares would be deposited, sums due to stockholders in payment for fractional shares that are not timely claimed after the Effective Time may be required to be paid to the designated agent for each such jurisdiction. Thereafter, stockholders otherwise entitled to receive such funds may have to seek to obtain them directly from the state to which they were paid.

Accounting Matters

If the Reverse Stock Split is effected, the par value per share of Class A Common Stock and Class B Common Stock will remain unchanged at $0.0001. Accordingly, the stated capital on the Company’s consolidated balance sheets attributable to our Class A Common Stock and Class B Common Stock will be reduced proportionally based on the Reverse Stock Split ratio selected by our Board of Directors. In addition, cash paid to stockholders for the fractional shares to which they would have been entitled from the Reverse Stock Split will be recorded as a reduction to the additional paid-in capital account. The per share net income or loss of our Class A Common Stock and Class B Common Stock will be increased because there will be fewer shares of Common Stock outstanding. The effects of the Reverse Stock Split will be applied retrospectively to the Company’s consolidated balance sheets, consolidated statements of stockholders’ equity and per share amounts for all periods presented for all financial statements not yet issued. We do not anticipate that any other material accounting consequences would arise as a result of the Reverse Stock Split.

No Going Private Transaction

Notwithstanding the decrease in the number of outstanding shares following the Reverse Stock Split, our Board of Directors does not intend for this transaction to be the first step in a “going private transaction” within the meaning of Rule 13e-3 of the Exchange Act.

No Dissenters’ Rights of Appraisal

Under the Delaware General Corporation Law, stockholders will not be entitled to dissenters’ rights of appraisal with respect to the Reverse Stock Split, and we do not intend to independently provide stockholders with any such right or any similar right.

Interest of Certain Persons in Matters to Be Acted Upon

Certain of our directors and executive officers have an interest in this proposal as a result of their ownership of shares of Common Stock, as set forth in the “Security Ownership of Certain Beneficial Owners and Management” section of this Proxy Statement. However, we do not believe that our directors or executive officers have interests in this proposal that are different from or greater than those of any of our other stockholders.

Anti-takeover Effects of Proposed Amendments

The Certificate of Amendment will result in a relative increase in the number of authorized but unissued shares of Class A Common Stock and Class B Common Stock, and thus could, under certain circumstances, have an anti-takeover effect. However, this is not the purpose or intent of our Board of Directors. A relative increase in the number of our authorized but unissued shares could enable our Board of Directors to render more difficult or discourage an attempt by a party to obtain control of the Company by tender offer or other means. The issuance of Class A Common Stock or Class B Common Stock in a public or private sale, merger or similar transaction would increase the number of outstanding shares entitled to vote, increase the number of votes required to approve a change of control of the Company and dilute the interest of a party attempting to obtain control of the Company. Any such issuance could deprive stockholders of benefits that could result from an attempt to obtain control of the Company, such as the realization of a premium over the market price that such an attempt could cause. Moreover, the issuance of Class A Common Stock or Class B Common Stock to persons friendly to our Board of Directors could make it more difficult to remove incumbent officers and directors from office even if such change were favorable to stockholders generally.

As stated above, the Company has no present intent to use the relative increase in the number of authorized shares of Class A Common Stock or Class B Common Stock for anti-takeover purposes, and the Certificate of Amendment is not part of a plan by our Board of Directors to adopt a series of anti-takeover provisions; however, if the Certificate of Amendment is filed with the Secretary of State of the State of Delaware, then a greater number of shares of Class A Common Stock and Class B Common Stock would be available for such purposes than is currently available. This proposal, including the relative increase in the number of authorized shares, is not the result of any attempt to obtain control of the Company and our Board of Directors has no present intent to authorize the issuance of additional shares of Common Stock to discourage any such efforts if they were to arise.

Certain Material U.S. Federal Income Tax Consequences of the Reverse Stock Split

The following is a discussion of certain material U.S. federal income tax consequences of the Reverse Stock Split to U.S. holders of our Common Stock. This discussion is included for general information purposes only and does not purport to address all aspects of U.S. federal income tax law that may be relevant to stockholders in light of their particular circumstances. This discussion is based on the Internal Revenue Code of 1986, as amended (the “Code”), current Treasury regulations promulgated thereunder, administrative rulings and court decisions, all of which are subject to change, possibly on a retroactive basis. Any such change could affect the continuing validity of this discussion.We have not sought and will not seek an opinion of counsel or any rulings from the IRS regarding the

matters discussed below. There can be no assurance the IRS or a court will not take a contrary position to that

discussed below regarding the tax consequences of the Reverse Stock Split.

This discussion does not address the tax consequences to U.S. holders that are subject to special tax rules, such as financial institutions, regulated investment companies, partnerships, S corporations, dealers or traders in securities or currencies that use a mark-to-market method of tax accounting, tax-exempt entities, persons holding shares as part of a straddle, hedge, conversion transaction or other integrated investment, persons who acquired our Common Stock in connection with employment or the performance of services, persons subject to alternative minimum taxes or the unearned income Medicare tax and persons whose functional currency is not the U.S. dollar. In addition, this discussion does not address stockholders that are not U.S. holders (as defined below). This summary also assumes that the U.S. holder holds the pre-Reverse Stock Split Common Stock, and will hold the post-Reverse Stock Split Common Stock, as a “capital asset” as defined in Section 1221 of the Code (generally, property held for investment). All stockholders are urged to consult with their own tax advisors with respect to the U.S. federal tax consequences, as well as any state, local or non-U.S. tax consequences, of the Reverse Stock Split.

If an entity treated as a partnership for U.S. federal income tax purposes holds our Common Stock, the tax treatment

of a partner in the partnership will depend on the status of the partner, the activities of the partnership, and certain

determinations made at the partner level. Accordingly, partnerships holding our Common Stock and the partners in

such partnerships should consult their tax advisors regarding the U.S. federal income tax consequences of the

Reverse Stock Split.

As used herein, the term “U.S. holder” means a holder that, for U.S. federal income tax purposes, is a beneficial owner of our Common Stock and is:

•a citizen or individual resident of the United States;

•a corporation or other entity taxable as a corporation created or organized in or under the laws of the United States, any state thereof, or the District of Columbia;

•a trust if (i) a court within the United States may exercise primary supervision over the trust’s administration and one or more U.S. persons have the authority to control all substantial decisions of the trust or (ii) the trust has a valid election in effect to be treated as a U.S. person for U.S. federal income tax purposes; or

•an estate the income of which is subject to U.S. federal income tax regardless of its source.

In general, the Reverse Stock Split should be treated as a tax-free reorganization under Section 368(a) of the Code, and no gain or loss should be recognized by a U.S. holder upon the exchange of pre-Reverse Stock Split Common Stock for post-Reverse Stock Split Common Stock, except with respect to cash received in lieu of a fractional share of Common Stock, as discussed below. The aggregate tax basis of the post-Reverse Stock Split Common Stock should be the same as the aggregate tax basis of the pre-Reverse Stock Split Common Stock exchanged in the Reverse Stock Split (excluding any portion of such basis that is allocated to any fractional share of Common Stock). A U.S. holder’s holding period in the post-Reverse Stock Split Common Stock should include the period during which the U.S. holder held the pre-Reverse Stock Split Common Stock exchanged in the Reverse Stock Split. U.S. holders holding shares of Common Stock that were acquired on different dates and at different prices should consult their tax advisors regarding the allocation of the tax basis and holding period of such shares.

As noted above, we will not issue fractional shares of Common Stock in connection with the Reverse Stock Split. Instead, U.S. holders who would have been entitled to receive a fractional share of Common Stock will instead be entitled to receive a cash payment in lieu thereof. A U.S. holder of Common Stock that receives cash in lieu of a fractional share of Common Stock pursuant to the Reverse Stock Split is expected to be treated as first receiving such fractional share and then receiving cash in redemption of such fractional share. A U.S. holder of Common Stock that receives cash in lieu of a fractional share and whose proportionate interest in us is reduced (after taking into account certain constructive ownership rules) should generally recognize capital gain or loss in an amount equal to the difference between the amount of cash received and the U.S. holder’s tax basis allocable to such fractional share of Common Stock. Any such capital gain or loss should be long-term capital gain or loss if the U.S. holder’s holding period in the fractional share of Common Stock surrendered is longer than one year as of the effective date of the Reverse Stock Split. Long-term capital gains recognized by non-corporate taxpayers are subject to reduced tax rates. The deductibility of capital losses is subject to limitations. A U.S. holder of Common Stock that receives cash in lieu of a fractional share and whose proportionate interest in us is not reduced (after taking into account certain constructive ownership rules) should generally be treated as having received a distribution that will be treated first as dividend income to the extent paid out of our current or accumulated earnings and profits, and then as a tax-free return of capital to the extent of the U.S. holder’s tax basis in our Common Stock, with any remaining amount being treated as capital gain. U.S. holders should consult their tax advisors regarding the tax effects to them of receiving cash in lieu of fractional shares based on their particular circumstances.

A U.S. holder of Common Stock may be subject to information reporting and backup withholding on cash paid in lieu of fractional shares in connection with the Reverse Stock Split. A U.S. holder will be subject to backup withholding if such holder is not otherwise exempt and such holder does not provide its taxpayer identification number in the manner required (such as by submitting a properly completed IRS Form W-9) or otherwise fails to comply with applicable backup withholding tax rules. Backup withholding is not an additional tax. Any amounts withheld under the backup withholding rules may be refunded or allowed as a credit against a U.S. holder’s federal income tax liability, if any, provided the required information is timely furnished to the Internal Revenue Service.

The tax treatment of a U.S. holder may vary depending upon the particular facts and circumstances of such stockholder. Each U.S. holder is urged to consult with its own tax advisor with respect to the tax consequences of the Reverse Stock Split.

Vote Required for Approval of This Proposal

The approval of the Reverse Stock Split Proposal requires the affirmative vote of the holders of a majority of the voting power of all outstanding Common Stock entitled to vote on the proposal. Abstentions will have the same effect as votes against the Reverse Stock Split Proposal. Brokerage firms have authority to vote shares held in street name on the Reverse Stock Split Proposal, without instructions from beneficial owners, and as a result, we do not expect there will be any broker non-votes on this matter.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL OF AN AMENDMENT TO OUR CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT.

PROPOSAL NO. 2

TO APPROVE THE ADJOURNMENT OF THE SPECIAL MEETING, IF NECESSARY, TO SOLICIT ADDITIONAL PROXIES IF THERE ARE INSUFFICIENT VOTES AT THE TIME OF THE SPECIAL MEETING TO APPROVE THE REVERSE STOCK SPLIT PROPOSAL

Background of and Rationale for the Adjournment Proposal

The Board believes that, if the number of affirmative votes received from the holders of outstanding shares of our Common Stock entitled to vote on the Reverse Stock Split are insufficient to approve the Reverse Stock Split Proposal, it is in the best interests of the stockholders to enable the Board to continue to seek to obtain a sufficient number of additional affirmative votes to approve the Reverse Stock Split Proposal.

In the Adjournment Proposal, we are asking stockholders to authorize the holder of any proxy solicited by the Board to vote in favor of adjourning the Special Meeting or any adjournment thereof. If our stockholders approve this proposal, we could adjourn the Special Meeting, and any adjourned session of the Special Meeting, to use the additional time to solicit additional proxies in favor of the Reverse Stock Split Proposal.

Additionally, approval of the Adjournment Proposal could mean that, in the event we receive proxies indicating that a majority of the voting power of the outstanding shares of our Common Stock entitled to vote on the Reverse Stock Split Proposal have voted against the Reverse Stock Split Proposal, we could adjourn the Special Meeting without a vote on the Reverse Stock Split Proposal and use the additional time to solicit the holders of those shares to change their vote in favor of the Reverse Stock Split Proposal.

If it is necessary or appropriate (as determined in good faith by the Board) to adjourn the Special Meeting, no notice of the adjourned meeting is required to be given to our stockholders, other than an announcement at the Special Meeting of the time and place to which the Special Meeting is adjourned, so long as the meeting is adjourned for 30 days or less and no new record date is fixed for the adjourned meeting. At the adjourned meeting, we may transact any business which might have been transacted at the original meeting.

Vote Required for Approval of This Proposal

The approval of the Adjournment Proposal requires the affirmative vote of the holders of a majority of the voting power of the shares of Common Stock present virtually or represented by proxy and voting affirmatively or negatively (excluding abstentions and broker non-votes) on the matter. Abstentions will have no effect on the Adjournment Proposal. Brokerage firms have authority to vote shares held in street name on the Adjournment Proposal, without instructions from beneficial owners, and as a result, we do not expect there will be any broker non-votes on this matter.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ADJOURNMENT OF THE SPECIAL MEETING, IF NECESSARY, TO SOLICIT ADDITIONAL PROXIES IF THERE ARE INSUFFICIENT VOTES AT THE TIME OF THE SPECIAL MEETING TO APPROVE THE REVERSE STOCK SPLIT PROPOSAL.

OTHER MATTERS

The Board of Directors knows of no other matters that will be presented for consideration at the Special Meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on such matters in accordance with their best judgment.

HOUSEHOLDING

The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for Notices of Internet Availability of Proxy Materials or other Special Meeting materials with respect to two or more stockholders sharing the same address by delivering a Notice of Internet Availability of Proxy Materials or other Special Meeting materials addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for stockholders and cost savings for companies.

A number of brokers with account holders who are Allbirds stockholders will be “householding” the Company’s proxy materials. A single Notice of Internet Availability of Proxy Materials will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker that they will be “householding” communications to your address, “householding” will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in “householding” and would prefer to receive a Notice of Internet Availability of Proxy Materials, please notify your broker or Allbirds. Direct your written request to Allbirds, Inc., Secretary, 30 Hotaling Place, San Francisco, CA 94111. Stockholders who currently receive multiple copies of the Notices of Internet Availability of Proxy Materials at their addresses and would like to request “householding” of their communications should contact their brokers.

STOCKHOLDER PROPOSALS

To be considered for inclusion in the proxy materials for our 2025 annual meeting of stockholders, your proposal must be submitted in writing by December 26, 2024 to Allbirds’ Secretary at 30 Hotaling Place, San Francisco, CA 94111.

With respect to proposals (including director nominations) not to be included in the proxy materials for our 2025 annual meeting of stockholders our Amended and Restated Bylaws (the “Bylaws”) provide that to be timely you must deliver your notice to our Secretary at the address above between February 7, 2025 and March 9, 2025. Your notice to the Secretary must set forth all of the information specified in our Bylaws, including, without limitation, your name and address and the class and number of shares of our stock that you beneficially own. In the event that we hold the 2025 annual meeting of stockholders more than 30 days before or after the one-year anniversary of the previous year’s annual meeting of stockholders, notice of a stockholder proposal that is not intended to be included in our proxy statement must be received no earlier than the close of business on the 120th day before the 2025 annual meeting of stockholders and no later than the close of business of the later of the following two dates:

•the 90th day prior to the 2025 annual meeting of stockholders; or

•the 10th day following the day on which public announcement of the date of our 2025 annual meeting of stockholders is first made.

In addition to satisfying the foregoing requirements under our Bylaws, to comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must provide in their notice the additional information required by Rule 14a-19 under the Exchange Act and comply with the additional requirements of Rule 14a-19(b) under the Exchange Act.

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the ownership of the Company’s common stock as of June 20, 2024 by:

•each person or group of affiliated persons known by us to beneficially own greater than 5% of our Class A or Class B common stock;

•each of our named executive officers and directors; and

•all directors and officers as a group.