Table of Contents

As filed with the Securities and Exchange Commission on January 31, 2025

No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

BLACKBOXSTOCKS INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

7371

|

45-3598066

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer

Identification Number)

|

| |

|

|

| |

5430 LBJ Freeway, Suite 1485

Dallas, Texas 75240

(972) 726-9203

|

|

|

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

|

Gust Kepler

President and Chief Executive Officer

5430 LBJ Freeway, Suite 1485

Dallas, Texas 75240

(972) 726-9203

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copy to:

Jeffrey M. McPhaul, Esq.

Winstead PC

2728 N. Harwood Street, Suite 500

Dallas, Texas 75201

(214) 745-5400

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

|

Non-accelerated filer ☒

|

Smaller reporting company ☒

|

| |

Emerging growth company ☒

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated January 31, 2025

PROSPECTUS

BLACKBOXSTOCKS INC.

$50,000,000

Common Stock

Preferred Stock

Warrants

Units

We may from time to time offer and sell, in one or more offerings under this prospectus, shares of common stock, $0.001 par value per share (the “Common Stock”), shares of preferred stock, $0.001 par value per share (the "Preferred Stock"), warrants to purchase such shares of Common Stock (the “Warrants”) or units to purchase a combination thereof (the "Units") of Blackboxstocks Inc., a Nevada corporation (the “Company”). The aggregate initial offering price of all securities sold under this prospectus will not exceed $50,000,000. This prospectus provides you with a general description of the securities we may offer and certain other information about the Company. We may offer the securities in amounts, at prices and on terms determined at the time of the offering.

We will provide specific terms of these offerings and securities in one or more supplements to this prospectus, which may also supplement, update or amend information contained in this document. You should carefully read this prospectus and any accompanying prospectus supplement, together with the documents we incorporate by reference, before you invest in any of these securities.

We may sell these securities on a continuous or delayed basis directly, through agents, dealers or underwriters as designated from time to time, or through a combination of these methods. We reserve the sole right to accept, and together with any agents, dealers and underwriters, reserve the right to reject, in whole or in part, any proposed purchase of securities. If any agents, dealers or underwriters are involved in the sale of any securities offered by this prospectus, the applicable prospectus supplement will set forth any applicable commissions or discounts. Our net proceeds from the sale of securities also will be set forth in the applicable prospectus supplement, as well as the specific terms of the plan of distribution.

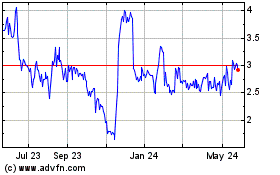

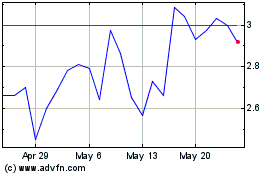

Our Common Stock is listed on the Nasdaq Capital Market under the symbol “BLBX.” On January 28, 2025, the last reported sale price of the Common Stock on the Nasdaq Capital Market was $3.87 per share.

As of January 29, 2025, the aggregate market value of our outstanding common stock held by non-affiliates was $7,455,845, based on 3,541,087shares of outstanding common stock, of which 1,827,413shares are held by non-affiliates, and the last reported sale price of our common stock of $4.08 per share on January 28, 2025. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell securities in a primary offering with a value exceeding more than one-third of our public float in any 12-month period so long as our public float remains below $75,000,000. We have not sold any securities pursuant to General Instruction 1.B.6 of Form S-3 during the 12 calendar month period that ends on and includes the date hereof.

We are an “emerging growth company” as defined under the federal securities laws and, as such, have elected to comply with certain reduced public company reporting requirements.

Investing in our securities involves a high degree of risk. See the section entitled “Risk Factors” beginning on page 5 of this prospectus and under similar headings in the other documents that are incorporated by reference into this prospectus. You should carefully read and consider these risk factors before you invest in our securities.

You should rely only on the information contained in this prospectus or any prospectus supplement or amendment hereto. We have not authorized anyone to provide you with different information.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is ____________, 2025.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement filed with the Securities and Exchange Commission (the “SEC”) using a “shelf” registration process. Under this shelf registration process, we may offer to sell any combination of the securities described in this prospectus in one or more offerings for an aggregate offering price of up to $50,000,000. This prospectus provides you with a general description of the securities which we may offer. Each time we offer securities for sale, we will provide a prospectus supplement that contains specific information about the terms of that offering. Any prospectus supplement may also add, update or change information contained in this prospectus. You should read both this prospectus and any prospectus supplement, including all documents incorporated herein or therein by reference, together with additional information described below under “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.”

This prospectus may not be used to consummate a sale of securities unless it is accompanied by a prospectus supplement.

The registration statement that contains this prospectus (including the exhibits thereto) contains additional important information about us and the securities we may offer under this prospectus. We may file with the SEC certain other legal documents that establish the terms of the securities offered by this prospectus as exhibits to documents or future prospectus supplements.

You should rely only on the information contained or incorporated by reference in this prospectus and in any prospectus supplement or amendment hereto. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making offers to sell or solicitations to buy the securities in any jurisdiction in which an offer or solicitation is not authorized or in which the person making that offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make an offer or solicitation.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to actual documents for complete information. All summaries are qualified in their entirety by the actual documents. You should not assume that the information in this prospectus or any prospectus supplement, as well as the information we file or previously filed with the SEC that we incorporate by reference in this prospectus or any prospectus supplement, is accurate as of any date other than its respective date. Our business, financial condition, results of operations and prospects may have changed since those dates.

The Blackboxstocks design logo and the Blackboxstocks mark appearing in this prospectus are the property of Blackboxstocks Inc. Trade names, trademarks and service marks of other companies that may appear in this prospectus or any prospectus supplement are the property of their respective holders. We have omitted the ® and ™ designations, as applicable, for the trademarks used in this prospectus.

In this prospectus, unless the context otherwise requires, references to “we,” “us,” “our,” “our company,” “the Company,” or “Blackboxstocks” refer to Blackboxstocks Inc. and its subsidiaries.

This prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. Please read the sections below entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements.”

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference herein include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements are intended to be covered by the safe harbor for forward-looking statements provided by the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts contained in this prospectus and the documents incorporated by reference herein, including statements regarding our future results of operations and financial position, business strategy and plans, and our objectives for future operations, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “will,” “would” and similar expressions that convey uncertainty of future events or outcomes are intended to identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained in this prospectus are based on our current expectations and beliefs concerning future developments and their potential effects on us. These statements are based on various assumptions and on the current expectations of management and are not predictions of actual performance, nor are these statements of historical facts. These statements are subject to a number of risks and uncertainties regarding our business, and actual results may differ materially. These risks and uncertainties include, but are not limited to, our continued operating and net losses in the future; our need for additional capital for our operations and to fulfill our business plans; changes in the business environment in which we operate, including inflation and interest rates, and general financial, economic, regulatory and political conditions affecting the industry in which we operate; adverse litigation developments; inability to refinance existing debt on favorable terms; changes in taxes, governmental laws, and regulations; competitive product and pricing activity; difficulties of managing growth profitably; the loss of one or more members of our management team; uncertainty as to the long-term value of our Common Stock; the risks discussed in the Annual Report on Form 10-K for the year ended December 31, 2023 under the heading “Risk Factors,” as updated from time to time by the Quarterly Reports on Form 10-Q and other documents we file from time to time with the SEC. The risk factors described in these documents may not be exhaustive.

There may be additional risks that we presently know or that we currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements provide our expectations, plans or forecasts of future events and views as of the date of this communication. We anticipate that subsequent events and developments will cause our assessments to change. However, while we may elect to update these forward-looking statements at some point in the future, we specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing our assessments as of any date subsequent to the date of this communication.

PROSPECTUS SUMMARY

This prospectus summary highlights selected information contained elsewhere in this prospectus or in documents incorporated by reference. This summary does not contain all of the information that you should consider before making an investment decision. You should carefully read the entire prospectus, the applicable prospectus supplement, including under the section titled “Risk Factors” and the documents incorporated by reference into this prospectus, before making an investment decision.

Overview of Business

On April 1, 2024 we incorporated and subsequently contributed substantially all of our business assets into a wholly owned subsidiary, Blackbox.io Inc. References to the business of Blackboxstocks in this section include the historical operations of Blackboxstocks and the continuing operations conducted through Blackbox.io Inc.

We have developed a financial technology and social media hybrid platform offering real-time proprietary analytics and news for stock and options traders of all levels combined with a social media element and educational materials. Our web-based platform and native iOS and Android applications (the “Blackbox System”) employ “predictive technology” enhanced by artificial intelligence to find volatility and unusual market activity that may result in the rapid change in the price of a stock or option. Our Blackbox System continuously scans the New York Stock Exchange (“NYSE”), NASDAQ, Chicago Board Options Exchange (the “CBOE”) and other options markets, analyzing over 10,000 stocks and over 1,500,000 options contracts multiple times per second. We provide our subscribing members with a fully interactive audio and text based social media platform that is integrated into our Blackbox System dashboard, enabling subscribing members to exchange information and ideas quickly and efficiently through a common network. We believe that the Blackbox System is a disruptive financial technology platform that uniquely integrates proprietary analytics with a community supported by a broadcast enabled social media system which connects traders of all kinds worldwide on an intuitive and user-friendly platform.

Our goal is to provide retail investors with the type of sophisticated trading tools that were previously available only to large institutional hedge funds and high-frequency traders together with an interactive community of traders and investors of all levels at an affordable price. We also strive to provide these trading tools in a user-friendly format that does not require complicated configurations by the user.

We employ a subscription-based Software as a Service (“SaaS”) business model and maintain a base of members that we strive to grow. We currently offer monthly subscriptions to our platform for $99 per month and annual subscriptions for $959 per year.

The Company’s Mission

Our mission is to provide powerful proprietary analytics in a simple and concise format to level the playing field for the average retail investor. We strive to educate its members through our live trading community as well as our scheduled, calendared classes with live instructors. We want every member to feel they are part of a team with the goal of improving financial literacy. We believe that we are the antithesis of the “trading guru” platforms that feature a trading or investing expert that charges for what are often expensive courses. We do not charge for our classes. We do not upsell our members. All education and community programs are free with the subscription to our platform.

Revenue Model

We generate revenue from a software as a service (or SaaS) model whereby members pay either an annual or monthly fee for a subscription to our platform. We do not currently offer more than one level of subscription with varying levels of features. All members have full access to all of the features and educational resources of our platform.

Monthly subscriptions are currently priced at $99 and annual subscriptions are currently priced at $959 (a discount of $241). We occasionally offer gift cards and promotional discounts on our subscriptions.

Education

We offer all members full access to our curriculum of classes, orientations, and live market sessions. All of our education programs are free to our members. Our curriculum includes classes for beginner, intermediate, and advanced-level traders. We believe education is vital to increasing the probability of our members long term success in the markets. We have many regularly calendared live webinars, Q&A sessions, as well as recorded classes. In addition to our regularly calendared classes, we often feature ad hoc classes taught by seasoned members of our community. The educators of these classes often specialize in specific market sectors or trading strategies.

One of the most attractive aspects of our education program is that the classes are taught by members of our community. The student members who take these are often familiar with the instructor from following them in live trading channels on our platform. We believe this familiarity often brings an element of authenticity and heightened engagement increasing the success of these educational endeavors as well as adding to the community aspect of our platform.

The Blackbox Advantage

A principal component to our platform is the flexibility to provide members intuitive yet powerful technical analytics that scale with user knowledge. Our preconfigured dashboard defaults to a general setting that is designed to be easy for new members to navigate. Within this same dashboard we provide a multitude of toggles and filters for more sophisticated traders to allow them to implement custom features for their more advanced trading strategies. Most importantly, our live community consisting of thousands of traders creates a real-time community curated support system whereby seasoned traders often mentor newer members. We believe this is one of the primary strengths and differentiators of our platform. Although we offer a complete curriculum of scheduled classes weekly, the live interaction amongst our members proves to be invaluable. We believe this is due to the level of excitement created when new members can watch seasoned members of the community making trades in real time and providing an accompanying narrative. In addition to the educational component, the community element of our platform harnesses a powerful dynamic that can be described as “the best of man and machine”. Our powerful algorithm technology scans the NYSE, NASDAQ, CBOE and other options exchanges to find market volatility and anomalies and displays them on a common dashboard shared across the globe. With thousands of eyes on this data, our members can quickly interact and form a consensus on the trading opportunity at hand.

Corporate Information

Our principal executive offices are located at 5430 LBJ Freeway, Suite 1485, Dallas, Texas 75240, and our telephone number is (972) 726-9203. The Blackboxstocks website is https://blackboxstocks.com. The information on, or that can be accessed through, its website is not part of this information statement/prospectus. We have included our website address as an inactive textual reference only.

RISK FACTORS

Investing in our securities involves a high degree of risk. Please see the Risk Factors set forth in Part I, Item 1A of our most recent Annual Report on Form 10-K and Part II or our Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings we make with the SEC, which are incorporated herein by reference. Additional risk factors may be included in a prospectus supplement relating to a particular offering of securities. Before making an investment decision, you should carefully consider these risks as well as other information we include or incorporate by reference in this prospectus. The risks and uncertainties we have described are not the only risks and uncertainties we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business operations. These risks could materially affect our business, results of operations or financial condition and cause the value of our securities to decline.

Risks Relating to Market Volatility

Future sales or issuances of our common stock may dilute the ownership interest of existing stockholders and depress the trading price of our common stock.

We cannot predict the effect, if any, that future sales of our common stock or the availability of our common stock for future sale will have on the market price of shares of our common stock. Future sales or issuances of our common stock may dilute the ownership interests of our existing stockholders. In addition, future sales or issuances of substantial amounts of our Common Stock may adversely impact the market price of our common stock and the terms upon which we may obtain additional equity financing in the future. The perception that such sales or issuances may occur could also negatively impact the market price of our common stock.

The price of our common stock may fluctuate significantly.

The market price of our common stock may fluctuate significantly in response to many factors, including:

| |

•

|

actual or anticipated variations in our operating results;

|

| |

•

|

changes in our cash flows from operations or earnings;

|

| |

•

|

additions or departures of key management personnel;

|

| |

•

|

actions by significant stockholders;

|

| |

•

|

speculation in the press or investment community;

|

| |

•

|

the passage of legislation or other regulatory developments that adversely affect us or our industry;

|

| |

•

|

the realization of any of the other risk factors included in, or incorporated by reference to, this prospectus or the accompanying prospectus supplement;

|

| |

•

|

general market and economic conditions; and

|

| |

•

|

the effect of a potential "short squeeze" due to a sudden increase in demand for our common stock.

|

In addition, many of the factors listed above are beyond our control. These factors may cause the market price of our common stock to decline, regardless of our financial condition, results of operations, business or prospects. It is impossible to ensure that the market price of our common stock will not fall in the future.

DESCRIPTION OF SECURITIES THAT MAY BE OFFERED

The following is a summary of the rights of our securities and certain provisions of our articles of incorporation and amended and restated bylaws. This summary does not purport to be complete and is qualified in its entirety by reference to documents incorporated by reference to the registration statement of which this prospectus is a part.

We are a Nevada corporation. Our authorized capital stock consists of 100,000,000 shares of Common Stock, par value $0.001 per share, and 10,000,000 shares of Preferred Stock, par value $0.001 per share. Of the 10,000,000 shares of authorized Preferred Stock, 5,000,000 shares are designated Series A Convertible Preferred Stock and 2,400,000 shares are designated Series B Convertible Preferred Stock. As of January 28], 2025, there were 3,541,087 shares of our Common Stock outstanding held by 614 holders of record, 3,269,998 shares of Series A Convertible Preferred Stock held be our Gust Kepler, a director, our Chairman and Chief Executive Officer, and no shares of Series B Convertible Preferred Stock outstanding. The number of record holders is based upon the actual number of holders registered at such date and does not include holders of shares in “street name” or persons, partnerships, associations, corporations or entities in security position listings maintained by depositories.

Description of Common Stock

Each share of Common Stock entitles a stockholder to one vote on all matters upon which stockholders are permitted to vote. No stockholder has any preemptive right or other similar right to purchase or subscribe for any additional securities issued by us, and no stockholder has any right to convert the Common Stock into other securities. No shares of Common Stock are subject to redemption or any sinking fund provisions. All the outstanding shares of our Common Stock are fully paid and non-assessable. Subject to the rights of the holders of the preferred stock, if any, our stockholders of common stock are entitled to dividends when, as and if declared by our board from funds legally available therefore and, upon liquidation, to a pro-rata share in any distribution to stockholders. We do not anticipate declaring or paying any cash dividends on our common stock in the foreseeable future.

Transfer Agent and Registrar

The transfer agent and registrar for our Common Stock is Securities Transfer Corporation, 2901 N. Dallas Parkway, Suite 380, Plano, Texas 75093.

Securities Exchange

Our Common Stock is traded on the Nasdaq Capital Market under the symbol “BLBX.”

Description of Preferred Stock

Pursuant to our Articles of Incorporation, as amended, our board has the authority, without further stockholder approval, to provide for the issuance of up to 10,000,000 shares of Preferred Stock, par value $0.001 per share, in one or more series and to determine the dividend rights, conversion rights, voting rights, rights in terms of redemption, liquidation preferences, the number of shares constituting any such series and the designation of such series. Our board has the power to afford preferences, powers and rights (including voting rights) to the holders of any preferred stock preferences, such rights and preferences being senior to the rights of holders of common stock. Although we have no present intention to issue any shares of preferred stock, the issuance of shares of preferred stock, or the issuance of rights to purchase such shares, may have the effect of delaying, deferring or preventing a change in control of our company.

Of the 10,000,000 shares of authorized Preferred Stock, 5,000,000 shares are designated Series A Convertible Preferred Stock and 2,400,000 shares are designated Series B Convertible Preferred Stock.

Series A Convertible Preferred Stock

As designated, each holder of Series A Convertible Preferred Stock is entitled to 100 votes, for each share held of record on the applicable record date on all matters presented for a vote of the stockholders of the Company, including, without limitation, the election of directors. Each share of Series A Convertible Preferred Stock is convertible into one share of Common Stock. Shares of Series A Convertible Preferred Stock shall rank, with respect to dividend rights and rights on liquidation, winding up and dissolution of the Company, pari passu with the Company's Common Stock.

Series B Convertible Preferred Stock

As designated, the Series B Convertible Preferred Stock has no dividend rights. Except as required by law, or the amended and restated bylaws of the Company, holders of Series B Stock have no voting rights. However, for as long as any shares of Series B Convertible Preferred Stock are outstanding, the Company may not, without the affirmative vote of the holders of a majority of the then outstanding shares of the Series B Convertible Preferred Stock, (i) alter or change adversely the powers, preferences or rights given to the Series B Convertible Preferred Stock or alter or amend the Designation, (ii) amend the Company’s articles of incorporation in any manner that adversely affects any rights of the holders of Series B Convertible Preferred Stock, or (iii) enter into any agreement with respect to any of the foregoing. Each share of Series B Convertible Preferred Stock are be convertible into one share of Company common stock, subject to adjustment for reclassification, exchange, substitution or reorganization. All shares of Series B Convertible Preferred Stock previously issued by the Company have been forfeited, retired and cancelled.

A prospectus supplement relating to any series of Preferred Stock being offered will include specific terms related to the offering. They will include, where applicable:

| |

●

|

the title and stated value of the series of Preferred Stock and the number of shares constituting that series;

|

| |

●

|

the number of shares of the series of Preferred Stock offered, the liquidation preference per share and the offering price of the shares of Preferred Stock;

|

| |

●

|

the dividend rate(s), period(s) and/or payment date(s) or the method(s) of calculation for those values relating to the shares of Preferred Stock of the series;

|

| |

●

|

the date from which dividends on shares of Preferred Stock of the series shall cumulate, if applicable;

|

| |

●

|

our right, if any, to defer payment of dividends and the maximum length of any such deferral period;

|

| |

●

|

the procedures for any auction and remarketing, if any, for shares of Preferred Stock of the series;

|

| |

●

|

the provision for redemption or repurchase, if applicable, of shares of Preferred Stock of the series;

|

| |

●

|

any listing of the series of shares of Preferred Stock on any securities exchange;

|

| |

●

|

the terms and conditions, if applicable, upon which shares of Preferred Stock of the series will be convertible into shares of Preferred Stock of another series or our Common Stock, including the conversion price, or manner of calculating the conversion price;

|

| |

●

|

whether the Preferred Stock will be exchangeable into debt securities, and, if applicable, the exchange period, the exchange price, or how it will be calculated, and under what circumstances it may be adjusted;

|

| |

●

|

voting rights, if any, of the Preferred Stock;

|

| |

●

|

restrictions on transfer, sale or other assignment, if any;

|

| |

●

|

whether interests in shares of Preferred Stock of the series will be represented by global securities;

|

| |

●

|

any other specific terms, preferences, rights, limitations or restrictions of the series of shares of Preferred Stock;

|

| |

●

|

a discussion of any material United States federal income tax consequences of owning or disposing of the shares of Preferred Stock of the series;

|

| |

●

|

the relative ranking and preferences of shares of Preferred Stock of the series as to dividend rights and rights upon liquidation, dissolution or winding up of the Company; and

|

| |

●

|

any limitations on issuance of any series of shares of Preferred Stock ranking senior to or on a parity with the series of shares of preferred stock as to dividend rights and rights upon liquidation, dissolution or winding up of the Company.

|

If we issue shares of Preferred Stock under this prospectus, the shares will be fully paid and nonassessable and will not have, or be subject to, any preemptive or similar rights.

Provisions Having A Possible Anti-Takeover Effect

Our Articles of Incorporation, as amended to date, and Bylaws contain certain provisions that are intended to enhance the likelihood of continuity and stability in the composition of our board and in the policies formulated by our board and to discourage certain types of transactions which may involve an actual or threatened change of our control. Our board is authorized to adopt, alter, amend and repeal our Bylaws or to adopt new Bylaws. In addition, our board has the authority, without further action by our stockholders, to issue up to 10,000,000 shares of our preferred stock in one or more series and to fix the rights, preferences, privileges and restrictions thereof. Of the 10,000,000 shares of authorized Preferred Stock, 5,000,000 shares are designated Series A Convertible Preferred Stock. As designated, each holder of Series A Convertible Preferred Stock is entitled to 100 votes, for each share held of record on the applicable record date on all matters presented for a vote of the stockholders of the Company, including, without limitation, the election of directors. The issuance of our preferred stock or additional shares of common stock could adversely affect the voting power of the holders of common stock and could have the effect of delaying, deferring or preventing a change in our control.

Description of Warrants

We may issue Warrants for the purchase of our Common Stock or Preferred Stock. As explained below, each Warrant will entitle its holder to purchase our Common Stock or Preferred Stock at an exercise price set forth in, or to be determined as set forth in, the related prospectus supplement. Warrants may be issued separately or together with our Common Stock or Preferred Stock. The Warrants are to be issued under warrant agreements to be entered into between us and the investors or a warrant agent.

The particular terms of each issue of Warrants and the warrant agreement relating to the Warrants will be described in the applicable prospectus supplement, including, as applicable:

| |

●

|

the title of the Warrants;

|

| |

●

|

the initial offering price;

|

| |

●

|

the aggregate number of warrants and the aggregate number of shares of Common Stock or Preferred Stock purchasable upon exercise of the warrants;

|

| |

●

|

if applicable, the designation and terms of the equity securities with which the Warrants are issued, and the number of warrants issued with each equity security;

|

| |

●

|

the date on which the right to exercise the Warrants will commence and the date on which the right will expire;

|

| |

●

|

if applicable, the minimum or maximum number of the Warrants that may be exercised at any one time;

|

| |

●

|

anti-dilution provisions of the Warrants, if any;

|

| |

●

|

redemption or call provisions, if any, applicable to the Warrants;

|

| |

●

|

any additional terms of the Warrants, including terms, procedures and limitations relating to the exchange and exercise of the Warrants; and

|

| |

●

|

the exercise price.

|

Holders of Warrants will not be entitled, solely by virtue of being holders, to vote, to receive dividends, to receive notice as stockholders with respect to any meeting or written consent of stockholders for the election of directors or any other matter, or to exercise any rights whatsoever as a holder of the equity securities purchasable upon exercise of the Warrants. Until any warrants to purchase Common Stock or Preferred Stock are exercised, the holder of the warrants will not have any rights of holders of Common Stock or Preferred Stock that can be purchased upon exercise.

Description of Units

The following description, together with the additional information we may include in any applicable prospectus supplements, summarizes the material terms and provisions of the Units that we may offer under this prospectus.

While the terms we have summarized below will apply generally to any Units that we may offer under this prospectus, we will describe the particular terms of any Units in more detail in the applicable prospectus supplement. The terms of any Units offered under a prospectus supplement may differ from the terms described below. However, no prospectus supplement will fundamentally change the terms that are set forth in this prospectus or offer a security that is not registered and described in this prospectus at the time of its effectiveness.

We will file as exhibits to the registration statement of which this prospectus is a part, or will incorporate by reference from a current report on Form 8-K that we file with the SEC, the form of unit agreement that describes the terms of the Units we are offering, and any supplemental agreements, before the issuance of the related Units. The following summaries of material terms and provisions of the Units are subject to, and qualified in their entirety by reference to, all the provisions of the unit agreement and any supplemental agreements applicable to the particular Units. We urge you to read the applicable prospectus supplements related to the particular Units that we sell under this prospectus, as well as the complete unit agreement and any supplemental agreements that contain the terms of the Units.

We may issue Units comprised of one or more shares of our Common Stock, shares of our Preferred Stock and Warrants in any combination. Each Unit will be issued so that the holder of the Unit is also the holder of each security included in the Unit. Thus, the holder of a Unit will have the rights and obligations of a holder of each included security. The unit agreement under which a Unit is issued may provide that the securities included in the Unit may not be held or transferred separately, at any time or at any time before a specified date.

We will describe in the applicable prospectus supplement the terms of the series of Units, including:

| |

●

|

the designation and terms of the Units and of the securities comprising the Units, including whether and under what circumstances those securities may be held or transferred separately;

|

| |

●

|

any provisions of the governing unit agreement that differ from those described below; and

|

| |

●

|

any provisions for the issuance, payment, settlement, transfer or exchange of the Units or of the securities comprising the Units.

|

The provisions described in this section, as well as those described under “Description of Common Stock," “Description of Preferred Stock” and “Description of Warrants” will apply to each Unit and to any Common Stock, Preferred Stock, or Warrant included in each Unit, respectively.

USE OF PROCEEDS

We will retain broad discretion over the use of the net proceeds from the sale of the securities offered hereby. Unless we state otherwise in an accompanying prospectus supplement, we intend to use the net proceeds from the sale of the securities offered by us under this prospectus and any related prospectus supplement for working capital and other general corporate purposes of Blackboxstocks and our subsidiaries. Until the net proceeds are used for these purposes, we may deposit them in interest-bearing accounts or invest them in short-term marketable securities.

More specific allocations may be included in a prospectus supplement relating to a specific offering of securities. All expenses relating to an offering of securities and any compensation paid to underwriters, dealers or agents, as the case may be, will be paid out of our general funds, unless otherwise stated in the applicable prospectus supplement.

PLAN OF DISTRIBUTION

We may offer and sell the securities in any one or more of the following ways:

| |

• |

to or through underwriters, brokers or dealers;

|

| |

• |

directly to one or more other purchasers;

|

| |

• |

through a block trade in which the broker or dealer engaged to handle the block trade will attempt to sell the securities as agent, but may position and resell a portion of the block as principal to facilitate the transaction;

|

| |

• |

through agents on a best-efforts basis;

|

| |

• |

in “at the market” offerings, as defined in Rule 415 under the Securities Act, at negotiated prices, at prices prevailing at the time of sale or at prices related to such prevailing market prices, including sales made directly on the Nasdaq Capital Market or sales made through a market maker other than on an exchange or other similar offerings through sales agents; or

|

| |

• |

otherwise through any other method permitted by applicable law or a combination of any of the above methods of sale.

|

In addition, we may enter into option, share lending or other types of transactions that require us to deliver shares of common stock to an underwriter, broker or dealer, who will then resell or transfer the shares of common stock under this prospectus. We may also enter into hedging transactions with respect to our securities. For example, we may:

| |

• |

enter into transactions involving short sales of the shares of common stock by underwriters, brokers or dealers;

|

| |

• |

sell shares of common stock short and deliver the shares to close out short positions;

|

| |

• |

enter into option or other types of transactions that require the delivery of shares of common stock to an underwriter, broker or dealer, who will then resell or transfer the shares of common stock under this prospectus; or

|

| |

• |

loan or pledge the shares of common stock to an underwriter, broker or dealer, who may sell the loaned shares or, in the event of default, sell the pledged shares.

|

We may enter into derivative transactions with third parties, or sell securities not covered by this prospectus to third parties in privately negotiated transactions. If the applicable prospectus supplement indicates, in connection with those derivatives, the third parties may sell securities covered by this prospectus and the applicable prospectus supplement, including in short sale transactions. If so, the third party may use securities pledged by or borrowed from us or others to settle those sales or to close out any related open borrowings of stock, and may use securities received from us in settlement of those derivatives to close out any related open borrowings of stock. The third party in such sale transactions will be an underwriter and, if not identified in this prospectus, will be identified in the applicable prospectus supplement (or a post-effective amendment). In addition, we may otherwise loan or pledge securities to a financial institution or other third party that in turn may sell the securities short using this prospectus. Such financial institution or other third party may transfer its economic short position to investors in our securities or in connection with a concurrent offering of other securities.

Each time we sell securities, we will provide a prospectus supplement that will name any underwriter, dealer or agent involved in the offer and sale of the securities. Any prospectus supplement will also set forth the terms of the offering, including:

| |

• |

the purchase price of the securities and the proceeds we will receive from the sale of the securities;

|

| |

• |

any underwriting discounts and other items constituting underwriters’ compensation;

|

| |

• |

any public offering or purchase price and any discounts or commissions allowed or re-allowed or paid to dealers;

|

| |

• |

any commissions allowed or paid to agents;

|

| |

• |

any other offering expenses;

|

| |

• |

any securities exchanges on which the securities may be listed;

|

| |

• |

the method of distribution of the securities;

|

| |

• |

the terms of any agreement, arrangement or understanding entered into with the underwriters, brokers or dealers; and

|

| |

• |

any other information we think is important.

|

The securities may be sold from time to time by us in one or more transactions:

| |

• |

at a fixed price or prices, which may be changed;

|

| |

• |

at market prices prevailing at the time of sale;

|

| |

• |

at prices related to such prevailing market prices;

|

| |

• |

at varying prices determined at the time of sale; or

|

| |

• |

at negotiated prices.

|

Such sales may be effected:

| |

• |

in transactions on any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale;

|

| |

• |

in transactions in the over-the-counter market;

|

| |

• |

in block transactions in which the broker or dealer so engaged will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction, or in crosses, in which the same broker acts as an agent on both sides of the trade;

|

| |

• |

through the writing of options; or

|

| |

• |

through other types of transactions.

|

The securities may be offered to the public either through underwriting syndicates represented by one or more managing underwriters or directly by one or more of such firms. If underwriters or dealers are used in the sale, the securities will be acquired by the underwriters or dealers for their own account. Unless otherwise set forth in the prospectus supplement, the obligations of underwriters or dealers to purchase the securities offered will be subject to certain conditions precedent and the underwriters or dealers will be obligated to purchase all the offered securities if any are purchased. Any public offering price and any discount or concession allowed or re-allowed or paid by underwriters or dealers to other dealers may be changed from time to time.

The securities may be sold directly by us or through agents designated by us from time to time. Any agent involved in the offer or sale of the securities in respect of which this prospectus is delivered will be named, and any commissions payable to such agent will be set forth in, the prospectus supplement. Unless otherwise indicated in the prospectus supplement, any such agent will be acting on a best efforts basis for the period of its appointment.

Offers to purchase the securities offered by this prospectus may be solicited, and sales of the securities may be made by us directly to institutional investors or others, who may be deemed to be underwriters within the meaning of the Securities Act with respect to any resale of the securities. The terms of any offer made in this manner will be included in the prospectus supplement relating to the offer.

Some of the underwriters, dealers or agents used by us in any offering of securities under this prospectus may be customers of, engage in transactions with, and perform services for us or affiliates of ours in the ordinary course of business. Underwriters, dealers, agents and other persons may be entitled to indemnification against and contribution toward certain civil liabilities, including liabilities under the Securities Act, and to be reimbursed for certain expenses.

Subject to any restrictions relating to debt securities in bearer form, any securities initially sold outside the United States may be resold in the United States through underwriters, dealers or otherwise.

Any underwriters to which offered securities are sold by us for public offering and sale may engage in transactions that stabilize, maintain or otherwise affect the price of the Common Stock during and after this offering, but those underwriters will not be obligated to do so and may discontinue any market making at any time. Specifically, the underwriters may over-allot or otherwise create a short position in the securities for their own accounts by selling more securities than have been sold to them by us. The underwriters may elect to cover any such short position by purchasing securities in the open market or by exercising the over-allotment option granted to the underwriters. In addition, the underwriters may stabilize or maintain the price of the securities by bidding for or purchasing securities in the open market and may impose penalty bids. If penalty bids are imposed, selling concessions allowed to syndicate members or other broker-dealers participating in the offering are reclaimed if securities previously distributed in the offering are repurchased, whether in connection with stabilization transactions or otherwise. The effect of these transactions may be to stabilize or maintain the market price of the securities at a level above that which might otherwise prevail in the open market. The imposition of a penalty bid may also affect the price of the securities to the extent that it discourages resales of the securities. The magnitude or effect of any stabilization or other transactions is uncertain. These transactions may be effected on the Nasdaq Capital Market or otherwise and, if commenced, may be discontinued at any time.

In connection with this offering, the underwriters and selling group members may also engage in passive market making transactions in our securities. Passive market making consists of displaying bids on the Nasdaq Capital Market limited by the prices of independent market makers and effecting purchases limited by those prices in response to order flow. Rule 103 of Regulation M promulgated by the SEC limits the amount of net purchases that each passive market maker may make and the displayed size of each bid. Passive market making may stabilize the market price of the securities at a level above that which might otherwise prevail in the open market and, if commenced, may be discontinued at any time.

We are subject to the applicable provisions of the Exchange Act and the rules and regulations under the Exchange Act, including Regulation M. This regulation may limit the timing of purchases and sales of any of the shares of securities offered in this prospectus by any person. The anti-manipulation rules under the Exchange Act may apply to sales of shares in the market and to the activities of us.

The anticipated date of delivery of the securities offered by this prospectus will be described in the applicable prospectus supplement relating to the offering.

Any broker-dealer participating in the distribution of the shares of securities may be deemed to be an “underwriter” within the meaning of the Securities Act with respect to any securities such entity sells pursuant to this prospectus.

To comply with the securities laws of some states, if applicable, the securities may be sold in these jurisdictions only through registered or licensed brokers or dealers. In addition, in some states the securities may not be sold unless they have been registered or qualified for sale or an exemption from registration or qualification requirements is available and is complied with.

LEGAL MATTERS

The validity of the issuance of the securities offered hereby will be passed upon for us by Winstead PC, Dallas, Texas. Additional legal matters may be passed upon for us or any underwriters, dealers or agents, by counsel that we will name in the applicable prospectus supplement.

EXPERTS

The financial statements of Blackboxstocks, Inc. as of December 31, 2023 and 2022 incorporated herein by reference in this prospectus from our Annual Report on Form 10-K have been audited by Turner, Stone & Company, L.L.P., an independent registered public accounting firm, and are included in reliance upon such report given on the authority of such firm as an expert in accounting and auditing.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

This prospectus is part of the registration statement, but the registration statement includes and incorporates by reference additional information and exhibits. The SEC allows us to “incorporate by reference” information into this prospectus, which means that we can disclose important information about us by referring you to another document filed separately with the SEC. These other documents contain important information about us, our financial condition and our results of operations. The information incorporated by reference is considered to be a part of this prospectus. You should read carefully the information incorporated herein by reference because it is an important part of this prospectus. We hereby incorporate by reference the following documents into this prospectus:

| |

●

|

Our Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on April 1, 2024;

|

| |

●

|

Our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2024, June 30, 2024 and September 30, 2024 filed with the SEC on May 15, 2024, August 15, 2024 and November 14, 2024, respectively, and that certain Amendment No. 1 to Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2024 filed on October 16, 2024;

|

| |

●

|

Our Current Reports on Form 8-K (and amendments thereto as applicable) as filed with the SEC on January 2, 2024, April 22, 2024, May 10, 2024, July 3, 2024, October 9, 2024, December 13, 2024, December 26, 2024, January 7, 2025, January 16, 2025, January 17, 2025, January 22, 2025 and January 27, 2025; and

|

| |

●

|

Our Definitive Proxy Statement on Schedule 14A filed with the SEC on December 13, 2024, Amendment No. 1 to Schedule 14A filed with the SEC on December 27, 2024 and the Proxy Statement Supplement filed with the SEC on January 8, 2025.

|

Additionally, all documents filed by us with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (other than any portions of filings that are furnished rather than filed pursuant to Items 2.02 and 7.01 of a Current Report on Form 8-K), after the date of this prospectus and before the termination or completion of this offering (including all such documents filed with the SEC after the date of the initial registration statement and prior to the effectiveness of the registration statement) shall be deemed to be incorporated by reference into this prospectus from the respective dates of filing of such documents. Any information that we subsequently file with the SEC that is incorporated by reference as described above will automatically update and supersede any previous information that is part of this prospectus.

You may obtain any of the documents incorporated by reference in this prospectus from the SEC through the SEC’s website at http://www.sec.gov. You may also request and we will provide, free of charge, a copy of any document incorporated by reference in this prospectus (excluding exhibits to such document unless an exhibit is specifically incorporated by reference in the document) by visiting our investor relations website at https://blackboxstocks.com or by writing or calling us at the following address or telephone number:

Blackboxstocks Inc.

Attention: Robert Winspear, Secretary

5430 LBJ Freeway, Suite 1485

Dallas, Texas 75240

investors@blackboxstocks.com

(972) 726-9203

You should rely only on the information contained in, or incorporated by reference into, this prospectus, in any accompanying prospectus supplement or in any free writing prospectus filed by us with the SEC. We have not authorized anyone to provide you with different or additional information. We are not offering to sell or soliciting any offer to buy any securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information in this prospectus or in any document incorporated by reference is accurate as of any date other than the date on the front cover of the applicable document.

WHERE YOU CAN FIND MORE INFORMATION

The Registration Statement that we have filed with the SEC registers the securities offered by this prospectus under the Securities Act. The registration statement, including the exhibits to it, contains additional relevant information about us. The rules and regulations of the SEC allow us to omit some information included in the registration statement from this prospectus.

We are subject to the reporting requirements of the Exchange Act and file annual, quarterly and current reports, proxy statements and other information with the SEC as required by the Securities Exchange Act of 1934, as amended. You can read our filings with the SEC, including this prospectus, over the internet at the SEC’s website at http://www.sec.gov. You may also read and copy any document the Company files with the SEC at the SEC’s Public Reference Room located at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. You may also obtain copies of the materials described above at prescribed rates by writing to the SEC, Public Reference Section, 100 F Street, N.E., Washington, D.C. 20549.

We also make available free of charge on the “Investors” section of our website, https://blackboxstocks.com, all materials that we file electronically with the SEC, including our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Section 16 reports and amendments to those reports as soon as reasonably practicable after such materials are electronically filed with, or furnished to, the SEC. Information contained on our website or any other website is not incorporated by reference into, and does not constitute a part of, this prospectus.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The following table sets forth the various expenses expected to be incurred by the Company in connection with the sale and distribution of the securities being registered hereby, other than underwriting discounts and commissions. All such expenses will be borne by the Company. All amounts are estimated except the SEC registration fee.

|

SEC registration fee

|

|

$ |

7,655.00 |

|

|

FINRA filing fee (1)

|

|

|

|

|

|

Accounting fees and expenses (1)

|

|

|

|

|

|

Legal fees and expenses (1)

|

|

|

|

|

|

Printing expenses (1)

|

|

|

|

|

|

Miscellaneous fees and expenses (1)

|

|

|

|

|

|

Total (1)

|

|

|

|

|

|

(1)

|

Fees and expenses (other than the SEC registration fee to be paid upon the filing of this registration statement) will depend on the number and nature of the offerings of securities and cannot be estimated at this time. An estimate of the aggregate expenses in connection with the issuance and distribution of the securities being offered will be included in any applicable prospectus supplement.

|

Item 15. Indemnification of Directors and Officers

Blackboxstocks’ Articles of Incorporation and bylaws authorize it to provide indemnification of (and advancement of expenses to) its officers and directors to the fullest extent permitted by applicable law. Blackboxstocks is incorporated under the laws of the State of Nevada. The Nevada Revised Statutes (the “NRS”) allows a company to indemnify its officers, directors, employees, and agents from any threatened, pending, or completed action, suit, or proceeding, whether civil, criminal, administrative, or investigative, except under certain circumstances. Indemnification may only occur if a determination has been made that the person exercised their respective powers in good faith with a view to the interests of Blackboxstocks or acted in good faith and in a manner which he or she reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe the conduct was unlawful. A determination may be made by the Blackboxstocks stockholders; by a majority of Blackboxstocks’ directors who were not parties to the action, suit, or proceeding; or by opinion of independent legal counsel in a written opinion, if a quorum of directors who were not a party to such action, suit, or proceeding does not exist.

Provided the terms and conditions of these provisions under Nevada law are met, officers, directors, employees, and agents of Blackboxstocks may be indemnified against expenses actually and reasonably incurred by the person in connection with defending the action, including, without limitation, attorney’s fees, arising out of any liability under the Securities Act of 1933. Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of Blackboxstocks, Blackboxstocks has been advised that in the opinion of the SEC, such indemnification is against public policy and is, therefore, unenforceable.

The NRS provide for certain mandatory and permissive indemnification of officers and directors.

|

A.

|

NRS 78.7502. Discretionary indemnification of officers, directors, employees and agents: General provisions.

|

| |

1.

|

A corporation may indemnify pursuant to this subsection any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative, except an action by or in the right of the corporation, by reason of the fact that the person is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise or as a manager of a limited-liability company, against expenses, including attorneys’ fees, judgments, fines and amounts paid in settlement actually and reasonably incurred by the person in connection with the action, suit or proceeding if the person:

|

| |

(a)

|

Is not liable pursuant to NRS 78.138; or

|

| |

(b)

|

Acted in good faith and in a manner which he or she reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe the conduct was unlawful.

|

| |

|

The termination of any action, suit or proceeding by judgment, order, settlement, conviction or upon a plea of nolo contendere or its equivalent, does not, of itself, create a presumption that the person is liable pursuant to NRS 78.138 or did not act in good faith and in a manner which he or she reasonably believed to be in or not opposed to the best interests of the corporation, or that, with respect to any criminal action or proceeding, he or she had reasonable cause to believe that the conduct was unlawful.

|

| |

2.

|

A corporation may indemnify pursuant to this subsection any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by or in the right of the corporation to procure a judgment in its favor by reason of the fact that the person is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise or as a manager of a limited-liability company, against expenses, including amounts paid in settlement and attorneys’ fees actually and reasonably incurred by the person in connection with the defense or settlement of the action or suit if the person:

|

| |

(a)

|

Is not liable pursuant to NRS 78.138; or

|

| |

(b)

|

Acted in good faith and in a manner which he or she reasonably believed to be in or not opposed to the best interests of the corporation.

|

Indemnification pursuant to this section may not be made for any claim, issue or matter as to which such a person has been adjudged by a court of competent jurisdiction, after exhaustion of any appeals taken therefrom, to be liable to the corporation or for amounts paid in settlement to the corporation, unless and only to the extent that the court in which the action or suit was brought or other court of competent jurisdiction determines upon application that in view of all the circumstances of the case, the person is fairly and reasonably entitled to indemnity for such expenses as the court deems proper.

| |

3.

|

Any discretionary indemnification pursuant to this section, unless ordered by a court or advanced pursuant to subsection 2 of NRS 78.751, may be made by the corporation only as authorized in each specific case upon a determination that the indemnification of a director, officer, employee or agent of a corporation is proper under the circumstances. The determination must be made by:

|

| |

(b)

|

The board of directors, by majority vote of a quorum consisting of directors who were not parties to the action, suit or proceeding; or

|

| |

(c)

|

Independent legal counsel, in a written opinion, if:

|

| |

(1)

|

A majority vote of a quorum consisting of directors who were not parties to the action, suit or proceeding so orders; or

|

| |

(2)

|

A quorum consisting of directors who were not parties to the action, suit or proceeding cannot be obtained.

|

|

B.

|

NRS 78.751. Mandatory indemnification of directors, officers, employees and agents; advancement of expenses; other rights to indemnification and advancement of expenses; primary obligor with respect to indemnification or advancement of expenses; effect of amendment to provision of articles or bylaws providing right to indemnification or advancement of expenses.

|

| |

1.

|

A corporation shall indemnify any person who is a director, officer, employee or agent to the extent that the person is successful on the merits or otherwise in defense of:

|

| |

(a)

|

Any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative, including, without limitation, an action by or in the right of the corporation, by reason of the fact that the person is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise; or

|

| |

(b)

|

Any claim, issue or matter therein,

|

| |

against

|

expenses actually and reasonably incurred by the person in connection with defending the action, including, without limitation, attorney’s fees.

|

| |

2.

|

Unless otherwise restricted by the articles of incorporation, the bylaws or an agreement made by the corporation, the corporation may pay the expenses of officers and directors incurred in defending a civil or criminal action, suit or proceeding as they are incurred and in advance of the final disposition of the action, suit or proceeding, upon receipt of an undertaking by or on behalf of the director or officer to repay the amount if it is ultimately determined by a court of competent jurisdiction that the director or officer is not entitled to be indemnified by the corporation. The articles of incorporation, the bylaws or an agreement made by the corporation may require the corporation to pay such expenses upon receipt of such an undertaking. The provisions of this subsection do not affect any rights to advancement of expenses to which corporate personnel other than directors or officers may be entitled under any contract or otherwise by law.

|

| |

3.

|

The indemnification pursuant to this section and NRS 78.7502 and the advancement of expenses authorized in or ordered by a court pursuant to this section:

|

| |

(a)

|

Does not exclude any other rights to which a person seeking indemnification or advancement of expenses may be entitled under the articles of incorporation or any bylaw, agreement, vote of stockholders or disinterested directors or otherwise, for either an action in the person’s official capacity or an action in another capacity while holding office, except that indemnification, unless ordered by a court pursuant to NRS 78.7502 or for the advancement of expenses made pursuant to subsection 2, may not be made to or on behalf of any director or officer finally adjudged by a court of competent jurisdiction, after exhaustion of any appeals taken therefrom, to be liable for intentional misconduct, fraud or a knowing violation of law, and such misconduct, fraud or violation was material to the cause of action.

|

| |

(b)

|

Continues for a person who has ceased to be a director, officer, employee or agent and inures to the benefit of the heirs, executors and administrators of such a person.

|

| |

4.

|

Unless the articles of incorporation, the bylaws or an agreement made by a corporation provide otherwise, if a person is entitled to indemnification or the advancement of expenses from the corporation and any other person, the corporation is the primary obligor with respect to such indemnification or advancement.

|

| |

5.

|

A right to indemnification or to advancement of expenses arising under a provision of the articles of incorporation or any bylaw is not eliminated or impaired by an amendment to such provision after the occurrence of the act or omission that is the subject of the civil, criminal, administrative or investigative action, suit or proceeding for which indemnification or advancement of expenses is sought, unless the provision in effect at the time of such act or omission explicitly authorizes such elimination or impairment after such act or omission has occurred.

|

|

C.

|

NRS 78.752. Insurance and other financial arrangements against liability of directors, officers, employees and agents.

|

| |

1.

|

A corporation may purchase and maintain insurance or make other financial arrangements on behalf of any person who is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise for any liability asserted against the person and liability and expenses incurred by the person in his or her capacity as a director, officer, employee or agent, or arising out of his or her status as such, whether or not the corporation has the authority to indemnify such a person against such liability and expenses.

|

| |

2.

|

The other financial arrangements made by the corporation pursuant to subsection 1 may include the following:

|

| |

(a)

|

The creation of a trust fund.

|

| |

(b)

|

The establishment of a program of self-insurance.

|

| |

(c)

|

The securing of its obligation of indemnification by granting a security interest or other lien on any assets of the corporation.

|

| |

(d)

|

The establishment of a letter of credit, guaranty or surety.

|

| |

No financial arrangement made pursuant to this subsection may provide protection for a person adjudged by a court of competent jurisdiction, after exhaustion of all appeals therefrom, to be liable for intentional misconduct, fraud or a knowing violation of law, except with respect to the advancement of expenses or indemnification ordered by a court.

|

| |

3.

|

Any insurance or other financial arrangement made on behalf of a person pursuant to this section may be provided by the corporation or any other person approved by the board of directors, even if all or part of the other person’s stock or other securities is owned by the corporation.

|

| |

4.

|

In the absence of fraud:

|

| |

(a)

|

The decision of the board of directors as to the propriety of the terms and conditions of any insurance or other financial arrangement made pursuant to this section and the choice of the person to provide the insurance or other financial arrangement is conclusive; and

|

| |

(b)

|

The insurance or other financial arrangement:

|

| |

(1)

|

Is not void or voidable; and

|

| |

(2)

|

Does not subject any director approving it to personal liability for his or her action,

|

| |

even

|

if a director approving the insurance or other financial arrangement is a beneficiary of the insurance or other financial arrangement.

|

| |

5.

|

A corporation or its subsidiary which provides self-insurance for itself or for another affiliated corporation pursuant to this section is not subject to the provisions of title 57 of NRS.

|

Further, under the Blackboxstocks bylaws, unless ordered by a court, no indemnification will be provided to a director or an officer unless a determination shall have been made that such person acted in good faith and in a manner such person reasonably believed to be in or not opposed to the best interests of Blackboxstocks and, with respect to any criminal proceeding, such person had no reasonable cause to believe his or her conduct was unlawful. Such determination shall be made by (a) a majority vote of disinterested directors, (b) a committee comprised of disinterested directors, such committee having been designated by a majority vote of the disinterested directors, (c) if there are no disinterested directors, or if a majority of disinterested directors so directs, by independent legal counsel in a written opinion, or (d) by Blackboxstocks’ stockholders.