Backblaze Announces Full Exercise of Over-Allotment Option

26 November 2024 - 4:51PM

Business Wire

Backblaze, Inc. (Nasdaq: BLZE), the cloud storage innovator

providing a modern alternative to traditional cloud providers,

today announced the underwriters of its recently completed upsized

public offering of shares of its Class A common stock (the “Common

Stock”), which closed on November 22, 2024, have exercised in full

their option to purchase an additional 937,500 shares of Common

Stock. The additional shares of Common Stock were sold at a price

to the public of $5.60, before underwriting discounts. The exercise

of the underwriters’ option to purchase additional shares of Common

Stock closed on November 25, 2024 and brings the total net proceeds

to Backblaze to $37.5 million, after deducting underwriting

discounts and commissions.

Oppenheimer & Co. Inc. and Needham & Company, LLC acted

as joint book-running managers and Craig-Hallum Capital Group LLC

acted as co-manager for the offering.

The offering was made pursuant to an effective shelf

registration statement on Form S-3 that was filed with the U.S.

Securities and Exchange Commission (the “SEC”) on May 1, 2024 and

declared effective by the SEC on May 13, 2024. A prospectus

supplement and accompanying prospectus relating to and describing

the terms of the proposed offering were filed with the SEC. When

available, copies of the prospectus supplement relating to the

offering may be obtained by contacting: Oppenheimer & Co. Inc.,

Attention: Syndicate Prospectus Department, 85 Broad Street, 26th

Floor, New York, New York 10004, by telephone at (212) 667-8055, or

by email at EquityProspectus@opco.com; or from Needham &

Company, LLC, Attention: Prospectus Department, 250 Park Avenue,

10th Floor, New York, NY 10177, telephone: (800) 903-3268, or by

emailing prospectus@needhamco.com.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation, or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

About Backblaze, Inc.

Backblaze is the cloud storage innovator providing a modern

alternative to traditional cloud providers. We deliver

high-performance, secure cloud object storage that customers use to

develop applications, manage media, secure backups, build AI

workflows, protect from ransomware, and more. Backblaze helps

businesses break free from the walled gardens that traditional

providers lock customers into, enabling them to use their data in

open cloud workflows with the providers they prefer at a fraction

of the cost. Headquartered in San Mateo, CA, Backblaze (NASDAQ:

BLZE) was founded in 2007 and serves over 500,000 customers in 175

countries around the world. For more information, please go to

www.backblaze.com.

Forward-looking Statements

Except for historical information, certain statements in this

press release, including statements regarding the proposed

follow-on public offering and the proposed terms of such offering

are “forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. All statements other than

statements of historical facts contained in this press release,

including statements regarding our future results of operations or

financial condition, business strategy and plans and objectives of

management for future operations, are forward-looking statements.

These statements involve known and unknown risks, uncertainties,

and other important factors that are in some cases beyond our

control and may cause our actual results, performance, or

achievements to be materially different from any future results,

performance, or achievements expressed or implied by the

forward-looking statements and relate to market conditions, the

ability to complete the offering, and the satisfaction of the

closing conditions related to the follow-on public offering. The

forward-looking statements made in this press release relate only

to events as of the date on which the statements are made.

Backblaze undertakes no obligation to update any forward-looking

statements made in this press release to reflect events or

circumstances after the date of this press release or to reflect

new information or the occurrence of unanticipated events, except

as required by law. The outcome of the events described in these

forward-looking statements is subject to risks, uncertainties and

other factors described in the section titled “Risk Factors”

section in Backblaze’s effective shelf registration statement on

Form S-3 initially filed with the SEC on May 1, 2024, including the

documents incorporated by reference therein, including Backblaze’s

Annual Report on Form 10-K for the year ended December 31, 2023,

filed with the SEC on April 1, 2024 and its Quarterly Report on

Form 10-Q for the quarter ended September 30, 2024, filed with the

SEC on November 7, 2024.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241125788867/en/

Investors Contact: Mimi Kong Investor Relations

ir@backblaze.com

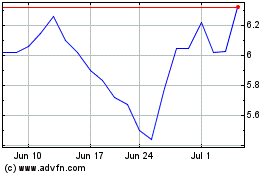

Backblaze (NASDAQ:BLZE)

Historical Stock Chart

From Dec 2024 to Jan 2025

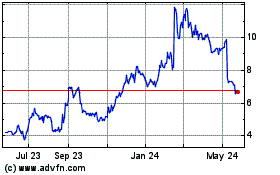

Backblaze (NASDAQ:BLZE)

Historical Stock Chart

From Jan 2024 to Jan 2025