false

0001845942

0001845942

2023-12-18

2023-12-18

0001845942

BNIX:CommonStockParValue0.01PerShareMember

2023-12-18

2023-12-18

0001845942

BNIX:RedeemableWarrantsEachWholeWarrantExercisableForOneShareOfCommonStockAtExercisePriceOf11.50Member

2023-12-18

2023-12-18

0001845942

BNIX:OneRightToReceive110thOfOneShareOfCommonStockMember

2023-12-18

2023-12-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

8-K

Current

Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 18, 2023

Bannix

Acquisition Corp.

(Exact

Name of Registrant as Specified in its Charter)

| Delaware |

|

1-40790 |

|

86-1626016 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

8265

West Sunset Blvd., Suite # 107

West Hollywood, CA |

|

90046 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (323) 682-8949

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act |

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act |

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act |

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities registered

pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.01 per share |

|

BNIX |

|

The

Nasdaq Stock Market LLC |

| Redeemable

Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 |

|

BNIXW |

|

The

Nasdaq Stock Market LLC |

| One

Right to receive 1/10th of one share of Common Stock |

|

BNIXR |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01. Entry into a Material Definitive

Agreement

On April 17, 2023, Bannix Acquisition

Corp. (“Bannix”), EVIE Autonomous Group Ltd. (“EVIE”) and EVIE’s shareholders entered into a Business Combination

Agreement pursuant to which Bannix agreed to acquire EVIE. In addition, on August 8, 2023, Bannix entered into a Patent Purchase Agreement

(“PPA”) with GBT Tokenize Corp. (“Tokenize”), which is 50% owned by GBT Technologies Inc. (“GBT”),

where GBT provided its consent, to acquire the entire right, title, and interest to intellectual property including patents and patent

applications providing a machine learning driven technology that controls radio wave transmissions, analyzes their reflections data, and

constructs 2D/3D images of stationary and moving objects. The closing date of the PPA will be immediately following the closing of the

acquisition of EVIE by Bannix. The Purchase Price is set at 5% of the consideration that Bannix is paying to the shareholders of EVIE.

The Business Combination Agreement sets the consideration to be paid by Bannix at $850 million and, in turn, the consideration in the

PPA to be paid to Tokenize is $42.5 million. If the final purchase price is less than $30 million, Tokenize has the option to cancel the

PPA. In accordance therewith, Bannix agrees to pay, issue and deliver to Tokenize, $42.5 million in Series A Preferred Stock to Tokenize,

which such terms will be more fully set forth in the Series A Preferred Stock Certificate of Designation to be filed with the Secretary

of State of the State of prior to the closing date. The Series A Preferred Stock will have stated value of face value of $1,000 per share

and is convertible, at the option of Tokenize, into shares of common stock of Bannix at 5% discount to the VWAP during the 20 trading

days prior to conversion, and in any event not less than $1.00. The Series A Preferred Stock will not have voting rights and will be entitled

to dividends only in the event of liquidation. The Series A Preferred Stock will have a 4.99% beneficial ownership limitation.

Series A Preferred Stock and the

shares of common stock issuable upon conversion of the Series A Preferred Stock (the “Conversion Shares”) shall be subject

to a lock-up beginning on the closing date and ending on the earliest of (i) the six (6) months after such date, (ii) a change in control,

or (iii) written consent of Bannix (the “Seller Lockup Period”)

On December 18, 2023, Bannix and

Tokenize entered into Amendment No. 1 to the PPA. Per the amendment, Bannix and Tokenize agreed that the shares of common stock to be

issued upon conversion of the Series A Preferred Stock will not exceed 19.99% of the aggregate number of shares of common stock issued

and outstanding as of the closing of Bannix’s acquisition of EVIE (such maximum number of shares, the “Exchange Cap”)

unless Bannix’s stockholders have approved the issuance of shares of common stock upon conversion of the Series A Preferred Stock

pursuant to the PPA in excess of the Exchange Cap in accordance with the applicable rules of the market or exchange on which Bannix’s

shares of common stock trade.

The foregoing description of the

terms of the above transactions do not purport to be complete and are qualified in their entirety by reference to the provisions of such

agreements, the forms of which are filed as exhibits to this Current Report on Form 8-K.

Item

9.01 Financial Statements and Exhibits

(d) Exhibits. The following exhibits are filed with this Form 8-K:

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: December 19, 2023 |

|

| |

|

| BANNIX ACQUISITION CORP. |

|

| |

|

| By: |

/s/ Douglas Davis |

|

| Name: |

Douglas Davis |

|

| Title: |

Chief Executive Officer |

|

EXHIBIT 10.1

AMENDMENT NO. 1 TO PATENT PURCHASE AGREEMENT

This Amendment No. 1 to the

Patent Purchase Agreement (the "Amendment") dated December 18, 2023 is entered into by and between Bannix Acquisition

Corp. (the “Purchaser”) and GBT Tokenize Corp. (the "Seller").

WHEREAS, the Purchaser

and the Seller are parties to that certain Patent Purchase Agreement, dated August 8, 2023 (the "Patent Purchase Agreement"),

pursuant to which, among other things, the Purchaser agreed, on the Closing Date, to acquire the Patents from the Seller on the terms

and subject to the conditions set forth in the Patent Purchase Agreement;

WHEREAS, capitalized

terms used in this Amendment, but not otherwise defined herein, are used herein with the respective meanings ascribed to such terms under

the Patent Purchase Agreement;

WHEREAS, Purchaser

and Seller wish to amend the Patent Purchase Agreement as set forth herein.

NOW, THEREFORE, in consideration

of the foregoing, and the mutual terms, covenants and conditions herein below set forth, and for other good and valuable consideration,

the receipt and sufficiency of which are hereby acknowledged, the parties hereto, intending to be legally bound, hereby agree as follows:

1. Amendments to the

Patent Purchase Agreement. Purchaser and Seller agree to add Section 2.4 to the Patent Purchase Agreement as follows:

Notwithstanding anything to the contrary herein,

the Seller may not convert the Series A Preferred Stock into shares of common stock of the Purchaser to the extent that after giving effect

to conversion the aggregate number of shares of common stock issued under the Agreement would exceed 19.99% of the aggregate number of

shares of common stock issued and outstanding as of the closing of the Purchaser’s acquisition of EVIE Autonomous Group Ltd. (such

maximum number of shares, the “Exchange Cap”) unless the Company’s stockholders have approved the issuance of

shares of common stock upon conversion of the Series A Preferred Stock pursuant to this Agreement in excess of the Exchange Cap in accordance

with the applicable rules of the market or exchange on which the Purchaser’s shares of common stock trade.

2. Miscellaneous.

This Amendment may be executed in counterparts, each of which shall be deemed an original, but all of which together shall be deemed to

be one and the same agreement. A signed copy of this Amendment delivered by facsimile, e-mail or other means of electronic transmission

shall be deemed to have the same legal effect as delivery of an original signed copy.

IN WITNESS WHEREOF, the parties have executed

this Agreement the day and year first above written.

GBT TOKENIZE CORP.

By:___________________________

Name: Michael Murray

Title: CEO

BANNIX ACQUISITION CORP.

By:___________________________

Name: Douglas Davis

Title: CEO

We give our consent:

GBT Technologies, Inc.

By:___________________________

Name: Mansour Khatib

Title: Chief Executive Officer

v3.23.4

Cover

|

Dec. 18, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 18, 2023

|

| Entity File Number |

1-40790

|

| Entity Registrant Name |

Bannix

Acquisition Corp.

|

| Entity Central Index Key |

0001845942

|

| Entity Tax Identification Number |

86-1626016

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

8265

West Sunset Blvd.

|

| Entity Address, Address Line Two |

Suite # 107

|

| Entity Address, City or Town |

West Hollywood

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90046

|

| City Area Code |

(323)

|

| Local Phone Number |

682-8949

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Common Stock, par value $0.01 per share |

|

| Title of 12(b) Security |

Common

Stock, par value $0.01 per share

|

| Trading Symbol |

BNIX

|

| Security Exchange Name |

NASDAQ

|

| Redeemable Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 |

|

| Title of 12(b) Security |

Redeemable

Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50

|

| Trading Symbol |

BNIXW

|

| Security Exchange Name |

NASDAQ

|

| One Right to receive 1/10th of one share of Common Stock |

|

| Title of 12(b) Security |

One

Right to receive 1/10th of one share of Common Stock

|

| Trading Symbol |

BNIXR

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=BNIX_CommonStockParValue0.01PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=BNIX_RedeemableWarrantsEachWholeWarrantExercisableForOneShareOfCommonStockAtExercisePriceOf11.50Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=BNIX_OneRightToReceive110thOfOneShareOfCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

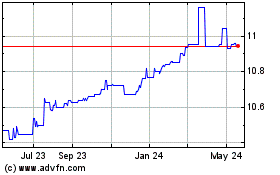

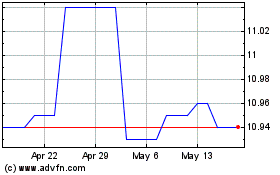

Bannix Acquisition (NASDAQ:BNIX)

Historical Stock Chart

From Apr 2024 to May 2024

Bannix Acquisition (NASDAQ:BNIX)

Historical Stock Chart

From May 2023 to May 2024