UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington

D.C. 20549

SCHEDULE

14A

Proxy Statement Pursuant to Section 14(a)

of the

Securities

Exchange Act of 1934

Filed by the Registrant

☒

Filed by a party other than

the Registrant ☐

Check the appropriate box:

☐Preliminary

Proxy Statement

☐Confidential

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒Definitive

Proxy Statement

☐Definitive

Additional Materials

☐Soliciting

Material under §240.14a-12

Bannix

Acquisition Corp.

(Name of

Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement

if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒No

fee required

☐Fee

paid previously with preliminary materials

☐Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

BANNIX ACQUISITION CORP.

1063 North Spaulding

West Hollywood CA 90046

NOTICE OF ANNUAL MEETING

TO BE HELD ON MARCH 8, 2024

TO THE STOCKHOLDERS OF BANNIX ACQUISITION CORP.:

You are cordially invited to attend

the annual meeting (the “annual meeting”) of stockholders of Bannix Acquisition Corp. (the “Company”

“we” “us” or “our”) to be held at 10:00 a.m. Eastern

Time on March 8, 2024. The annual meeting will be held virtually at http://www.virtualshareholdermeeting.com/BNIX2024SM At the

annual meeting the stockholders will consider and vote upon the following proposals:

1. A proposal to amend (the “Extension

Amendment”) the Company’s Amended and Restated Certificate of Incorporation (our “charter”) to extend the

Termination Date (as defined below) by which the Company must consummate a business combination (as defined below) (the “Extension”)

from March 14, 2024 (the date that is 30 months from the closing date of the Company’s initial public offering of units (the

“IPO”)) to September 14, 2024 (the date that is 36 months from the closing date of the IPO) (the “Extended Date”)

by allowing the Company without another stockholder vote to elect to extend the Termination Date to consummate a business combination

on a monthly basis up to six times by an additional one month each time after the Termination Date by resolution of the Company’s

board of directors (the “Board”) if requested by Instant Fame LLC, a Nevada limited liability company (the “Sponsor”)

and the successor sponsor to Bannix Management LLP a Delaware limited liability partnership our original sponsor and upon five

days’ advance notice prior to the applicable Termination Date until the Termination Date (such proposal the “Charter

Amendment Proposal”);

2. A proposal to amend (the “Trust

Amendment”) the Company’s Investment Management Trust Agreement dated as of September 10, 2021 and as amended on March

8, 2023 (the “Trust Agreement”) by and between the Company and Continental Stock Transfer & Trust Company (the

“Trustee”) allowing the Company in the event that the Company has not consummated a business combination by the Extended

Date to extend by resolution of the Board and without approval of the Company’s stockholders the Termination Date up to six

times each by one additional month (for a total of up to six additional months) by depositing into the Trust Account for each such

monthly extension an amount equal to the lesser of (x) $25,000 and (y) $0.05 for each share that is not redeemed in connection

with the annual meeting (such proposal the “Trust Amendment Proposal”);

3. A proposal to amend the charter (the

“NTA Amendment”), which amendment shall be effective, if adopted and implemented by the Company, prior to the consummation

of the proposed Business Combination, to remove from the charter the Redemption Limitation, as defined in the charter, contained

under Section 9.2(a) preventing the Company from closing a business combination if it would have less than $5,000,001 of net tangible

assets in order to expand the methods that the Company may employ so as not to become subject to the “penny stock”

rules of the United States Securities and Exchange Commission (the “NTA Proposal”).

4. A proposal to elect six (6) nominees to our board of directors

(the “Directors Proposal”);

5. A proposal to ratify the appointment of RBSM LLP (“RBSM”)

as our independent registered public accounting firm for the fiscal year ending December 31, 2023 (the “Auditor Proposal”);

6. A proposal to approve the adjournment of the Annual Meeting

from time to time to a later date or dates, if necessary and appropriate, under certain circumstances, including for the purpose

of soliciting additional proxies in favor one or more of the foregoing proposals, in the event the Company does not receive the

requisite stockholder vote to approve such proposal(s) or establish a quorum (the “Adjournment Proposal”); and

The Adjournment Proposal will only be presented at the Annual

Meeting if there are not sufficient votes to approve the above-mentioned Proposals.

Each of the Proposal is more fully described in the accompanying

proxy statement.

Only holders of record of our common

stock at the close of business on February 7, 2024 are entitled to notice of the Annual Meeting and to vote at the Annual Meeting

and any adjournments or postponements of the Annual Meeting. To support the health and well-being of our stockholders the annual

meeting will be a virtual meeting. You will be able to attend and participate in the annual meeting online by visiting http://www.virtualshareholdermeeting.com/BNIX2024SM

As previously announced, the Company

entered into a Business Combination Agreement, dated as of June 23, 2023 (as may be further amended and restated, the “Business

Combination Agreement,” and together with the other agreements and transactions contemplated by the Business Combination

Agreement, the “Business Combination”), by and among the Company, EVIE Autonomous Group Ltd., a private company newly

formed under the Laws of England and Wales (“EVIE”), and the shareholder of Evie (the “Shareholder”),

pursuant to which, subject to the satisfaction or waiver of certain conditions precedent in the Business Combination Agreement,

the following transactions will occur: the acquisition by the Company of all of the issued and outstanding share capital of Evie

from the Shareholder in exchange for the issuance of 85,000,000 new shares of common stock of the Company, $0.01 par value per

share (the “Common Stock”), pursuant to which Evie will become a direct wholly owned subsidiary of the Company (the

“Share Acquisition”) and (b) the other transactions contemplated by the Business Combination Agreement and the Ancillary

Documents referred to therein.

On August 8, 2023, the Company entered

into a Patent Purchase Agreement (“PPA”) with GBT Tokenize Corp. (“Tokenize”). Tokenize is 50% owned of

GBT Technologies Inc. (“GBT”) and 50% owned by Magic Internacional Argentina FC, S.L. (“Magic”). Magic

is controlled by Sergio Fridman who has no connection to the Company or any of its directors or sponsors. GBT provided its consent,

to acquire the entire right, title, and interest of certain patents and patent applications providing an intellectual property

basis for a machine learning driven technology that controls radio wave transmissions, analyzes their reflections data, and constructs

2D/3D images of stationary and in motion objects, (the “Patents”). There are no current arrangements between the executive

officers and the board of directors of either GBT or the Company’s executive officers, directors or stockholders of the Company.

The closing date of the PPA will immediately follow the closing of the Business Combination. The Purchase Price is set at 5% of

the consideration that the Company is paying to the Shareholder in connection with the Business Combination. The Business Combination

Agreement sets the consideration to be paid by the Company at $850 million and, in turn, the consideration in the PPA to be paid

to Tokenize is $42.5 million. If the final Purchase Price is less than $30 million, Tokenize has the option to cancel the PPA.

In accordance therewith, the Company agrees to pay, issue and deliver to Tokenize, $42,500,000 in series A preferred stock to Tokenize,

which such terms will be more fully set forth in the Series A Preferred Stock Certificate of Designation to be filed with the Secretary

of State of the State of prior to the closing. The 42,500 Series A Preferred Stock will have stated value of face value of $1,000

per share and is convertible, at the option of Tokenize, into shares of common stock of Bannix at 5% discount to the VWAP during

the 20 trading days prior to conversion, and in any event not less than $1.00. The Series A Preferred Stock will not have voting

rights and will be entitled to dividends only in the event of liquidation. The Series A Preferred Stock will have a 4.99% beneficial

ownership limitation providing that the Series A Preferred Stock may not be converted into more than 4.99% of the shares of common

stock outstanding at any point in time. Series A Preferred Stock and the shares of common stock issuable upon conversion of the

Series A Preferred Stock (the “Conversion Shares”) shall be subject to a lock-up beginning on the Closing Date and

ending on the earliest of (i) the six (6) months after such date, (ii) a Change in Control, or (iii) written consent of Purchaser

(the “Seller Lockup Period”).

The Charter Amendment Proposal and the

Trust Amendment Proposal are essential to the overall implementation of the Board’s plan to extend the date by which the

Company to complete the Business Combination. The purpose of the Charter Amendment Proposal, the Trust Amendment Proposal, and,

if necessary, the Adjournment Proposal, is to allow us additional time to complete our Business Combination. The adoption of the

NTA Amendment is being proposed in order to facilitate the consummation of the Business Combination, by permitting redemptions

by public stockholders even if such redemptions result in the Company having net tangible assets that are less than $5,000,001

and by permitting consummation of a business combination even if it would cause the Company’s NTA to be less than $5,000,001

either immediately prior to or upon consummation of such a business combination. The Company is presenting the NTA Proposal so

that the parties may consummate the Business Combination even if the Company has $5,000,000 or less in net tangible assets at the

Closing in order to expand the methods that the Company may employ so as not to become subject to the “penny stock”

rules of the United States Securities and Exchange Commission.

The Director Proposal and Auditor Proposal

are regular corporate matters that need our stockholder approval at the annual meeting. While we are currently working on finalizing

the terms of the Business Combination, the Board currently believes that there will not be sufficient time before March 14, 2024

to complete the Business Combination. Accordingly, the Board believes that in order to be able to consummate the Business Combination,

we will need to obtain the Extension. Therefore, the Board has determined that it is in the best interests of our stockholders

to extend the date by which the Company has to consummate a Business Combination to the Extended Date.

The Company and other

parties to the Business Combination Agreement are currently working towards satisfaction of the conditions to completion of the

Business Combination, including drafting the necessary filings with the U.S. Securities and Exchange Commission (the “SEC”)

related to the transaction, but have determined that there will not be sufficient time before March 14, 2024 (its current termination

date) to hold an annual meeting to obtain the requisite stockholder approval of, and to consummate, the Business Combination. We

intend to complete the Business Combination as soon as possible and in any event on or before the Extended Date.

Approval of the Charter

Amendment Proposal, Trust Amendment Proposal require the affirmative vote of holders of at least 65% of our outstanding shares

of common stock. Approval of the Auditor Proposal and the Adjournment Proposal require the affirmative vote of the holders of a

majority of the issued and outstanding shares of stock represented by virtual attendance or by proxy and entitled to vote thereon

at the Annual Meeting. Approval of the election of each director nominees under the Director Proposal requires plurality of the

votes of the stockholders by virtual attendance or represented by proxy at the Annual Meeting and entitled to vote thereon.

Approval of the Charter Amendment Proposal

and the Trust Amendment Proposal is a condition to the implementation of the Extension. In addition, the Company is also seeking

to have the NTA Proposal approved which would remove the Redemption Limitation from the charter in order to expand the methods

that the Company may employ so as not to become subject to the “penny stock” rules of the United States Securities

and Exchange Commission. If the NTA Proposal is not approved, we will not proceed with the Extension if the number of redemptions

of our common stock causes the Company to have less than $5,000,001 of net tangible assets following approval of the Charter Amendment

Proposal and the Trust Amendment Proposal.

Our Board has fixed the close of business

on February 7, 2024 as the record date for determining the Company’s stockholders entitled to receive notice of and vote

at the annual meeting and any adjournment thereof. Only holders of record of the Company’s common stock on that date are

entitled to have their votes counted at the annual meeting or any adjournment thereof. A complete list of stockholders of record

entitled to vote at the annual meeting will be available for ten days before the annual meeting at the Company’s principal

executive offices for inspection by stockholders during ordinary business hours for any purpose germane to the annual meeting.

If the Charter Amendment Proposal and

the Trust Amendment Proposal are approved and the Extension is implemented holders of common may elect to redeem their common stock

for a per share price payable in cash equal to the aggregate amount then on deposit in the trust account established by the Company

in connection with its IPO (the “trust account”) as of two business days prior to the annual meeting

including any interest earned on the trust account deposits (net of taxes payable) divided by the number of then outstanding common

stock (the “Election”) regardless of whether or how such stockholders vote on the Charter Amendment Proposal

or the Trust Amendment Proposal. However, if the NTA Proposal is not approved, the Company may not redeem our common stock in an

amount that would cause our net tangible assets to be less than $5,000,001. If the Charter Amendment Proposal, the Trust Amendment

Proposal and the NTA Proposal are approved by the requisite vote of stockholders holders of common stock that do not make the Election

will retain the opportunity to have their common stock redeemed in conjunction with the consummation of a business combination

subject to any limitations set forth in our charter as amended. In addition, stockholders who do not make the Election would be

entitled to have their common stock redeemed for cash if the Company has not completed a business combination by the Extended Date.

If the Charter Amendment Proposal and

the Trust Amendment Proposal are approved our Sponsor or its designee has agreed to advance to us as loans for deposit into the

Trust Account the needed monthly amounts equal to the lesser of (x) $25,000 and (y) $0.05 for each share that is not redeemed in

connection with the annual meeting. In addition if the Charter Amendment Proposal and the Trust Amendment Proposal are approved

and the Extension Amendment and Trust Amendment become effective in the event that the Company has not consummated a business combination

by March 14, 2024 the Company may by resolution of the Board and without approval of the Company’s public stockholders if

requested by the Sponsor and upon five days’ advance notice prior to the applicable Termination Date extend the Termination

Date up to six times each by one additional month (for a total of up to six additional months to complete a business combination)

provided that the Sponsor or its designee will for each such monthly extension advance to us as a loan for deposit into the Trust

Account an amount equal to the lesser of (a) $25,000 or (b) $0.05 for each public share that is not redeemed in connection with

the annual meeting for an aggregate deposit of up to the lesser of (x) $150,000 or (y) $0.30 for each public share that is not

redeemed in connection with the annual meeting (if all six additional monthly extensions are exercised). The advances are conditioned

upon the implementation of the Charter Amendment Proposal and the Trust Amendment Proposal and will not occur if either the Charter

Amendment Proposal or the Trust Amendment Proposal is not approved or the Extension is not completed. The amount of the advances

will not bear interest and will be repayable by the Company to our Sponsor or its designees upon consummation of the business combination.

If our Sponsor or its designee advises the Company that it does not intend to make the advances then the Charter Amendment Proposal

the Trust Amendment Proposal and the Adjournment Proposal will not be put before the shareholders at the annual meeting and we

may decide in accordance with our charter to extend the period of time to consummate an initial Business Combination or to dissolve

and liquidate. Our Sponsor or its designees will have the sole discretion whether to continue extending for additional calendar

months until the Extended Date and if our Sponsor determines not to continue extending for additional calendar months its obligation

to make additional advances will terminate.

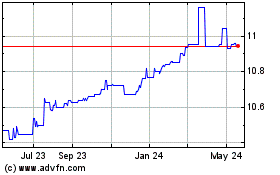

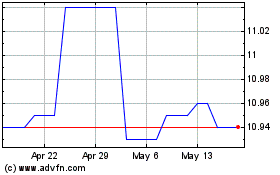

The Company estimates that the per share

price at which the common stock may be redeemed from cash held in the trust account will be approximately $10.99 at the time of

the annual meeting. The closing price of the Company’s common stock on the Nasdaq Stock Market LLC (“NASDAQ”)

on February 7, 2024, the record date of the annual meeting was $10.85. Accordingly, if the market price were to remain the same

until the date of the annual meeting exercising redemption rights would result in a public stockholder receiving approximately

$0.14 more than if such stockholder sold the common stock in the open market as of February 7, 2024 . The Company cannot assure

stockholders that they will be able to sell their common stock in the open market even if the market price per share is higher

than the redemption price stated above as there may not be sufficient liquidity in its securities when such stockholders wish to

sell their shares.

The Adjournment Proposal if adopted

will allow our Board to adjourn the annual meeting to a later date or dates if necessary or appropriate to permit further solicitation

of proxies. The Adjournment Proposal will be presented to our stockholders only in the event that there are insufficient for or

otherwise in connection with the approval of the Charter Amendment Proposal or the Trust Amendment Proposal.

If either the Charter Amendment Proposal

or the Trust Amendment Proposal is not approved the Company and the Company does not consummate an initial business combination

within the Combination Period as contemplated by our IPO prospectus and in accordance with our charter the Company will (i) cease

all operations except for the purpose of winding up (ii) as promptly as reasonably possible but not more than ten business

days thereafter and subject to having lawfully available funds therefor redeem 100% of the outstanding common stock at a per share

price payable in cash equal to the aggregate amount then on deposit in the trust account including any interest earned on the trust

account deposits (which interest shall be net of taxes payable and after setting aside up to $100,000 to pay dissolution expenses)

divided by the number of then outstanding common stock which redemption will completely extinguish stockholders’ rights as

stockholders (including the right to receive further liquidation distributions if any) subject to applicable law and (iii) as

promptly as reasonably possible following such redemption subject to the approval of our remaining stockholders and our Board in

accordance with applicable law dissolve and liquidate subject in each case to our obligations under Delaware law to provide for

claims of creditors and the requirements of other applicable law. The Company and the Sponsor may elect to extend the Combination

Period to September 14, 2024 but are under no obligation to do so. There will be no redemption rights or liquidating distributions

with respect to our warrants including the warrants included in the units sold in the IPO (the “public warrants”)

which will expire worthless in the event the Company winds up.

The Company reserves the right at any

time to cancel the Annual Meeting and not to submit the Charter Amendment Proposal, Trust Amendment Proposal to stockholders

or implement any of the amendments as described in the Charter Amendment Proposal or the Trust Amendment Proposal.

You are not being asked to vote on

a business combination at this time. If the Extension is implemented and you do not elect to redeem your common stock in connection

with the Extension you will retain the right to vote on a business combination when it is submitted to the stockholders (provided

that you are a stockholder on the record date for a meeting to consider a business combination) and the right to redeem your common

stock for a pro rata portion of the trust account in the event a business combination is approved and completed or the Company

has not consummated a business combination by the Extended Date.

After careful consideration of all

relevant factors, the Board of Directors has determined that each of the proposals are advisable and recommends that you vote or

give instruction to vote “FOR” such proposals.

Enclosed is the proxy statement containing

detailed information concerning the Charter Amendment Proposal Adjournment Proposal and the annual meeting. Whether or not you

plan to attend the annual meeting the Company urges you to read this material carefully and vote your shares.

| February 16, 2024 |

|

By Order of the Board of Directors |

| |

|

|

| |

|

/s/ Douglas Davis |

| |

|

Douglas Davis |

| |

|

Co- Chair of the Board and Chief Executive Officer |

| |

|

|

| |

|

/s/ Craig J. Marshak |

| |

|

Craig J. Marshak |

| |

|

Co- Chair of the Board |

Your vote is important. If you are

a stockholder of record, please sign date and return your proxy card as soon as possible to make sure that your shares are represented

at the annual meeting. If you are a stockholder of record, you may also cast your vote virtually at the annual meeting. If your

shares are held in an account at a brokerage firm or bank you must instruct your broker or bank how to vote your shares or you

may cast your vote virtually at the annual meeting by obtaining a proxy from your brokerage firm or bank. Your failure to

vote or instruct your broker or bank how to vote will have the same effect as voting against the Charter Amendment Proposal and

an abstention will have the same effect as voting against the Charter Amendment Proposal. Abstentions will be counted in connection

with the determination of whether a valid quorum is established but will have no effect on the outcome of the Adjournment Proposal.

Important Notice Regarding the Availability

of Proxy Materials for the Annual meeting of Stockholders to be held on March 8, 2024: This notice of meeting and the accompanying

proxy statement are available at www.proxyvote.com.

TO EXERCISE YOUR REDEMPTION RIGHTS

YOU MUST (1) IF YOU HOLD COMMON STOCK THROUGH UNITS ELECT TO SEPARATE YOUR UNITS INTO THE UNDERLYING COMMON STOCK AND PUBLIC

WARRANTS PRIOR TO EXERCISING YOUR REDEMPTION RIGHTS WITH RESPECT TO THE COMMON STOCK (2) SUBMIT A WRITTEN REQUEST TO THE TRANSFER

AGENT BY 5:00 P.M. EST ON MARCH 6, 2024 THE DATE THAT IS TWO BUSINESS DAYS PRIOR TO THE SCHEDULED VOTE AT THE ANNUAL MEETING THAT

YOUR COMMON STOCK BE REDEEMED FOR CASH INCLUDING THE LEGAL NAME PHONE NUMBER AND ADDRESS OF THE BENEFICIAL OWNER OF THE SHARES

FOR WHICH REDEMPTION IS REQUESTED AND (3) DELIVER YOUR SHARES OF COMMON STOCK TO THE TRANSFER AGENT PHYSICALLY OR ELECTRONICALLY

USING THE DEPOSITORY TRUST COMPANY’S DWAC (DEPOSIT WITHDRAWAL AT CUSTODIAN) SYSTEM IN EACH CASE IN ACCORDANCE WITH THE PROCEDURES

AND DEADLINES DESCRIBED IN THE ACCOMPANYING PROXY STATEMENT. IF YOU HOLD THE SHARES IN STREET NAME YOU WILL NEED TO INSTRUCT THE

ACCOUNT EXECUTIVE AT YOUR BANK OR BROKER TO WITHDRAW THE SHARES FROM YOUR ACCOUNT IN ORDER TO EXERCISE YOUR REDEMPTION RIGHTS.

BANNIX ACQUISITION CORP.

1063 North Spaulding

West Hollywood CA 90046

PROXY STATEMENT FOR THE ANNUAL MEETING

OF STOCKHOLDERS

TO BE HELD ON MARCH 8, 2024

The annual meeting

of stockholders (the “annual meeting”) of Bannix Acquisition Corp. (the “Company”

“we” “us” or “our”) a Delaware corporation will be

held at 10:00 a.m. Eastern Time on March 8, 2024. The annual meeting will be held virtually at http://www.virtualshareholdermeeting.com/BNIX2024SM

At the annual meeting the stockholders will consider and vote upon the following proposals:

1. A proposal to amend (the “Extension

Amendment”) the Company’s Amended and Restated Certificate of Incorporation (our “charter”) to extend the

Termination Date (as defined below) by which the Company must consummate a business combination (as defined below) (the “Extension”)

from March 14, 2024 (the “Termination Date”) (the date that is 30 months from the closing date of the Company’s

initial public offering of units (the “IPO”)) to September 14, 2024 (the date that is 36 months from the closing date

of the IPO) (the “Extended Date”) by allowing the Company without another stockholder vote to elect to extend the Termination

Date to consummate a business combination on a monthly basis up to six times by an additional one month each time after the Termination

Date by resolution of the Company’s board of directors (the “Board”) if requested by Instant Fame LLC, a Nevada

limited liability company (the “Sponsor”) and the successor sponsor to Bannix Management LLP a Delaware limited liability

partnership our original sponsor and upon five days’ advance notice prior to the applicable Termination Date until September

14, 2024 (such proposal the “Charter Amendment Proposal”);

2. A proposal to amend (the “Trust

Amendment”) the Company’s Investment Management Trust Agreement dated as of September 10, 2021and as amended on March

8, 2023 (the “Trust Agreement”) by and between the Company and Continental Stock Transfer & Trust Company (the

“Trustee”) allowing the Company in the event that the Company has not consummated a business combination by the Extended

Date to extend by resolution of the Board and without approval of the Company’s stockholders the Termination Date up to six

times each by one additional month (for a total of up to six additional months) by depositing into the Trust Account for each such

monthly extension an amount equal to the lesser of (x) $25,000 and (y) $0.05 for each share that is not redeemed in connection

with the annual meeting (such proposal the “Trust Amendment Proposal”);

3. A proposal to amend the charter (the

“NTA Amendment”), which amendment shall be effective, if adopted and implemented by the Company, prior to the consummation

of the proposed Business Combination, to remove from the charter the Redemption Limitation, as defined in the charter, contained

under Section 9.2(a) preventing the Company from closing a business combination if it would have less than $5,000,001 of net tangible

assets in order to expand the methods that the Company may employ so as not to become subject to the “penny stock”

rules of the United States Securities and Exchange Commission (the “NTA Proposal”).

4. A proposal to elect six (6) nominees to our board of directors

(the “Directors Proposal”);

5. A proposal to ratify the appointment of RBSM LLP (“RBSM”)

as our independent registered public accounting firm for the fiscal year ending December 31, 2023 (the “Auditor Proposal”);

6. A proposal to approve the adjournment

of the Annual Meeting from time to time to a later date or dates, if necessary and appropriate, under certain circumstances, including

for the purpose of soliciting additional proxies in favor one or more of the foregoing proposals, in the event the Company does

not receive the requisite stockholder vote to approve such proposal(s) or establish a quorum (the “Adjournment Proposal”);

and

The Adjournment Proposal will only be presented at the Annual

Meeting if there are not sufficient votes to approve the above-mentioned Proposals.

Our Board has fixed the close of business

on February 7, 2024 as the record date for determining the Company’s stockholders entitled to receive notice of and vote

at the annual meeting and any adjournment thereof. Only holders of record of the Company’s common stock on that date are

entitled to have their votes counted at the annual meeting or any adjournment thereof. A complete list of stockholders of record

entitled to vote at the annual meeting will be available for ten days before the annual meeting at the Company’s principal

executive offices for inspection by stockholders during ordinary business hours for any purpose germane to the annual meeting.

Enclosed is the

proxy statement containing detailed information concerning the annual meeting. Whether or not you plan to attend the annual meeting

the Company urges you to read this material carefully and vote your shares.

IMPORTANT

WHETHER OR NOT

YOU PLAN TO PARTICIPATE VIRTUALLY IN THE ANNUAL MEETING, IT IS REQUESTED THAT YOU INDICATE YOUR VOTE ON THE ISSUES INCLUDED ON

THE ENCLOSED PROXY AND DATE, SIGN AND MAIL IT IN THE ENCLOSED SELF-ADDRESSED ENVELOPE WHICH REQUIRES NO POSTAGE IF MAILED IN THE

UNITED STATES OF AMERICA OR SUBMIT YOUR PROXY THROUGH THE INTERNET AS PROMPTLY AS POSSIBLE.

IMPORTANT NOTICE

REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON March 8, 2024. THIS PROXY

STATEMENT TO THE STOCKHOLDERS WILL BE AVAILABLE AT http://www.virtualshareholdermeeting.com/BNIX2024SM.

BANNIX ACQUISITION CORP.

1063 North Spaulding

West Hollywood CA 90046

FORWARD-LOOKING STATEMENTS

The statements

contained in this proxy statement that are not purely historical are “forward-looking statements.” Our forward-looking

statements include but are not limited to statements regarding our or our management team’s expectations hopes beliefs intentions

or strategies regarding the future. In addition, any statements that refer to projections forecasts or other characterizations

of future events or circumstances including any underlying assumptions are forward-looking statements. The words “anticipate”

“believe” “continue” “could” “estimate” “expect” “intends”

“may” “might” “plan” “possible” “potential” “predict” “project”

“should” “would” and similar expressions may identify forward-looking statements but the absence of these

words does not mean that a statement is not forward-looking. Forward-looking statements in this proxy statement may include without

limitation statements about:

| ● |

our ability to select an appropriate target business or businesses; |

| |

|

| ● |

our ability to complete our initial business combination on attractive terms or at all; |

| |

|

| ● |

our ability to consummate an initial business combination due to the uncertainty resulting from the COVID-19 pandemic (“COVID-19”) and economic uncertainty and volatility in the financial markets; |

| |

|

| ● |

our expectations around the performance of the prospective target business or businesses; |

| |

|

| ● |

our success in retaining or recruiting or changes required in our officers key employees or directors following our initial business combination; |

| |

|

| ● |

our officers and directors allocating their time to other businesses and potentially having conflicts of interest with our business or in approving our initial business combination; |

| |

|

| ● |

actual and potential conflicts of interest relating to our management team Sponsor or directors or any of their respective affiliates; |

| |

|

| ● |

our ability to draw from the support and expertise of affiliates of our Sponsor; |

| |

|

| ● |

our potential ability to obtain additional financing to complete our initial business combination on attractive terms or at all; |

| |

|

| ● |

our pool of prospective target businesses including the location and industry of such target businesses; |

| |

|

| ● |

the ability of our management team to generate a number of potential business combination opportunities; |

| |

|

| ● |

failure to maintain the listing on or the delisting of our securities from NASDAQ or an inability to have our securities listed on NASDAQ or another national securities exchange following our initial business combination; |

| |

|

| ● |

our public securities’ potential liquidity and trading; |

| |

|

| ● |

the lack of a market for our securities; |

| |

|

| ● |

the use of proceeds not held in the trust account (the “trust account”) or available to us from interest income on the trust account balance; |

| |

|

| ● |

the trust account not being subject to claims of third parties; or |

| |

|

| ● |

our financial performance. |

The forward-looking

statements contained in this proxy statement are based on our current expectations and beliefs concerning future developments and

their potential effects on us. There can be no assurance that future developments affecting us will be those that we have anticipated.

These forward-looking statements involve a number of risks uncertainties (some of which are beyond our control) or other assumptions

that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking

statements. These risks and uncertainties include but are not limited to those factors described under the heading “Risk

Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 filed with the SEC on April 11,

2023 and subsequent periodic filings with the SEC. Should one or more of these risks or uncertainties materialize or should any

of our assumptions prove incorrect actual results may vary in material respects from those projected in these forward-looking statements.

We undertake no obligation to update or revise any forward-looking statements whether as a result of new information future events

or otherwise except as may be required under applicable law.

RISK FACTORS

In addition to the below risk factor,

you should consider carefully all of the risks described in our Annual Report on Form 10-K, filed with the SEC on April 11, 2023,

any subsequent Quarterly Reports on Form 10-Q filed with the SEC and in the other reports we file with the SEC before making a

decision to invest in our securities. The risks and uncertainties described in the aforementioned filings and below are not the

only ones we face. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may

also become important factors that adversely affect our business, financial condition and operating results or result in our liquidation.

There are no assurances that the Extension will enable

us to complete a business combination.

Approving the Extension

involves a number of risks. If the Extension is approved, the Company can provide no assurances that a business combination will

be announced or consummated prior to the Extended Date. Our ability to consummate any business combination, is dependent on a variety

of factors, many of which are beyond our control. If the Extension is approved, the Company expects to seek stockholder approval

of a business combination. We are required to offer stockholders the opportunity to redeem shares in connection with the Charter

Amendment, and we will be required to offer stockholders redemption rights again in connection with any stockholder vote to approve

a business combination. Even if the Extension or a business combination are approved by our stockholders, it is possible that redemptions

will leave us with insufficient cash to consummate a business combination on commercially acceptable terms, or at all. The fact

that we will have separate redemption periods in connection with the Extension and a business combination vote could exacerbate

these risks. Other than in connection with a redemption offer or liquidation, our stockholders may be unable to recover their investment

except through sales of our shares on the open market. The price of our shares may be volatile, and there can be no assurance that

stockholders will be able to dispose of our shares at favorable prices, or at all.

We may

be deemed to be an investment company for purposes of the Investment Company Act (as defined below), in which case we would be

required to institute burdensome compliance requirements and our activities would be severely restricted. As a result, in such

circumstances, unless we were able to modify our activities so that we would not be deemed an investment company, we may be forced

to abandon our efforts to complete an initial business combination and instead be required to liquidate the Company.

On

January 24, 2024, the SEC issued rules (the “New SPAC Rules”) for the regulation of special purpose

acquisition companies like Bannix, relating to, among other items, disclosures in business combination transactions involving SPACs

and private operating companies; the condensed financial statement requirements applicable to transactions involving shell companies;

the use of projections by SPACs in SEC filings in connection with business combination transactions; the potential liability of

certain participants in business combination transactions; and the extent to which SPACs could become subject to regulation under

the Investment Company Act of 1940 (the ”Investment Company Act”). These rules apply to

us, and, if they become effective before we complete a Business Combination, may increase the costs and the time needed to complete

the Business Combination and may constrain the circumstances under which we can complete the Business Combination. In addition,

we could become subject to additional laws and regulations in the future that could have a similar effect.

The

longer that the funds in the trust account are held in U.S. Treasury securities or in money market funds invested primarily

in such securities, there is a greater risk that we may be considered an unregistered investment company, in which case we would

be subject to additional regulatory burdens and expenses for which we have not allotted funds, and as a result we may be required

to liquidate. If we are required to liquidate the Company, our investors would not be able to realize the benefits of owning stock

in a successor operating business, including the potential appreciation in the value of our stock and rights following such a transaction,

and our rights would expire worthless. For so long as the funds in the trust account are held in U.S. Treasury securities

or in money market funds invested primarily in such securities, the risk that we may be considered an unregistered investment company

and required to liquidate is greater than that of a special purpose acquisition company that has elected to liquidate such investments

and to hold all funds in its trust account in cash (i.e., in one or more bank accounts). Accordingly, we may determine, in our

discretion, to liquidate the securities held in the trust account at any time, and instead hold all funds in the trust account

in cash, which would further reduce the dollar amount our public shareholders would receive upon any redemption or our liquidation.

Historically,

substantially all of the assets held in the Trust Account were held in money market funds, which were invested primarily in U.S. Treasury

securities. However, on April 6, 2023, in order to mitigate the risk that the Company could be deemed to be operating as an unregistered

investment company under the Investment Company Act, the Company instructed Continental Stock Transfer & Trust Company

to liquidate the Company’s investments in money market funds invested primarily in U.S. Treasury securities and thereafter

to hold all funds in the Trust Account in cash or in U.S. Treasury securities until the earlier of the consummation of the

initial business combination or the Company’s liquidation.

We may be subject to the new 1% U.S. federal excise

tax in connection with redemptions of our Common Stock.

On August 16,

2022, the Inflation Reduction Act of 2022 (the “IR Act”) was signed into law. The IR Act provides for, among other

things, a new 1% U.S. federal excise tax (the “Exercise Tax”) on certain repurchases (including redemptions) of stock

by publicly traded U.S. corporations after December 31, 2022. The Exercise Tax is imposed on the repurchasing corporation

itself, not its stockholders from whom the shares are repurchased (although it may reduce the amount of cash distributable in a

current or subsequent redemption). The amount of the Exercise Tax is generally 1% of any positive difference between the fair market

value of any shares repurchased by the repurchasing corporation during a taxable year and the fair market value of certain new

stock issuances by the repurchasing corporation during the same taxable year. In addition, a number of exceptions apply to this

Exercise Tax. The U.S. Department of the Treasury (the “Treasury”) has been given authority to provide regulations

and other guidance to carry out, and prevent the abuse or avoidance of, this Exercise Tax. Consequently, the Excise Tax may make

a transaction with us less appealing to potential business combination targets.

On December 27,

2022, the Treasury published Notice 2023-2, which provided clarification on some aspects of the application of the excise tax.

The notice generally provides that if a publicly traded U.S. corporation completely liquidates in a liquidation to which Section 331

of the Code applies (so long as Section 332(a) of the Code also does not apply), distributions in such complete liquidation

and other distributions by such corporation in the same taxable year in which the final distribution in complete liquidation is

made are not subject to the excise tax. Consequently, we would not expect the 1% Exercise Tax to apply if there is a complete liquidation

of our company under Section 331 of the Code.

Any excise tax that

may be imposed on any redemption or other repurchase effected by us, in connection with a business combination, extension vote

or otherwise, would be payable by us and not by the redeeming holder, it could cause a reduction in the value of our common stock,

par value $0.01 (the “Common Stock”) or cash available for distribution in a subsequent liquidation. Whether and to

what extent we would be subject to the excise tax in connection with a business combination will depend on a number of factors,

including (i) the structure of the business combination, (ii) the fair market value of the redemptions and repurchases

in connection with the business combination, (iii) the nature and amount of any equity issuances in connection with the business

combination (or any other equity issuances within the same taxable year of the business combination) and (iv) the content

of any subsequent regulations, clarifications, and other guidance issued by the Treasury. The Company does not intend to use the

proceeds placed in the Trust Account to pay excise taxes or other fees or taxes similar in nature (if any) that may be imposed

on the Company pursuant to any current, pending or future rules or laws, including any excise tax due imposed under the IR Act

on any redemptions in connection with the Extension or a business combination by the Company.

Nasdaq may delist our securities

from trading on its exchange, which could limit investors’ ability to make transactions in our securities and subject us

to additional trading restrictions.

Currently, the Company’s

Common Stock, Warrants and Rights are separately listed on The Nasdaq Capital Market (“Nasdaq”). However, we cannot

assure you that our securities will continue to be listed on Nasdaq or other Nasdaq listing tiers in the future or prior to our

initial business combination, including as a result of the redemptions in connection with the Extension. In order to continue listing

our securities on Nasdaq prior to our initial business combination, we must maintain certain financial, distribution and share

price levels.

On January 9, 2024,

the Company received a notice from the Listing Qualifications Department of Nasdaq stating that the Company failed to hold an annual

meeting of stockholders within 12 months after its fiscal year ended December 31, 2022, as required by Nasdaq Listing Rule 5620(a).

In accordance with Nasdaq Listing Rule 5810(c)(2)(G), the Company has 45 calendar days (or until February 23, 2024) to submit a

plan to regain compliance and, if Nasdaq accepts the plan, Nasdaq may grant the Company up to 180 calendar days from its fiscal

year end, or until June 28, 2024, to regain compliance. This annual meeting is intended to satisfy this requirement. In addition,

the Company intends to submit a compliance plan within the specified period. While the compliance plan is pending, the Company’s

securities will continue to trade on Nasdaq. If Nasdaq does not accept the Company’s plan, then the Company will have the

opportunity to appeal that decision to a Nasdaq Hearings Panel.

If Nasdaq delists

our securities from trading on its exchange and we are not able to list our securities on another national securities exchange,

we expect our securities could be quoted on an over-the-counter market. If this were to occur, we could face significant material

adverse consequences, including (i) a limited availability of market quotations for our securities, (ii) reduced liquidity

for our securities, (iii) a determination that our Common Stock is a “penny stock” which will require brokers

trading in our Common Stock to adhere to more stringent rules and possibly result in a reduced level of trading activity in the

secondary trading market for our securities, (iv) a limited amount of news and analyst coverage in the future; (iv) institutional

investor losing interests in our securities; (v) subjection to stockholder litigation and (vi) a decreased ability to

issue additional securities or obtain additional financing in the future.

INFORMATION ABOUT

THE ANNUAL MEETING

Date, Time and Place of the Annual Meeting

The enclosed proxy

is solicited by the Board of Directors (the “Board”) of Bannix Acquisition Corp. (the “Company,” “Bannix”

or “we”), a Delaware corporation, in connection with the Annual Meeting of Stockholders to be held on March 8, 2024

at 10:00 a.m. Eastern time for the purposes set forth in the accompanying Notice of Meeting. The Company will be holding the

Annual Meeting via live webcast. You will be able to attend the Annual Meeting, vote and submit your questions online during the

Annual Meeting by visiting http://www.virtualshareholdermeeting.com/BNIX2024SM. You will also be able to attend the Annual Meeting

via teleconference and to vote during the Annual Meeting using the following dial-in information:

Telephone access (listen-only):

The principal executive office of the

Company is 1063 North Spaulding, West Hollywood, CA 90046, and its telephone number, including area code, is (323) 682-8949.

Purpose of the Annual Meeting

At the Annual Meeting, you will be asked to consider and

vote upon the following matters:

1. A proposal to amend (the “Extension

Amendment”) the Company’s Amended and Restated Certificate of Incorporation (our “charter”) to extend the

Termination Date (as defined below) by which the Company must consummate a business combination (as defined below) (the “Extension”)

from March 14, 2024 (the “Termination Date”) the date that is 30 months from the closing date of the Company’s

initial public offering of units (the “IPO”) to September 14, 2024 (the date that is 36 months from the closing date

of the IPO) (the “Extended Date”) by allowing the Company without another stockholder vote to elect to extend the Termination

Date to consummate a business combination on a monthly basis up to six times by an additional one month each time after the Extended

Date by resolution of the Company’s board of directors (the “Board”) if requested by Instant Fame LLC, a Nevada

limited liability company (the “Sponsor”) and the successor sponsor to Bannix Management LLP a Delaware limited liability

partnership our original sponsor and upon five days’ advance notice prior to the applicable Termination Date until September

14, 2024 (such proposal the “Charter Amendment Proposal”);

2. A proposal to amend (the “Trust

Amendment”) the Company’s Investment Management Trust Agreement dated as of September 10, 2021and as amended on March

8, 2023 (the “Trust Agreement”) by and between the Company and Continental Stock Transfer & Trust Company (the

“Trustee”) allowing the Company in the event that the Company has not consummated a business combination by the Extended

Date to extend by resolution of the Board and without approval of the Company’s stockholders the Termination Date up to six

times each by one additional month (for a total of up to six additional months) by depositing into the Trust Account for each such

monthly extension an amount equal to the lesser of (x) $25,000 and (y) $0.05 for each share that is not redeemed in connection

with the annual meeting (such proposal the “Trust Amendment Proposal”);

3. A proposal to amend the charter (the

“NTA Amendment”), which amendment shall be effective, if adopted and implemented by the Company, prior to the consummation

of the proposed Business Combination, to remove from the charter the Redemption Limitation, as defined in the charter, contained

under Section 9.2(a) preventing the Company from closing a business combination if it would have less than $5,000,001 of net tangible

assets in order to expand the methods that the Company may employ so as not to become subject to the “penny stock”

rules of the United States Securities and Exchange Commission (the “NTA Proposal”).

4. A proposal to elect six (6) nominees

to our board of directors (the “Directors Proposal”);

5. A proposal to ratify the appointment

of RBSM LLP (“RBSM”) as our independent registered public accounting firm for the fiscal year ending December 31, 2023

(the “Auditor Proposal”);

6. A proposal to approve the adjournment

of the Annual Meeting from time to time to a later date or dates, if necessary and appropriate, under certain circumstances, including

for the purpose of soliciting additional proxies in favor one or more of the foregoing proposals, in the event the Company does

not receive the requisite stockholder vote to approve such proposal(s) or establish a quorum (the “Adjournment Proposal”);

and

The Adjournment Proposal will only be

presented at the Annual Meeting if there are not sufficient votes to approve the above-mentioned Proposals.

Each of the Proposal is more fully described in the accompanying

proxy statement.

Only holders of record of our common

stock at the close of business on February 7, 2024 are entitled to notice of the Annual Meeting and to vote at the Annual Meeting

and any adjournments or postponements of the Annual Meeting. To support the health and well-being of our stockholders the annual

meeting will be a virtual meeting. You will be able to attend and participate in the annual meeting online by visiting http://www.virtualshareholdermeeting.com/BNIX2024SM

As previously announced, the Company

entered into a Business Combination Agreement, dated as of June 23, 2023 (as may be further amended and restated, the “Business

Combination Agreement,” and together with the other agreements and transactions contemplated by the Business Combination

Agreement, the “Business Combination”), by and among the Company, EVIE Autonomous Group Ltd., a private company newly

formed under the Laws of England and Wales (“EVIE”), and the shareholder of Evie (the “Shareholder”),

pursuant to which, subject to the satisfaction or waiver of certain conditions precedent in the Business Combination Agreement,

the following transactions will occur: the acquisition by the Company of all of the issued and outstanding share capital of Evie

from the Shareholder in exchange for the issuance of 85,000,000 new shares of common stock of the Company, $0.01 par value per

share (the “Common Stock”), pursuant to which Evie will become a direct wholly owned subsidiary of the Company (the

“Share Acquisition”) and (b) the other transactions contemplated by the Business Combination Agreement and the Ancillary

Documents referred to therein.

On August 8, 2023, the Company entered

into a Patent Purchase Agreement (“PPA”) with GBT Tokenize Corp. (“Tokenize”). Tokenize is 50% owned of

GBT Technologies Inc. (“GBT”) and 50% owned by Magic Internacional Argentina FC, S.L. (“Magic”). Magic

is controlled by Sergio Fridman who has no connection to the Company or any of its directors or sponsors. GBT provided its consent,

to acquire the entire right, title, and interest of certain patents and patent applications providing an intellectual property

basis for a machine learning driven technology that controls radio wave transmissions, analyzes their reflections data, and constructs

2D/3D images of stationary and in motion objects, (the “Patents”). There are no current arrangements between the executive

officers and the board of directors of either GBT or the Company’s executive officers, directors or stockholders of the Company.

The closing date of the PPA will immediately follow the closing of the Business Combination. The Purchase Price is set at 5% of

the consideration that the Company is paying to the Shareholder in connection with the Business Combination. The Business Combination

Agreement sets the consideration to be paid by the Company at $850 million and, in turn, the consideration in the PPA to be paid

to Tokenize is $42.5 million. If the final Purchase Price is less than $30 million, Tokenize has the option to cancel the PPA.

In accordance therewith, the Comapny agrees to pay, issue and deliver to Tokenize, $42,500,000 in series A preferred stock to Tokenize,

which such terms will be more fully set forth in the Series A Preferred Stock Certificate of Designation to be filed with the Secretary

of State of the State of prior to the closing. The 42,500 Series A Preferred Stock will have stated value of face value of $1,000

per share and is convertible, at the option of Tokenize, into shares of common stock of Bannix at 5% discount to the VWAP during

the 20 trading days prior to conversion, and in any event not less than $1.00. The Series A Preferred Stock will not have voting

rights and will be entitled to dividends only in the event of liquidation. The Series A Preferred Stock will have a 4.99% beneficial

ownership limitation providing that the Series A Preferred Stock may not be converted into more than 4.99% of the shares of common

stock outstanding at any point in time. Series A Preferred Stock and the shares of common stock issuable upon conversion of the

Series A Preferred Stock (the “Conversion Shares”) shall be subject to a lock-up beginning on the Closing Date and

ending on the earliest of (i) the six (6) months after such date, (ii) a Change in Control, or (iii) written consent of Purchaser

(the “Seller Lockup Period”).

The Charter Amendment Proposal and the

Trust Amendment Proposal are essential to the overall implementation of the Board’s plan to extend the date by which the

Company to complete the Business Combination. The purpose of the Charter Amendment Proposal, the Trust Amendment Proposal, and,

if necessary, the Adjournment Proposal, is to allow us additional time to complete our Business Combination. The Director Proposal

and Auditor Proposal are regular corporate matters that need our stockholder approval at the annual meeting. While we have entered

into a Business Combination Agreement with the EVIE Group and the Shareholder, the Board currently believes that there will not

be sufficient time before March 14, 2024 to complete the Business Combination. Accordingly, the Board believes that in order to

be able to consummate the Business Combination, we will need to obtain the Extension. Therefore, the Board has determined that

it is in the best interests of our stockholders to extend the date by which the Company has to consummate a Business Combination

to the Extended Date.

The Company and other

parties to the Business Combination Agreement are currently working towards satisfaction of the conditions to completion of the

Business Combination, including drafting the necessary filings with the U.S. Securities and Exchange Commission (the “SEC”)

related to the transaction, but have determined that there will not be sufficient time before March 14, 2024 (its current termination

date) to hold an annual meeting to obtain the requisite stockholder approval of, and to consummate, the Business Combination. We

intend to complete the Business Combination as soon as possible and in any event on or before the Extended Date.

Approval of the Charter

Amendment Proposal, Trust Amendment Proposal and the NTA Proposal require the affirmative vote of holders of at least 65% of our

outstanding shares of common stock. Approval of the Auditor Proposal and the Adjournment Proposal require the affirmative vote

of the holders of a majority of the issued and outstanding shares of stock represented by virtual attendance or by proxy and entitled

to vote thereon at the Annual Meeting. Approval of the election of each director nominees under the Director Proposal requires

plurality of the votes of the stockholders by virtual attendance or represented by proxy at the Annual Meeting and entitled to

vote thereon.

Approval of the Charter Amendment Proposal

and the Trust Amendment Proposal is a condition to the implementation of the Extension. In addition, the Company is also seeking

to have the NTA Proposal approved which would remove the Redemption Limitation from the charter in order to expand the methods

that the Company may employ so as not to become subject to the “penny stock” rules of the United States Securities

and Exchange Commission. If the NTA Proposal is not approved, we will not proceed with the Extension if the number of redemptions

of our common stock causes the Company to have less than $5,000,001 of net tangible assets following approval of the Charter Amendment

Proposal and the Trust Amendment Proposal.

Our Board has fixed the close of business

on February 7, 2024 as the record date for determining the Company’s stockholders entitled to receive notice of and vote

at the annual meeting and any adjournment thereof. Only holders of record of the Company’s common stock on that date are

entitled to have their votes counted at the annual meeting or any adjournment thereof. A complete list of stockholders of record

entitled to vote at the annual meeting will be available for ten days before the annual meeting at the Company’s principal

executive offices for inspection by stockholders during ordinary business hours for any purpose germane to the annual meeting.

If the Charter Amendment Proposal and

the Trust Amendment Proposal are approved and the Extension is implemented holders of common may elect to redeem their common stock

for a per share price payable in cash equal to the aggregate amount then on deposit in the trust account established by the Company

in connection with its IPO (the “trust account”) as of two business days prior to the annual meeting

including any interest earned on the trust account deposits (net of taxes payable) divided by the number of then outstanding common

stock (the “Election”) regardless of whether or how such stockholders vote on the Charter Amendment Proposal

or the Trust Amendment Proposal. In addition, the Company is also seeking to have the NTA Proposal approved which would remove

the Redemption Limitation from the charter in order to expand the methods that the Company may employ

so as not to become subject to the “penny stock” rules of the United States Securities and Exchange Commission. If

the NTA Proposal is not approved, we will not proceed with the Extension if the number of redemptions of our common stock causes

the Company to have less than $5,000,001 of net tangible assets following approval of the Charter Amendment Proposal and the Trust

Amendment Proposal. If the Charter Amendment Proposal and the Trust Amendment Proposal are approved by the requisite vote of stockholders

holders of common stock that do not make the Election will retain the opportunity to have their common stock redeemed in conjunction

with the consummation of a business combination subject to any limitations set forth in our charter as amended. In addition, stockholders

who do not make the Election would be entitled to have their common stock redeemed for cash if the Company has not completed a

business combination by the Extended Date.

If the Charter Amendment Proposal and

the Trust Amendment Proposal are approved our Sponsor or its designee has agreed to advance to us as loans for deposit into the

Trust Account the needed monthly amounts equal to the lesser of (x) $25,000 and (y) $0.05 for each share that is not redeemed in

connection with the annual meeting. In addition if the Charter Amendment Proposal and the Trust Amendment Proposal are approved

and the Extension Amendment and Trust Amendment become effective in the event that the Company has not consummated a business combination

by March 14, 2024 the Company may by resolution of the Board and without approval of the Company’s public stockholders if

requested by the Sponsor and upon five days’ advance notice prior to the applicable Termination Date extend the Termination

Date up to six times each by one additional month (for a total of up to six additional months to complete a business combination)

provided that the Sponsor or its designee will for each such monthly extension advance to us as a loan for deposit into the Trust

Account an amount equal to the lesser of (a) $25,000 or (b) $0.05 for each public share that is not redeemed in connection with

the annual meeting for an aggregate deposit of up to the lesser of (x) $150,000 or (y) $0.30 for each public share that is not

redeemed in connection with the annual meeting (if all six additional monthly extensions are exercised). The advances are conditioned

upon the implementation of the Charter Amendment Proposal and the Trust Amendment Proposal and will not occur if either the Charter

Amendment Proposal or the Trust Amendment Proposal is not approved or the Extension is not completed. The amount of the advances

will not bear interest and will be repayable by the Company to our Sponsor or its designees upon consummation of the business combination.

If our Sponsor or its designee advises the Company that it does not intend to make the advances then the Charter Amendment Proposal

the Trust Amendment Proposal and the Adjournment Proposal will not be put before the shareholders at the annual meeting and we

may decide in accordance with our charter to extend the period of time to consummate an initial Business Combination or to dissolve

and liquidate. Our Sponsor or its designees will have the sole discretion whether to continue extending for additional calendar

months until the Extended Date and if our Sponsor determines not to continue extending for additional calendar months its obligation

to make additional advances will terminate.

Holders (“Public

Stockholders”) of the Company’s common stock $0.01, par value per share (“Public Shares”), may elect to

redeem their shares for their pro rata portion of the funds available in the trust account in connection with the Charter

Amendment Proposal (the “Election”) regardless of whether or how such public stockholders vote with respect to the

Charter Amendment Proposal. If the Charter Amendment Proposal, the Trust Amendment Proposal and the Written Consent Proposal are

approved by the requisite vote of stockholders, the remaining public stockholders will retain their right to redeem the public

shares for their pro rata portion of the funds available in the trust account when the Business Combination is submitted to

the stockholders. Furthermore, if the Charter Amendment Proposal and the Trust Amendment Proposal are approved and the Extension

or any additional extension(s) is implemented, then in accordance with the terms of that certain investment management trust agreement,

dated as of September 10, 2021 and as amended on March 8, 2023, by and between the Company and Continental Stock Transfer &

Trust Company (as amended, the “Trust Agreement”), the trust account will not be liquidated (other than to effectuate

the redemptions) until the earlier of (a) receipt by the trustee of a termination letter (in accordance with the terms of

the Trust Agreement) or (b) the Extended Date.”

Any demand for redemption, once made,

may be withdrawn at any time until the deadline for exercising redemption requests and thereafter, with our consent, until the

vote is taken with respect to the Charter Amendment Proposal and the Trust Amendment Proposal. Furthermore, if a holder of a public

share delivered its certificate in connection with an election of its redemption and subsequently decides prior to the applicable

date not to elect to exercise such rights, it may simply request that the transfer agent return the certificate (physically or

electronically).

The withdrawal of funds from the trust

account in connection with the Election will reduce the amount held in the trust account following the redemption, and the amount

remaining in the trust account may be significantly reduced from the approximately $31.914 million that was in the trust account

as of November 30, 2023.

The Company estimates that the per share

price at which the common stock may be redeemed from cash held in the trust account will be approximately $10.99 at the time of

the annual meeting. The closing price of the Company’s common stock on the Nasdaq Stock Market LLC (“NASDAQ”)

on February 7], 2024, the record date of the annual meeting was $10.85. Accordingly, if the market price were to remain the same

until the date of the annual meeting exercising redemption rights would result in a public stockholder receiving approximately

$0.14 more than if such stockholder sold the common stock in the open market as of February 7, 2024. The Company cannot assure

stockholders that they will be able to sell their common stock in the open market even if the market price per share is higher

than the redemption price stated above as there may not be sufficient liquidity in its securities when such stockholders wish to

sell their shares.

The Adjournment Proposal if adopted

will allow our Board to adjourn the annual meeting to a later date or dates if necessary or appropriate to permit further solicitation

of proxies. The Adjournment Proposal will be presented to our stockholders only in the event that there are insufficient for or

otherwise in connection with the approval of the Charter Amendment Proposal or the Trust Amendment Proposal.

If either the Charter Amendment Proposal

or the Trust Amendment Proposal is not approved the Company and the Company does not consummate an initial business combination

within the Combination Period as contemplated by our IPO prospectus and in accordance with our charter the Company will (i) cease

all operations except for the purpose of winding up (ii) as promptly as reasonably possible but not more than ten business

days thereafter and subject to having lawfully available funds therefor redeem 100% of the outstanding common stock at a per share

price payable in cash equal to the aggregate amount then on deposit in the trust account including any interest earned on the trust

account deposits (which interest shall be net of taxes payable and after setting aside up to $100,000 to pay dissolution expenses)

divided by the number of then outstanding common stock which redemption will completely extinguish stockholders’ rights as

stockholders (including the right to receive further liquidation distributions if any) subject to applicable law and (iii) as

promptly as reasonably possible following such redemption subject to the approval of our remaining stockholders and our Board in

accordance with applicable law dissolve and liquidate subject in each case to our obligations under Delaware law to provide for

claims of creditors and the requirements of other applicable law. The Company and the Sponsor may elect to extend the Combination

Period to September 14, 2024 but are under no obligation to do so. There will be no redemption rights or liquidating distributions

with respect to our warrants including the warrants included in the units sold in the IPO (the “public warrants”)

which will expire worthless in the event the Company winds up.

The Company reserves the right at any

time to cancel the Annual Meeting and not to submit the Charter Amendment Proposal, Trust Amendment Proposal to stockholders

or implement any of the amendments as described in the Charter Amendment Proposal or the Trust Amendment Proposal.

You are not being asked to vote on

a business combination at this time. If the Extension is implemented and you do not elect to redeem your common stock in connection

with the Extension you will retain the right to vote on a business combination when it is submitted to the stockholders (provided

that you are a stockholder on the record date for a meeting to consider a business combination) and the right to redeem your common

stock for a pro rata portion of the trust account in the event a business combination is approved and completed or the Company

has not consummated a business combination by the Extended Date.

Only holders of record

of our common stock at the close of business on February 7, 2024 are entitled to notice of the Annual Meeting and to vote at the

Annual Meeting and any adjournments or postponements of the Annual Meeting.

After careful

consideration of all relevant factors, the Board of Directors has determined that each of the proposals are advisable and recommends

that you vote or give instruction to vote “FOR” such proposals.

Record Date; Voting Rights and Revocation of Proxies

The record date with

respect to this solicitation is the close of business on February 7, 2024 (the “Record Date”) and only stockholders

of record at that time will be entitled to vote at the Annual Meeting and any adjournment or adjournments thereof.

The shares of Common

Stock represented by all validly executed proxies received in time to be taken to the Annual Meeting and not previously revoked

will be voted at the meeting. This proxy may be revoked by the stockholder at any time prior to its being voted by filing with

the Secretary of the Company either a notice of revocation or a duly executed proxy bearing a later date. We intend to release

this Proxy Statement and the enclosed proxy card to our stockholders on or about February 16, 2024.

Dissenters’ Right of Appraisal

Holders of shares

of our Common Stock do not have appraisal rights under Delaware law or under the governing documents of the Company in connection

with this solicitation.

Outstanding Shares and Quorum

The number of outstanding

shares of Common Stock entitled to vote at the Annual Meeting is 5,463,613. Each share of Common Stock is entitled to one

vote. The presence represented by virtual attendance or by proxy at the Annual Meeting of the holders of 3,551,348 shares, or a

majority of the number of outstanding shares of Common Stock, will constitute a quorum. There is no cumulative voting. Shares that

abstain or for which the authority to vote is withheld on certain matters (so-called “broker non-votes”) will be treated

as present for quorum purposes on all matters.

Broker Non-Votes

Holders of shares

of our Common Stock that are held in street name must instruct their bank or brokerage firm that holds their shares how to vote

their shares. If a stockholder does not give instructions to his or her bank or brokerage firm, it will nevertheless be entitled

to vote the shares with respect to “routine” items, but it will not be permitted to vote the shares with respect to

“non-routine” items. In the case of a non-routine item, such shares will be considered “broker non-votes”

on that proposal.

Proposal 1 (Charter Amendment) is a matter that we believe

will be considered “non-routine.”

Proposal 2 (Trust Amendment) is a matter that we believe

will be considered “non-routine.”

Proposal 3 (NTA Proposal) is a matter that we believe will

be considered “non-routine.”

Proposal 4 (Director Proposal) is a matter that we believe

will be considered “non-routine.”

Proposal 5 (Auditor Proposal) is a matter that we believe

will be considered “routine.”

Proposal 6 (Adjournment) is a matter that we believe will

be considered “routine.”

Banks or brokerages

cannot use discretionary authority to vote shares on Proposal 1, 2 or 3 if they have not received instructions from their clients.

Please submit your vote instruction form so your vote is counted.

Required Votes for Each Proposal to Pass

Assuming the presence of a quorum at the Annual Meeting:

| Proposal |

Vote Required |

Minimum Number of Unaffiliated Public Shares of Common Stock Required to Vote in Favor of the Proposal |

Minimum Percentage of Unaffiliated Public Shares of Common Stock Required to Vote in Favor of the Proposal |

Broker Discretionary

Vote Allowed |

| Charter Amendment |

At least sixty-five percent (65%) of outstanding shares of Common Stock |

1,027,348 |

18.80% |

No |

| Trust Amendment |

At least sixty-five percent (65%) of outstanding shares of Common Stock |

1,027,348 |

18.80% |

No |

| NTA Proposal |

At least sixty-five percent (65%) of outstanding shares of Common Stock |

1,027,348 |

18.80% |

No |

| Director Proposal |

Plurality of the votes of the stockholders by virtual attendance or represented by proxy at the Annual Meeting and entitled to vote thereon |

Not Applicable |

Not Applicable |

No |

| Auditor Proposal |

Majority of the issued and outstanding shares of stock represented by virtual attendance or by proxy and entitled to vote thereon at the Annual Meeting |

262,443 |

4.80% |

Yes |