Current Report Filing (8-k)

23 October 2020 - 7:23AM

Edgar (US Regulatory)

0000034067FALSE00000340672020-10-222020-10-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): October 22, 2020

DMC Global Inc.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

0-8328

|

|

84-0608431

|

(State or Other Jurisdiction of

Incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

11800 Ridge Parkway, Suite 300, Broomfield, Colorado 80021

(Address of Principal Executive Offices, Including Zip Code)

(303) 665-5700

(Registrant’s Telephone Number, Including Area Code)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol

|

|

Name of exchange on which registered

|

|

Common Stock, $0.05 Par Value

|

|

BOOM

|

|

The Nasdaq Global Select Market

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 1.01 Entry into a Material Definitive Agreement.

On October 22, 2020, DMC Global Inc., a Delaware corporation (the “Company”) entered into an equity distribution agreement (the “Equity Distribution Agreement”) with KeyBanc Capital Markets Inc., as sales agent (the “Sales Agent”), under which the Company may, from time to time, issue and sell shares of the Company’s common stock, $0.05 par value per share (the “Shares”), through the Sales Agent for aggregate sales proceeds of up to $75,000,000 through an “at the market” offering program (the “ATM Program”). The common stock will be distributed at the market prices prevailing at the time of sale. As a result, prices of the Shares sold under the ATM Program may vary as between purchasers and during the period of distribution.

Upon delivery of a placement notice and subject to the terms and conditions of the Equity Distribution Agreement, the Sales Agent will use reasonable efforts consistent with its normal trading and sales practices, applicable state and federal laws, rules and regulations, and the rules of the Nasdaq Global Select Market (“Nasdaq”) to sell the Shares from time to time based upon the Company’s instructions for the sales, including any price, time or size limits specified by the Company. Under the Equity Distribution Agreement, the Sales Agent may sell the Shares by any method permitted by law deemed to be an “at the market” offering as defined in Rule 415 of the Securities Act of 1933, as amended (the "Securities Act"), including without limitation sales made directly on Nasdaq or on any other existing trading market for the Shares.

The Equity Distribution Agreement provides that the Sales Agent will be entitled to compensation for its services in the form of a commission of up to 1.5% of the aggregate gross proceeds from each sale of the Shares. The Company also agreed to provide the Sales Agent with customary indemnification and contribution rights. The Company is not obligated to sell any Shares under the Equity Distribution Agreement and may at any time suspend solicitation and offers under the Equity Distribution Agreement. The Equity Distribution Agreement may be terminated (i) by the Company at any time by giving three days’ written notice to the Sales Agent for any reason, (ii) by the Sales Agent at any time by giving three days’ written notice to the Company for any reason, or (iii) automatically upon the issuance and sale of all of the Shares through the Sales Agent on the terms and subject to the conditions set forth in the Equity Distribution Agreement.

The Company intends to use the net proceeds of the ATM Program, if any Shares are sold, for general corporate purposes, which may include working capital, debt repayment and potential acquisitions or investments in businesses, products or technologies.

The sales and issuances of the Shares under the Equity Distribution Agreement will be made pursuant to the Company’s effective shelf registration statement on Form S-3 (File No. 333-238211) declared effective by the Securities and Exchange Commission (the “SEC”) on May 28, 2020 as supplemented by the Prospectus Supplement dated October 22, 2020, relating to the sale of the Shares (the “Prospectus Supplement”).

The foregoing description of the Equity Distribution Agreement is not complete and is qualified in its entirety by reference to the full text of such agreement, a copy of which is filed herewith as Exhibit 1.1 to this Current Report on Form 8-K and is incorporated herein by reference. A copy of the Equity Distribution Agreement has been included with this Current Report on Form 8-K to provide security holders with information regarding its terms. It is not intended to provide any other factual information about the Company. The representations, warranties and covenants contained in the Equity Distribution Agreement were made solely for purposes of the ATM Program and as of specific dates, were solely for the benefit of the parties to the Equity Distribution Agreement, may be subject to limitations agreed upon by the contracting parties, and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to security holders. Security holders are not third-party beneficiaries under the Equity Distribution Agreement and should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of the Company. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Equity Distribution Agreement, which subsequent information may or may not be fully reflected in the Company’s public disclosures.

The legal opinion of Davis Graham & Stubbs LLP relating to the Shares being offered pursuant to the Equity Distribution Agreement and Prospectus Supplement is filed as Exhibit 5.1 to this Current Report on Form 8-K.

Item 2.02 Results of Operations and Financial Condition.

On October 22, 2020, the Company issued a press release announcing its financial results for the quarter ended September 30, 2020. A copy of the Company’s press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information provided in Item 2.02 this Current Report, including Exhibit 99.1 hereto, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended and shall not be deemed incorporated by reference in any filings under the Securities Act unless specifically stated so therein.

Item 9.01 Financial statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

1.1

|

|

|

|

|

|

|

|

5.1

|

|

|

|

|

|

|

|

23.1

|

|

Consent of Davis Graham & Stubbs LLP (included in Exhibit 5.1).

|

|

|

|

|

|

99.1

|

|

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding anticipated sales of Shares under the ATM Program and the intended use of proceeds from the ATM Program. These statements are subject to risks and uncertainties, including whether any sales are completed under the ATM Program and changes in the use of proceeds due to unanticipated developments and other factors that may cause actual results, performance or achievements to be materially different than those expressed or implied. The Company assumes no obligation to update this information. Additional risks relating to the Company may be found in the periodic and current reports filed with the SEC by the Company, including the Company’s Annual Report on Form 10-K for the year ended December 31, 2019.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DMC Global Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

Dated:

|

October 22, 2020

|

By:

|

/s/ Michael Kuta

|

|

|

|

|

Michael Kuta

|

|

|

|

|

Chief Financial Officer

|

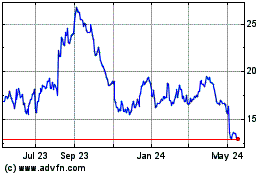

DMC Global (NASDAQ:BOOM)

Historical Stock Chart

From Jun 2024 to Jul 2024

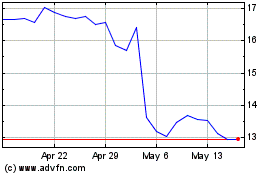

DMC Global (NASDAQ:BOOM)

Historical Stock Chart

From Jul 2023 to Jul 2024